Miljø- og Planlægningsudvalget 2009-10

MPU Alm.del Bilag 135

Offentligt

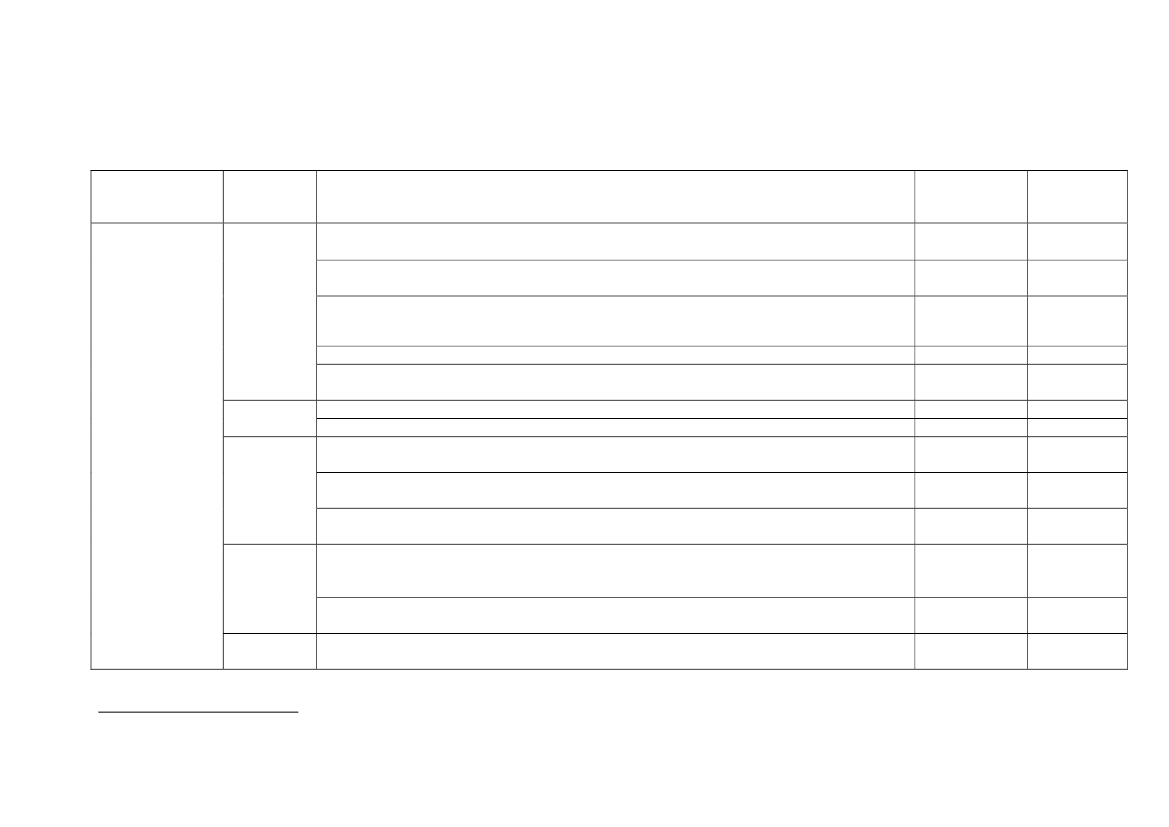

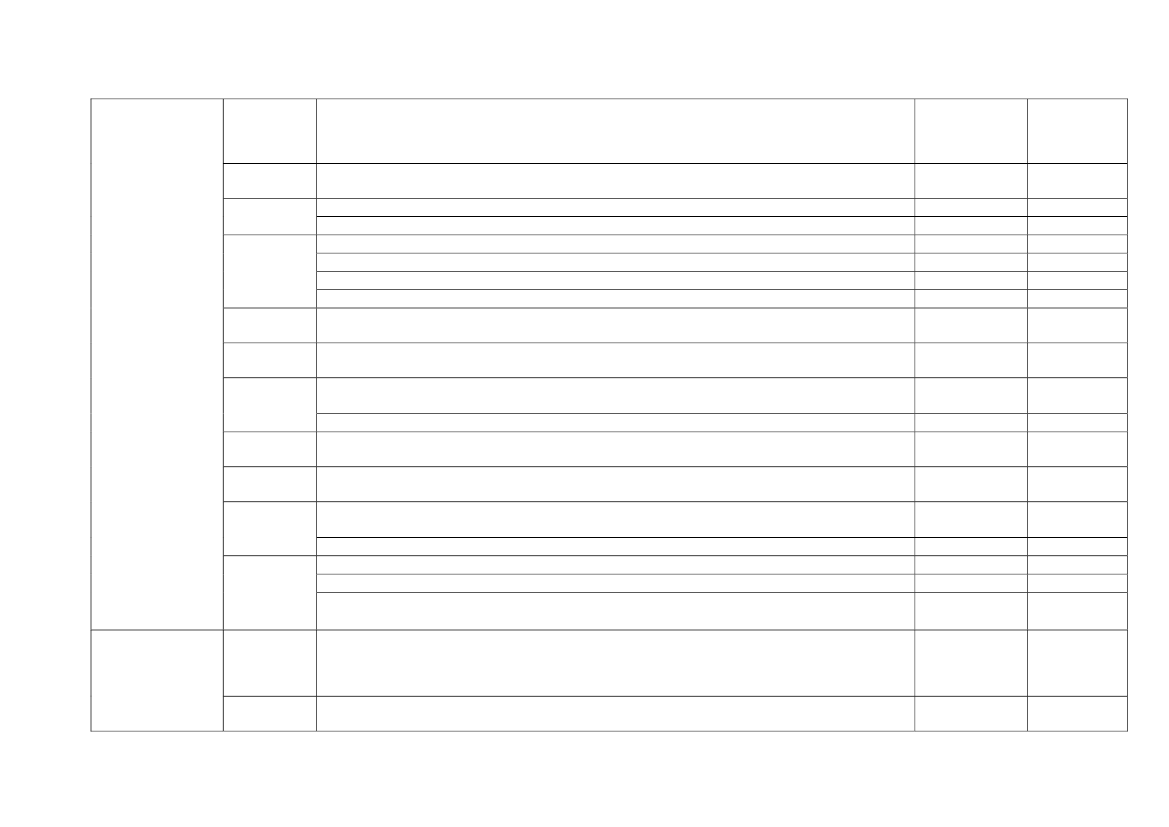

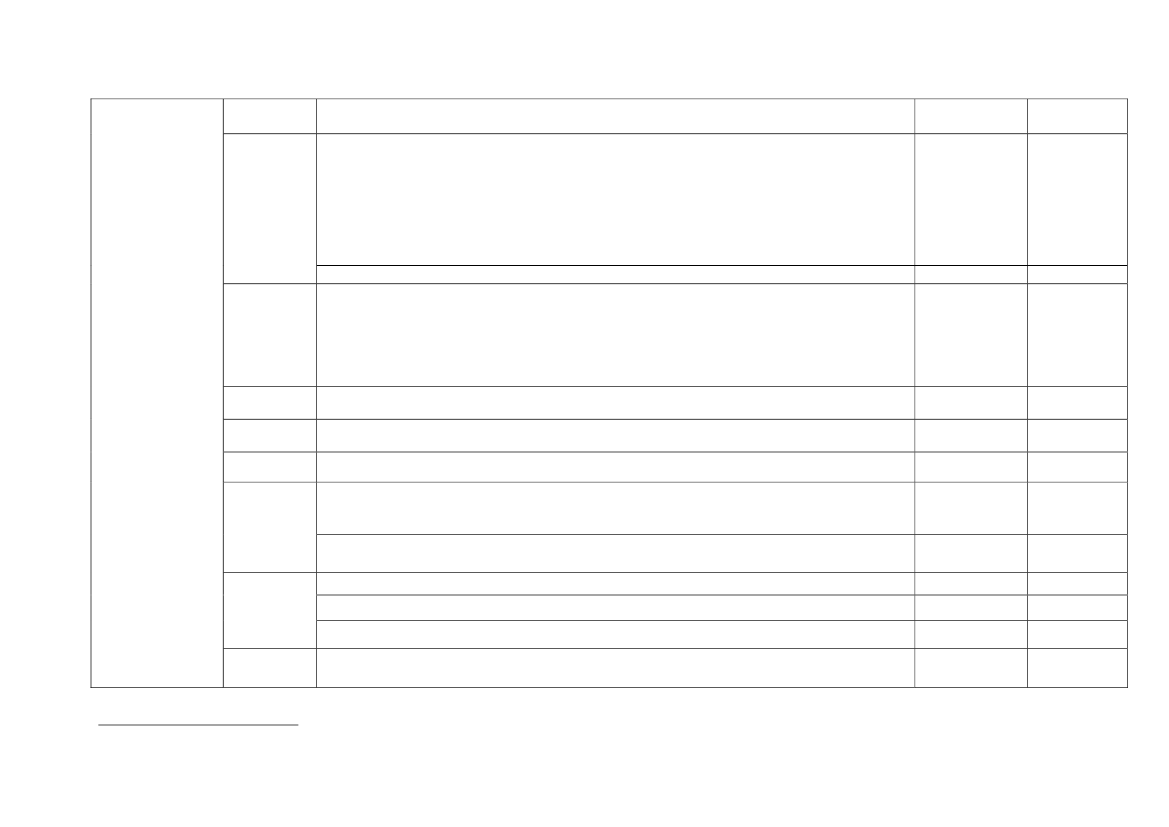

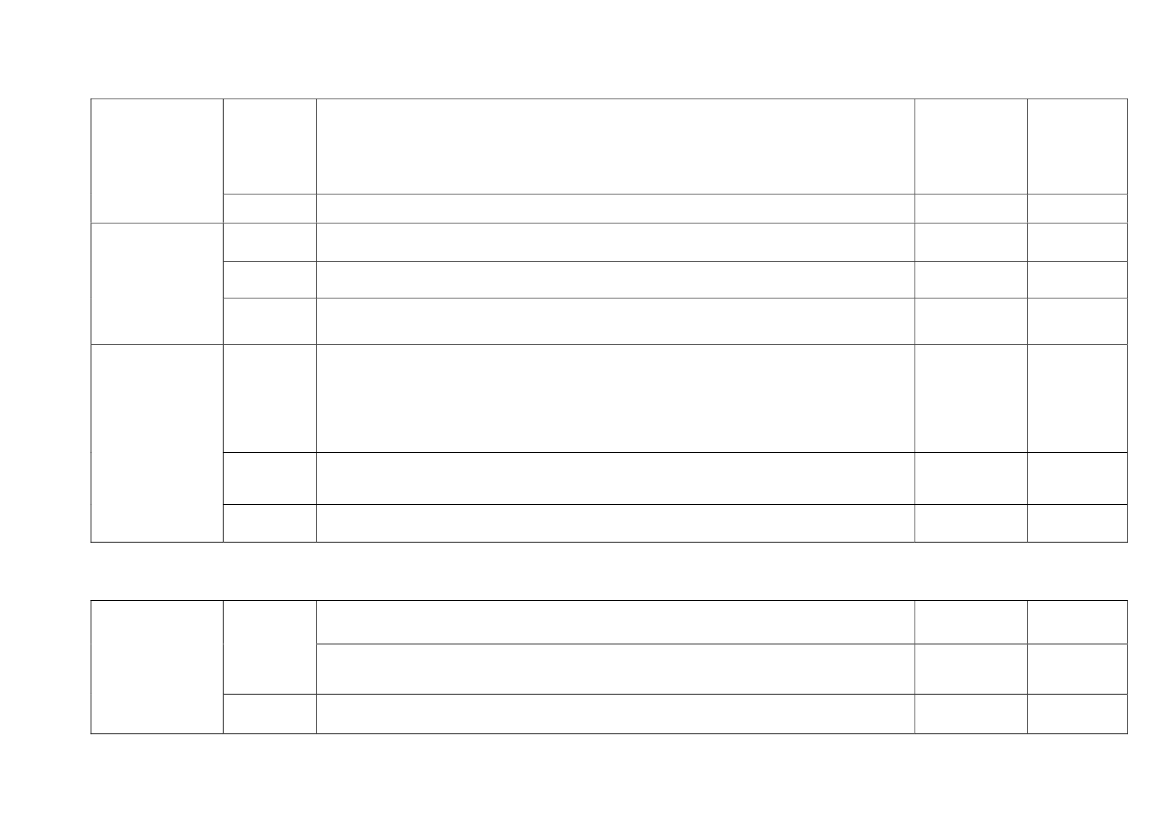

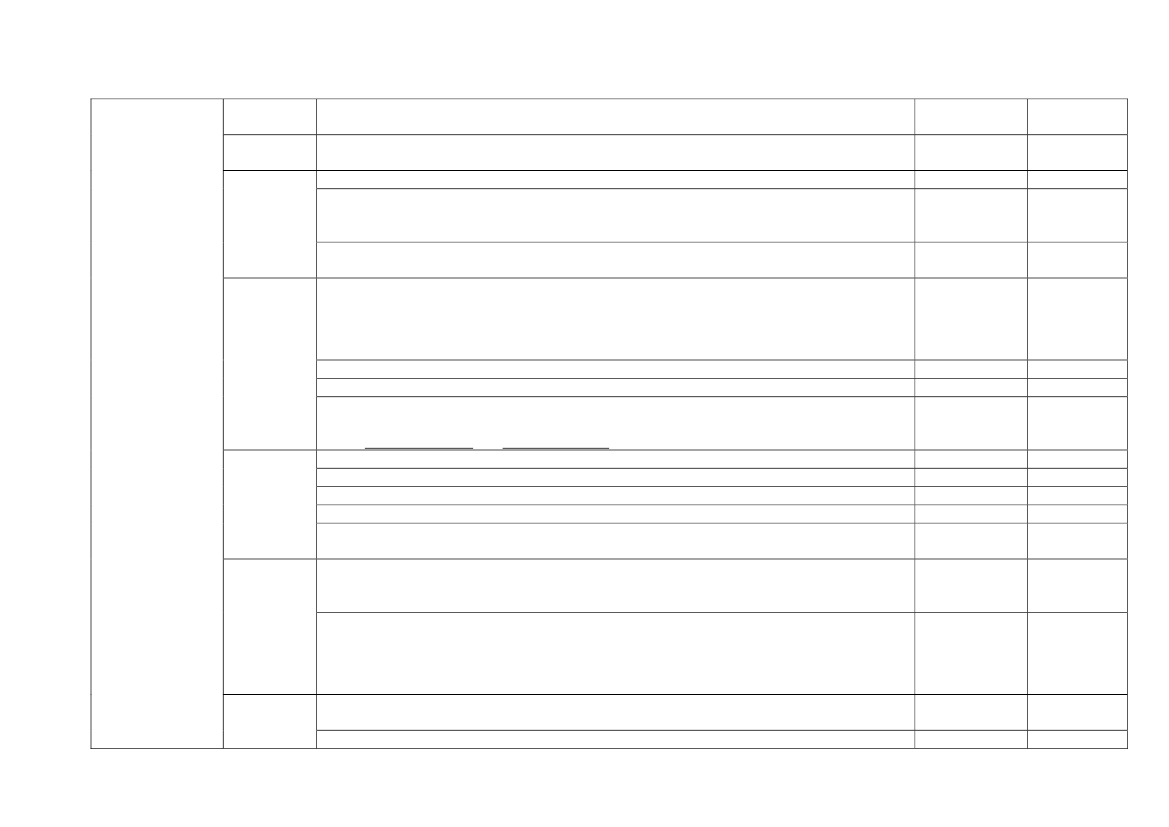

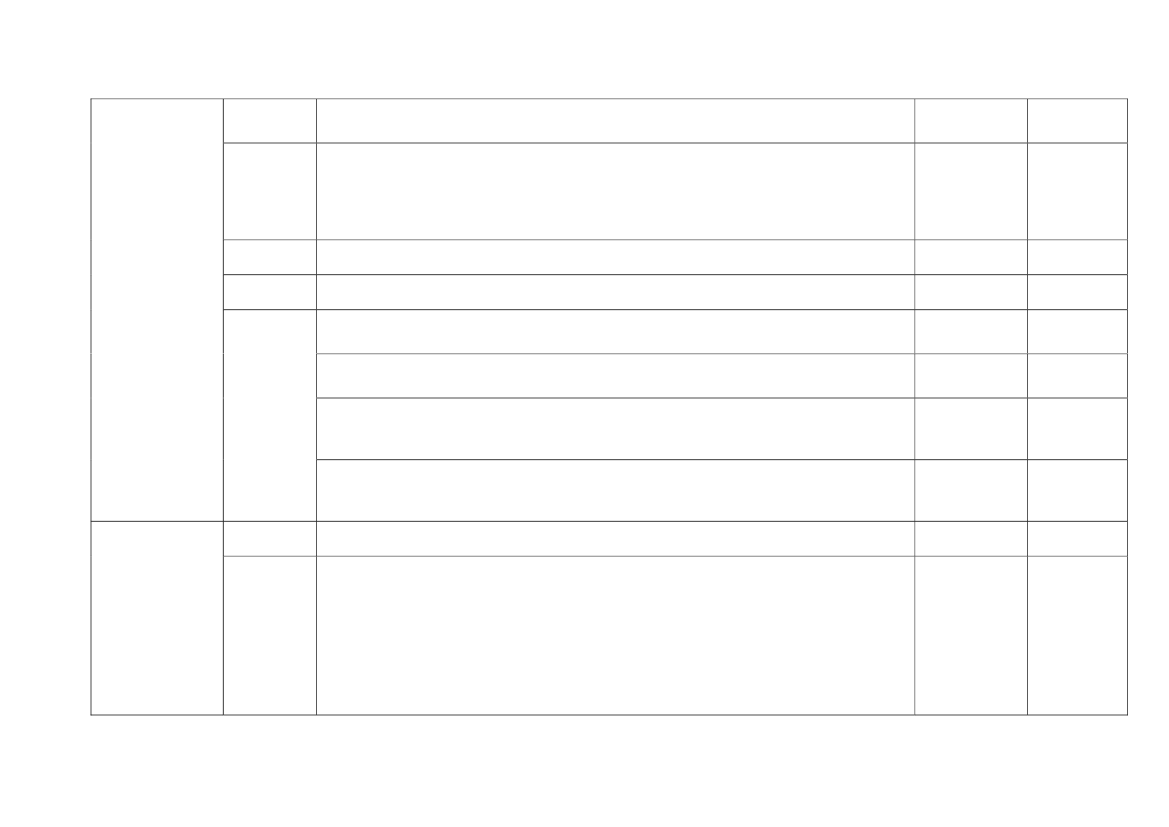

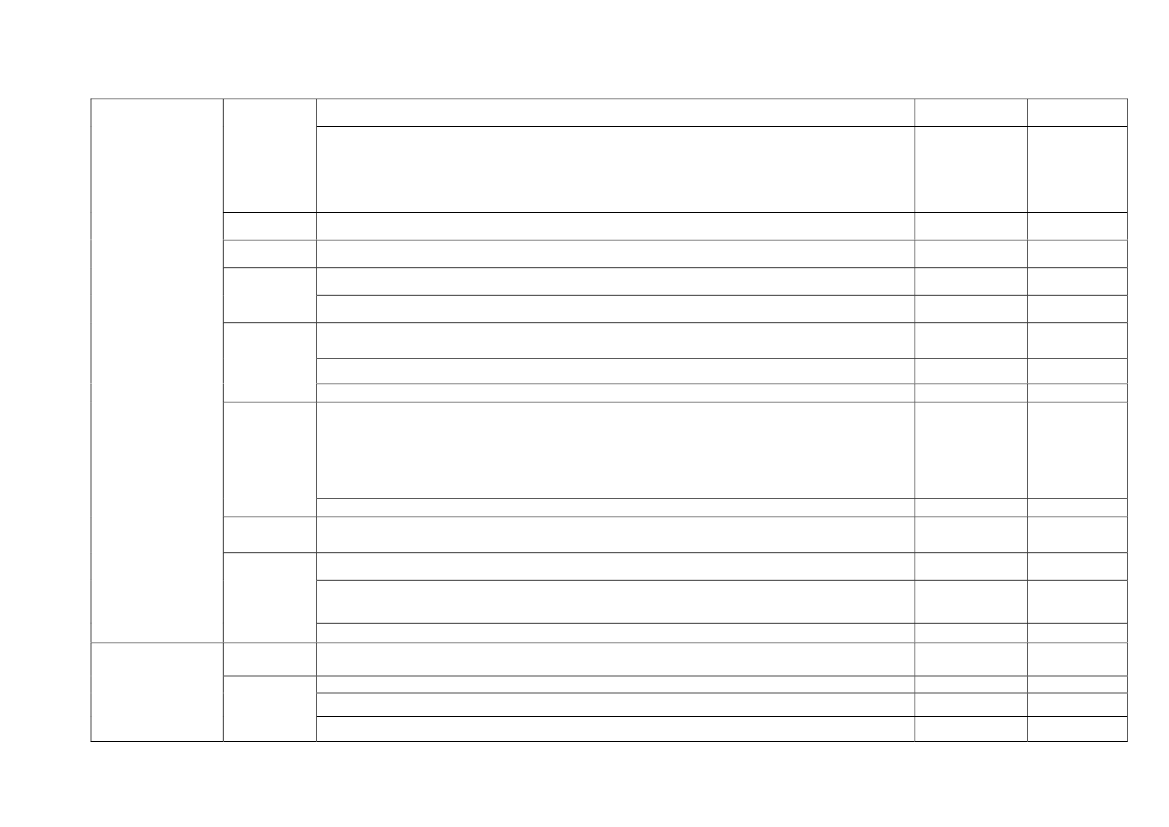

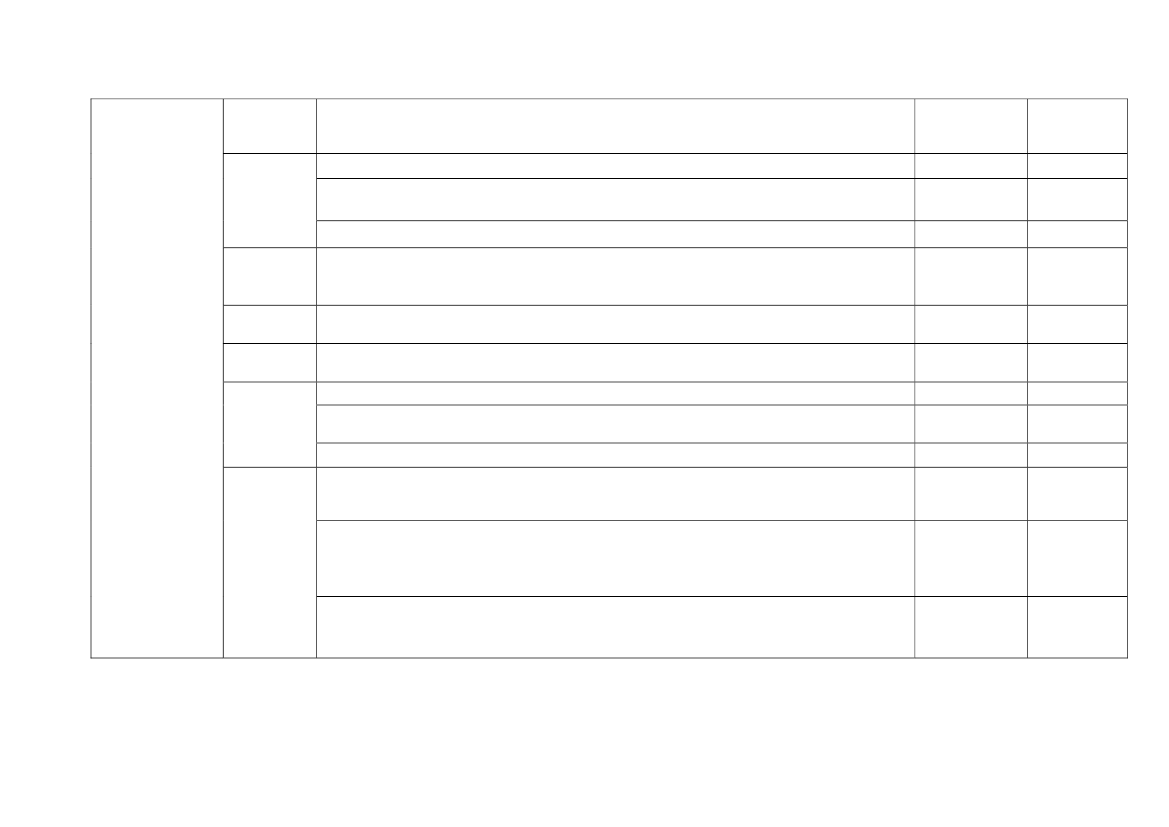

Annex 2.Examples of Member States' investments in different sectors1SectorMemberStateMeasureInvestment in thermal renovation of public buildingsThermal renovation by private households, and Companies supported by the governmentATAdditional credit volume in subsidised credit for energy efficiency projectsState guarantees for the Austria WirtschaftsserviceLow-interest loans especially for energy efficiency projects, also for emissions and wastereductionReduction of energy cost - loans for energy saving investmentEnergy saving investment in public buidings (GPP)Subsidy for the high quality heat cladding for residential buildings (part of € 900 million GreenInvestment Scheme Programme)Subsidy Programme of an Energy Buildings' Demand Reduction (it is not clear whether thepreceding one is not the same)Boost of the Subsidy Programme "PANEL" (it is not clear whether the preceding one is not thesame)Diversification of energy supply sources. (Establishment of the Vassilikos Energy Centre inorder to decrease the dependency on imported oil and increase energy efficiency of thecountry’s energy sector, reduce green house gases and emissions etc.)Subsidy Scheme for enterprises, households and government services to adopt energy savingmeasuresRenovation of public buildings (among them educational infrastructure mainly – 33%), largeresidential estates, hospitals city planning, rural areasForeseenBudget€ 91 million€50 million€50 million€ 500 million(partly EIFmoney)

Timing2009 - 20102009-20102009 - 20102009 - 20102009 - 2010n/an/a2009-2012n/an/a2004-20132006-20102009-2011

€ 800 million€ 100 million€ 200million€ 100 million€ 656 million€ 240 million€ 24 million€ 8 millionn/a€3.2 billion

Energy efficiency

BE

CZ

CY

DE

1

Some of the measures below contain "green" as well as "non-green" elements. Where the available information does not allow the quantification of the green elements,the measure is put in italics.

1

DKEE

ES

Renovation subsidy scheme: Funds set aside to subsidies for maintenance and constructionworks, including energy savings, in owner-occupied housingLow interest rate loans (+loan guarantee scheme) for investments in energy conservation inhousing/ energy efficiency of block housesModernisation of buildings in touristic regionsEnergy efficiency initiatives plus renewables and energy savings projects (initiatives aiming atlowering energy consumption in private and public buildings, labelling policy, socialcampaigns on energy savings)Energy efficient construction and rehabilitation. Foreseen investment of € 4.100 bn, however,the share to be allocated to energy efficiency is not specifiedHousehold tax deduction for renovation, including energy-efficiency related repairs, anincrease in energy renovation allowance

€ 200 million€ 17 million(grant) + loan

2009-20102009-2013n/a2008-20112009-2012n/a

€401.2 million€ 245 millionn/a€50 million(on-budget)€725 million(off-budgetguarantees)

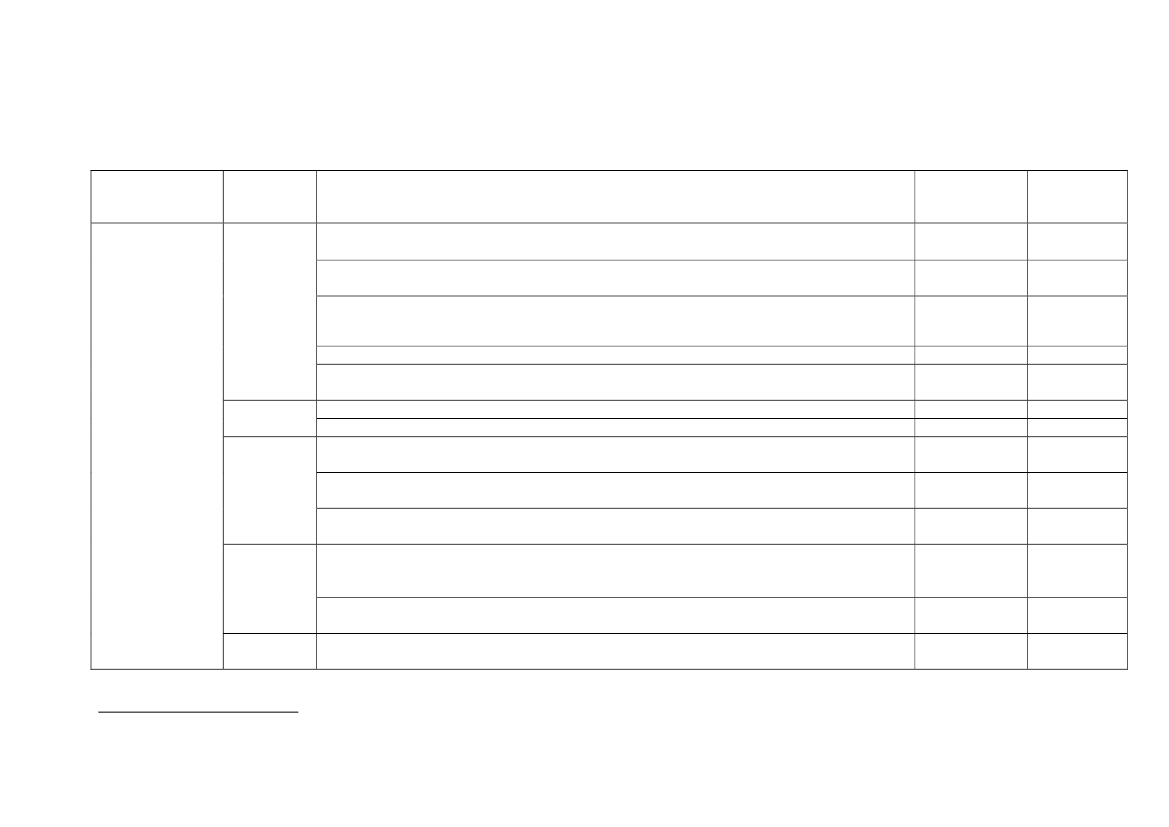

FIEnergy efficiency

FR

HU

Transport projects, adjustment in the level of energy subsidiesRenovation subsidy of 10% for housing companiesIncrease energy subsidies, andSupport for rapidly launched projects with a positive impact on employment that promote theuse of renewable energy and energy efficiencyRenovation public buildingsEnergy efficiency in agriculture (tractors, buildings)Energy efficiency RATP (0,45)Renovation poor housing80 % of the French population allowed to cumulate zero-rate loan for buying or building lowenergy house, and tax credit for renovate for thermo-insulationSupport the upgrade of the energy efficiency of municipal infrastructure, includingrehabilitation of heating and power distribution systems, replacement of outdated boilers andimprovement of thermal insulation of buildingsenergy efficiency in buildings

€632 million€ 25 millionby €8 millionby €2 million€ 200 million.€ 30 million€ 7.5 million€ 200 million€83 million€ 25 million(from EBRDloan)

n/a2009-201120082009-20102009-2013200920092009 - 2010n/an/a

€ 98 millionfrom AAU(AssignedAmount Unit )sale

IE

Introduction of smart meters as a test project prior to the roll out of the new smart grid to every n/ahome in the countryBetter insulation in over 30,000 houses in 2009; the budget for 2010-2011 is yet to be€49 million

n/a2009-tbd

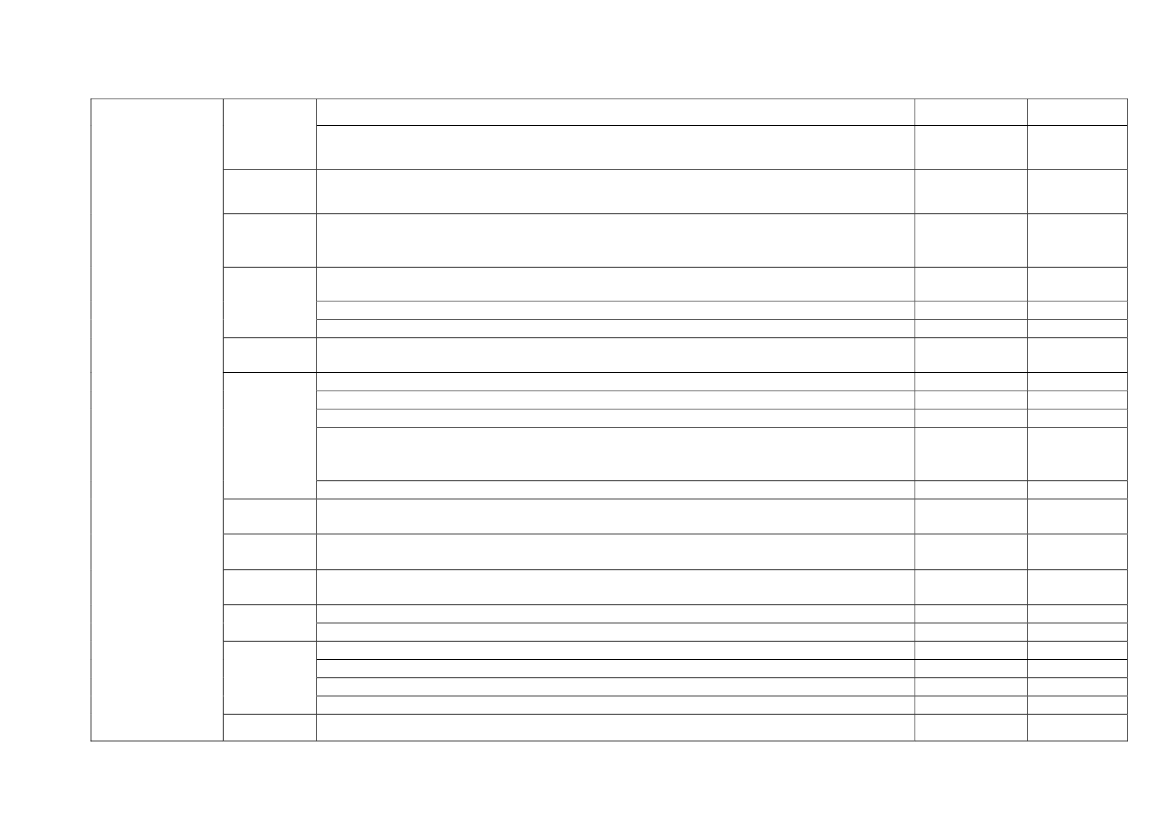

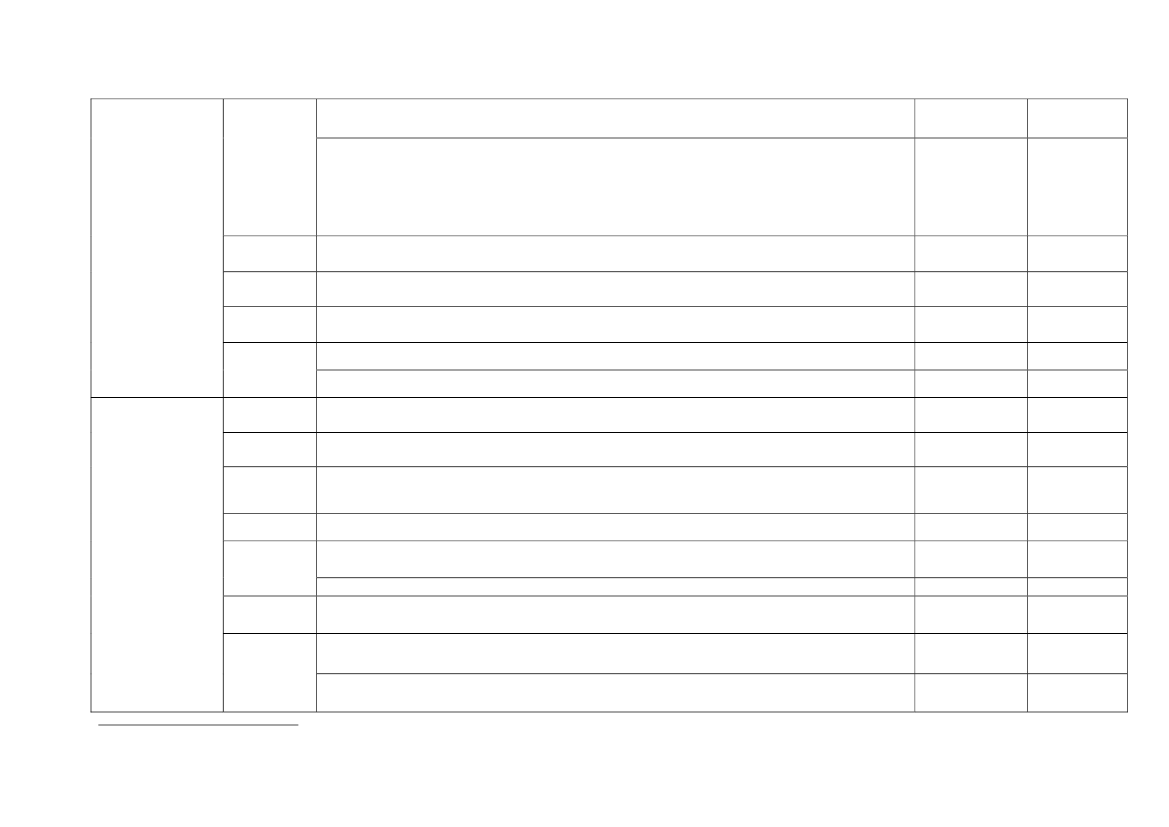

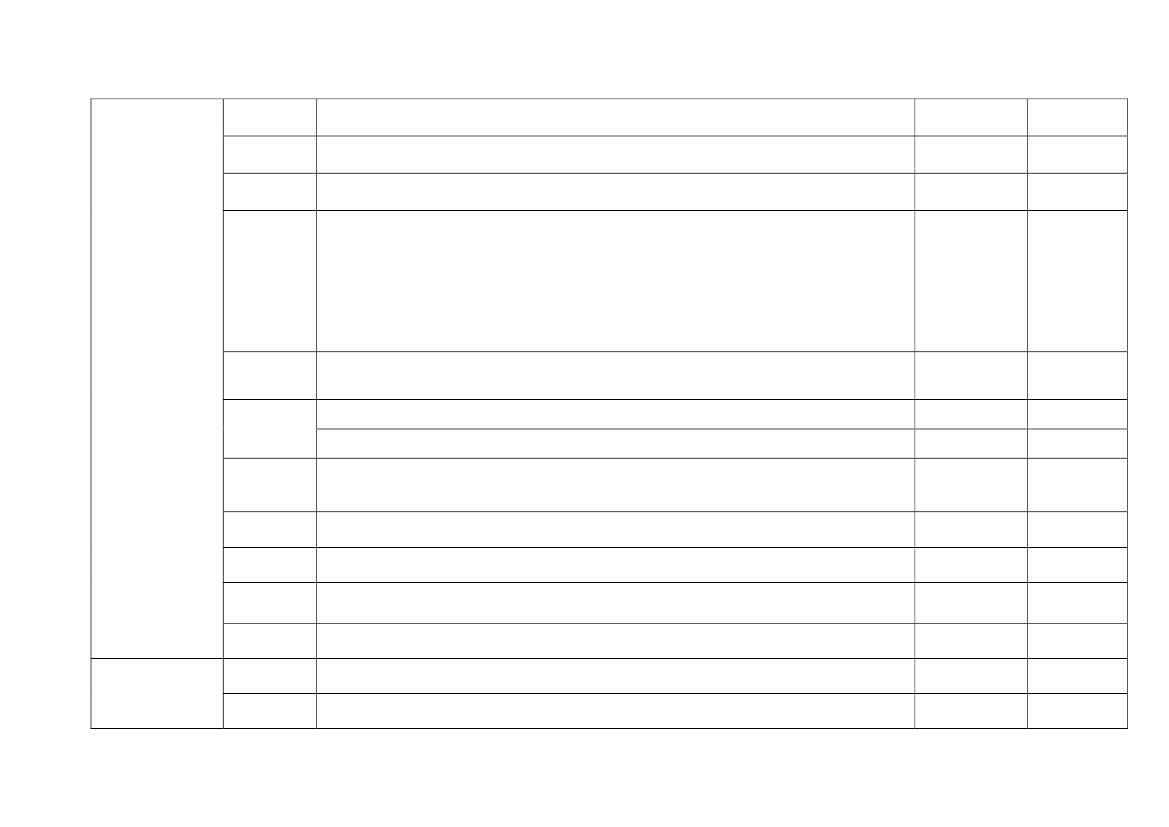

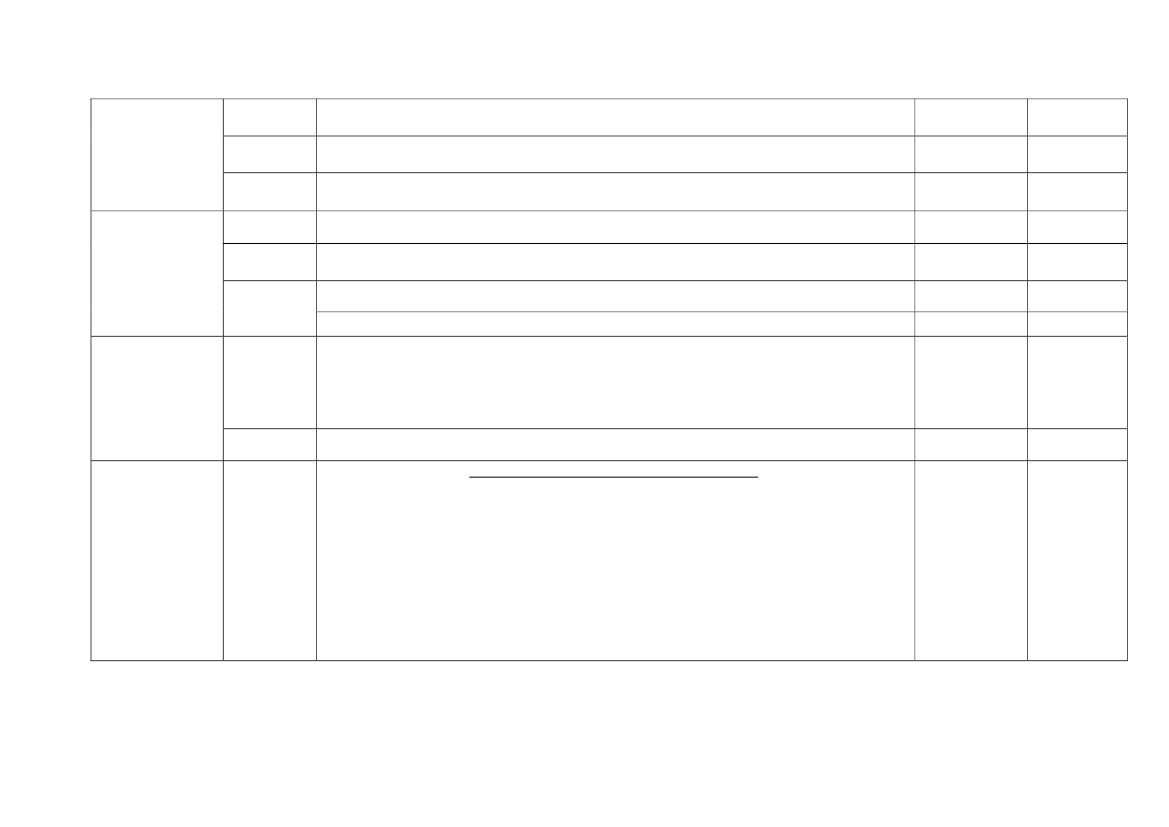

2

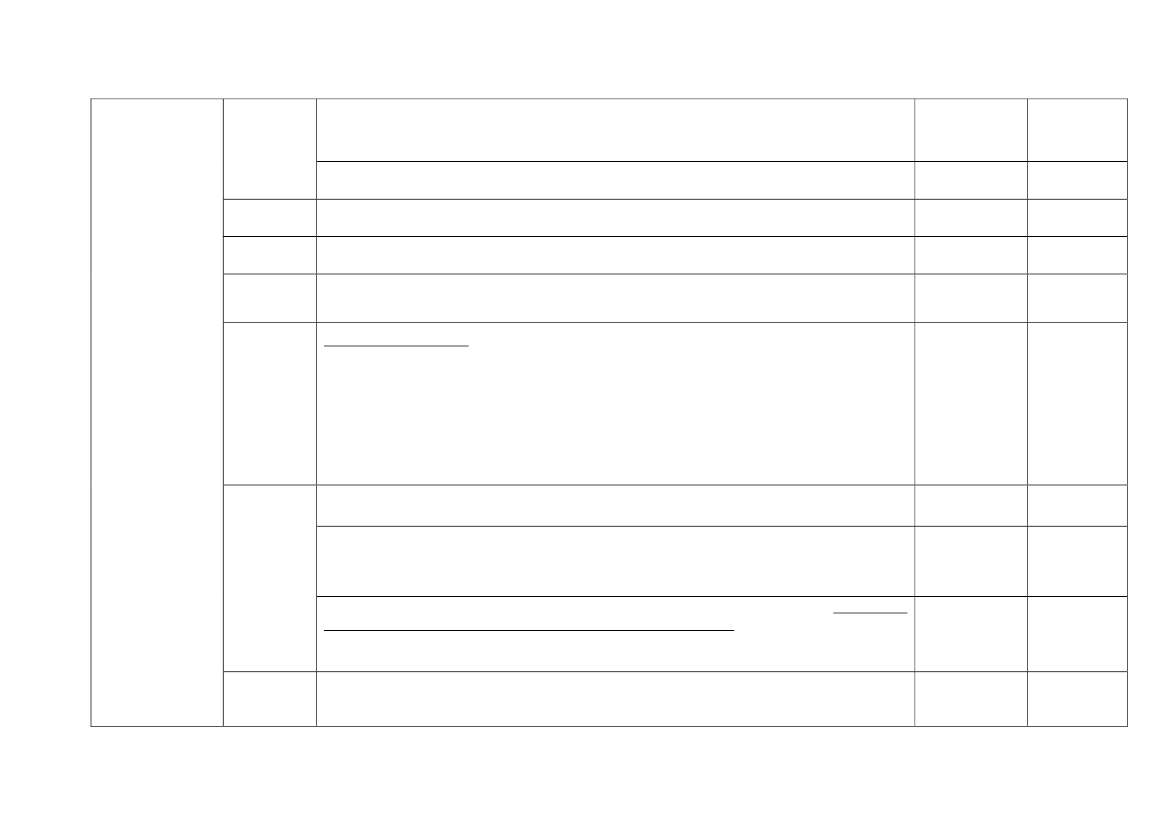

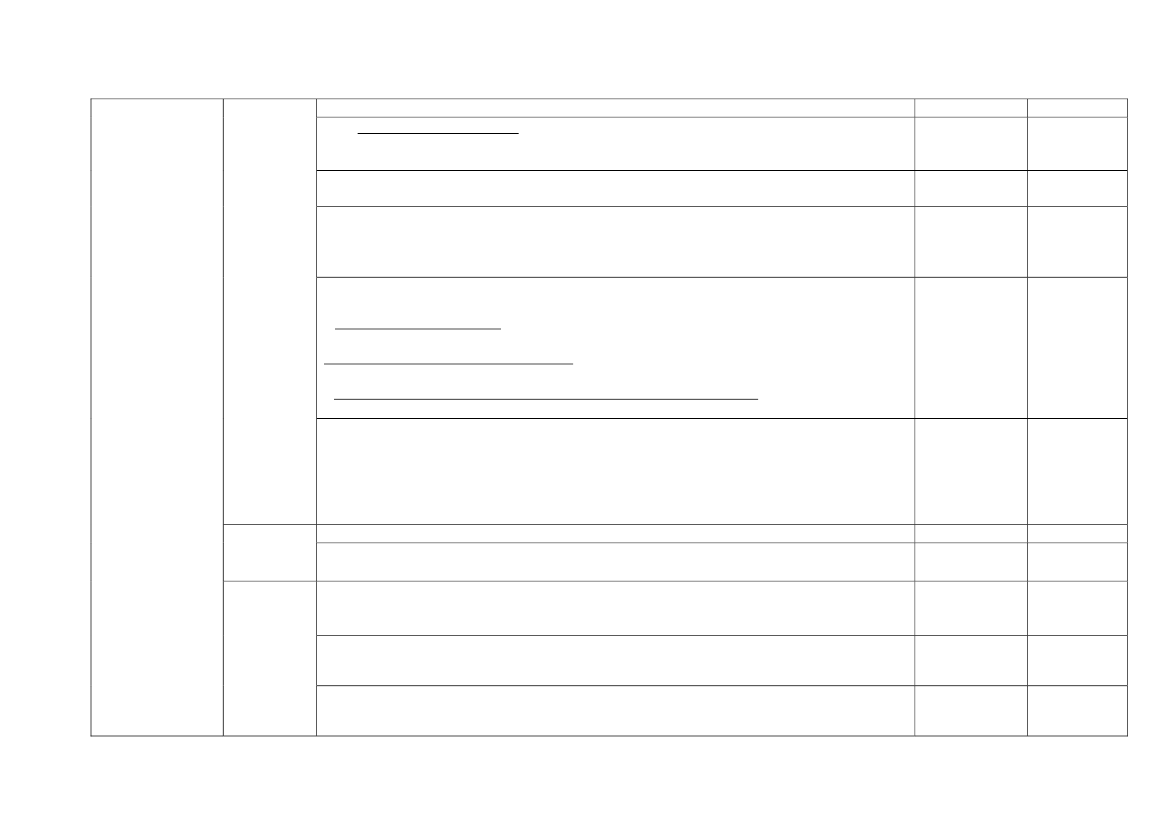

Energy efficiency

IT

determinedThe Warmer Homes Scheme: to assist private households on low incomes, includingimprovement of the thermal efficiency of 15,000 dwellings in 2009. The budget for 2010-2011is yet to be determined.Grant support to efficiency upgrades and retrofits in business and the public sector. The budgetfor 2010-2011 is yet to be determined.Revision of Building Regulations by 2010: to improve energy consumption and CO2emissionsby 60% for new dwellings over 2005 standards (in 2007 the standards were increased by 40%over the 2005 baseline). IE is considering an introduction of new standard for Carbon NeutralBuilding Standard in 2013.Sustainable Energy Ireland: to support energy efficient demonstration projects in the socialhousing sector, including:- Towards Carbon Neutral: support local authorities in building their expertise in deliveringhighly energy efficient dwellings;- Retrofitting Demonstration Projects: support a number of demonstration projects for theretrofitting of insulation and improvement of energy efficiency in existing stock.;- Energy Efficiency Improvements to Vacant Local Authority Stock: retrofitting of insulationand improvements in energy efficiency measures of vacant propertiesIncrease the range of energy efficient equipment (e.g. lighting, lighting controls, motors,variable speed drives and building energy management systems, heating and electricityprovision, ICT, process and heating, ventilation and air-conditioning control systems, electricand alternative fuel vehicles) purchased by companies that can qualify for accelerated capitalallowances (e.g. energy efficient data-server systems, electricity provision equipment andcontrol systems). The budget for 2011 is yet to be determined.Allocation to energy efficiency initiatives55% income tax deduction for building restructuring is renewed. Works done in 2008 will bespread over 3 years, from 2009 on over 5 years.Requirements for a passive energy consumption, which will be applied for newly constructedbuildings financed from state and municipality budgets; and in a more distant future suchrequirements will be applied to building modernisation.Renovation of public buildings (schools, hospitals, day-care centres and foster homes).Renovation of residential buildings

€ 20 million€ 6 millionn/a

2009-tbd2009-tbd2007-2016

€20 million€5 million€20 million€ 6 million2009-ongoing20092008-2010

€ 940 millionn/an/a€232 million(from StructuralFunds)

n/an/an/a2009-2010.2009-2010

LT

€290 million(up to €203million

3

from StructuralFund,€87 million fromEIB loan)

LULVMTNLPLEnergy efficiencyPTSESISK

Subventions for the promotion of refrigerating equipment of low energy consumption (A++).Renovation of residential buildingsRenovation of public buildings including social buildingsIncrease in subsidies for the purchase of energy efficient equipmentIntroduction of a scheme to encourage use of energy efficient applianceGrants to enterprises to carry out audits for their systems and energy useDistribution of energy saving lamps to all familiesEnergy saving in housing through lower tax for housing corporationsIntroduction of white certificates that gives incentives to decrease the energy useRenovation of most energy-consuming public buildings (hospitals, universities, law courts,offices of public services, etc.)Investment in energy metering networksImproving energy efficiency in different sectorsWeatherproofing public buildings and broadband connectionsLoans from the EBRD (€ 125 mil. for 2009-2010) aimed at enhancement of energy efficiencyand improvement of energy infrastructure from 2009.programme to support home renovationsBringing forward capital spending from 2010-11 (housing and regeneration investment)Increased energy efficiency obligations for energy suppliersNew/accelerated public spending on heating and energy efficiency in households at risk of fuelpoverty.Replacement of non-ecological heating by low-emission boilers using biomass and effectiveheat pumpsIncrease of the subsidised capacity of photovoltaic systems from 5KW to 20KW.

n/a€ 57 million€ 35 million€ 24 millionn/an/an/a€ 277.5 millionn/a€100 million€15 million€142.9 million€20 million€125 million€ 10 million€ 878 millionn/a€ 57 million€ 244 million(part of € 900million GISProgramme)

n/a2009-20132009-2013n/an/an/an/a2009-2010n/a200920092010-20142009-2011n/an/an/an/an/a2009-2012

UKCZ

CY

n/a

2007-2010

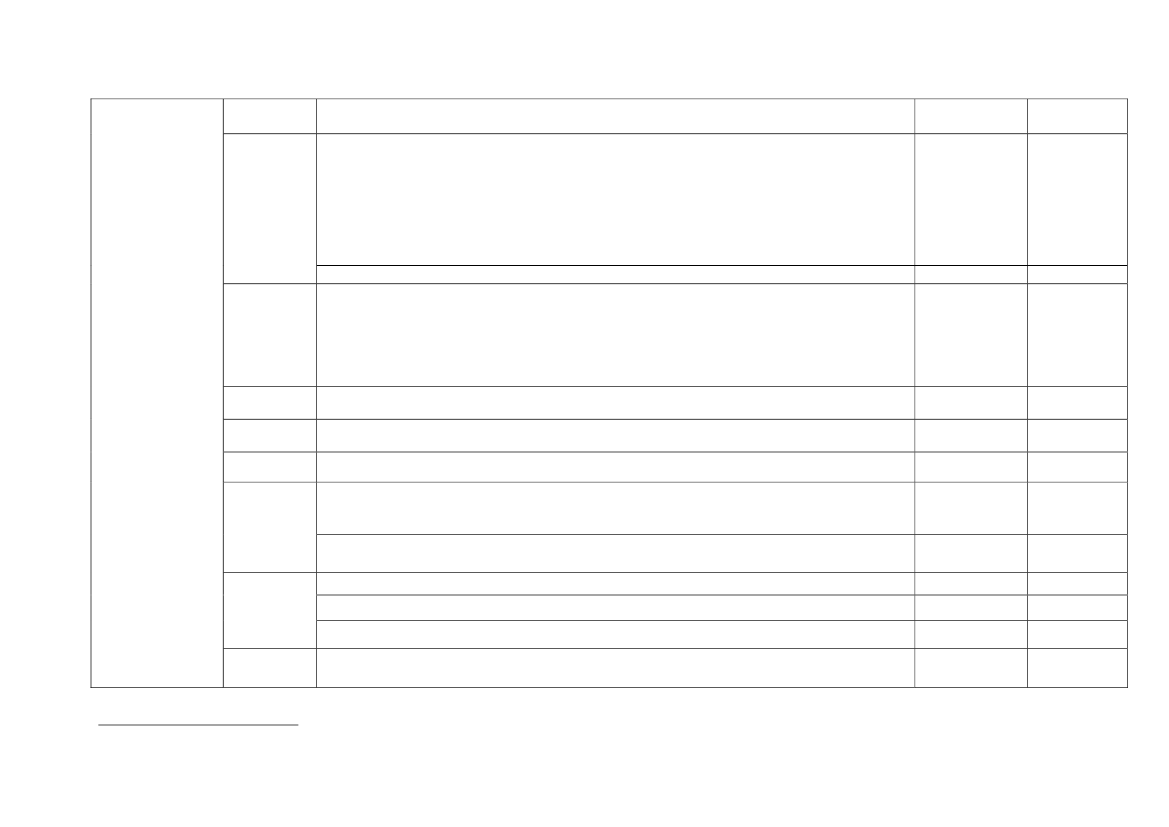

4

EE

To meet 30 percent of its energy needs with wind farms within the next decade.

n/a

2009-20192009-2013By 20122009-201120092009-20102009n/a2009-2025by 2030n/a2010-ongoingn/a2009- 2010n/a2009-20132009-2013n/an/an/an/a2009-2025

Investments in renewable energy development (incl alternative energy sources in transport) € 68 millionand protection of ambient air and mitigation of climate changeESFIRenewablesFRHUTo reach 20% share of renewable energy in total consumption (financed under energyefficiency measures).n/a

Energy subsidies - a major part of the funding will be directed to wind energy projects. The € 69 millionrest of the funding is allocated to promote use of other renewable energy sources and energyefficiency.Renewable energy investments by EDF€ 300 millionNew energies and durable development by SNCFSustainable development investments in solar energyInvestment in renewal energy sources (wind, solar, biomass and geothermal)New electricity transmission system to tap into renewable energy resourcesZero emissions corporate plan and a related long term investment budgetInvestment strategy to develop gas network and clean energy technologiesThe Strategic Infrastructure Act is to be amended, providing for a fast track consent process forinter alia major wind, wave and tidal energy projects on State foreshore. Foreseencommencement from January 2010.Development and commercialisation of ocean energy technologiesA feed-in tariff for solar thermodynamic energy€ 20 million€ 120 millionn/a€4 billion€22 billion€5 billionn/an/an/a

IE

ITLTLULVMT

To build 200 megawatts of renewable energy. Landowners with suitable sites for renewable n/aenergy sources will be able to get a large rebate to build.To increase and introduce the subventions in the domain of renewable energy for buildings.n/aDevelopment of Biomass Co-generation electro stationsPromotion of biogas productionRefunds to solar water heaters, photovoltaic cell systems and roof insulationScheme to invest in renewable energy generation/alternative sources of energyConstruction of offshore wind farmTax credit to photovoltaic cellsWind Energy at Sea (15 in 2010 and 160 in 2011 and 160 per year since 2011 till 2025)€ 24 million€ 20 millionn/an/an/an/a€ 2.255 billion

NL

5

Stimulation of biomass for advanced use in chemicals, materials and combustion for heat and € 346.1 millionpower and other measuresPLNational Environmental fund will elaborate new instruments to finance and co-finance € 250 millioninvestments in renewables. The fund will be fed by 250 million euro (coming mainly from carregistration tax revenues) (1bnPLN) by the mid of 2009. This action is expected to produceinvestment worth 250-800 M€ (1,5-2,5 bnPLN) boosting demand in construction sector at thesame time.Installation of solar panels and micro-generation units (mini-wind turbines).Programme to support biomass and solar energy use in households€ 145 million€ 8 million

2009-2010n/a

RenewablesPTSK

2009n/a2009-2010n/a2009-2011

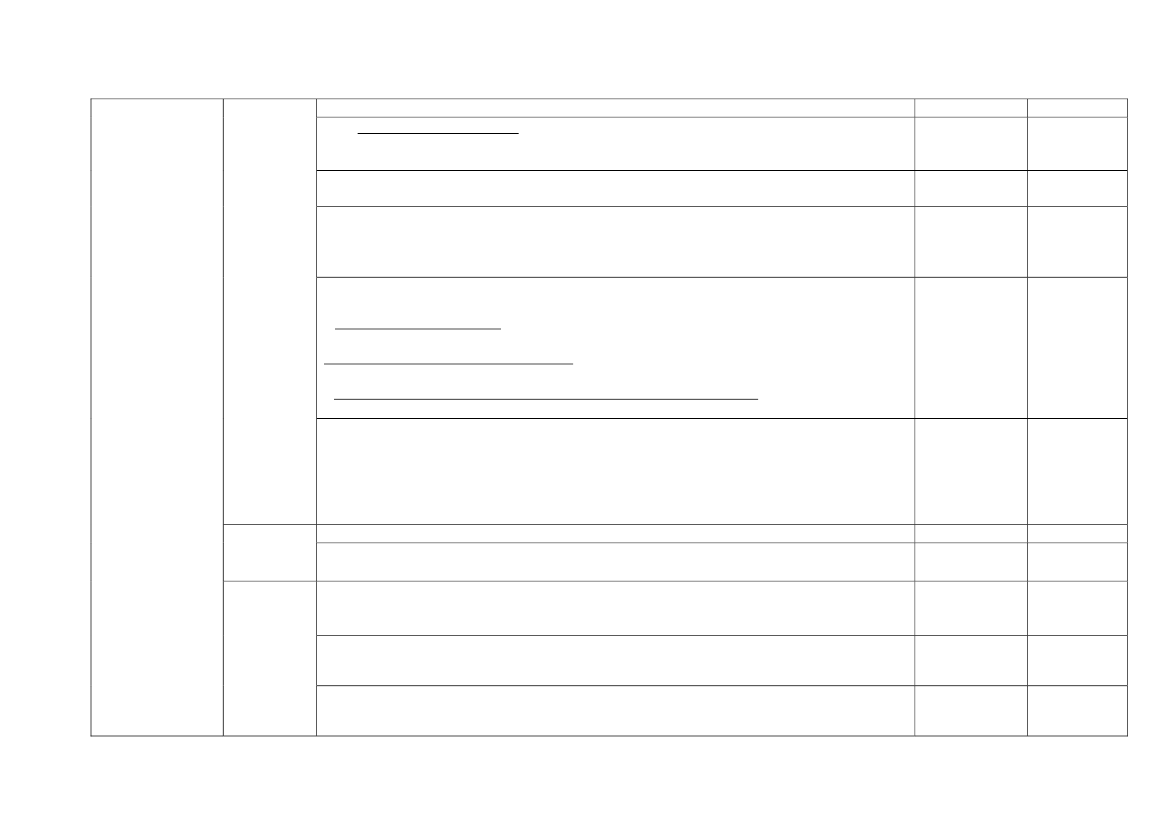

Review on uplift to the renewables obligations in order to secure appropriate returns to wind € 3,000 millioninvestment Offshore wind industry, in the current economic climateLending from the EIB for energy projects (there is a reference to renewables but not clearUp to € 4200millionwhether all projects are renewable ones)UKInvestment in anaerobic digestion technology, which converts food waste into energy. Five € 10 millionnew waste treatment plants using the technology were announced under the Defra AnaerobicDigestion Demonstration ProgrammeA renewable heat incentive to reward households and businesses that generate renewable n/aenergy on site.ATCZ€ 1.500 “eco-premium” (scrapping premium)€22.5 million

n/a

2009n/a

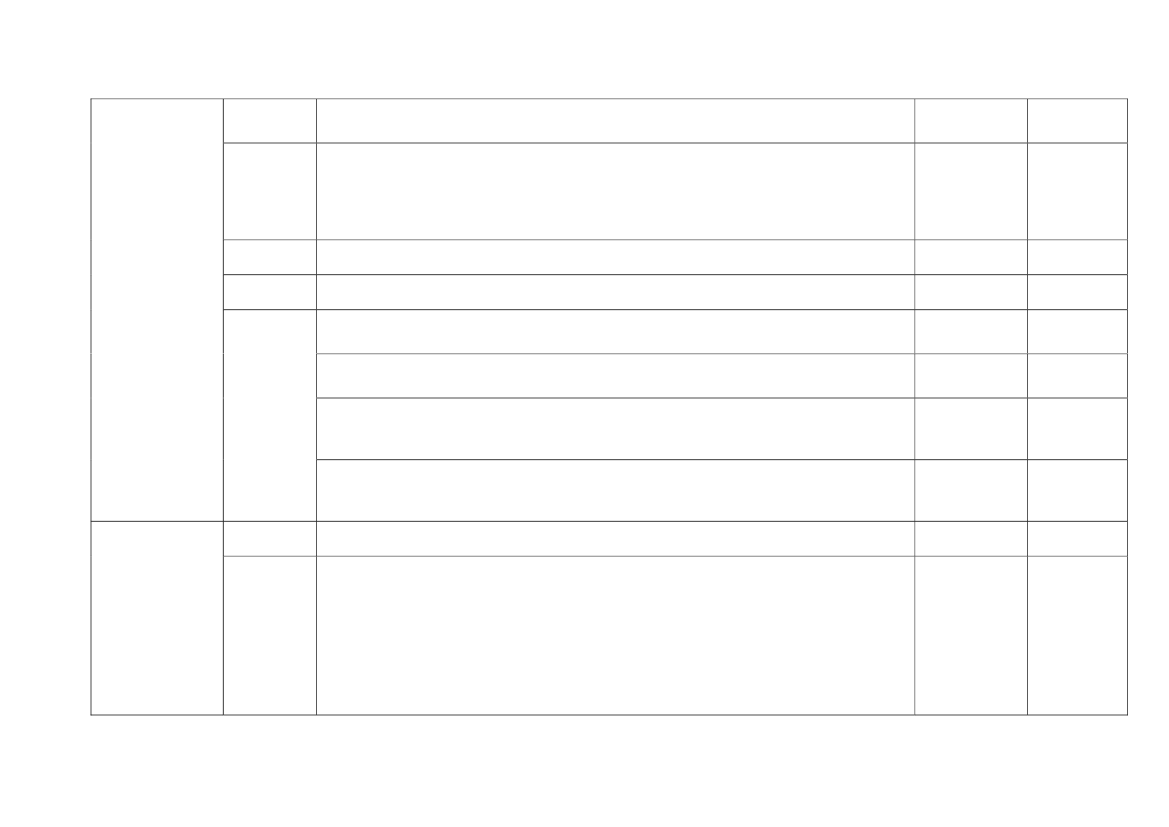

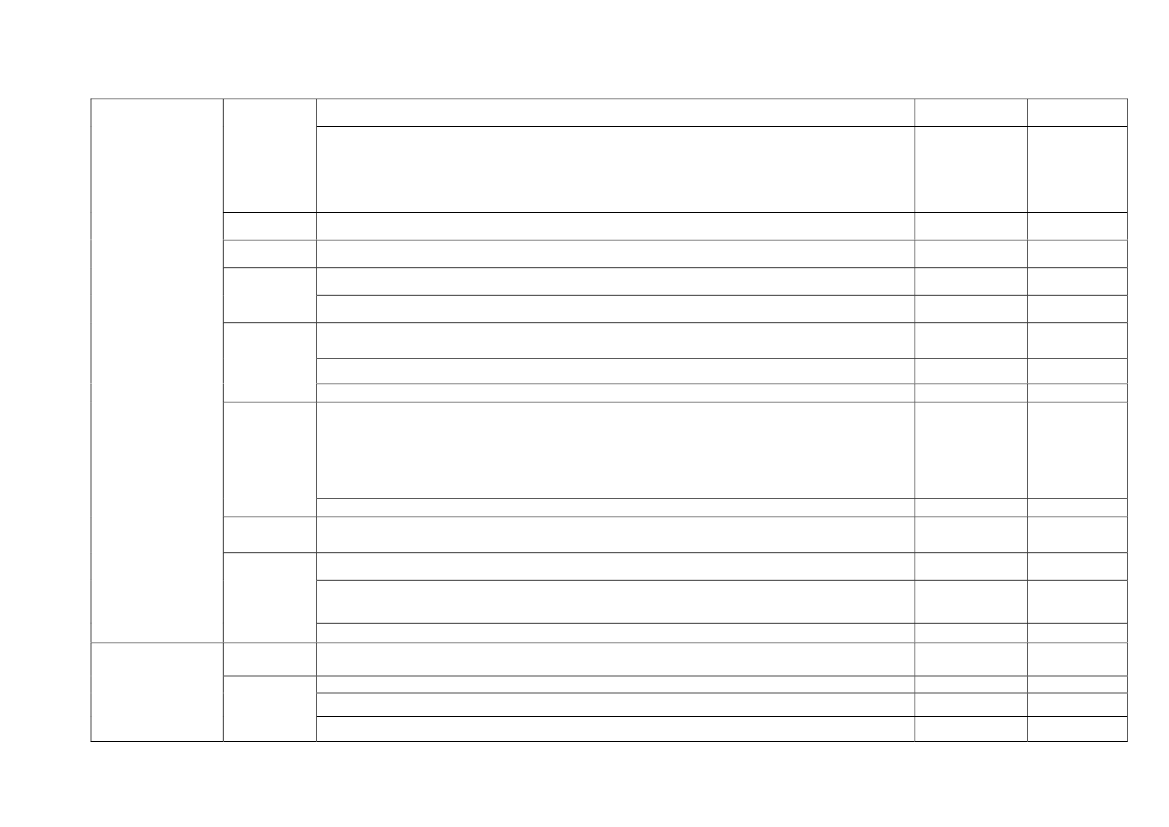

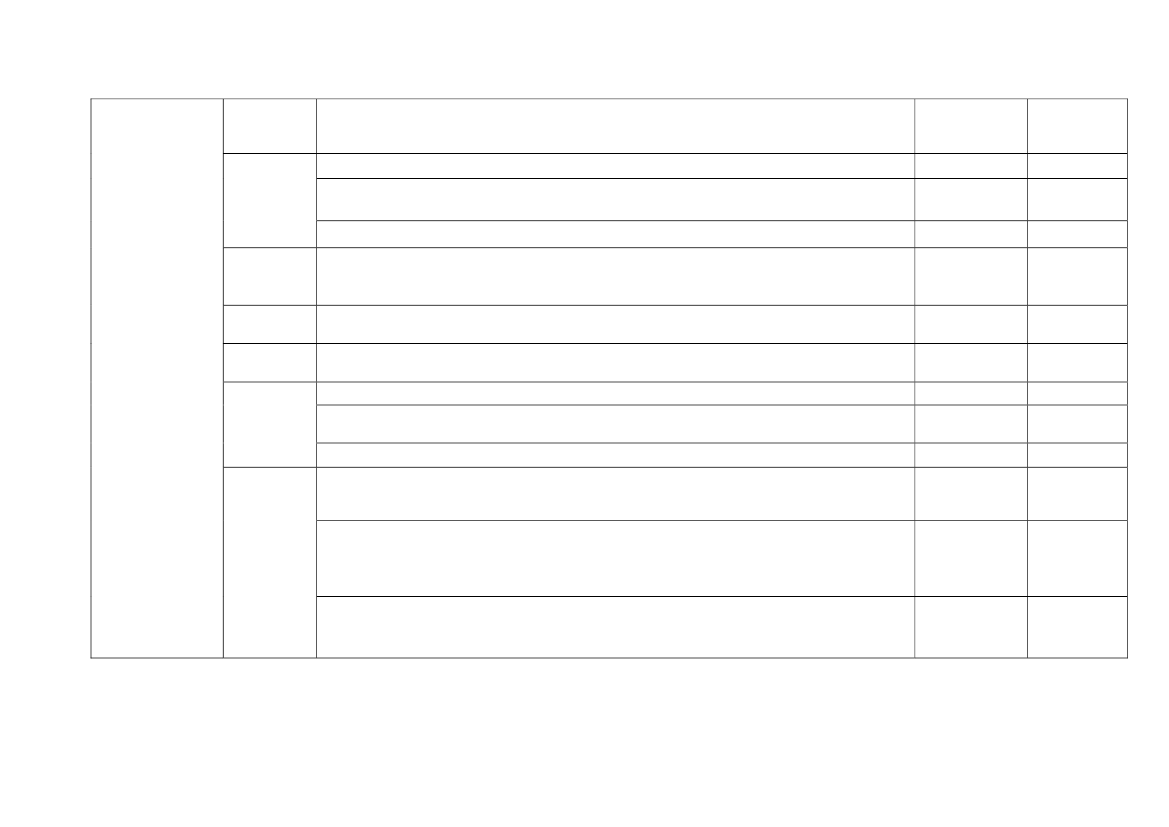

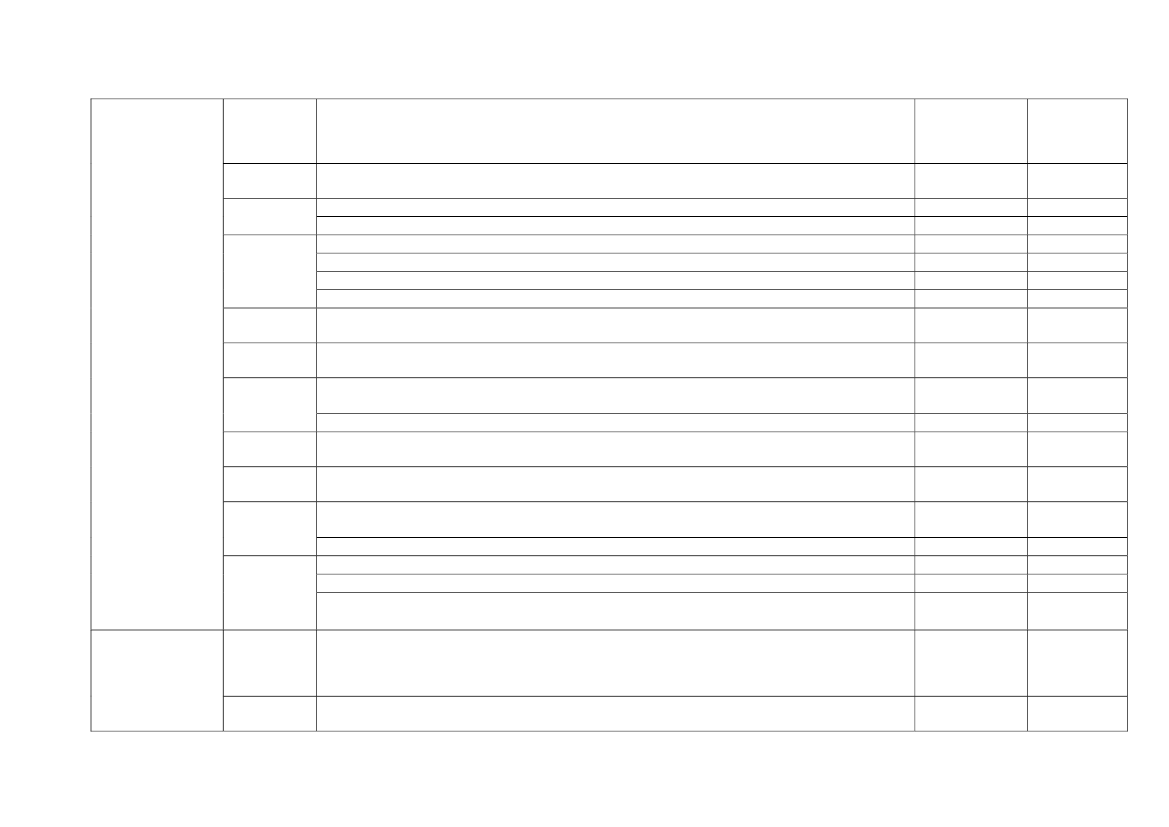

Car scrapping

A state subsidy for citizens (not for enterprises) when buying an ecological car and scrapping a n/acar more than 10 years old at the same time. The new car should either fulfilling EURO 4 (orhigher EURO), with combined CO2 emissions lower than 160 g per km and its price is lowerthan 500 000 CZK (the subsidy is then 30 000 CZK), or the price of the new car is lower than700 000 CZK and the car is fulfilling one of the following: 1. it is using only an electric drive,2. it is a hybrid using electric drive combined with a combustion engine, 3. it uses CNG engine(the subsidy is 60 000 CZK. Approved by the lower chamber of the Parliament in May 2009(the legislative process not yet completed); expected time-frame - 2009-2010. Details shall bestated in a government decree.

6

DEESFRIT

Tax breaks on purchase of new more environment-friendly for 2009 and 2010.An environmental bonus for scrapping a car more than 9 years oldInterest –free loan up to €10,000 for scrapping a car more than 10 years old and more than25,000 km mileage€ 1000for car older than 10 years, new car with less than 160 gCO2/km or light utility vans

Up to €5000million€1200 million€ 220 million

20092009-20102009-20102009

Car scrappingLUMT

€ 1,500-3,000 "eco-premium" for purchase of a Euro 4-5 car (below 130 gCO2/Km if diesel, n/abelow 140 if gas) and at the same time scrapping of vehicle older than 10 years; € 2,500-6,500"eco-premium" for purchase of new LCVs if at the same time scrapping Euro 0-1-2 LCVregistered before 31stDecember 1999 , . A bonus of 1.500 Euro for the purchase of anecologic car (methane/ electric/ hydrogen) without scrapping. Ecologic cars with particularlylow CO2 emissions can reach a bonus of 3.500 Euro, and up to 4.000 Euro for the purchase(without scrapping) of innovative new vehicles (methane/electric/hydrogen). Incentives can becumulated with scrappingGovernmental subventions for the green consumption: "Prime à la casse" bonus €35 million(€ 1,500-1,750) when scrapping a car more than 10 years oldcar scrapping scheme for purchase of smaller and cleaner cars (no details available)increase in incentives on the purchase of electric vehicles€ 65 millionn/a

n/an/an/a2009-201020092009n/a20092009 - 2012n/a

NLPTROSESKATBE

€ 750 - 1,750 for scrapping cars and vans older than 13 years (9 years for diesel), and € €80 millionpurchasing a newer vehicle (petrol cars produced after 1 January 2001, for vans – having a'soot filter')€ 1,000 "eco-premium" for scrapping cars older tan 10 years, and € 1,250 for cars older than n/a15 yearsApprox € 900 "eco-premium" for scrapping a car more than 10 years old€2 billionState loan guarantees for 'greening'.€ 1,000-1,500 "eco-premium" for cars older than 10 yearsRail infrastructureinvestment projects in public transport (metro, SNCB)€ 1.75 billion€ 33 million€699 million€ 500 million

7

CZDE

Rail infrastructureInnovation and investment programme for railways, and to maintain waterways.

€315 million2Part of € 2billion(this alsoincludesmaintenance andexpansion offederalhighways)

2009n/a

DK

Publictransport/infrastructureEEELESFI

Infrastructure improvement – among that measures to mitigate the noiseInvestment in rail infrastructure (investment includes roads, trams, railways (signals), bicycletrails etc. with focus on public transport). The policy also contains initiatives on green cartaxation, the main one being the introduction of road pricing throughout DK.

€3.5 billion

€ 12.5 million(possiblyincludesspending on allinfrastructure,not just rail)

2009-20102009-2020

Investments in public transport infrastructureThe extension of the existing metro lines, electric railway, tram lines. These projects are eitherprivate self-financed projects or PPP, for which engagement of public funds is minimum.Incentivise public transport and shift it (both personal and commercial) from roads to rail

€ 12 millionn/a€ 4.717 million

2009-2013n/an/an/a20092009-20102009-20102009-20102012

FR

Launching 6 new transport projects, adjustment in the level of energy subsidies and some n/asmaller investments. On-budget authorisation €632mln; plus bringing forward some smallerinvestments.basic road maintenance - (improvements for the prerequisites of public transport, the€ 40.9 millionconstruction of pedestrian and bicycle paths and improving protection against noise)regeneration of railway network€ 72 millionacceleration and new railway construction projects€ 150 millionanticipation of future projects (land acquisition etc)€ 61 millionn/aElectricity interconnections

IE

2

a loan from the EIB is now being prepared8

IT

Railway infrastructure investments. New resources (€480 mln for each year of the 2009-2011period) allocated to ensure the necessary public-transport service by railInstallation of antiparticulate devices on public transport vehicles: financing of contributionsfor the installation of particulate emissions abatement devices by local public transportcompanies. 25% of cost is reimbursed with a maximum of 1.000 Euro per vehicle

€1,440 million€ 55 million(€ 44 millionof which to bedrawn fromhigher VATrevenue)

2009-2011

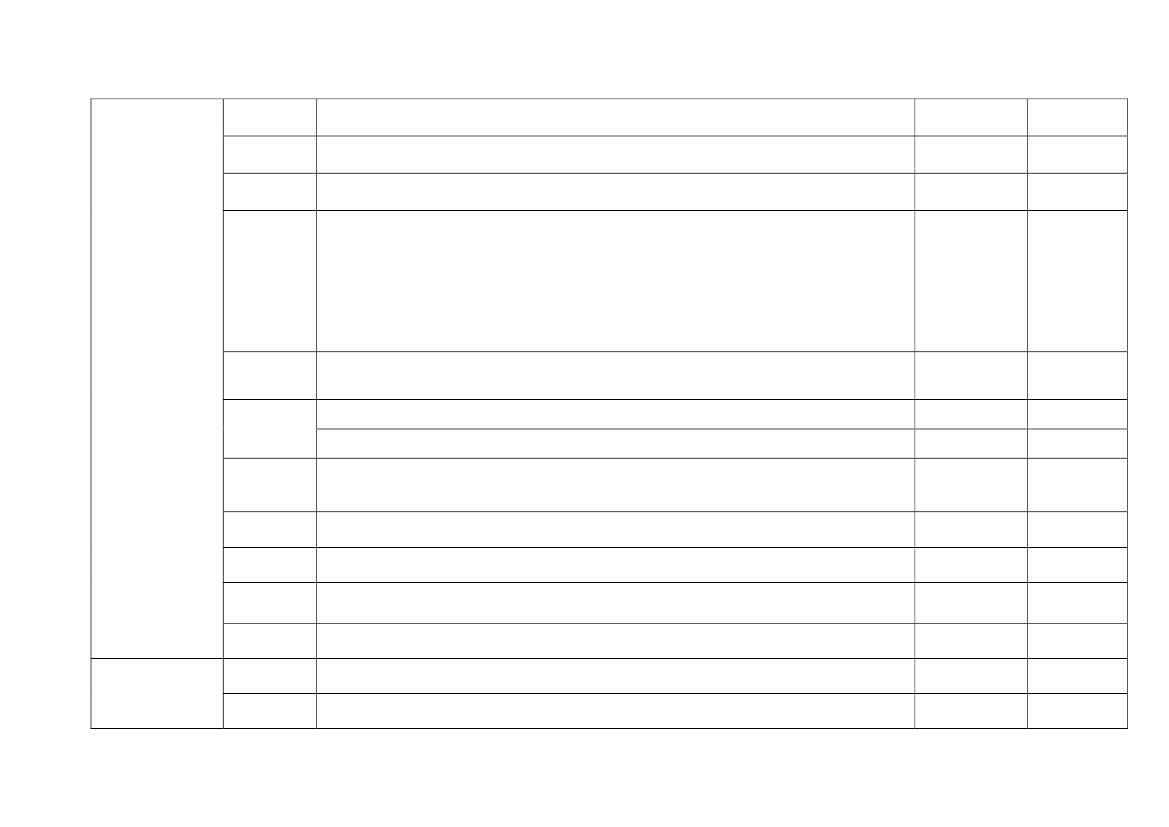

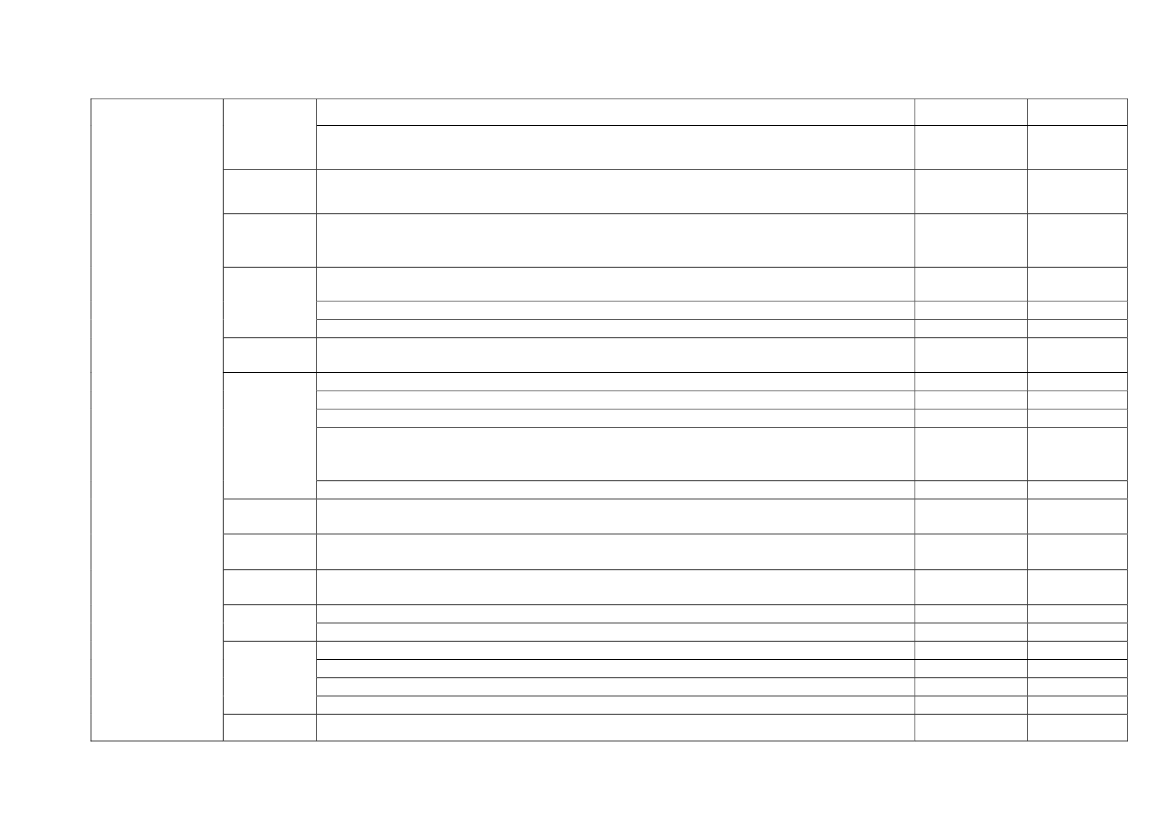

LTMTSEUKCZDEDKEEESEco-innovationand R&D

A cut from 80 percent to 60 percent of excise revenues generated from the sale of petrol, diesel n/afuel and energy products contributing to the Road Maintenance and Development Programme.bicycle grantn/a- Tightened the requirements for the share of environmental cars in public procurement.- All cars bought or leased from central government have to be environmental cars.Support for expansion of rail network capacityCapital spending on energy efficiency, rail transport, and adaptation measures.Investment in environment related R&DElectric vehicles (for research and development)Use of new technologies such as modern electrical cars and plug-in hybrid cars.Improvement of fuel efficiency.Investments in R&D and innovation of environmental technologiesHybrid and electric cars research and development supportn/a€ 315 million€ 600 million€25.9 million€ 500 millionn/a€ 13 million€ 800 million

n/an/an/a2009-2010n/a2007-20122009-20112009-20102009-2013n/a2008-20112009-20112009-20122009-2012

FIFR

Support for R&D in field of Health, energy and environment€ 490 million3Additional budget authority for the Finnish funding agency for technology and innovation € 15 million(TEKES)creation of fund 'demonstrateur' for ADEME (Agence de l'Environnement et de la Maîtrise de €400 millionl'Energie )(terrestrial mobility)clean car aid from PREDIT (National Programme for Experimental Research and Innovation €200 millionin terrestrial transport)

3

Distribution between those three fields is not defined9

IE

10% of Ireland’s road transport fleet to be electrically powered

n/a

by 20202009-2014

LVMTNL

Competence Centre Programme, which involves the establishment of industry groups to form € 7 millionresearch initiatives under the Competence Centres programme. The centres that have particular(for 2009)environmental emphasis are: Composites Competence Centre, Innovation for Ireland’s EnergyEfficiency, BioEnergy and BioRefinery Competence Centre and Innovation Value InstituteConsortium Competence Centre.Promotion of eco technologies and eco-innovations€ 558 millionscheme for industry on eco-innovationinvestment in energy innovationelectric car development (65 m by gvmnt and the rest with help of local authorities)n/a€ 103 million€ 400 million€ 32.3 million€ 83.3 million

2009-2013n/an/a2009-20112009-20112009-20112009-20092009

SE

To commercialize green technologiesTo support pilot and demonstration projects for second-generation biofuelsSupport for green investment in car industry (including EIB loans)

SI

€ 2664 millionSupport to the strategic projects in the field of clean and technologically advanced€ 100 million

industry: Priority fields for intensified investment in R&D are: environment andefficient use of energy, safety, comfort and new materials and technologies for the firstthree fields, including the investments in technological and non-technologicalinnovations.Funds to support R&D€ 98 millionreallocation of funds in the Operational Programme for the R&D to the energy and € 42 millionenvironmental sectorLow carbon technologies and manufacturing€ 670 millionLending which could be enabled, including EIB, to support investment in the automotive sectorUp to € 2300millionwhich includes contributing towards meeting environmental and energy efficiency targetsn/an/a2009-2011n/a2010-20142009-20112009-102009-102009-10

SKUK

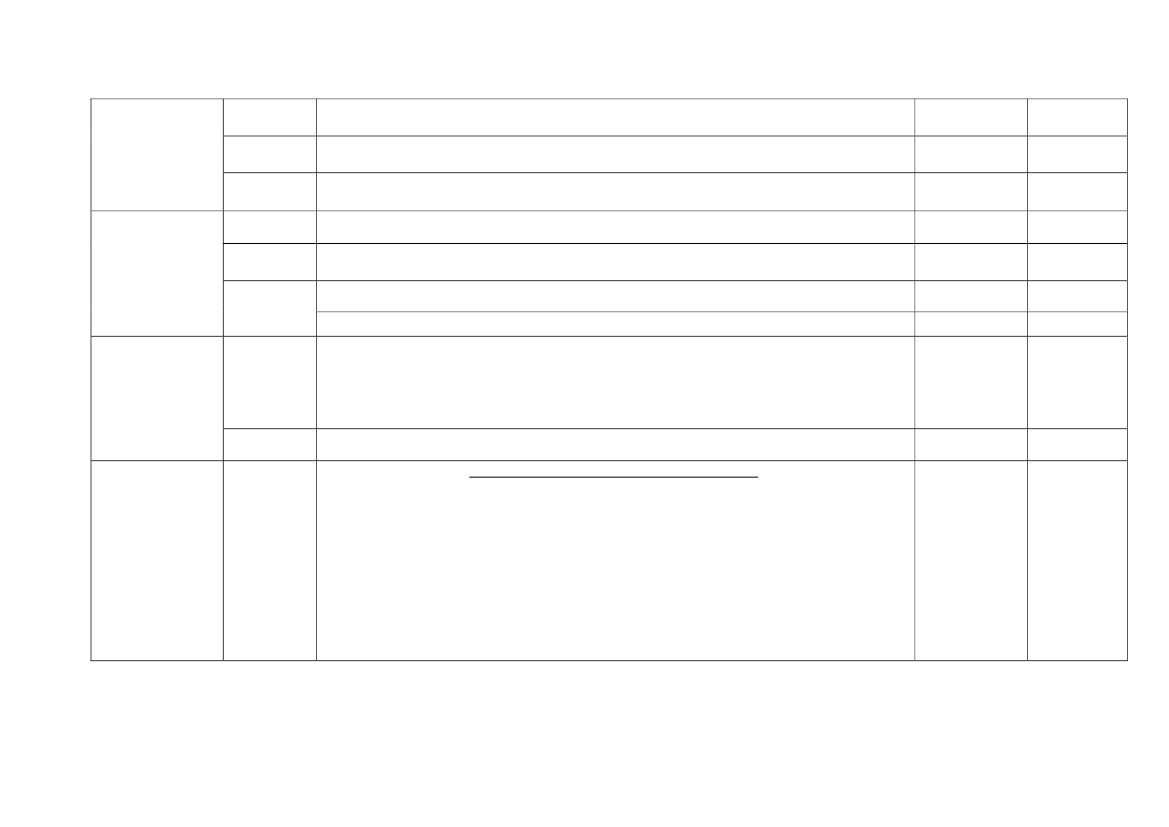

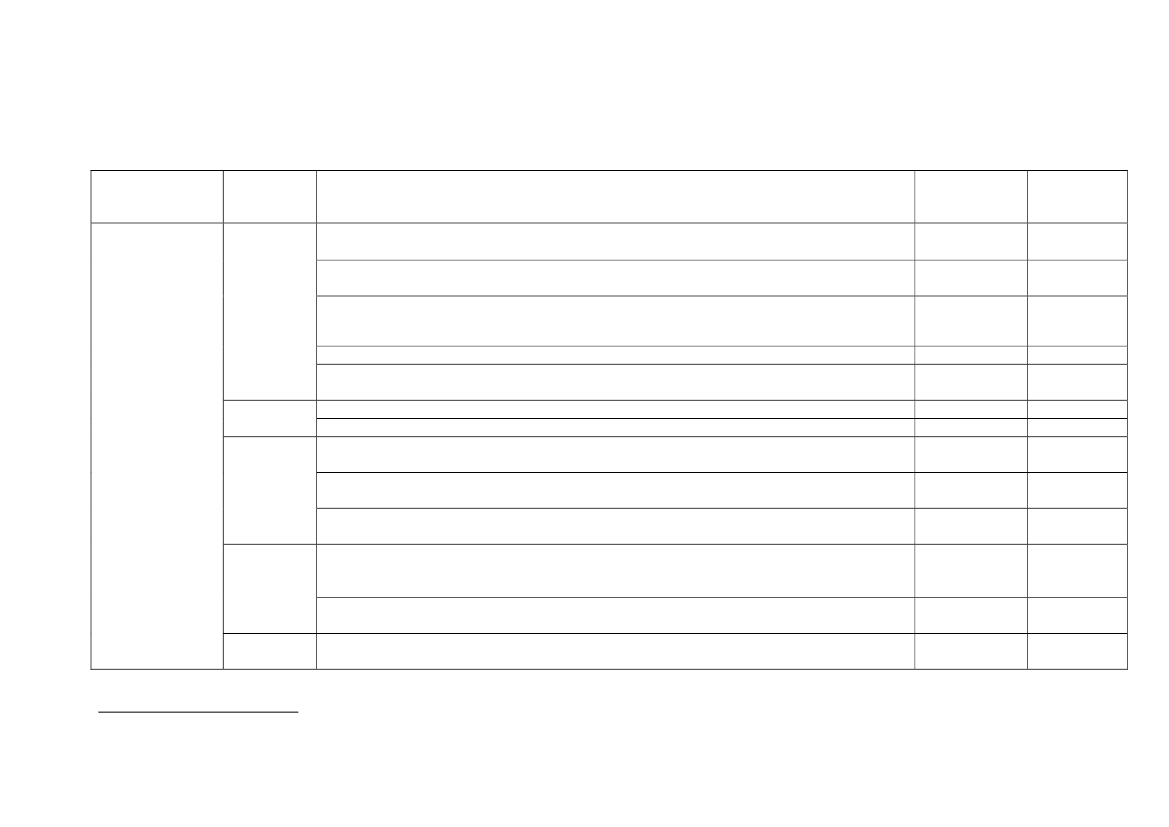

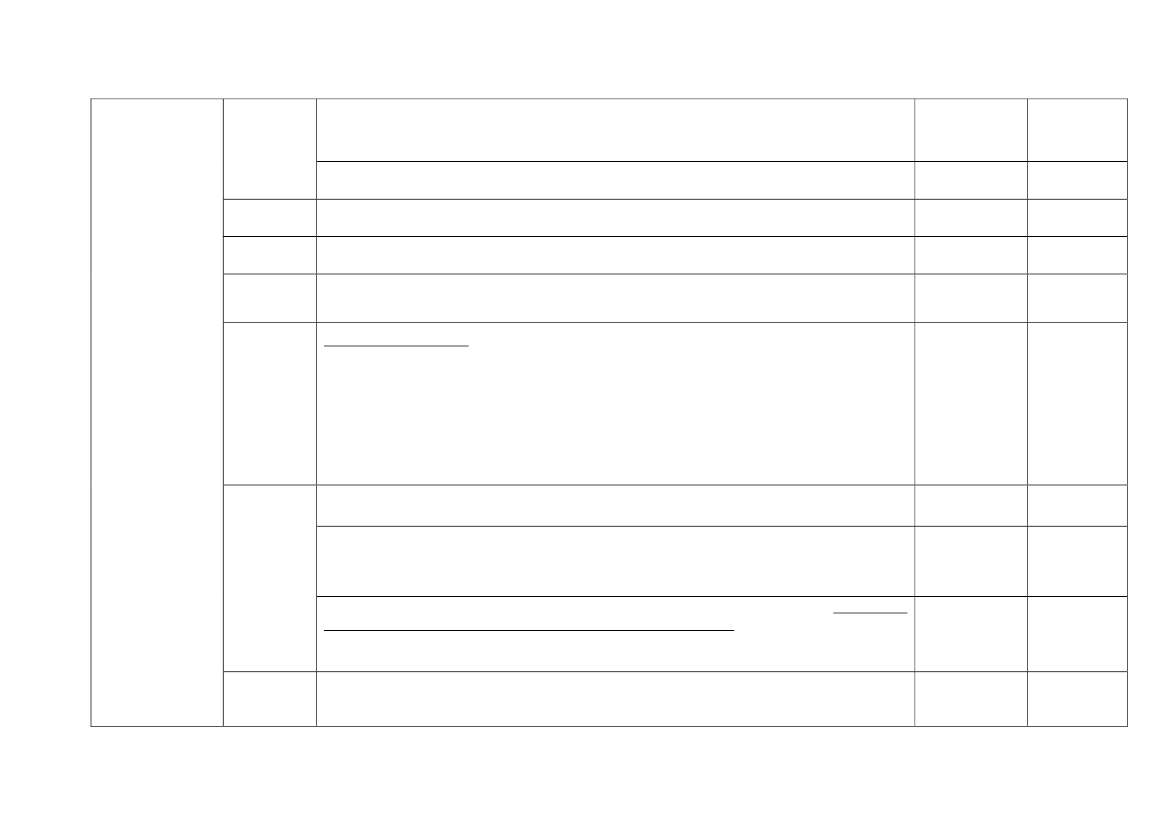

Water

FIFR

Financial support for ultra low carbon vehicles (development, manufacturer, purchase)water supply and sewerage projects + waste water projectsanticipation of maritime project (land acquisitions)maritime project and damn reconstructionwater, waste water and waste investments in Corsica

€ 265 million€ 19.2 million€ 20 mio€ 100 mio€ 20 mio

10

MTNLUKEEWaste recyclingFRMT

increase in yacht licences (maritime pollution control)New Delta programme, measures against rising sea levelinvestment on flood defences supporting 27,000 homes.Investments in reduction of waste generation, development of waste recyclingwater, waste water and waste investments in Corseconverting disused dump through a gas treatment plant installation projectinvestment in waste management infrastructure and water treatment

n/a€ 130million€ 23.3 million€ 40 millionListed above inwater-related

n/a2009-2010n/a2009-2013

n/a€ 8 million€ 7000 million

n/an/a2010-2015

DKNatureconservationMTIE

Green Growth plan combines environmental and climate protection, and nature conservationwith agricultural sector. The foreseen outcome: reduction of nitrate leaching with 19,000 tonsand of phosphor with 210 tons by 2015; reduction of pesticide load from 2.1 to 1.4 by 2013;reduction of GHG emissions from agriculture by 700,000 tons CO2 equiv. by 2020; up to75,000 ha increase in nature area by 2015. No information on concrete measures.New afforestation initiatives, management of protected sites

n/a

n/a2009-2014

Other

Ireland will establish a High-Level Action Group on Green Enterprise. The Group will report -to Government within four months, setting out an Action Plan for developing green enterprisein Ireland. This Action Plan will include a response to the policy recommendations of theForfás/Inter Trade Ireland report in the areas of:•development of skills through the education and training systems;•environmental research and development;•the role of public procurement;•environmental legislation;•incentives for developing the sector;•access to start-up and growth finance; andcollaborative business networks

11

IT

Incentive of 500 Euro for the purchase of a new motorcycle Euro 3 up to 400 cubic n/acentimetres, with contemporary scrapping of a motorbike or moped Euro 0-1.This one is not scrapping (should it be a new category?): The State contribution fortransforming gas engine cars towards low-environmental impact increases from 350 to 500 €(for Lpg) and from 500 to 600 € (for methane)Financial support for ultra low carbon vehicles€ 265 millionn/an/a

2009

UKIEGreenprocurementLVSEELGreen jobs

2010-201420092009-2013n/a2009-2013

Plans to introduce environmental considerations into the public procurement process in2009Promotion of green procurement

Intends to tighten the requirements for the share of environmental cars in publicn/aprocurement.Training programme for unemployed in “green jobs” combined with guaranteed employment € 94 millionof 30% of the trainees in “green jobs” in relevant places (in the field of sustainable growth,renewable energy, sustainable production of energy, management of outcast litter, HYTA(“Sanitary Legal Waste Disposal Sites”), re-establishment of landscape etc). Implemented 1stquarter 2009 in the framework of hte O.P. "Human Ressearch Development" 2007-2013 andtargeted at 7.000 unemployed.To support workers affected by the construction slowdown, including retraining in areas such To beas installation of sustainable technologies, environmentally sustainable building activities, and confirmedcompliance and regulatory work.Environmental initiatives such as installing energy-efficient insulation in the housingn/a

IEUK

2009-2014n/a

sector have already involved re-training and up-skilling.

Fiscal measures introduced by MSFiscalinstrumentsCZSupport to exporting activities of Czech firms (including green products), road tax exemptions n/afor environmentally friendly cars, environment related excise taxBroadening of VAT deductions on private vehicles. This measure is targeted at business 96 million €investment as it allows companies to buy personal cars with VAT deduction. It is also intendedto support car industry.Circulation taxes on motor vehicles will in future policy be linked to the emission of carbon n/adioxiden/an/an/a

DEFiscal

12

DK

Higher green taxes. The tax reform implies that income taxes are reduced by more€ 2.9 millionthan 28 billion DKK (1½ per cent of GDP), while taxes on pollution and energyconsumption are raised.Green Transportation Policy: also contains initiatives on green car taxation, the main one being n/athe introduction of road pricing throughout Denmark.Household tax deduction to boost repairs in household energy and other renovations, anincrease in energy renovation allowanceEco-loan at 0% for energy efficiency building renovations€ 83 mio8% extra tax to be collected from energy providers and traders for the next two years. The n/arevenue will allow funds for all panel buildings to introduce individual heating measurement.Environmental Taxes: A flat rate levy of €200 per annum on the provision of car parking n/aspaces in major urban areas was announced in Budget 2009. A tax incentive to promotecycling to work was also introduced in Budget 2009. Measures to further lower carbonemissions and to phase in on a revenue neutral basis appropriate fiscal measures including acarbon levy over the lifetime of the Government is being examined, and fiscal measures toprotect and enhance the environment are being investigated. Further appropriate modificationsof the motor tax system will be considered to encourage continuous improvements in theefficiency of the car fleet and to encourage a move from advanced plug-in hybrid vehicles tofull electric vehicles, as part of the wider review.55% income tax deduction for building restructuring is renewed. Works done in 2008 will be n/aspread over 3 years, from 2009 on over 5 years.In June 2008, the government had issued a decree introducing a 5.5 point surcharge on the n/acorporate tax, applicable to companies operating in research and exploitation of hydrocarbons,oil refining, production and sale of petrol, gas and similar products, and to production and saleof electricity ('Robin tax')Tax deductions (split over 5 years) are introduced for the purchase of furniture, high-energy n/aefficiency domestic electric appliances, televisions and computers; they must be connected todomestic restructuring works, with a 20% deduction of costs incurred, up to a maximum of10.000 EuroA cut from 80 percent to 60 percent of excise revenues generated from the sale of petrol, diesel n/afuel and energy products contributing to the account of the Road Maintenance andDevelopment Programme.

2010-11(2019?)2009-2020

FIFRHUIE

2009-20102009-2010n/a

IT

n/an/a

n/a

LT

n/a

13

LUMT

The motor vehicle tax on company cars, other than buses and taxis, used for the transport of n/aemployees is no longer deductible from corporate tax. These cars also benefit from a subsidyof € 750 if they emit less than 120g CO2/kmTax credit to photovoltaic cellsn/aIn 2009, a primarily CO2 emission-based registration tax has been introduced for vehicles in n/aMalta.eco-contribution on plastic bagsn/aincrease in green tax allowances for companies investing in sustainable production € 60 millionfacilities.(VAMIL/MIA). The tax allowance is given to companies that invest in technologiesthat are demonstrably at the top-end of sustainabilityIncrease in excise duties on fuel and others as April 2009n/aA tax credit for renovations, conversions and building maintenance (for households) was also n/aintroduced in January 2009Study on the introduction of “green tax reform”n/aIn 2008, the government increased the excise duties on unleaded petrol, diesel fuel with effect n/afrom January 2009Increase in investment allowance for agriculture and forestry activitiesn/aBetween 1 December 2008 and 31 December 2009, several reductions and exemptions apply. n/aIn particular, a reduced rate of VAT 5 % applies, for example to fuel and power, but also onthe installation of energy-saving materialsTax differentials between leaded and unleaded petrol have been increased and new n/adifferentials introduced between ultra-low sulphur and standard petrol and diesel. The fuelduty rates will increase in the coming years (by 1.84 pence per litre from April 2009 and by 0.5pence per litre above indexation in April 2010).From November 2009, the government will restructure the air passenger duty to a four- n/adistance band structure at 2 000 mile intervals from London with the aim of sending betterenvironmental signals. New rates will also be introduced

n/an/an/an/a2009-2010

NL

ROSESI

n/an/an/an/an/an/an/a

UK

n/a

Sources:1. National Recovery Plans2.ECFIN data

14

3. EREF Report (See list of references, section 7)4. HSBC Report (See list of references, section 7)5. Deutsche Bank GroupReport (See list of references, section 7)6.OECD Green growth: overcoming the crisis and beyond7. Taxation trends in the European Union, Data for the EU Member States and Norway, Eurostat 2009

15