Det Energipolitiske Udvalg 2009-10, Miljø- og Planlægningsudvalget 2009-10

EPU Alm.del Bilag 59, MPU Alm.del Bilag 123

Offentligt

World Energy Outlook 2009Copenhagen, 11 November 2009

� OECD/IEA - 2009

The contextThe worst economic slump since the 2ndWorld War & signs of

recovery –but how fast?An oil price collapse & then a rebound –rising marginal costs point to

higher prices in the longer term, but are current levels sustainable?A slump in energy investment due to the financial & economic crisis –

will it bounce back quickly enough to avert a supply squeeze later?Difficult negotiations on a post-2012 climate deal leading up to

Copenhagen– what is needed to avert catastrophic climate change?

� OECD/IEA - 2009

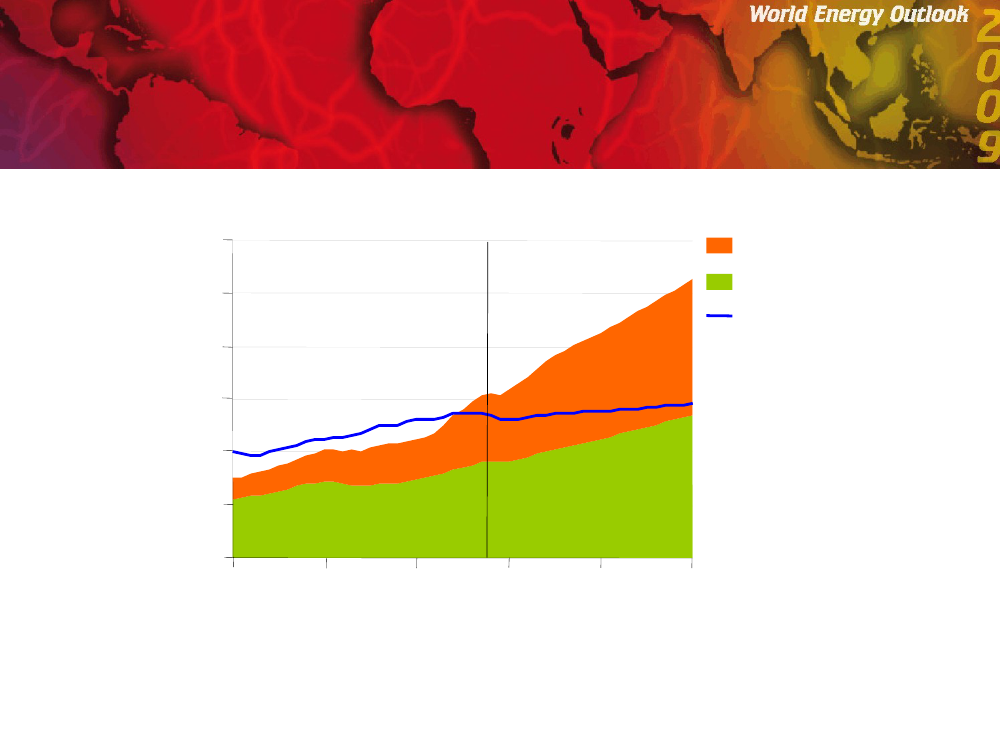

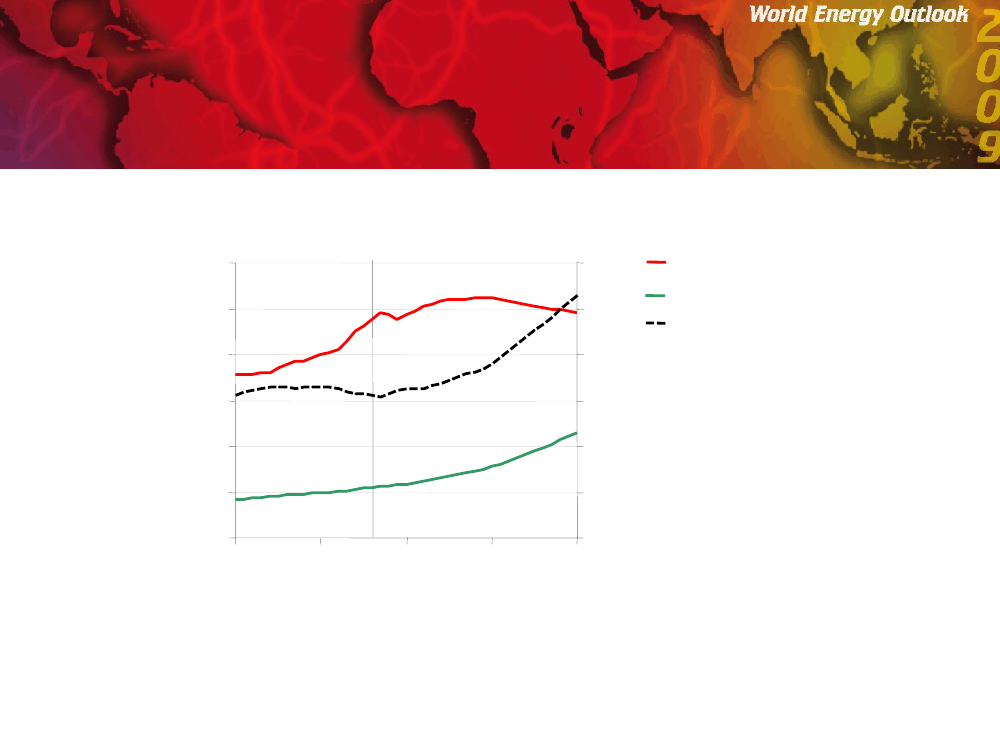

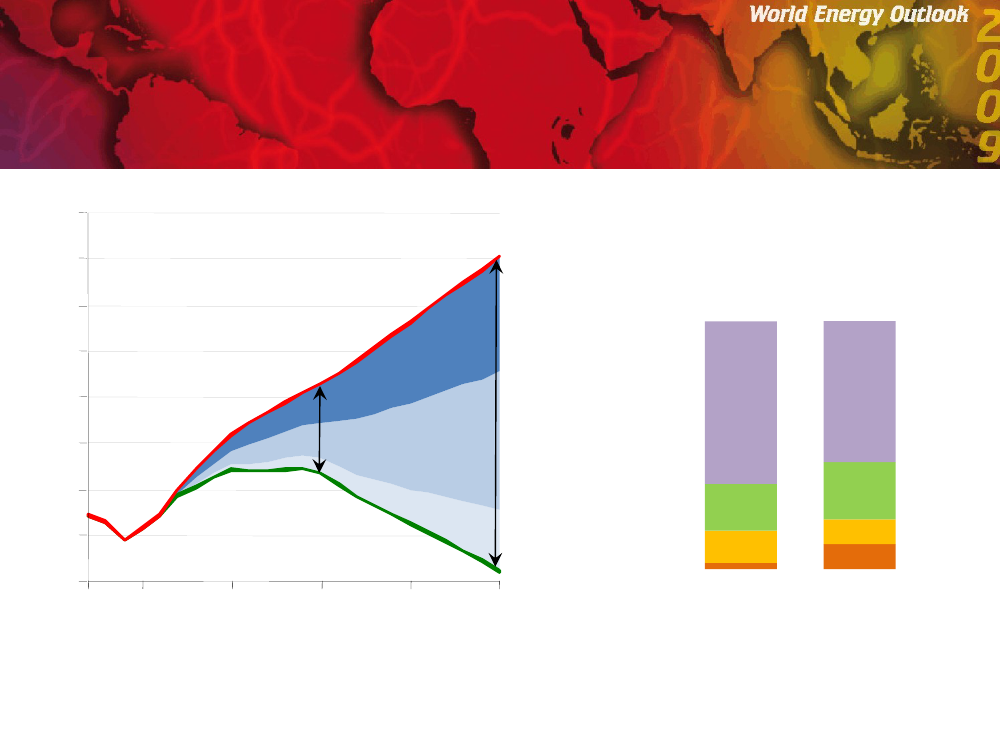

World primary energy demandin the Reference ScenarioMtoe12 00010 0008 0006 0004 0002 00001980China and IndiaRest of non-OECD

OECD

1990

2000

2010

2020

2030

Non-OECD countries account for 93% of the increase in global demandbetween 2007 & 2030, driven largely by China & India� OECD/IEA - 2009

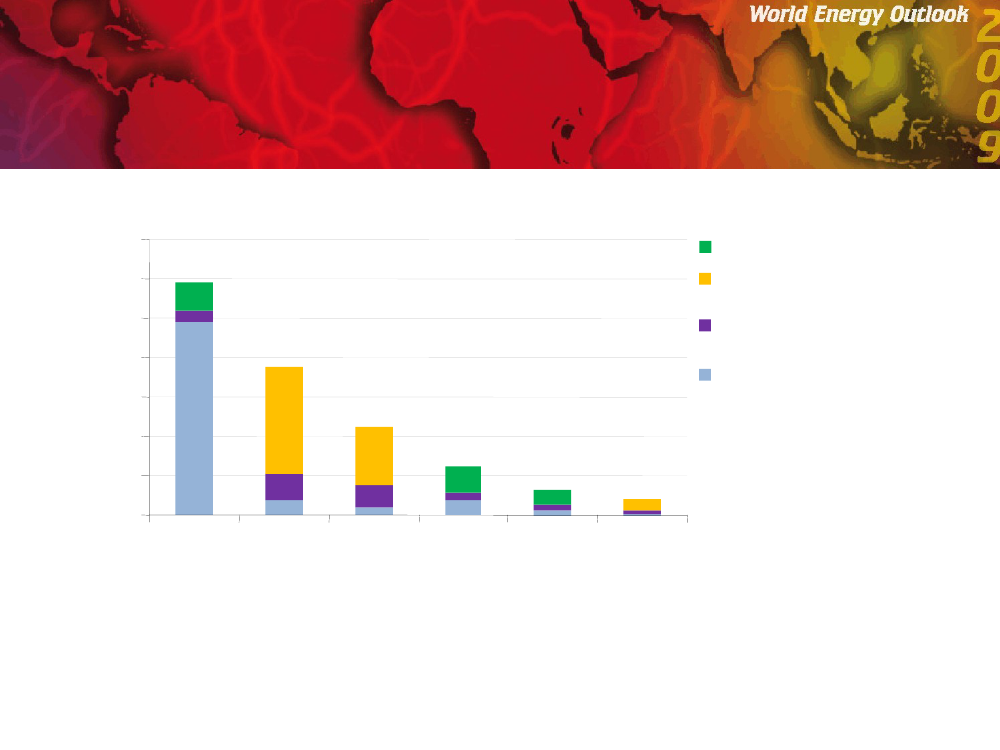

Change in primary energy demandin the Reference Scenario, 2007-20302007-

CoalOilGasNuclear

OECDNon-OECD

HydroBiomassOther renewables

- 500

0

500

1 000

1 500

2 000Mtoe

Fossil fuels account for 77% of the increase in world primary energy demand in 2007-2030,with oil demand rising from 85 mb/d in 2008 to 88 mb/d in 2015 & 105 mb/d in 2030� OECD/IEA - 2009

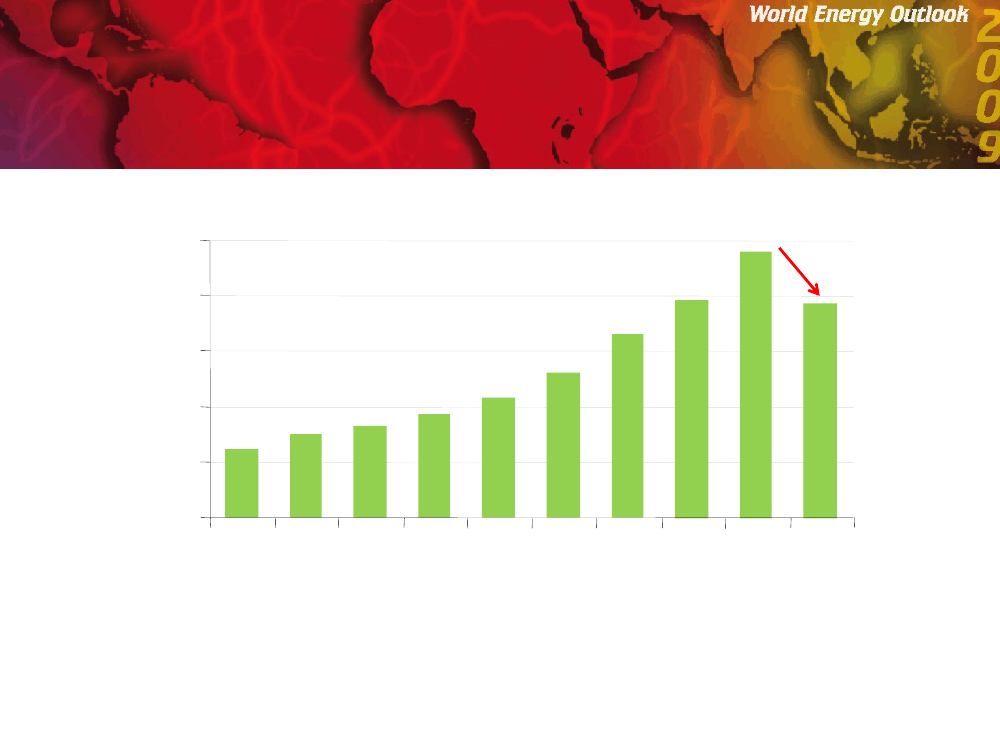

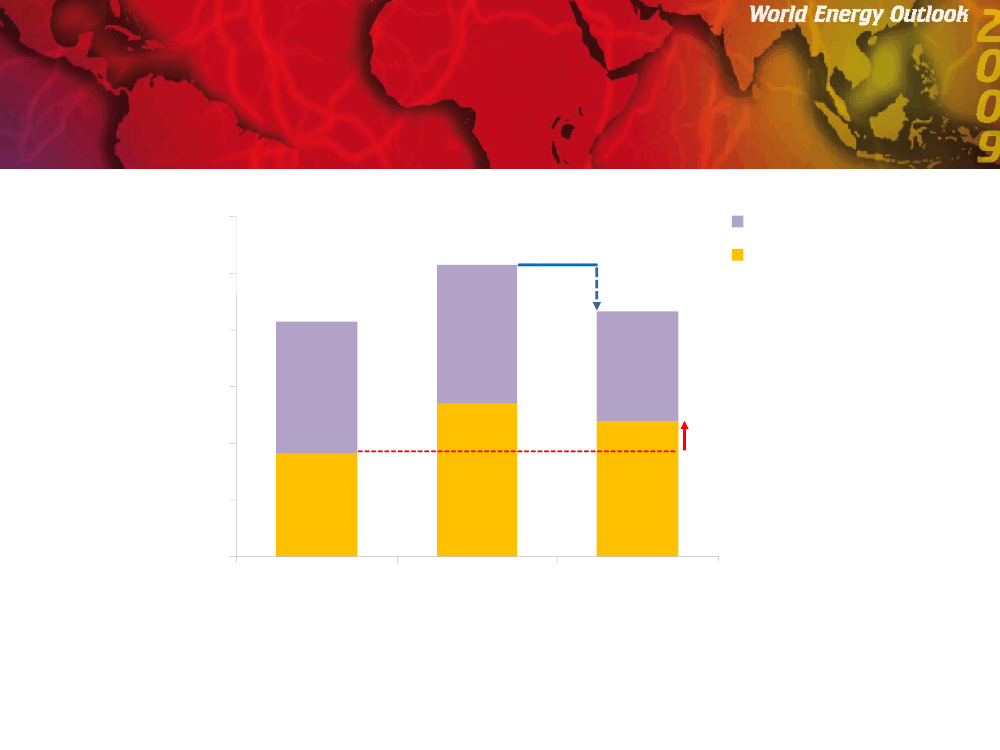

Worldwide upstream oil & gascapital expendituresBillion dollars

5004003002001000200020012002200320042005200620072008 2009** Budgeted spending

Global upstream spending (excluding acquisitions) is budgeted to fall by over $90 billion,or 19%, in 2009 – the first fall in a decade� OECD/IEA - 2009

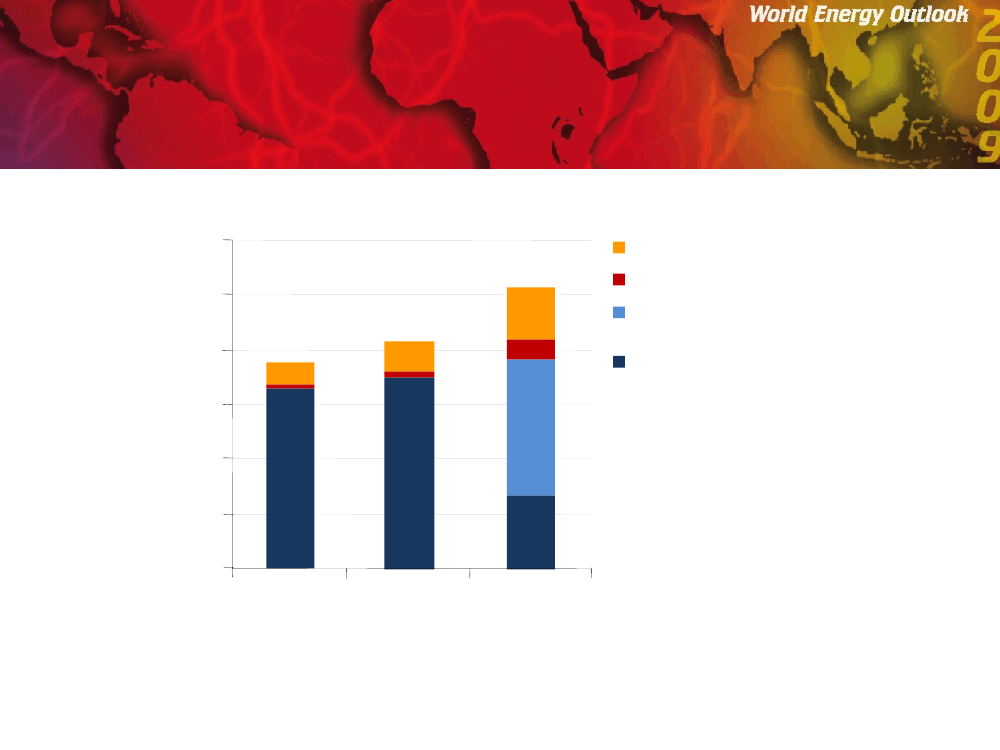

Oil productionin the Reference Scenariomb/d12010080604020NGLsUnconventional oilCrude oil – fields yet to be developedor foundCrude oil – currently producing fields

0200020082030

Sustained investment is needed mainly to combat the decline in output at existing fields,which will drop by almost two-thirds by 2030� OECD/IEA - 2009

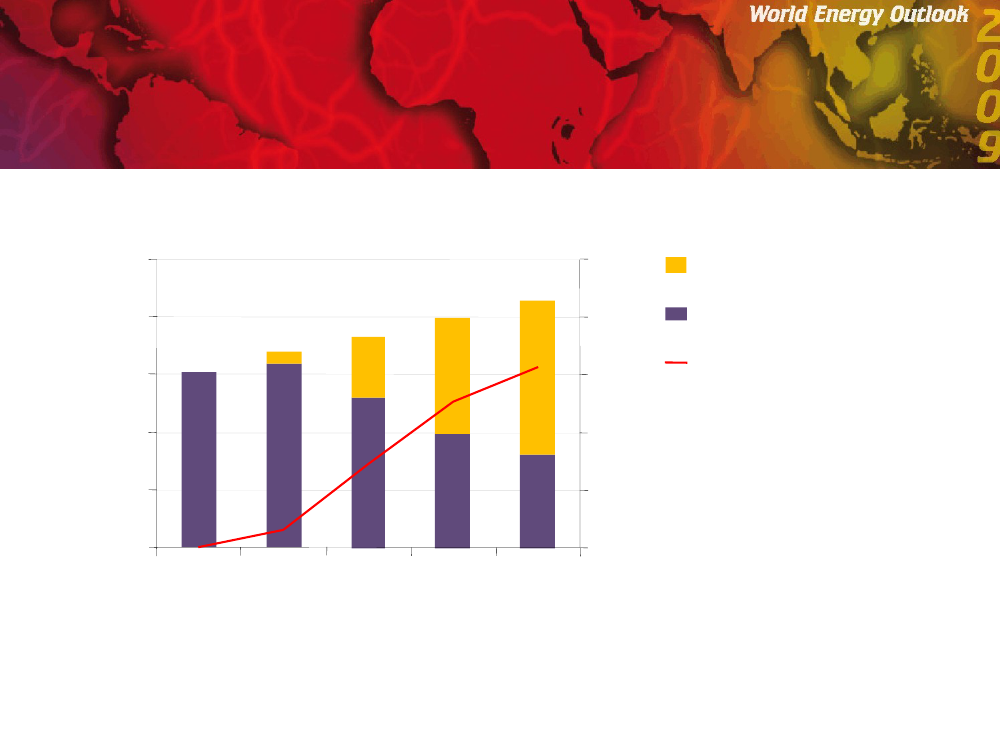

Impact of decline on world natural gas productionin the Reference Scenario

tcm

54321020072015202020252030

100%80%60%40%20%0%

Fields yet to be developed or foundCurrently producing fieldsShare from fields not yet producing(right axis)

Additional capacity of around 2 700 bcm, or 4 times current Russian capacity, is neededby 2030 – half to offset decline at existing fields & half to meet the increase in demand� OECD/IEA - 2009

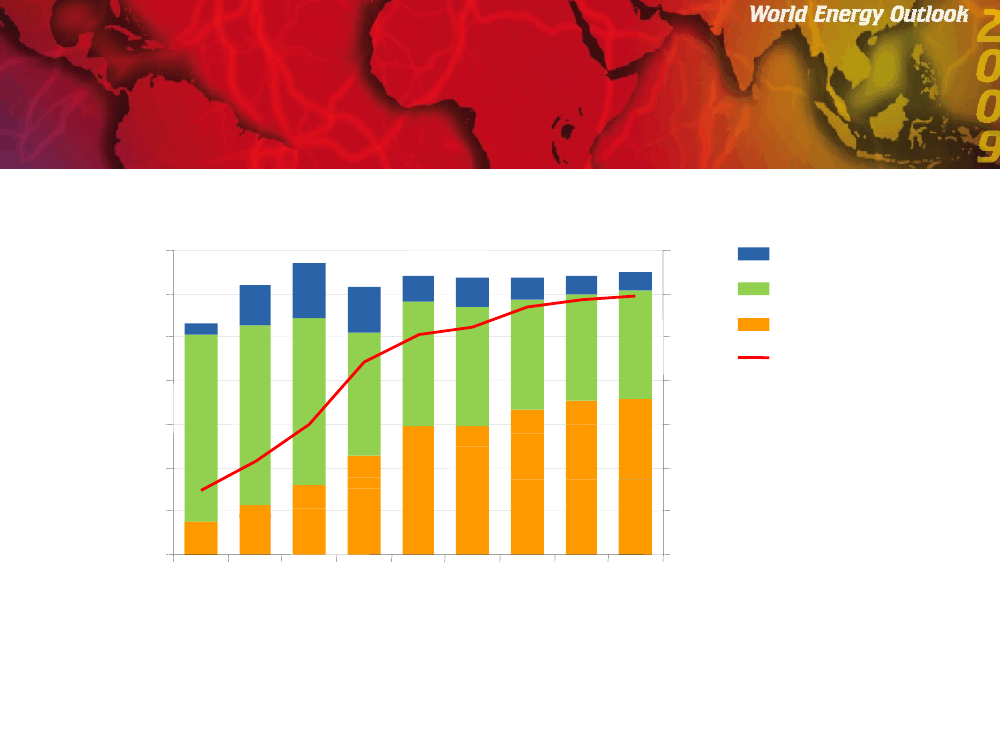

US natural gas supplyin the Reference Scenario700600500

bcm

70%60%50%40%30%20%10%0%

Net importsConventionalUnconventionalShare of unconventionalin total supply

4003002001000

1990 1995 2000 2005 2008 2015 2020 2025 2030

Thanks mainly to shale gas, US gas output grows gradually through to 2030,outstripping demand & squeezing imports� OECD/IEA - 2009

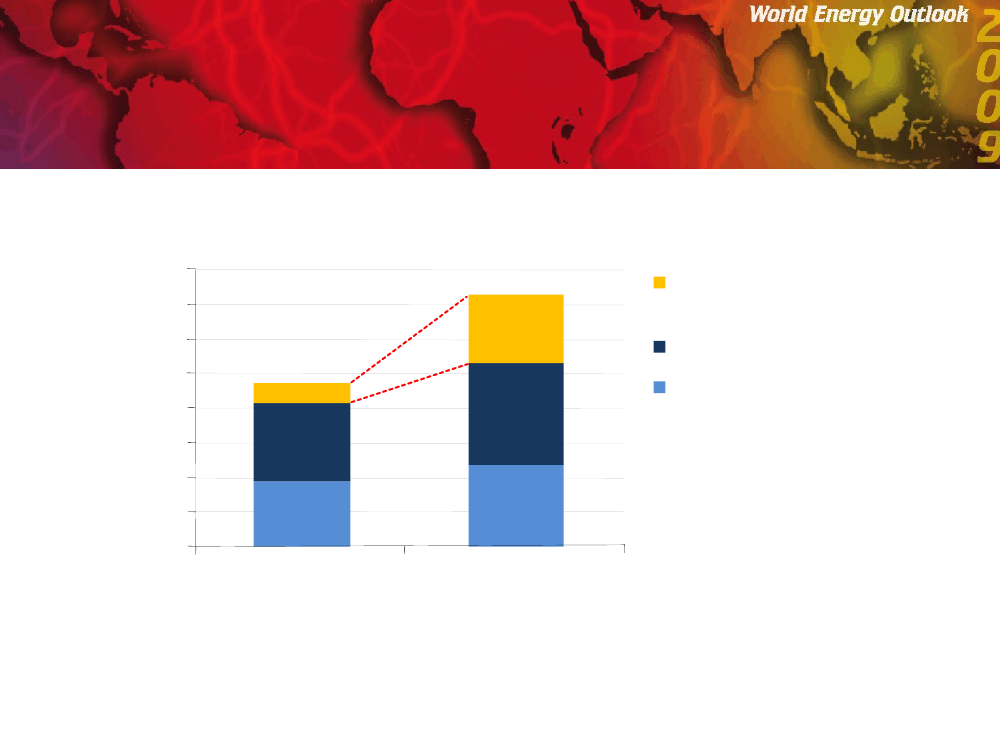

Natural gas transportation capacity

bcm

800700600

73%

Unutilised LNG liquefaction& pipeline capacityLNG tradePipeline trade% Capacity utilisation rate

5004003002001000

88%

2007

2015

A glut of gas is developing – reaching 200 bcm by 2015 – due to weaker than expecteddemand & plentiful US unconventional supply, with far-reaching implications for gas pricing� OECD/IEA - 2009

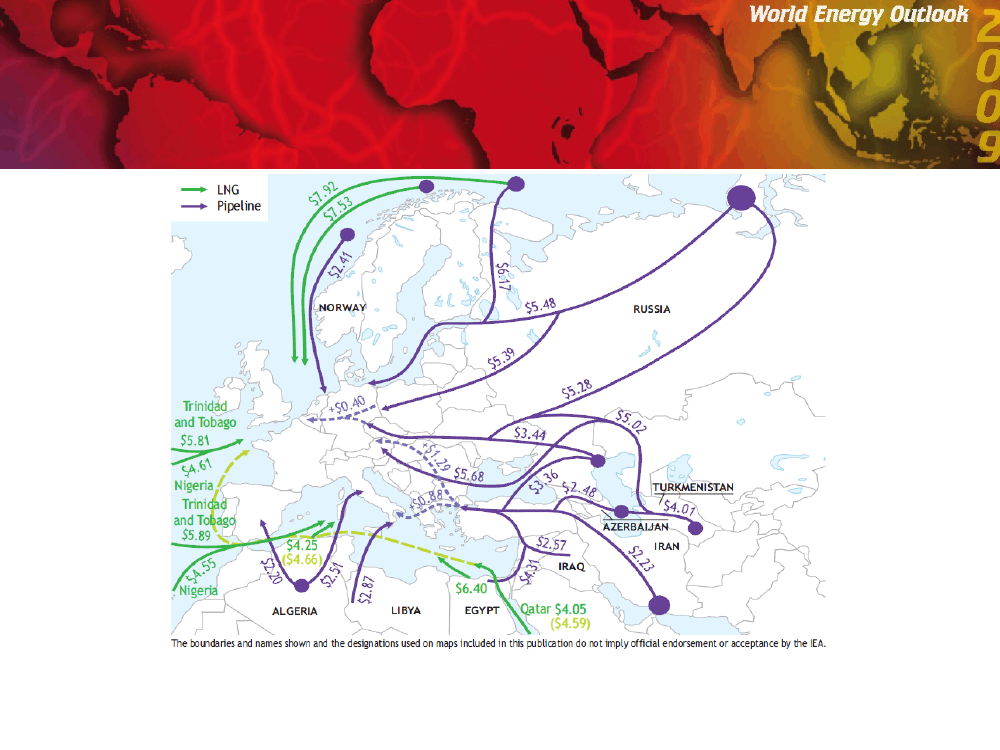

Indicative costs for potential new sources of gasdelivered to Europe, 2020 ($/MBtu)($/MBtu)

Although indigenous resources are limited & output is declining, Europe isgeographically well placed to secure gas supplies from a variety of external sources� OECD/IEA - 2009

Average annual expenditure on net importsof oil & gas in the Reference ScenarioBillion dollars (2008)6005004003002001000EuropeanUnionUnitedStatesChinaJapan1%2%2%

1971-20082008-2030% Share of GDP3%

1%2%1%

3%

6%3%3%0.4%

India

ASEAN

The Reference Scenario implies persistently high spending on oil & gas imports, with Chinaovertaking the United States by around 2025 to become the world's biggest spender� OECD/IEA - 2009

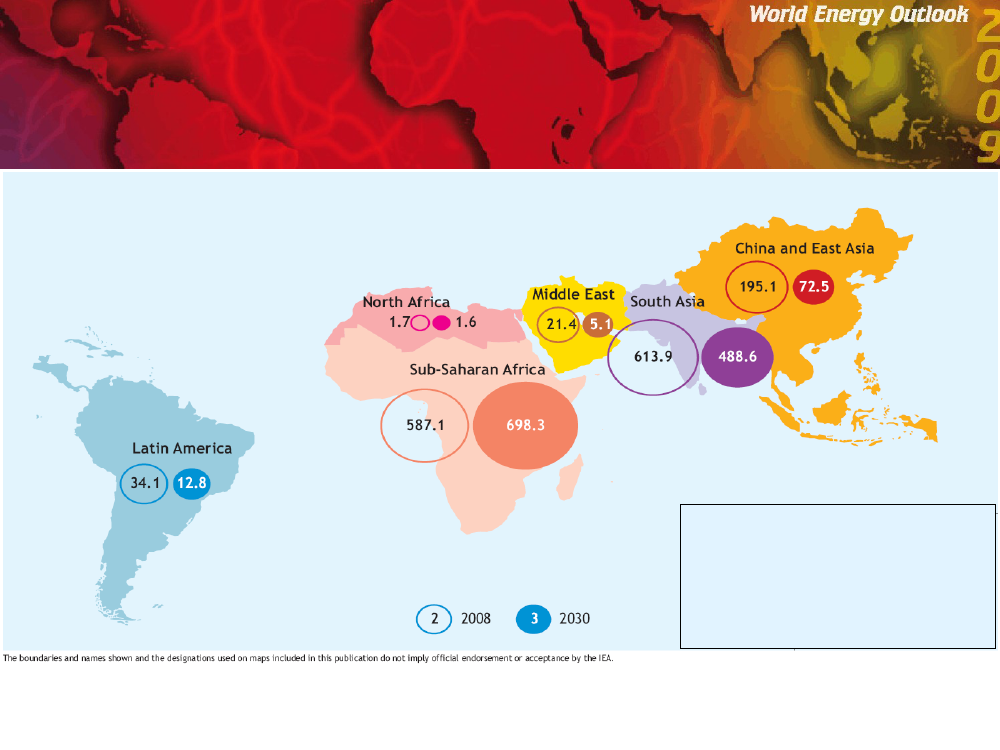

Number of people without access to electricityin the Reference Scenario (millions)

World population withoutaccess to electricity2008: 1.5 billion people2030: 1.3 billion people$35 billion per year more investment than in the Reference Scenario would be needed to 2030– equivalent to just 5% of global power-sector investment – to ensure universal access� OECD/IEA - 2009

The policy mechanismsin the 450 ScenarioA combination of policy mechanisms, which best reflects nations’

varied circumstances & negotiating positionsWe differentiate on the basis of three country groupings>OECD+: OECD & other non-OECD EU countries>Other Major Economies (OME): Brazil, China, Middle East, Russia & South Africa>Other Countries (OC): all other countries, including India & ASEAN

A graduated approach>Up to 2020, only OECD+ have national emissions caps>After 2020, Other Major Economies are also assumed to adopt emissions caps>Through to 2030, Other Countries continue to focus on national measures

Emissions peaking by 2020 will require>A CO2price of $50 per tonne for power generation & industry in OECD+>Investment needs in non-OECD countries of $200 billion in 2020, supported byOECD+ through carbon markets & co-financing� OECD/IEA - 2009

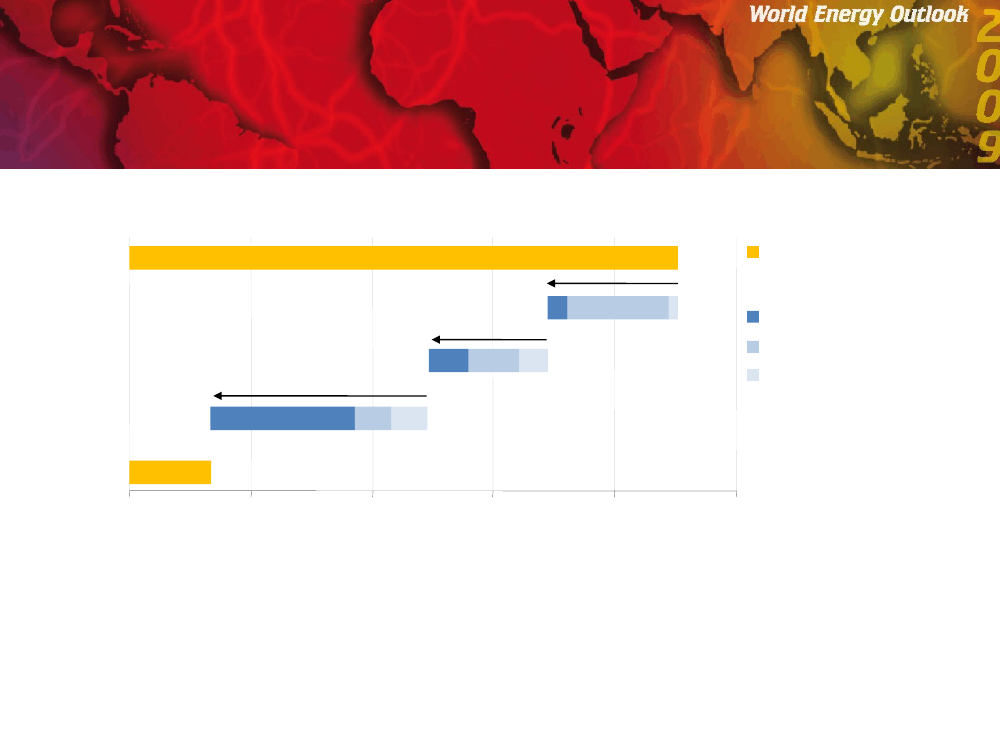

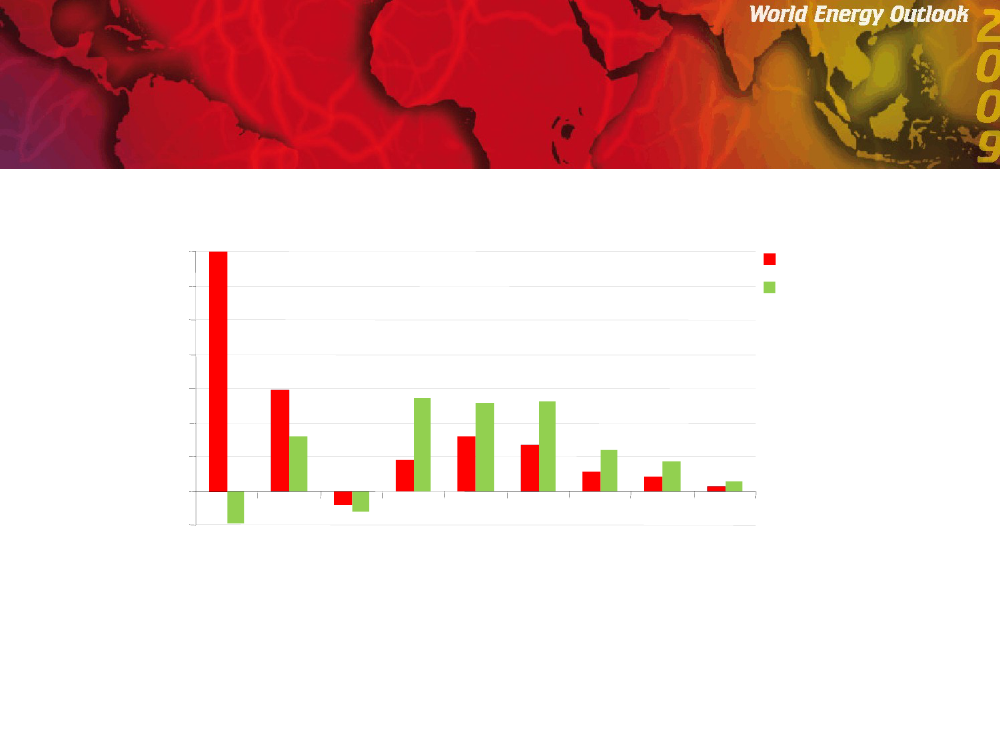

Abatement by policy type in the 450 Scenariorelative to the Reference Scenario, 2020EmissionsAbatement:OECD+Other Major EconomiesOECD+ cap-and-trade forpower and industry(including international credits)450 ScenarioOther Countries

Reference ScenarioDomestic policies and measures

Sectoral agreements

30

31

32

33

34

35Gt

After realising the abatement potential of policies & measures and sectoral approaches,cap-and-trade in OECD+ yields a further 1.8 Gt� OECD/IEA - 2009

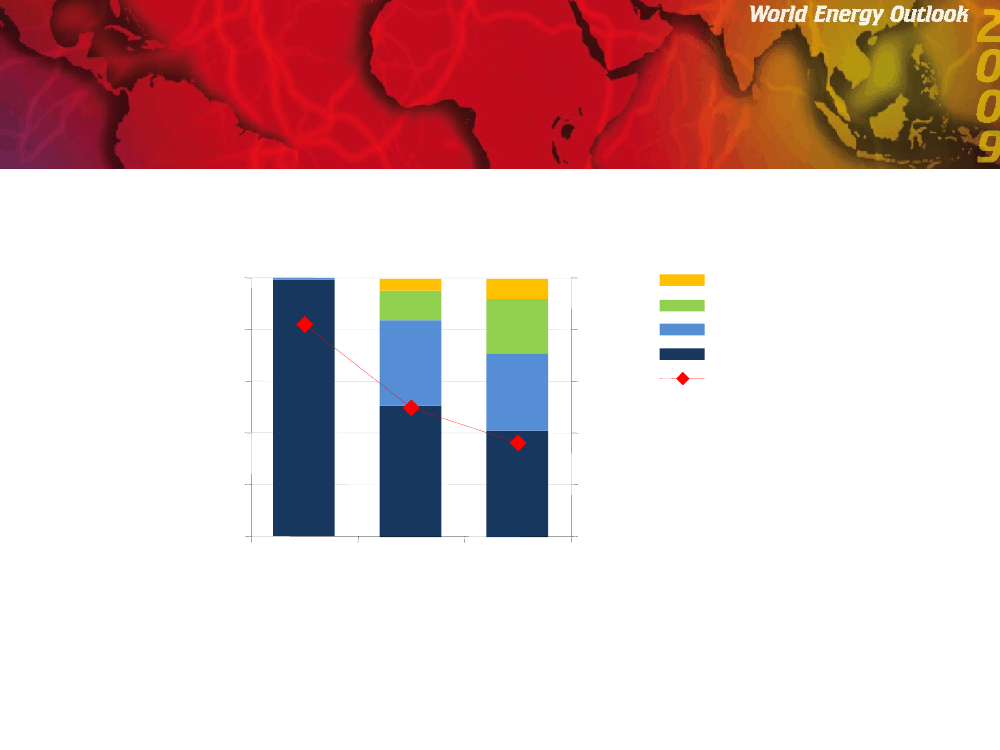

World primary energy demand by fuelin the 450 Scenario

Mtoe

12 00010 0008 0006 000

36%30%24%18%12%6%0%2030

Fossil fuelsZero-carbon fuelsShare of zero- carbon fuels(right axis)

4 0002 00001990

2000

2010

2020

In the 450 Scenario, demand for fossil fuels peaks by 2020, and by 2030 zero-carbon fuelsmake up a third of the world's primary sources of energy demand� OECD/IEA - 2009

World oil productionby scenariomb/d

12010080604011 mb/d36mb/d

Non-OPECOPEC

16 mb/d

200

2008

Reference Scenario2030

450 Scenario2030

Curbing CO2emissions would also improve energy security by cutting oil demand, but evenin the 450 Scenario, OPEC production increases by 11 mb/d between now and 2030� OECD/IEA - 2009

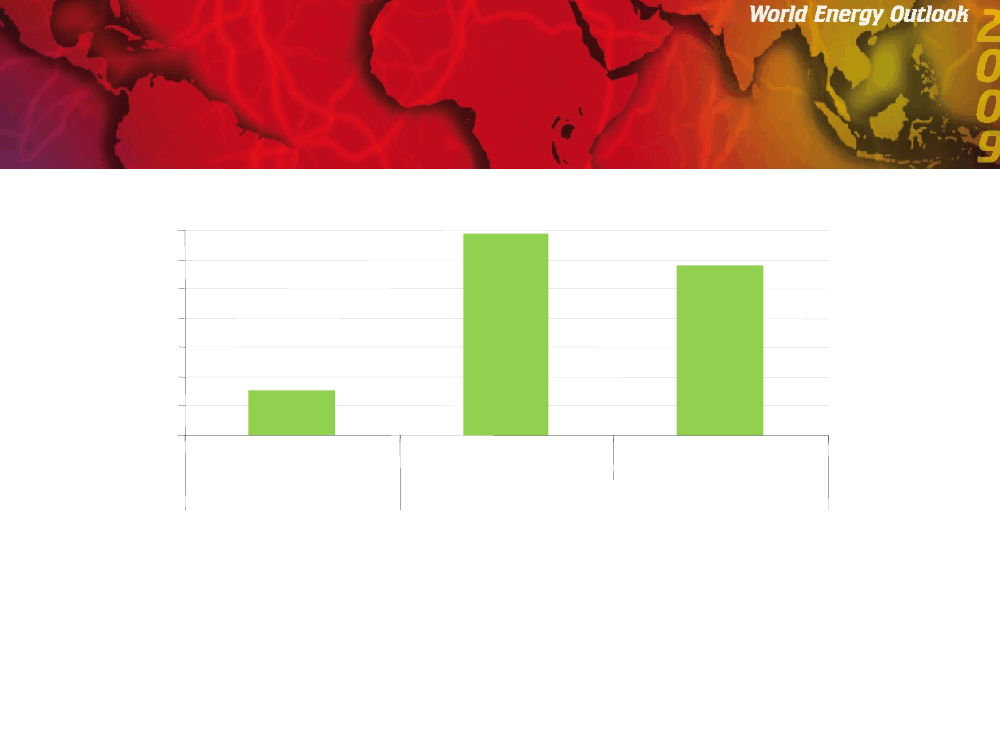

Cumulative OPEC oil export revenuesby scenarioTrillion dollars (2008)2824201612840Reference Scenario1985-20072008-2030450 Scenario

Though slightly lower than in the Reference Scenario, OPEC revenues in the 450 Scenarioare over four times as high as in the last 20 years� OECD/IEA - 2009

World primary natural gas demandby scenariobcm

4 5003 7503 000

+41% (1 264 bcm)

Reference Scenario450 Scenario+17% (511 bcm)

2 2501 500750020072015202020252030

Gas demand continues to grow in both scenarios, peaking by around 2025 in the 450 Scenario& highlighting the potential role of gas as a transition fuel to a clean energy future� OECD/IEA - 2009

World abatement of energy-related CO2emissionsenergy-in the 450 ScenarioGt

424038OECD+3634323028OC450 Scenario20152020202520303.8 Gt13.8 GtOMERenewables& biofuelsNuclearCCS19%13%3%23%10%10%Efficiency65%57%Reference ScenarioWorld abatement by technology20203.8 Gt203013.8 Gt

262007 2010

An additional $10.5 trillion of investment is needed in total in the 450 Scenario, withmeasures to boost energy efficiency accounting for most of the abatement through to 2030� OECD/IEA - 2009

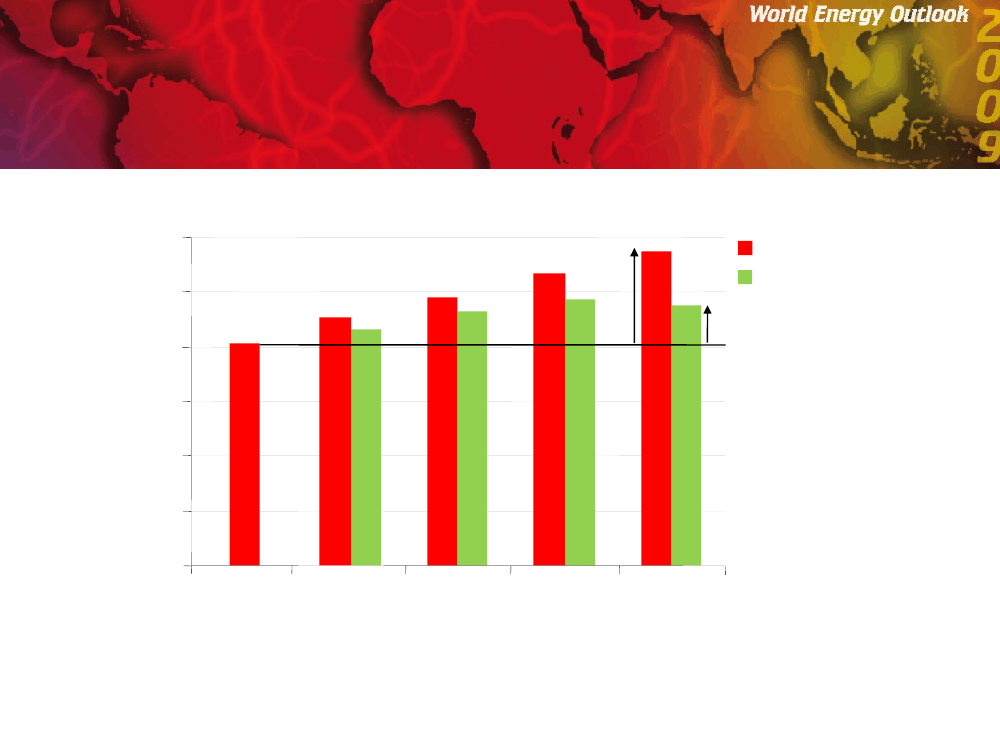

Abatement in the 450 Scenario by key emitters, 2020

Gt

1.41.21.00.80.60.40.20

International carbon marketsCap & trade in power& industry sectorsInternation sectoral standardsin transport & industryNational policies

China

UnitedStates

EuropeanUnion

India

Russia

Japan

China, the United States, the European Union, India, Russia & Japan account for almostthree-quarters of the 3.8 Gt reduction in the 450 Scenario� OECD/IEA - 2009

Incremental world electricity productionin the Reference and 450 Scenarios, 2007-20302007-7 0006 000

TWh

Reference Scenario450 Scenario

5 0004 0003 0002 000

1 0000-1 000CoalGasOilNuclear Hydro Wind Biomass Solar Otherrenewables

Renewables, nuclear and plants fitted with CCS account for around 60% of electricitygeneration globally in 2030 in the 450 Scenario, up from less than one-third today� OECD/IEA - 2009

World passenger vehicle sales & average new vehicleCO2intensity in the 450 Scenario

80%

200

20560%40%20%0%200720202030

1501259010050

0

Improvements to the internal combustion engine & the uptake of next-generation vehicles &biofuels lead to a 56% reduction in new-car emission intensity by 2030� OECD/IEA - 2009

Grammes per kilometre

Share of sales

100%

250

Electric vehiclesPlug-in hybridsHybrid vehiclesICE vehiclesCO2intensityof new vehicles(right axis)

Summary & conclusionsThe financial crisis has halted the rise in global fossil-energy use, but its

long-term upward path will resume soonon current policiesTackling climate change & enhancing energy security require a massivedecarbonisation of the energy system>We are now on course for a 6�C temperature rise & rising energy costs

>Limiting temperature rise to 2�C will require big emission reductions in all

regions

A 450 path towards ‘Green Growth’ would bring substantial benefits>Avoiding the worst effects & costs of climate change

>Energy-security benefits, lower oil & gas imports & reduced energy bills

>Much less air pollution & huge health benefits

Natural gas can play a key role as a bridge to a cleaner energy futureThe challenge is enormous – but it can and must be met>Improved energy efficiency & technology deployment are critical

>Each year of delay adds $500 bn to mitigation costs between today & 2030

� OECD/IEA - 2009