Det Energipolitiske Udvalg 2009-10

EPU Alm.del Bilag 128

Offentligt

Design of Feed-in Tariffsfor Sub-5MW Electricity inGreat Britain

Quantitative analysis forDECC

Final ReportJuly 2009

URN 09D/704

Element Energy Limited60 Newman StreetLondonW1T 3DATel: 020 7462 5299Fax: 020 7323 4546

Design of Feed-in Tariffs for Great BritainFinal Report

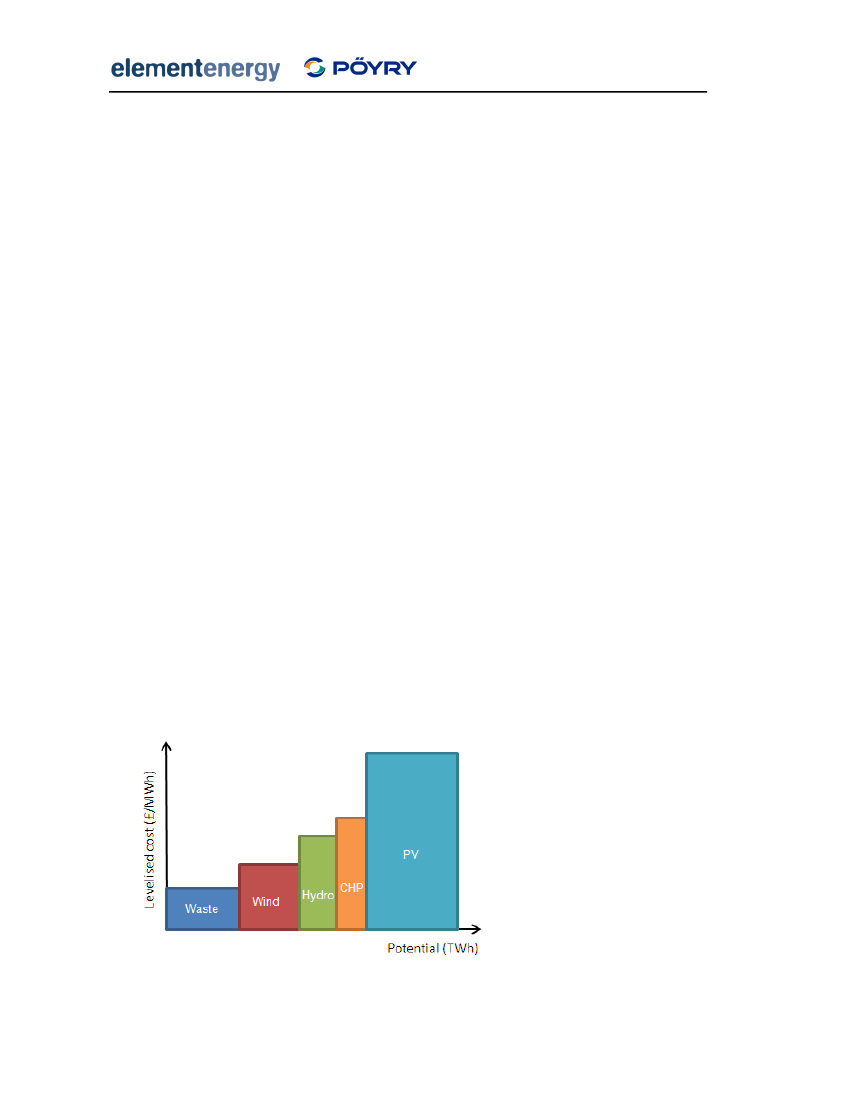

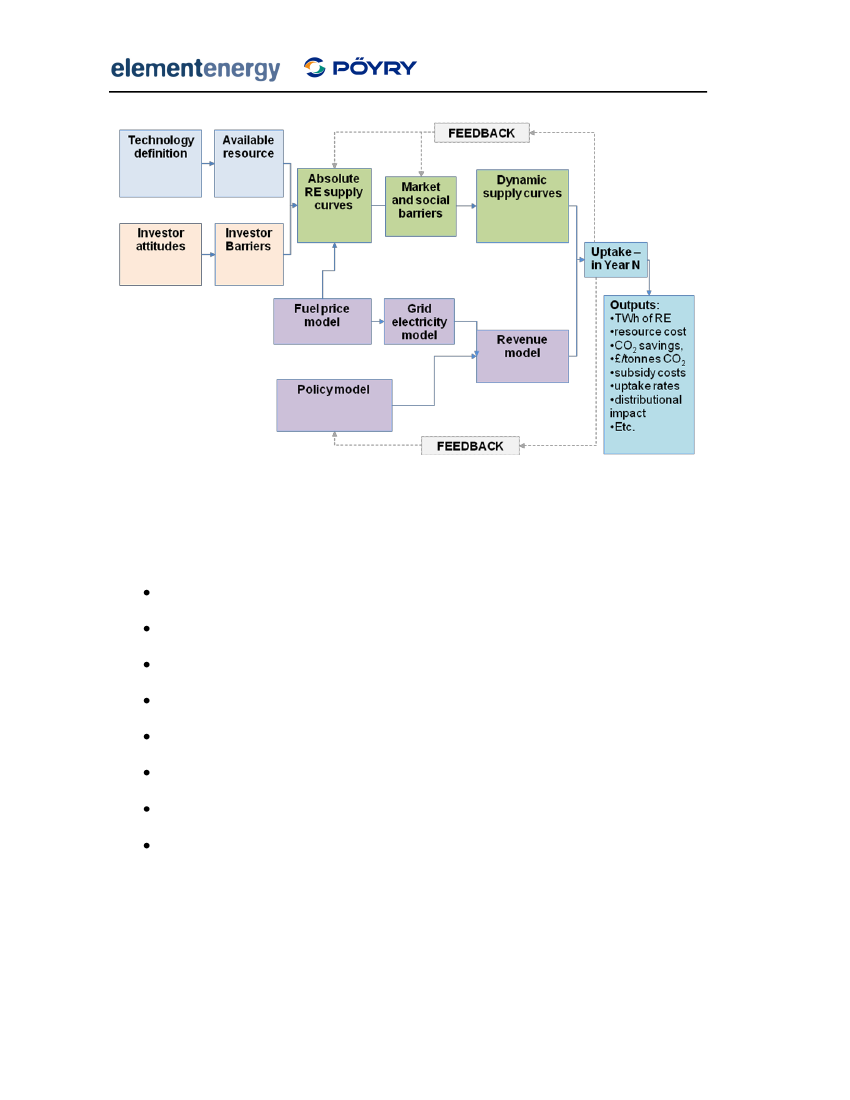

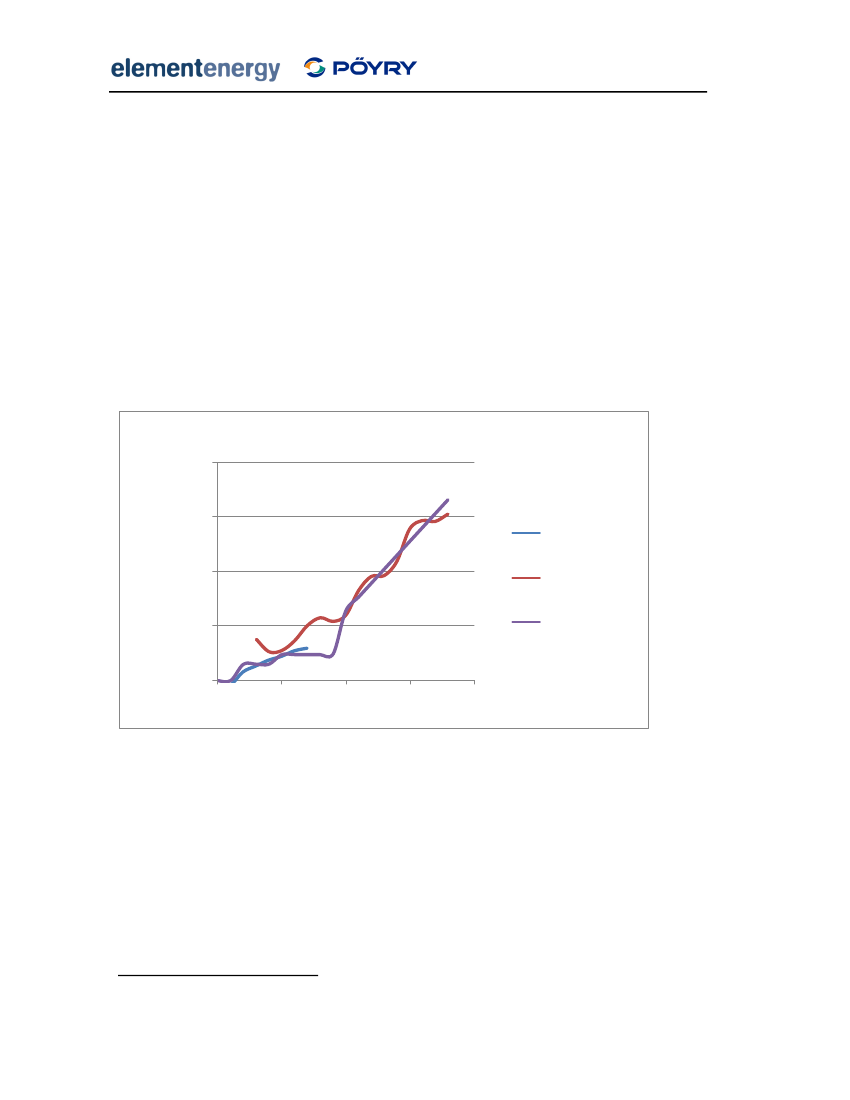

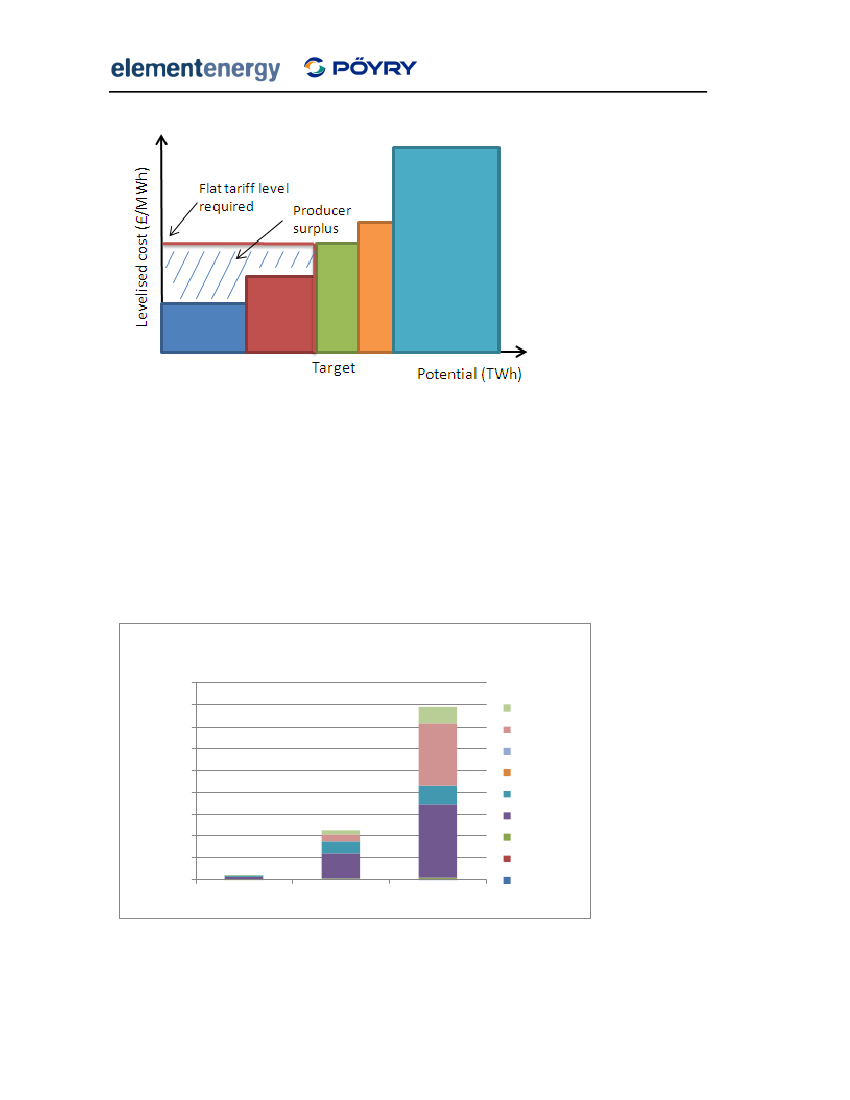

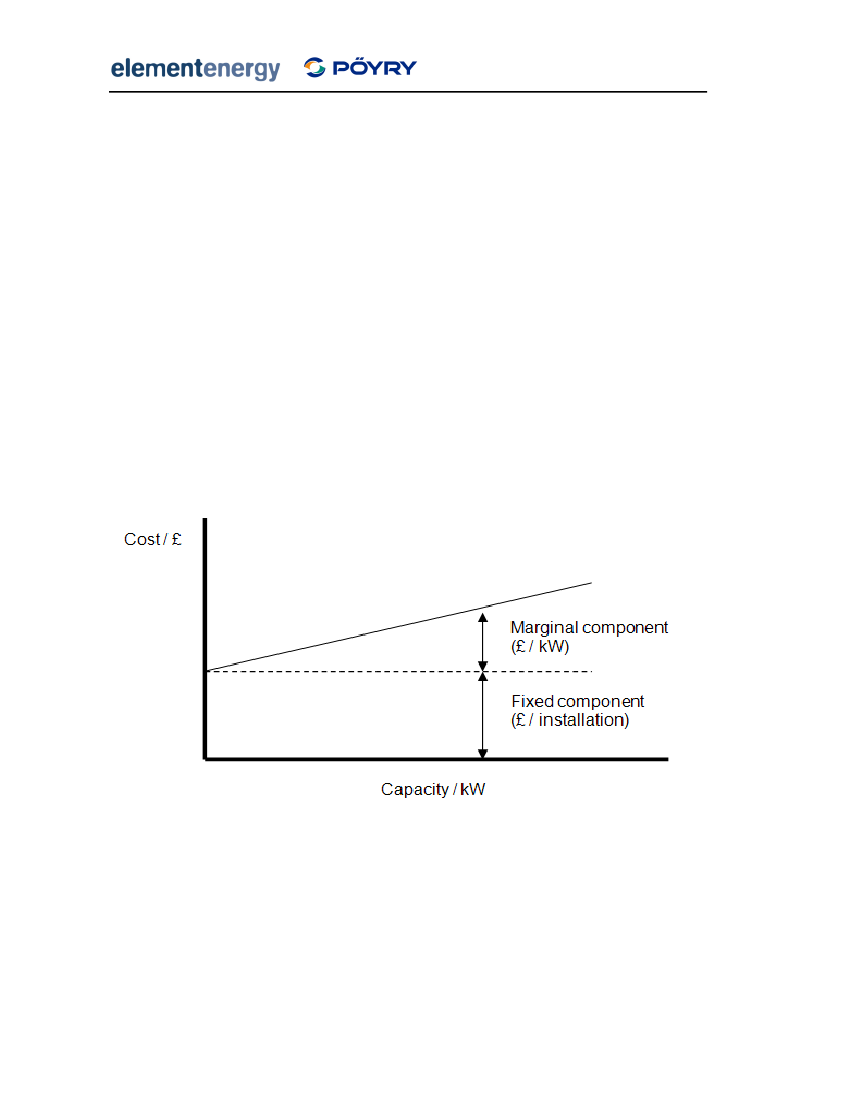

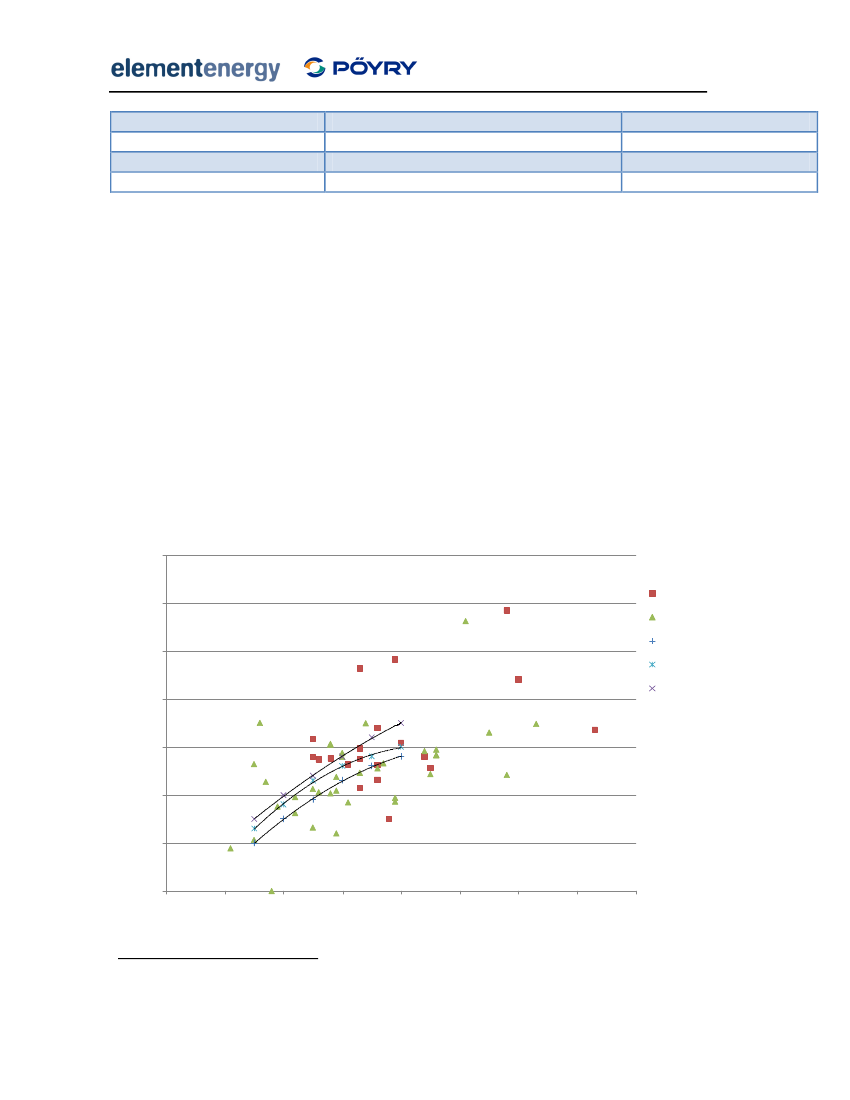

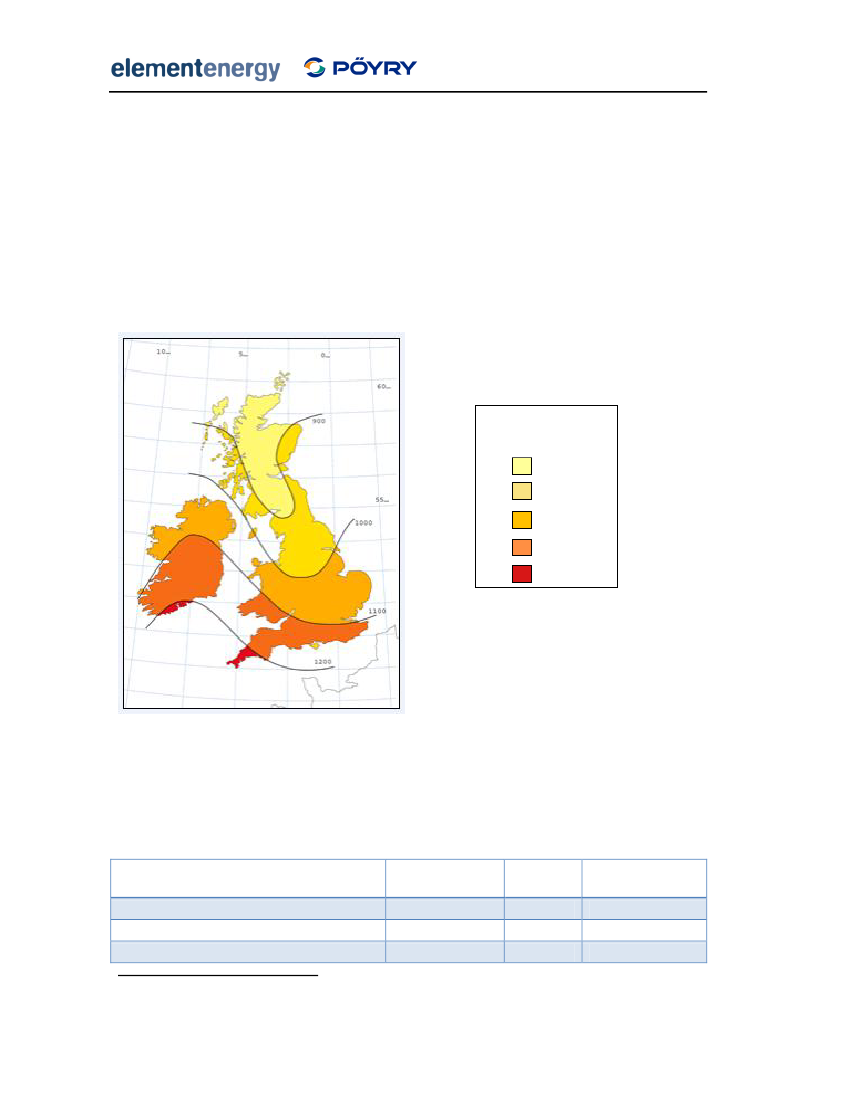

1 Executive SummaryThe EU Renewable Energy Directive sets the UK an ambitious target of meeting 15% of itsfinal energy consumption using renewable energy sources by 2020. In conjunction with alarge increase in the use of renewable heat and, to a lesser extent, renewable transport fuels,renewable electricity is expected to make a major contribution to the achievement of thistarget. Recent changes to the Renewables Obligation (RO) are predicted to deliver largeamounts of renewable electricity from large-scale technologies, such as onshore and offshorewind. However, the banding of support within the RO does not provide sufficient incentivesto small-scale renewable generators to encourage widespread uptake. For this reason, in theEnergy Act 2008 the Government took powers to introduce a Feed-in Tariff for renewableelectricity technologies up to 5MWein size and gas CHP systems up to 50kWe. ElementEnergy and Pöyry Energy Consulting were contracted by the Department of Energy andClimate Change to conduct a detailed review and analysis of the options for designing a Feed-in Tariff for Great Britain.MethodologyThe modelling approach is based on the construction of renewable electricity supply curvesshowing the size of the resource available at a given generating cost, as shown in Figure 1.The resource potentials for each technology were estimated using a combination of industryconsultation, literature review and primary analysis using Geographical Information Systems(GIS). The resource potentials were combined with a technology cost and performancemodel, and a representation of investor behaviour based on telephone discussions withrenewable energy investors. The resulting model is able to project uptake of each renewabletechnology under a wide range of feed-in tariff designs.

Figure 1 Illustrative renewable energy supply curve

2

Design of Feed-in Tariffs for Great BritainFinal Report

Following discussions with DECC, the following technologies were considered in the model:PhotovoltaicsOnshore windHydroelectric powerWave powerTidal powerBiomass CHPWaste to energy technologiesGas-fired CHPSewage gas and landfill have been deployed on a large scale under the RenewablesObligation. For the purposes of the modelling, it is assumed that these two technologiescontinue to receive support under the RO and are not supported under the FIT. In the mainscenarios investigated, it is assumed that biomass electricity installations that do not makeuse of waste heat are not supported under the Feed-in Tariff. The interactions between theFIT and the Renewable Heat Incentive are discussed in the Analysis.A representation of large-scale investor behaviour was developed based on telephonediscussions with renewable energy investors. Investors are assumed to have technology-specific hurdle rates that they use when assessing the financial case investing in renewabletechnologies1. These hurdle rates vary from 8% for utilities investing in establishedtechnologies such as large wind turbines, to 14% for commercial developers investing innovel technologies such as Advanced Thermal Treatment of waste. To reflect the range ofhurdle rates observed among investors in the real world, a distribution of hurdle rates wasassumed, with early adopters requiring only 8% returns for all technologies before investing.Small-scale investors, such as householders and commercial building owners, are assumed tohave a wider range of hurdle rates, which is consistent with the literature on energyefficiency purchases. For example, householders have a minimum hurdle rate of 3%, close tothe social discount rate, and a maximum rate of 20%.Assessment of the potential for sub-5MW electricityThe total technical resource was estimated for each of the technologies considered in themodel. The technical potential represents the upper bound for the amount of a technologythat can be deployed if sufficient policy and financial support were provided. The technical1

An investor’s hurdle rate is the minimum financial return they would require from a project in orderto invest in it.

3

Design of Feed-in Tariffs for Great BritainFinal Report

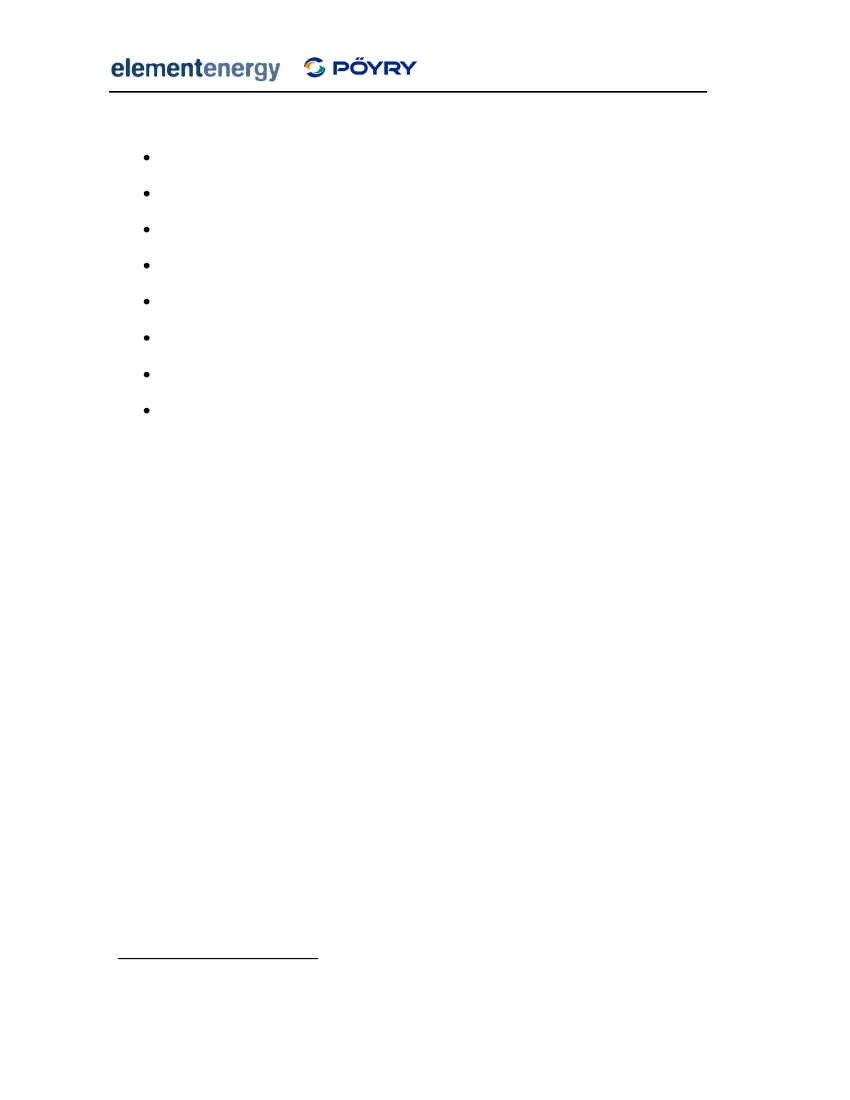

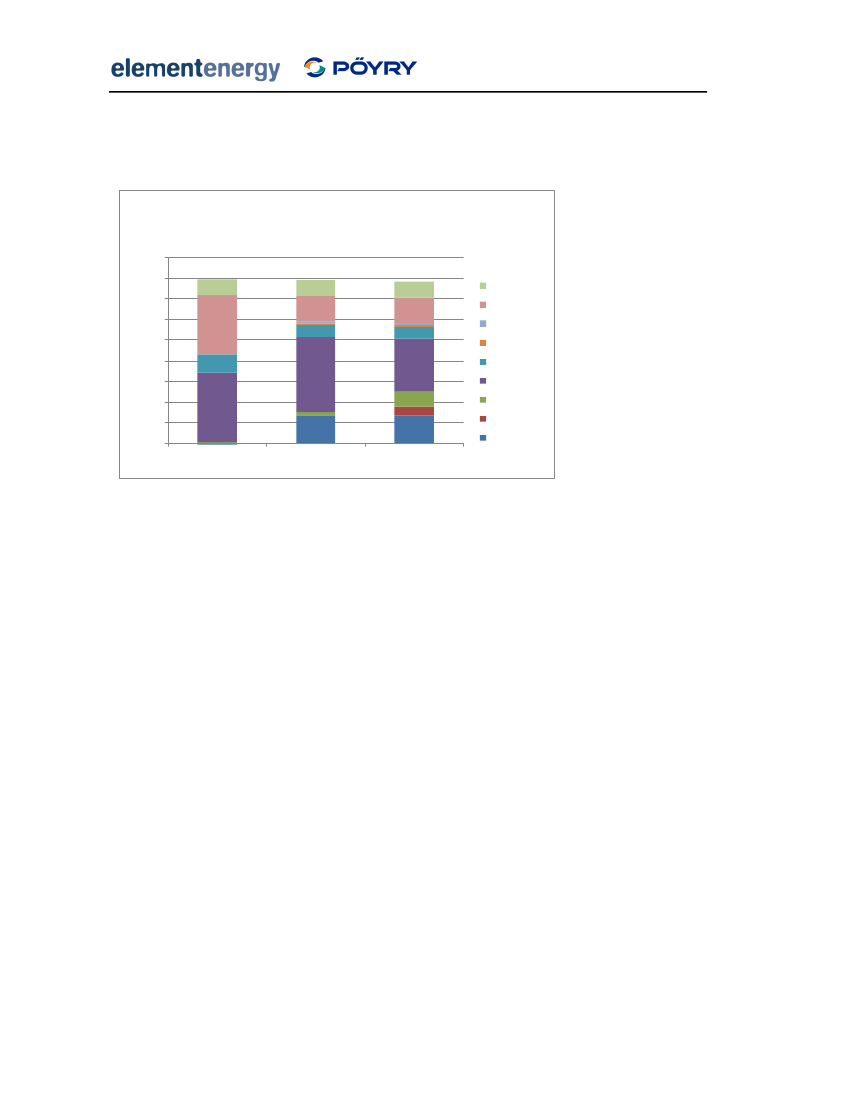

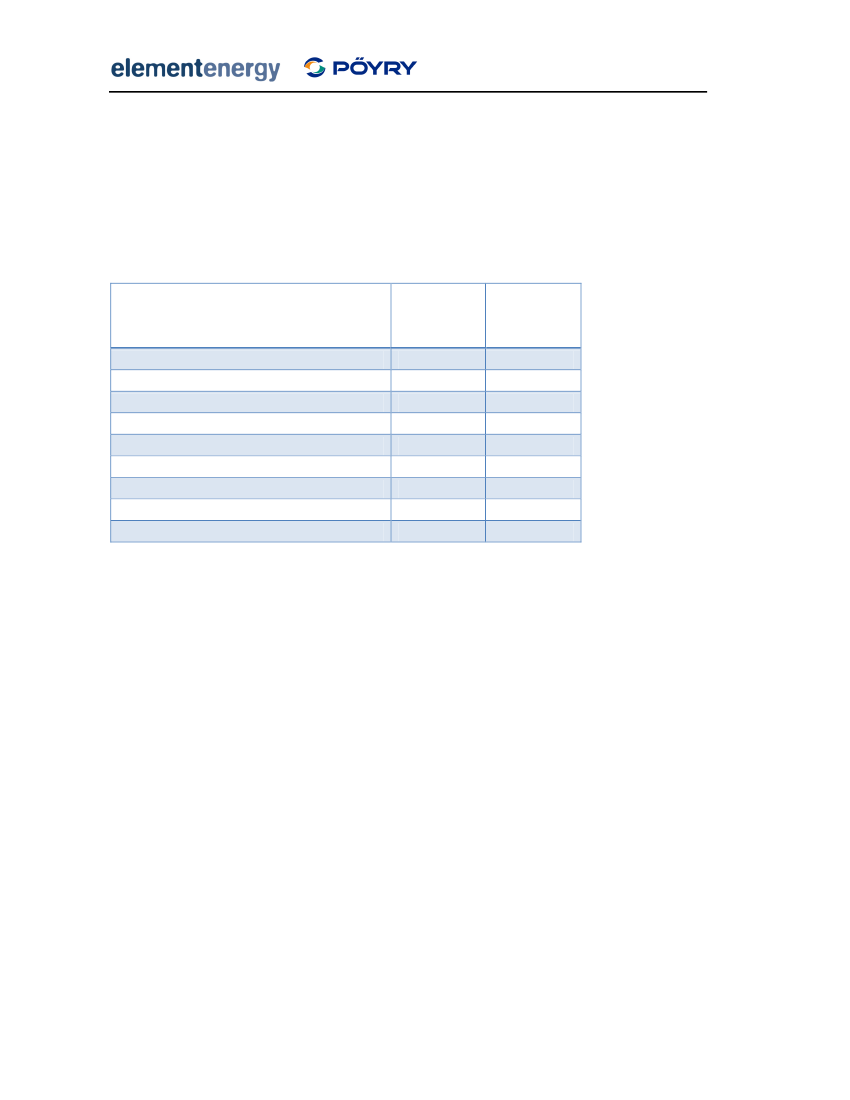

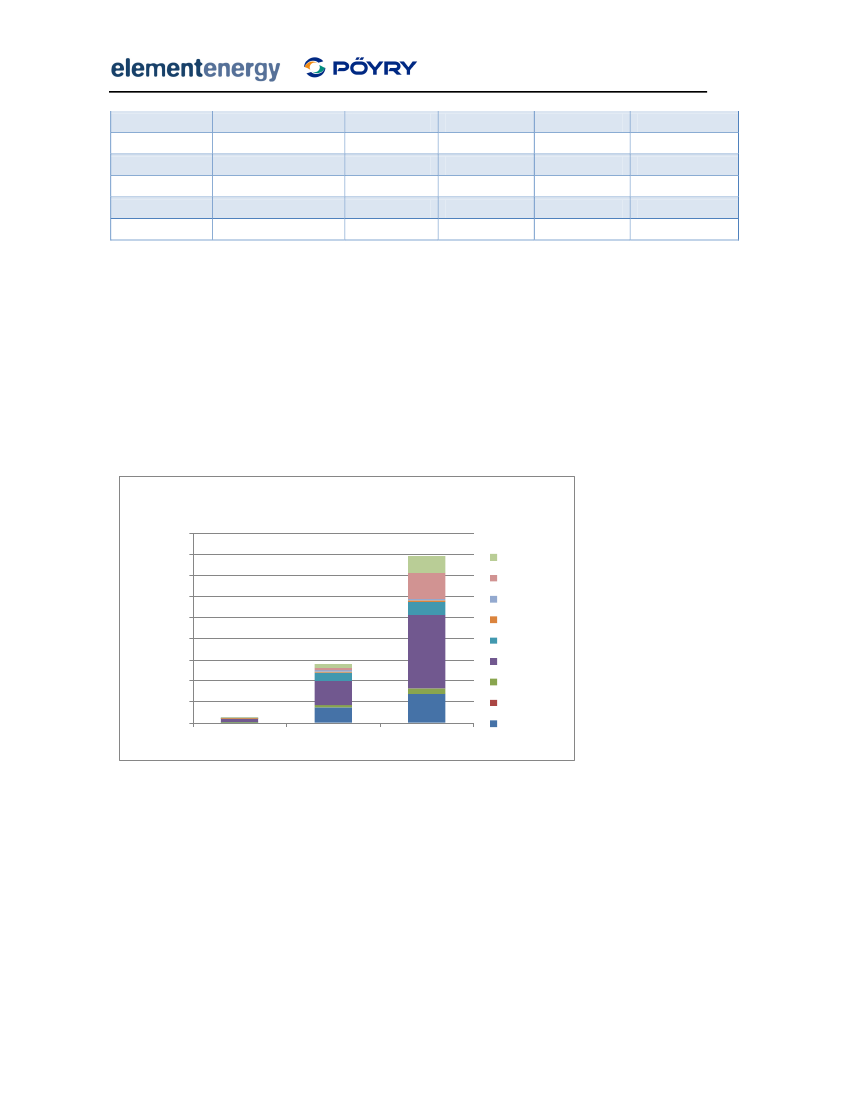

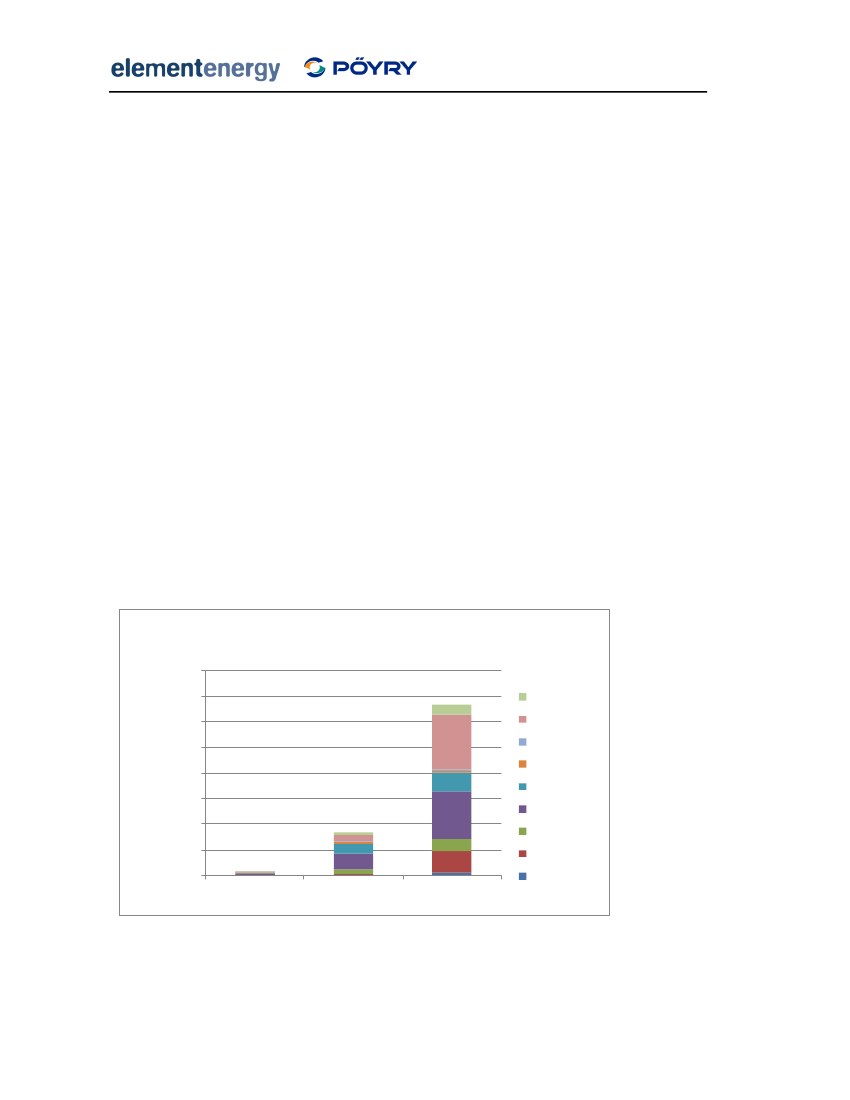

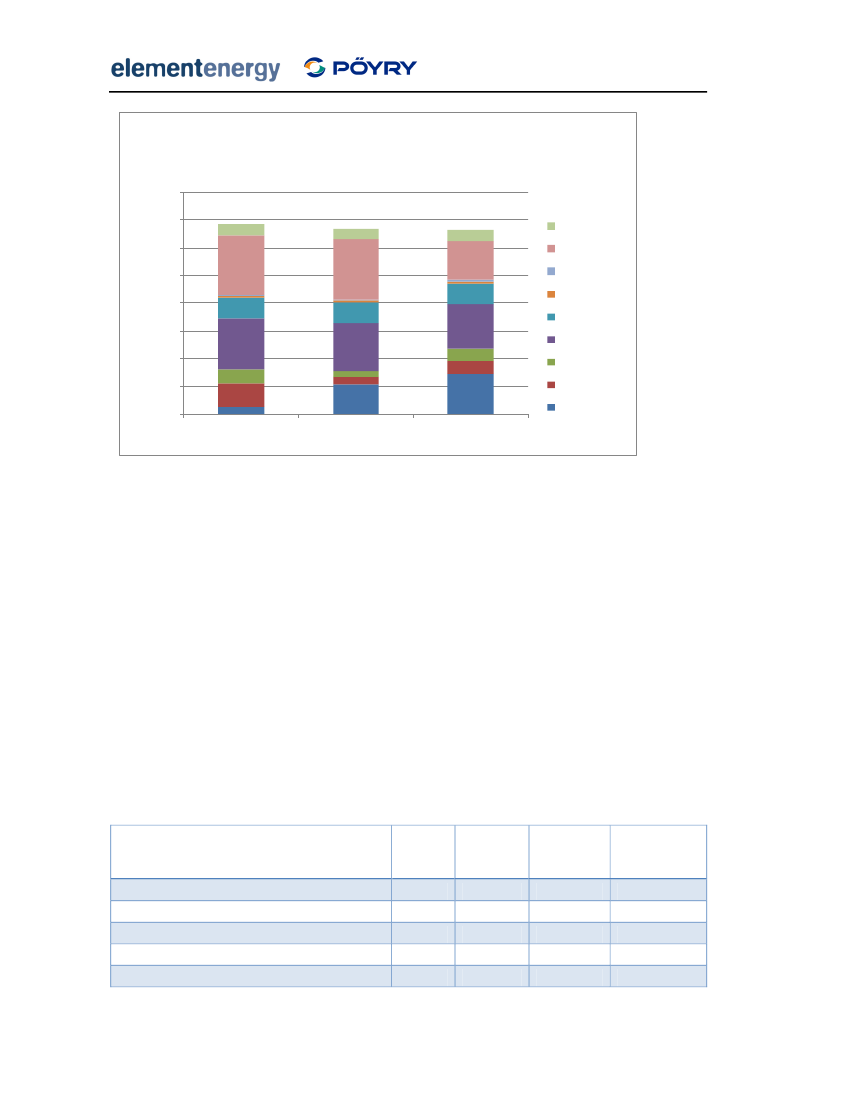

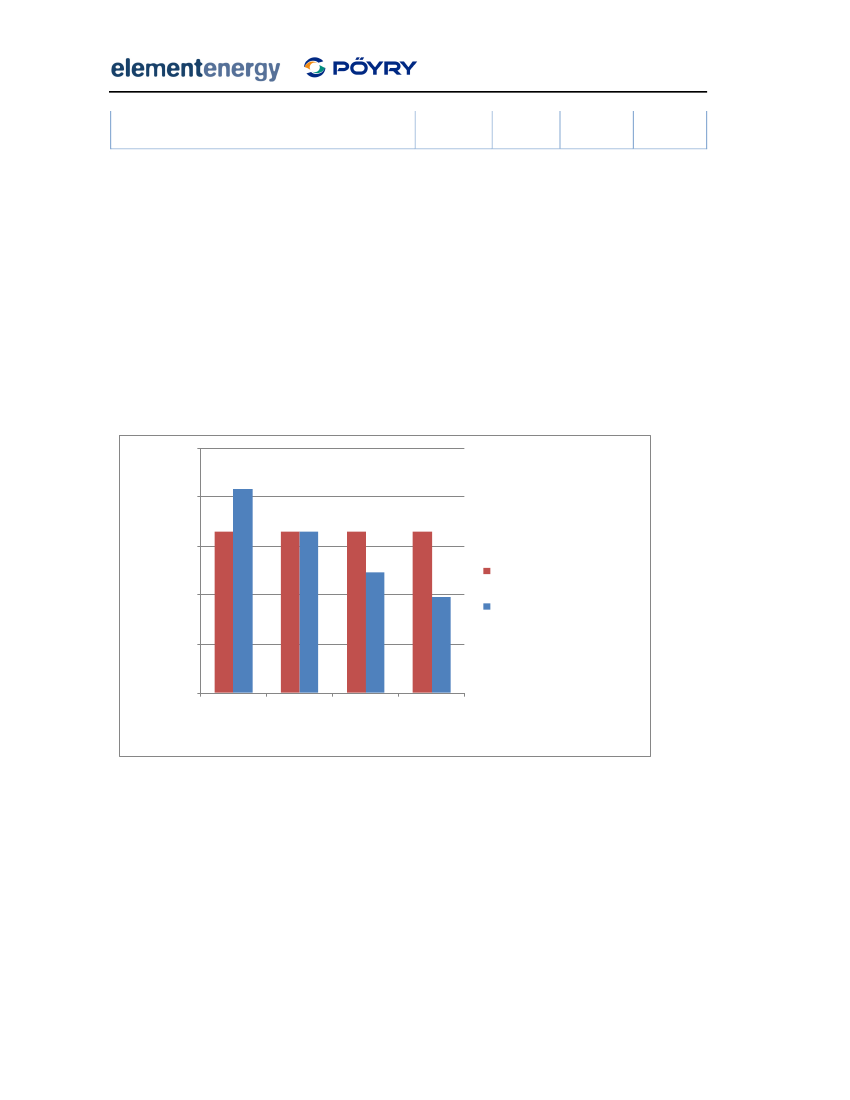

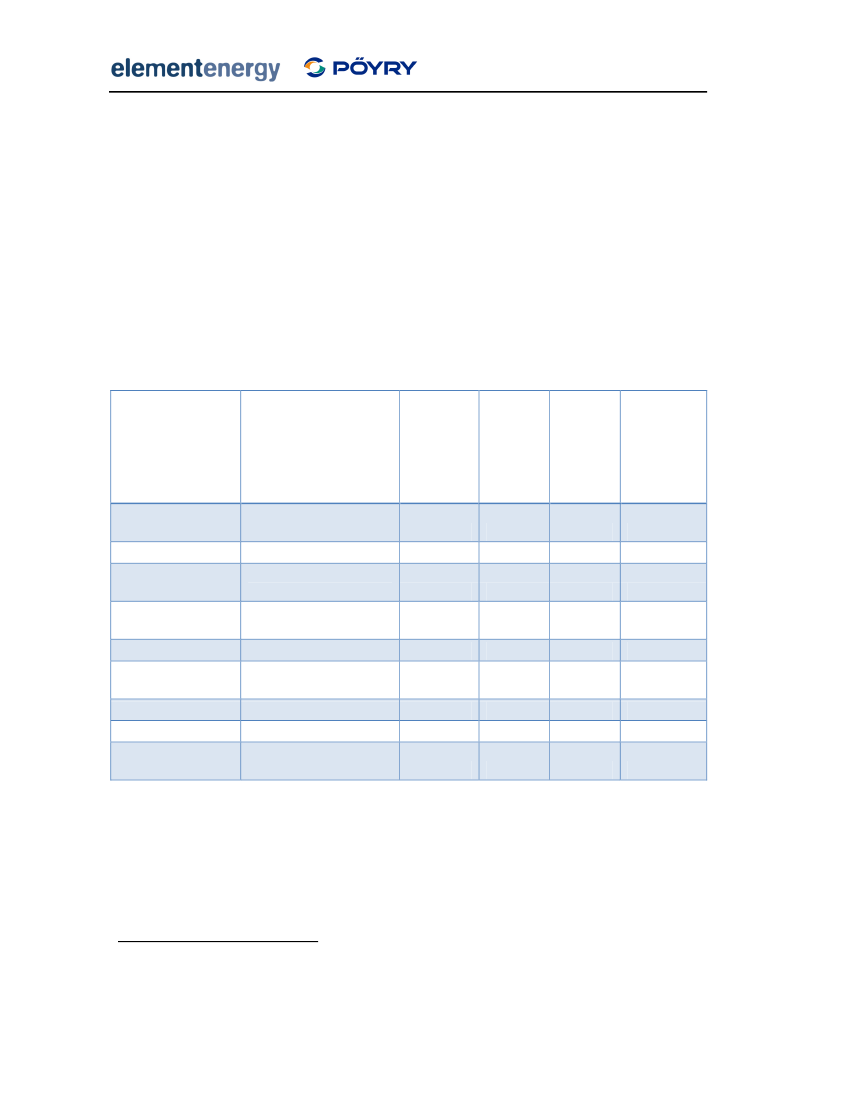

potential does not include time-dependent constraints such as the maximum growth rate ofthe industry or a limit on consumer demand in a given year; these constraints are imposed onthe absolute supply curves to give dynamic supply curves, which show the resource availablein a given year.Barriers are implemented at several points in the model. These dictate the level ofdeployment in a given year, and are caused by both market and social constraints. Themarket constraint is based on the ability of an industry to supply a demand for renewableenergy technologies. The social barriers represent the social acceptance of renewabletechnologies changing as more are deployed. For example, it is assumed that socialacceptance of wind-power decreases with increasing deployment as impacts from multipledevelopments begin to accumulate. Finally, an overall market growth constraint is applied toeach technology, which limits the year on year growth of the industry. This is particularlyimportant in the early years of the policy, where industries must grow rapidly from a smallinitial size.BaselineIn order to assess the impacts of the Feed-in tariff scenarios, a baseline was established thatprojected uptake of sub-5MW technologies under Business as Usual. The baseline assumesthat the banded RO continues to be the primary support measure for all technologies. Figure2 shows the uptake from sub-5MW technologies in the baseline. Over 2TWh of electricity isgenerated from new installations in 2020, and the generation is provided exclusively by large-scale technologies such as on-shore wind, hydro and waste.Total electricity generation by sub-5MW RES-E bytechnology - BaselineTotal electricity generation (GWh per year)

2,500Waste2,0001,5001,000Bio

TidalWaveHydro

Wind (Large)5000201020152020Wind (Small)PV (Large)

PV (Small)

Figure 2 Electricity generation from sub-5MW technologies in the baseline

Policy results4

Design of Feed-in Tariffs for Great BritainFinal Report

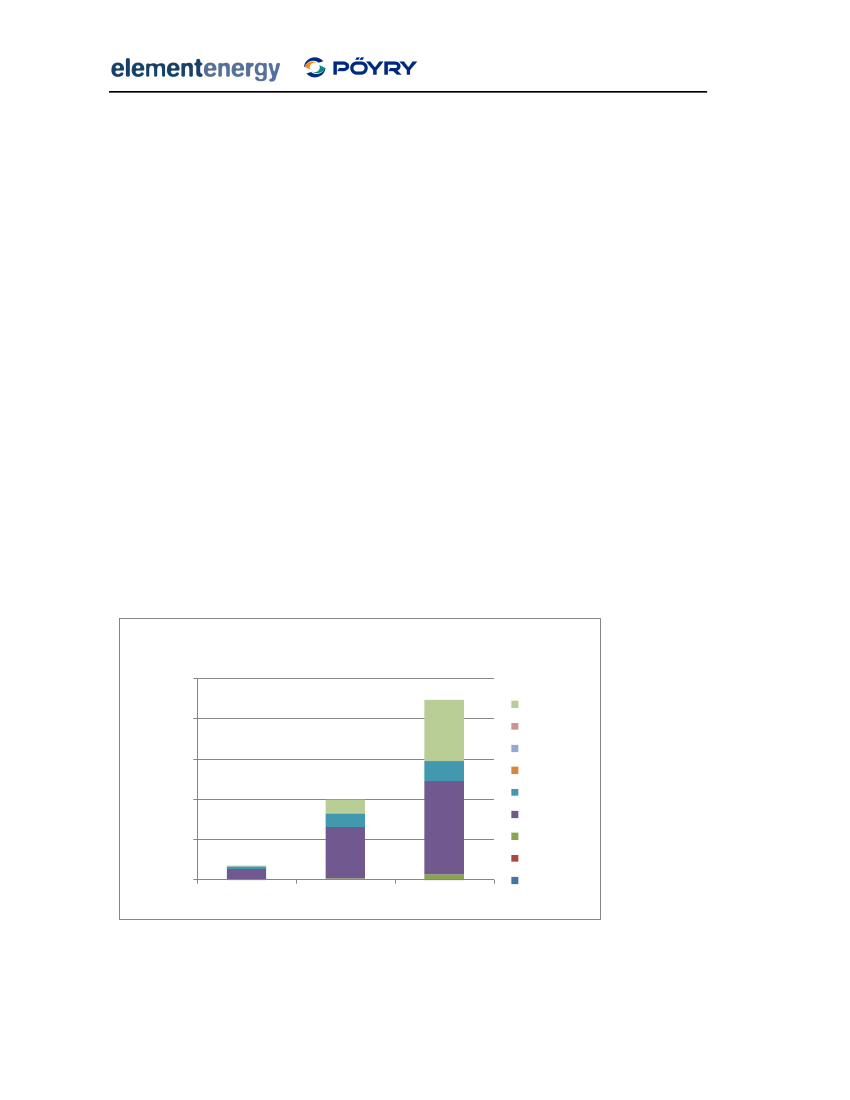

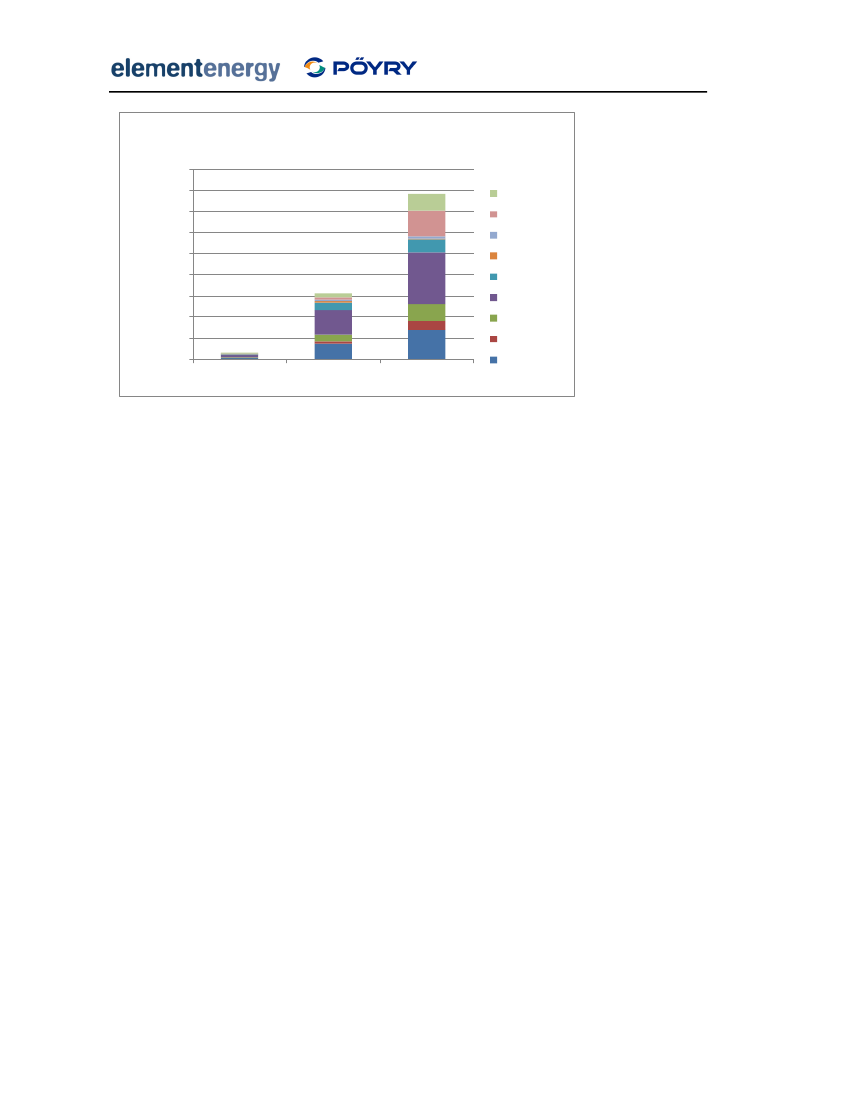

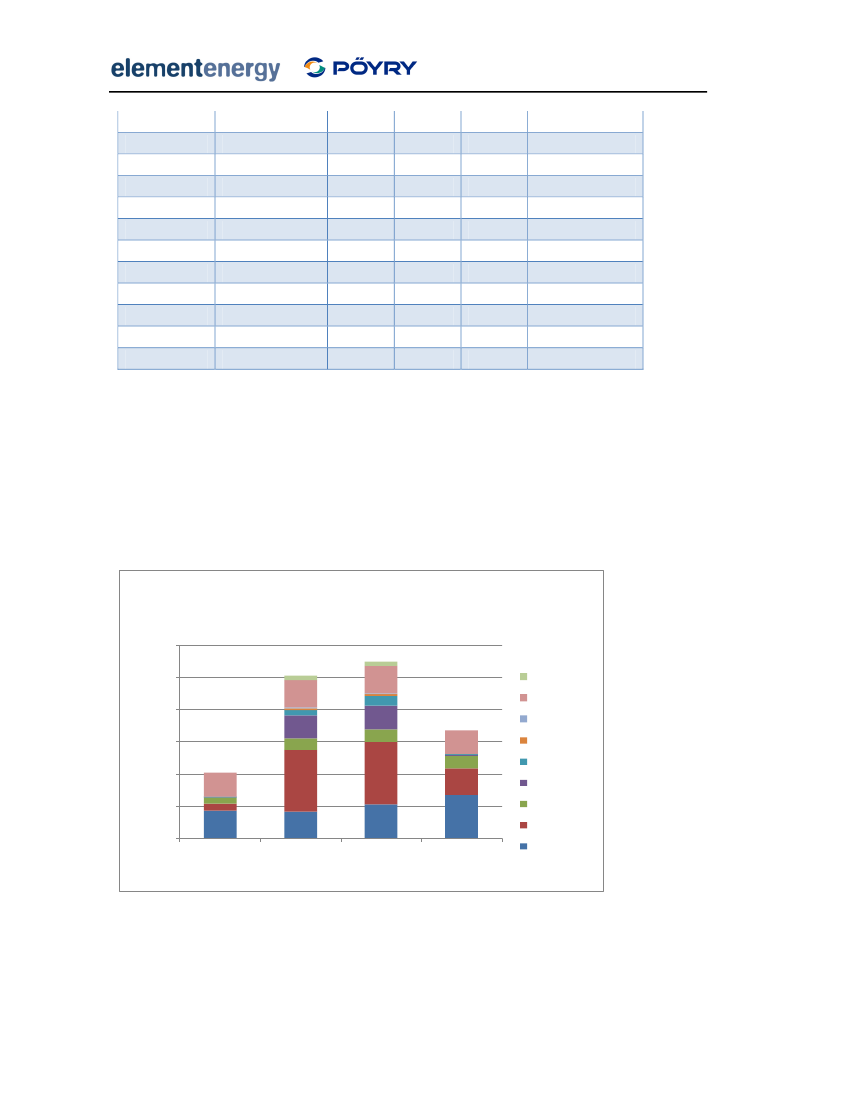

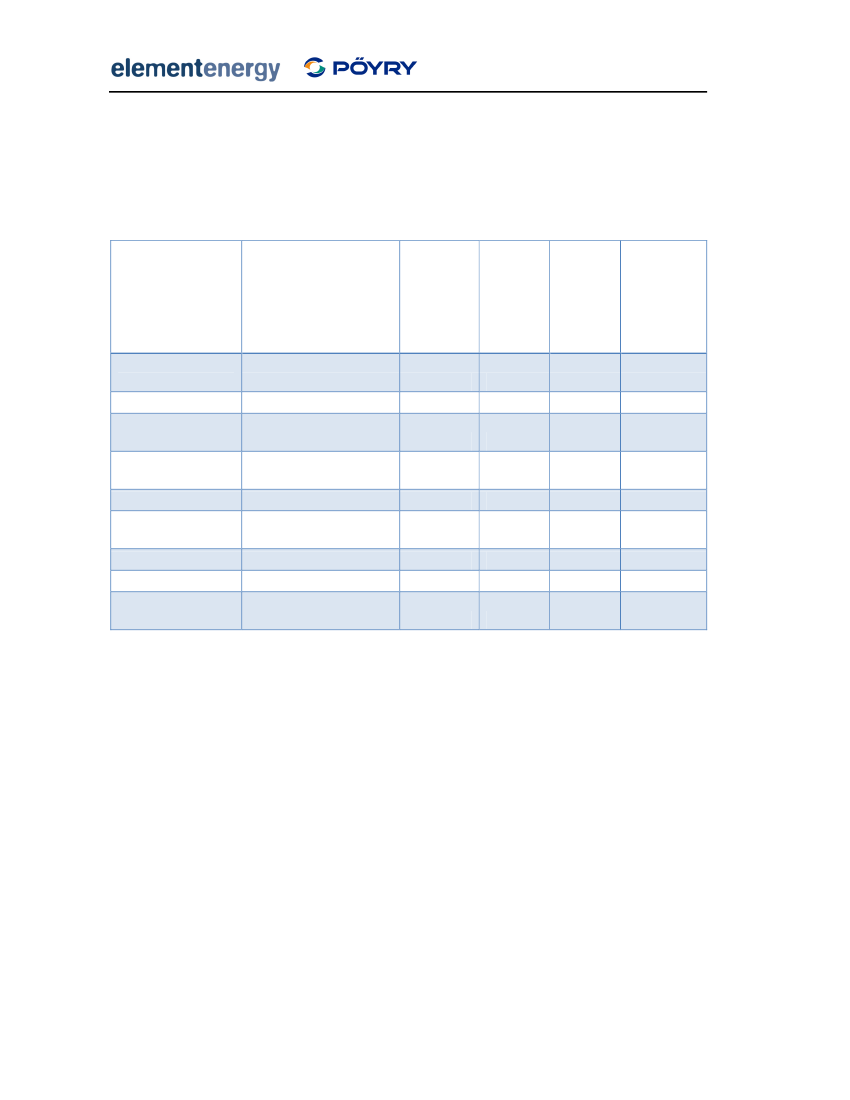

The design of the Feed-in Tariff and the support levels paid to different technologies isguided by the overall aims for the policy. A scheme designed to meet a specific electricitygeneration target at the lowest cost to consumers and the economy will deliver a technologymix that is very different from a scheme designed to drive uptake of domestic – andcommunity-scale installations. To allow easier comparison between scenarios, a totalelectricity generation target for 2020 was set so that the overall technology deployment wasconstant between runs. Following discussions with DECC, two targets were used in themodelling, corresponding to 2% and 3.5% of UK electricity. This is equivalent to 8TWh and13.5TWh based on DECC’s projection of UK electricity demand in 2020. Figure 3 shows thetechnology mix for a flat tariff of £155/MWh. This tariff level is the minimum tariff requiredto provide 8TWh of generation in 2020. In other words, it is equal to the generating cost ofthe most expensive technology required to meet the target. This tariff is paid to allrenewable generators, and includes the market electricity price. It is assumed to stayconstant throughout the policy to 2020. Although the total deployment in this scenario issignificantly larger than in the baseline, the majority of generation is still from large-scaletechnologies. Over 2.5TWh of biomass CHP is deployed by 2020, almost all of which is instandalone installations rather than those connected to district heating sites, due to the highadditional cost of installing a district heating system.Total electricity generation by sub-5MW RES-E bytechnology - 2% least costTotal electricity generation (GWh per year)9,0008,0007,0006,000WasteBio

TidalWaveHydro

5,0004,0003,0002,0001,000

Wind (Large)Wind (Small)PV (Large)

0201020152020

PV (Small)

Figure 3 Electricity generation from sub-5MW renewables - £155/MWh tariff

An alternative to pursuing a least cost approach in the design of the policy is to aim tostimulate across a wide range of technologies and scales. For small-scale consumers who canonly access small, higher-cost technologies, tariffs significantly higher than £155/MWh arerequired. Table 1 shows the tariff levels for two scenarios that result in more diversetechnology mixes. In the ‘community bias’ scenario, tariffs are set specifically to encourage

5

Design of Feed-in Tariffs for Great BritainFinal Report

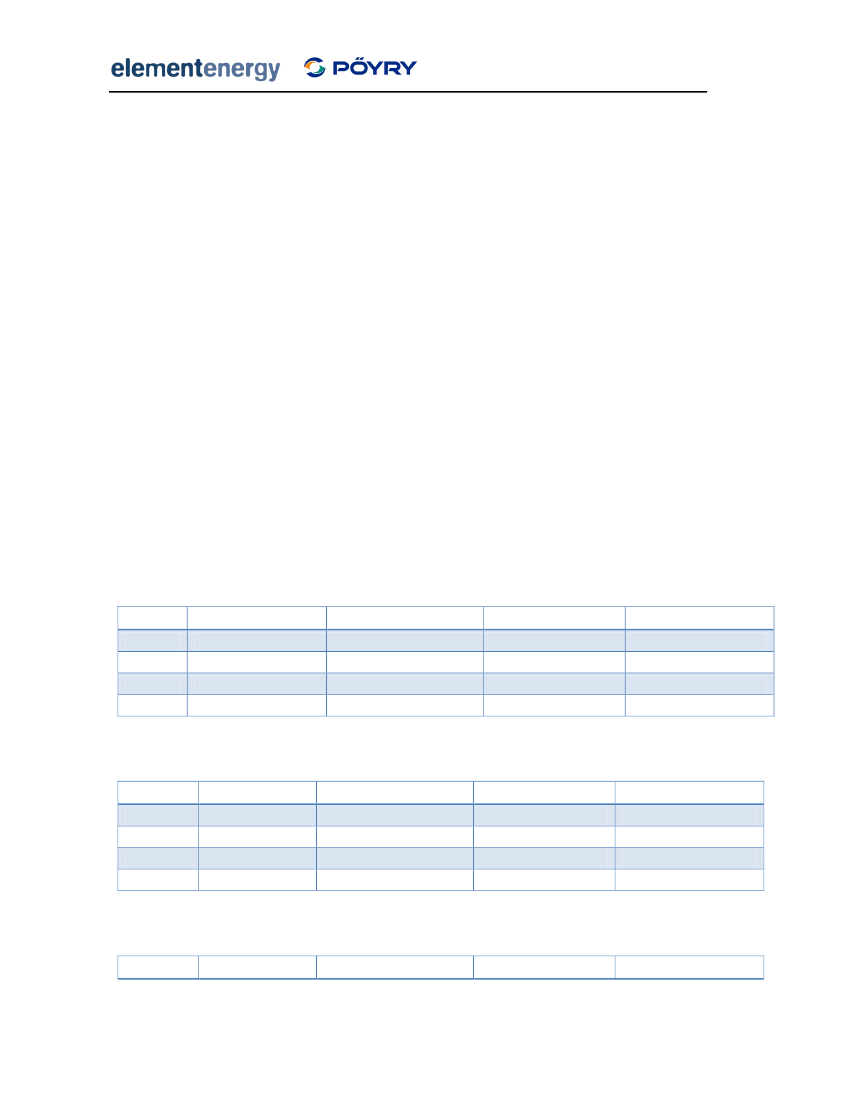

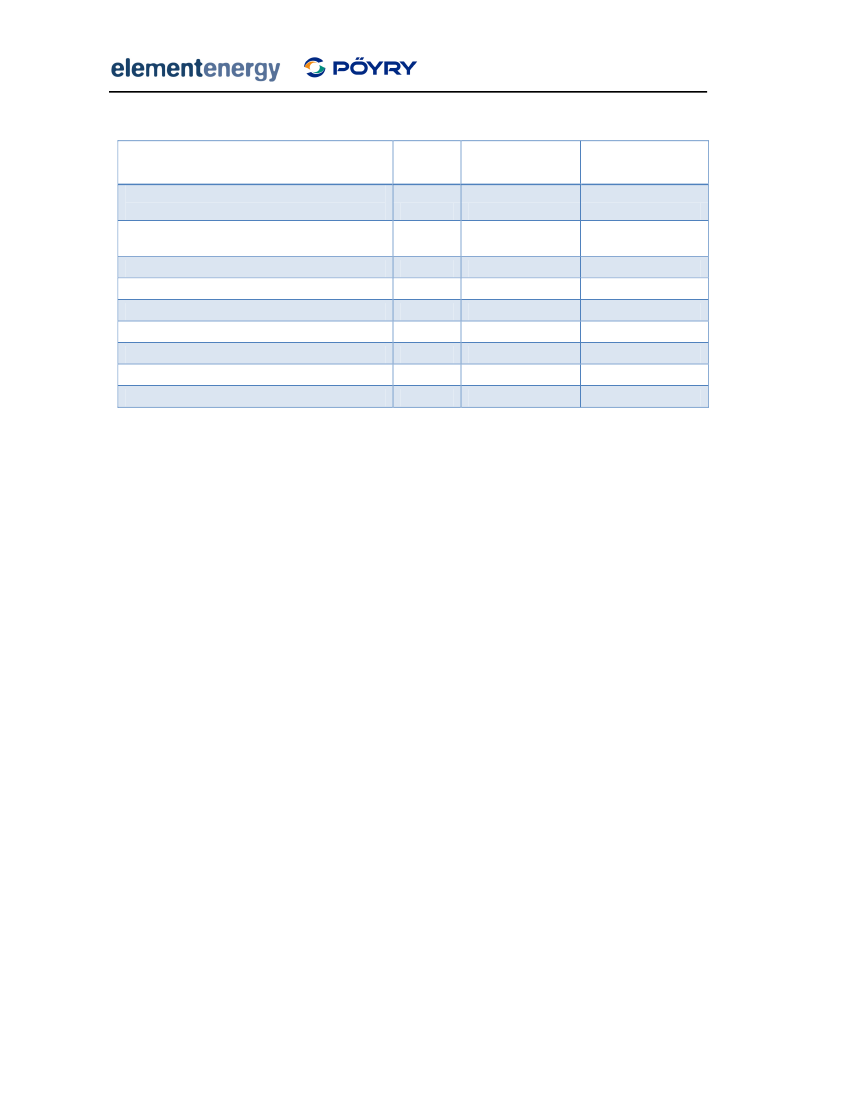

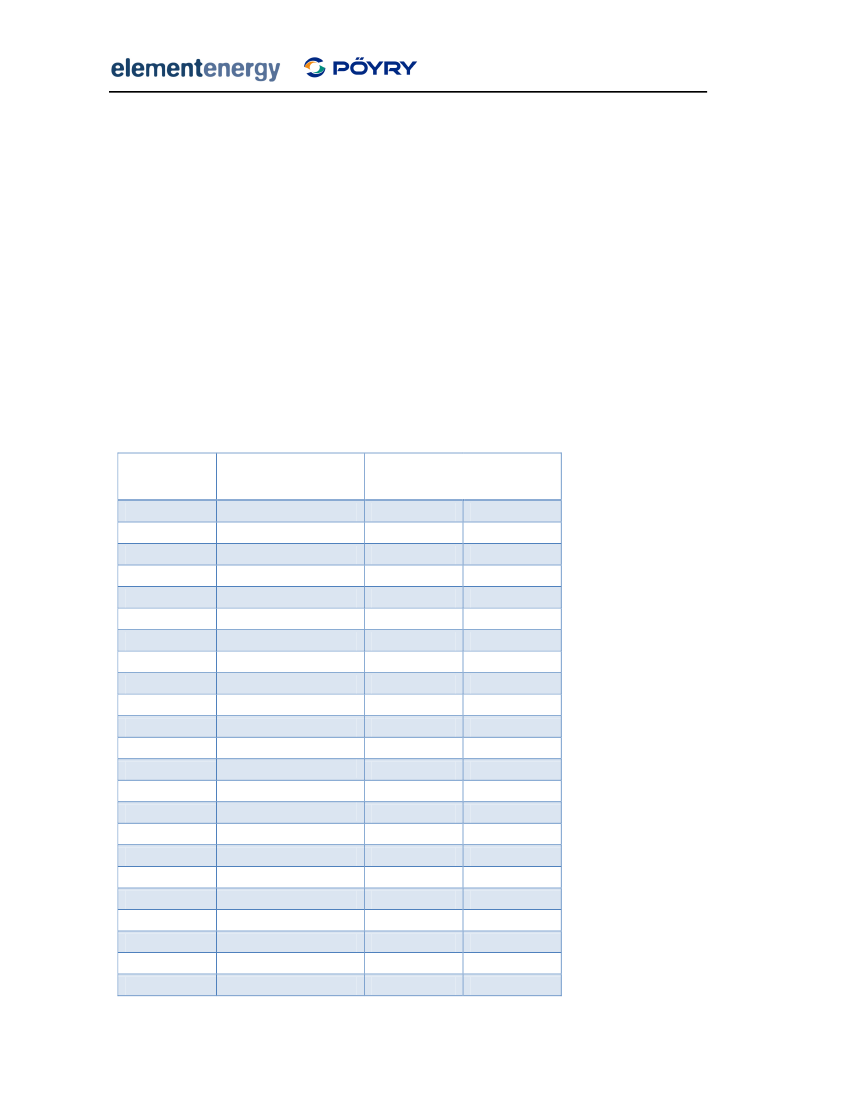

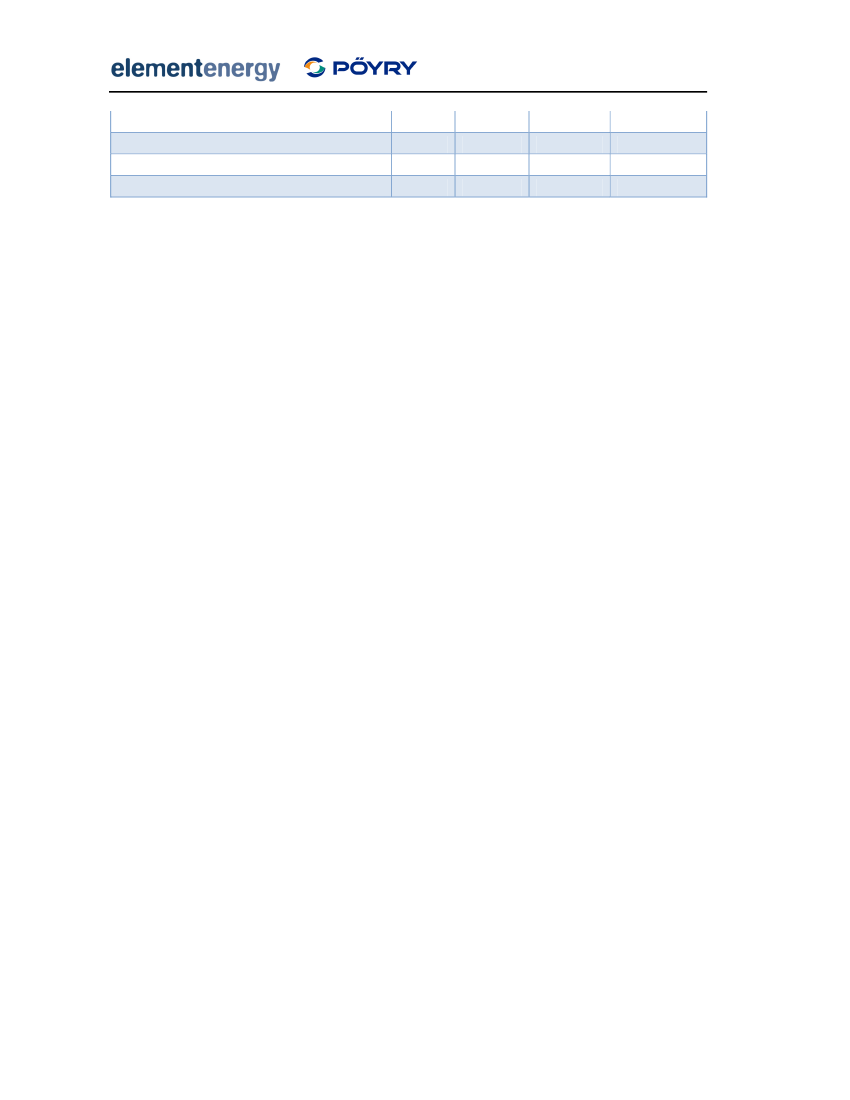

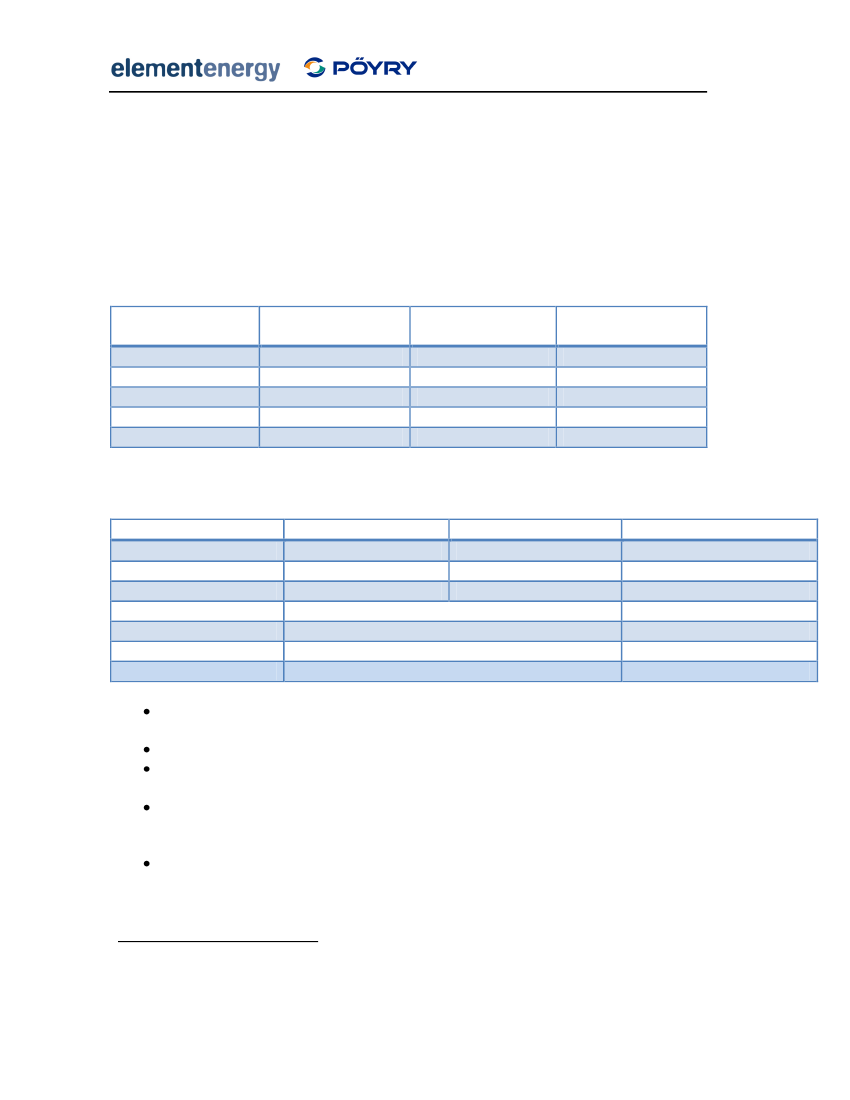

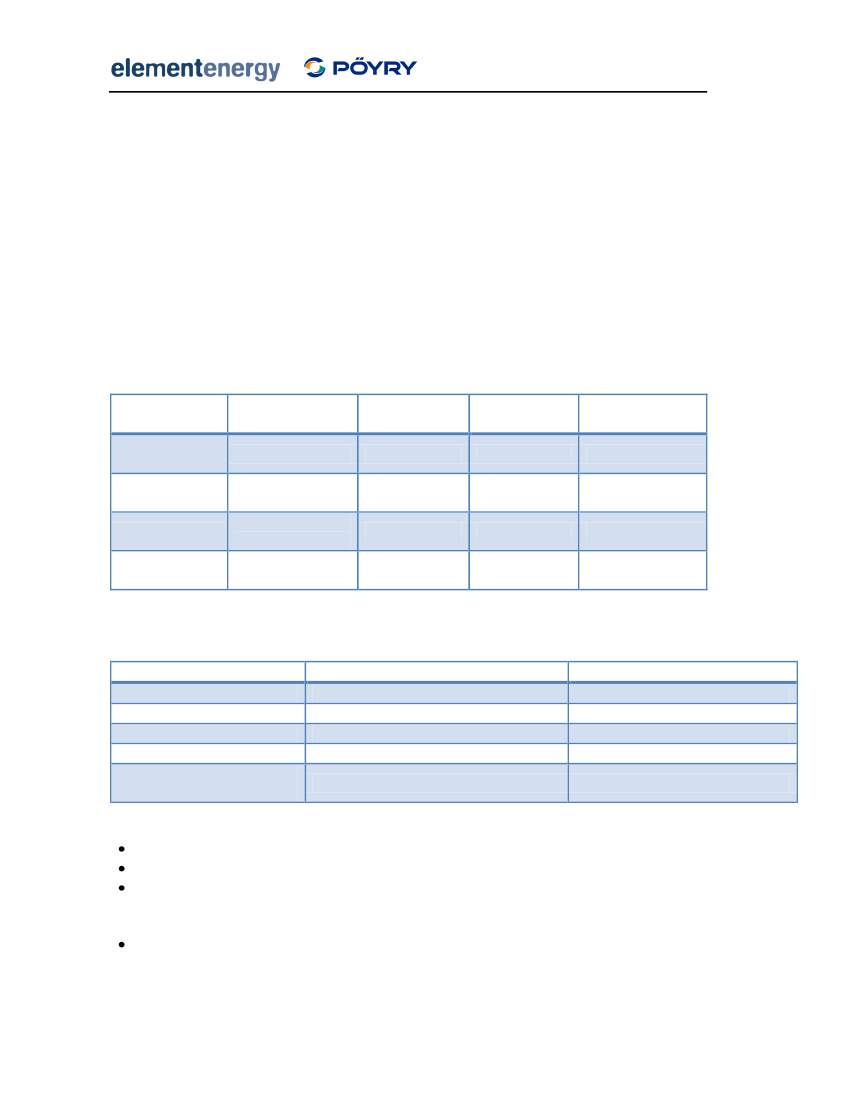

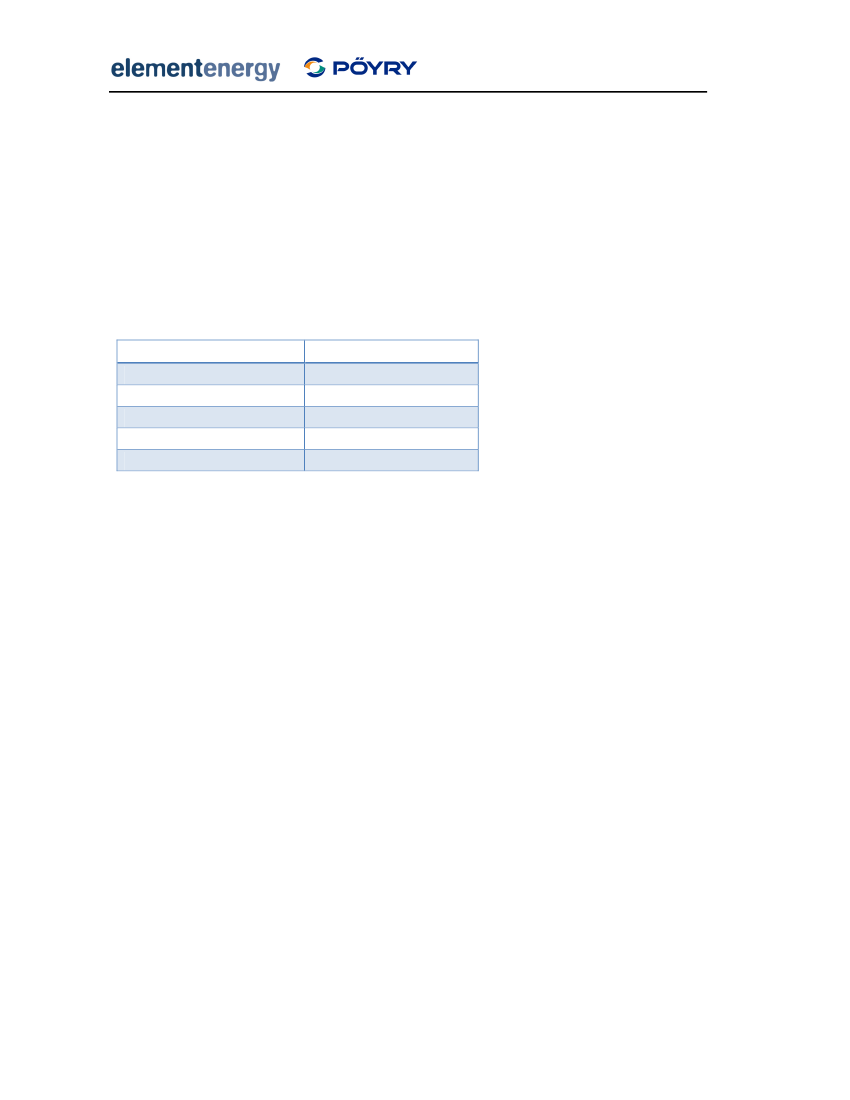

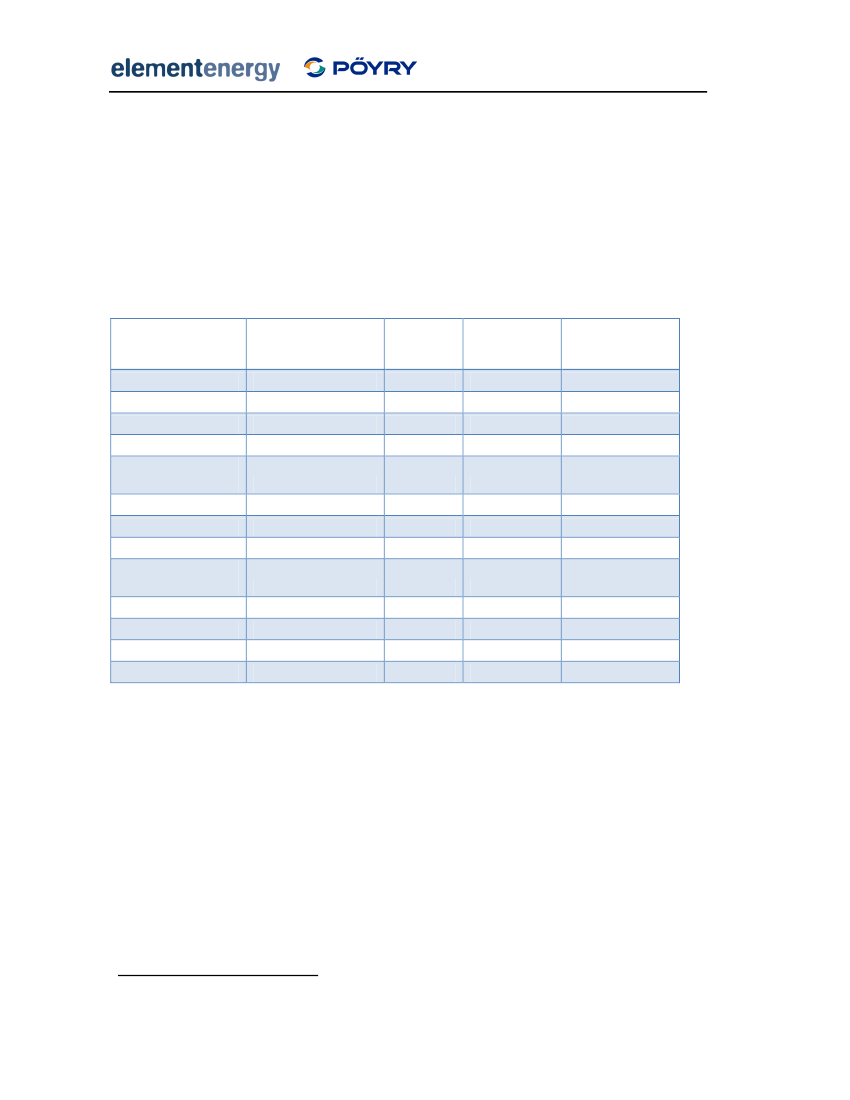

deployment of community- and domestic-scale technologies, such as small and medium windand PV systems.Table 1 Tariff levels for 2% diverse and community runs

2% diverse mixTechnologyPV

2% community bias

Wind

Hydro

WaveTidalBiomass

Waste

Initial tariff Degression2Initial tariffDegression (%Size(£/MWh)(% per year) (£/MWh)per year)Domestic£4005%£4005%4-10kW£3805%£3805%10-100kW£2505%£3505%100-5000kW£2505%£3005%Stand-alone£2505%£3005%Micro£2000%£3000%1-15kW£2000%£3000%15-50kW£2000%£2500%50-250kW£2000%£2000%250-500kW£2000%£1800%500-3000kW£1600%£1430%1-10kW£1450%£1450%10-50kW£1450%£1450%50-500kW£1450%£1400%500kW+£1400%£1400%All types£2502%£2502%All types£2500%£2500%Heat turbine£1300%£1300%ORC£1300%£1300%Steam turbine CHP£1300%£1300%Electricity only£00%£00%Electricity only£1000%£1000%AD£1000%£1000%Incineration£1000%£1000%

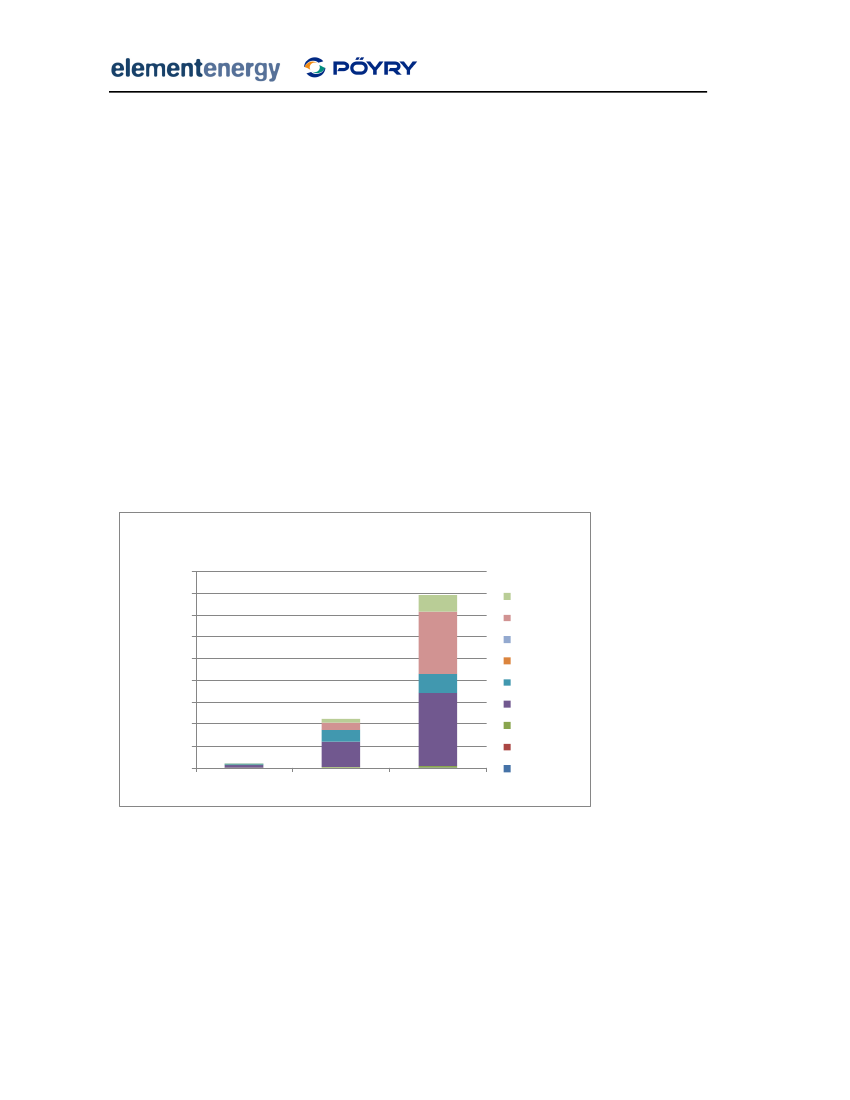

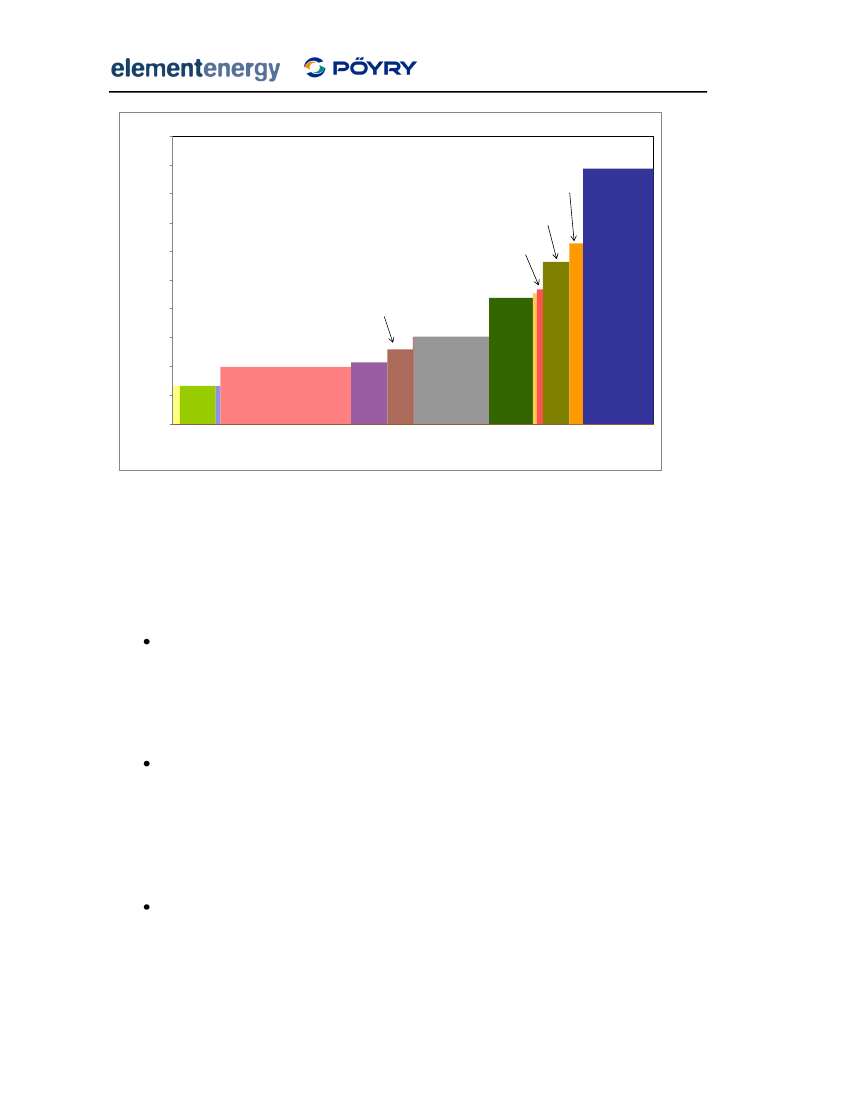

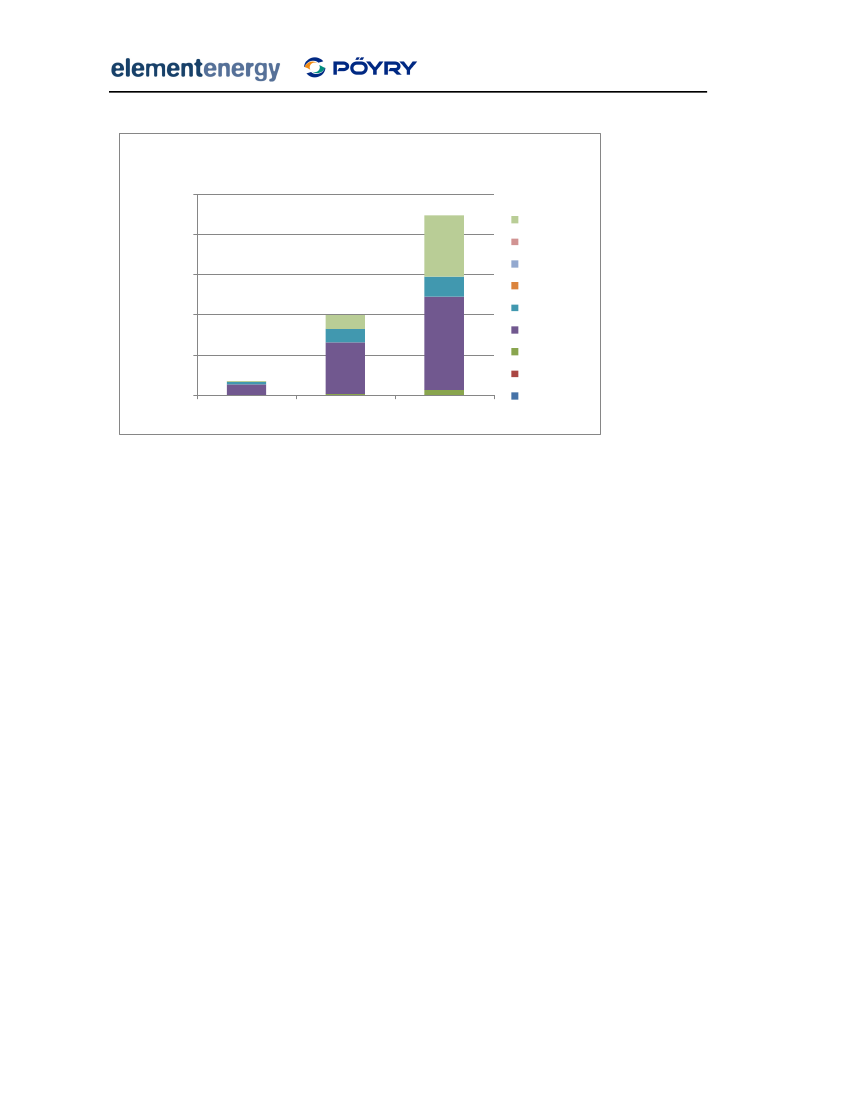

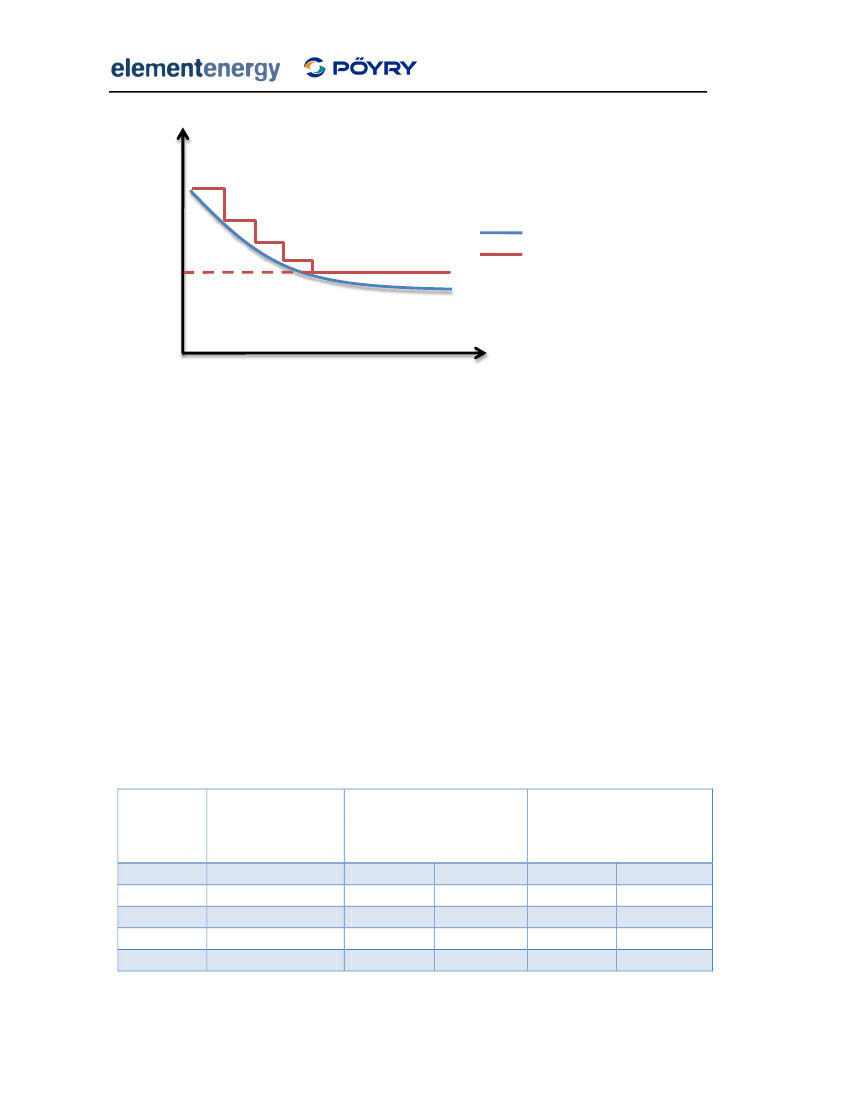

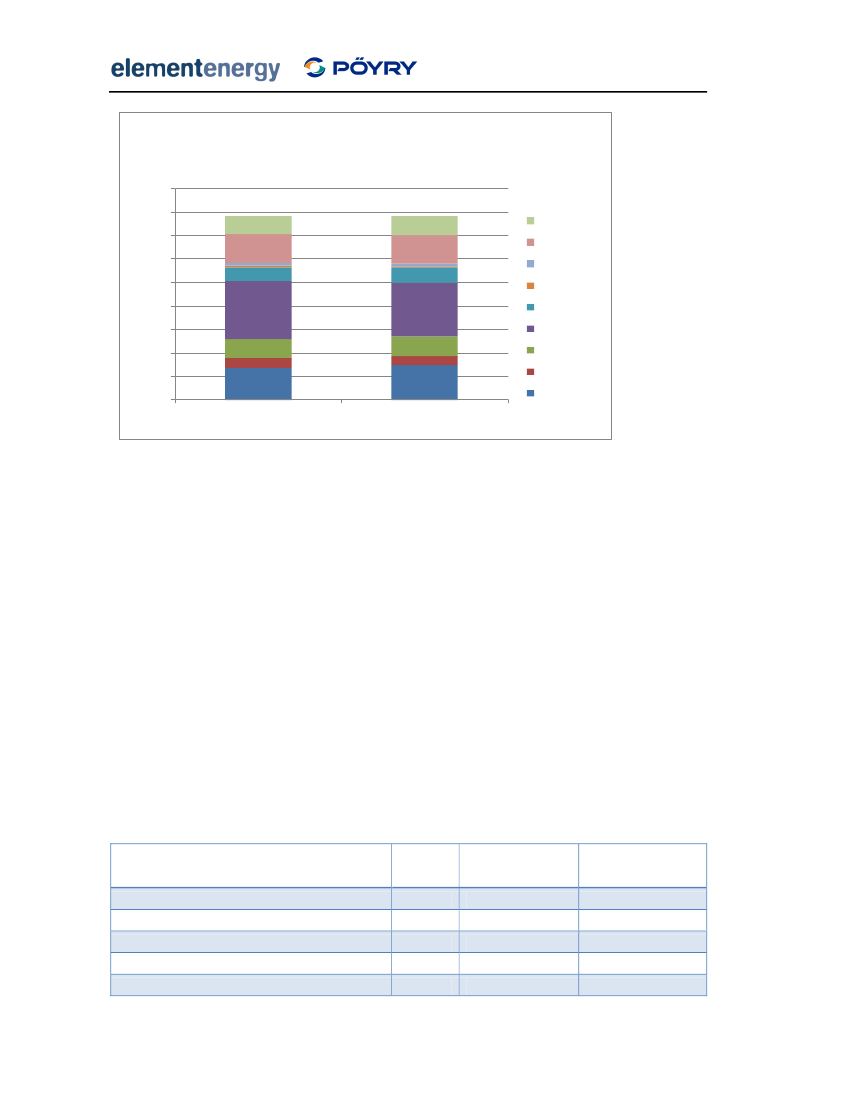

Figure 4 shows the electricity generation mix with the tariffs shown above. Although theoverall generation remains constant at 8TWh, the diversity of the generation mix issignificantly increased. In the ‘community-bias’ scenario, over 1.5TWh per year are generatedfrom PV, the majority of which is from domestic-scale installations. Small wind turbines up to250kW in size also contribute 0.5TWh in 2020. The costs of increasing technology diversity is2

The degression rate is the annual reduction in the tariff paid to new installations. The degression ratereflects anticipated reductions in technology costs and reduces overpayments to investors purchasingsystems in the future.

6

Design of Feed-in Tariffs for Great BritainFinal Report

high, with a cumulative resource cost (defined as the total money spent on capital equipmentand running costs for renewable energy plant) by 2020 of nearly £4 billion relative toBusiness as Usual, compared to £1.0 billion in the least cost scenario.

Electricity generation in 2020 - 2%scenarios9

Electricity generation in 2020 (TWh)

8765432102% least cost2% diverse2% community

WasteBio

TidalWaveHydroWind (Large)Wind (Small)PV (Large)PV (Small)

Figure 4 Renewable electricity generation in 2020 - diverse and community scenarios

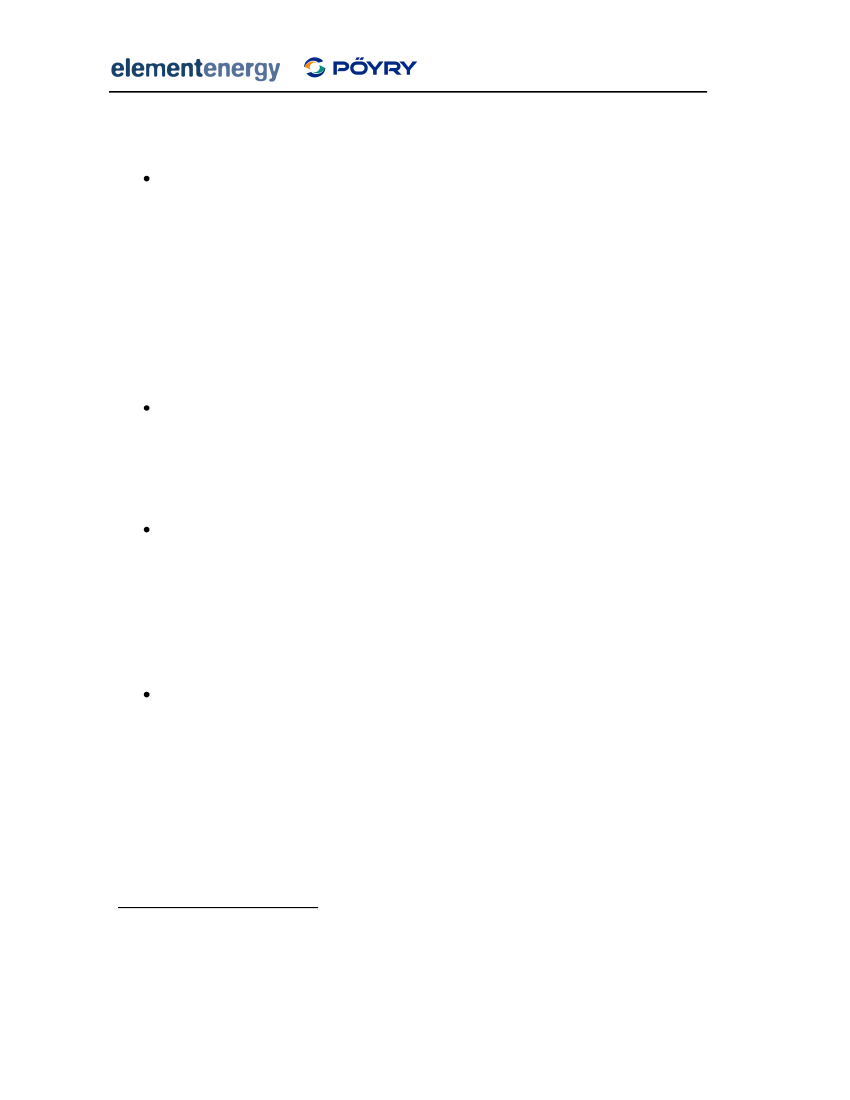

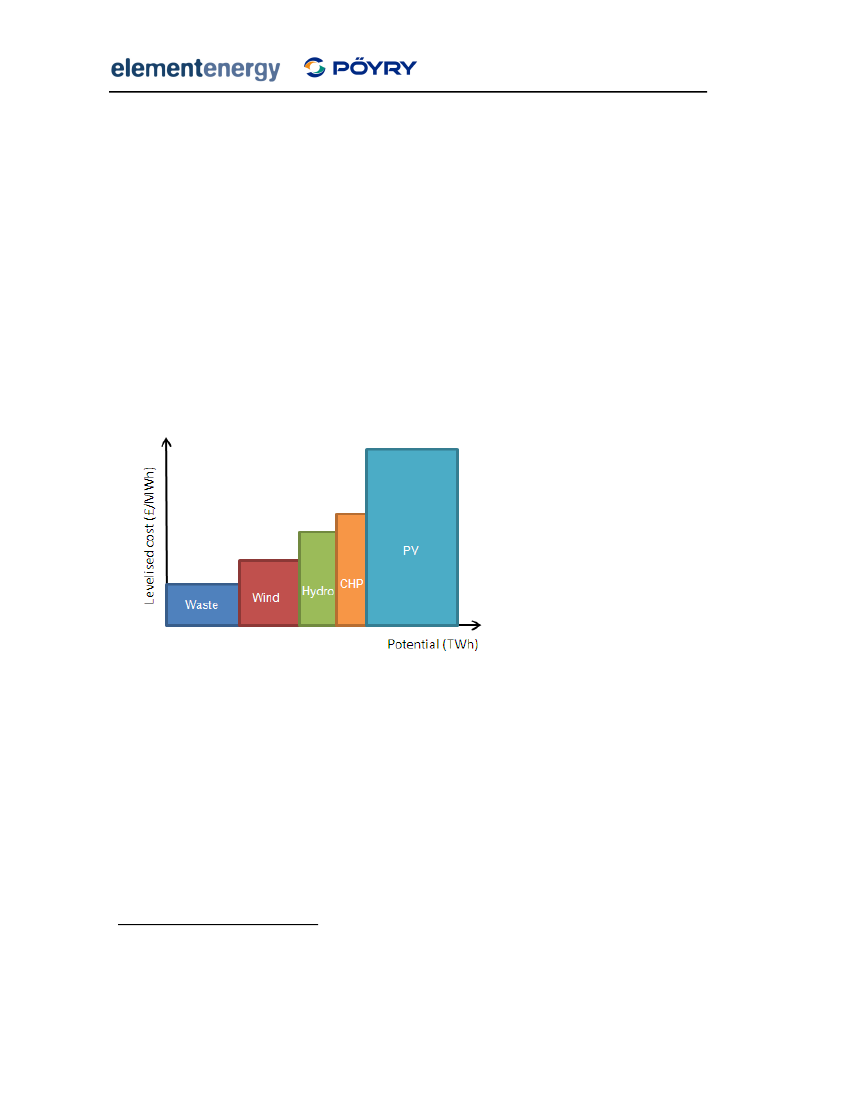

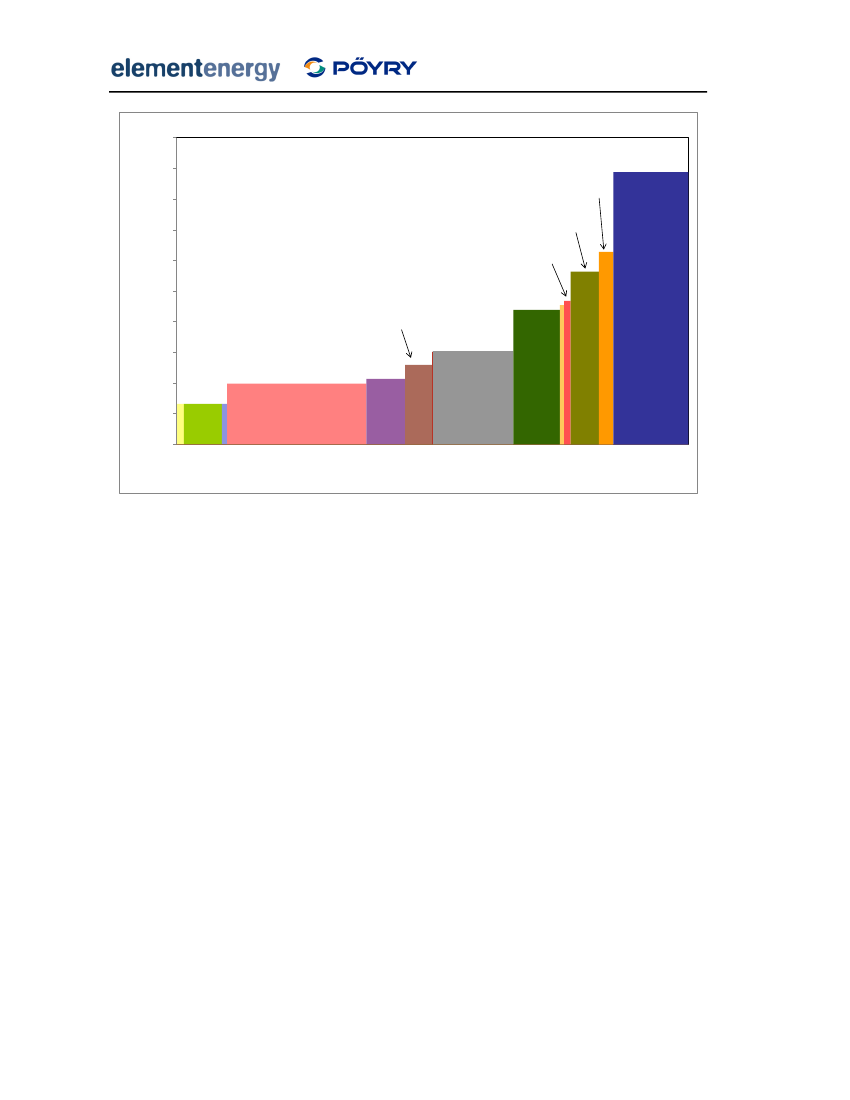

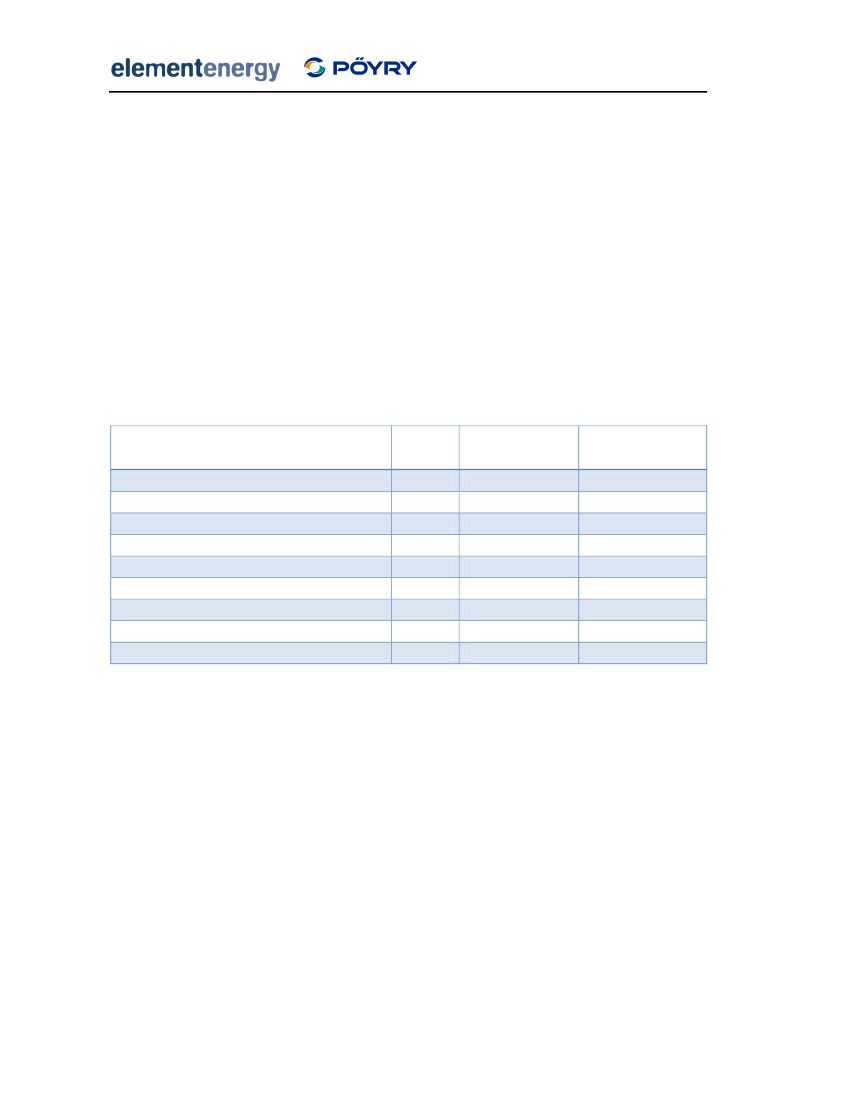

Figure 5 shows the supply curve for sub-5MW renewable electricity for the 2% ‘communityscenario. The width of each bar represents the amount of electricity generated by eachtechnology in 2020, while the height shows the levelised cost of energy in 2020 (in £ perMWh). Note that for simplicity, only the 2020 technology costs are shown. For technologieswhose costs decrease over time, some of the resource shown in Figure 5 is deployed earlierthan 2020 and so has a higher generating cost. All of the generation costs are calculatedusing a 10% cost of capital over the project lifetime. The figure shows that the wastetechnologies have the lowest cost of electricity, since plants earn revenue from heat salesand waste gate fees. Anaerobic digestion makes the largest contribution of the sub-5MWwaste technologies. There is nearly 6TWh of resource available in 2020 for a generating costof less than £150/MWh. There is then a significant gap between the generating costs ofbiomass CHP and small wind turbines while the levelised cost of domestic PV is still£450/MWh in 2020, at a 10% rate of return.

7

Design of Feed-in Tariffs for Great BritainFinal ReportSub-5MW renewable electricity supply curve - 2% Community scenario

£500£450

Domestic PVSmall PV

£400Technology cost in 2020 (£/MWh)

£350

Large PVWave /tidalSmallwindBiomassCHP

£300£250£200

MediumwindLargehydro

£150£100

Large windWaste

£50£0

1

2

Renewable Electricity Production in 2020 (TWh)

3

4

5

6

7

8

Figure 5 Renewable electricity supply curve - community bias

ConclusionsThe results above illustrate the overall costs of meeting a given generation target withdifferent technology mixes. The analysis also quantifies the effects of a range of other issuesrelevant to the design of Feed-in Tariffs. The key conclusions are summarised below:A 2% generation target can be achieved at relatively low cost using mega-watt scaletechnologies. The cumulative resource cost by 2020 is £1.0 billion higher thanbusiness as usual. Diversifying the technology mix to include domestic-scale PV andwind comes at a high cost, with the cumulative resource cost in 2020 increasing to £4billion.Banding tariffs by technology can lead to significant reductions in subsidy costs whilemaintaining the same overall generation by reducing overpayments to low-costgenerators. The importance of banding increases with increasing technologydiversity, since the differences in costs between technologies becomes larger thandifferences within technologies (for example large wind turbines at different wind-speed sites).Increasing the generation target to 3.5% of the UK electricity demand significantlyincreases the cost to the country by 2020, from £1 billion to £4 billion for the leastcost scenarios. A 3.5% least cost scenario results in significant uptake of small-scaletechnologies, with over 3TWh of electricity per year generated from PV and small8

Design of Feed-in Tariffs for Great BritainFinal Report

wind. This is because for ambitious targets, large-scale technologies cannot bedeployed quickly enough to meet the target by 2020.For technologies whose costs are expected to decrease over time, reducing tarifflevels each year is necessary to avoid overpayments to investors making investmentsin the second half of the next decade. However, matching tariff levels to technologycosts from the first year of the policy results in significantly higher policy costs thansetting a flat tariff so that the technology is only deployed when its costs decrease. Inother words, there is a financial benefit to delaying uptake until technologies arecheaper. The risk of this approach is that if investor demand is low for the first fewyears of the policy because the tariffs are not sufficiently generous, the industry willnot make the investments necessary to deliver large amounts of renewable energy atlow cost towards 2020.Premium tariffs, where tariff payments are made on top of the market electricityprice, carry a higher risk than a fixed tariff with an equivalent total support level, dueto volatility of electricity prices3. This additional risk is likely to be reflected in ahigher cost of capital for projects and higher hurdle rates. This means that overallsupport must be higher under a premium tariff to encourage a given level of uptake.In the results above, it is assumed that tariffs are paid over the lifetime of thetechnology. Where investors employ high discount rates and place a low financialvalue on revenues received in the distant future, total subsidy costs can besignificantly reduced by paying tariffs over a shorter period. For example, for aninvestor with a 10% discount rate, a 10 year tariff that provides the same perceivedvalue as a 25 year tariff has a 25% lower lifetime subsidy cost (assessed at the socialdiscount rate of 3.5%).The benefit of paying tariffs over a shorter period is highly sensitive to the way inwhich investors value long term benefits. For an early adopter with a similar discountrate to the social discount rate, there is no benefit to paying tariffs over a shorterperiod. For investors with very high discount rates, such as many domesticconsumers, costs can be reduced by paying tariffs up-front at the point of purchase(capitalisation). The risk of this approach is that the investor has less incentive tocontinue to operate the system after the majority of the tariff has been paid. Inaddition, capitalisation requires the energy output of each system to be ‘deemed’(estimated), and would require additional verification that the device actuallydelivered the electricity that it was predicted to generate.3

In addition to exposing investors to variability in market electricity prices, premium tariff designs alsorequire that generators participate in the grid balancing and settlement processes. This can reduce thecosts to the grid operator of large amounts of intermittent renewable generating capacity, but thetransaction costs can be high for small generators. A detailed assessment of fixed and premium tariffsis provided in the companion report on Qualitative Design Issues.

9

Design of Feed-in Tariffs for Great BritainFinal Report

Tariff designs based on setting tariffs to fulfil a certain policy objective risk ‘pickingwinners’, because the uptake of individual technologies is very sensitive to the tarifflevel. For example, in designing a tariff to deliver a significant quantity of renewableelectricity from small-scale PV, the government must ‘choose’ to support thistechnology relative to other, less costly alternatives. A more transparent method ofsetting tariffs is to provide an equal rate of return to all technologies.Setting tariffs to provide an 8% rate of return for all technologies encourages uptakeof small-scale, higher cost technologies but does not stimulate deployment of large-scale systems. This is because there is a significant proportion of domestic investorswho are willing to accept returns of 8% or less, but the majority of large-scaleinvestors have hurdle rates above 8%.The treatment of electricity from biomass must be considered carefully in the designof the Feed-in Tariff. A tariff structure that fails to provide additional incentives forplants utilising waste heat is likely to encourage the construction of electricity-onlyplants. This is an inefficient use of biomass compared to CHP plants and co-firing ingigawatt-scale electricity plants.A heat incentive of £10/MWhth, similar to the additional 0.5 ROCs per MWhepaid toCHP plants under the RO, is sufficient to encourage use of waste heat in on-siteapplications. However, higher support is required to encourage deployment of plantsconnected to district heating networks due to the high additional costs involved. Thishigher support could be provided through the Feed-in Tariff, the Renewable HeatIncentive, or other policy support such as low-cost finance or grants for theconstruction of the heat distribution networks.There is a very large potential for gas-fired CHP available at relatively low cost. A flattariff of £155/MWh, equivalent to the market electricity price plus the 2 ROCs perMWh currently paid to renewable microgenerators, delivers nearly 22TWh of CHPelectricity by 2020. The annual CO2savings from gas-fired CHP in that year are over 3million tonnes. However, the majority of this potential is from domestic-scale deviceswhich are not currently available in commercial quantities. As a result there is someuncertainty over the long term costs of these technologies.A flat tariff of £155/MWh for gas-fired CHP has significantly lower subsidy costs thanan initial tariff of £240/MWh degressed at 5% per year. This is because uptake isinitially constrained by the ability of the industry to ramp up production capacity.Paying higher initial tariffs results in overpayments to investors who were willing toinvest with lower support levels, while failing to deliver any additional deployment.This supports holding tariffs at the same level for the first few years of the policy,before introducing degression to match any further cost reductions.

10

Design of Feed-in Tariffs for Great BritainFinal Report

Contents123Executive Summary ............................................................................................................. 2Introduction ...................................................................................................................... 15Methodology ..................................................................................................................... 173.1Overview of model methodology.............................................................................. 17Technologies considered ................................................................................... 19

3.1.13.23.33.4

Investor behaviour .................................................................................................... 20Assessment of resource potentials ........................................................................... 22Barriers to uptake...................................................................................................... 25Social acceptance .............................................................................................. 25Market barriers ................................................................................................. 26Growth rate constraints .................................................................................... 27

3.4.13.4.23.4.33.53.63.7

Model Calibration...................................................................................................... 28Fuel prices ................................................................................................................. 30Model outputs ........................................................................................................... 32Additional electricity and heat generation ....................................................... 32Resource costs ................................................................................................... 33Costs to consumers ........................................................................................... 33Annual CO2savings ............................................................................................ 34

3.7.13.7.23.7.33.7.44

Baseline ............................................................................................................................. 354.1.14.1.2Baseline assumptions ........................................................................................ 35Baseline results.................................................................................................. 36

5

Results and analysis........................................................................................................... 3911

Design of Feed-in Tariffs for Great BritainFinal Report

5.1

2% target ................................................................................................................... 40Flat tariffs .......................................................................................................... 40Tariff banding .................................................................................................... 42Least cost scenarios........................................................................................... 43Enhancing technology diversity ........................................................................ 44

5.1.15.1.25.1.35.1.45.2

3.5% target ................................................................................................................ 50Flat tariff ............................................................................................................ 50Least cost tariff .................................................................................................. 51Diverse and community scenarios .................................................................... 52

5.2.15.2.25.2.35.35.45.55.65.75.867

Degressed tariffs ....................................................................................................... 56Premium tariffs ......................................................................................................... 59Effect of tariff lifetime ............................................................................................... 63Tariffs based on rate of return .................................................................................. 66Interaction between the feed-in tariffs and the Renewable Heat Incentive ............ 70Gas-fired CHP ............................................................................................................ 73

Conclusions ....................................................................................................................... 77Appendix A - Technology cost and performance assumptions ......................................... 807.17.27.37.47.57.67.7PV .............................................................................................................................. 83Wind .......................................................................................................................... 85Hydro power.............................................................................................................. 89Wave power .............................................................................................................. 91Tidal power................................................................................................................ 93Biomass CHP .............................................................................................................. 94Gas CHP ..................................................................................................................... 96

8

Appendix B – Estimation of the potential for sub-5MW renewable electricity. ............... 98

12

Design of Feed-in Tariffs for Great BritainFinal Report

8.1.18.1.28.1.38.1.48.1.58.1.68.1.78.1.8

Photovoltaics ..................................................................................................... 98Wind ................................................................................................................ 100Hydro power.................................................................................................... 104Wave power .................................................................................................... 105Tidal power ...................................................................................................... 106Biomass ........................................................................................................... 107Waste .............................................................................................................. 111Gas CHP ........................................................................................................... 112

13

Design of Feed-in Tariffs for Great BritainFinal Report

DisclaimerWhile Pöyry Energy (Oxford) Ltd (“Pöyry”) and Element Energy Limited (“Element”) considerthat the information and opinions given in this work are sound, all parties must rely upontheir own skill and judgement when making use of it. Neither Pöyry nor Element make anyrepresentation or warranty, expressed or implied, as to the accuracy or completeness of theinformation contained in this report and assumes no responsibility for the accuracy orcompleteness of such information. Neither Pöyry nor Element will assume any liability toanyone for any loss or damage arising out of the provision of this report.The report contains projections that are based on assumptions that are subject touncertainties and contingencies. Because of the subjective judgements and inherentuncertainties of projections, and because events frequently do not occur as expected, therecan be no assurance that the projections contained herein will be realised and actual resultsmay be different from projected results. Hence the projections supplied are not to beregarded as firm predictions of the future, but rather as illustrations of what might happen.Parties are advised to base their actions on an awareness of the range of such projections,and to note that the range necessarily broadens in the latter years of the projections.Contact details:Element EnergyAlex Stewart (Consultant)Twenty Station RoadCambridgeCB1 2JD01223 227533[email protected]Ben Madden (Director)60 Newman StreetLondonW1T 3DA[email protected]

14

Design of Feed-in Tariffs for Great BritainFinal Report

2 IntroductionThe EU Renewable Energy Directive 2008 sets an ambitious target that 20% of energy used inthe EU in 2020 should come from renewable sources. This target applies to all energy usesincluding electricity, heat and transport. The Directive sets out individual targets for eachmember state, and the UK must derive 15% of its final energy consumption from renewablesources. The Energy Strategy will set out how the UK Government intends to meet this targetover the next ten years. In the RES consultation published in 2008, the Government indicatedthat renewable electricity would make a major contribution to the overall target, with 30-35% of electricity being renewable in 2020. While the majority of this increase will be fromlarge-scale technologies such as onshore and offshore wind delivered through theRenewables Obligation, it is expected that a contribution from smaller-scale technologies willbe required if the overall target is to be met.The Energy Act 2008 gives the Government powers to introduce Feed-in Tariffs for small-scale generators with capacities under 5MWe. Feed-in Tariffs will apply to a wide range oftechnologies, from domestic-scale solar photovoltaics and wind systems through tomegawatt scale wind turbines and biomass electricity plants. Feed-in Tariffs are widely usedto promote renewable electricity in continental Europe, and have led to widespreaddeployment of higher-cost technologies such as photovoltaics that have not been deliveredin large numbers under the UK’s Renewable Obligation. While all Feed-in Tariff schemesshare common features, such as guaranteed payments for eligible generators andguaranteed grid access, the detailed design and implementation of the policies differmarkedly between member states. For example, in some schemes generators receive fixedtariffs for generated electricity that are independent of the market electricity price, while inother schemes generators are required to participate in the electricity market in the sameway that large fossil fuel plants do.Element Energy and Pöyry were commissioned in early 2009 to conduct a detailed reviewand analysis of Feed-in Tariff schemes across the EU to inform the design of the Feed-in Tariffthat will be implemented in England, Scotland and Wales in April 2010. The work was splitinto two parallel streams. The first stream was an exhaustive qualitative review of Feed-inTariff design parameters, drawing on experience of best-practice from existing schemes. Thatreport is published by Pöyry and Element Energy alongside this one. The second stream is aquantitative analysis of the optimal design of Feed-in Tariffs for Great Britain. This was basedon the development of a model of the potential for sub-5MW renewable electricity in GreatBritain, which can be used to investigate technology uptake under different Feed-in Tariffdesigns.The modelling approach, described in detail in Section 3, is based on the construction ofrenewable electricity supply curves showing the size of the resource available at a given15

Design of Feed-in Tariffs for Great BritainFinal Report

generating cost. The resource potentials for each technology were estimated using acombination of industry consultation, literature review and primary analysis usingGeographical Information Systems (GIS). The resource potentials were combined with atechnology cost and performance model and a representation of investor behaviour basedon telephone discussions with renewable energy investors. The resulting model is able toproject uptake of each renewable technology under a wide range of feed-in tariff designs.These range from relatively simple designs that aim to minimise the costs to the economyand electricity consumers for a given electricity generation target, to more complexapproaches based on encouraging a wide range of technologies and scales or offering equalrates of return to all investors. Many design issues discussed in the qualitative report, such asthe effects of premium versus fixed tariffs and degression, can be investigated and quantifiedusing the model.

16

Design of Feed-in Tariffs for Great BritainFinal Report

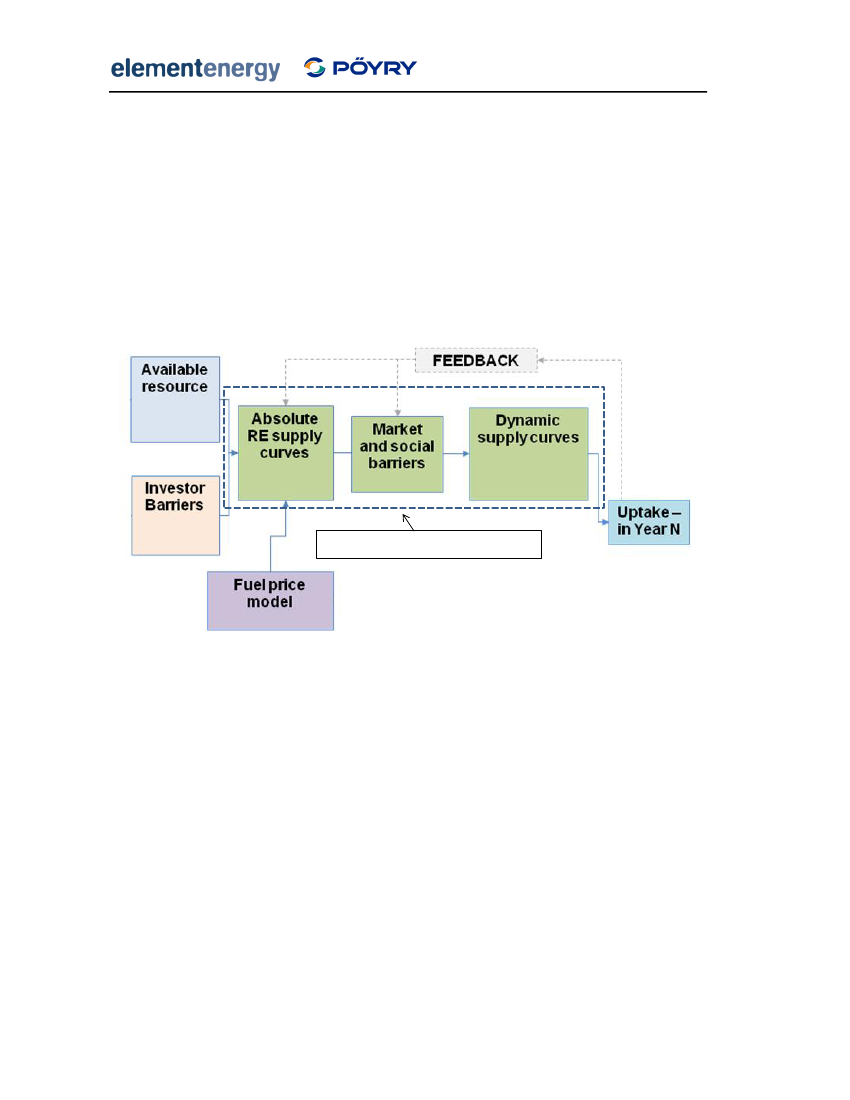

3 Methodology3.1 Overview of model methodologyThis section describes the modelling approach employed to investigate the effect of differentFeed-in Tariff designs on the uptake of sub-5MW renewable electricity. The overall approachbuilds on previous Element Energy analysis of the potential for medium-scale wind and PV inthe commercial buildings sector4, and is based on the construction of renewable energysupply curves, which show the cost of electricity and potential resource for each technology(see Figure 6). This is similar to the approach employed by Green-X, which modelled uptakeof renewable electricity technologies under Feed-in Tariffs and tradable green certificateschemes in the EU5.

Figure 6 Illustrative renewable energy supply curve

The overall model structure is shown in Figure 7. Absolute supply curves are derived for eachtechnology by combining cost data and a model of investor behaviour with the assessment ofthe technical potential described in Section 3.3. The absolute supply curves show themaximum quantity of renewable technology that can be deployed at a given generation cost;they do not include any demand or supply-side constraints. These market and social barriersare then applied to the absolute supply curve to yield dynamic supply curves, which show themaximum deployment for each technology in a given year.The renewable electricity technologies on the supply curve are disaggregated according tothe following attributes:4

Element Energy (2008): The Growth Potential for On-site Renewable Electricity in the Non-domesticSector.5Green-X (2004) – Deriving optimal promotion strategies for increasing the share of renewableelectricity in a dynamic European electricity market.

17

Design of Feed-in Tariffs for Great BritainFinal Report

Technology type - e.g. PV or windTechnology scale - e.g. building mounted, small and large windSite type - e.g. wind-speed, heat load, insolation levelInvestor - e.g. householder or utility. The investor type affects the cost of capital andhence the overall project costs.Year - this influences the technology costs and the maximum deployment in thatyear.Once the dynamic supply curves have been established, a revenue model is used to calculatethe total income per megawatt-hour for each technology. The revenue model includes themarket value of electricity and heat, as well as payments made from Feed-in Tariffs. If thetotal revenue exceeds the generating costs for a given technology and investors, thepotential of that technology in that year is deployed. The model reports uptake in terms ofnumbers of installations, electricity generation and installed capacity for each technology andyear. It also reports net costs and benefits to the country in line with Government guidelineson appraising low carbon policies.Feedbacks are implemented at several stages in the model. The market and social barriersused to build the dynamic supply curves for each year depend on the cumulative uptake ofeach technology. For example, the amount of PV that can be deployed in each year dependson the sales in the last year since the industry has a finite growth rate. In addition, tarifflevels paid to generators under the FIT can be linked to uptake, so that tariffs are reduced ifuptake in the last year exceeded a set value. This is implemented in Germany, where tariffsare ‘degressed’ by an additional 1% over the standard reduction last year’s installed capacityexceeded a pre-defined value.

18

Design of Feed-in Tariffs for Great BritainFinal Report

Figure 7 Overview of model structure

3.1.1

Technologies considered

Following discussions with DECC, the following technologies were considered in the model:PhotovoltaicsOnshore windHydroelectric powerWave powerTidal powerBiomass CHPWaste to energy technologiesGas-fired CHP (up to 50kWe)In line with the capacity limit for the Feed-in Tariff described in the Energy Act 2008, onlysub-5MWeprojects considered. Some of the technologies considered, such as incineration,are traditionally sized higher than 5MWedue to economies of scale. Where this was the case,only sub-5MW plants were included in the model, and the total resource was restricted tosites suitable for smaller plants (see Section 3.3).

19

Design of Feed-in Tariffs for Great BritainFinal Report

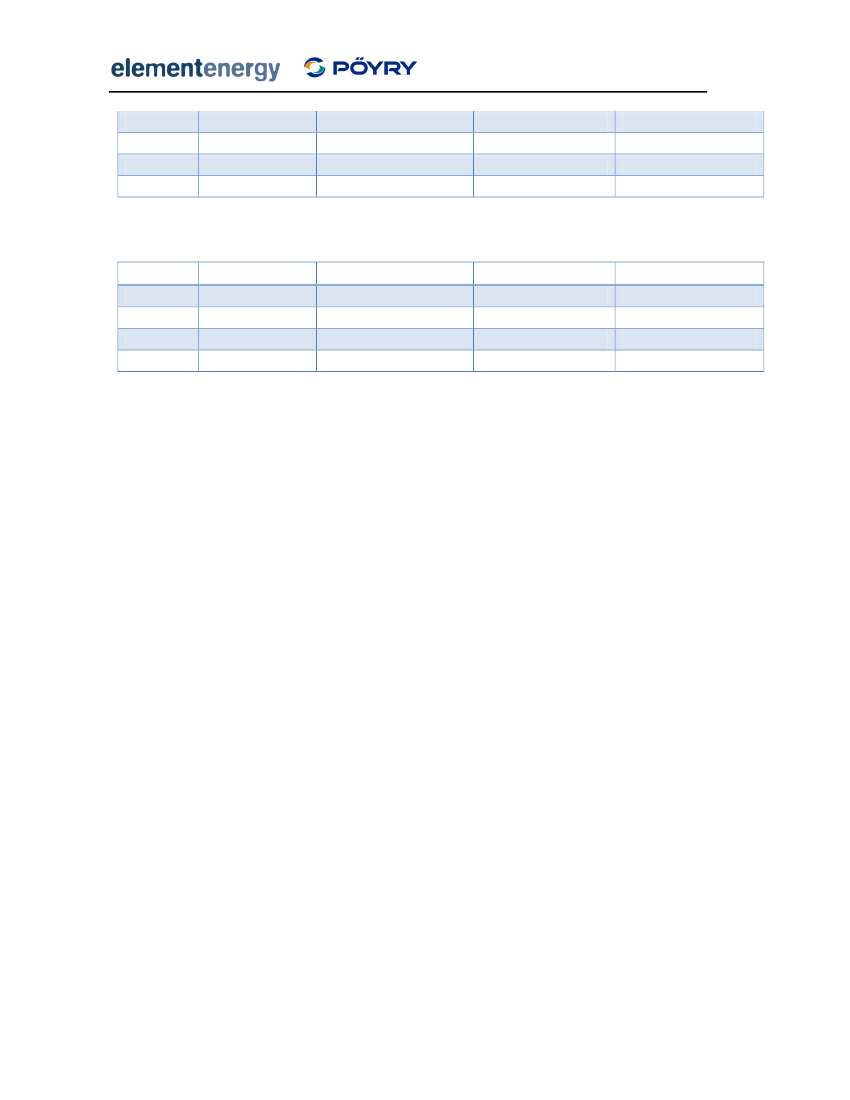

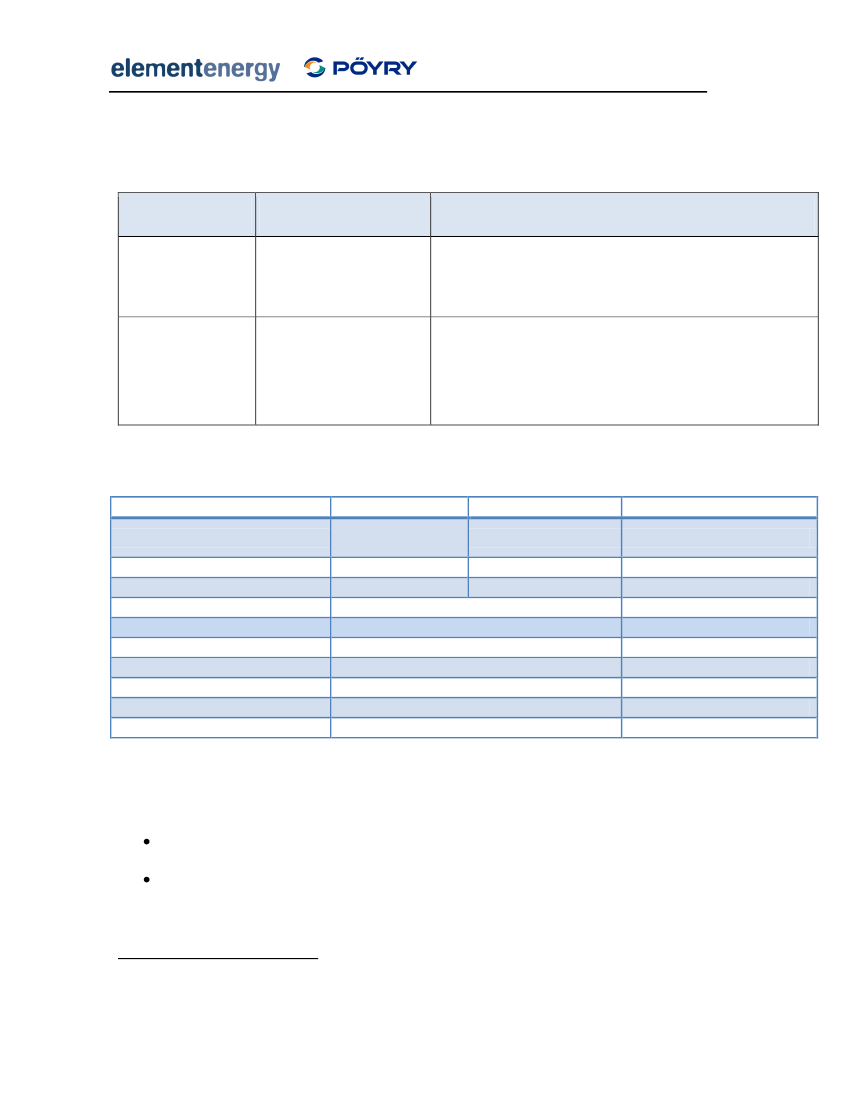

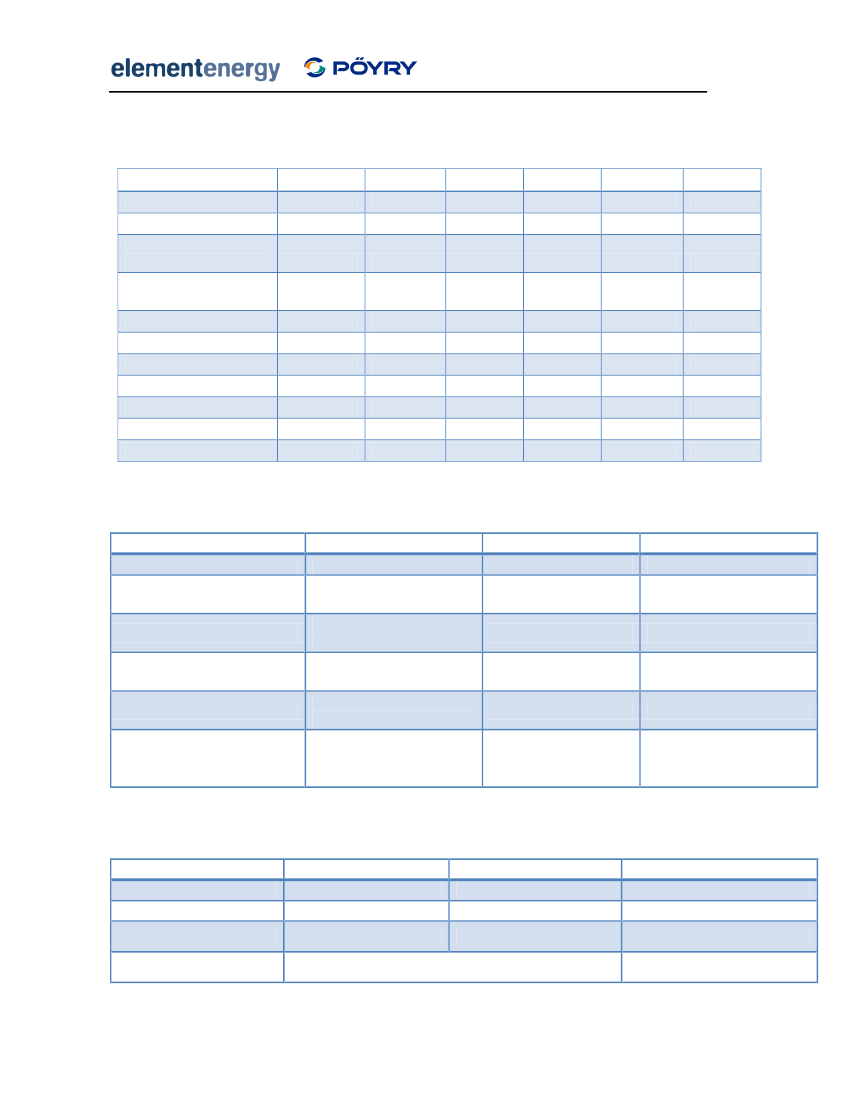

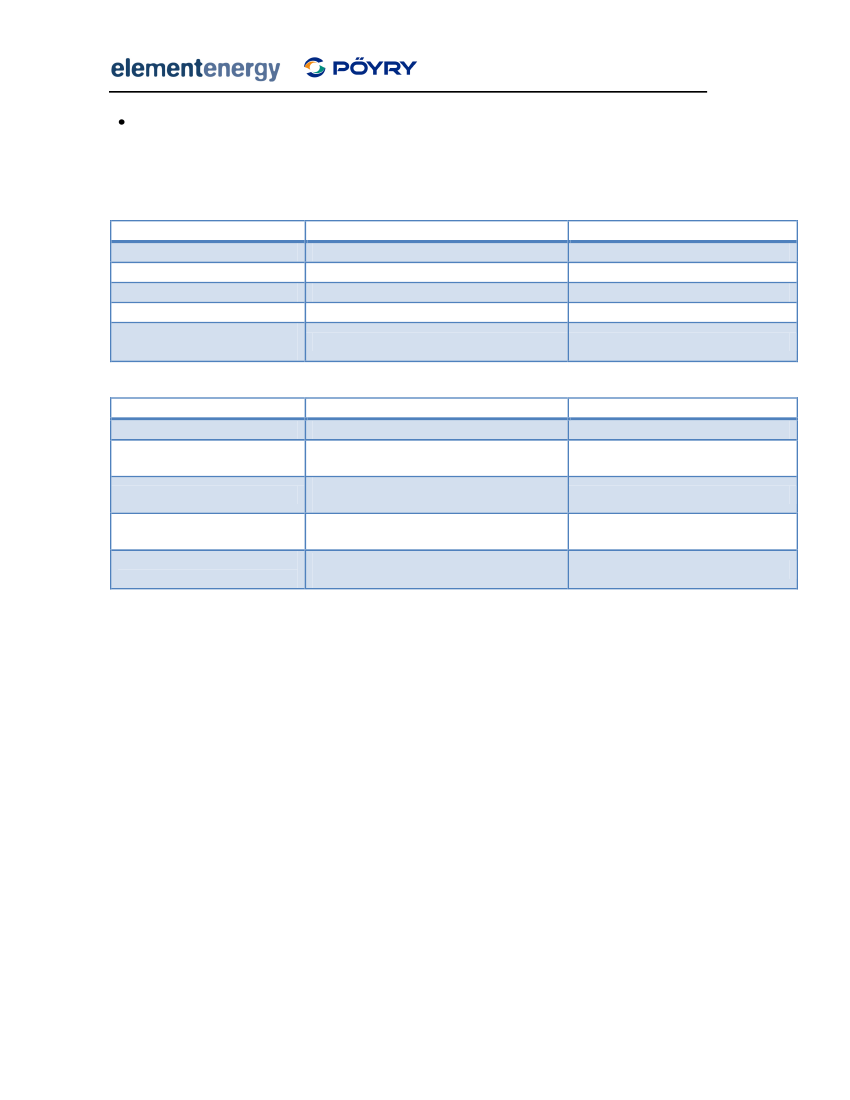

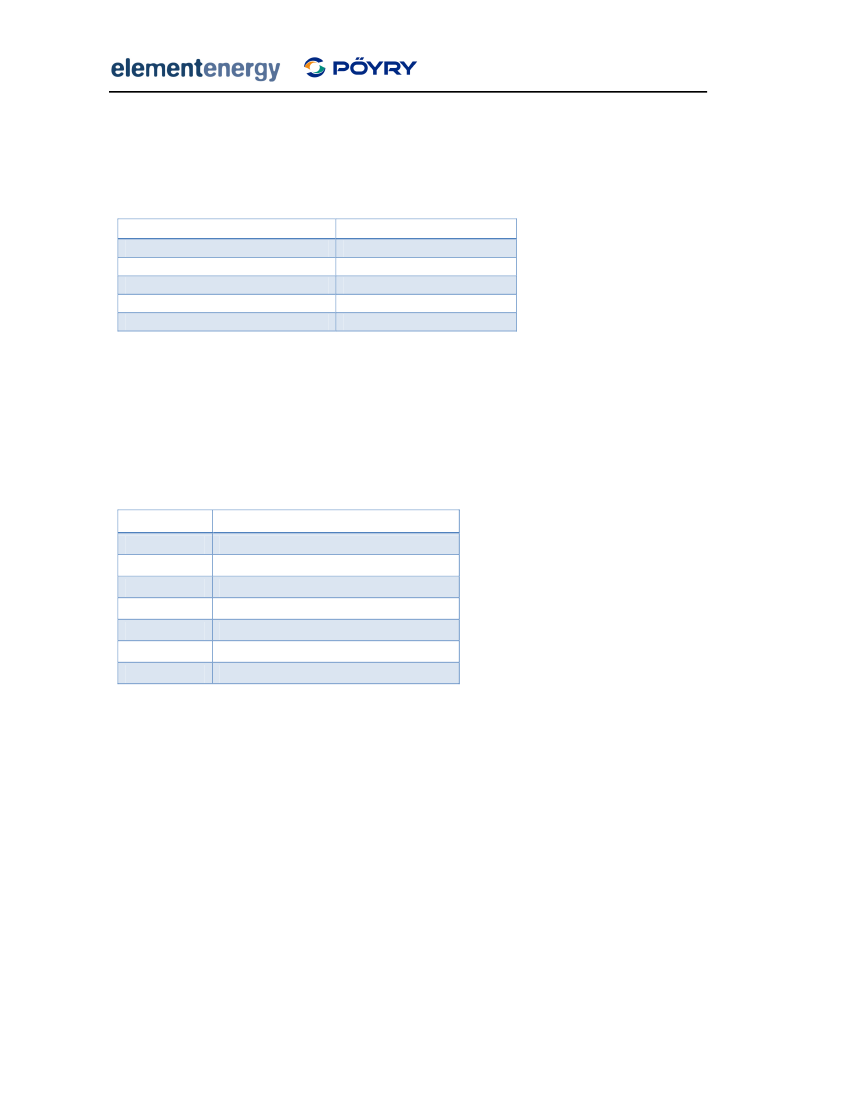

3.2 Investor behaviourThe uptake of renewable electricity technologies under a supportive Feed-in Tariff dependson whether or not the rate of return of the project exceeds the hurdle rate of potentialinvestors. The hurdle rate of large-scale investors is based on their Weighted Average Cost ofCapital (WACC), which is itself dependent on the risk associated with the project. This meansthat projects employing novel technologies, such as marine power or advanced thermaltreatment of waste, will have higher hurdle rates than those using established technologies,to reflect the risk of technology failure.The hurdle rates assumed for large-scale investors are based on telephone discussions with anumber of investors conducted by Pöyry in early 2009. Detailed results of these discussionsare included in the report by Element and Pöyry on qualitative design issues thataccompanies this report. Table 2 summarises the hurdle rates by investor and technologyfrom the discussions. In general utility companies have lower hurdle rates than developersdo for similar projects, and rates for novel high risk technologies are two to four percentagepoints higher for novel, higher risk technologies. The values in Table 2 show the maximumhurdle rates for each technology. To represent the range of hurdle rates observed in thewhole population, a distribution of hurdle rates was implemented. Large-scale investors areassumed to have a minimum hurdle rate of 8%, regardless of technology, and the maximumvalues shown below. The figures below are post-tax nominal hurdle rates.Table 2 Hurdle rates for large scale investors

Utility/ESCO

Developer

Large scale Medium scale Large scaleSolar PVOnshore WindHydroBiomassWaveTidalWaste ADGasificationIncineration8%8%8%10%12%12%8%12%8%10%12%12%12%10%10%10%12%14%14%10%14%10%

20

Design of Feed-in Tariffs for Great BritainFinal Report

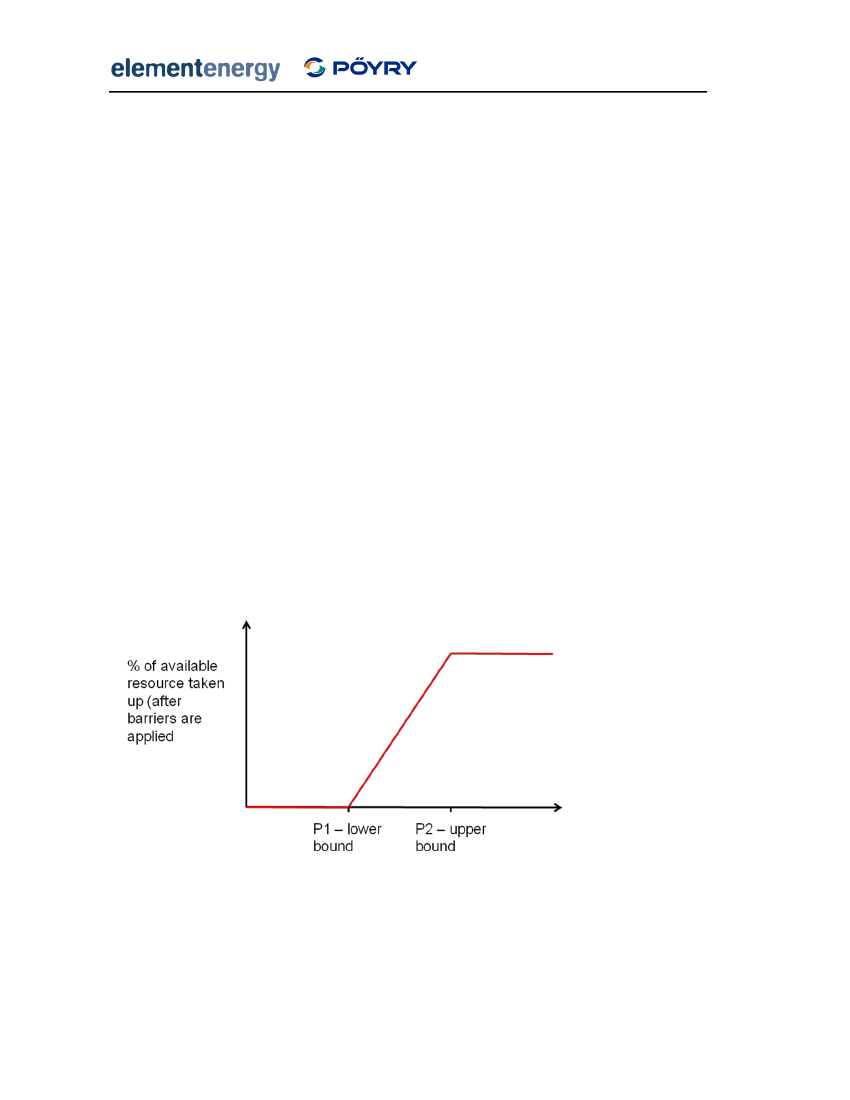

Smaller-scale investors such as householders and commercial building do not use a singlehurdle rate when assessing investment decisions. Instead, the effective hurdle rate of aproject includes a number of intangible factors such as hassle costs and transaction costs,which vary significantly between investors. For example, literature on uptake of energyefficiency measures suggests that many domestic consumers have very high hurdle rates,expecting returns of 20% per year, while early adopters invest in technologies which do notprovide positive returns in their lifetimes. To represent this range of consumer behaviour, adistribution of hurdle rates was implemented in the model. At the domestic scale, theminimum hurdle rate was assumed to be 3%, close to the social discount rate of 3.5%, andthe maximum was 20%. Commercial building owners are assumed to have a narrowerdistribution, with minimum and maximum hurdle rates of 6% and 15% respectively. Therange of hurdle rates is significantly higher than for large-scale investors described above.For both large and small-scale consumers, hurdle rates are distributed linearly through thepopulation, as shown in Figure 8. In the figure, P1 and P2 represent the levelised technologycosts when assessed at the minimum and maximum hurdle rates. If the total revenuethrough the feed-in tariff is lower than P1, no uptake occurs. If the revenue is half waybetween P1 and P2, 50% of the potential in the dynamic supply curve is deployed. Ifrevenues are higher than the levelised cost when assessed at the maximum hurdle rate,100% of the maximum annual potential is deployed. This implies that increasing revenuesbeyond these values does not increase technology uptake, but increases producer profits andthe total subsidy spend.

Figure 8 Distribution of investor behaviour in the model

21

Design of Feed-in Tariffs for Great BritainFinal Report

3.3 Assessment of resource potentialsThe total technical resource was estimated for each of the technologies considered in themodel. The technical potential represents the upper bound for the amount of a technologythat can be deployed if sufficient policy and financial support were provided. The technicalpotential does not include time-dependent constraints such as the maximum growth rate ofthe industry or a limit on investor demand in a given year; these constraints are imposed onthe absolute supply curves to give dynamic supply curves, which show the resource availablein a given year.

Development of supply curves

Figure 9 Steps used in the development of dynamic supply curves

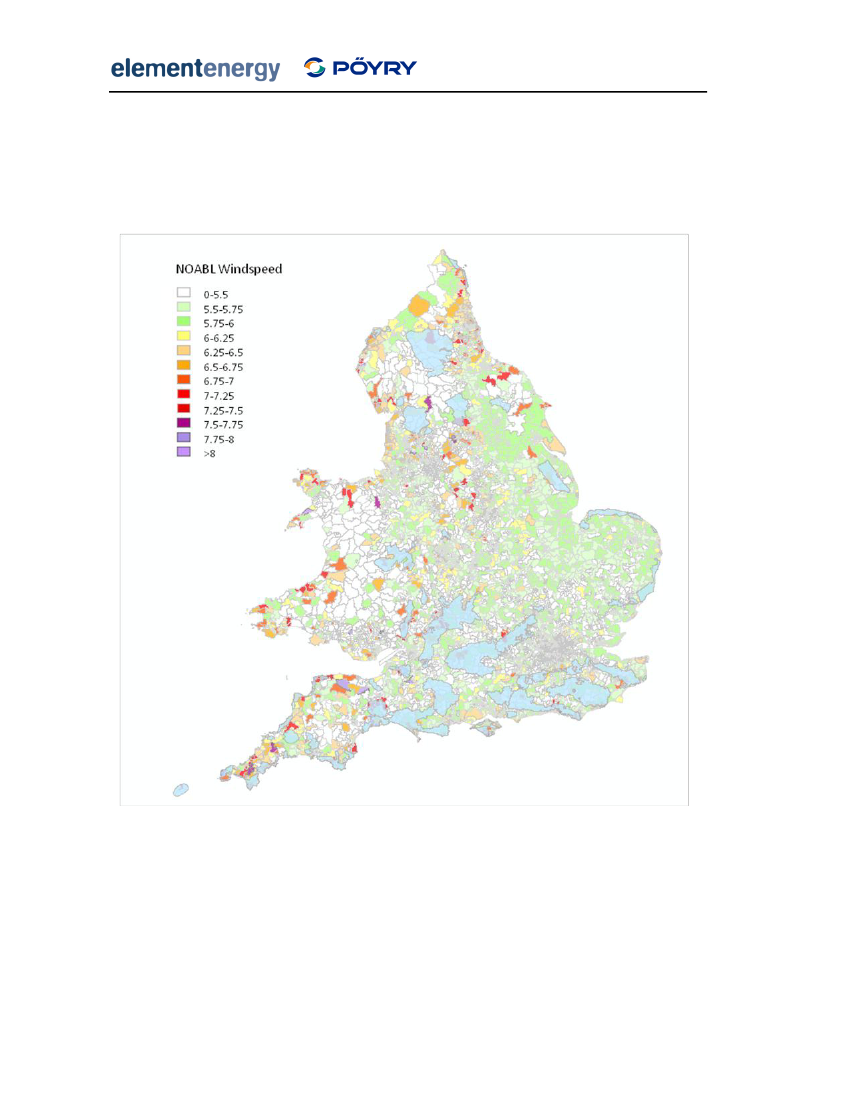

The factors constraining the absolute resource potentials are technology-specific. Forexample, the potential for building-attached photovoltaics is constrained by the amount ofavailable roof space in the commercial and domestic sectors. On-shore wind power isconstrained by the availability of high wind-speed sites, as well as by the strength of the localelectricity grid and the proximity of buildings. For technologies using a finite feed-stock, suchas biomass or waste, the availability of the feed-stock often constrains the overalldeployment. For example, anaerobic digestion has a specific requirement for biologicalwaste, and ‘competes’ with other disposal methods such as advanced thermal treatment andcomposting for that resource. It should be noted that although the supply of domesticallygrown biomass is limited due to land availability, the UK can import large quantities ofbiomass from overseas. For the purposes of this study, it is assumed that the availability ofbiomass is not a constraint on the potential for sub-5MW systems.

22

Design of Feed-in Tariffs for Great BritainFinal Report

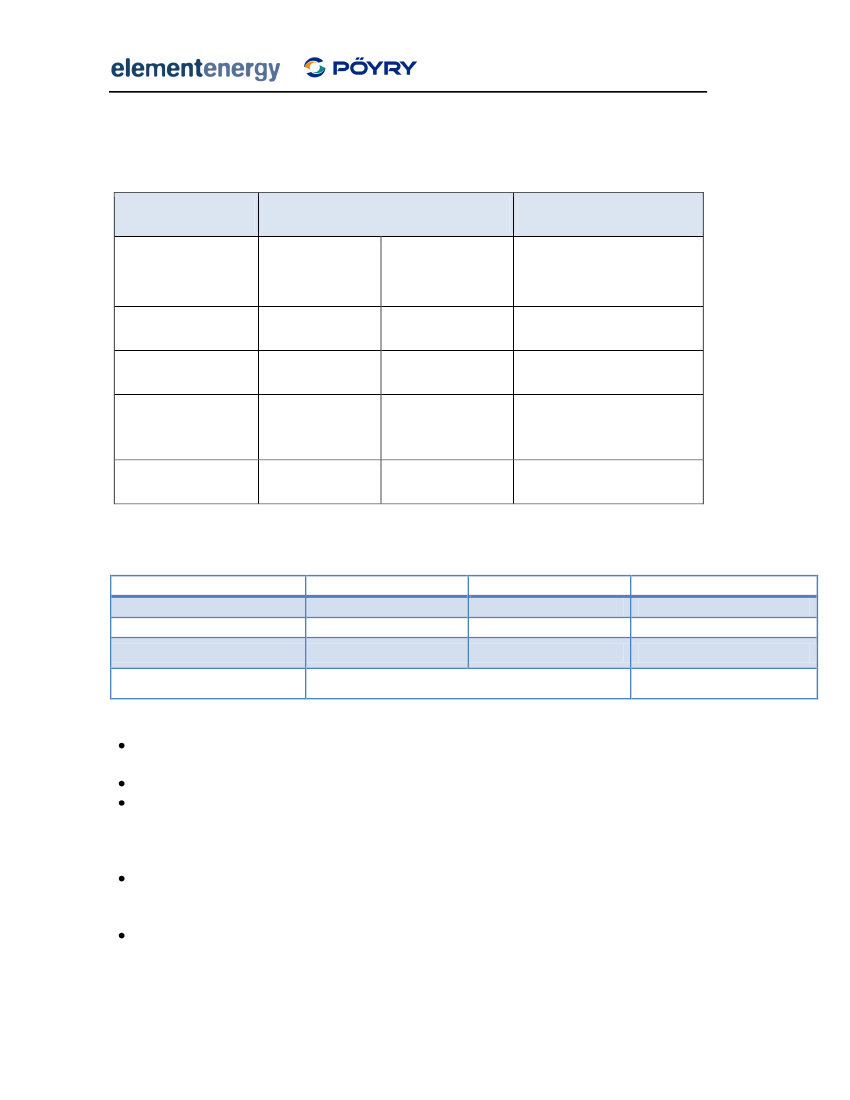

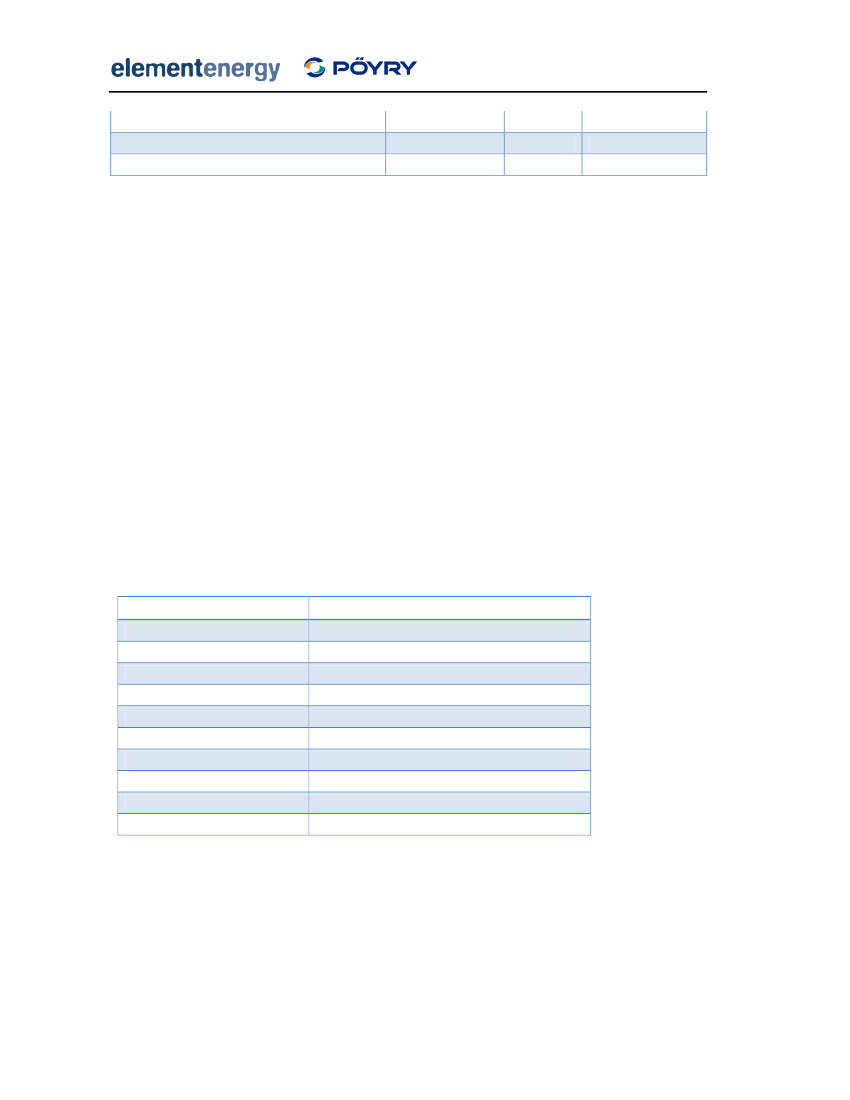

The 5MW capacity cap under the UK Feed-in Tariff makes the estimation of resourcepotentials for several technologies challenging. For example, wave and tidal technologies arelikely to be deployed in clusters with total capacities exceeding 5MWe, due to prohibitivecosts of grid connection and maintenance for sites far from the shore. Therefore, ourassessment of the sub-5MW marine resource excludes sites in deep water that are far fromthe coast, and only near-shore sites appropriate for smaller projects are included. Themethodologies used to estimate the resource potentials for each technology are described indetail in Appendix B.Table 3 summarises the technical potentials for sub-5MW renewable electricity in the UK. Interms of absolute potential, PV has the highest potential of the renewable technologies withover 60TWh per year. The potential for biomass electricity is over 40TWh a year, even whenconstrained by heat demands. The potential for gas-fired CHP is extremely large, equivalentto over 25% of UK electricity demand. The majority of this is in the domestic sector, andassumes that a technology such as fuel cell CHP is commercialised that allows high run hoursin sites with relatively low heat demands, such as new homes.

23

Design of Feed-in Tariffs for Great BritainFinal Report

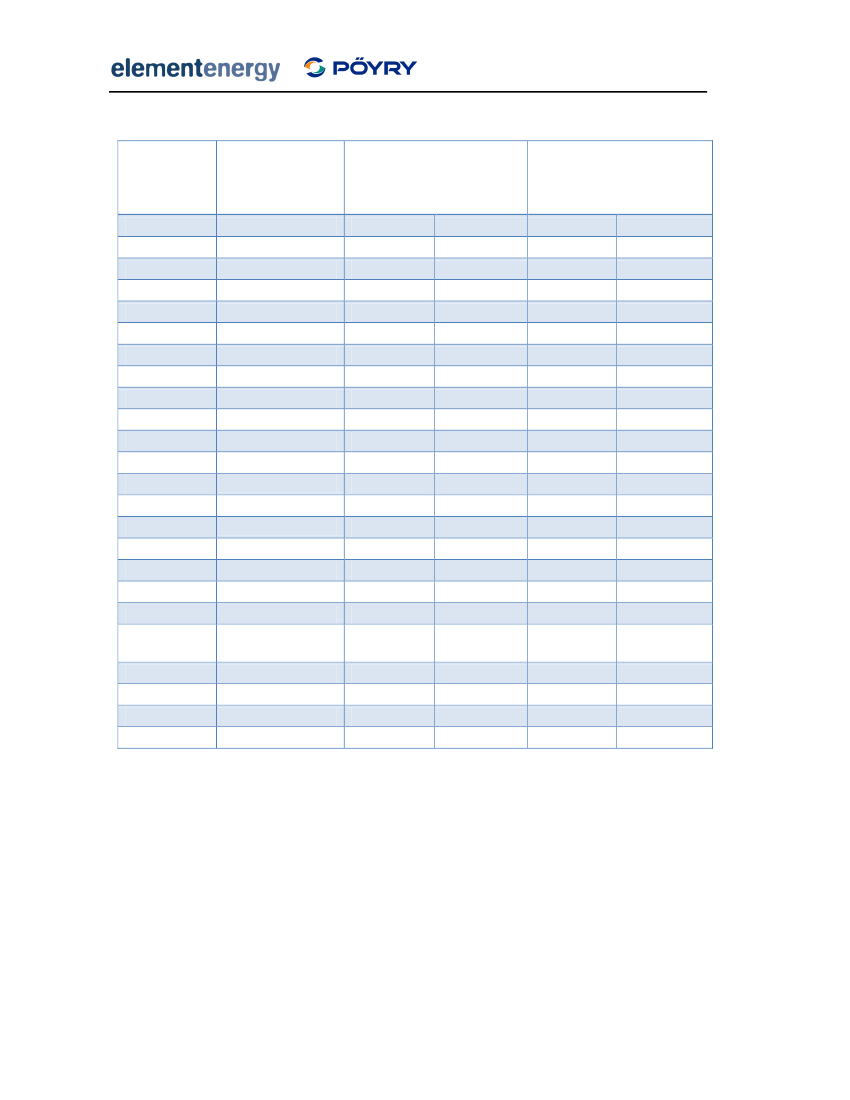

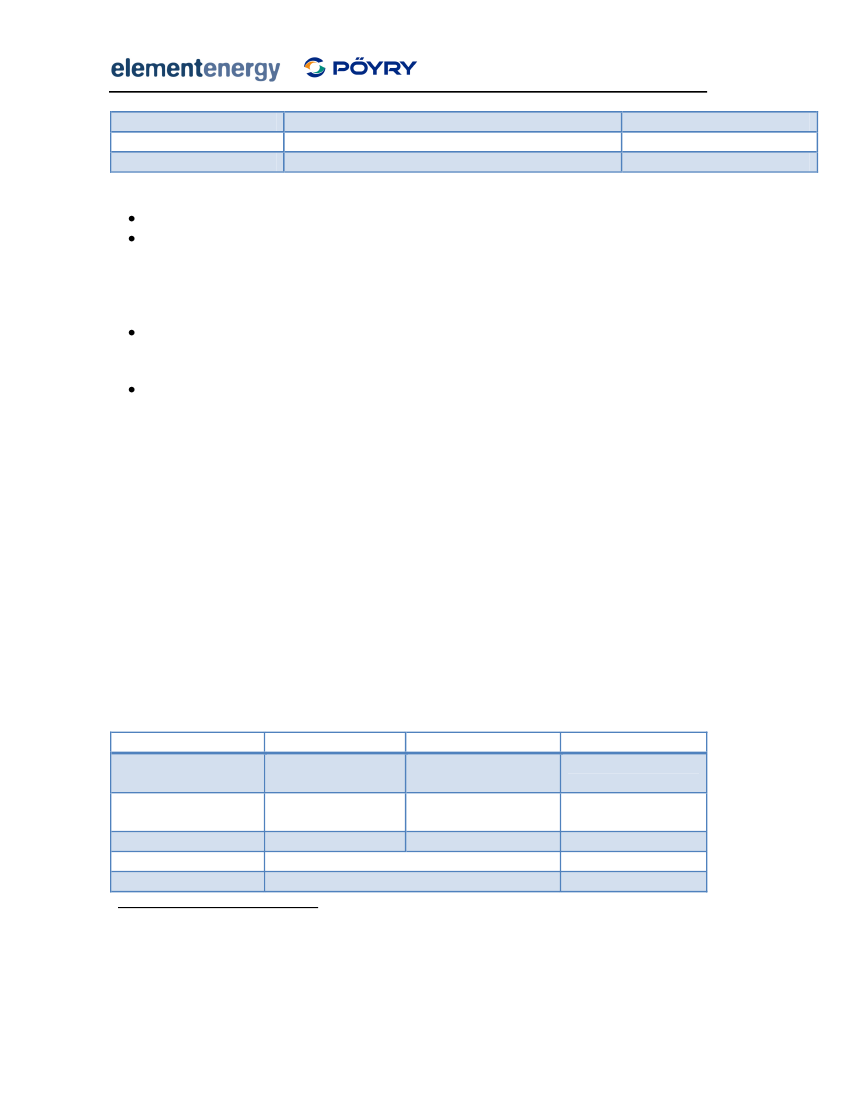

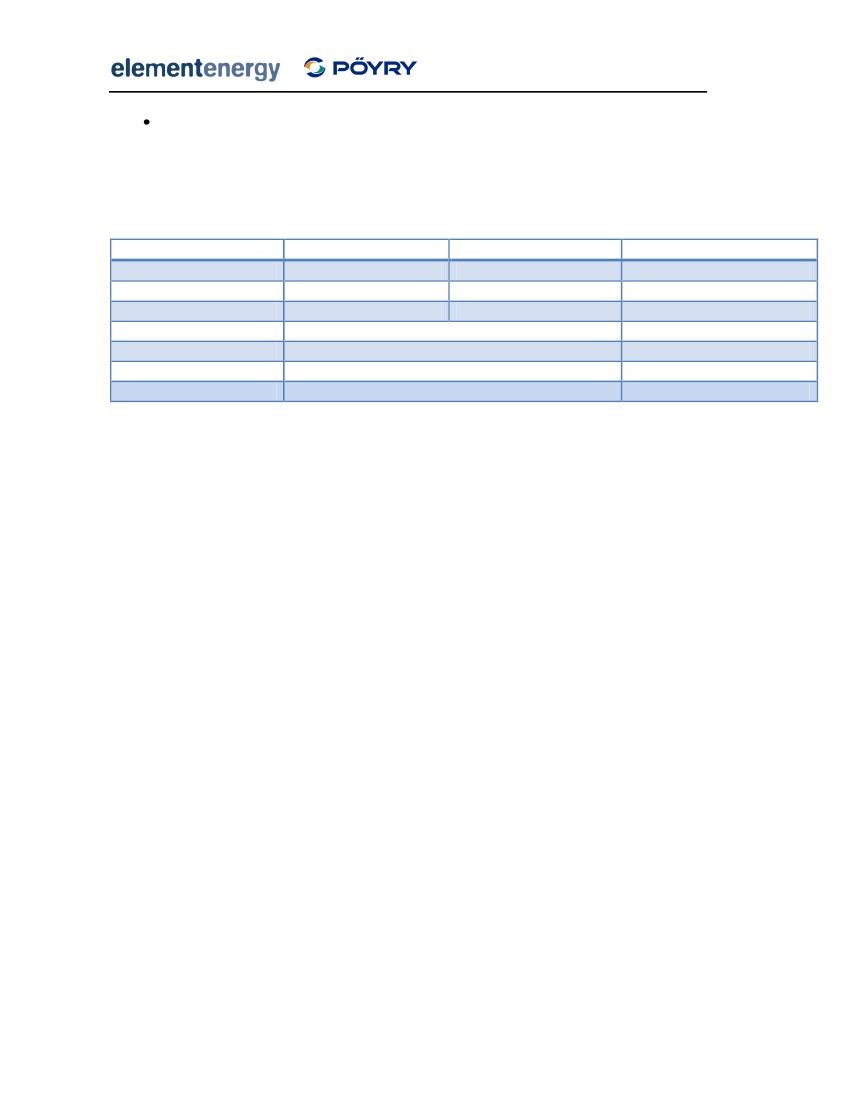

Table 3 Summary of resource potentials for sub-5MW electricity in the UK.

TechnologyPV

Wind

Hydro

TypeDomesticMedium/large building attachedStand-aloneMicro1.5-15kW15-50kW50-250kW250-500kW500-3000kW1-100kW100-1000kW1000+ kWSub-5MWSub-5MWDistrict heating - new buildDistrict heating - retrofitStand-alone commercialLow temperature industrialAdvanced Thermal TreatmentAnaerobic DigestionIncinerationDomestic 1kW1-50kWTotal renewableTotal including gas CHP

Technical potential (TWh/year)22.329.68.53.81.11.41.51.68.40.53.01.30.40.21.517.06.018.80.73.30.588.723.8131.2243.7

WaveTidalBiomass

Waste

Gas CHP

24

Design of Feed-in Tariffs for Great BritainFinal Report

3.4 Barriers to uptakeAs shown above, the technical potential is extremely large for the majority of renewableenergy technologies. However, there are numerous barriers that restrict the amount ofrenewable energy that can be deployed in a given year. There are three barriers within themodel that are used to generate dynamic supply curves for each year from the staticresource potentials.

3.4.1

Social acceptance

For many renewable energy technologies, social acceptance is a key factor determining themaximum deployment. This is especially true for large scale technologies such as on-shorewind and waste, where there can be strong public opposition due to concerns over visualimpact, noise, traffic movements or air quality. The social acceptance of these technologiestends to decrease with increasing deployment, for example as concerns grow with thecumulative impact on the landscape of a large number of wind farms. In addition, developersare likely to exploit sites with smaller anticipated planning issues first, so new deploymentover time occurs in more and more ‘difficult’ sites. For novel technologies with lowcumulative deployments, however, social acceptance is likely to increase at first as the publicfamiliarity increases and misconceptions are overcome. Figure 10 shows the socialacceptance barriers implemented in the model. The percentage of the remaining potentialthat can be deployed in a given is assumed to decrease exponentially with the percentage ofabsolute potential achieved. To reflect the increasing social acceptance of novel technologieswith low deployments, the starting point of the function is set sufficiently high that it is lessrestrictive than supply side barriers.

25

Design of Feed-in Tariffs for Great BritainFinal Report

Social barriers% of additional potential available in each year

0.40.350.3

0.25bS10.20.150.10.05000.10.20.30.40.50.60.70.80.91bS2bS3bS4bS5

Achievement of absolute potential

Figure 10 Social acceptance barriers employed in the model. bS1 – bS5 represent different levels of socialbarriers.

3.4.2

Market barriers

Penetration of new technologies tends to follow an S-shaped curve when market share isplotted against time. This is due to changes in demand and supply at different levels ofdeployment. For a novel technology entering the market place, investor demand is likely tobe low due to lack of awareness and technological uncertainty, as well as high costs due toimmature supply chains and manufacturing processes. In turn, the capacity of the supplychain is low since there is insufficient mass-market demand to justify large-scale investmentsin capacity. As technologies are taken up by early adopters, awareness and hence demandamong mass-market consumers increases. This in turn drives increased capacity in the supplychain. In conventional diffusion theory, it is assumed that the maximum rate of deploymentoccurs at a market share of 50%. After this point, consumer demand decreases as the pool ofremaining investors shrinks. For renewable electricity technologies, this reduction in demandalso reflects the increased project costs of less-optimal sites, for example those with lowwind speeds.To achieve an S-shaped deployment curve, a function relating the annual rate of deploymentto the proportion of absolute potential realised was used, as shown in Figure 11. Lessrestrictive barriers allow the cumulative deployment to grow faster and for the market tosaturate earlier than for a highly restrictive barrier. The exact shape of the curve is set foreach technology during the calibration of the model.

26

Design of Feed-in Tariffs for Great BritainFinal Report

Market barriers0.5% of additional potential available in each year

0.450.40.350.30.250.20.15

bM1bM2bM3bM4bM5

0.10.05000.10.20.30.40.50.60.70.80.91

Achievement of long-term potential

Figure 11 Market constraints implemented in the model. bM1 – bM5 represent different levels of marketconstraints.

3.4.3

Growth rate constraints

The social and market barriers above are applied independently to each of the technologysub-types. For example, if feed-in tariffs were to cause widespread deployment of large-scalePV but no uptake at the domestic, the proportion of absolute potential achieved will bedifferent for the two sub-types and hence the percentage of the remaining potential that canbe deployed in the following year will be different. However, given that the overall supplychains are very similar for the PV industry as a whole, a technology-specific growth constraintis applied across each technology which sets a limit on the increase in annual deploymentrelative to last year’s sales.The maximum growth rates assumed for each technology are shown in Table 4. Technologieswith low current deployment in the UK have higher growth rates than large-scale andestablished technologies. The growth rates are set to reflect experience from other countrieswhich have seen significant deployment of renewable energy technologies. For example,under the German Feed-in Tariff, the growth rate of the PV industry has averaged 70% peryear for the last five years. However, this growth has been highly variable, with a decrease intotal sales in one year and a 300% growth rate in another. For technologies with very lowcurrent sales in the UK, such as PV, it is likely that spare supply capacity in other countries27

Design of Feed-in Tariffs for Great BritainFinal Report

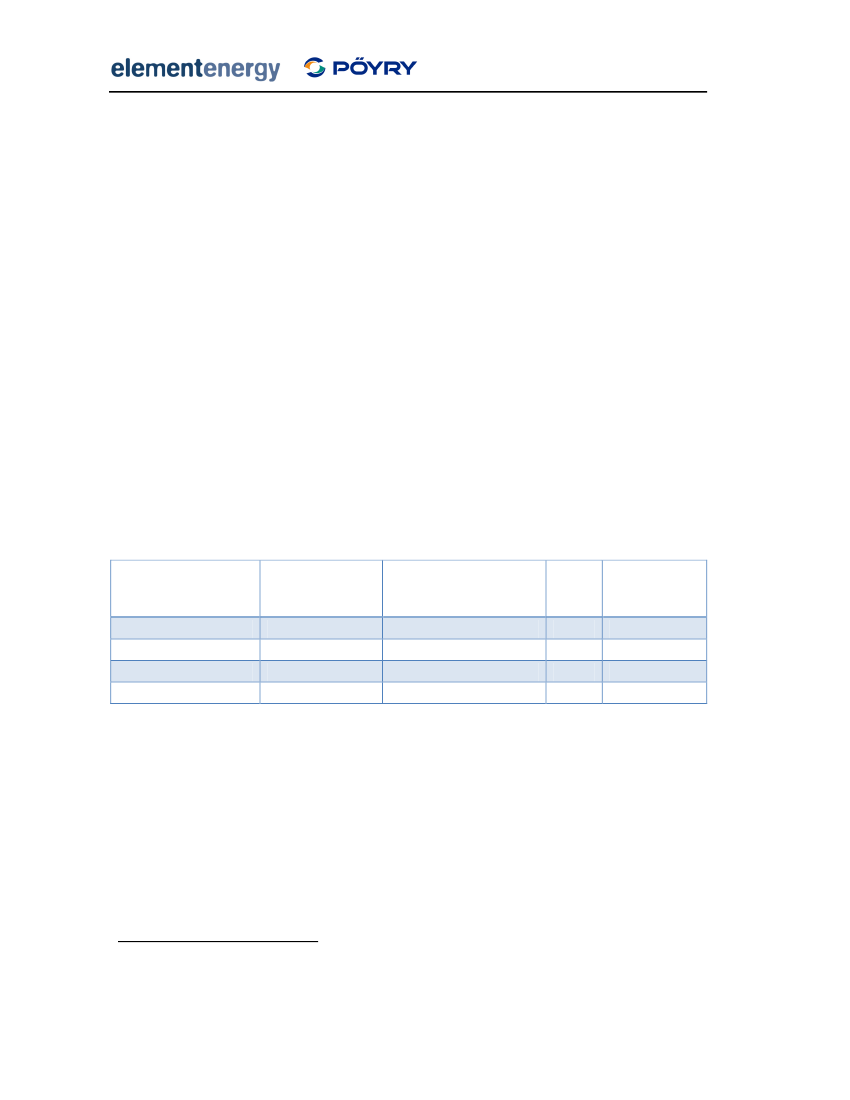

both in manufacturing and installation could be used to meet rapidly growing UK demand.This means that in the short term, annual UK sales may be able to grow significantly quickerthan 70% per year. For this reason, it is assumed that each technology may undergo a one-time increase in annual sales, as shown in Table 4. For example, if a Feed-in Tariff introducedin 2010 for PV stimulates sufficient demand, the industry may install up to 50MW in the firstyear of the policy, despite this being more than 70% higher than current deployment of lessthan 10MW per year. Once the annual sales exceed 50MW, the industry then grows at themaximum growth rate shown. It should be noted that these one-time increases areconservative estimates. During the growth of the PV industry in Germany, much larger yearon year increases in sales occurred in individual years. However, the average annual growthrate over the last five years has been close to 70%.Table 4 Maximum technology growth rates

TechnologyPVWindHydroWaveTidalBiomassWaste

Maximum annual growth rate One time increase permitted70%50MW50%50MW70%10MW70%10MW70%10MW50%10MW30%10MW

3.5 Model CalibrationOnce the technology cost and performance data had been combined with the absolute anddynamic resource potentials, the model was calibrated to ensure that it reflected experienceof other countries which have successfully deployed renewable energy technologies.Calibration was achieved by setting the market and social barriers for each technology sothat they matched historic UK uptake in the baseline, and levels of uptake under generousFeed-in Tariffs were consistent with growth rates observed in other countries and industries.

Figure 12 shows the results of the calibration process for PV. Two data series have been usedfor the calibration. The first is historic uptake that occurred in the UK since the start of thedecade, based on data from the IEA. Annual PV installations remained very low, at between 3and 5MW. Since many of these installations were supported with capital grants under theMajor PV Demonstration Programme and Low Carbon Buildings Programme, historic capitalsubsidies were included in the model. The second data series used in the calibration is PVdeployment in Germany under the Feed-in Tariff. Since its introduction in 2002, the PVindustry has grown rapidly, with over 1GW of modules installed in 2008. Although the tariff28

Design of Feed-in Tariffs for Great BritainFinal Report

structures are slightly different from the ones modelled for the UK, and soft loans werewidely available to consumers when the policy began, the German deployment data stillprovides a useful indication of how PV may grow in the UK under generous policy support.For the purposes of the calibration, the German data were time-shifted so that the policy‘started’ in 2010. Figure 12 shows that the model can closely replicate both historic UKuptake and deployment under a German-style feed-in tariff.There were no data available on the historic deployment of sub-5MW systems underEuropean Feed-in Tariffs for wind power, since the UK is unique in imposing a 5MW eligibilitylimit. In this case, historic UK uptake data from the ROC Register6on sub-5MW generatorswere used in the calibration. For technologies with no historic deployment such as wave andtidal power, the barriers were set equal to other technologies for which data were available.

Model calibration - historic PV uptake10000

Annual PV uptake (MW per year)

1000

UK100Germany (timeshifted)UK Predicted

10

120002005201020152020

Figure 12 Calibration of model against historic uptake – PV

6

https://www.renewablesandchp.ofgem.gov.uk/

29

Design of Feed-in Tariffs for Great BritainFinal Report

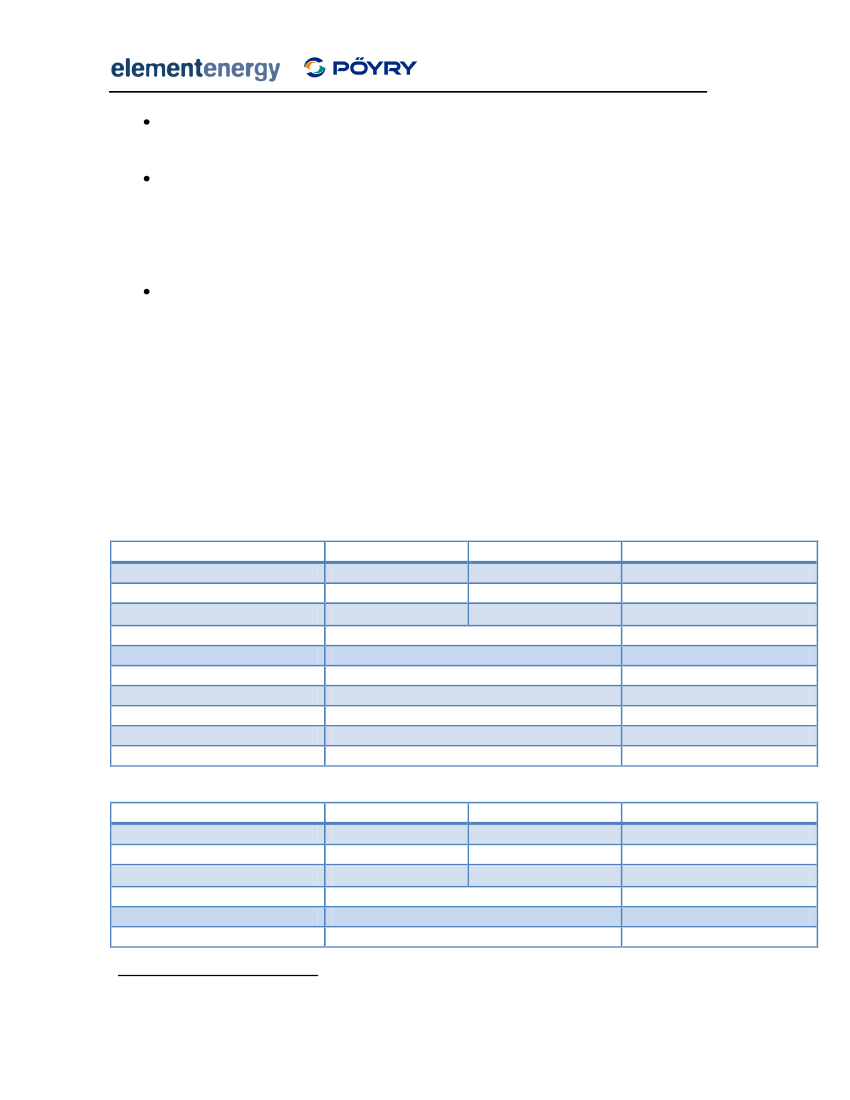

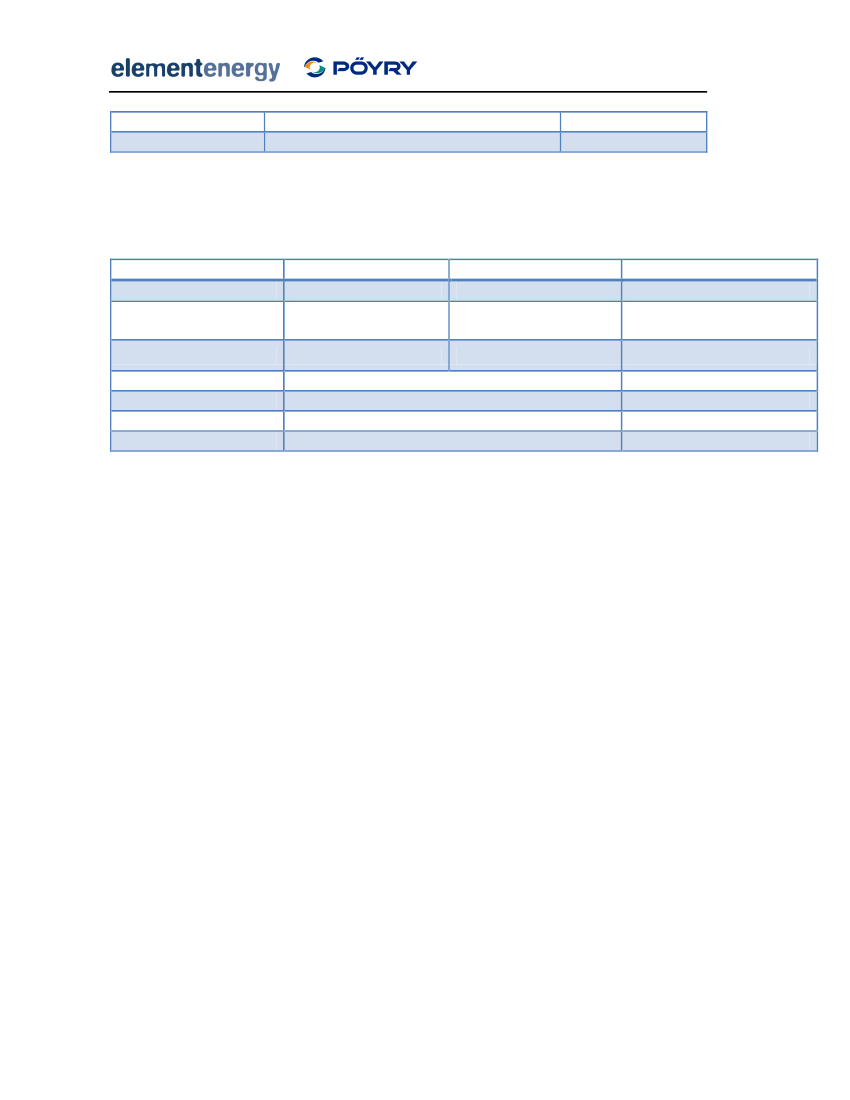

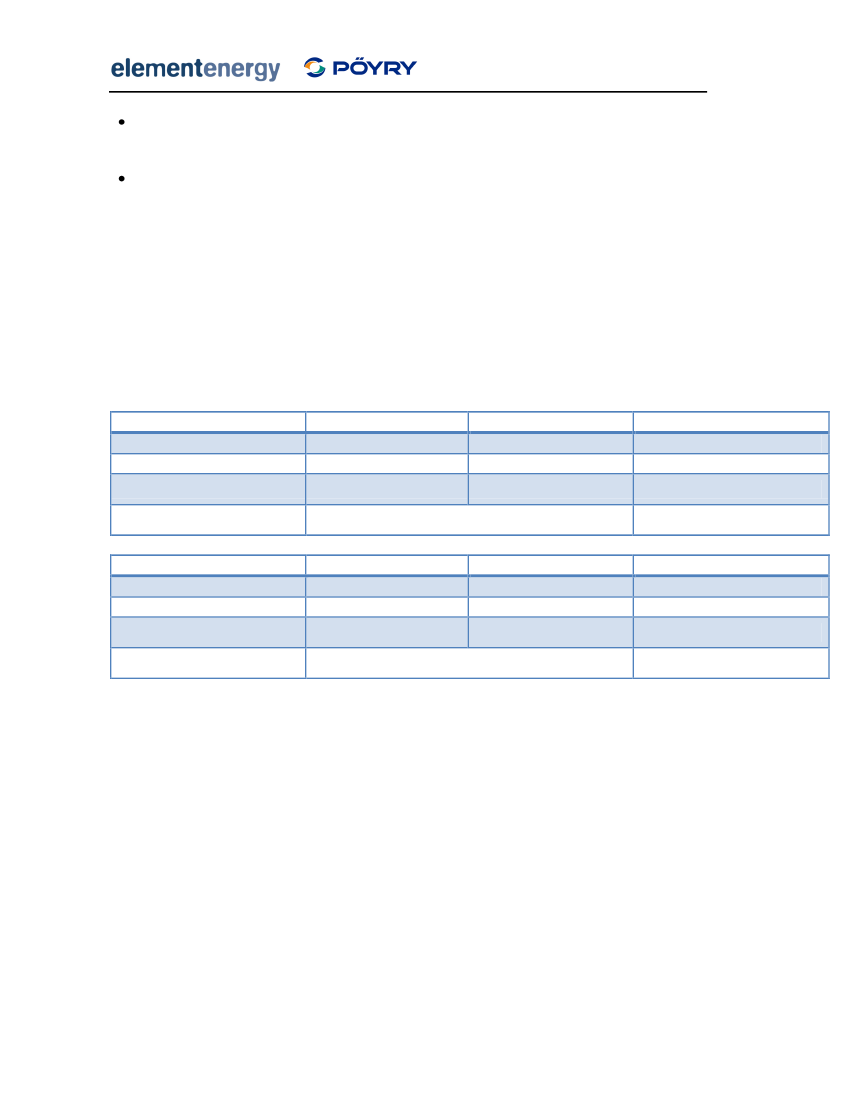

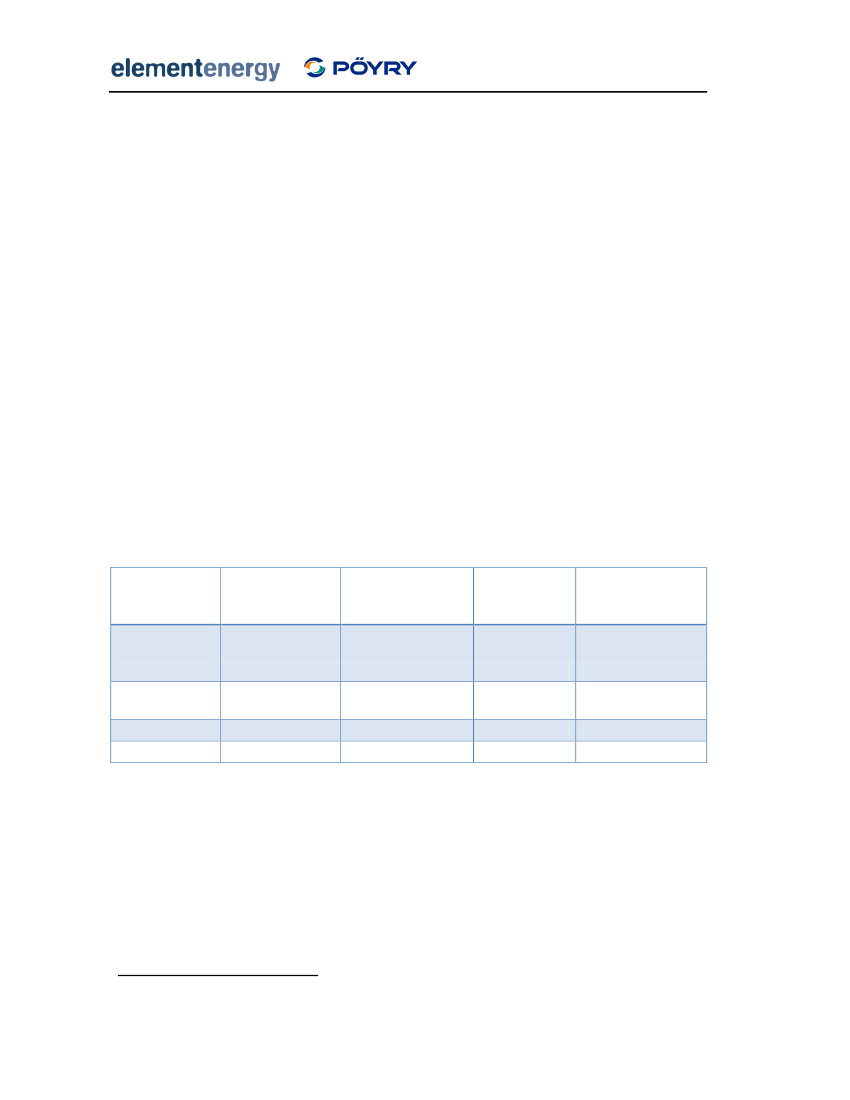

3.6 Fuel pricesFuel prices used in the model are based on DECC’s fossil fuel price scenarios. These containprojections for the price of electricity and gas for domestic, commercial and industrialconsumers from 2008 to 2025. The projections are split into four scenarios from a low energydemand case to a ‘significant supply constraints’ scenario, where prices increase substantiallytowards the end of the decade. The tables below show the projected electricity prices foreach of the four scenarios. All figures are in 2008 prices. The central projection (‘Timelyinvestment, moderate demand’) was used in all model runs unless stated otherwise.The figures below include a CO2price and are the prices that consumers pay for electricity. Inthe absence of additional support under the Feed-in tariff, the prices also represent the valuereceived by renewable energy generators. Electricity that is generated and used on-site isvalued at the retail price, while exported electricity is valued at the wholesale price. Smallrenewable energy systems that are linked to nearby buildings, for example PV and small windturbines, are assumed to export 50% of their output to the grid, while large-scaletechnologies are assumed to export their entire output at the wholesale price.For the purposes of calculating resource costs in the cost-benefit analysis, modifiedelectricity prices were used that did not include carbon prices or taxes.Table 5 Electricity prices – Low Energy Demand

YearDomestic(p/kWh)Commercial (p/kWh)Industrial (p/kWh)Wholesale (p/kWh)200814.939.9711.467.38201012.487.649.124.78201511.947.749.224.43202012.858.5910.084.56

Table 6 Electricity prices – Timely investment, moderate demand

Year2008201020152020

Retail (p/kWh)Commercial (p/kWh)Industrial (p/kWh)Wholesale (p/kWh)14.939.9711.467.4215.0610.0911.585.9214.6010.2711.755.8515.8711.4712.966.25

Table 7 Electricity prices – High demand, producers’ market power

Year

Retail (p/kWh)

Commercial (p/kWh)

Industrial (p/kWh)

Wholesale (p/kWh)

30

Design of Feed-in Tariffs for Great BritainFinal Report

2008201020152020

14.9315.8116.3418.42

9.9710.8111.9213.90

11.4612.3013.4115.39

7.387.948.599.83

Table 8 Electricity prices – High demand, significant supply constraints

Year2008201020152020

Retail (p/kWh)Commercial (p/kWh)Industrial (p/kWh)Wholesale (p/kWh)14.939.9711.467.3817.8512.7514.249.8719.1114.5616.0511.2220.6115.9917.4811.91

31

Design of Feed-in Tariffs for Great BritainFinal Report

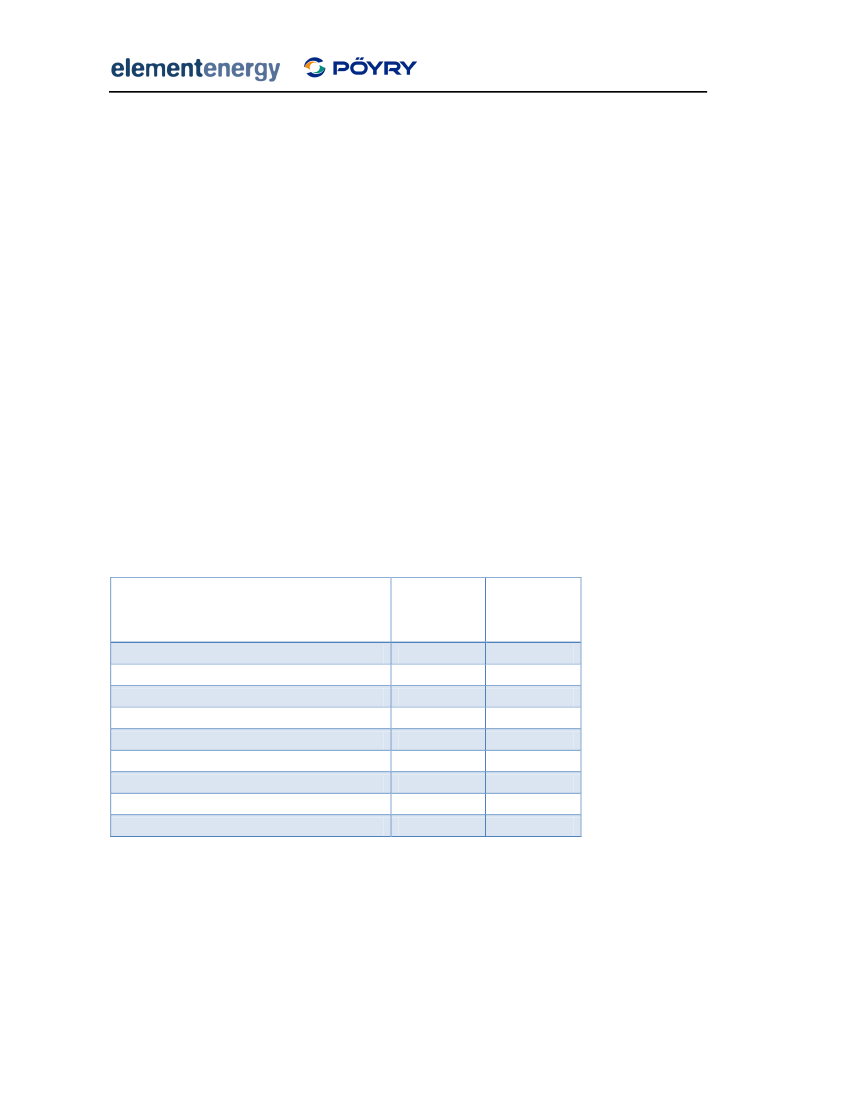

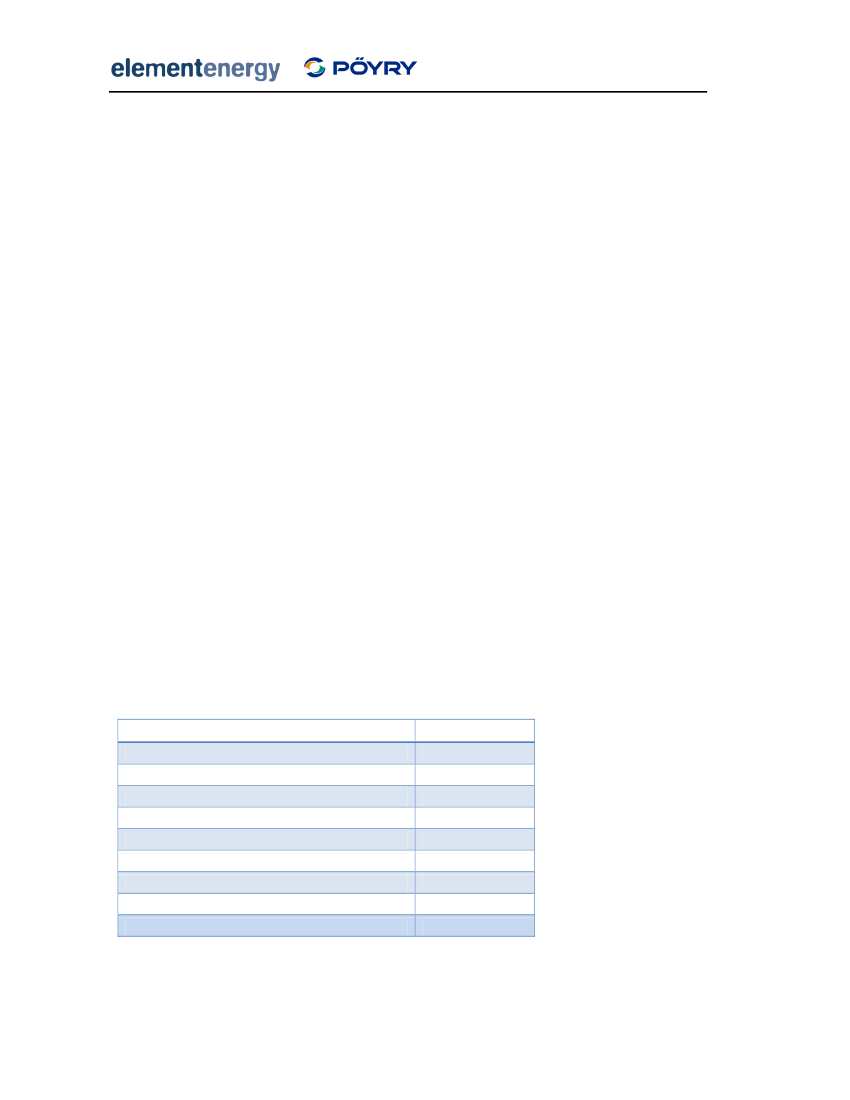

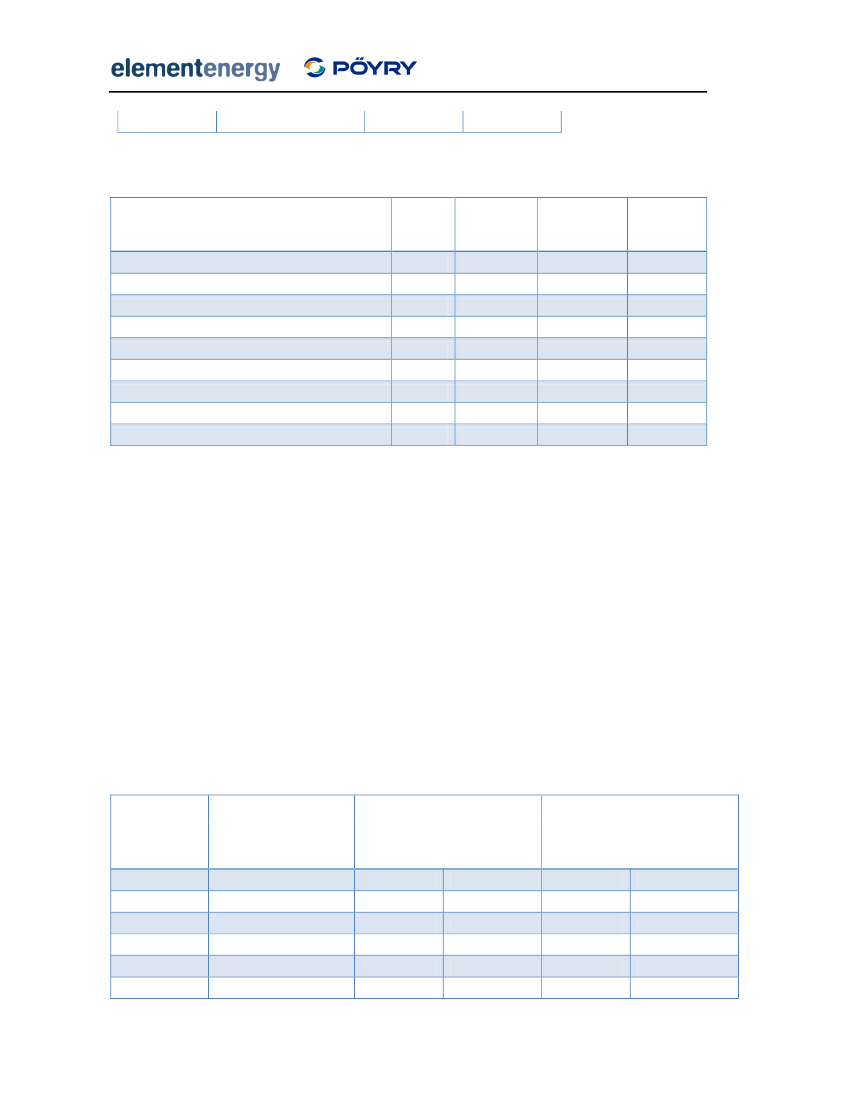

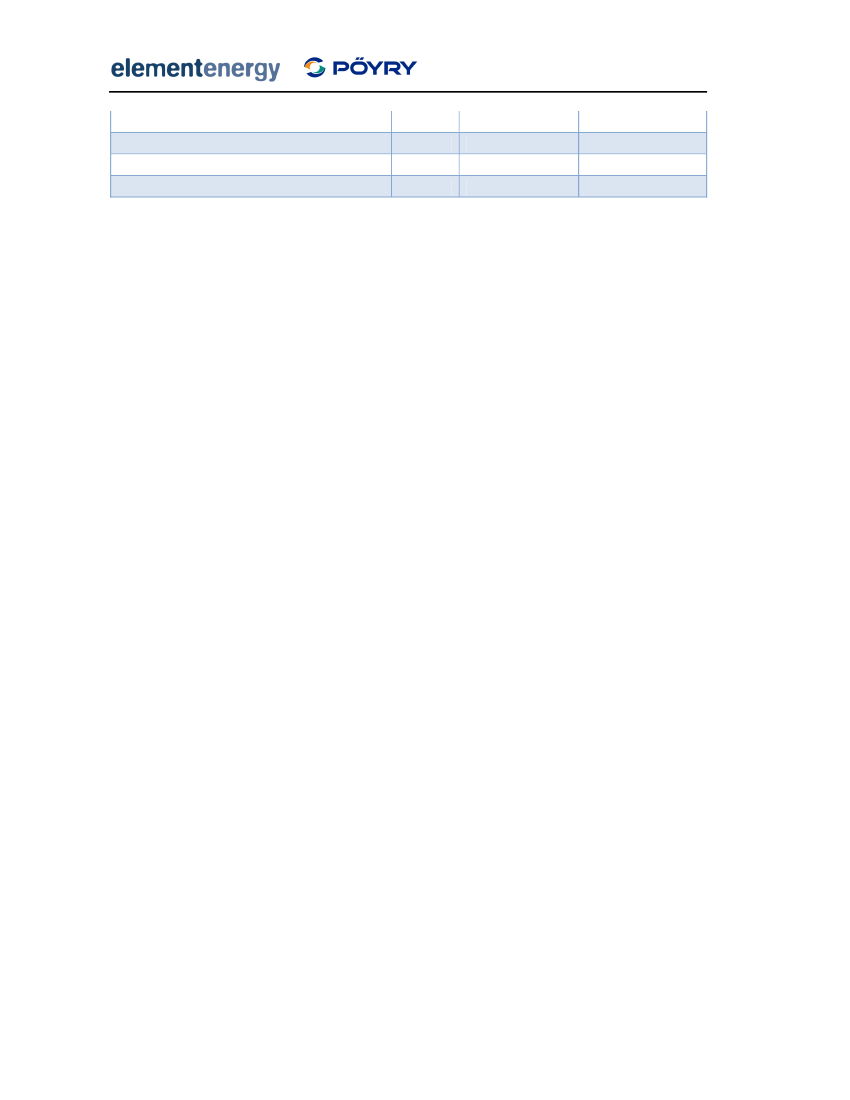

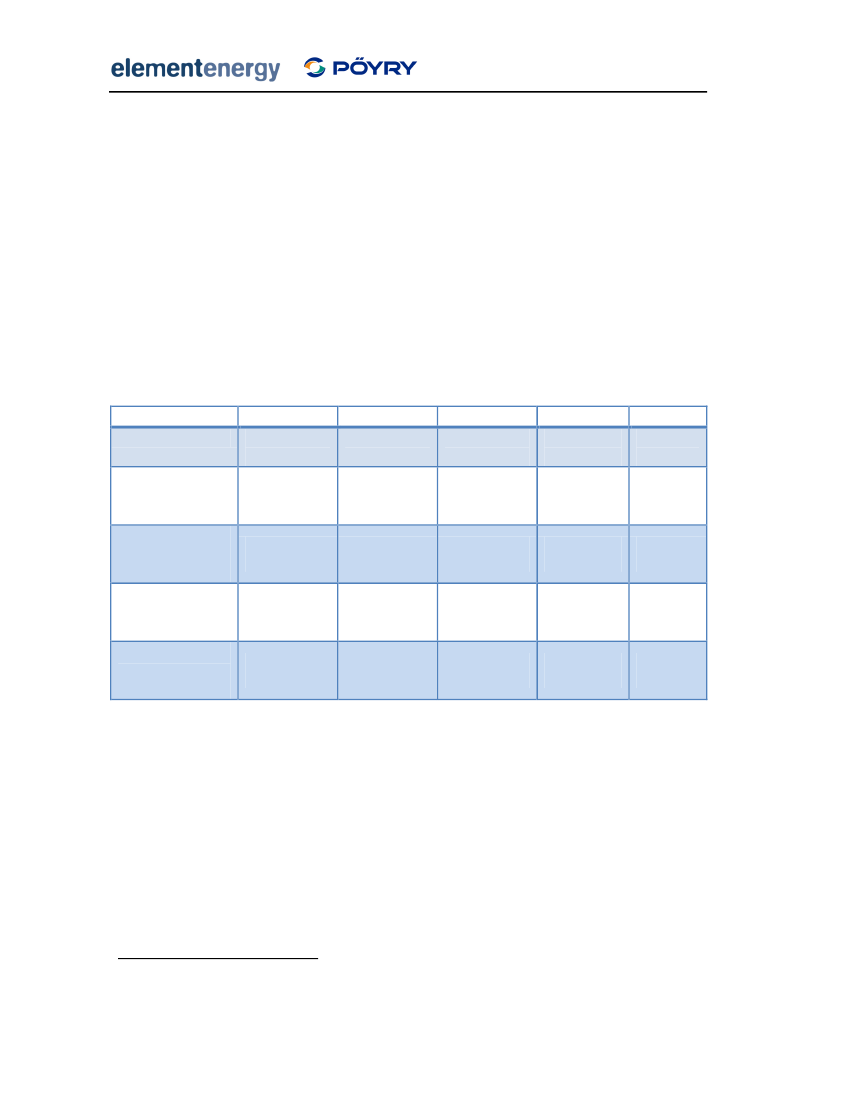

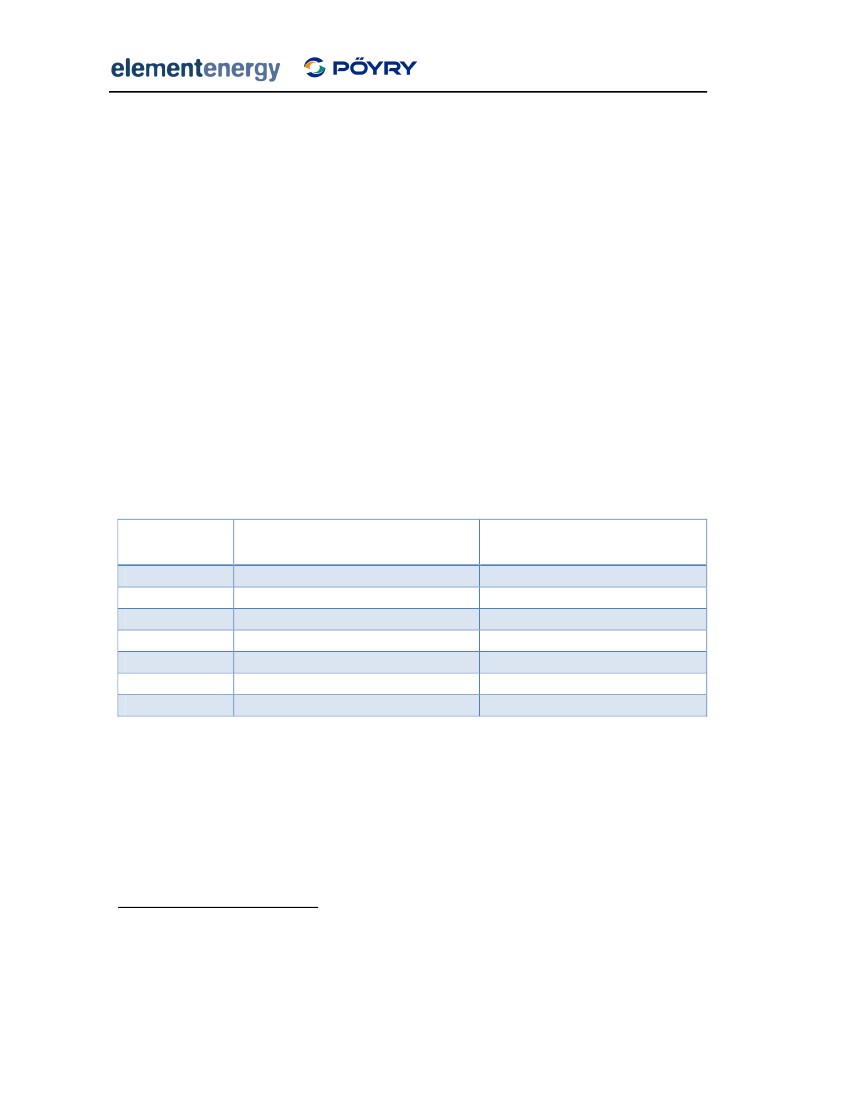

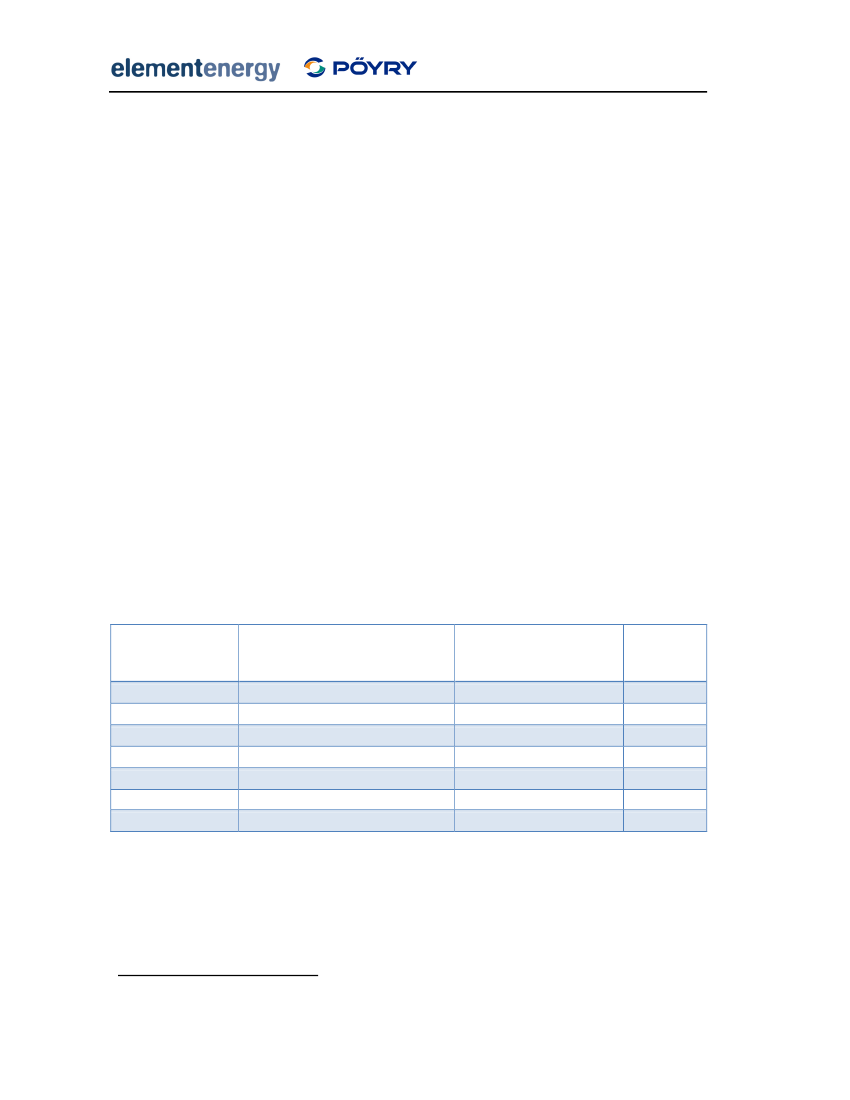

3.7 Model outputsFor each Feed-in Tariff scenario, the primary model outputs are electricity generation,installed capacity and CO2savings for each year of the policy. These outputs are split bytechnology, size, site type (for example, different wind speed bands) and investor type. Forclarity, only partially disaggregated results are shown in the summary graphs and tables inthe Results section.In addition to the primary outputs, the model also provides a detailed cost benefit analysis ofeach Feed-in Tariff using a methodology agreed with the DECC. Numerous studies that haveconducted cost benefit analyses of low carbon policies for all technologies and scales havedone so using a wide range of input assumptions and methodologies. This causes difficultieswhen the costs and benefits of different policies are compared across studies. For thisreason, the CBA methodology is described below. Table 9 shows the summary cost benefitanalysis outputs as they are presented in the Results section, and each output is describedbelow.Table 9 Example of summary CBA outputs

ParameterAdditional electricity generation in 2015Additional electricity generation in 2020Renewable heat generation in 2020Annual resource cost in 2020Cumulative resource cost to 2020Annual resource cost in 2020Annual cost to consumers in 2020Cumulative cost to consumers to 2020Annual CO2 savings in 20203.7.1

UnitTWhTWhTWh£m£m£/MWh£m£mMtCO2

Value1.25.79.11991,037353311,5232.4

Additional electricity and heat generation

Throughout the CBA, a counterfactual scenario is deducted so that all values are additional tothe baseline. The counterfactual scenario is assumed to be the Business as Usual case as setout in the Results section, and assumes that the Renewables Obligation continues to be the32

Design of Feed-in Tariffs for Great BritainFinal Report

main source of support for renewable electricity technologies. This means that additionalelectricity generation in 2015 is less than the total generated in a given scenario. Forexample, although the additional electricity generation in 2020 in the table above is 5.7TWh,the total generated in the scenario is 8TWh since 2.3TWh is generated in the baseline.

3.7.2

Resource costs

Resource costs are defined as the costs to the country of pursuing a particular policy relativeto a counterfactual scenario. The costs include capital spent on equipment and operatingcosts, and in this case include savings from electricity generated by renewable technologies.Resource costs explicitly exclude transfers, or payments made from one part of society toanother, and so exclude taxes, subsidies and CO2prices.In order to calculate resource costs, capital costs are annualised over the equipment lifetime.Capital costs are annualised using an interest rate of 10% for all consumers, which representsa standard cost of capital that might be applied to renewable energy projects. The cost ofcapital does not attempt to capture the large range of discount rates seen in domesticconsumers, which are represented in the uptake model using a distribution of hurdle rates.This is because the observed high hurdle rates capture a range of hidden and ‘hassle costs’that do not accrue to the country as a whole. Therefore the discount rates used in the CBAreflect only the actual cost of capital.The electricity produced each year by renewable technologies is valued at electricity pricesprovided by DECC, which exclude the carbon price. Costs occurring in the future arediscounted back to present values using the Green Book social discount rate of 3.5% peryear.The annual resource cost per MWh in 2020 is defined as the additional resource cost in thatyear relative to the baseline divided by the additional electricity generation in that year. Thisfigure is also discounted back to 2008 prices.3.7.3Costs to consumers

Since the tariffs paid to renewable energy generators under the Feed-in Tariff are funded byelectricity consumers, the cost to consumers records the total value of tariffs paid each yearunder the policy. Since money paid to generators under a fixed tariff includes the value of theelectricity itself, the wholesale price is deducted from the total tariff paid when calculatingthe cost to consumers. For example, a fixed tariff of £200/MWh represents an additional costto consumers of £150/MWh if the electricity itself is valued at £50/MWh. Like the resourcecosts, all future costs are discounted to present values prices at 3.5% per year.

33

Design of Feed-in Tariffs for Great BritainFinal Report

3.7.4

Annual CO2savings

To avoid double counting CO2savings from renewable heat production in this study andparallel work on the Renewable Heat Incentive, unless stated otherwise the CO2savingsreported here related only to the renewable electricity generation. The CO2displacement forrenewable electricity is based on DECC’s projection for the marginal long term emissionsfactor, assumed to be constant throughout the model timeframe at 0.43t/MWh. Biomass isassumed to have a net CO2intensity of zero.

34

Design of Feed-in Tariffs for Great BritainFinal Report

4 BaselineWith the exception of landfill and sewage gas, historic investment in sub-5MW renewableelectricity technologies has been low. However, due to changing fossil fuel prices andtechnologies, it is likely that there will be an increase in installed capacity between now and2020 under current policies. The Business as Usual scenario is a projection of likelydeployment under the current policy regime, without any support from a Feed-in Tariff. Inmany of the model outputs, this baseline is then deducted from the installations occurring ina given Feed-in Tariff scenario, to give theadditionaldeployment under the FIT.4.1.1Baseline assumptions

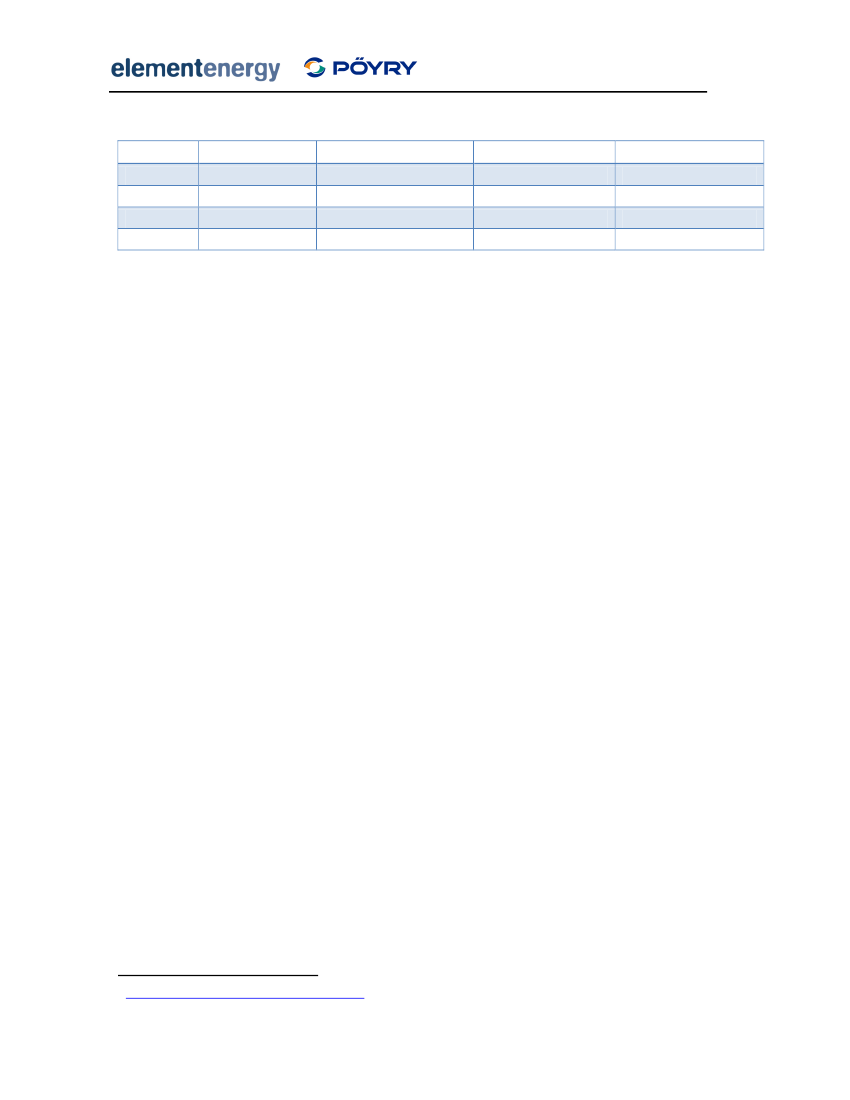

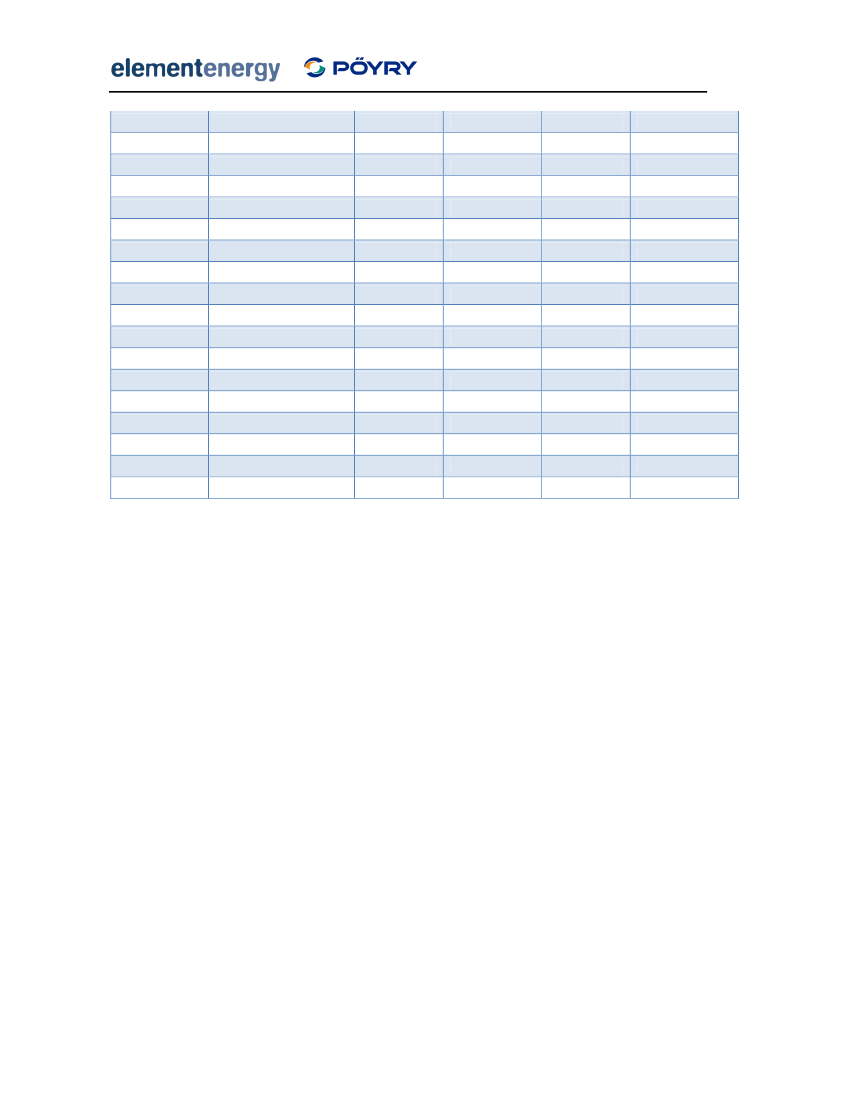

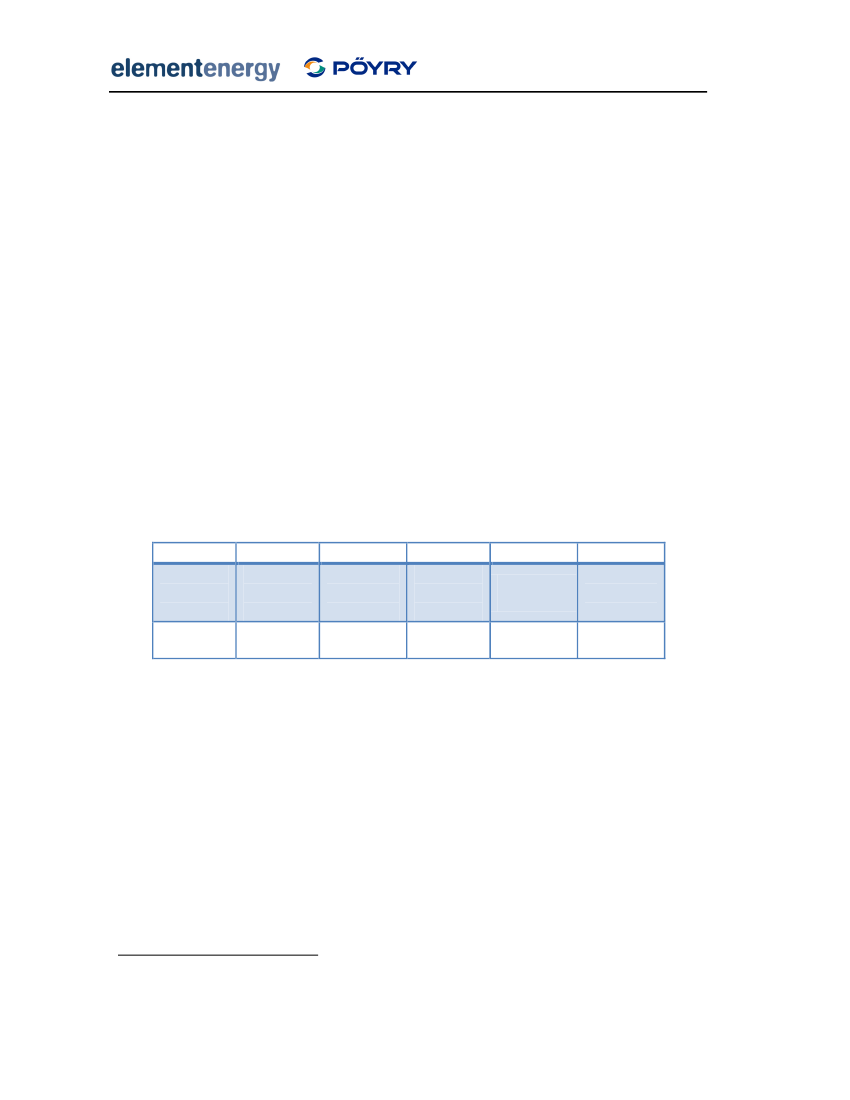

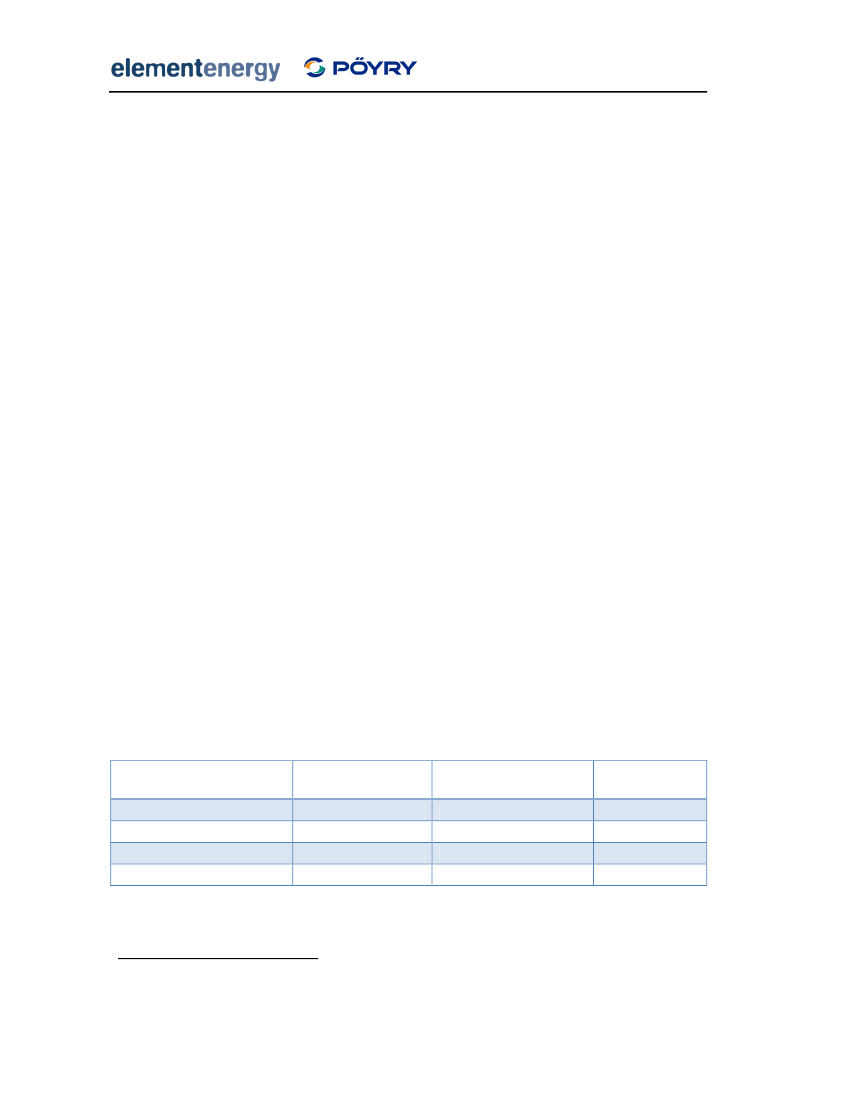

In April 2009, the primary support mechanism for renewable electricity, the RenewablesObligation, was modified to encourage deployment of a wide range of renewabletechnologies. The support payable is banded by technology, so that post-demonstration andemerging technologies receive higher support.The baseline includes the following support for renewable generators under the bandedRenewables Obligation. Note that for simplicity in this model, support from the Low CarbonBuildings Programme is assumed to end at the end of 2009 so that ROCs are the only supportmechanism available between 2010 and 2020. Previous analysis by Element Energy suggeststhat likely supplier contributions to small PV and wind systems under CERT or a post-2011Supplier Obligation are too low to substantially improve the economics of these systems, andso these policies have not been explicitly modelled in the baseline.Table 10 RO support received under Business as Usual

TechnologyMicrogeneration (all systems under 50kWe)PVWave and tidal powerAnaerobic digestionAdvanced thermal treatmentBiomass CHPWindHydroBiomass (electricity only)

ROCs per MWh222222111

35

Design of Feed-in Tariffs for Great BritainFinal ReportTable 11 Electricity prices in the Business as Usual scenario (2008 prices)

Year20082010201520204.1.2

Retail (p/kWh)Commercial (p/kWh)Industrial (p/kWh)Wholesale (p/kWh)14.939.9711.467.4215.0610.0911.585.9214.6010.2711.755.8515.8711.4712.966.25

Baseline results

Figure 13 shows the total new sub-5MW generation in 2020 under Business as Usual. Notethat this excludes projects commissioned before 2010. Total generation in 2020 is 2TWh,with uptake dominated by large scale technologies such as on-shore wind, hydro power andwaste. The baseline results suggest that the offering 2 ROCs per MWh to anaerobicdigestion, when combined with revenues from gate fees, is sufficient to drive significantuptake. Over 80 1MW anaerobic digestion plants are installed by 2020. Uptake of advancedthermal treatment plants is lower, with 0.1TWh of generation in 2020. Although the levelisedcosts per MWh are similar to anaerobic digestion, the absolute potential is lower due tocompetition for waste feedstocks from other technologies, such as incineration with CHP, orlarger thermal treatment plants. For example, the first advanced thermal treatment plant togain ROC accreditation was a 2MWeEnergos plant on the Isle of Wight. However, this is ademonstration scale facility; a planned commercial scale plant in Derbyshire is sized at8MWe.7This suggests that the future role of sub-5MW advanced thermal treatment plantsmay be limited.

7

http://www.energ.co.uk/?OBH=69&ID=21

36

Design of Feed-in Tariffs for Great BritainFinal Report

Total electricity generation by sub-5MW RES-E bytechnology - BaselineTotal electricity generation (GWh per year)

2,500Waste2,0001,5001,000Bio

TidalWaveHydro

Wind (Large)5000201020152020Wind (Small)PV (Large)

PV (Small)

Figure 13 Electricity generation by sub-5MW RES-E in 2020 under Business as Usual

Table 12 shows the size distribution of uptake under the baseline. Although the majority ofinstalled capacity is from large-scale projects, there is significant uptake of small hydroinstallations. This suggests that 2 ROCs per MWh is sufficient to stimulate uptake of sub-50kW hydro power. There are also over 4,000 small wind installations, defined as those withpeak capacities of between 1.5kW and 50kW. Uptake of the other emerging or post-demonstration technologies is negligible, with no deployment of wave or tidal power in thebaseline. PV uptake is also extremely low, with 125 systems being installed in 2019 and 2020.Given the assumption that consumers make purchasing decisions based on rates of return,the model is unable to accurately represent uptake by consumers who are willing to acceptnegative rates of return, which is the case with PV and micro-wind in the baseline. Such earlyadopters are likely to be few in number compared to the absolute potential for thesetechnologies, and so the distribution of hurdle rates in the model is designed to provide agood representation of mass-market behaviour.

37

Design of Feed-in Tariffs for Great BritainFinal Report

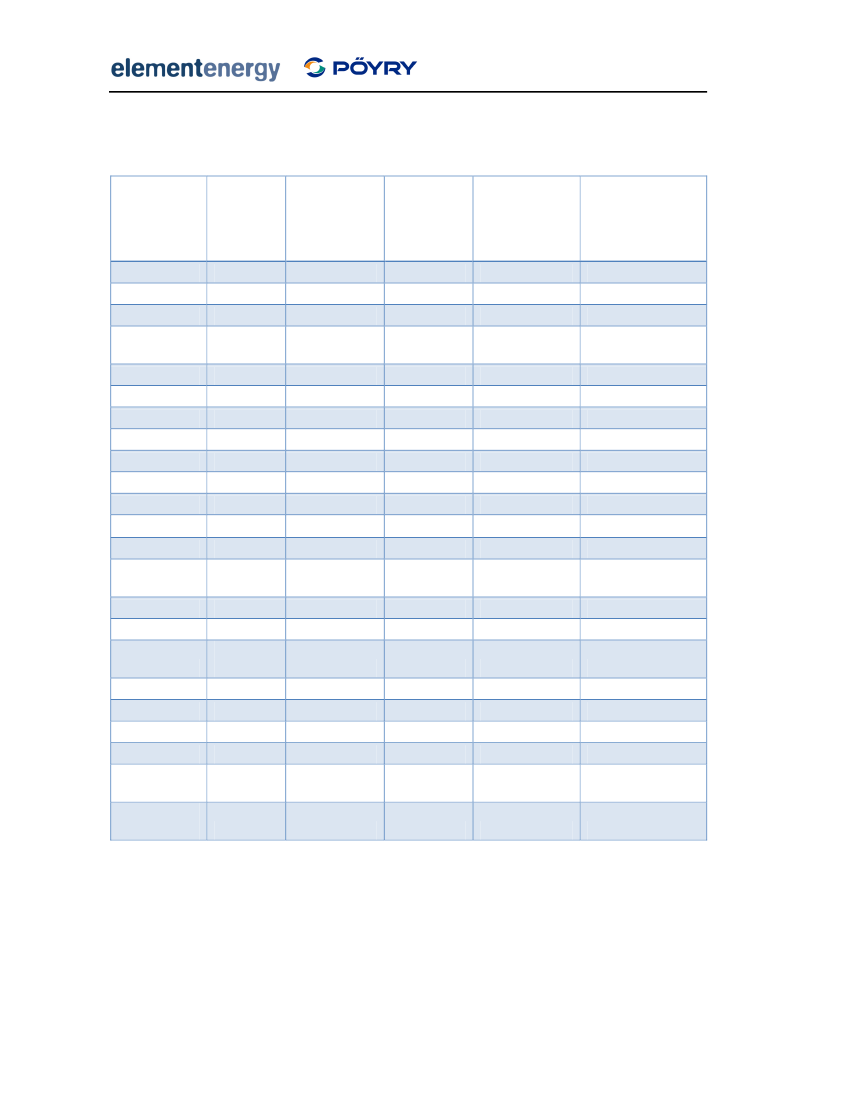

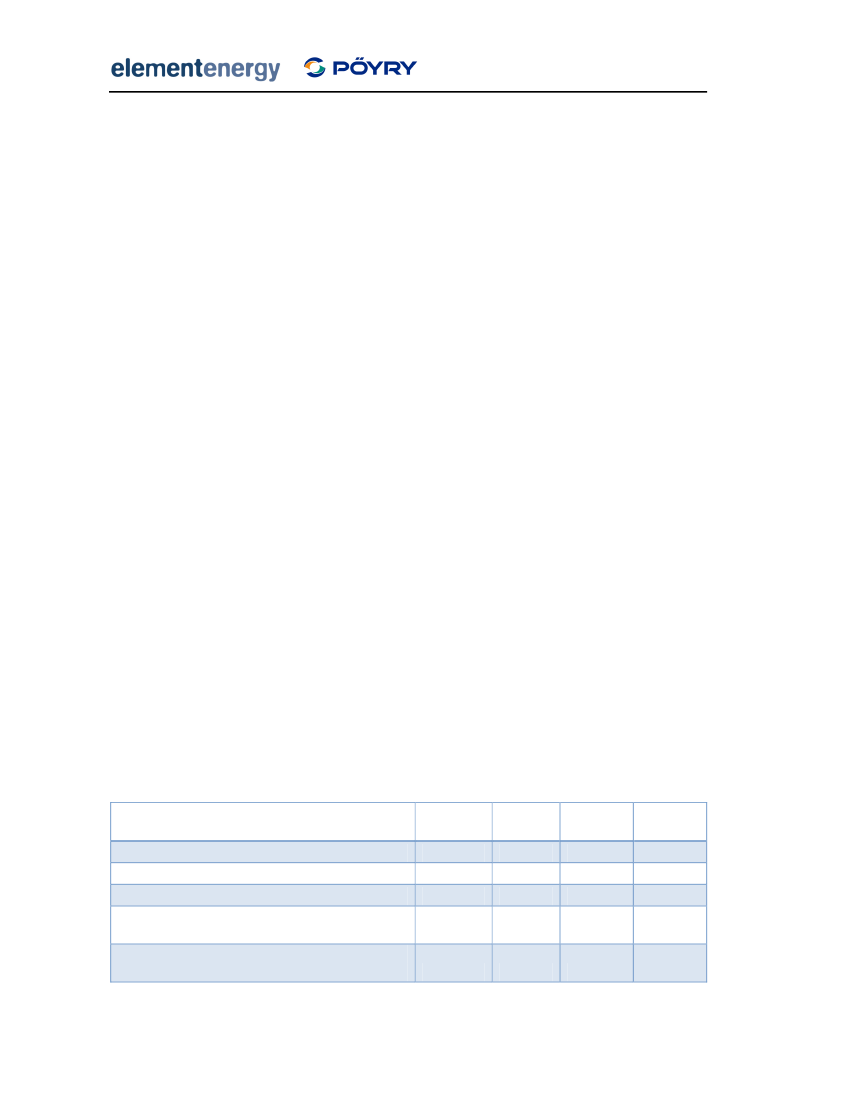

Table 12 Number of installations in 2020 by technology size - Business as Usual

TechnologyPV

Wind

HydroWaveTidalBiomass

Waste

Gas CHP

SizeDomesticSmallLargeStand-aloneMicroSmallMediumLargeSmallLargeAllAllCHPElectricityonlyATTADIncinerationStirlingFuel cell10kW gas50kW gas

Annual GWhCumulativeCumulative electricityAnnual CO2installations MW ingeneration in savings in 2020in 202020202020(MtCO2)125000.00000.00000.0004,340927436530000038810146,8358559315,237153,858003445495900000178840147947791993005781,158132360000121619250730512792,2373,2980.00.00.00.00.50.00.10.00.00.00.00.10.30.00.00.30.00.11.01.4

TotalrenewableTotal inc.CHP

Since CHP is strictly a low carbon rather than fully renewable technology, its uptake is notincluded in the renewable electricity generation and cost-benefit analysis outputs below.Results for CHP are shown separately in Section 5.8.

38

Design of Feed-in Tariffs for Great BritainFinal Report

5 Results and analysisDesigning a Feed-in Tariff to drive uptake of renewable electricity technologies is aninherently complex task. The sizes of the technologies to be stimulated vary from 1kWdomestic systems to 5MW industrial plants, and the technologies themselves range frombeing cost-effective under existing policies to having generating costs over five times theretail electricity price. In addition, costs of many technologies are expected to decrease overtime as supply chains mature, and support levels must reflect these changes if significantoverpayments to investors are to be avoided.A thorough review of qualitative Feed-in Tariff design issues has been conducted by ElementEnergy and Pöyry as part of this project. This review draws on a wide range of policyexperience gained in other European countries that have successfully implemented Feed-inTariffs. Some design issues, such as the process for reviewing tariff levels, cannot beinvestigated using a quantitative model, and so are covered exclusively in the qualitativereport. However, there is a wide range of issues, such as tariff banding, degression and tariffpayment periods whose effects on uptake, diversity, and costs can be directly quantified. Inthe following section, these issues are investigated by setting a ‘target’ for the amount ofrenewable generation desired by a given date. By holding overall uptake constant, the effectsof policy design on uptake of different technologies, as well as policy costs, can beinvestigated and seen more clearly. The generation ‘targets’ used in the main scenarios are2% and 3.5% of UK electricity demand in 2020. This demand is projected by DECC to be386TWh in 2020, so the targets correspond to approximately 8TWh and 13.5TWhrespectively.

39

Design of Feed-in Tariffs for Great BritainFinal Report

5.1 2% targetFor a given target, there is a potentially infinite number of technology combinations that willdeliver the electricity generation required. We have used a number of policy approaches todetermine the tariff levels for each scenario. In the simplest case, the approach is to meetthe generation target while minimising the policy costs as measured by resource cost or thecost to consumers. More complex scenarios aim to encourage the deployment of severaltechnologies, such as community- or domestic-scale PV or wind, which will result in highercosts than the ‘least-cost’ approach.5.1.1Flat tariffs

The simplest tariff structure of all is one in which a single tariff is paid to all generators,regardless of technology, size or year of deployment. The value of the single tariff is equal tothe levelised costs of the most expensive technology required to meet the target. In otherwords, technologies are deployed in ascending order of cost along the supply curve (seeFigure 14). Due to the distribution of hurdle rates assumed in the model, each technology hasa range of levelised costs and the supply curve is not as discrete as the one shown. Unlessotherwise stated, all tariffs are ‘fixed tariffs’, so levels refer to the total revenue received bythe generator (i.e. there are no additional revenues from sale of electricity to theconventional electricity market). A comparison of policies based on flat and premium tariffscan be found in Section 5.4. For a 2% target, the tariff level required is £155/MWh.In all feed-in tariff scenarios described below, it is assumed that biomass CHP receivessupport under the RHI for each MWh of renewable heat delivered. The value of the RHI isassumed in the model to remain constant through time at £10/MWhthfor a CHP technologywith a heat to power ratio of 2.5 to 1, this support is equivalent to an extra electricity tariff of£25/MWherelative to an ‘electricity-only’ plant. This is a similar value to the extra 0.5ROCspayable under the banded Renewables Obligation for biomass plants that operate in CHPmode. For a fuller discussion on biomass electricity and the interaction between the FIT andRHI, see Section 5.7.

40

Design of Feed-in Tariffs for Great BritainFinal Report

Figure 14 Setting a flat tariff to achieve a generation target using lowest-cost technologies

Figure 15 shows the electricity generation in 2020 with a flat, fixed tariff of £155/MWh. Thetarget is met exclusively by large-scale technologies, with large wind-turbines providing3TWh in 2020. The combination of the FIT and RHI is sufficient to drive uptake of over700MW of biomass CHP, delivering 2.5TWh of renewable electricity in 2020. The majority ofthis capacity is in standalone installations linked to large individual heat demands rather thansystems connected to district heating networks, which are significantly more expensive.Uptake of higher cost technologies remains negligible in this scenario, since £155/MWh iswell below the levelised costs of marine systems and PV.Total electricity generation by sub-5MW RES-E bytechnology - 2% least costTotal electricity generation (GWh per year)9,0008,0007,0006,000WasteBio

TidalWaveHydro

5,0004,0003,0002,0001,000

Wind (Large)Wind (Small)PV (Large)

0201020152020

PV (Small)

Figure 15 Electricity generation in 2020 - £155/MWh flat tariff

41

Design of Feed-in Tariffs for Great BritainFinal Report

Table 13 shows a summary of the cost-benefit analysis outputs for the flat tariff. All outputsin the CBA are relative to the baseline, so theadditionalelectricity generation in 2020 is5.7TWh, since 2TWh were generated under Business as Usual. The cumulative resource costin 2020 is £1 billion. The cumulative cost to consumers in 2020 is £1.5 billion, implying thatsome investors are receiving higher revenues than those that would be required to make theinvestment attractive.Table 13 Summary CBA outputs - £155/MWh flat tariff

ParameterAdditional electricity generation in 2015Additional electricity generation in 2020Renewable heat generation in 2020Annual resource cost in 2020Cumulative resource cost to 2020Annual resource cost in 2020Annual cost to consumers in 2020Cumulative cost to consumers to 2020Annual CO2 savings in 20205.1.2Tariff banding

UnitTWhTWhTWh£m£m£/MWh£m£mMtCO2

Value1.25.79.11991,037353311,5232.4

Wherever technologies show significant differences in cost, a flat tariff design will result inoverpayments to the lowest-cost generators. As the generation target increases and highercost technologies on the supply curve are required to meet that target, the overpaymentsincrease significantly. The shaded area in Figure 14 shows the producer surplus for low-costgenerators. Producer surplus is defined as the difference between what an investor is paidand the minimum amount he would have to be paid and still make the investment. Onesolution to overcome this issue, and the one employed in almost all EU Feed-in Tariffschemes, is to band the tariff by technology. Tariffs can be set so that each technologyreceives support equal to its levelised costs per MWh, with more costly technologiesreceiving higher support. For technologies with a wide range of costs, such as large windturbines at different wind-speeds, a single tariff is set for the purposes of the model thatprovides sufficient returns for the majority of sites.Figure 16 illustrates a banded Feed-in Tariff design, where tariff levels are set equal to thelevelised costs for each technology. The shaded area represents the reduction in producersurplus of the banded tariff relative to a flat tariff delivering the same overall generationtarget.

42

Design of Feed-in Tariffs for Great BritainFinal Report

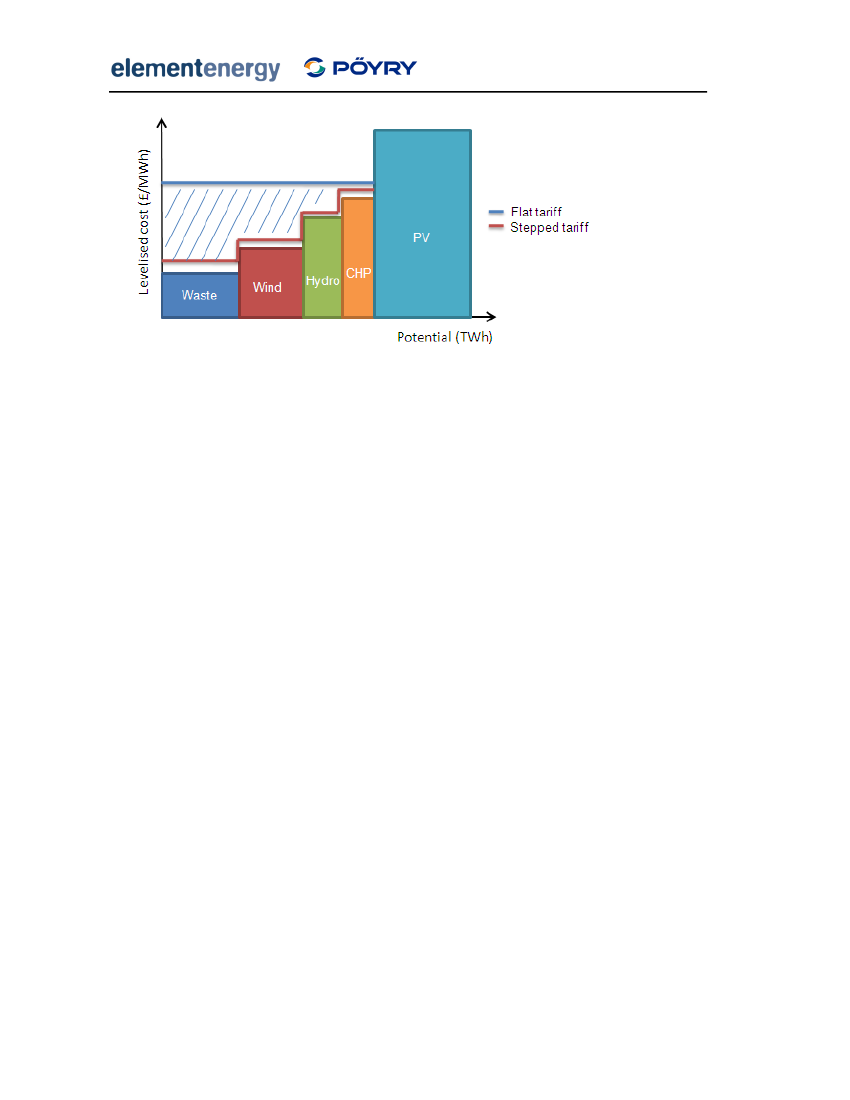

Figure 16 Illustration of a stepped tariff design

The potential for reducing rents through technology banding is relatively limited in the 2%scenario. Waste technologies are available at a lower cost than £155/MWh, and reducing thetariff paid to these projects reduces the cumulative cost to consumers in 2020 by £50 millionwithout affecting overall electricity generation. The limited effect of banding occurs becausethe rents caused by differences in costs between technologies are small compared with costdifferences within a technology due to scale or resource. These differences are particularlylarge for wind turbines at different wind-speeds, where levelised costs in 2010 vary frombetween £70/MWh at 8m/s to £150/MWh at 5.5 m/s. There is also significant variation inlevelised costs between different turbine sizes at the same wind-speed. To match tariff levelsto the levelised costs for each turbine and wind-speed band would require a large number ofbands, adding significant administrative complexity to the policy. Options for reducing rentsfor low-cost generators without multiple tariff bands include volume-based tariffs, wheretariff levels decrease as electricity output rises. This means that a wind turbine in a low wind-speed site receives a greater proportion of its tariff payments at a higher level, increasing theaverage revenue per MWh generated. In Germany, the energy outputs of large turbines arecompared against a reference turbine, and machines with lower outputs receive higherpayments. The higher payments are set so that although they provide good returns oninvestment for a wide range of sites, the highest returns are always available at high wind-speed sites. This ensures that turbines are preferentially deployed at the most cost-effectivesites.5.1.3Least cost scenarios

If the banded tariff described in Section 5.1.2 were modified to include varying tariffs fordifferent wind-speeds, it would be close to the lowest cost solution for meeting the 2%target. Since the cost of a policy can be measured by resource cost or the costs passed on toelectricity consumers, it useful to define the term ‘least cost’, since a given design canminimise one cost without the other.43

Design of Feed-in Tariffs for Great BritainFinal Report