Erhvervsudvalget 2009-10

ERU Alm.del Bilag 176

Offentligt

MEMORANDUMThe Danish FinancialSupervisory Authority andDanmarks Nationalbank

Danish Mortgage Credit and International RegulationProposals for quantitative liquidity standards are being consideredinternationally as part of the follow-up on the financial crisis. The DanishFinancial Supervisory Authority and Danmarks Nationalbank support theefforts to improve international regulation of the financial sector and findthat the proposal contains many positive elements and is a step in the rightdirection. The proposal also gives cause for concern, however.Danish mortgage credit is a key element of the Danish financial system.There is a risk that current deliberations concerning new internationalregulation may undermine parts of the system. These are primarily:1. A new definition of liquid assets that fails to allow for the fact thatDanish mortgage-credit bonds are just as liquid as manygovernment bonds.2. Liquidity requirements that make it impossible to maintain thepresent adjustable-rate loan model.3. A leverage restriction that does not take into account the collateralpledged for mortgage-credit loans.This memorandum describes the above three challenges in more detail. TheDanish Financial Supervisory Authority and Danmarks Nationalbank havepositions on other aspects of the proposal, but the focus here is on the abovethree.Danish mortgage creditThe Danish mortgage-credit system is of major significance to the entireDanish financial sector and thus also to financial stability in Denmark. Itssignificance can be illustrated by the fact that the market value of allmortgage-credit bonds is approximately kr. 2,300 billion. In comparison,Denmark's GDP is approximately kr. 1,700 billion. The market value of thebonds is thus approximately 1.4 times Denmark's GDP.The Danish mortgage-credit system is highly efficient and transparent.Borrowers pay the market rate on the mortgage-credit bonds plus a fee ofapproximately 0.5 percentage point to the mortgage-credit institute. Theyield spread between government bonds and mortgage-credit bonds isnormally limited as the real property pledged as collateral gives mortgage-

2/13

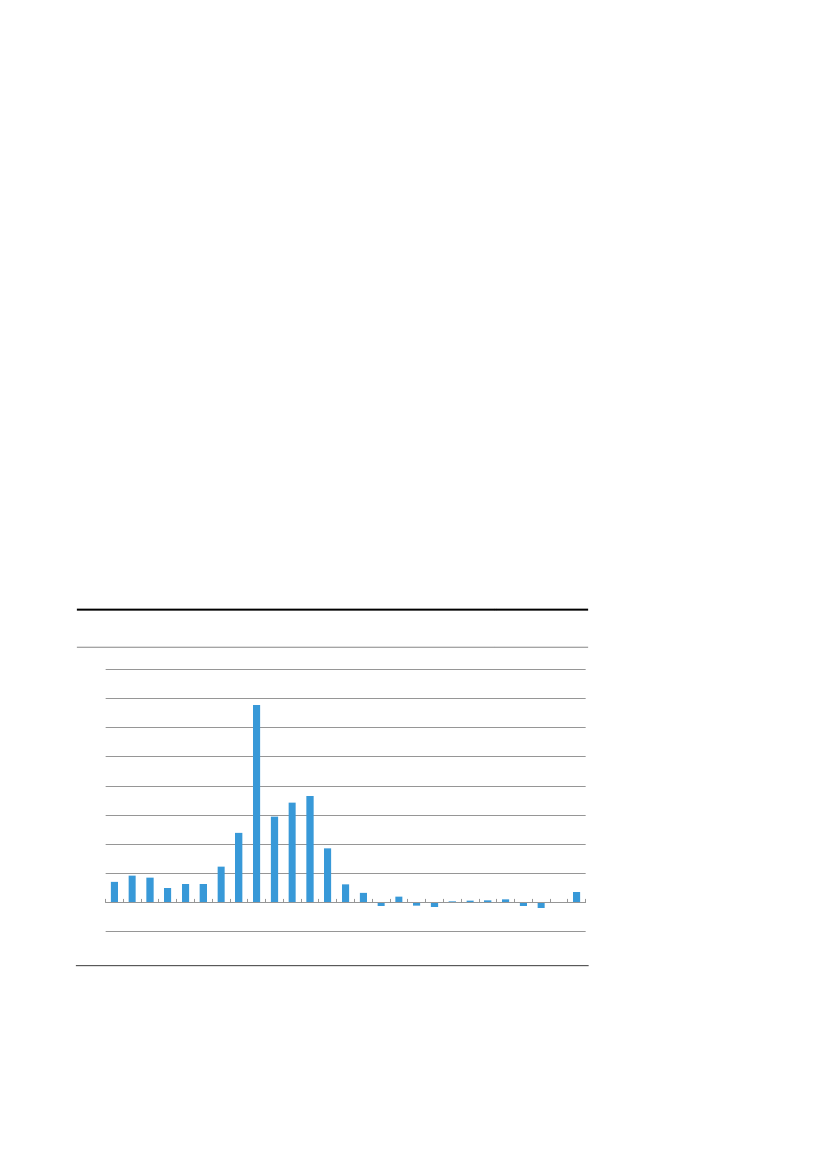

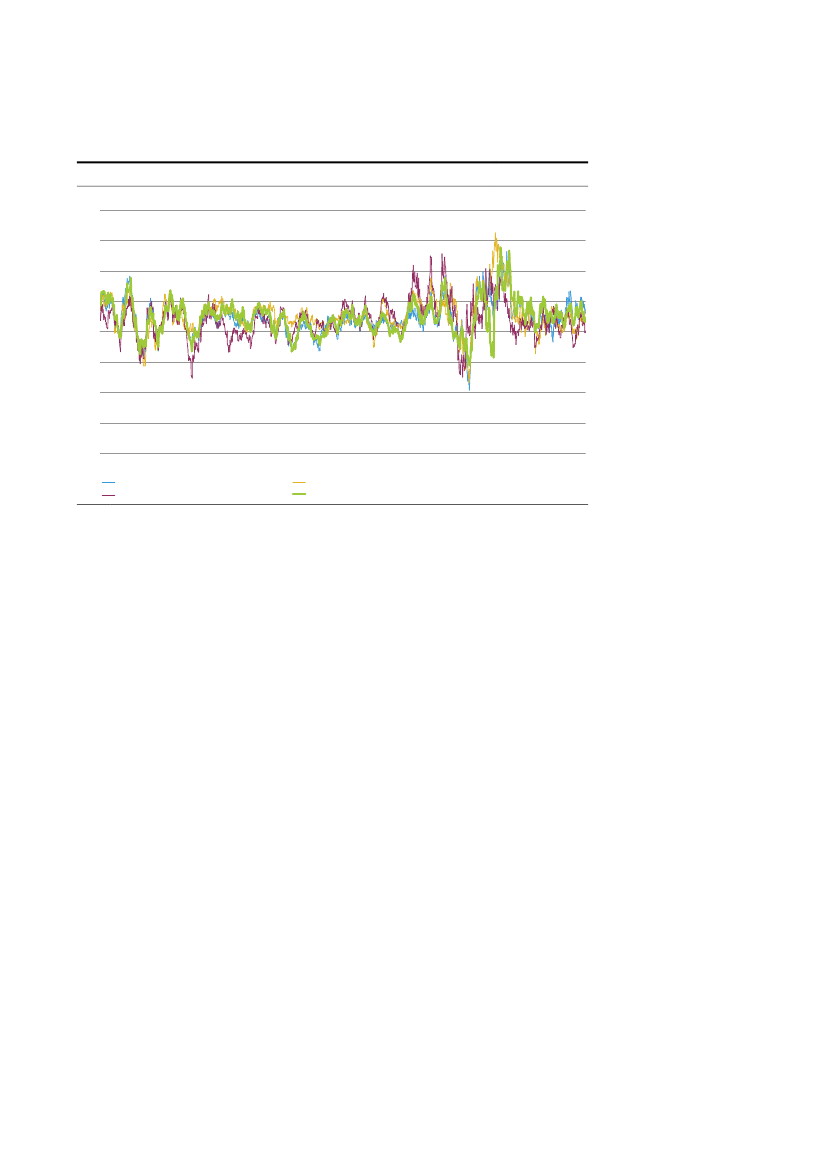

credit bonds a very high degree of security. During periods without marketturmoil the yield spread may be as low as 0.1 percentage point in e.g. the 2-year segment and 0.25 percentage point in the 5-year segment. This meansthat during such periods the overall borrowing rate will only be up to 0.75percentage point higher than the government-bond yield.From the investor's point of view it is a very secure product that has neverled to credit losses. In practice, the mortgage-credit institutes achieve thislevel of security by solely granting loans against real property as collateral,financed by issuing mortgage-credit bonds. Furthermore, the "balanceprinciple" limits the institutes' ability to assume risks other than credit risks.This ensures a close link between loans and bonds. Credit risk is limited byrestricting the extent to which the properties can be pledged as collateral andlaying down detailed rules on property valuation. In addition, bond investorshave priority in the event of failure, and borrowers are personally liable forthe loans. The lack of personal liability for the loans is a major explanatoryfactor behind the substantial losses on mortgage-credit loans in the USA.Finally, Denmark has a highly effective enforcement system.The above characteristics make the bonds particularly secure investmentswhile supporting Denmark's financial stability, cf. Chart 1, which shows theinstitutes' write-downs as a percentage of loans.WRITE-DOWNS AS A PERCENTAGE OF LOANS, MORTGAGE-CREDITINSTITUTESPer cent1.61.41.21.00.80.60.40.20.0-0.282 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08

Chart 1

The robustness of Danish mortgage credit can be illustrated by the fact thatit was possible to sell bonds for refinancing of adjustable-rate loans in theamount of approximately kr. 350 billion during the financial crisis, albeitwith a certain widening of the yield spread to government bonds. The

3/13

mortgage-credit institutes were able to do this without incurring highercosts, as the higher yield is passed on to the borrowers. For further details,1reference is made to an article inBIS Quarterly Review,March 2004 on theDanish mortgage market.International regulationBoth the Basel Committee and the EU are preparing proposals for newregulation to address some of the weaknesses revealed by the financialcrisis.As illustrated above, the mortgage-credit institutes are important to financialstability in Denmark. Substantial changes in the rules applying to "coveredbonds" – the European term for mortgage-credit bonds – and their use asliquidity instruments for the banks could have significant consequences, notonly for Danish mortgage-credit institutes, but also for Danish banks andDenmark as such.New definition of liquid assetsIn the liquidity area, the introduction of new strict definitions of liquid assetsis being considered. The proposal distinguishes between three types ofassets: 1) Fully liquid securities, including government bonds. 2) Corporatebonds and covered bonds, which may under certain circumstances beincluded in the stock of liquid assets. 3) Other securities, which may not beincluded. The assets under item 2 must not exceed 50 per cent of the overallstock and can be included at no more than 60 or 80 per cent of their marketvalue (40 or 20 per cent haircut).For corporate bonds and covered bonds to be included under item 2, theymust meet a number of requirements. A good many government bonds (e.g.low-rated government bonds) will not be able to meet those requirements,although they are immediately eligible for inclusion in the stock of liquidassets as a result of item 1.Since the breakdown between the first group of liquid assets and coveredbonds relates to the issuer, it does not take into account the liquidity of theasset concerned. Most Danish covered bonds are fully liquid securities asthey have remained liquid even during the financial crisis. Nevertheless,covered bonds can only be included as a limited share of the overall stockand at maximum 80 per cent of their value. The same applies to other groupsof securities that are not eligible for inclusion in the stock of liquid assetsdespite the fact that they are liquid.

1

Frankel, A, Gyntelberg, J, Kjeldsen, K and Persson, M (2004): The Danish mortgagemarket,BIS Quarterly Review,March, pp. 95-109

4/13

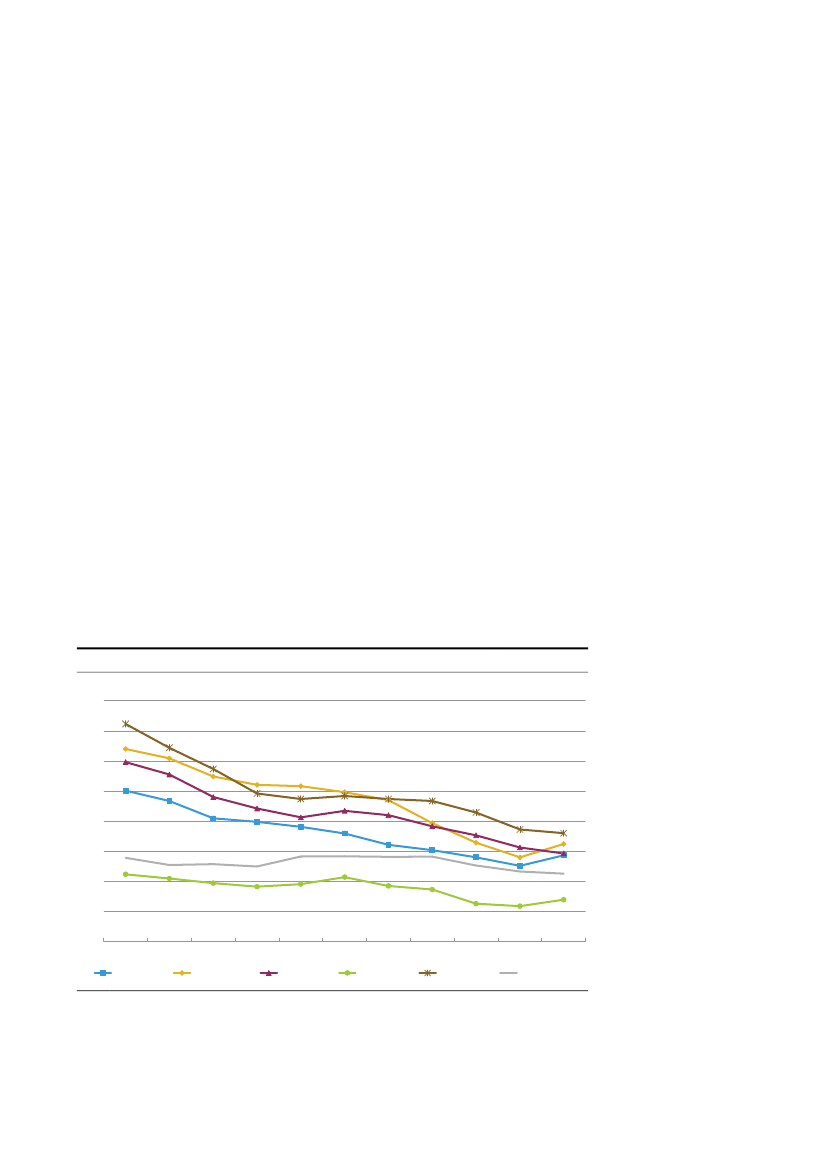

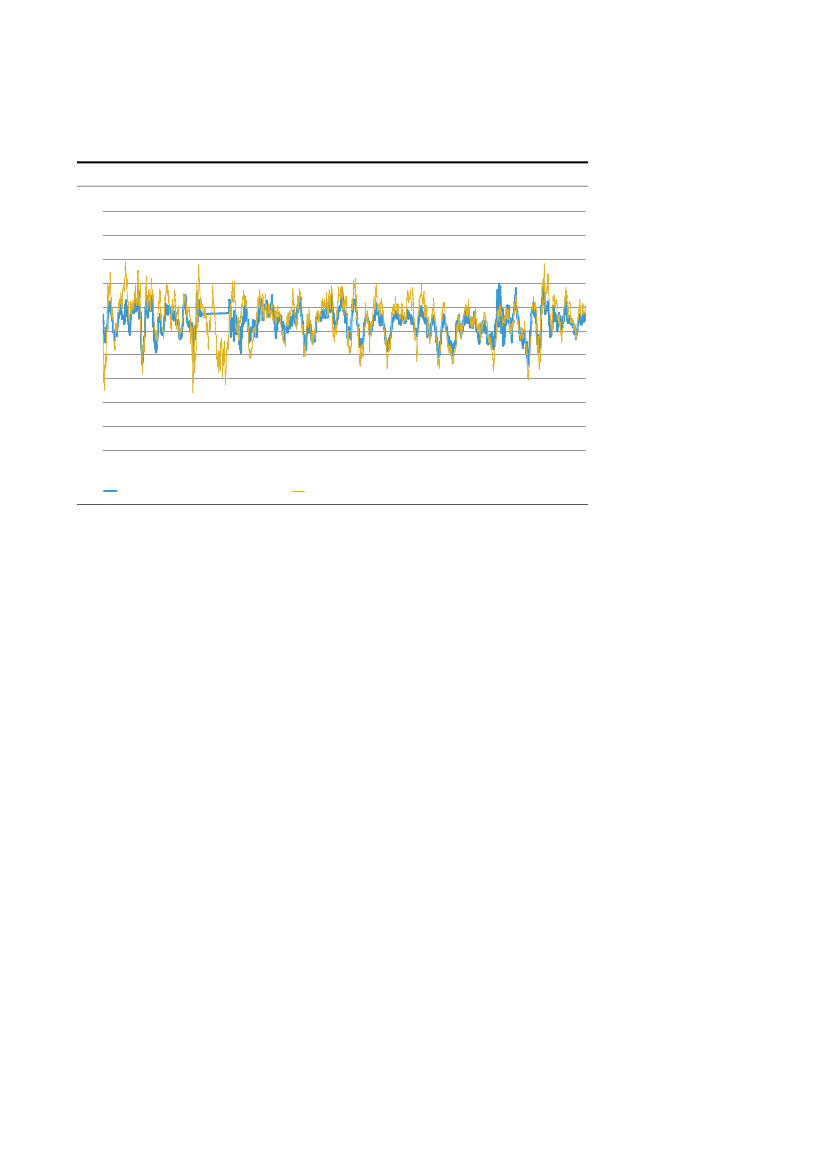

Danmarks Nationalbank includes mortgage-credit bonds in its collateral baseat a value reflecting the considerable liquidity of the securities. This wasalso the case before the crisis. Restricting the share of covered bonds thatcan be included in the stock of liquid assets and applying large haircuts maygive the institutes an incentive to pledge covered bonds as collateral toDanmarks Nationalbank rather than keeping the securities on their ownbooks, so that they can hold assets that can be fully included instead. Allother things being equal, this will make the institutes more dependent onDanmarks Nationalbank, which will be contrary to the object of the newrules.The proposed limits will also create problems for both banks and mortgage-credit institutes, which currently use covered bonds to a considerable extentin their liquidity management. It will be very difficult to replace Danishkrone-denominated covered bonds by krone-denominated governmentbonds. At present, the volume of circulating Danish government securitiesconstitutes only around one fourth of the circulation of covered bonds. Thisissue is particularly relevant if the liquidity requirement includes a currencymatch requirement.Other countries have also significantly reduced their government debt, cf.Chart 2. In such a situation with a limited supply of government bonds, adefinition of liquid assets that is too narrow may therefore have anundesirable impact on prices in the local markets.GOVERNMENT DEBT AS PERCENTAGES OF GDPPer cent807060504030201001998Canada19992000Denmark20012002Finland20032004Norw ay2005200620072008Sw edenSw it zerland

Chart 2

Note:Selected OECD countries.Source: OECD.

5/13

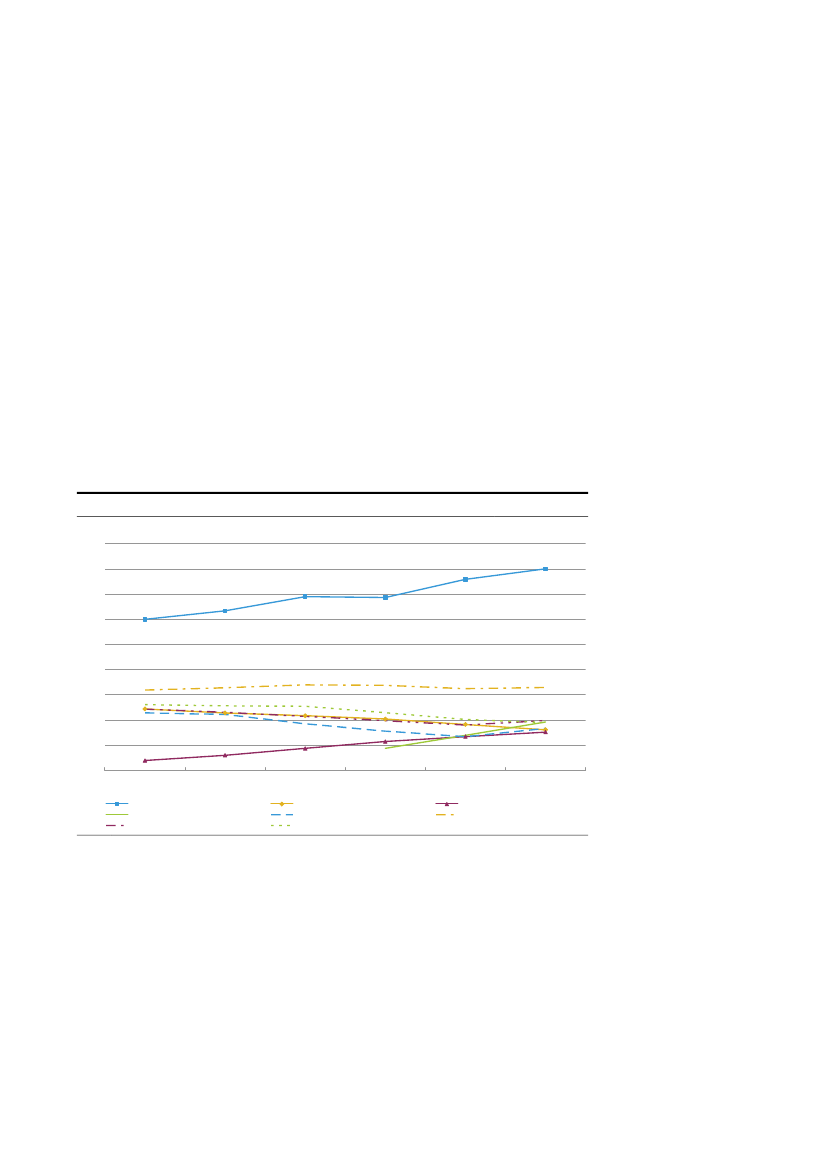

An alternative to the Basel proposal would be to base the assessment of allassets on their actual liquidity rather than whether they are governmentbonds or covered bonds. More specifically, this may entail that coveredbonds become eligible for inclusion in the first group if they have beenadmitted to trading on a regulated market, if the markets where they aretraded are of a considerable size, and if the markets have shown stablepricing (but not necessarily price stability) throughout the crisis. To theextent that it is necessary to make a distinction between securities withdiffering price stability, this can be done via the haircuts applied.Liquidity of Danish mortgage-credit bondsSeveral countries have a long-standing tradition for issuing covered bonds,and the outstanding volume of covered bonds is substantial compared togovernment debt, cf. Chart 3. In Denmark the volume of covered bonds ismore than 4.5 times as large as the government debt. Germany, Spain andSweden also have considerable volumes of covered bonds, however.GOVERNMENT DEBT AND COVERED BONDS AS PERCENTAGES OF GDPPer cent180160140120100806040200200320042005200620072008

Chart 3

Denmark - Covered BondsSw eden - Covered BondsSpain - Government debt

Germany - Covered BondsDenmark - Government debtSw eden - Government debt

Spain - Covered BondsGermany - Government debt

The data has been compiled on a comparable basis across countries, but it is not necessarily fully comparable with other Danishstatistics.Source: Eurostat and European Covered Bond Fact Book 2009.

Note:

In addition to the considerable size of the market, Danish covered bondshave a broad investor base. Table 1 shows the ownership distribution from2005 to 2009. As can be seen, the distribution is very stable over time.Although a tendency for foreign divestment of Danish covered bonds couldbe seen in 2008, the volume was only reduced from 14 to 11 per cent andwas offset by an increased ownership share for MFIs (monetary financialinstitutions), which hold around one third of the issued bonds. This verylarge MFI ownership share is also reflected in the fact that covered bonds

6/13

currently make up a considerable share of their liquid assets, cf. the sectionbelow on the liquidity of banks.

MORTGAGE-CREDIT ISSUE BY OWNERMFIs(excl.Non-financialowncorporations holdings )Otherfinancialinter-General Households,mediaries, Insuranceetc.and pension governmentetc.Unallocated

Table 1

Per cent

Abroad

20052006200720082009

................................6................................5................................5................................5................................5

3030313536

1313141111

2728272826

32223

65665

21122

1415141111

Note: Calculated on the basis of market values at year-end.Source: Danmarks Nationalbank.

The considerable volume and broad investor base support very stable pricingof Danish covered bonds. Chart 4 shows the 30-day price change (in percent) for an investment in a portfolio of non-callable covered bonds with aduration of two years compared with investments in two-year benchmarkgovernment securities in three Aaa-rated countries: Denmark, the UK andthe USA. It appears from the chart that in terms of prices the portfolio ofcovered bonds is just as stable an investment as Aaa-rated governmentsecurities. Accordingly, the negative return on the covered bond portfolioonly exceeded that on government bonds in the autumn of 2008. Even then,the loss measured over 30 days was smaller than the losses on governmentbonds seen in mid-2008.Chart 4 compares Danish covered bonds with government bonds from Aaa-rated countries. Government bonds are not required to be Aaa-rated in orderto be included in the banks' stock of liquid assets, however. A comparison ofDanish covered bonds with lower-rated government bonds will show thatDanish covered bonds are periodically amorestable investment in terms ofprices than such government bonds.

7/13

GOVERNMENT BONDS AND DANISH COVERED BONDSPer cent43210-1-2-3-42003200420052006200720082009

Chart 4

2010

Denmark government bondsUSA government bondsNote:

UK government bondsDenmark covered bonds

Return over 30 trading days. 2-year benchmark government bond. Covered bonds is a portfolio of non-callable bonds with aconstant duration of two years.Source: Nordea Analytics.

However, it is not only the pricing of short-term covered bonds that is verystable. Chart 5 shows the return over 30 days for investments in benchmarkDanish covered bonds with a remaining maturity of 10 and 30 years,respectively. According to the chart, the financial crisis has not resulted innegative returns of much more than 4 per cent, viewed over a 30-day period.This is much less than the benchmark price fluctuations of 10 per cent in theproposal. Despite the fact that the spread between covered bonds andgovernment securities has widened slightly during the financial crisis, thishas not resulted in negative returns that are larger in a historical perspectivethan previously observed based on general yield fluctuations. In the light ofthe price development, it is therefore difficult to see why covered bondsshould not be included in liquidity on an equal footing with governmentbonds.

8/13

DANISH COVERED BONDSPer cent1086420-2-4-6-8-101996199719981999 2000200120022003200420052006 200720082009

Chart 5

2010

10-year benchmark securit yNote:Return over 30 trading days.Source: Nordea Analytics.

30-year benchmark securit y

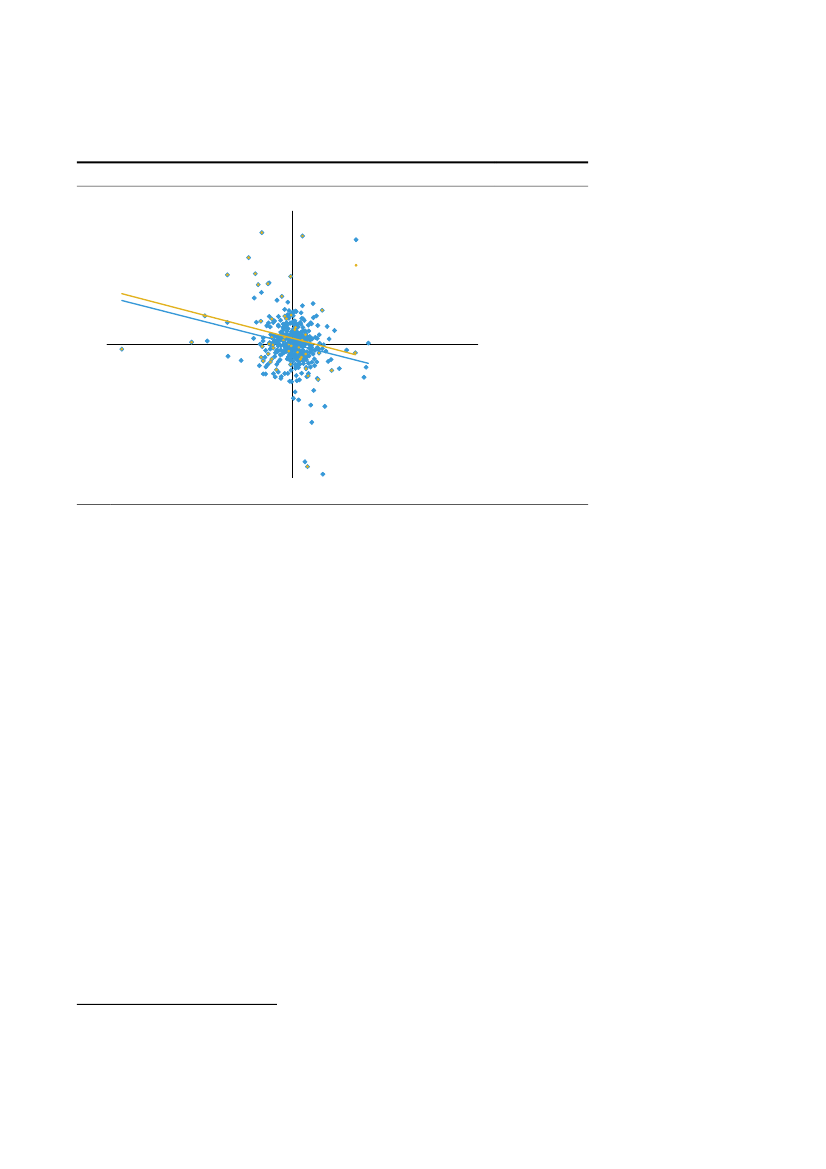

One argument against using covered bonds as liquidity on an equal footingwith government bonds might be that the return on the securities relative togovernment bonds is correlated with the market's confidence in the financialsector. If this is the case, the yield spread between covered bonds andgovernment bonds and the price development for financial corporationsmust be expected to be negatively correlated, i.e. falling prices will lead tohigher yield spreads.Chart 6 shows the weekly changes in the yield spread between a 10-yearDanish benchmark covered bond and a 10-year Danish government bond forthe period from mid-2001 to end-2009 and for 2008, respectively. The yieldspread changes are plotted against the weekly price changes for Danishfinancial shares. The chart indicates a weak tendency for the yield spread towiden in connection with a decline in the prices of financial shares. Thecoefficient of determination is very low, however.It is clear that the changes in the yield spread were greater in 2008 thanpreviously observed – particularly with regard to widening of the spread –which must be attributed to the financial crisis. Even during the peak of thefinancial turmoil, the correlation with the development in financial sharesremains weak, so there is no reason to restrict the use of covered bonds asliquidity against this background. Again, the yield spreads of certaingovernment bonds – measured relative to Germany – show a somewhatgreater correlation with the development in financial shares quoted in thecountry in question.

9/13

CORRELATION BETWEEN THE YIELD SPREAD AND FINANCIAL SHARESChange in yield spread, bps30Mid-2001 t o end 20092022008 (R = 5,8 pct .)

Chart 6

(R2= 5,2 pct .)

10

0

-10

-20Change in shareprices, per cent-30Note:

-30-20-100102030

Changes in yield spreads are weekly option-adjusted changes. Changes in share prices are weekly changes in an index offinancial shares in Denmark.Source: Nordea Analytics and Bloomberg.

As a general rule, Danish covered bonds are all admitted to trading atNASDAQ OMX Copenhagen and registered in VP Securities. This meansthey are eligible as collateral for loans from Danmarks Nationalbank and aretraded in large volumes in secondary markets (securities denominated ineuro and registered in VP Lux S.à r.l., VP Securities' subsidiary inLuxembourg, are also eligible as collateral for loans from the EuropeanCentral Bank).When covered bonds are pledged as collateral for loans from DanmarksNationalbank, the collateral value is calculated according to rules laid downby the European Central Bank. Covered bonds with a circulating volumeexceeding 1 billion euro or the equivalent amount in Danish kroner that arecomprised by the Danish Securities Dealers Association's market makerarrangement2and have at least three price quoters are placed in liquiditycategory 2, while the other covered bonds are placed in liquidity category 3,cf. Table 2. Compared with the haircuts used for covered bonds by theEuropean Central Bank and Danmarks Nationalbank, the proposal from theBasel Committee for a haircut of 20 per cent at a rating of minimum AAseems to be an extremely conservative approach.

2

The Danish Securities Dealers Association's market maker arrangement is a voluntaryarrangement between members of the Association for trading among themselves in anumber of mortgage-credit bonds.

10/13

HAIRCUTS FOR "COVERED BONDS" WITH A FIXED COUPON RATE AT DANMARKSNATIONALBANKRemaining maturityCategory 1Category 3

Table 2

0-1 year ..................................................................1-3 years .................................................................3-5 years .................................................................5-7 years .................................................................7-10 years ...............................................................> 10 years ...............................................................

1.0 pct.2.5 pct.3.5 pct.4.5 pct.5.5 pct.7.5 pct.

1.5 pct.3.0 pct.4.5 pct.5.5 pct.6.5 pct.9.0 pct.

Note: For eligible securities with a zero coupon rate, a floating coupun rate or an inverse floating rate, the haircuts appear from "Theimplementation of monetary policy in the euro area", ECB, November 2008.

When Danish covered bonds are pledged as collateral for loans in Danishkroner, no rating requirement is applied to the bonds. In practice, the bondswould be able to meet an exceedingly stringent rating requirement, however.The most important bond issuances from the three largest issuers have thusbeen given the highest possible rating by both Moody's and Standard &Poor's, while issuances from the other rated institutes have been given thesecond-highest rating by Moody's. A comparison of these ratings with thegovernment debt of various EU countries clearly shows that despite the factthat they are generally beginning to show a more conservative approach tocovered bonds, rating agencies continue to rate Danish covered bonds as aclass of assets with a very low credit risk.Consequences of the proposed change for the banks' liquidityThe liquidity requirements must also take into account the banks' ability toacquire a sufficient volume of assets that are defined as liquid. It wouldtherefore seem obvious that the most liquid covered bonds should be eligiblefor inclusion in the same group as government bonds. This would also allowfor the fact that in terms of credit risk and liquidity these bonds have morefeatures in common with government bonds than with corporate bonds.At end-2008, the banks' liquidity calculated according to national rulesamounted to kr. 940 billion. The Basel proposal restricts the definition ofliquidity. In the strictest interpretation of the proposal, where no types ofsecurities other than government bonds are eligible for inclusion in the stockof liquid assets, Danish banks will have "secure" liquidity of only kr. 174billion.The Basel proposal provides the option of including covered bonds andcorporate bonds in liquidity, albeit with a number of restrictions. They arenot allowed to make up more than 50 per cent of the overall stock of liquidassets. Considerable haircuts will be applied, and the bonds will have tomeet a number of requirements as regards market structures, bid-askspreads, etc.At end-2008, the banks' securities amounted to approximately kr. 900billion, cf. Table 3.

11/13

THE BANKS' HOLDINGS OF SECURITIES AT END-2008Kr. billion

Table 3

Mortgage-credit bonds ............................................Government bonds .................................................Other bonds ............................................................Bonds, total .............................................................Shares, etc. .............................................................

4437037088222

Assuming that mortgage-credit bonds meet the criteria for inclusion ascovered bonds, and that they must not exceed 50 per cent of stock of liquidassets, the overall stock will amount to kr. 348 billion, cf. Table 4.THE BANKS' STOCK OF LIQUID ASSETS, INCLUDING MORTGAGE-CREDIT BONDS, END-2008Table 4Kr. billion

"Secure" liquidity ..........................................................................Mortgage-credit bonds, including haircuts of 20 per cent ..............Total liquidity, max. 50 per cent mortgage-credit bonds ................

174354348

Hence, there seems to be a risk that the proposal will reduce the banks'liquidity from kr. 940 billion according to the existing local rules to justunder kr. 350 billion.The immediate conclusion is therefore that the banks will have to performextensive rebalancing, including portfolio restructuring from mortgage-credit bonds, etc. to government bonds, in order to comply with the Baselproposal.Requirement for stable funding – net stable funding ratioThe Basel proposal also operates with a requirement concerning fundingstability. According to the definition of stable funding, Danish coveredbonds with a remaining maturity of less than one year are not regarded asstable funding. At the same time, loans with a maturity of more than oneyear are subject to a 100 per cent stable funding requirement. This willcreate considerable problems in relation to Danish adjustable-rate loans thatare financed by short-term bonds.The same problem will occur – even without the stable funding requirement– in the last 30 days before the short-term bonds mature. The reason is that anew short-term liquidity coverage ratio is also being considered, whichwould require institutes to hold liquid assets that, as a minimum, match theirliquidity requirements over a 30-day horizon.

12/13

With regard to Danish mortgage-credit institutes, it should be noted that anyincreases in interest rates in connection with refinancing are borne by theborrower rather than the mortgage-credit institute. The Basel Committee'sliquidity target does not allow for the fact that this reduces the refinancingrisk.Leverage restrictionFinally, it should be noted that placing a restriction on leverage – totalactivities as a ratio of equity – is currently being considered. This is to bedone by introducing a leverage ratio as an actual capital requirement. Unlikethe usual capital requirement, such a leverage ratio would disregard whetherthe loans granted by the institute are good or bad. Particularly for the Danishmortgage-credit institutes, which are characterised by a very low credit risk,a universal capital requirement that does not take into account the specificcircumstances of the institute may result in much higher levels that do notreflect the actual underlying, more limited risks of the mortgage-creditinstitutes.Assuming a capital requirement of 4 per cent of unweighted assets, theimmediate result would be much stricter capital requirements than today.For several institutes this would raise the capital requirement by 100-200 percent.Given the mortgage-credit institutes' existing capital base, such arequirement would result in the capital base of a few institutes no longerbeing sufficient. For other institutes it would lead to a substantial reductionof the existing excess cover.In view of the limited risk that mortgage-credit institutes are allowed toassume as a result of considerable restrictions on market and credit risk, aswell as the borrower's personal liability, etc., such a substantial leveragerestriction therefore seems unreasonable for mortgage-credit institutes.If the requirement is maintained, leaving it up to the supervisory authority todetermine such a target based on the specific history and risk profile of theindividual institute should be considered.Alternatively, it may be considered to set a reduced target for mortgage-credit institutes in the light of historical experience in the area – with nobond investors ever having suffered credit losses – e.g. a low minimumrequirement such as 2 per cent of the balance sheet/loan stock.As a negative consequence of a requirement of e.g. 4 per cent, the mortgage-credit institutes may choose more risky corporate loans over more secureretail mortgage loans. Having to hold so much equity capital might give theinstitutes an incentive to take on more risky and profitable business of this

13/13

nature in order to achieve a return on equity. This will not benefit thesecurity of covered bonds, and in view of the importance and volume ofcovered bonds in Denmark it may also ultimately have a negative impact onfinancial stability.An alternative consequence might be that the institutes increase thecontribution rates (corresponding to the interest-rate margin) and thus theborrowers' costs.Leverage ratios should therefore not constitute specific independent capitalrequirements. Instead, they should be included in the calculation of theinstitutes' capital (solvency) need, which should, obviously, be supervisedby the Financial Supervisory Authority.