Det Energipolitiske Udvalg 2009-10

EPU Alm.del Bilag 354

Offentligt

Welcome to Nord Pool SpotThe largest market for electrical energy in the world

Our function?Provide a liquid market for electricalenergyProvide information to the marketProvide equal opportunities for allparticipantsThe central counter party in all tradesguaranteeing settlement for trade

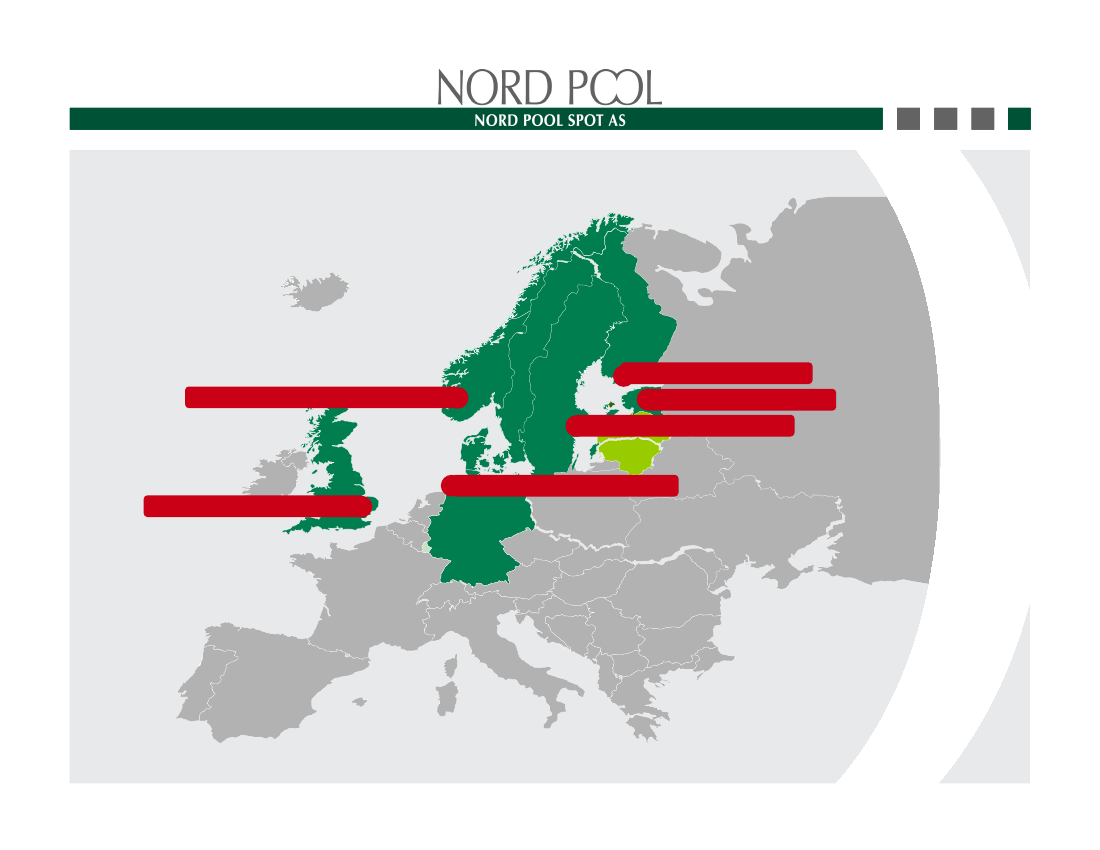

Offices

Helsinki, FinlandOslo, Norway - Head officeTallinn, EstoniaStockholm, Sweden

Fredericia, DenmarkLondon, England

Our vision and missionVision:Nord Pool Spot will be the leadingEuropean exchange for electrical energy

Mission:We add value to our customersby providing price transparency and quotingreliable prices

Our business goalsNord Pool Spot will drive the development and integrationof the European energy marketsNord Pool Spot will have profitable growthNord Pool Spot will provide the preferred market place for customers in EuropeNord Pool Spot will be an efficient and customer driven organisationNord Pool Spot will be a European organisation with high competenceand strong team spirit

History1991:The Norwegian electricity market is deregulated1993:Statnett Marked is established1996:A joint Norwegian-Swedish exchange is established and renamed to Nord Pool1998:Finland joins the Nordic exchange2000:The Nordic market becomes fully integrated as Denmark joins the exchange2002:Nord Pool Spot is established as a separate company2005:Nord Pool Spot opens the Kontek bidding area in Germany2009:Market coupling NPS and EPEX through EMCC launched.2010:Nord Pool Spot and NASDAQ OMX Commodities launch the UK market N2EX.Nord Pool Spot opens a bidding area in Estonia and delivers the technical solutionfor a new Lithuanian market place

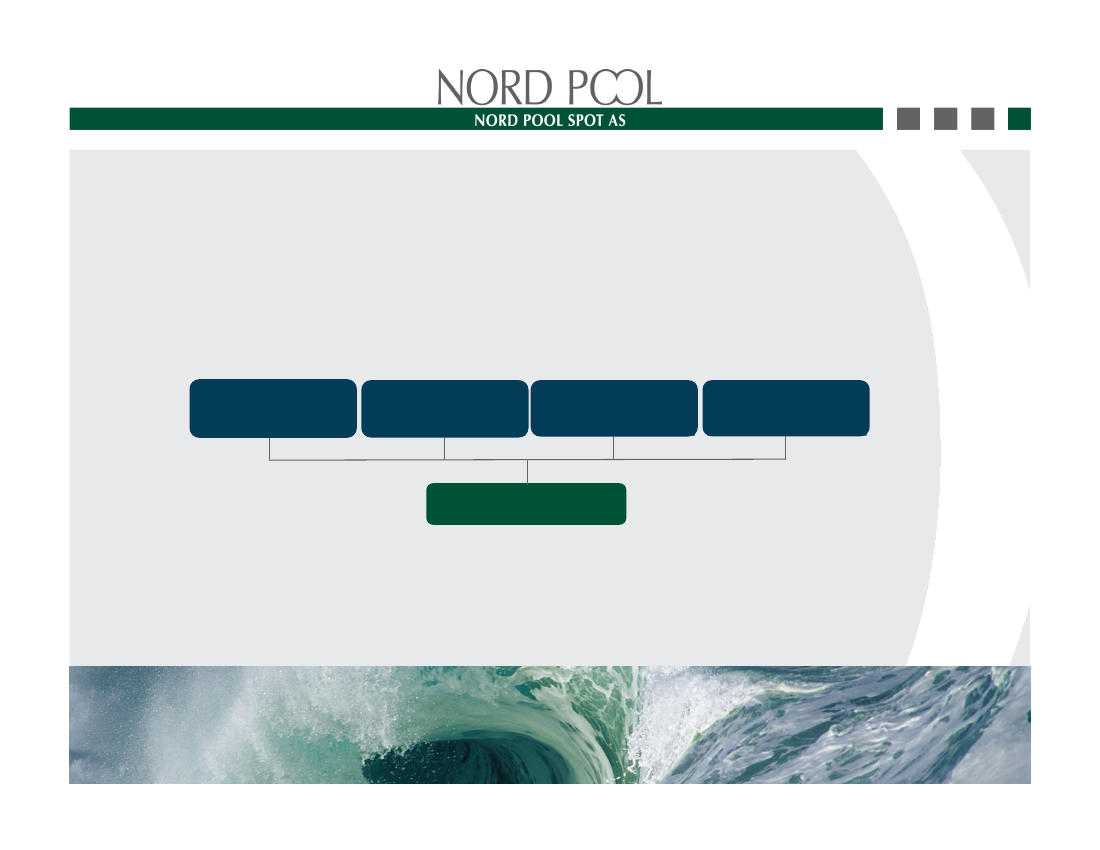

OwnershipWe are owned by the Nordic transmission system operators.

Statnett SF30%

Svenska Kraftnät30%

Fingrid Oyj20%

Energinet.dk20%

Nord Pool Spot AS

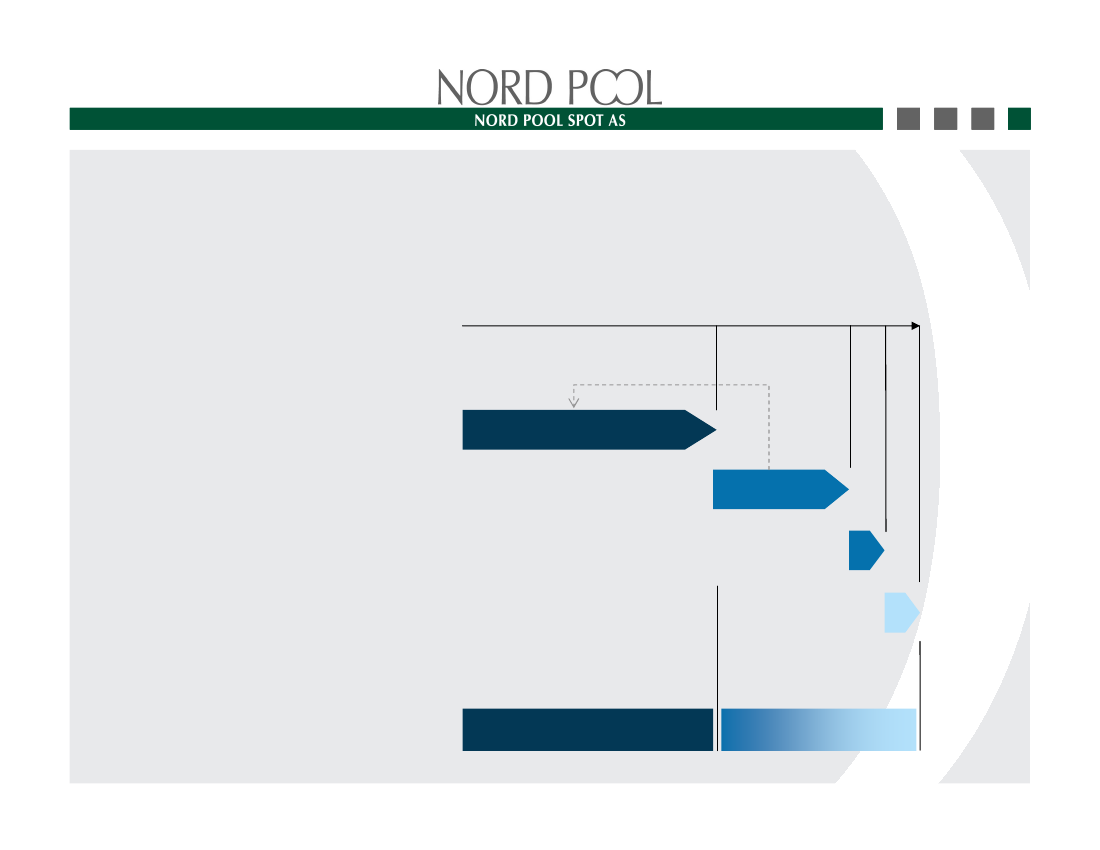

Power exchange conceptElspot-marketAuction - supply and demandcross. Mechanism forhandling of constraintsElbas-marketContinuous hourly marketfor balance adjustmentBalance servicesOperated by transmissionsystem operatorsFinancial marketCash settled futures, forwardsand options. Clearing servicesCash settledPhysical deliveryElbas-marketTime6 YearsReference priceFinancial marketElspot-market24 Hours0

Balance Services

ElspotThe spot market for electrical energy – andthe cornerstone of Nordic tradingAuction-based market for trading of electricalenergy for delivery the next dayCovers Norway, Sweden, Finland, Denmarkand Estonia.72 per cent of the total consumption ofelectrical energy in the Nordic countries istraded on the Elspot-market

ElbasServes as an adjustment market for Finland,Sweden, Denmark, Norway and GermanyContinuous intraday market for electricalenergy where one-hour contracts are tradeduntil one hour prior to delivery

Nord Pool Spot

Electrical energy marketsELSPOT Overview

Product:Delivery period:Type of trading:

Hourly contracts, physical delivery.All 24 hours through the next day (12-36 hours ahead in time).Auction trading. Accumulated bids and offers that form equilibriumpoint prices via an Implicit Auction that also reflects usage of aavailable transmission capacities between bidding areas.

Trading days:Bidding:

All days through the year.Bids and offers in standard exchange format (internet, EDIEL).

Trade currencies: Euro, NOK, SEK, DKK.Price calculation: 1200 am every day.ELBAS Overview

Product:Delivery period:Type of trading:Trading days:

Hourly contracts, physical delivery.All hours with Elspot price in present day andfollowing day up to 60 minutes before delivery.ContinuousEvery day through out the year 24h

Nord Pool Spot

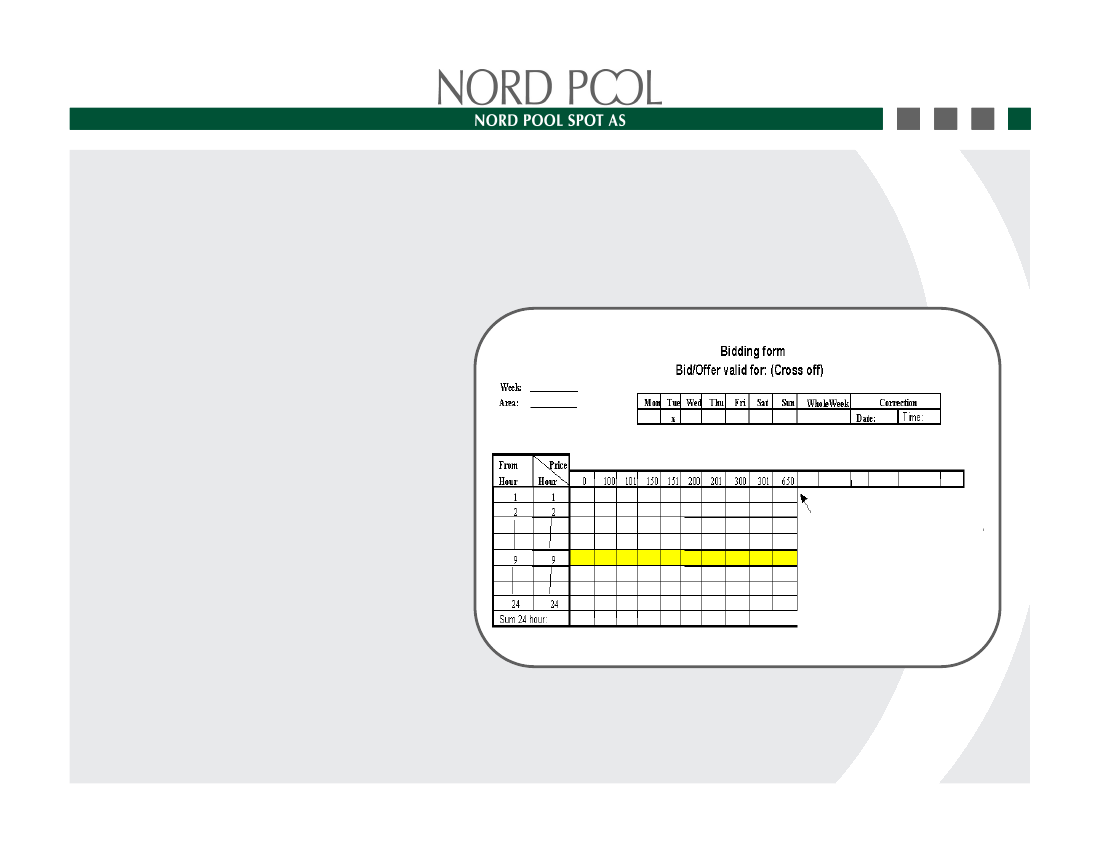

Elspot marketHourly biddingThe hourly bid is the basictype of Elspot market orderThe bid is used for bothpurchase and sale of powerEach participant selects therange of price steps for thehourly bid individually.The bid may consist of upto 62 price steps inaddition to the currentceiling and floor price limitsset by Nord Pool Spot.Bid can contain up to64 prices out of which0 and 2000 are given

Nord Pool Spot

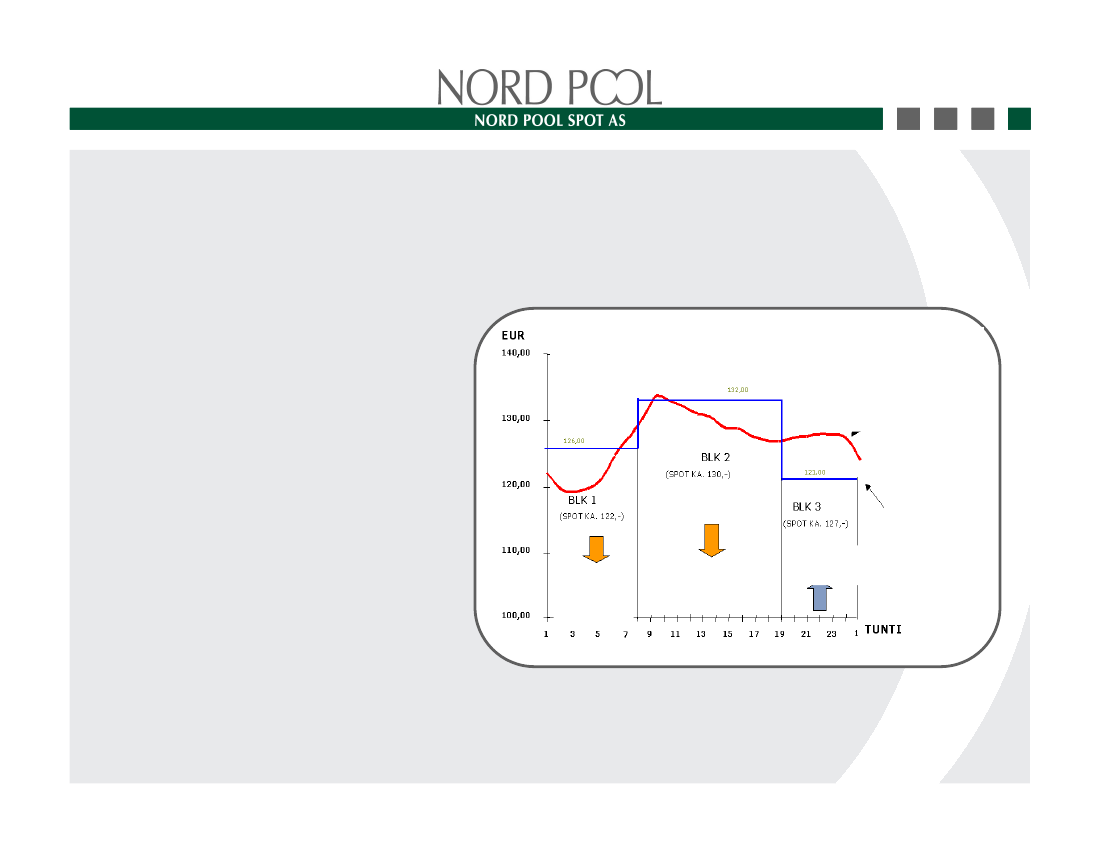

Elspot marketBlock BidsThe block bid gives theparticipant the opportunity to setan 'all or nothing' condition forall the hours within the block.The block bid is an aggregatedbid for several hours, with afixed price and volumethroughout these hours.The participants can freely pickthe start and stop hour of ablock.The block bid is particularlyuseful in cases where the cost ofstarting and stopping powerproduction is high. Also inflexibleproduction, consumption andcontracts can be handledefficiently with block bids.

SPOT-PRICE

NOTFULFILLED

NOTFULFILLED

FULFILLED

Blockbid(sell)

Price calculation

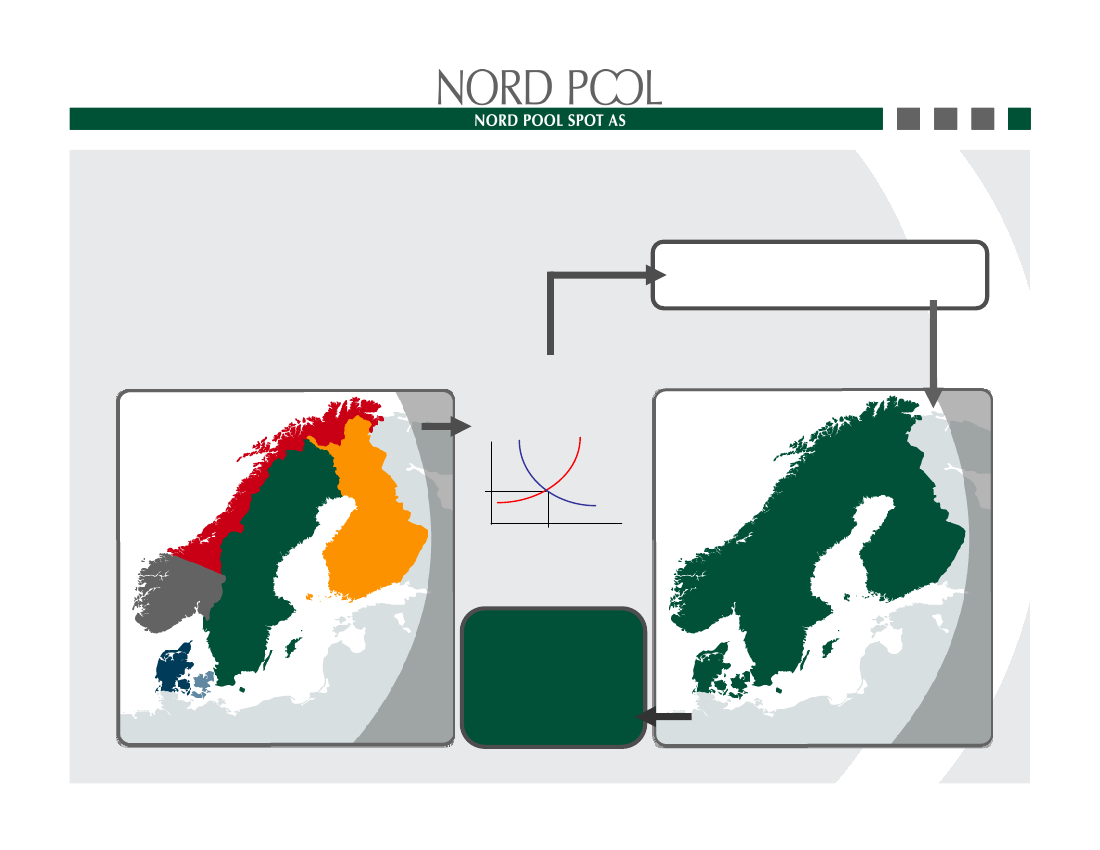

No bottlenecksChecking transmission limitsSix Elspot areasSystem pricecalculationPurchaseSell

One price

Ps

NO2

FI

NO1SE

DK1DK2

One priceacross the entireexchange area

Price calculation

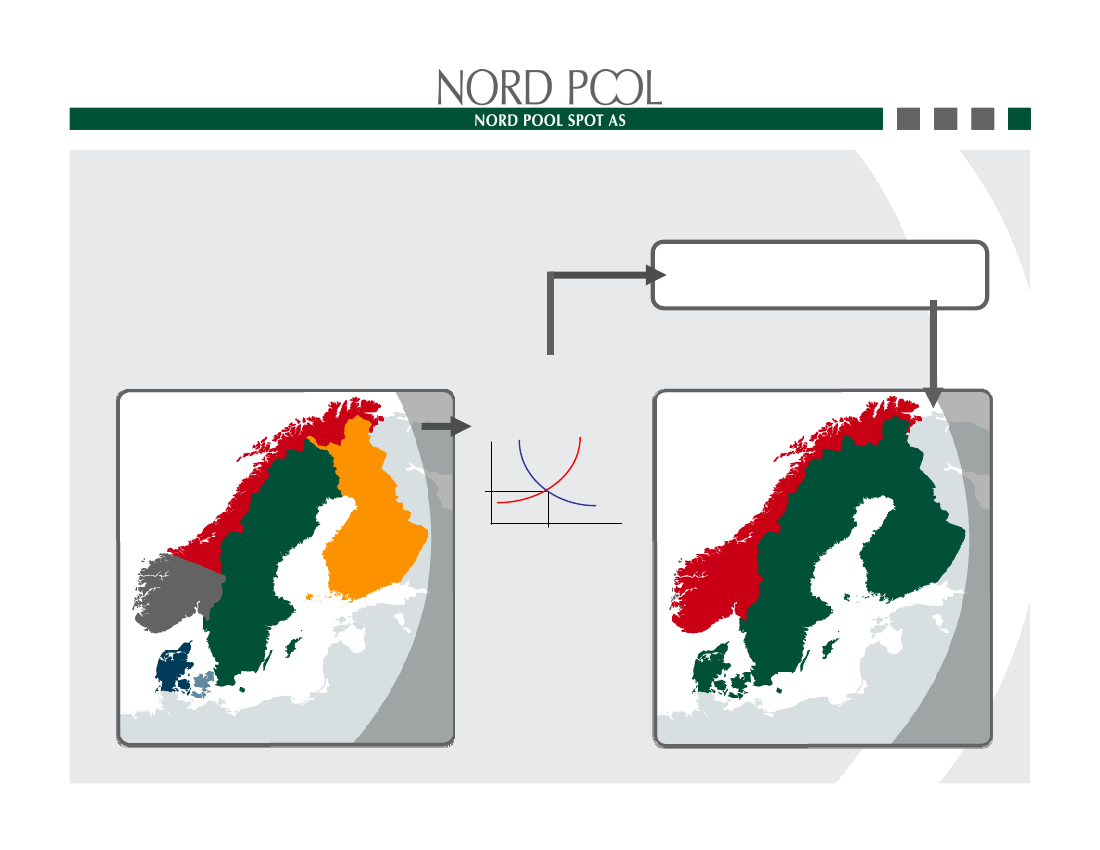

With bottlenecksSix Elspot areasSystem pricecalculationPurchaseSell

Optimization oftransmission capacities

Different prices

Ps

NO2

FI

NO1SE

DK1DK2

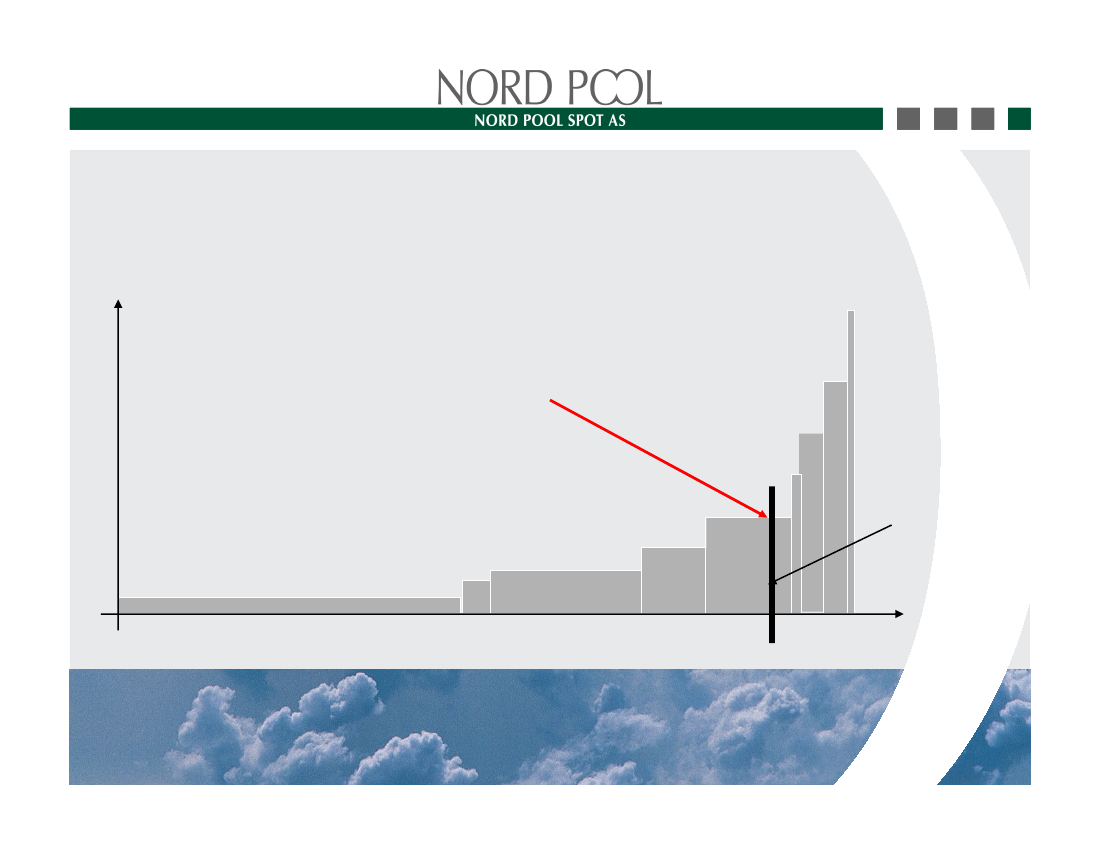

Theory

Price determinationProductioncostGas turbines

Average price

Condensing, oil

Condensing, coalCombined heat andpowerCHPindustryNuclearAnnualNordicconsumption

Hydro (average)100

200

300

400 TWh

After market for Elspot

Elbas marketAfter market for ElspotMarket areas available; Finland,Sweden, Denmark, Norway andGermanyAutomated control of transmissioncapacityHourly contracts can be traded until60 minutes before delivery hourContinuous trading 24/7Trading currency is EuroMarket makers 24 hours per day

Reporting and settlement

Physical marketsAll trades will be transferred automaticallyto clearing at Nord Pool SpotDeliveryNord Pool Spot and participant sends Elspot-and/or Elbas- net positions to system operatorMonetary transactionsInvoice / Credit note every banking dayCollateral callBased on a rolling net position for the last7-9 days of trade

Nord Pool Spot

Membership categoriesExchange participantEntity having entered into participant agreementwith Nord Pool Spot AS for principal trading

Trading and clearingrepresentative

Entity having entered into participant agreementwith Nord Pool Spot AS for principal trading andclient tradingAn entity that has been approved by Nord Pool Spot ASto have its trades subject to clearing with Nord PoolSpot AS, when represented by a trading and clearingrepresentative

Clearing customer

Nord Pool Spot

Trading feesAnnual feeDirect participants Elspot & Elbas*EUR 15 000Trading & clearing representative Elspot & Elbas*EUR 15 000Direct participants Elbas onlyEUR 10 000Clearing customers Elspot & ElbasEUR 2 000Additional area/portfolio**EUR 1 250View only license ElbasEUR 10 000

Variable trading feeElspotElbas***

EUR/MWh 0.03EUR/MWh 0.08

One annual fee covers both Elspot and ElbasCompanies bidding in more than one area. In this context, Norway or Denmark is considered as one Elspot area. The fee also applies to every additionalinternal portfolio in Elspot within an area under a direct participant or clearing customer.

Nord Pool Spot

Special offersGross biddingAgreement available for Elspot directparticipantsThe participant undertakes to carry out grossbidding for all sales and purchase portfoliosNo entrance fee for this agreementThe agreement will include one free chargeportfolio for gross bidding purposesGross volume fee of 0.0025 €/MWh with ayearly ceilingSmall customersDirect participants at Elspot can waive theannual fee and pay a higher variable fee of€/MWh 0.13There is a 3 000 €/year floor for the sum ofvolume fees in a calendar year

Nord Pool Spot

Our customers ElspotCustomer overviewNord Pool Spot ElspotDirect participantsTrading and clearingrepresentativesClearing customers3111117

193

Nord Pool Spot

Our customers ElbasCustomer overview

Nord Pool Spot ElbasDirect participantsTrading and clearingrepresentativesClearing customers

84682

13

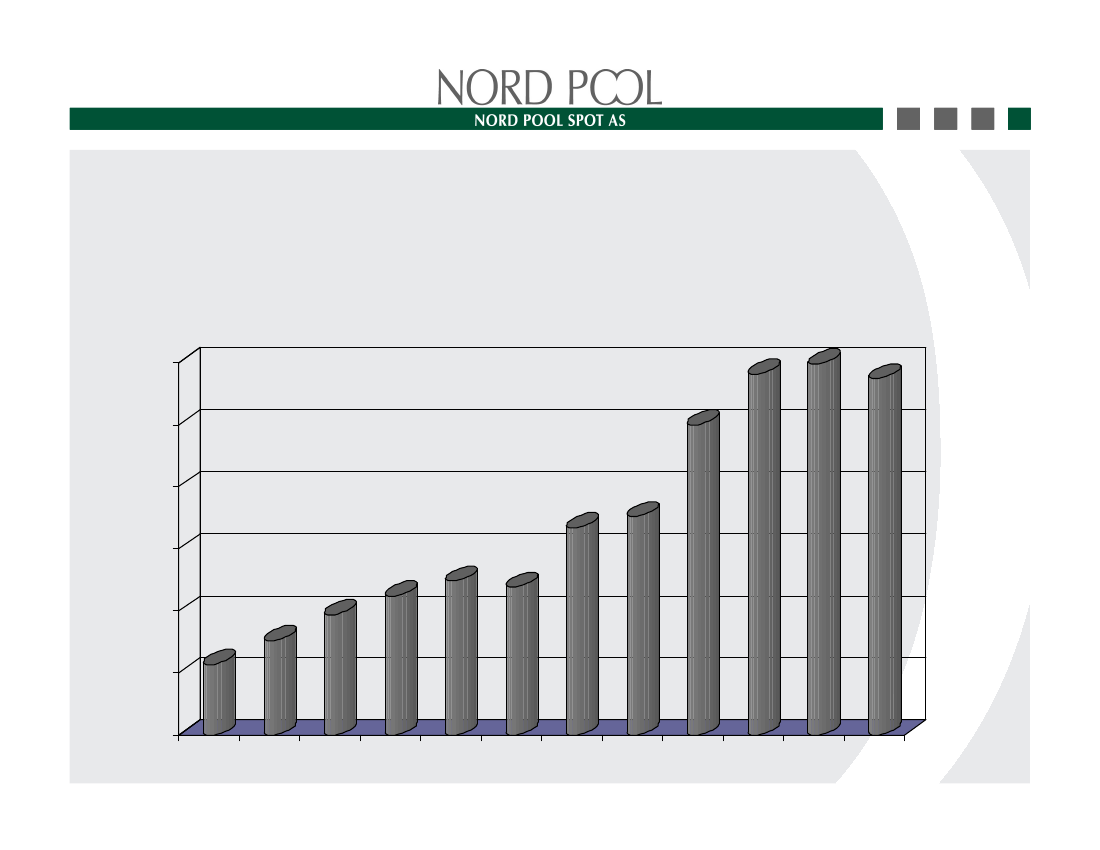

From 1998 to 2009

Trust proven by successfulvolume developmentTWh3002502001501005001998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Volume 2009287 TWh

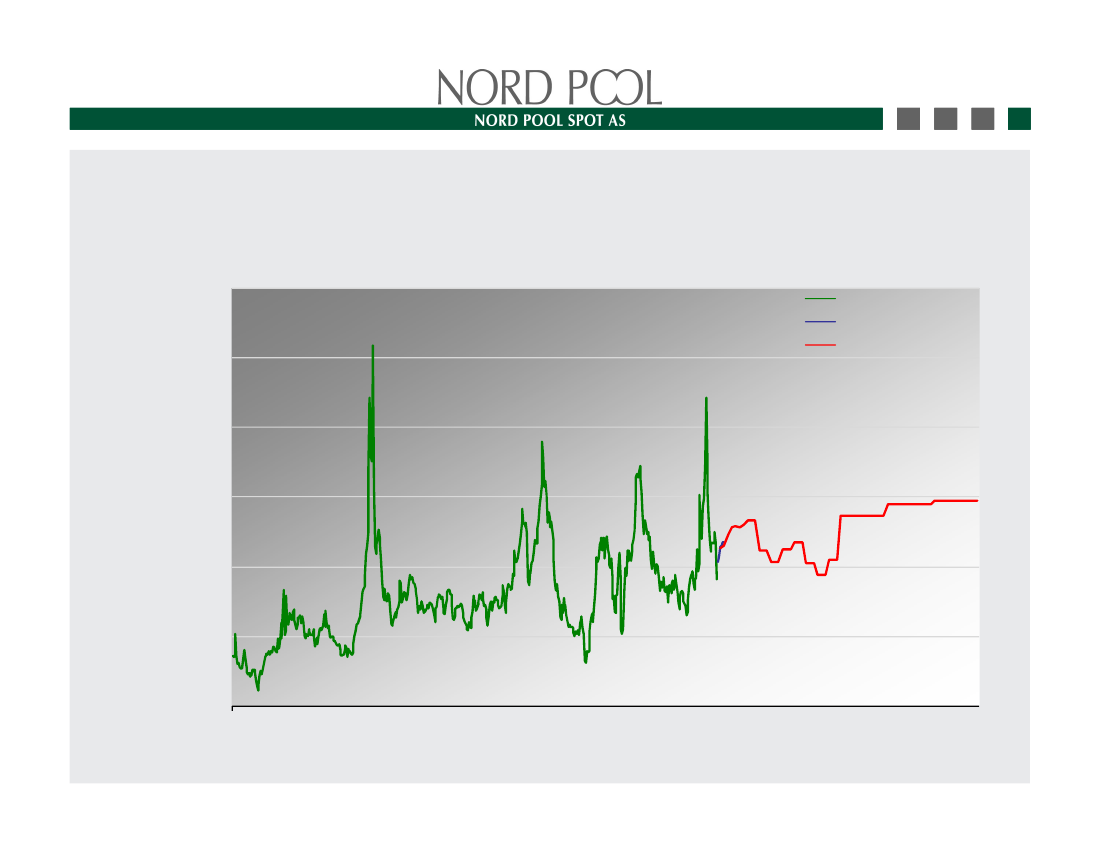

Prices at Nord PoolEUR/MWh

120

System priceFM-weekly prices

100

FM-monthly prices

80

60

40

20

02000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

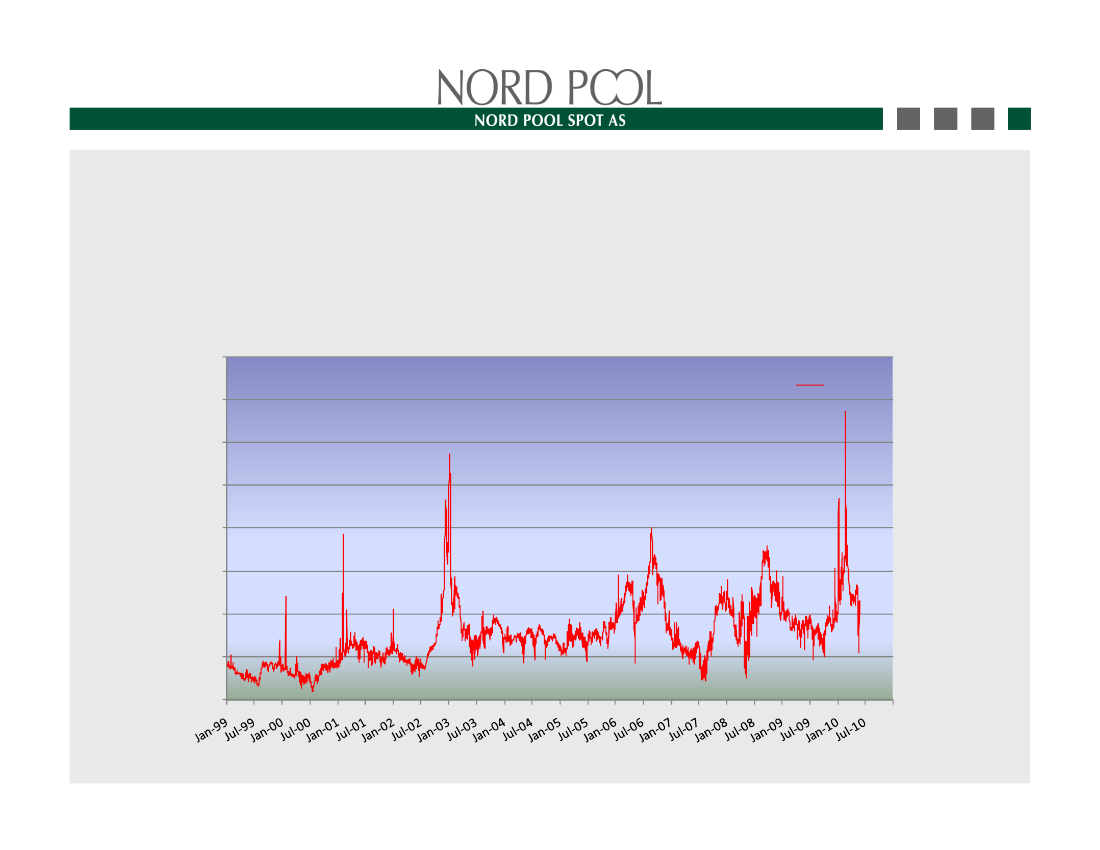

System priceDaily average 1999 - 2010EUR/MWh

160NP SYS140120100806040200

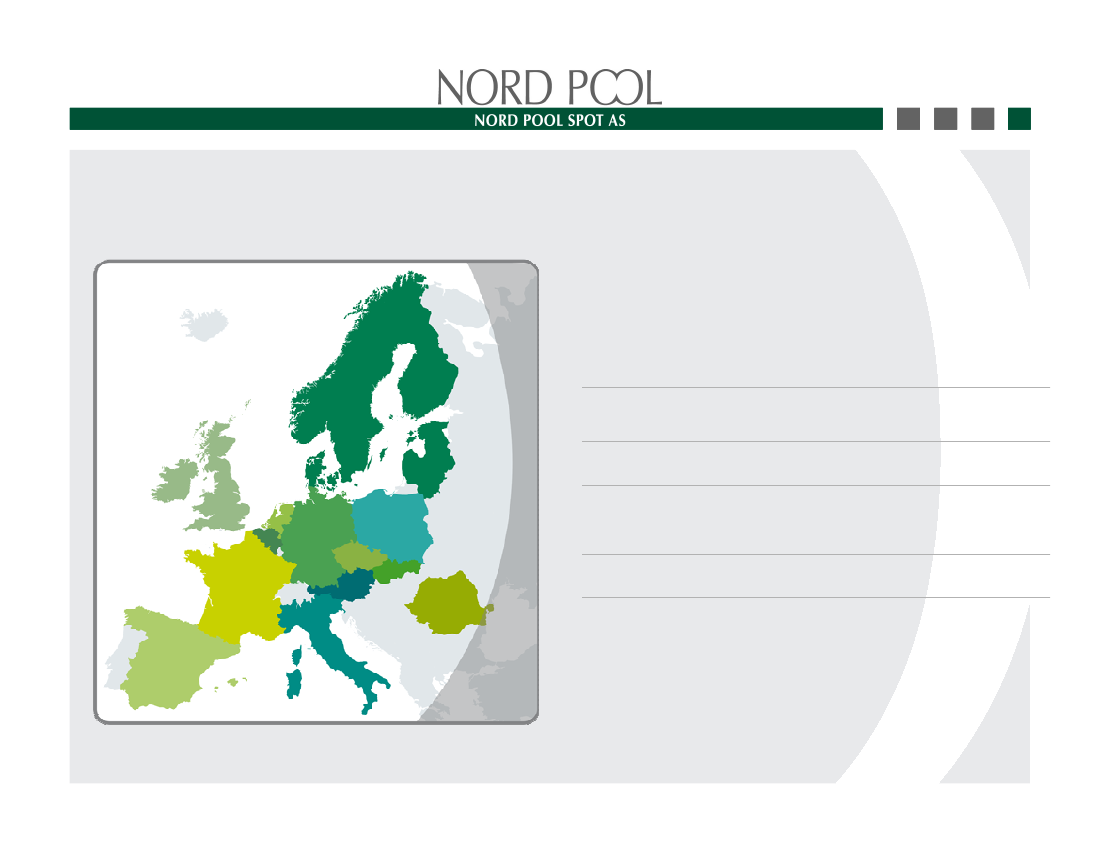

European exchanges for electrical energy

Overview2007TWhNord PoolSpotEEXAPXAPX UKN2EXAPXBelpxPowernextEXAASouth PoolGMEOpcomEEXGielda EnergiOTE

2008TWh2981462552-

2009TWh287-

2911232144-

NORD POOLSPOT

PowerNextEPEX Spot

-196

PXE

OMEL