Miljø- og Planlægningsudvalget 2008-09

MPU Alm.del

Offentligt

PwC Sustainability

Collection of statisticalinformation on Green PublicProcurement in the EUReport on data collection results

1

grön.*

grøn.*green.*groen.*

vihreä.*

grün.*

PricewaterhouseCoopers provides sector-specific services in the fields of Assurance, Tax & HRS and Advisory. Our objective is tohelp our clients improve their operational agility – not only as a service provider but also as a business partner. We give practicaladvice, identify opportunities and suggest innovative solutions: with a result-driven focus and often from a surprising perspective.We do this with some 4,800 colleagues in the Netherlands and more than 155,000 people in 153 countries around the world on thebasis of our Connected Thinking philosophy. We serve large national and international companies as well as governments,not-for-profit organisations and private companies.‘PricewaterhouseCoopers’ refers to the network of participating member firms of PricewaterhouseCoopers International Limited.Each member firm is a separate and independent legal entity.

Collection of statisticalinformation on Green PublicProcurement in the EUReport on data collection results

By PricewaterhouseCoopers, Significant and EcofysJanuary 2009

2

PricewaterhouseCoopers

ContentsManagement summary11.11.21.31.41.5

5101111121517

IntroductionBackgroundObjective and scopeMethodologies for measuring GPPMethodology for monitoring GPPContents of this report

22.12.22.32.4

Organising Green Public ProcurementSummaryEnvironmental policyProcurement policyImplementation of Green Public Procurement

1819191920

33.13.23.33.43.53.63.73.8

Green Public Procurement per countrySummaryAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

262729303132333435

44.14.24.34.44.54.64.74.84.94.104.11

Green Public Procurement per product groupSummaryCleaning products & servicesConstructionElectricityCatering & foodGardeningOffice IT EquipmentPaperTextilesTransportFurniture

383941424344454647484950

55.15.2

CO2impact of Green Public ProcurementCO2impact of GPP per functional unitCO2impact of GPP in 2006/2007

525353

66.16.2

Financial impact of GPPFinancial impact of GPP per functional unitFinancial impact of GPP in 2006/2007

606162

77.17.27.37.47.5

ConclusionsCurrent Green-7 level of GPPCO2benefits through GPPFinancial benefits through GPPComparison between CO2impact and financial impactReflection and recommendations on the methodology applied

686969697071

AppendixABCDEFGResponse rates per product groupPrecision levels per countryData sheets on organising GPPData sheet on the levels of GPPData sheets on the CO2impact of GPPData sheets on the financial impact of GPPResults verification interviews

72737475829497105

Management summaryBackgroundFor the achievement of sustainable development,changes in production and consumption patterns arecrucial. The European public service spendsapproximately 16% of European Union’s Gross NationalProduct on purchasing a large variety of products. Bytaking into account environmental criteria in itsprocurement procedures, contracting authorities promotemodes of production that are more environmentallyfriendly and stimulate the supply of ‘green’ goods andservices.In the renewed Sustainable Development Strategyadopted in 2006, the leaders of the European Union (EU)have set forth a target for Green Public Procurement(GPP), stating that, by the year 2008, the average level ofGPP should be at the current level of GPP in the bestperforming Member States. This target has been mademore specific in a Commission’s Communicationadopted on 16 July 2008, in which the Commissionproposes a 50% target for each Member State to bereached as from 2010. In September 2008, the EuropeanCouncil called upon the Commission to develop apractical evaluation methodology to measure progressmade by 2010 and thereafter. This study, performed in2008 by PricewaterhouseCoopers, Significant andEcofys, contributes to this need.Netherlands, Sweden and the United Kingdom (‘Green-7’)in 2006/2007. The results are based on a digitalquestionnaire amongst 2907 contracting authorities inthese Member States. The overall response was 1105(38%).For this study, a selection was made of ten productgroups frequently procured by public institutions.Respondents were asked to indicate whether their mostrecently concluded purchasing contracts comply withcertain ‘green criteria’. These criteria are linked to the keyenvironmental impacts of a product and are divided into‘core green’ (addressing the most significantenvironmental impacts) and ‘comprehensive green’ (bestenvironmental products).

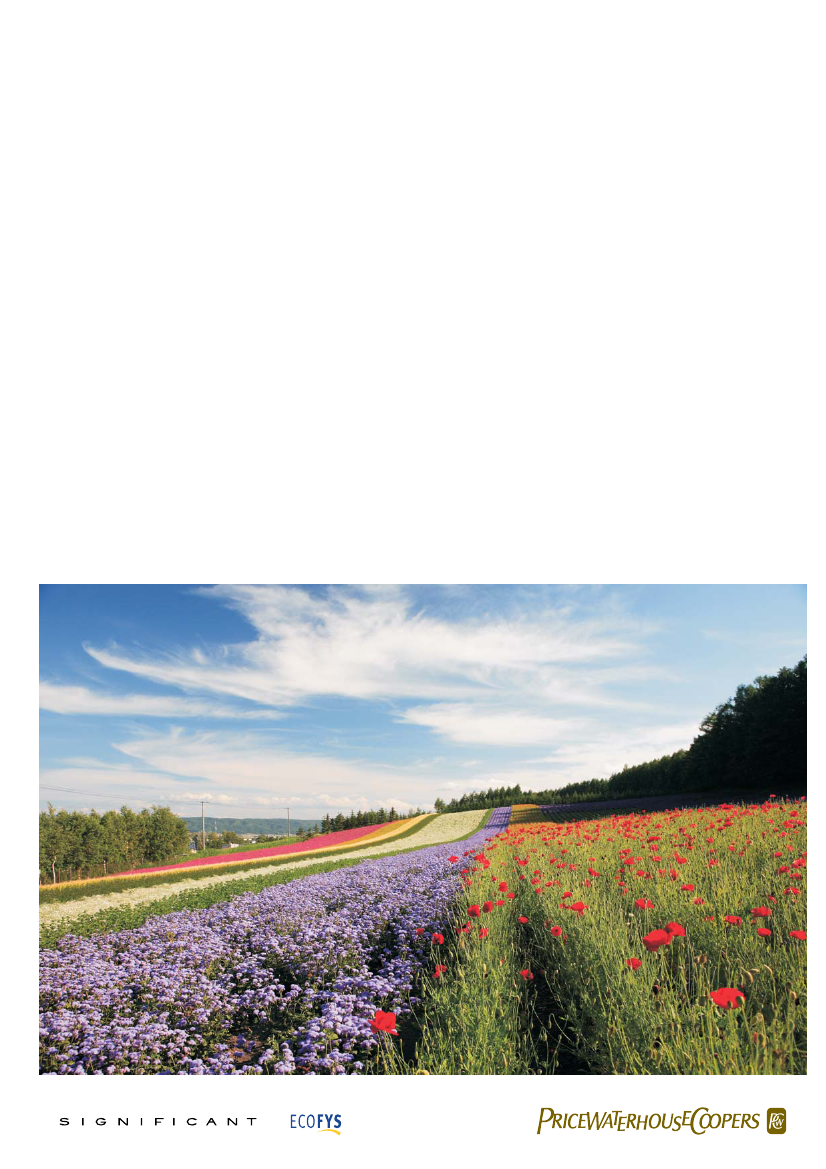

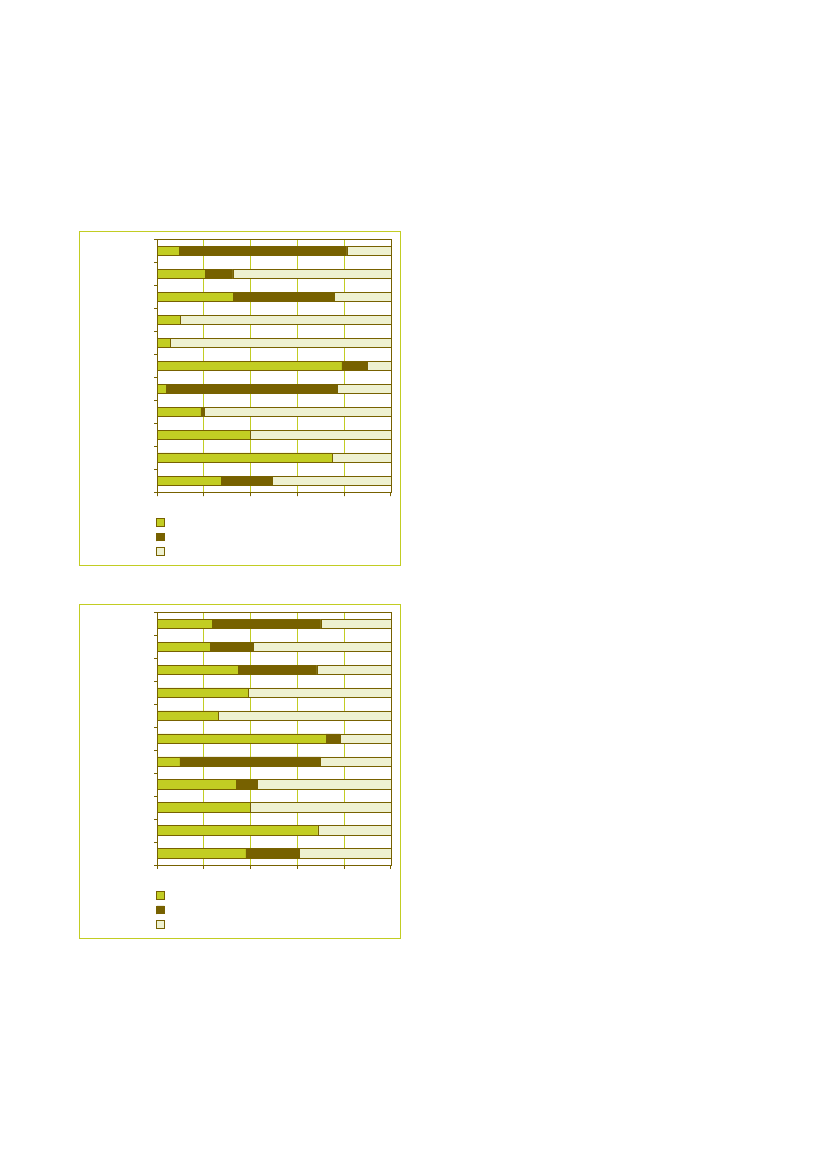

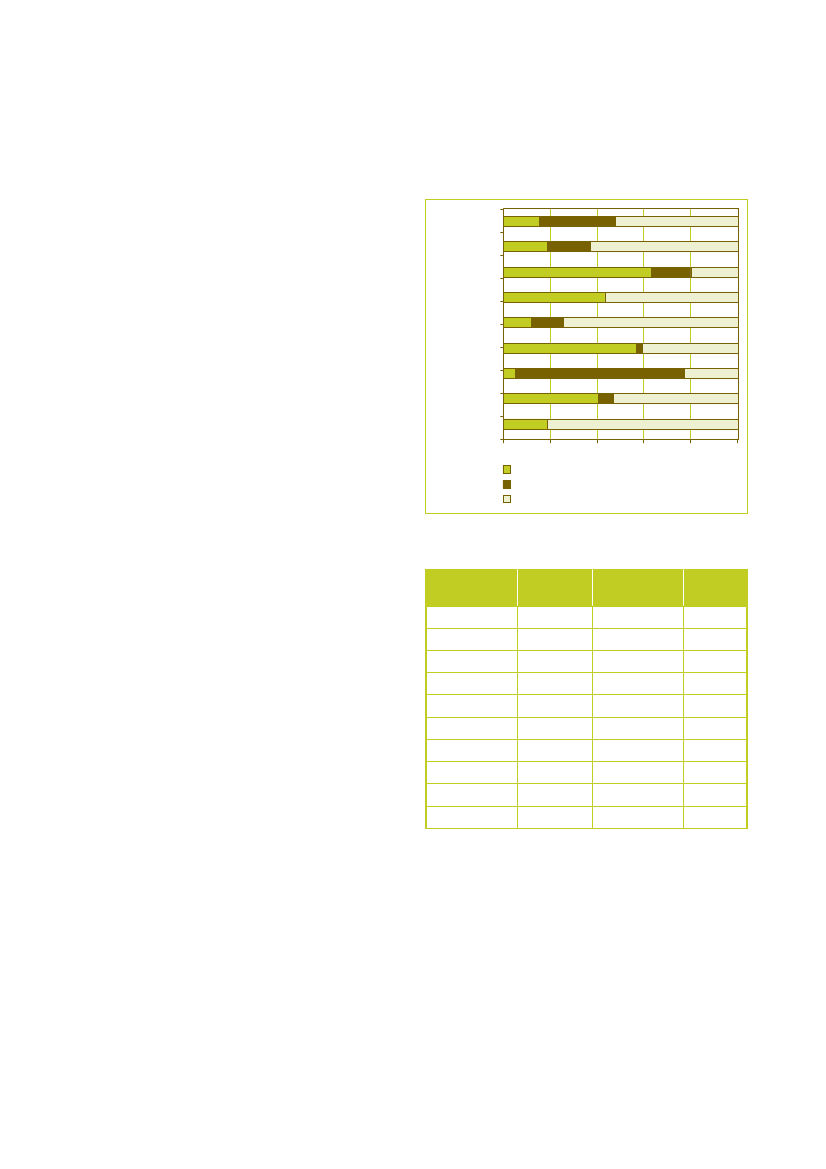

Current levels of GPPIn 2006/2007, efforts undertaken by the Green-7 havelead to an average overall level of 45% ‘green’ of the totalprocurement value (indicator 1) and 55% ‘green’ of thetotal number of contracts (indicator 2). On indicator 1 theUK is the best performing country, scoring a percentageof 74% on GPP, while the Netherlands scores lowest with26%. On indicator 2 Austria performs best with 62% andGermany comes last in line with 46%. Differences inpercentages between the indicators can be explained bythe fact that within indicator 1 a high value contract is ofgreater weight than a low value contract.

Objective and scopeThe main objective of this study is to monitor the currentlevel of GPP in the seven best performing Member Statesby developing and implementing methodologies for:1 Measuring quantitative levels of GPP (numbers andvalue of “green” contracts as compared to overallnumber and value of public procurement contracts)2 Measuring the CO2and financial impact of GPP3 Monitoring GPP in the Member StatesThis report presents the levels and impact of GPPmeasured in Austria, Denmark, Finland, Germany, The

Collection of statistical information on Green Public Procurement in the EU

5

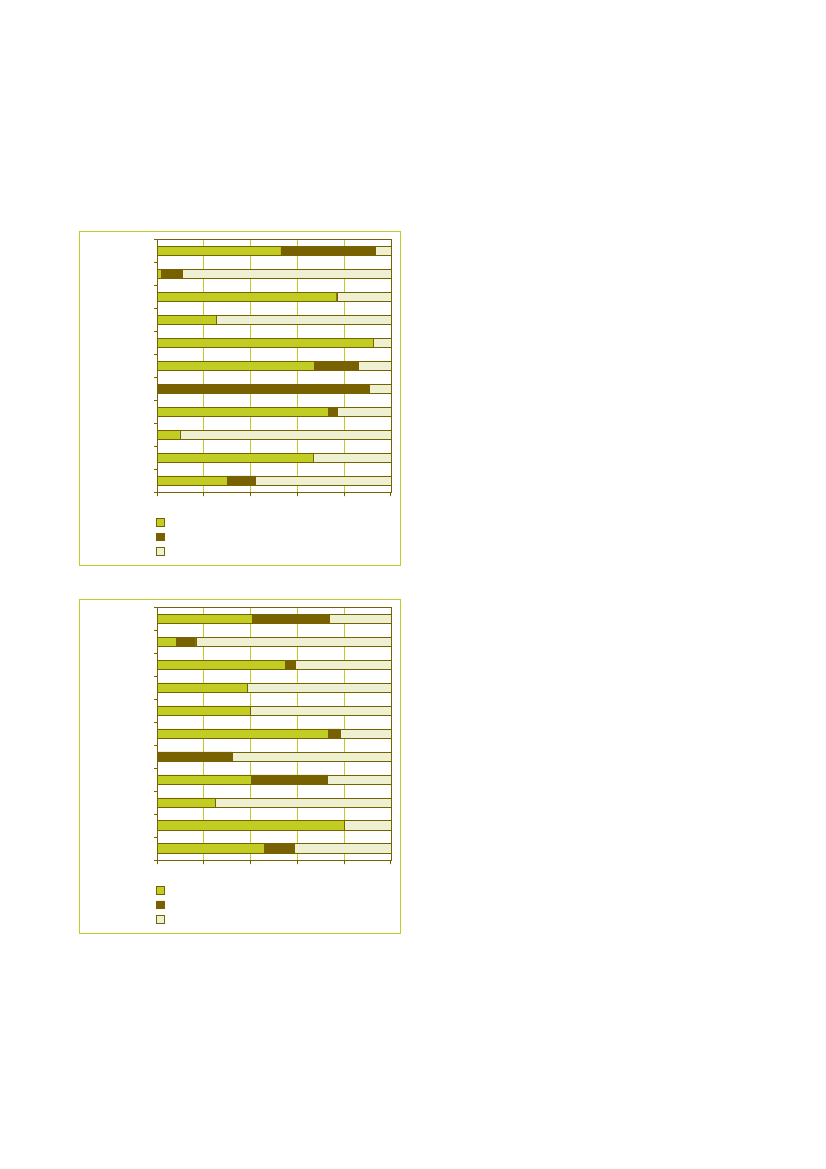

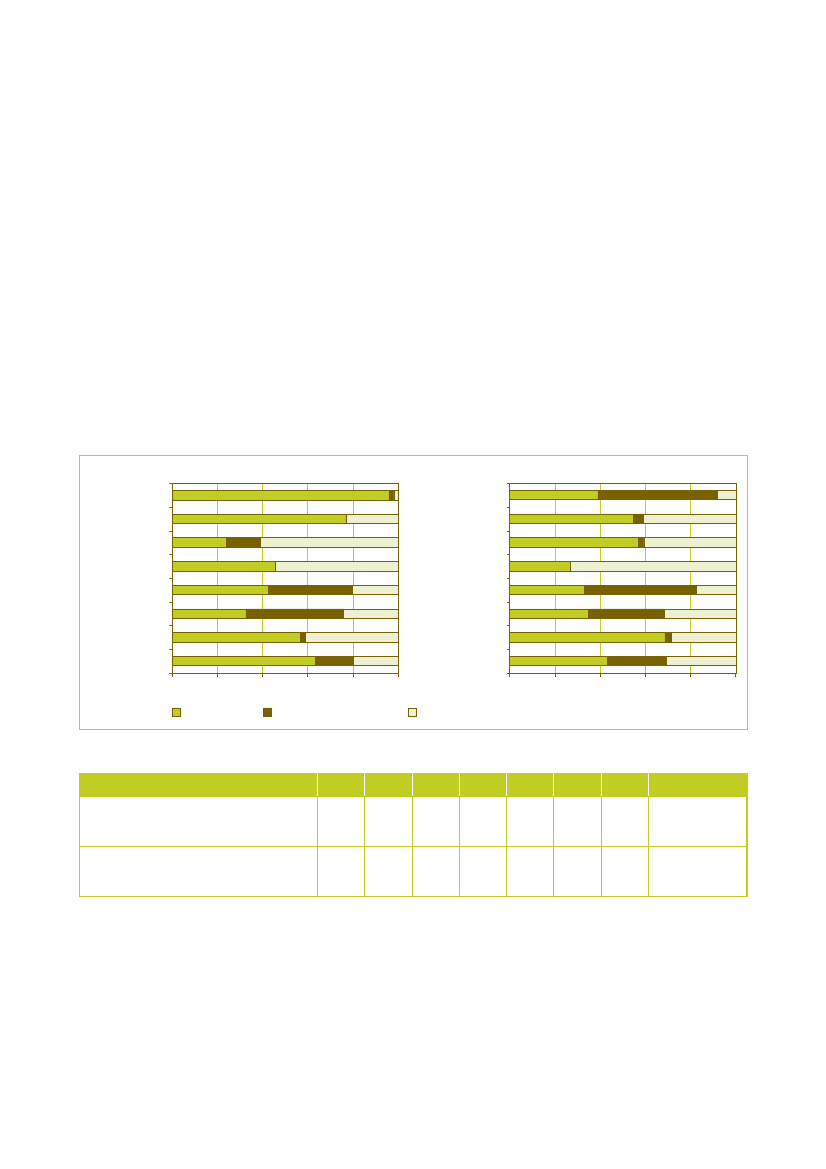

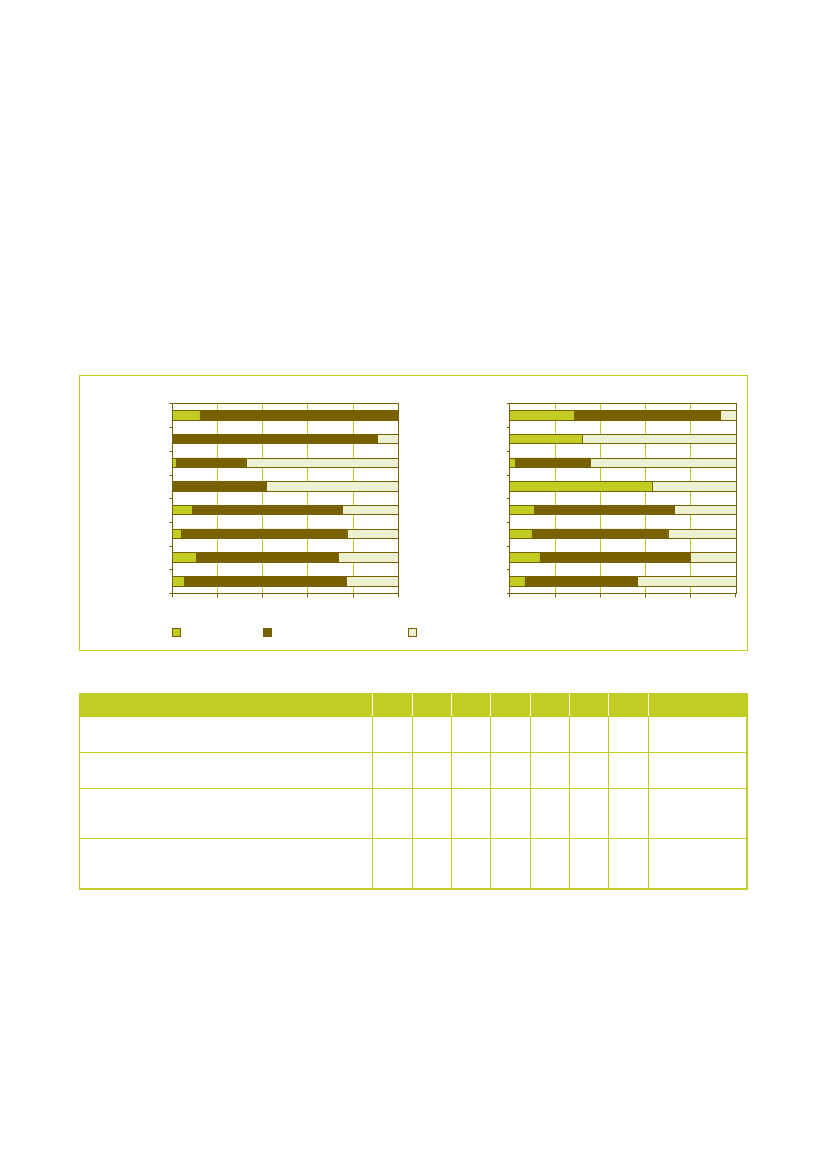

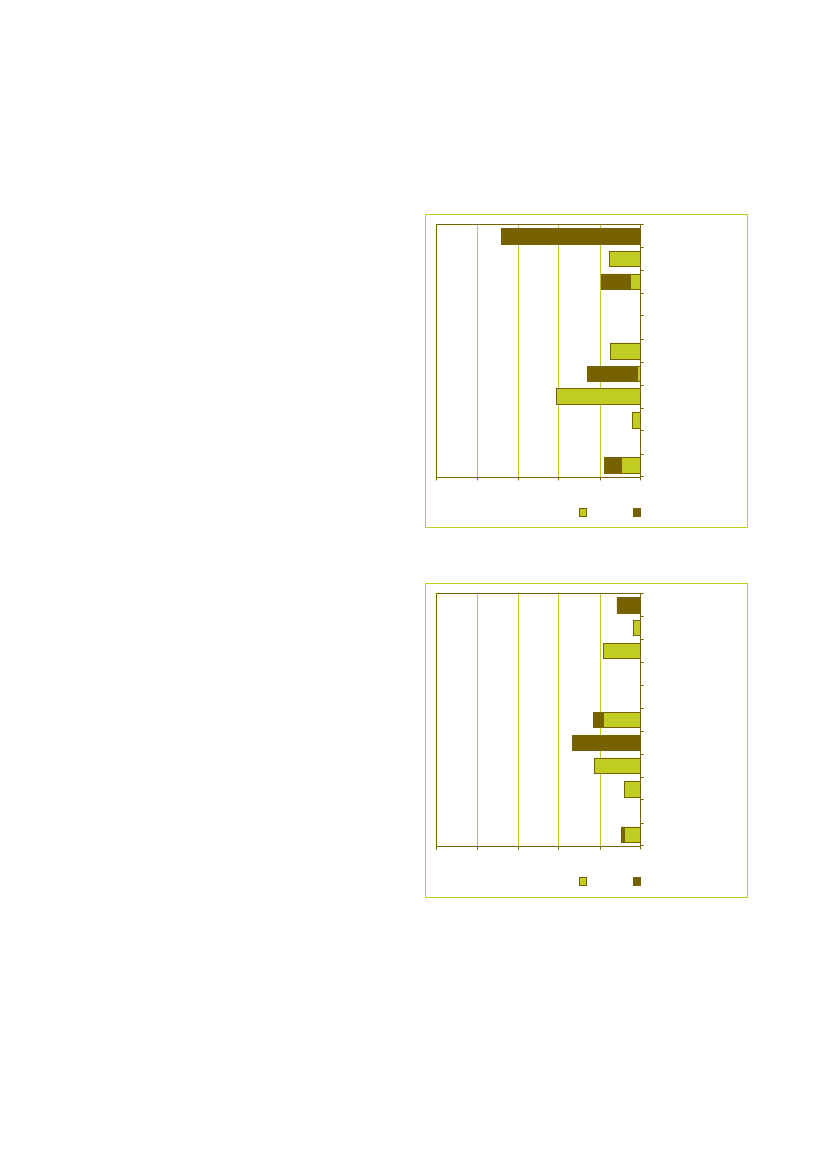

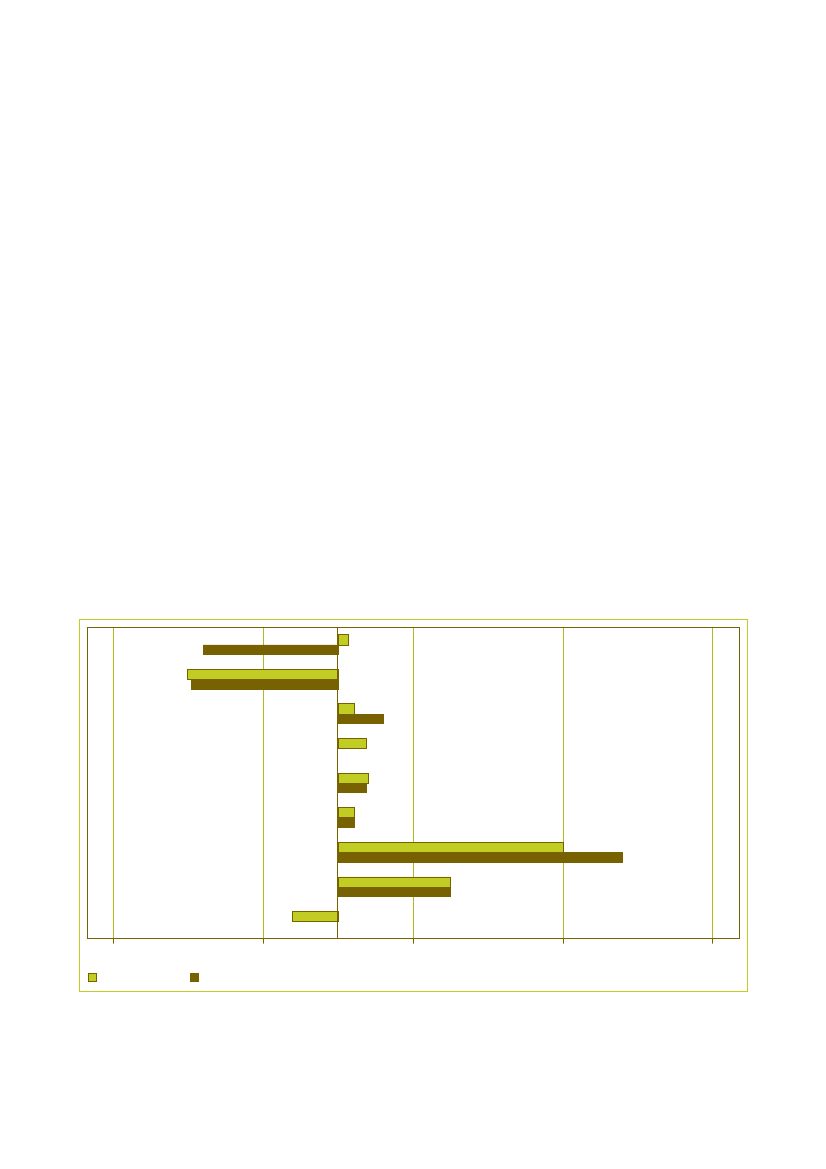

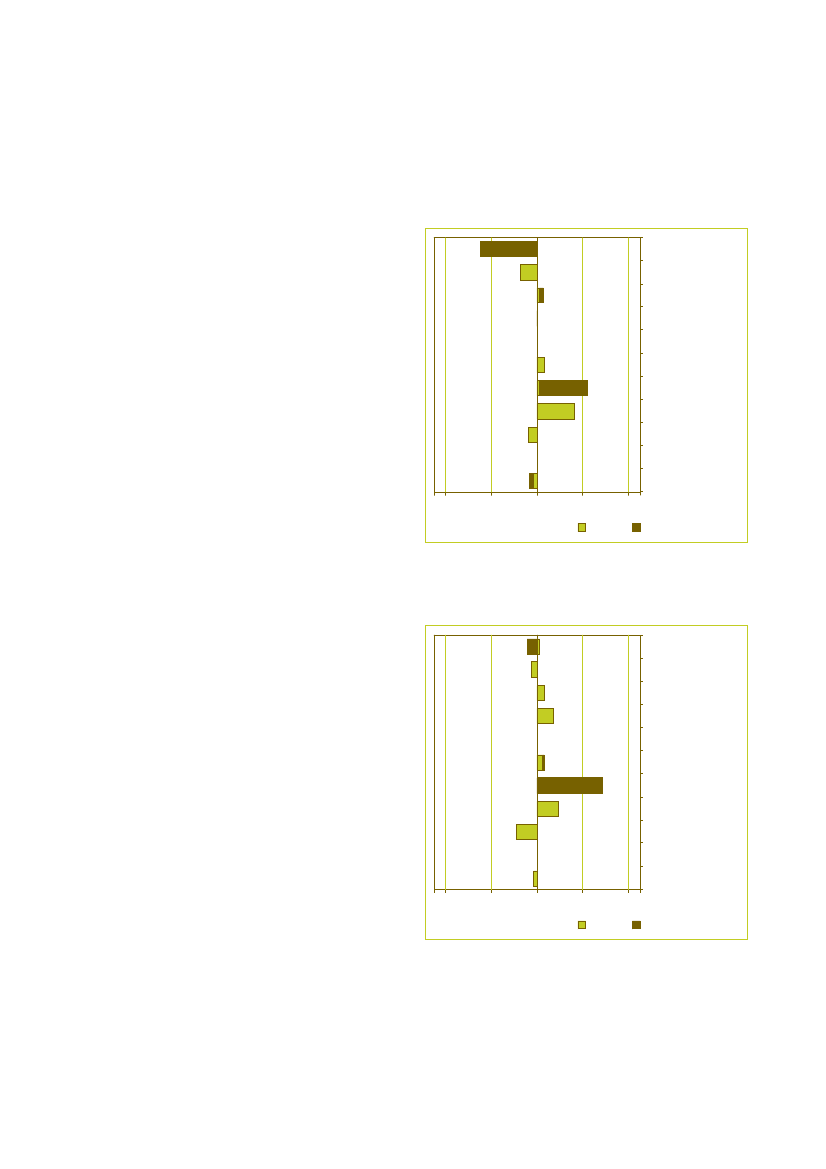

Figure 1: Overall scores on indicator 1United KingdomAustriaSwedenFinlandDenmarkGermany

Figure 3: Scores on indicator 1 per product group. Thefigures represent averages of the seven countries underscope.CleaningConstructionElectricityCateringGardening

NetherlandsGreen-7 average0%20%40%60%80% 100%

Office ITPaperClothingTransportFurniture

Core greenComprehensive greenNon green

Figure 2: Overall scores on indicator 2AustriaSwedenUnited KingdomDenmarkNetherlandsFinlandGermanyGreen-7 average0%20%40%60%80% 100%

0%

20%

40%

60%

80% 100%

Core greenComprehensive greenNon green

Figure 4: Scores on indicator 2 per product group. Thefigures represent averages of the seven countries underscopeCleaningConstructionElectricityCateringGardeningOffice ITPaper

Core greenComprehensive greenNon green

Within most countries a wide difference is shown on thelevel of GPP between the ten product groups. Overallelectricity, office IT and furniture attain the highest scoresin 2006/2007; construction, gardening and transport thelowest. Within product groups cleaning and paper, thelevels of compliance with comprehensive green criteriaare highest among all product groups, as can be seenfrom the figures 3 and 4.

ClothingTransportFurniture0%20%40%60%80% 100%

Core greenComprehensive greenNon green

6

PricewaterhouseCoopers

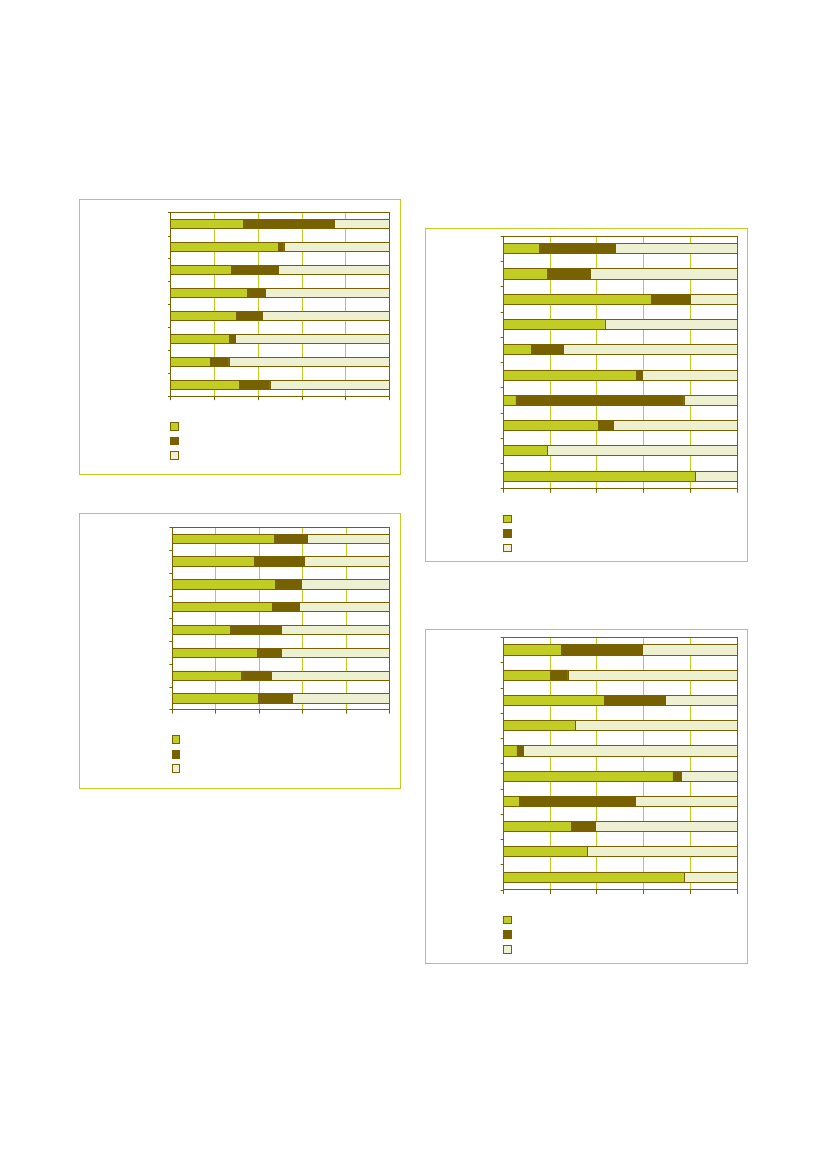

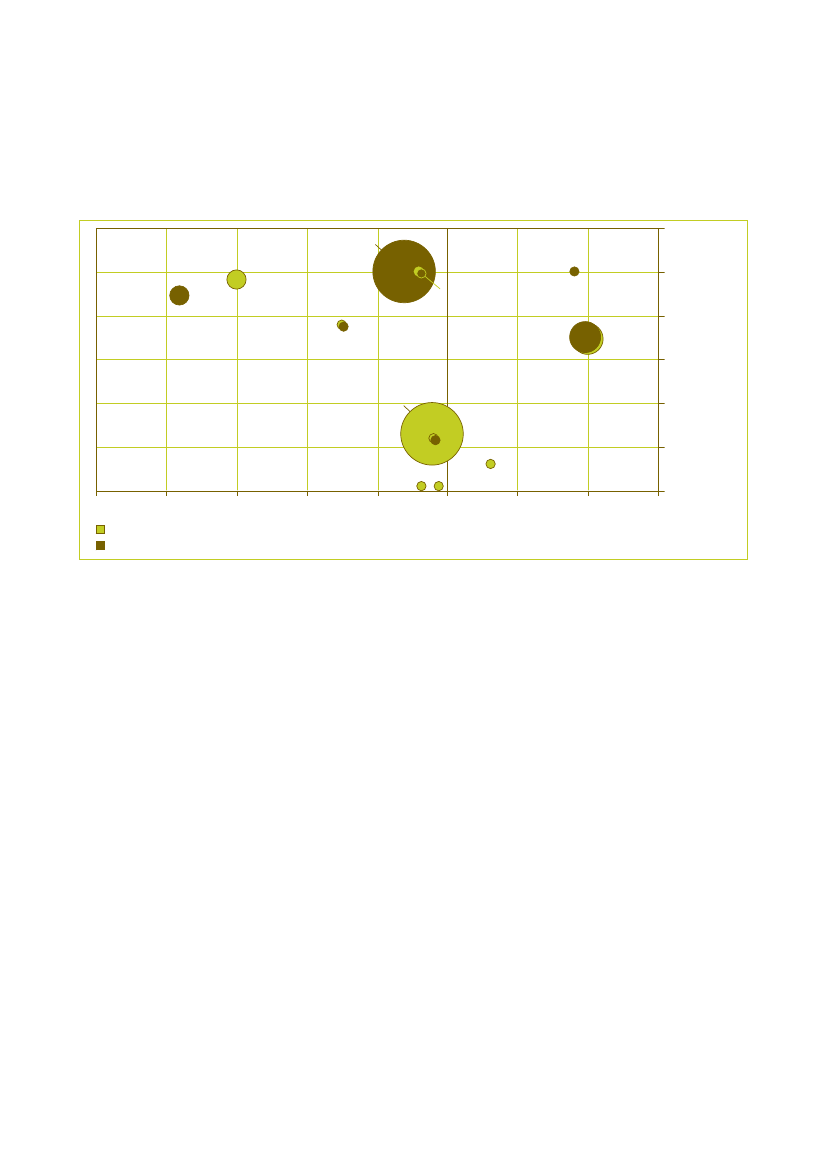

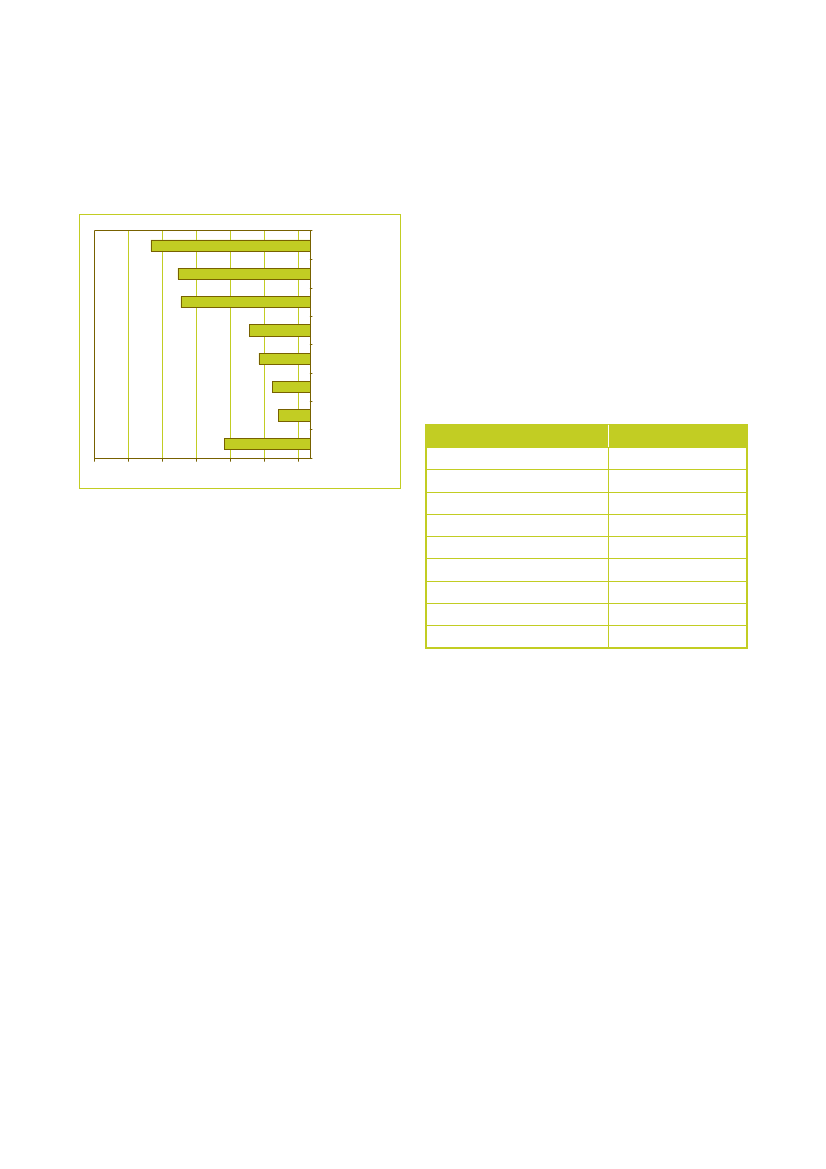

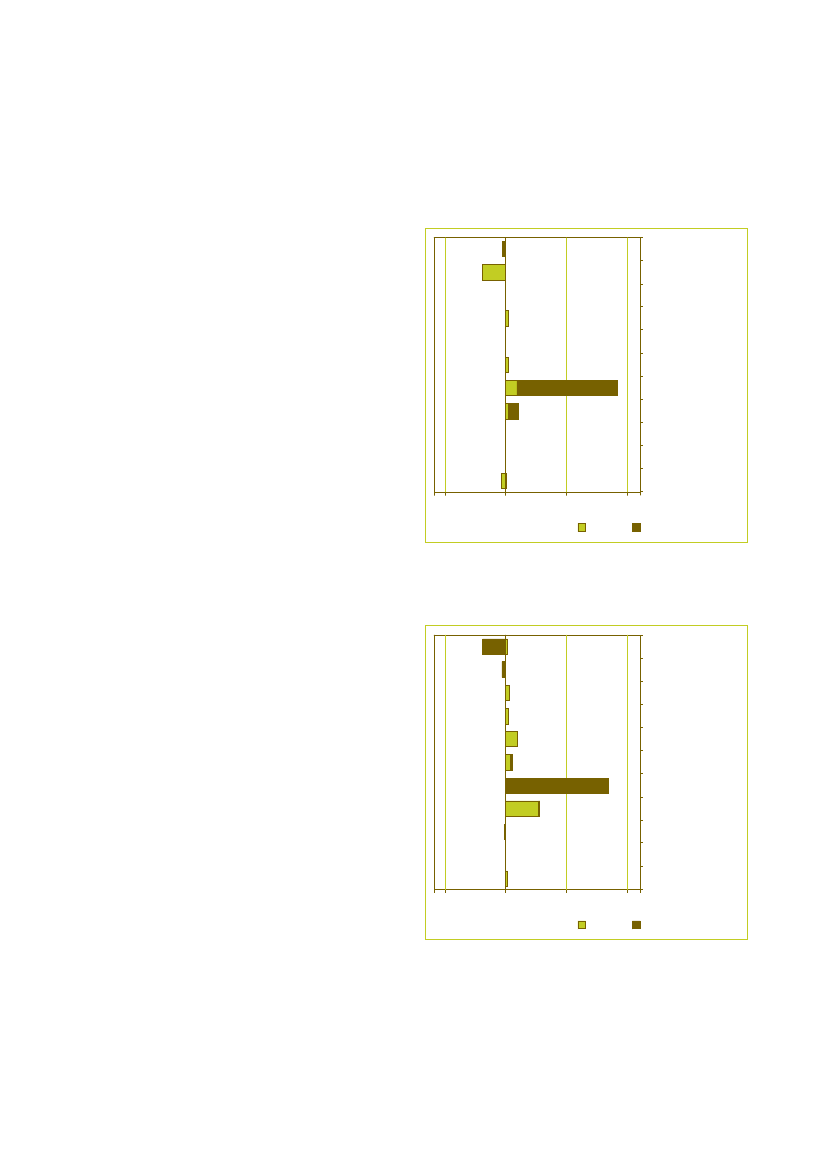

CO2benefits through GPPIt can be concluded that GPP contributes to an averagereduction of CO2emissions of 25% in 2006/2007 whenpurchasing green for the ten product groups subject tothis study. This means that public purchasers have thepossibility to substantially reduce CO2emissions throughGPP. The average CO2emissions impact in 2006/2007varies from -9% in Germany to -47% in the Netherlands,depending on the country-specific levels of GPP perproduct group. Our study shows that for most productgroups, GPP results in a reduction of CO2emissions;construction, gardening, paper and textiles attaining thehighest reduction percentages.Concerning the CO2impact of GPP, the reader shouldnote that the above mentioned figures should beregarded as best estimates, since we have not performedfull Life Cycle Analyses (LCA) in this study. A subsequentstudy could include an LCA for every product group, aswell as an analysis of CO2equivalents. Further, otherenvironmental indicators besides CO2could be studied,such as generation of waste, air pollution or ecotoxicity.Figure 5: CO2impact of GPP per country. Negative numbersimply reductions in CO2emissions

a Life Cycle Costing (LCC) approach in calculating thefinancial impact of GPP, the outcome is that the averagefinancial impact of GPP within the Green-7 is -1% in2006/2007. This means that, although the use ofenvironmental criteria in procurement procedures can leadto higher direct purchasing costs, it can result in anaverage decrease of overall costs for public organisationsof around 1%. The reason behind this is that higherpurchasing prices of green goods are compensated bylower operating costs. From our analysis we can concludethat there are mainly two product groups leading to costreductions through GPP: construction and transport.Figure 6: Financial impact of GPP. Negative numbers implycost reductions and positive numbers imply increases incosts.0,31%-0,17%-0,32%-0,48%-0,79%-1,24%DenmarkNetherlandsGermanyAustriaFinlandSwedenUnited Kingdom

The NetherlandsSwedenUnited KingdomFinlandDenmarkAustriaGermanyGreen-7 average0%-18%-15%-39%

-47%

-5,70%

-1,20%-38%

Green-7 average0%2%

-6%

-4%

-2%

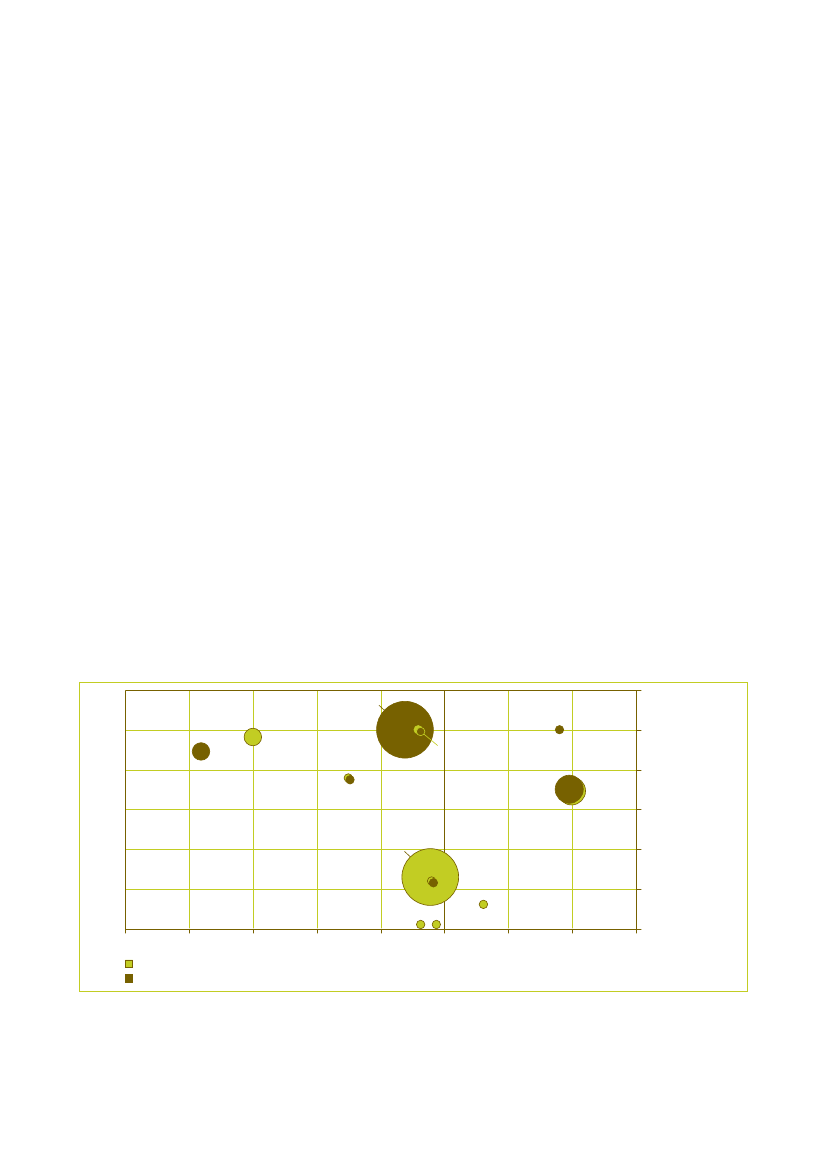

Combination of CO2impact and financial impact-11%-9%-25%-10% -20% -30% -40% -50% -60%

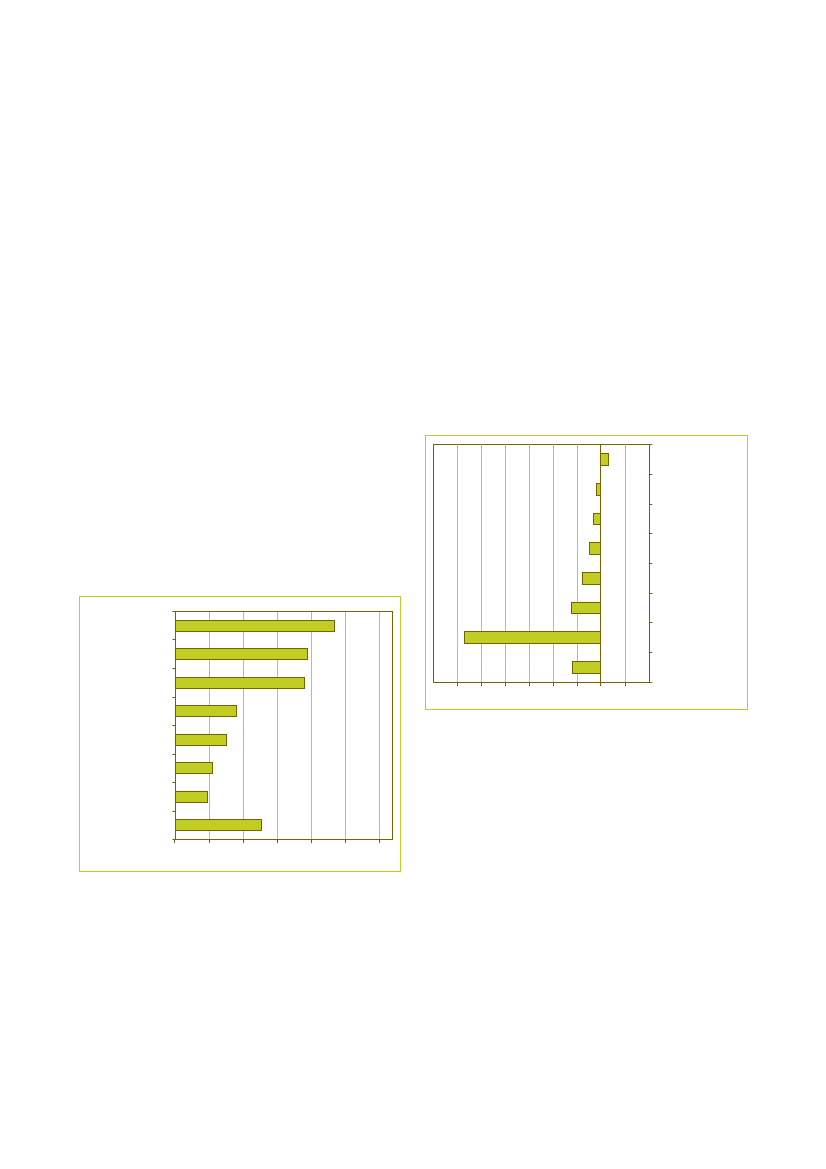

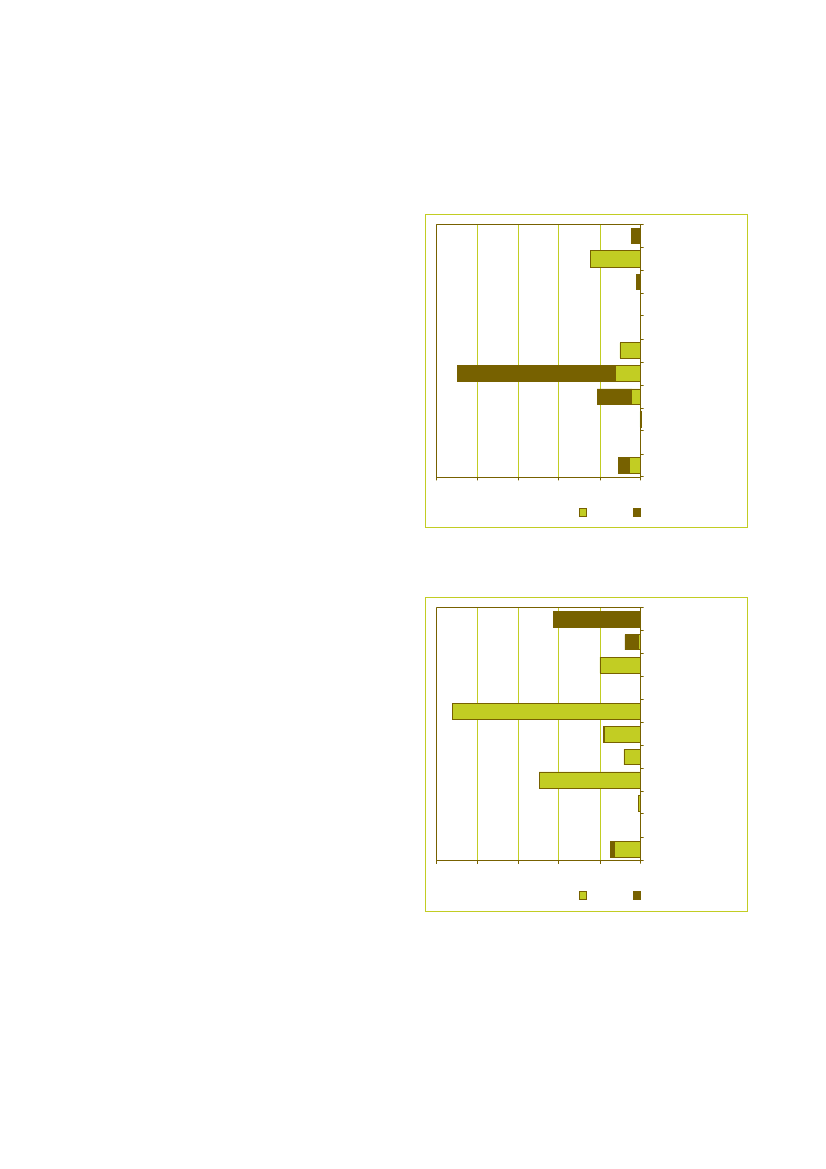

On a product group level, a comparison has been madebetween the CO2impact and financial impact. Since thefunctional unit used for determining both impacts is thesame, we can determine which product group leads toreductions in both CO2emissions and in costs, andwhether this is optimal for core or comprehensive levelsof GPP.The result is that only for transport, construction andcomprehensive green cleaning services, both the CO2impact and the financial impact are negative, as can beseen in figure 7. These are the product groups that publicpurchasers could focus on when implementing GPP.

Financial benefits through GPPIn contrast to common perception, this study shows thatGPP can also lead to decreases in costs for thepurchasing organisation instead of increases. When using

Collection of statistical information on Green Public Procurement in the EU

7

Figure 7: CO2impact and financial impact of GPP per functional unit. Negative numbers imply lower CO2emissions or lowercosts and positive numbers imply higher costs.

electricitycleaningpapergardeningpaperclothingconstruction

-120%

-100%

-80%

-60%

electricityoffice IT

-40%

-20%transportcatering25%20%15%10%5%cleaning0%-5%-10%0%-15%

Core greenComprehensive green

financial impact of GPP per functional unit

However, when also taking into account the product groupthat have the relatively higher CO2emissions (displayed bythe size of the bubbles), construction and electricity are theproduct groups to focus on.

ReflectionOverall, we have found that the use of the questionnaireand sampling has proven to be an adequate tool formeasuring the levels and impact of Green PublicProcurement in a Member State. With limited resourceswe have been able to reach a broad and representativesample population that has provided us with thenecessary data for this study. The methodologies can beapplied to assess statistically sound levels of GPP in allEuropean Members States. What is more, ourmethodology allows for a first estimation of the CO2impact and the financial impact of GPP.

8

PricewaterhouseCoopers

CO2impact of GPP per functional unit

1Introduction

1.1

Background

Green Public Procurement in the EU – Report onmethodologies’.This report includes the results of implementing thedeveloped methodology in the seven best performingMember States, the so-called Green-7, in the second halfof 2008. It presents the levels and impact of GPPmeasured in Austria, Denmark, Finland, Germany, TheNetherlands, Sweden and the United Kingdom. For areflection on the methodology for measuring GPP werefer the reader to the conclusions of this report inchapter 7.

For the achievement of sustainable development,changes in production and consumption patterns arecrucial. The European public service spendsapproximately 16% of European Union’s GNP (GrossNational Product) on purchasing goods such as furniture,office equipment and transport. By taking into accountenvironmental criteria in its procurement procedures, theEuropean Union (EU) can promote modes of productionthat are more environmentally friendly and stimulate thesupply of ‘green’ goods and services on the market.Recognition for the potential of Green PublicProcurement (GPP) as an effective instrument forstimulating sustainable development has grown over thelast few years. In 2003 the European Commission (EC)recommended the Member States to adopt nationalaction plans on GPP before the end 2006. In the renewedSustainable Development Strategy adopted in 2006, theEU leaders have set forth a GPP target, stating that, bythe year 2008, the average level of GPP should be at thecurrent (=2006) level of GPP in the best performingMember States.This target has been made more specific in theCommission’s Communication on public procurement fora better environment adopted on 16 July 2008(COM(2008)400), in which the Commission proposes a 50% target for each Member State to be reached as from2010. This target is linked to a series of priority sectorsand a process to facilitate the implementation of GPP ona European level, including the use of a common set ofgreen criteria and increased information on the benefitsand life cycle costs of environmental friendly products. InSeptember 2008, the European Council welcomed the50% target and called upon the Commission to develop apractical evaluation methodology to measure progress on1GPP made by 2010 and thereafter.This study by PricewaterhouseCoopers, Significant andEcofys aims to contribute to these developments. Amethodology for collecting the statistical data andmonitoring the level of GPP in each Member States wasdeveloped during the first half of 2008. A detaileddescription of this methodology can be found in theseparate report ‘Collection of statistical information on

1.2

Objective and scope

1.2.1ObjectiveThe main objective of this study is to measure the currentlevel of GPP in the seven best performing Member Statesby implementing the developed methodologies.These methodologies include:1 A methodology for measuring quantitative levels ofGPP (numbers and value of “green” contracts ascompared to overall number and value of publicprocurement contracts)2 A methodology for measuring the CO� and financialimpact of GPP3 A methodology for monitoring GPP in the MemberStatesThe monitor has been implemented in a broad range ofpublic and semi-public, central and non-central (i.e.regional and local) institutions in the seven participatingMember States. A detailed overview of the type of publicinstitutions included in this study can be found in theseparate report on methodologies - section 4.1.1.2.2Selected product groupsThe variety of products procured by European publicinstitutions is broad. Products consumed, used andinvested in by a public institution are subject to publicprocurement. This can range from paper to a computer,from cars used by civil servants to the purchase of publicinfrastructure. For measuring the level of GPP a selectionwas made of ten product groups frequently procured bypublic institutions. The product groups are the same asthe product groups for which a product sheet in the GPP2Training Toolkit has been developed. Secondly for eachproduct group a representative product type was

12

Council Conclusions on public procurement for a better environment. Council meeting, Brussels, 25 September 2008For the GPP training toolkit please go to http://ec.europa.eu/environment/gpp/toolkit_en.htm

Collection of statistical information on Green Public Procurement in the EU

11

identified. The selection procedure of these ten productgroups and types is described in the separate report onmethodologies - section 1.3.1.Table 1.1: Selected product groups with related producttypesProduct group1Cleaning products &servicesConstructionElectricityCatering & FoodGardeningOffice IT EquipmentPaperTextilesTransportFurnitureProduct typeCleaning services(including cleaningproducts)New buildings & officesElectricityCatering services(including food)Gardening services andmachineryComputers (desktops &laptops) and monitorsCopying & graphic paperClothingPassenger cars and lightduty vehiclesOffice furniture

Definition of GPP3:“Green Public Procurement (GPP) is a processwhereby public and semi-public authorities meet theirneeds for goods, services, works and utilities byseeking and choosing outcomes and solutions thathave a reduced impact on the environment throughouttheir whole life-cycle, as compared to comparableproducts/solutions. A procurement procedure will beconsidered as ‘green’ only if it has led to the purchaseof a substantively ‘greener’ product and only if theenvironmental characteristics of this product gobeyond what needs to be complied with on the basisof European or national environmental legislation.”

2345678910

1.3

Methodologies for measuring GPP

This definition focuses on the process of greenprocurement and defines a green product as a productwith specific environmental characteristics. In order togive procurement officers more guidance in identifyinggreen products, a practical GPP Training Toolkit wasdeveloped by the European Commission. This toolkitdescribes in detail which product characteristics define aproduct as green. These ‘green criteria’ are linked to thekey environmental impacts of a product and are dividedinto ‘core green’ (addressing the most significantenvironmental impacts and/or easy to verify) and‘comprehensive green’ (best environmental productswhich may require more efforts to procure in terms ofverification).It has not been considered appropriate to examinecompliance with all training toolkit criteria at this stage,considering the fact that the training toolkit was not yetpublicly available at the time of the launching andconclusion of the contracts subject to the monitoringexercise. However, in the future, monitoring will be basedon compliance with the core criteria of the training toolkit.In table 2 we give an overview of the selected productgroups and green criteria which have been applied in thisstudy.

1.3.1Defining GPPFor measuring the level of green in public procurementpractices, a clear and measurable definition of GreenPublic Procurement is needed. The definition of GPP asformulated by the European Commission is as follows:

3

Collection of statistical information on Green Public Procurement in the EU. Invitation to tender, May 2007. Reference ENV.G.2./SER/2007/0038

12

PricewaterhouseCoopers

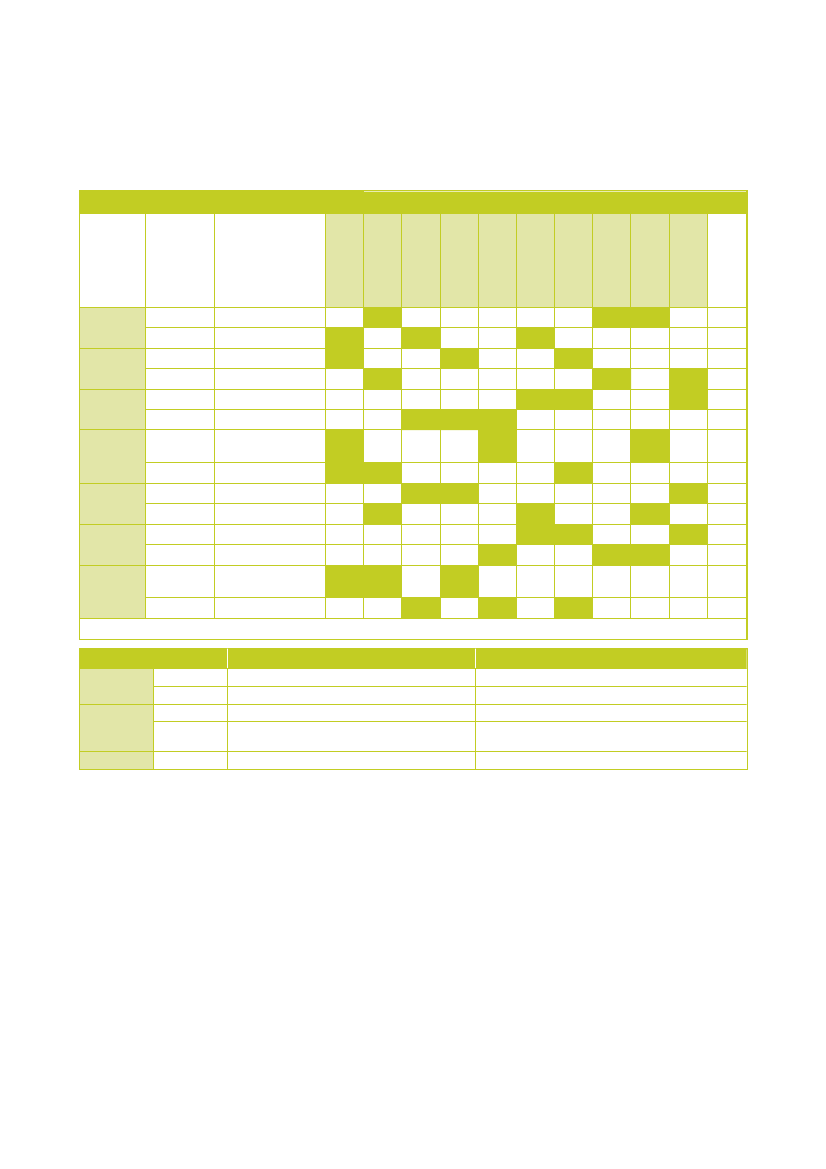

Table 1.2: Selected product groups and green criteria (core &comprehensive)Product group1Cleaning products& servicesProductCleaning services(including cleaningproducts)New buildings &officesCore criterial

Comprehensive criteriall

Use of cleaning products without hazardoussubstances

Training of employeesUse of reusable microfibercloths and/or dry-cleaningtechniquesUse of localized renewableenergy sources

2

Construction

llll

Consideration of energy-saving measures indesign and usage phase of buildingWater-saving technologies in kitchen andsanitary facilitiesUse of materials without hazardoussubstancesUse of timber from legal sources50% or higher electricity from renewableenergy sourcesorganic production of food productsUse of seasonal fruit, vegetables and fishFuel type use of gardening machinesUse of soil improvers without peat andsewage sludgeEnergy star standardsAccessibility and changeability of memory,hard disks and/or CD/DVD drivesProduction from recovered paper fibresUse of ECF/TCF paperPulp production from sustainably managedforests for paper based on virgin fibresÖko-Tex Standard 100Maximum CO2-emissions per vehicle segmentEuro 5 standardUse of wood from legally sourced timber andsustainably managed forests

l

345

ElectricityCatering & foodGardening

ElectricityCatering services(including food)Gardening servicesand machinery

l

l

100% electricity fromrenewable energy sources

llll

*

6

Office IT equipment Computers (desktops& laptops) andmonitorsPaperCopying & graphicpaper

ll

*

7

lll

*

8910

TextilesTransportFurniture

ClothingPassenger cars andlight duty vehiclesOffice furniture

llll

*

* No comprehensive criteria were included in the questionnaire, however the following labels and standards filled in by the respondentshave been classified as comprehensive: EU Ecolabel (all), Blaue Engel and Nordic Swan (Office IT equipment and Paper), TCO 05(Office IT equipment).

Collection of statistical information on Green Public Procurement in the EU

13

1.3.2Measuring the level of GPPThe level of Green Public Procurement is measuredbased on two indicators:ll

Indicator 1: % GPP of total public procurement interms of monetary valueIndicator 2: % GPP of total public procurement interms of the # of contracts

sample (for a product group). To have an average forGPP per country, the percentages per product grouphave been combined into one weighted percentage ofcomprehensive / core level contracts covering all tenproduct groups. When doing so, the weights awarded tothe different product groups have been based on theproportion of each product group within the total amountof purchasing (larger product groups outweighing thesmaller ones).Indicator 2 has been calculated by dividing the totalnumber of comprehensive and core level contracts in thesample by the total number of contracts in the sample(for a product group). Comparable to indicator 1, thepercentages per product group have been combined intoone weighted percentage for all ten product groups. Inorder to do so, the weights of the different productgroups are based on how many times a product grouphas been filled in by the sample population per country.Results of this study on indicators 1 and 2 are presentedin chapter 3 and 4 of this report. Chapter 3 includescomparisons between countries, chapter 4 comparisonsbetween product groups at country level.For a more detailed description of the definitions andmethods for calculating indicator 1 and 2 we refer to theseparate report on methodologies – chapter 2.1.3.3Measuring the impact of GPP

In our calculations for both indicators the distinctionbetween core green and comprehensive green has beentaken into account.Indicator 1 indicates the percentage of the amount ofmoney spent on green public procurement, compared tothe total amount spent on public procurement. Indicator 2indicates the percentage of the number of greencontracts, compared to the total annual number ofcontracts.The data used for the calculation of indicator 1 and 2 wasprovided by the contracting authorities that participatedin our study. This data was collected through an onlinequestionnaire. Information was asked on the total annualprocurement value (€) and the green criteria used in themost recent contract within each product group. Theyears of reference are 2006 and 2007. This means thatthe respondents have been asked to fill in thequestionnaire for the most recent purchasing contractconcluded in 2006/2007. The contract informationreceived for each product group represents all purchaseswithin that product group over the last two years. Thatmeans that if the most recent contract is consideredgreen, then 100% of the total annual value is consideredgreen.The resulting total percentage level of green per productgroup per country represents the percentage level ofgreen public procurement for the entire public sector inthat country. We have applied a sampling methodallowing us to base ourselves on the results from oursample population for calculating the levels of GPP forthe whole population (see also section 1.4.1). The resultsfrom the sample population have been corrected so thatthe proportion of central and de-central organisationsaligns with the actual proportions in the total population.Indicator 1 has been calculated by dividing the totalamount (€) of comprehensive and core level purchases inthe sample by the total amount (€) of purchases in the

Indicator 3: % CO2impact of GPPBecause of the current public awareness on climatechange, the correlation between CO2emissions fromhuman activity and global warming, and taking intoaccount the availability of data, indicator 3 focuses on theimpact of GPP on CO2emissions. Criteria are beingapplied that relate to reduced CO2emissions in aproducts’ life cycle. Indicator 3 is calculated bycomparing the CO2emissions of a green product withthose of a non-green product.Because of the complexity and resource intensity of thecalculations as well as the limited data available, themethod applied has several limitations which should bementioned beforehand:1. CO2equivalents are not included (i.e. we do notconvert emissions of other greenhouse gases such asmethane into CO2equivalents)2. Climate change is only one of the variousenvironmental impacts

14

PricewaterhouseCoopers

3. The study does not include a full Life Cycle Analysiswhich would allow to identify the most importantenvironmental impact based on a life cycleperspectiveOur analysis focuses on the production and/orconsumption phase which has the most CO2impact.From the GPP Training Toolkit, criteria have beenselected that allow for distinguishing between the CO2impact of a green and a non-green product. CO2relatedcriteria which make a distinction between core andcomprehensive levels of GPP were only available forelectricity, construction, cleaning services and paper.After having selected the criteria, non-green and greenproducts have been identified meeting those criteria, foreach product group. A so-called CO2ratio has beencalculated for each product as follows:a Selection of a functional unit for every product group2(e.g. number of computers or m floor cleaned);b Determination of CO2emissions per functional unit,both for the green and a non-green product withineach product group;c For those product groups of which the calculation of4the CO2emissions is partly based on energy use , wemake us of country-specific CO2emissions per kWhfor all countries under scope.The CO2ratio determines the CO2impact of GPP perfunctional unit of a product group. If we link this CO2impact per functional unit to the results of indicator 1, wecan determine for all countries the CO2impact of GPP in2006/2007. For more details on this calculation, we referto the separate report on methodologies. Results of thisstudy are presented in section 5.1 of this report. Wepresent comparisons between countries, as well ascomparisons between product groups at country level.Indicator 4: Financial impact of GPPThe financial impact of GPP is calculated by comparingthe costs of a green product with those of a non-greenproduct. Our analysis is based, as far as possible, on theconcept on Life Cycle Costs (LCC). This means that wedo not only take into account costs that result from thepurchase of a product or service, but also operationalcosts and costs for disposal. Thus, the financial analysisis performed for all stages of the life cycle that are relatedto the user of a product.

For each stage, we have determined so-called costratios, which are defined as the ratio of costs of a greenproduct as compared to the costs of a non-greenproduct. This is done both for core and comprehensivelevels of GPP. A cost ratio of 0.90 for a certain product ina certain stage of the life cycle means that a greenversion of this product leads to 10% lower costs at thisstage than the non-green version.When calculating cost ratios within the various stages ofthe life cycle of a product group, it becomes clear thatnot all stages account for the same percentage of thetotal cost for the user of a product. For example,operational costs of a computer during its 4-year life arelower than costs of purchasing. For this reason, we havedetermined the so-called costs structures for everyproduct group, in which we determine the percentagethat every element contributes to the total costs.The cost ratios for all relevant life cycles stagesdetermine, together with the cost structure, the financialimpact of GPP per functional unit of a product group. Ifwe link these results of our analysis to the results ofindicator 1, we can determine the actual financial impactof GPP in 2006/2007. For more details on this calculation,we refer to the separate report on methodologies. Theresults of this study are presented in section 5.2 of thisreport. We present comparisons between countries, aswell as comparisons between product groups at countrylevel.

1.41.4.1

Methodology for monitoring GPPSurveying and sampling methods

SurveyingThe instrument we used for collecting the data for thisstudy is an online questionnaire. The questionnaire wassent to a contact database including 2907 contractingauthorities in the seven participating Member States.These contacts were identified through (a) the personalnetwork of the research team within each of the sevenMember States; (b) the national purchasing associations;(c) GPP contact databases and (d) the Tender ElectronicDaily (TED) database.

4

These product groups are: construction (electricity use of a building), electricity, office IT equipment (electricity use of a computer or monitor, paper(electricity use during pulping process).

Collection of statistical information on Green Public Procurement in the EU

15

The questionnaire consisted of three sections A, B and C.Section A covered general questions on the respondentand his organisation. Section B included questionsconcerning the environmental policy, procurement policyand the implementation of green procurement in theorganisation. The answers to these qualitative questionsgive us information on the relationship between thebehaviour and the results of respondents. The mostvaluable insights for this study are presented in chapter 2of this report. Section C of the questionnaire containedquestions about the use of green criteria (based on theGPP training toolkit) within the most recent procurementcontract. In addition, section C contained questionsconcerning the total amount of money an organisationhas spent on a product group during the last fiscal year.The questionnaire was online from the 4th of June untilthe 31st of August 2008. During that time, response-increasing methods were applied to make sure asufficiently high response was achieved. Actions takenincluded:a) Clear communication to respondents.Announcements in relevant newsletters were placedand an announcement letter signed by the ministerresponsible for environmental affairs and/or the EChead of unit Environment and Industry. A projectwebsite was launched containing information and aFAQ list about this study.b) Professional help desk. Five days a week aprofessional helpdesk was available for questions andsupport in filling out the questionnaire.c) Reminders per email and telephone. One invitation andfour reminders were sent out per email. In total 1.360calling sessions were performed, 50 to 400 callingsessions per country. In countries where the responserate kept behind, respondents were stimulated extrathrough emails and relevant networks.VerificationIn order to verify the answers given in the questionnairewe selected 14 respondents, 2 per Member State, for averification interview by telephone. With the selection ofrespondents a balanced distribution of product groupsand type of institution was taken into account. In total 14interviews were performed, of which 2 central, 10 local, 1regional and 1 semi-governmental authority have beeninterviewed in the seven Member States. For an overviewof the outcomes we refer to Appendix G.SamplingThe sampling method used in this study aims to collectdata which is representative for the total population of

public institutions. This way, valid statements on the leveland impact of GPP can be made for the complete publicsector based on the data received from our samplepopulation. For this we determined the necessary grosssample size (number of questionnaires to be sent out) toreach the required net sample population (actual numberof respondents) based on:lActual number of public institutions in all countries.lEstimated response rates per country (based onexperiences with similar surveys).lA 20% precision level (a measure of the uncertainty ofthe estimated level of GPP that we find acceptable tomake statistical statements. We vary this precisionlevel in order to define an optimal, a base and apessimistic scenario.)lA confidence level of 95% (The level of uncertainty ischosen such that we can have a 95% confidence thatthe true level of GPP lies within the boundaries of theprecision level.)The base scenario with a 20% precision level has arequired total net sample size (# respondents) of 635.Apart from this an optimistic and pessimistic scenariowere sketched. In the optimistic scenario a total netsample size of 794 gives a precision level of 17%. Thepessimistic scenario has a total net sample size of 476and a precision level of 23%.As is shown in the separate report on methodologies, therequired net sample size differs per country, dependingon the total population size of that country. Thedifferences is a very small, even though there are greatdifference in the total population size. This is a result ofthe fact that from statistical theory, we found thatalthough there is a relation between the size of thepopulation and the required net sample size, theinfluence is not very high. For more explanation on thenumbers and definitions used in the sample size we referto the report on methodologies – chapter 4.Aiming at a 20% precision level, 2.907 contacts (thecalculated gross sample size) at public institutions wereidentified and received our questionnaire. Based on theactual response the precision levels per country werecalculated. This required a complex calculation takinginto account the spreading on central and non-centrallevel and was based on the actual respondents with atleast one contract in a product group in section C. For anoverview of the response rate numbers per productgroup per country we refer the reader to Appendix A.

16

PricewaterhouseCoopers

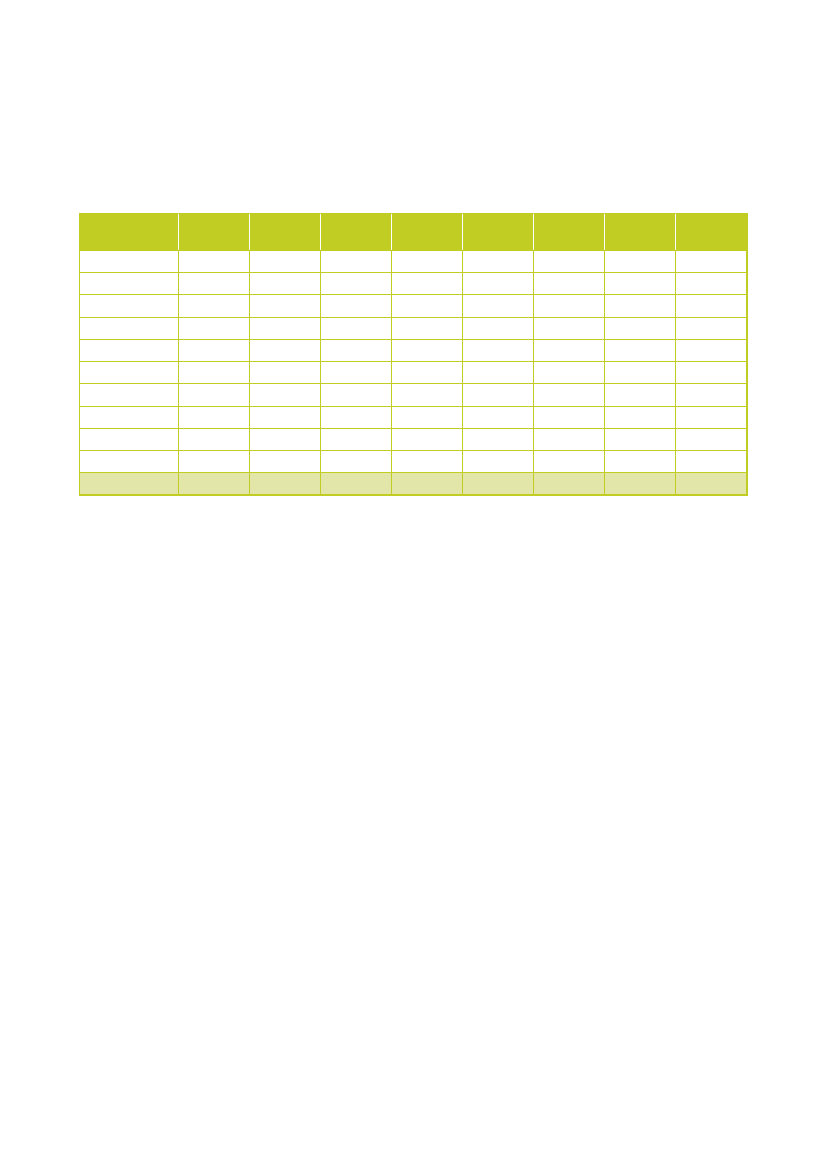

From the actual response, we have found that withachieved precision levels we can make statistically soundstatements on the level of GPP for all countries onindicator 2 and for three countries on indicator 1. For this,a maximum precision level of 20% has been taken intoaccount in order to make valid statement from astatistical point of view. On indicator 2, a very optimisticscenario was reached with precision levels lower (i.e.better) than 17% for all countries. On indicator 1,Denmark, The Netherlands and Sweden scored optimisticprecision levels of 17% or lower (i.e. better). Austria,Germany, Finland and UK however did not reach thepessimistic scenario with precision levels higher (i.e. notbetter than 23%). The differences in precision levelbetween these countries are explained by the number ofrespondents: Germany, Finland and UK achieved a lowerresponse rate than Denmark, The Netherlands andSweden. The precision levels for indicator 2 are betterthan indicator 1 because of the wider spreading of thedata on procurement values (indicator 1) than thespreading of data in number of contracts (indicator 2). Forthe exact precision levels per country (broken down forcore and comprehensive levels as well) we refer toAppendix B of this report.1.4.2Overall response ratesThe table below gives an overview of1) the number in sample: total of 2.907,

2) the number of respondents: the number ofrespondents that filled in section B of thequestionnaire as a minimum,3) the response rate: the percentage of responsescompared to the sample size,4) the number of organisations that respondentspurchase on behalf of: in each country there areseveral purchasing organisations that purchase onbehalf of other public institutions. These so-calledcentralized purchasing organisations have filled in thequestionnaire on behalf of more than one institution.

1.5

Contents of this report

This report provides an overview of the results of thecollection of data on Green Public Procurement in theseven participating Member States. In chapter 2 theresults of section B of the questionnaire (concerning thequalitative questions) are presented. They give us anindication of the level of implementation of GPP policy inthe participating organisations. Chapter 3 shows us themain results on the quantitative levels of Green PublicProcurement per country. Chapter 4 includes some moredetailed results per product group. Chapters 5 and 6present the results on the impact of Green PublicProcurement, respectively on CO2and financially. In thefinal chapter 7 overall conclusions are drawn on all resultspresented.

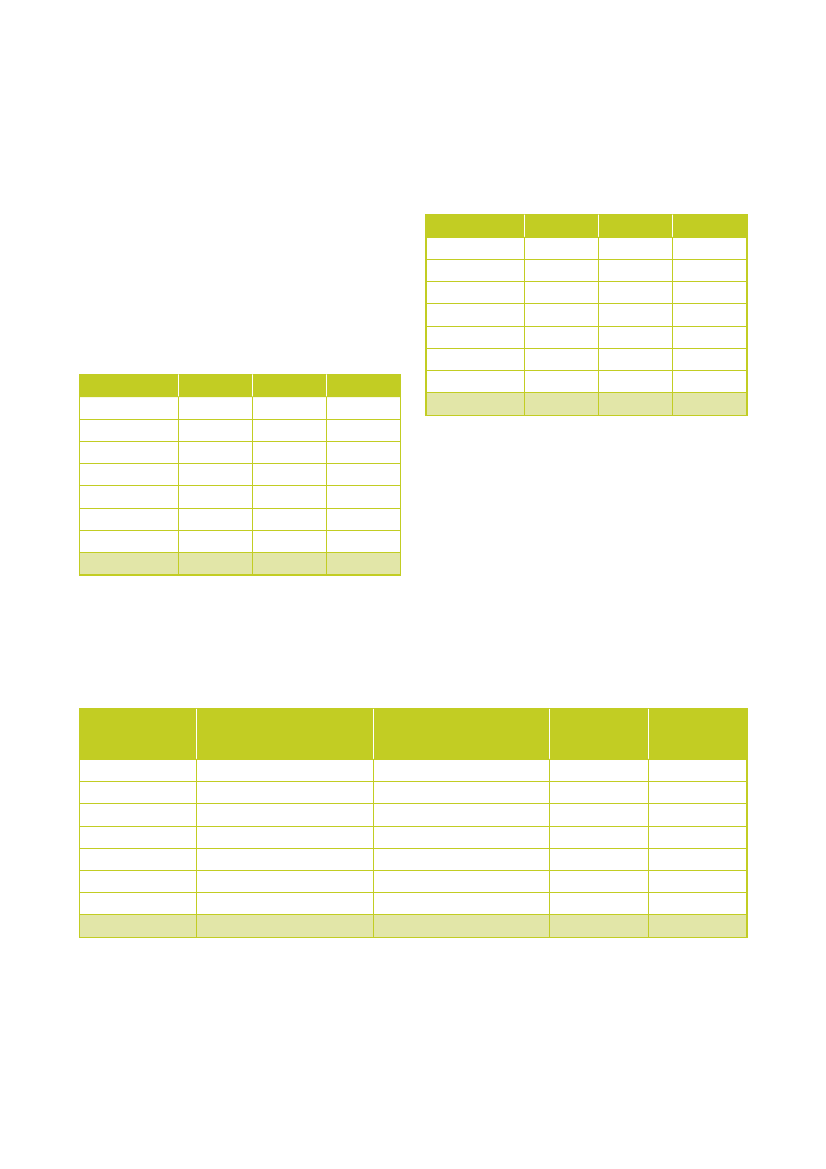

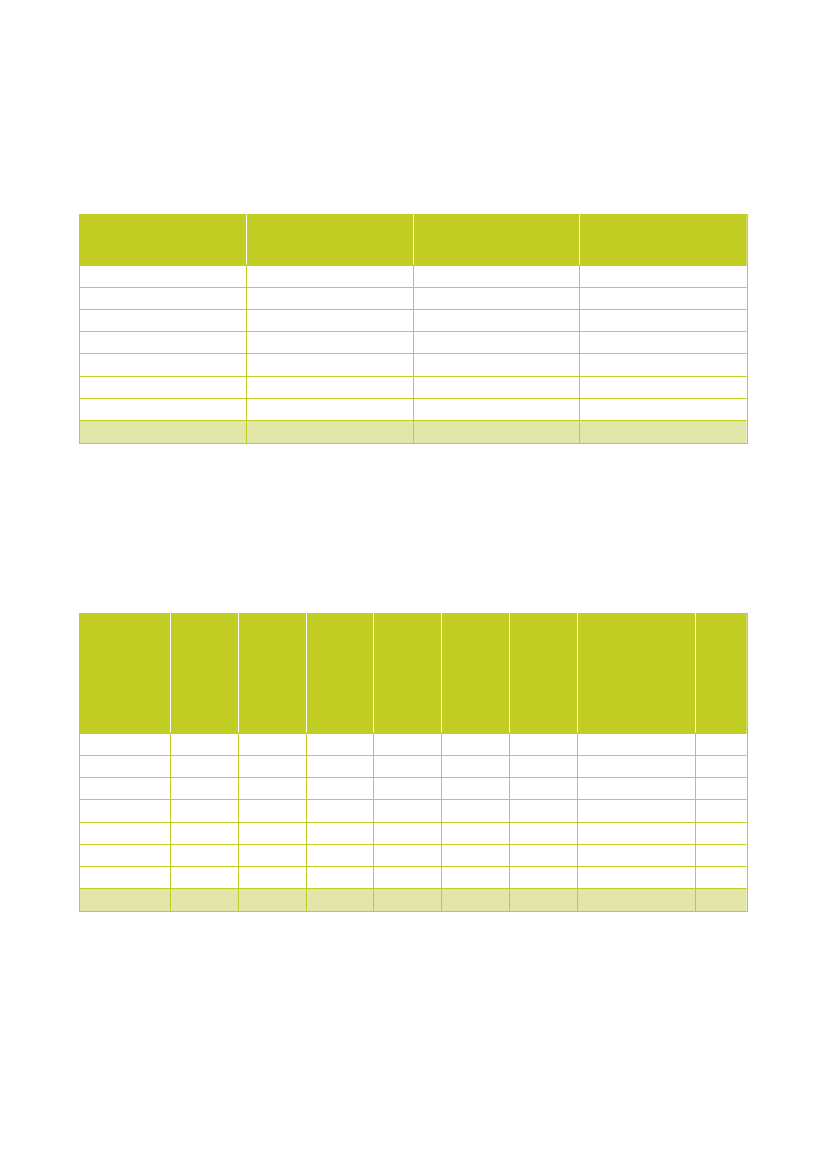

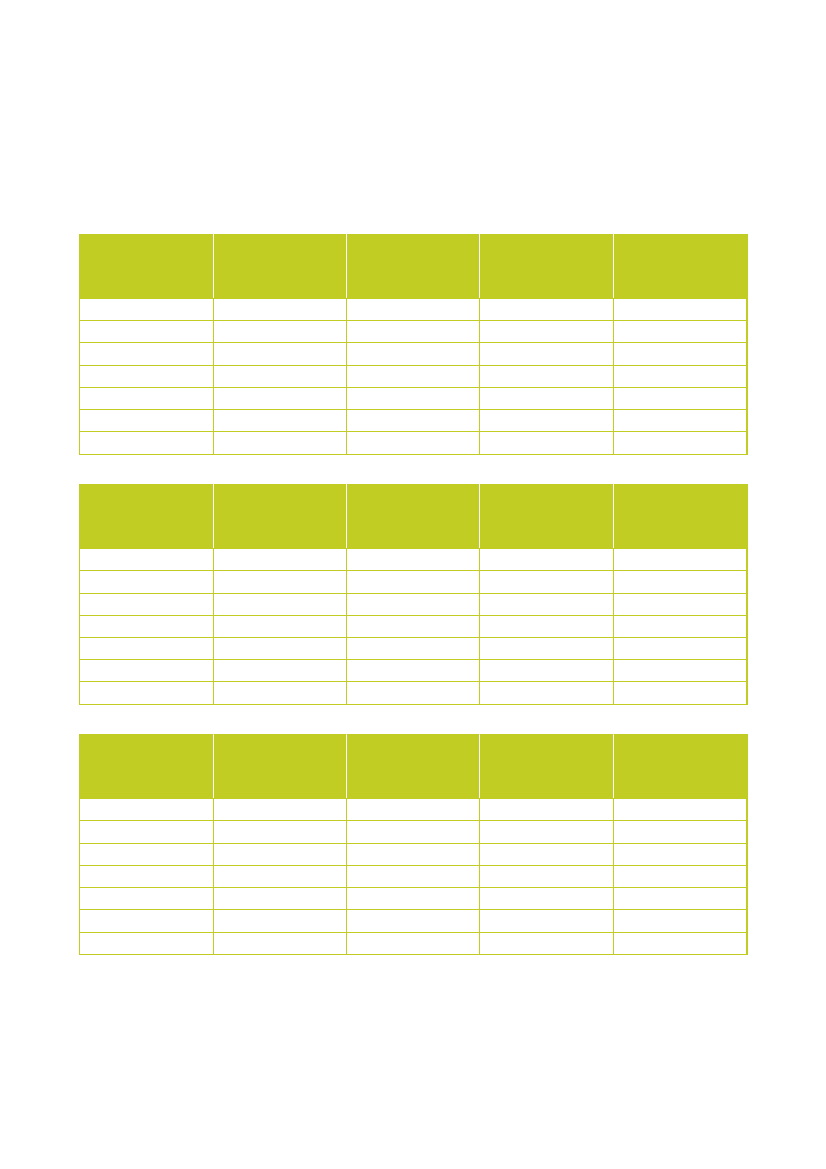

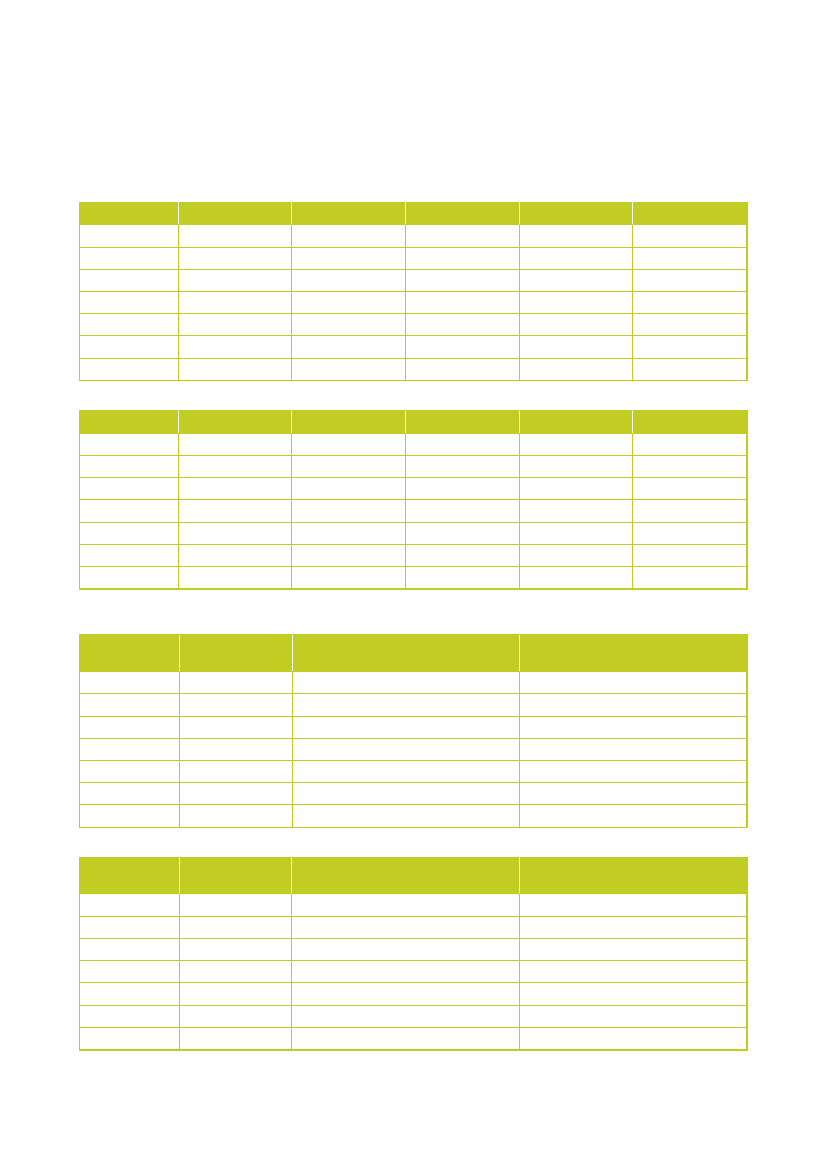

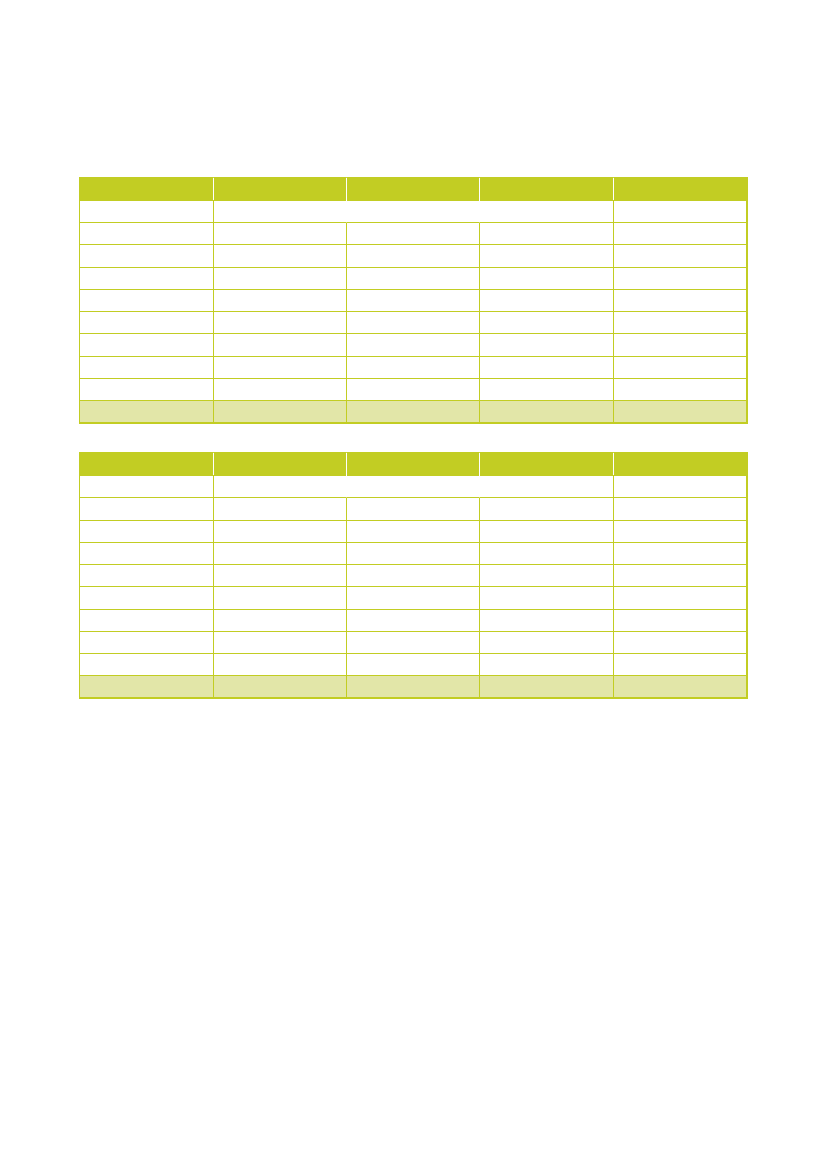

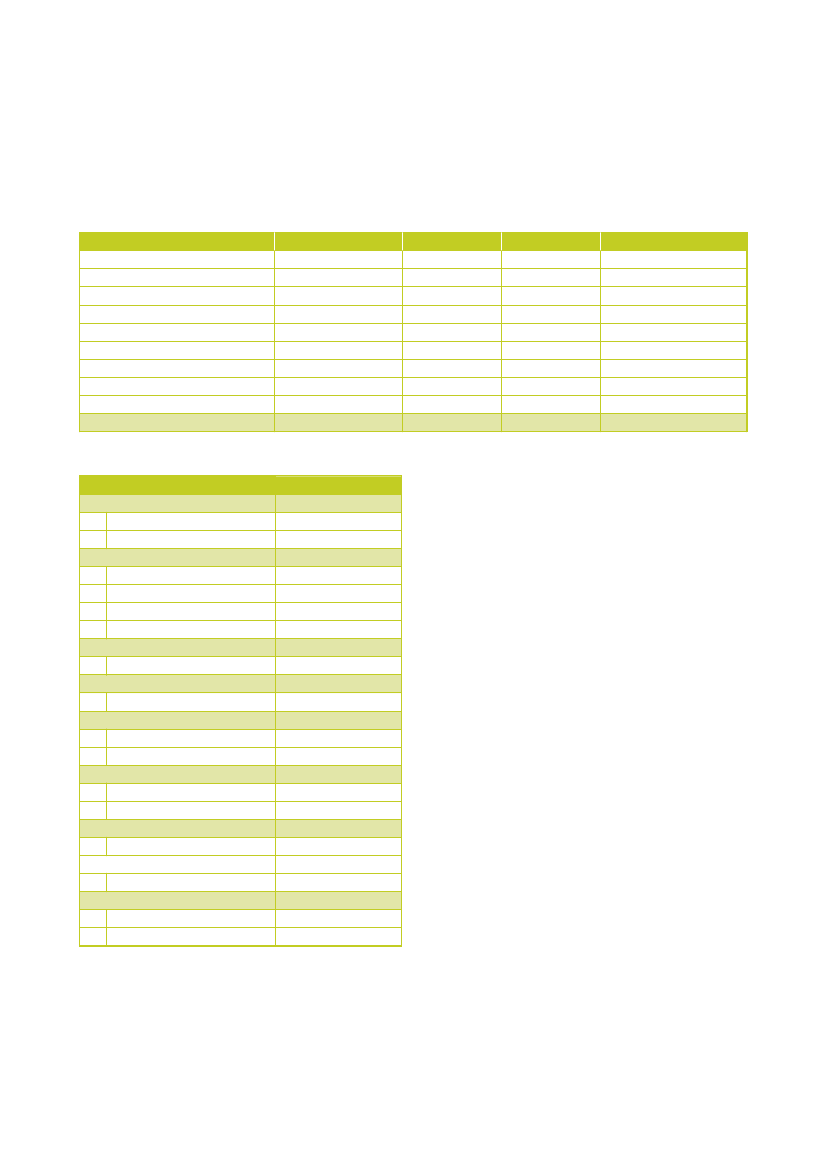

Table 1.3: response ratesCountryNo. in sampleNo. ofrespondents3843413874904144304612.90713690162103248267991.105Response %No. of organisationsrespondents purchaseon behalf of35%26%42%21%60%62%21%38%1551672461512663081131.406

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited KingdomAll countries

Collection of statistical information on Green Public Procurement in the EU

17

2OrganisingGreen PublicProcurement

The progress of Member States on Green PublicProcurement has been measured by means ofquantitative, result-oriented indicators (indicator1 and 2). Chapters 3 and 4 deal with the resultsof these indicators. In addition, thequestionnaire which was used for this study,contained a set of qualitative, process- andpolicy-oriented questions. The answers to thesequestions show what measures have been takenby governmental organisations to attain acertain level of GPP. This gives some indicationof future ‘GPP-potential’. In this chapter wepresent the results of this process-oriented partof the questionnaire, for each of the sevenseparate Member States. The questions arerelated to the environmental and procurementpolicies of governmental organisations, and onthe implementation of GPP. Appendix C includessome results on background information andbreakdowns of results between central andnon-central organisations.

procurement process, are the environmental impact ofthe purchase, and the availability of and the familiaritywith green alternatives.

2.2

Environmental policy

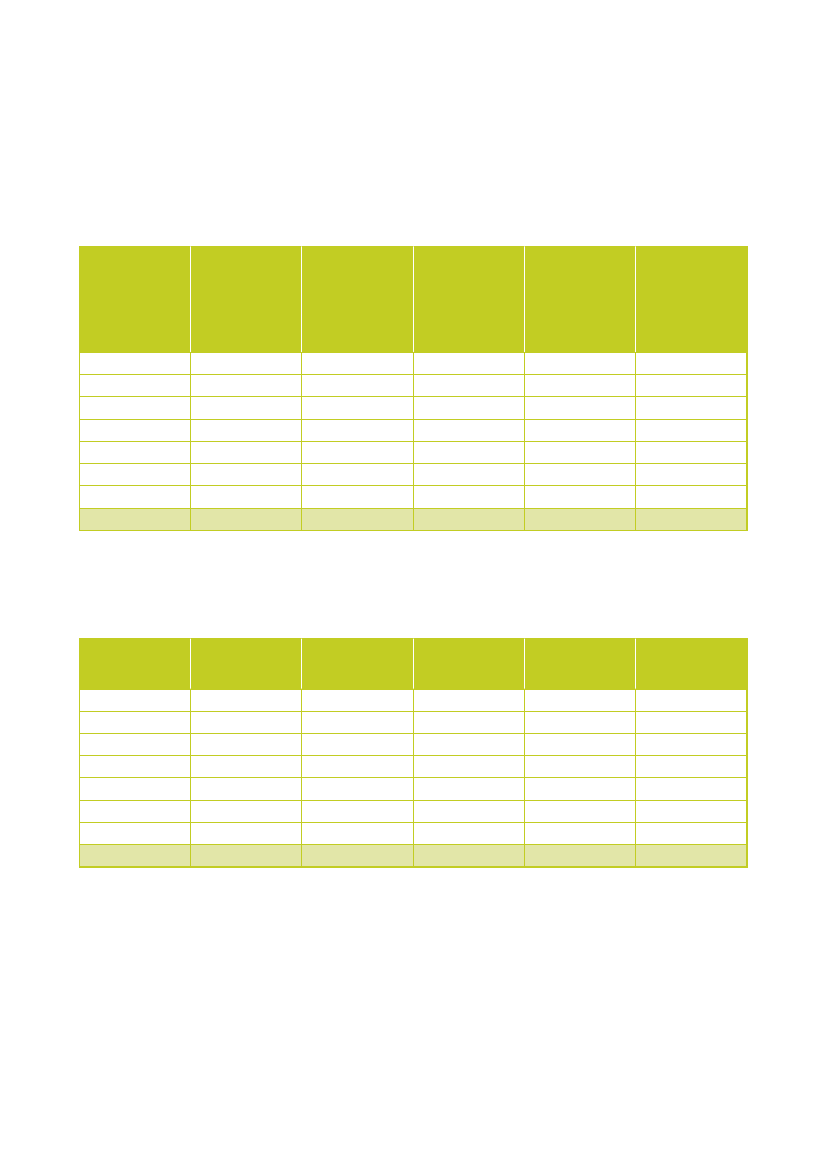

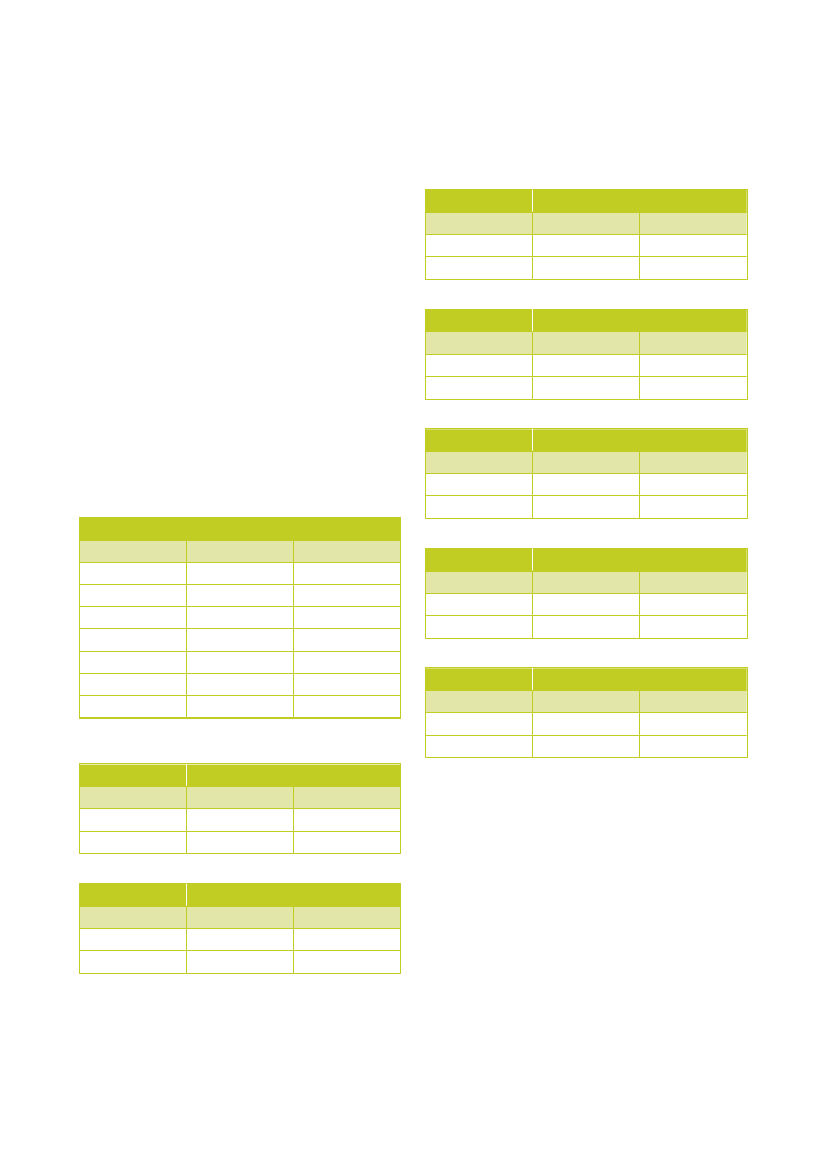

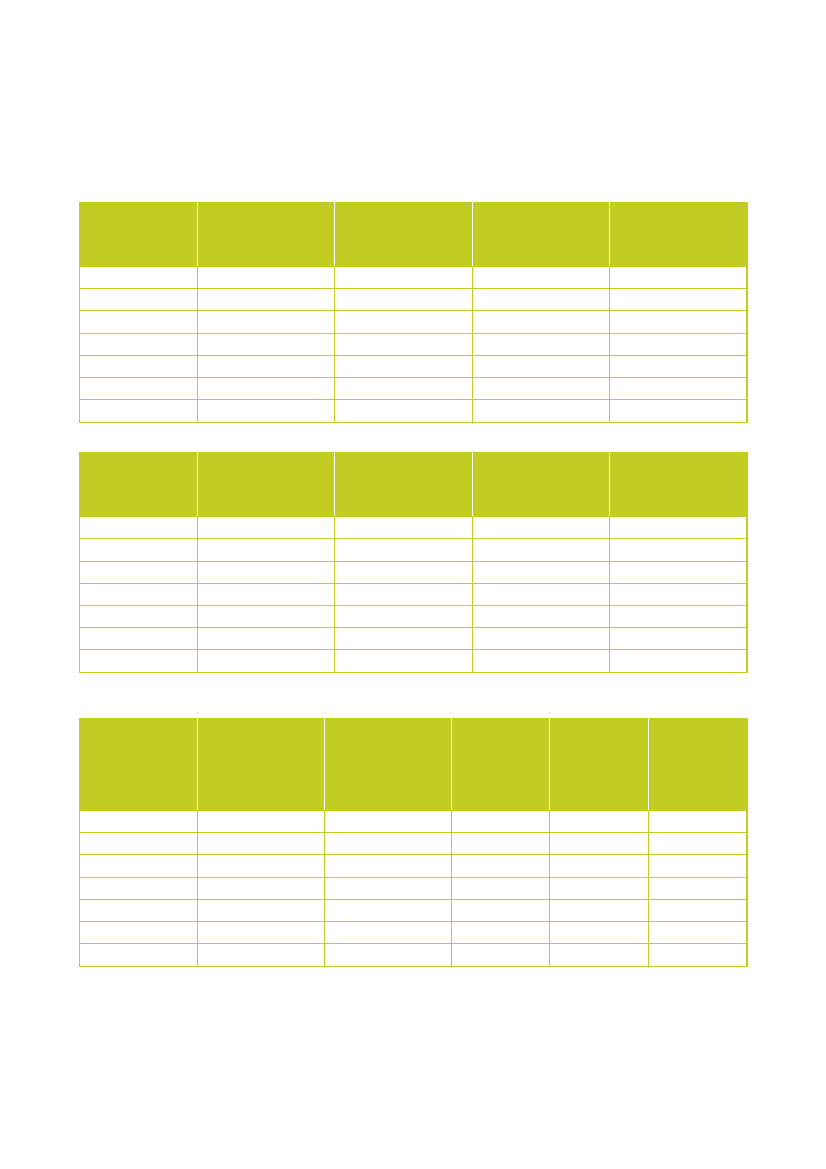

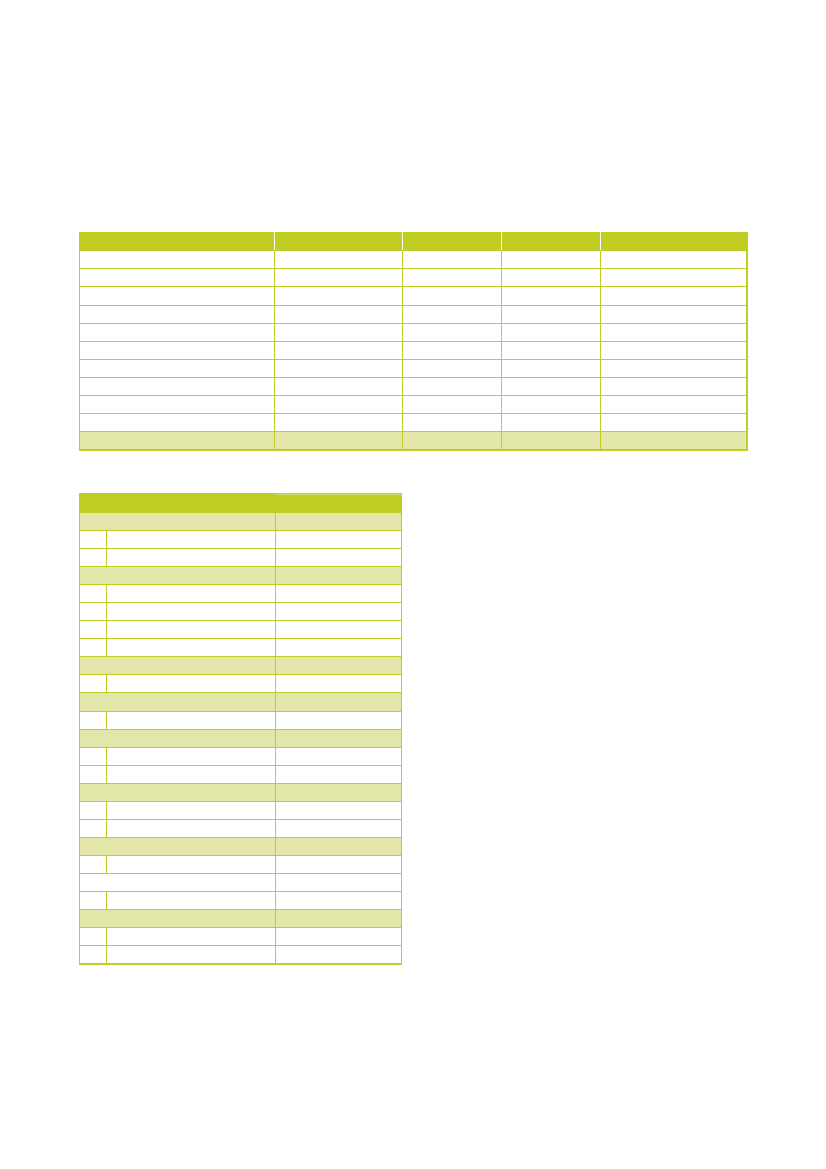

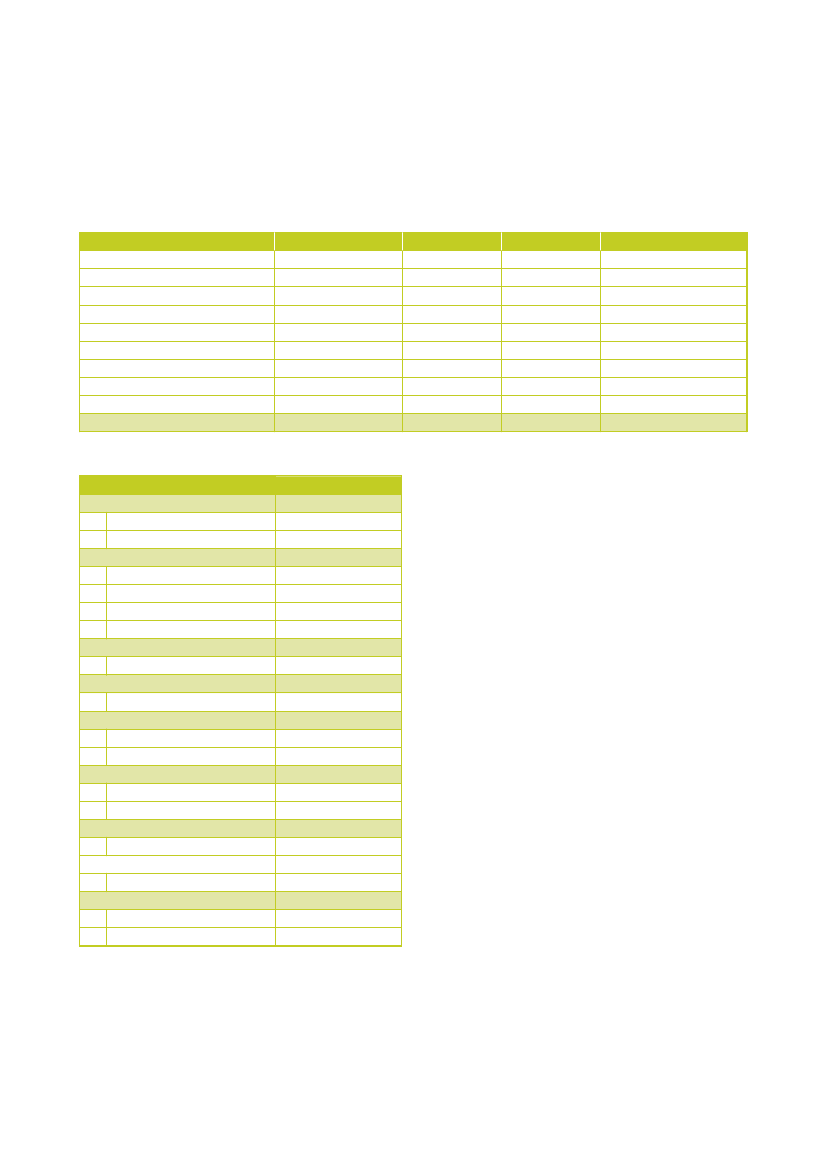

Table 2.1: Percentage of organisations having an5environmental management systemCentralAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom35%30%29%8%29%75%50%36%Non-central9%26%27%9%21%33%32%22%Total10%26%27%9%22%38%33%24%

2.1

Summary

Within the majority of organisations, the procurementpolicy contains a section on the environmental aspects ofprocurement. Responsibility for realizing ambitions ongreen procurement is mostly in the hands of the middlemanagement (for instance head of the procurement unit)or a higher level.Furthermore, to keep the level of knowledge andinformation up to date, respondents nameintergovernmental cooperation and seminars as the mostimportant sources. In addition, organisations use countryspecific sources, mostly reachable through the internet. Asubstantial part of the respondents (16 % on average)use the GPP website of the European Commission as anadditional source.Finally, this study shows that methods for Life CycleCosting (LCC) are not yet fully incorporated into theprocurement process. Organisations evaluate proposalsmore often on purchasing costs than on the outcome ofLCC. Decisive arguments for choosing ‘green’ during the

The table above shows the percentage of organisationsthat have implemented an environmental managementsystem (EMS). On average, less than a quarter of theorganisations has an EMS. Within most countries,percentages are higher for central government. Swedenranks highest among the seven countries.

2.3

Procurement policy

Table 2.2: Percentage of organisations having anenvironmental component to their procurement policyCentralAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom87%89%35%42%55%62%100%67%Non-central61%90%34%73%69%87%89%72%Total61%90%34%72%67%84%89%71%

5

The percentages equal the number of ‘yes’-answers as part of the total number of respondents. Percentages at the bottom of the table are thearithmetic means over all seven member states.

Collection of statistical information on Green Public Procurement in the EU

19

Within the majority of organisations, the procurementpolicy contains a section on the environmental aspects ofprocurement. Finland is an exception to this general rule.

Table 2.4: Percentage of organisations for which greenprocurement is part of the regular Planning & Control cycleCentralAustria53%39%31%17%26%37%100%43%Non-central14%41%34%12%21%38%49%30%Total15%41%34%12%21%38%52%31%

2.4

Implementation of Green PublicProcurementTasks and responsibilities

DenmarkFinlandGermanyThe Netherlands

2.4.1

Table 2.3: Percentage of organisations having an action planfor meeting goals on green procurementCentralAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom40%28%21%23%40%27%100%40%Non-central11%38%16%20%30%38%58%30%Total12%37%16%20%31%37%61%31%

SwedenUnited Kingdom

green procurement being part of the Planning & Controlcycle means that green procurement has been put intothe (financial) processes within the organisation. It is anindication that GPP is taken seriously. The results in thetable above show a picture which is similar to theprevious table. Again, UK organisations rank highest.When being asked who is responsible for realizingambitions on green procurement, most organisationsreply ‘middle management’ (for instance head of theprocurement unit) or a higher level. Relatively largedifferences can be seen between countries.

This question draws a divergent picture. The majority ofthe governmental organisations from the UK have anaction plan for meeting goals on green procurement.Other countries rank lower.

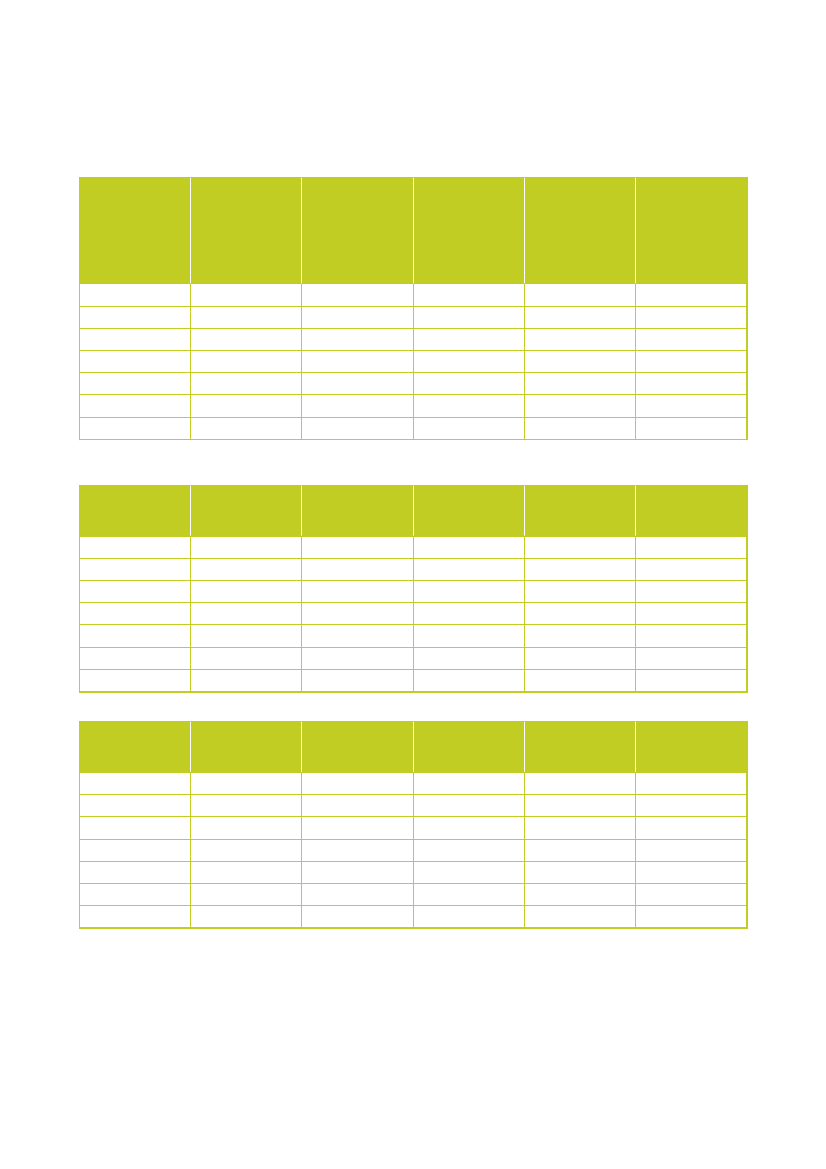

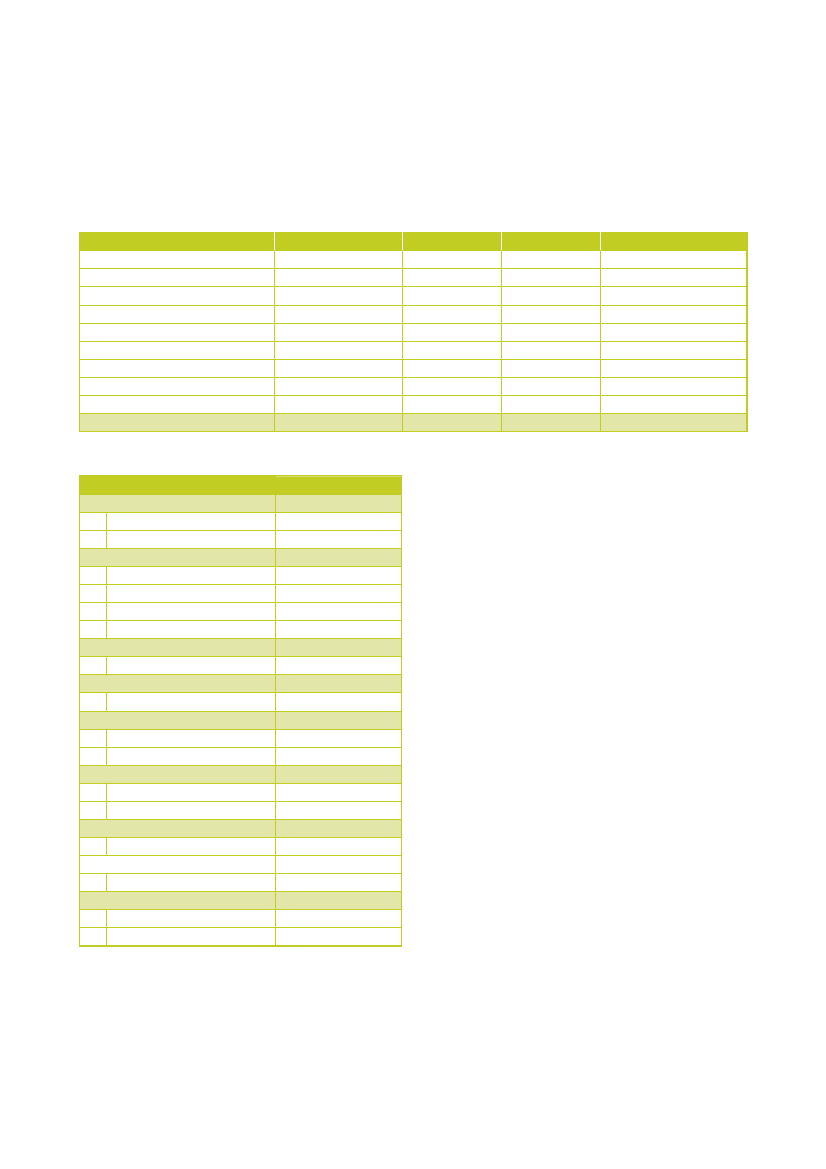

Table 2.5: Responsible level for meeting goals set for making procurement more sustainable (% of organisations)TotalManagement / directorate oforganisation (e.g. minister,municipal executive)49%7%19%36%22%20%10%23%Middle management (e.g.procurement coordinator,procurement department)23%77%41%8%32%46%66%42%ProcurersOther / unknown

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

9%0%18%24%10%25%7%13%

18%17%22%32%36%9%18%22%

20

PricewaterhouseCoopers

2.4.2

Empowerment and sources of information

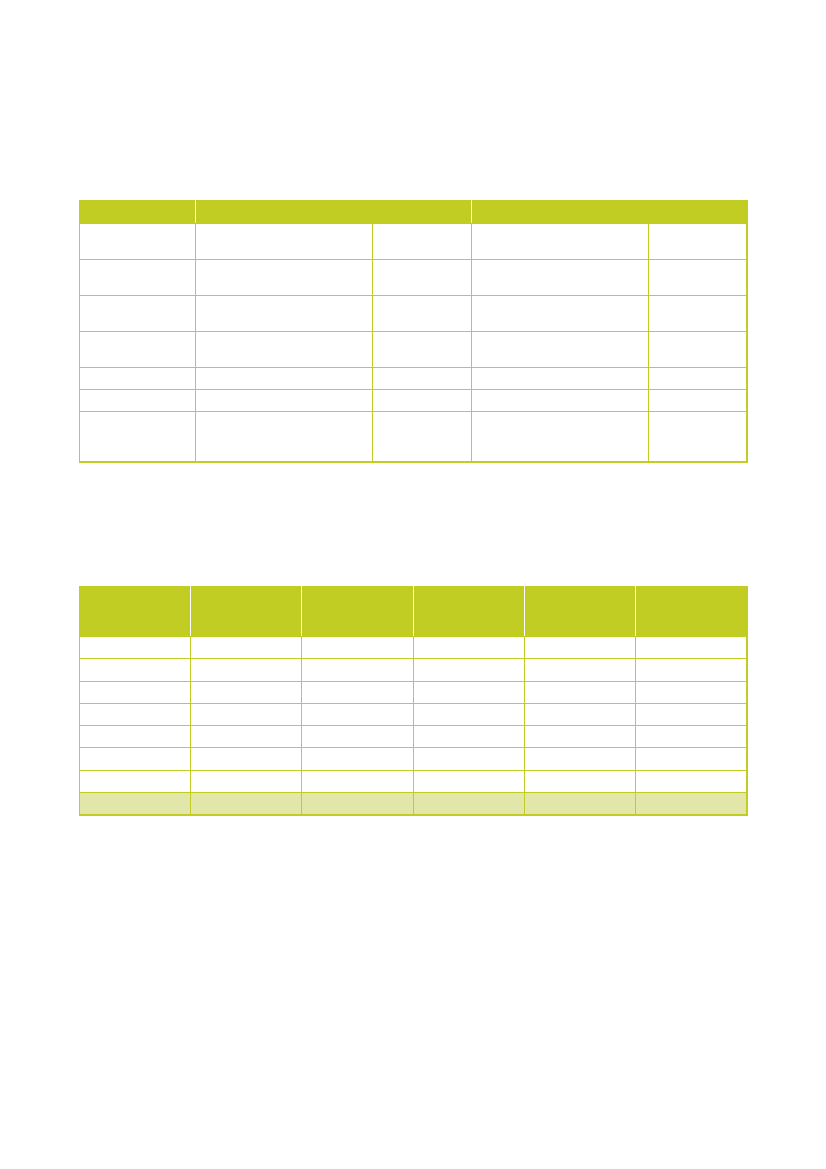

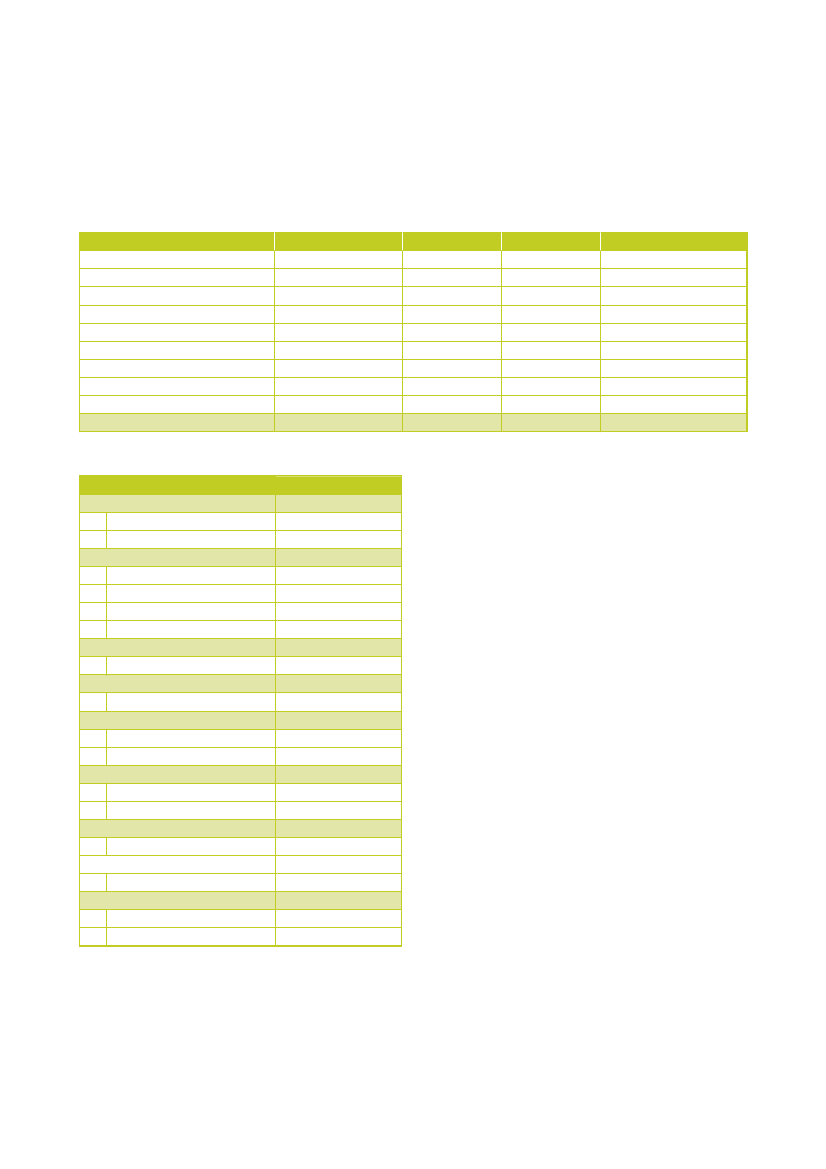

Table 2.6: Measures taken to empower the responsible people to meet the green procurement goals (multiple optionspossible)TotalTraining andeducation ofprocurement officersin the field of greenprocurementActivecommunicationtowards theorganisation aboutset goals in makingprocurement moresustainable22%32%15%21%35%22%49%28%Formally appointedpowers to theresponsible officersPolitical supportOther (incl. ‘nothinghas been done’)

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

9%28%17%9%24%39%57%26%

24%14%12%25%15%13%9%16%

6%17%2%6%12%16%24%12%

12%10%15%4%28%16%13%14%

To support the responsible people in meeting the organisational goals on green procurement, several measures havebeen taken. Training and education, and active communication are mentioned most frequently by the respondents,especially by UK governmental organisations. In most cases, political support for the responsible people is low.Table 2.7: External sources being used to find information about green procurement (multiple options possible)TotalEuropeanCommission GPPwebsite9%24%18%18%9%14%22%16%Procura+ websiteEcolabelCountry specificsources5%33%4%5%15%38%24%18%21%72%16%33%78%67%67%51%Other

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

4%2%7%4%4%33%14%10%

23%30%15%8%19%17%40%22%

For green procurement information, most organisations rely on country specific sources, mostly reachable through theinternet. This applies in particular to Denmark and the Netherlands. A substantial part of the respondents use the GPPwebsite of the European Commission as an additional source.

Collection of statistical information on Green Public Procurement in the EU

21

Table 2.8: Most frequently consulted country specific sources (% of organisations)TotalAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited KingdomExternal sourceTake it! (www.oekoweb.at/takeit)Staten og KommunernesIndkøbscentralSyke (Finnish EnvironmentInstitute)Website Blauer EngelMilieukeurNordiska ministerrådetDEFRA (Department forEnvironment, Food and RuralAffairs)11%55%16%33%20%4%48%External sourceCheck it!(www.ifz.tugraz.at/oekoeinkauf)Miljøvejledninger (Miljøstyrelsen)HymonetWebsite des Umweltbundesamts(beschaffung-info.de)SenterNovemMiljöstyrningsrådetOGC Buying Solutions21%69%13%33%78%67%67%

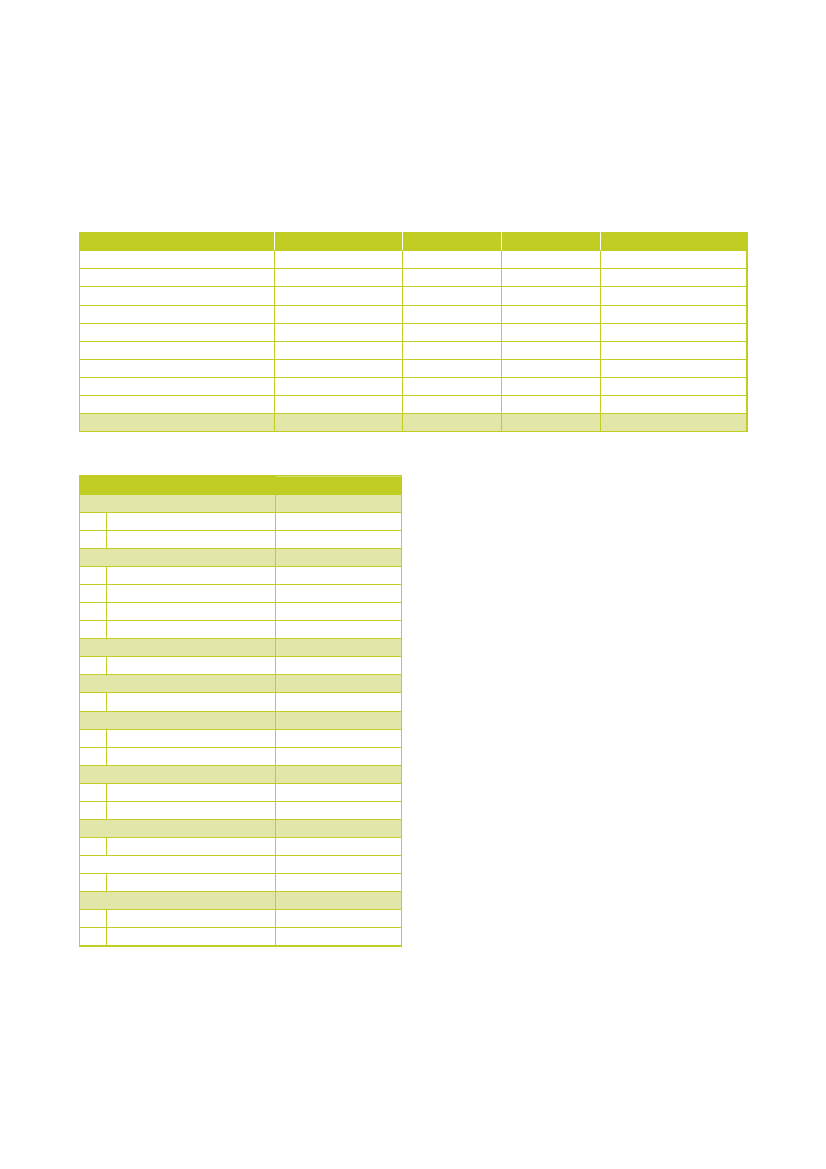

The table above shows which country specific sources are consulted. SenterNovem (Dutch agency on sustainabilityand innovation) has been consulted most frequently. Other popular sources include the Office of GovernmentCommerce from the UK, the Swedish Miljöstyrningsrådet (Environmental Management Council) and Miljøvejledninger(Ministry of the Environment) from Denmark.Table 2.9: Means to keep the level of knowledge and information on green procurement up to date (multiple options possible)TotalTraining andeducation11%9%27%12%19%34%50%23%SeminarsBy cooperating withother (governmental)organisations13%37%21%7%42%56%49%32%21%54%27%25%40%40%42%36%InternetOther (incl. ‘nothinghas been done’)9%42%18%19%52%32%29%29%14%18%11%7%15%6%10%12%

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

To keep knowledge and information up to date, again internet sources are being used frequently by sustainableprocurers. But even more frequently, respondents mention ‘cooperation’ and ‘seminars’ as important sources to stayup to date. Training and education seem to be slightly less important.

22

PricewaterhouseCoopers

In the table below, we list the internet sources most frequently used by the respondents (open question). By far themost frequently mentioned sources are www.senternovem.nl (Dutch) and www.msr.se (Swedish). This is in agreementwith the question on the external sources being used.Table 2.10: Internet sources most frequently used (% of organisations)TotalAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdomwww.oekokauf.wien.atwww.elsparefonden.dkwww.hymonet.comwww.umweltbundesamt.dewww.senternovem.nlwww.msr.sewww.ogc.gov.ukInternet source most frequently usedwww.ifz.tugraz.atwww.mst.dkwww.ymparisto.fiwww.beschaffung-info.dewww.pianoo.nlwww.avropa.nuwww.defra.gov.uk/sustainable/government/www.bbg.gv.atwww.ecolabel.dkwww.hansel.fiwww.iclei.orgsuppliers websitessuppliers websiteswww.eauc.org.uk

2.4.3

Procurement process

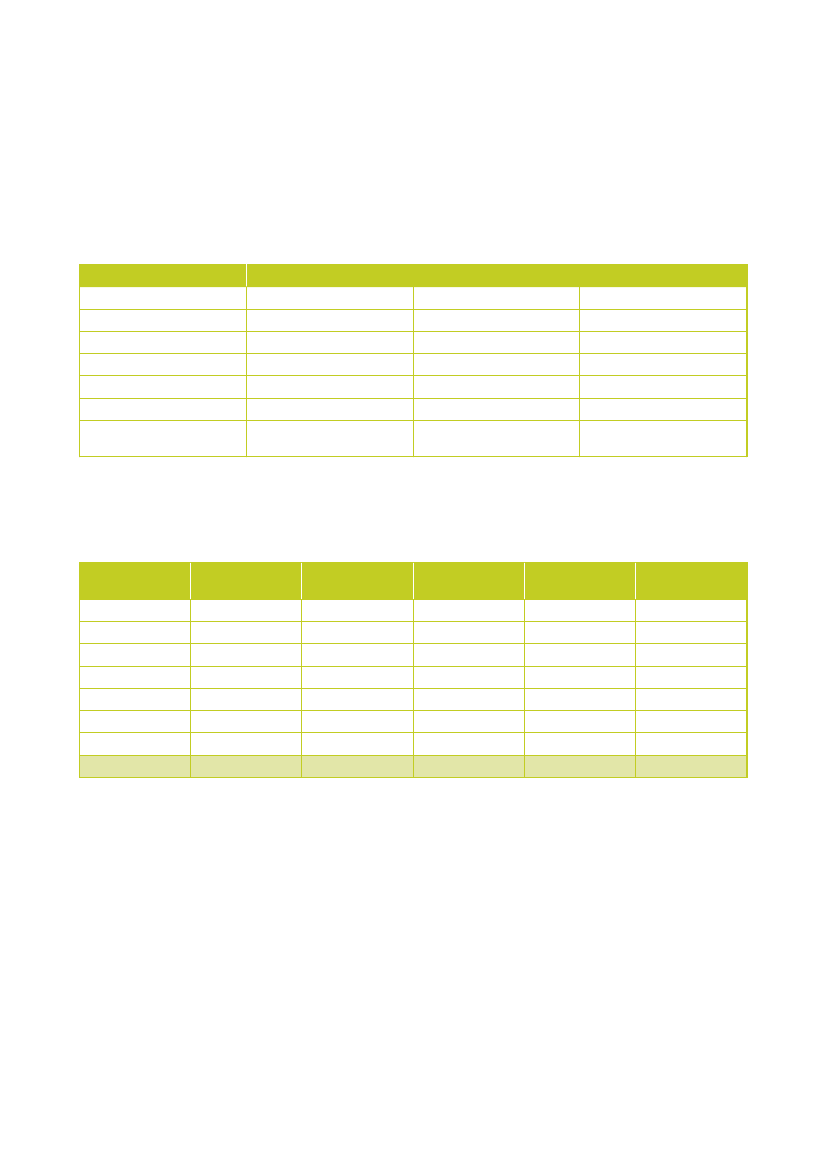

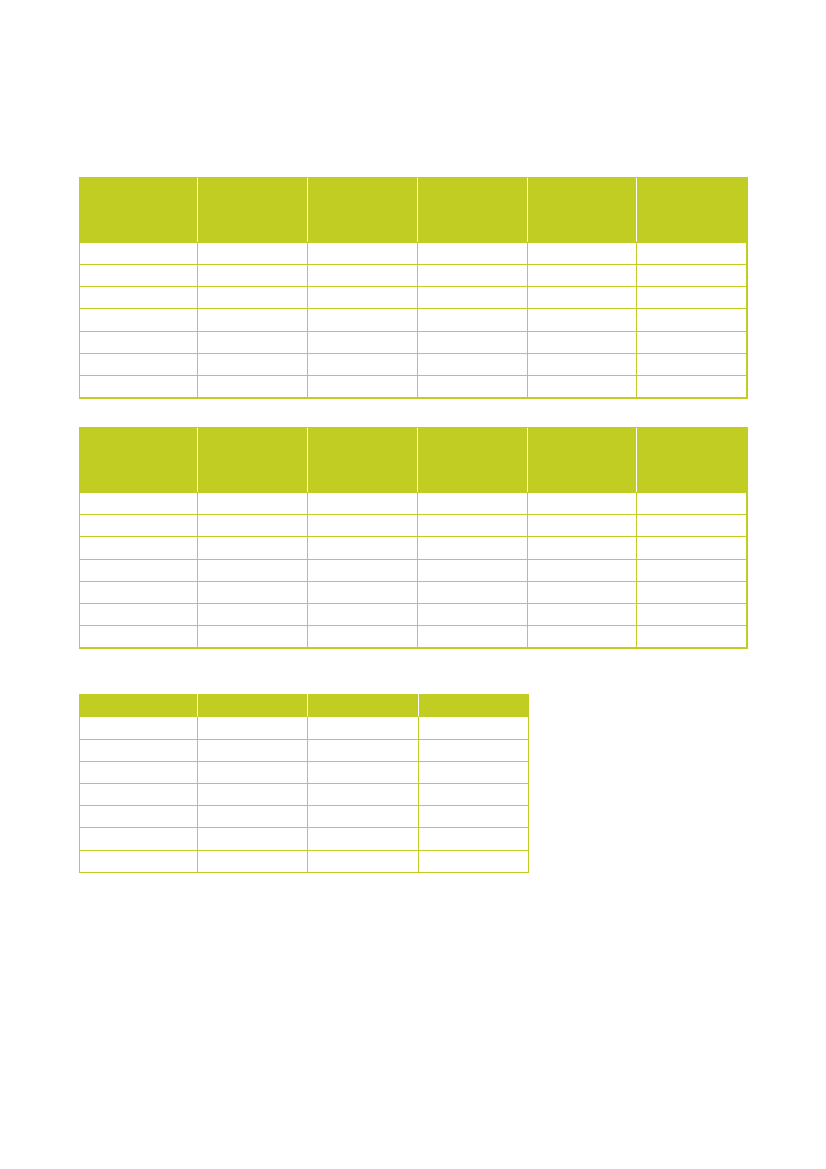

Table 2.11: Percentage of organisations comparing environmental aspects compared with price and other criteria during theprocurement processTotalAustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited KingdomYes, always5%17%7%17%14%3%25%13%Yes, most of thetime39%41%17%29%34%33%28%31%Yes, sometimes34%37%30%38%36%43%35%36%Seldom16%6%40%14%13%18%6%16%Never6%0%6%2%4%3%6%4%

In general, governmental organisations take environmental aspects into account within part of their tender processes(‘sometimes’ or ‘most of the time’). Within the UK and Denmark, the environmental aspects are most frequently part ofthe award process, within Finland least frequently.

Collection of statistical information on Green Public Procurement in the EU

23

Table 2.12: Percentage of organisations evaluating proposals on Life Cycle Costing or on the procurement costs of theproduct/service onlyTotalMostly evaluation on LCCSometimes evaluation on LCC,sometimes evaluation onpurchasing costs46%57%38%49%40%30%58%45%Mostly evaluation onpurchasing costs45%31%48%37%49%62%16%41%

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

9%12%14%14%11%7%26%13%

In an LCC analysis, various cost elements in the user life cycle of a product are taken into account. This means that notonly purchase prices are analyzed, but also other cost elements for the user, depending on the nature of the product orproduct group. From the table above, it appears that methods for LCC are not yet fully incorporated into theprocurement process. Organisations evaluate proposals more often on purchasing costs than based on the outcome ofLCC (see, for instance, the Netherlands and Finland). Again, the UK is an exception to this general rule. Within thiscountry, evaluation on LCC occurs more frequently than on purchasing costs only.Table 2.13: Decisive criteria for asking for “green” goods by including green criteria as minimum technical specifications or asaward criteria (multiple options possible)TotalVolume ofthe tender,only thelargertendersVolume ofthe tender,only thesmallertendersEnvironmen Availability Familiaritywith greenof greental impactalternatives alternativesof thepurchaseFamiliaritywithsuppliersthat offergreengoods/services18%31%14%11%23%21%15%19%The impact of thegreen alternative onthe processes of theorganisation - onlychoosing for thegreen alternativewhen impact isminimal9%3%3%10%19%6%9%8%Other

AustriaDenmarkFinlandGermanyThe NetherlandsSwedenUnited Kingdom

7%17%4%5%8%2%11%8%

2%5%1%2%1%2%4%2%

19%48%36%25%44%54%50%40%

45%41%29%29%53%57%45%43%

22%38%28%20%41%39%18%29%

7%11%8%3%13%6%4%7%

Finally, we asked the respondents which considerations are decisive for choosing ‘green’ during the procurementprocess. Most decisive are the environmental impact of the purchase, and the availability of and the familiarity withgreen alternatives. The volume of the tender and the impact on the organisation are considered least important by therespondents.

24

PricewaterhouseCoopers

3Green Public

Procurement percountry

This chapter reports on the main results ofindicators 1 and 2. First, the results will bepresented on an aggregated level over the sevenparticipating countries. In paragraph 3.2 andfurther the results will be presented brokendown per country and product group. AppendixD gives information on the results of scores percountry broken down by central anddecentralised government organisations.

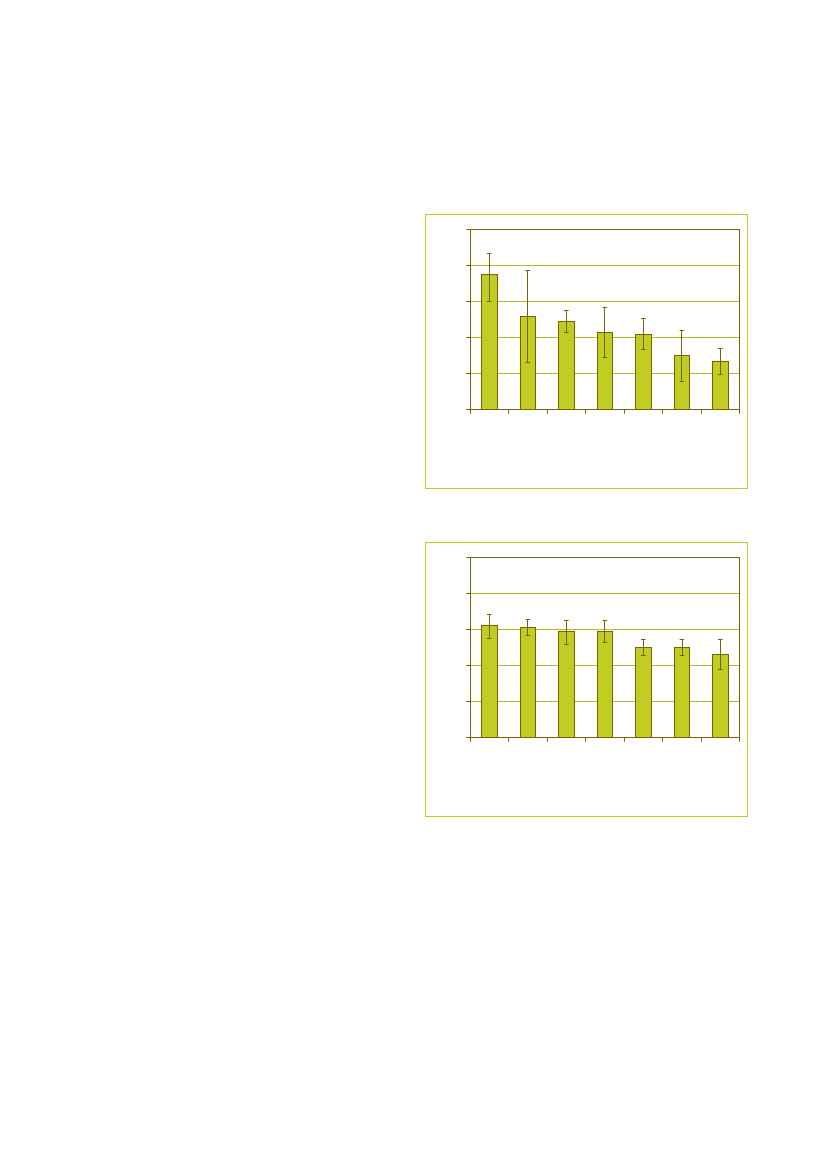

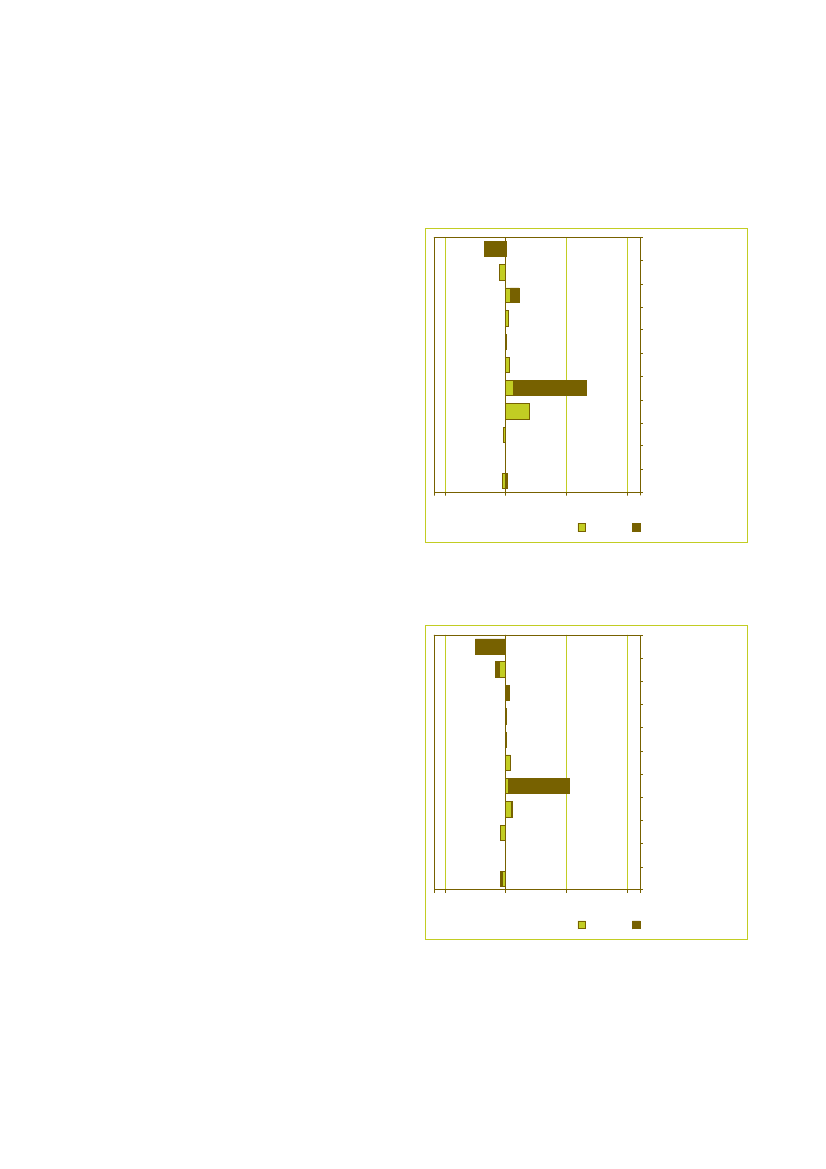

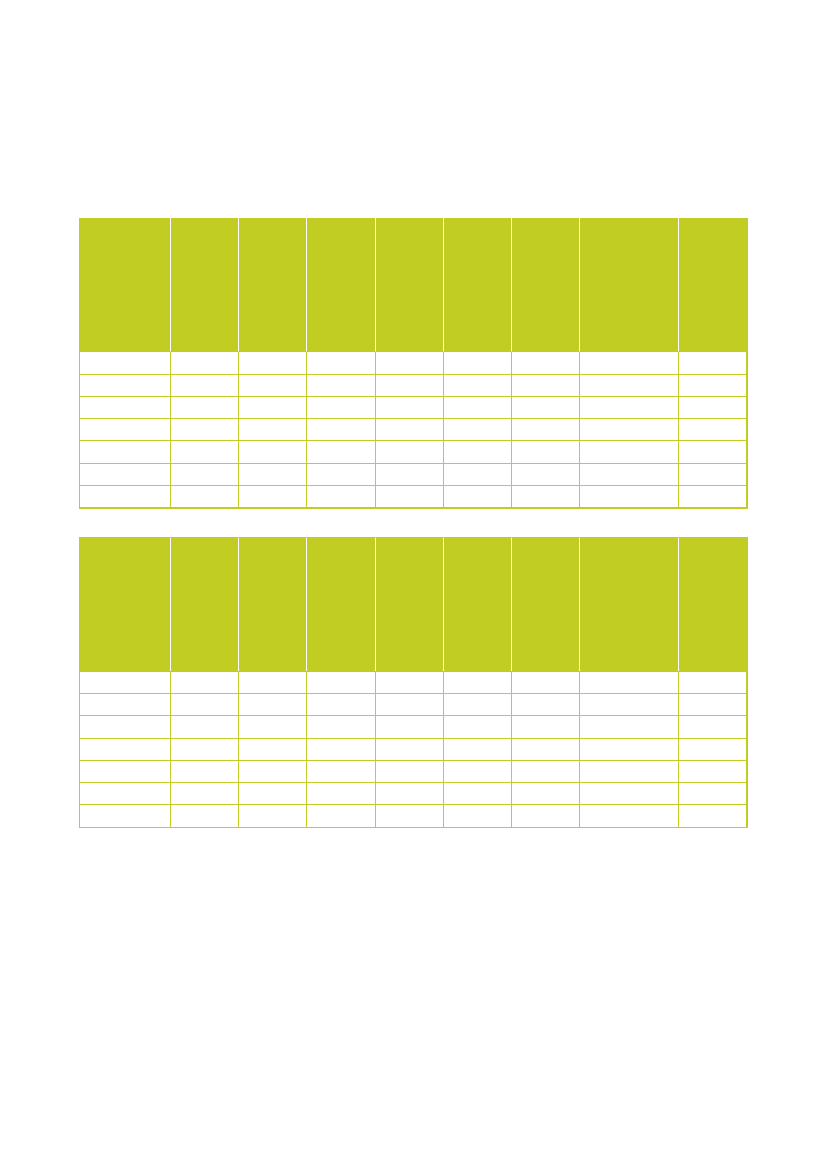

Figure 3.1: Overall scores on indicator 1. The precision levelsare indicated by the length of the uncertainty bars.100%80%60%40%20%0%

Almost all figures in this chapter show a core level ofGPP, a comprehensive level of GPP and a non-greenlevel of GPP per country or per product group. A corelevel of GPP represents the percentage of GPP meetingcore criteria only. The comprehensive level of GPPrepresents the percentage of procurement value ornumber of contracts meeting core criteria as well ascomprehensive criteria. The total percentage of greenprocurement is calculated by adding the percentage corelevel of GPP to the percentage of comprehensive level ofGPP.

UnitedKingdom

Sweden

Finland

Figure 3.2: Overall scores on indicator 2. The precision levelsare indicated by the length of the uncertainty bars.100%

3.1

Summary

80%60%40%20%0%

UnitedKingdom

Netherlands

Collection of statistical information on Green Public Procurement in the EU

Germany27

Denmark

The four figures below show the total amount of GPP percountry expressed as a percentage of the totalprocurement value and as a percentage of the totalamount of contracts per country. In the first two figures,we have indicated the levels of GPP of green purchases(i.e. core plus comprehensive), as well as the precisionlevels indicated by the length of the uncertainty bars. Inthe subsequent two figures, we have broken down thelevels of GPP into core levels and comprehensive levels.Also, the averages of the Green-7 are shown in thesefigures.

Sweden

Finland

Austria

Netherlands

Austria

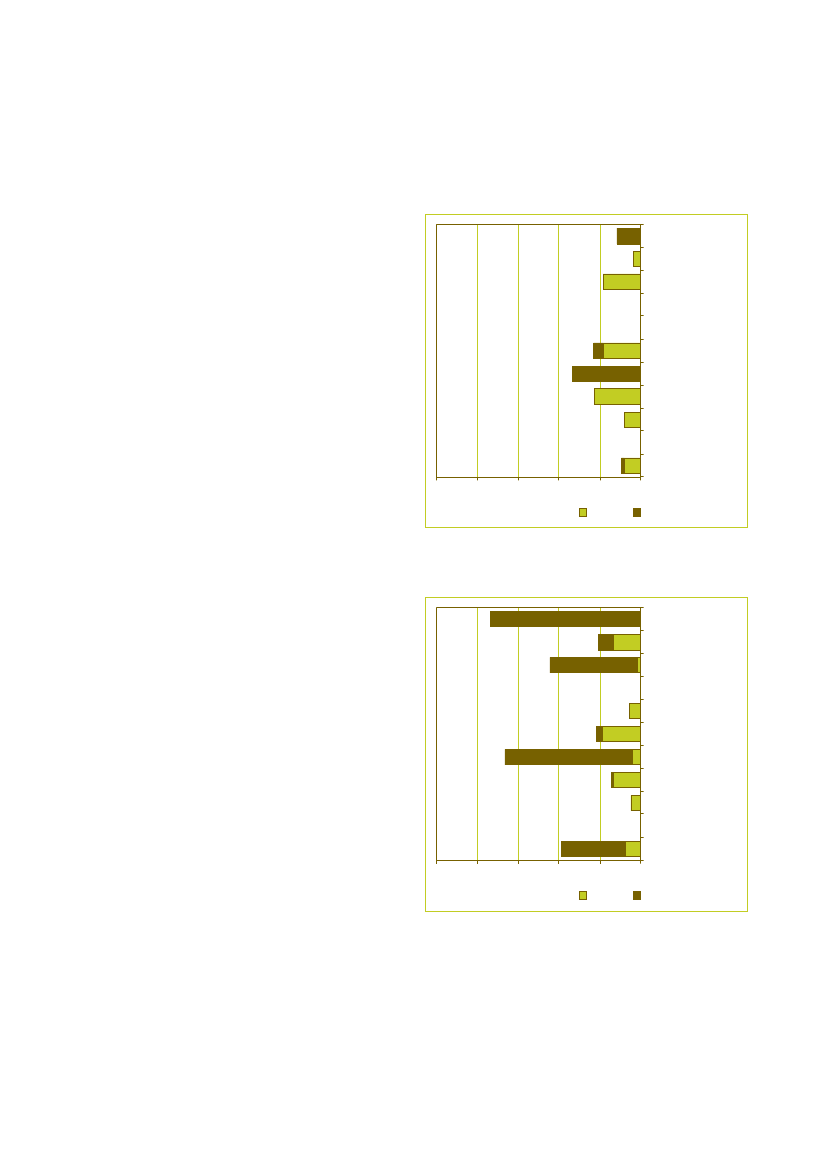

Germany

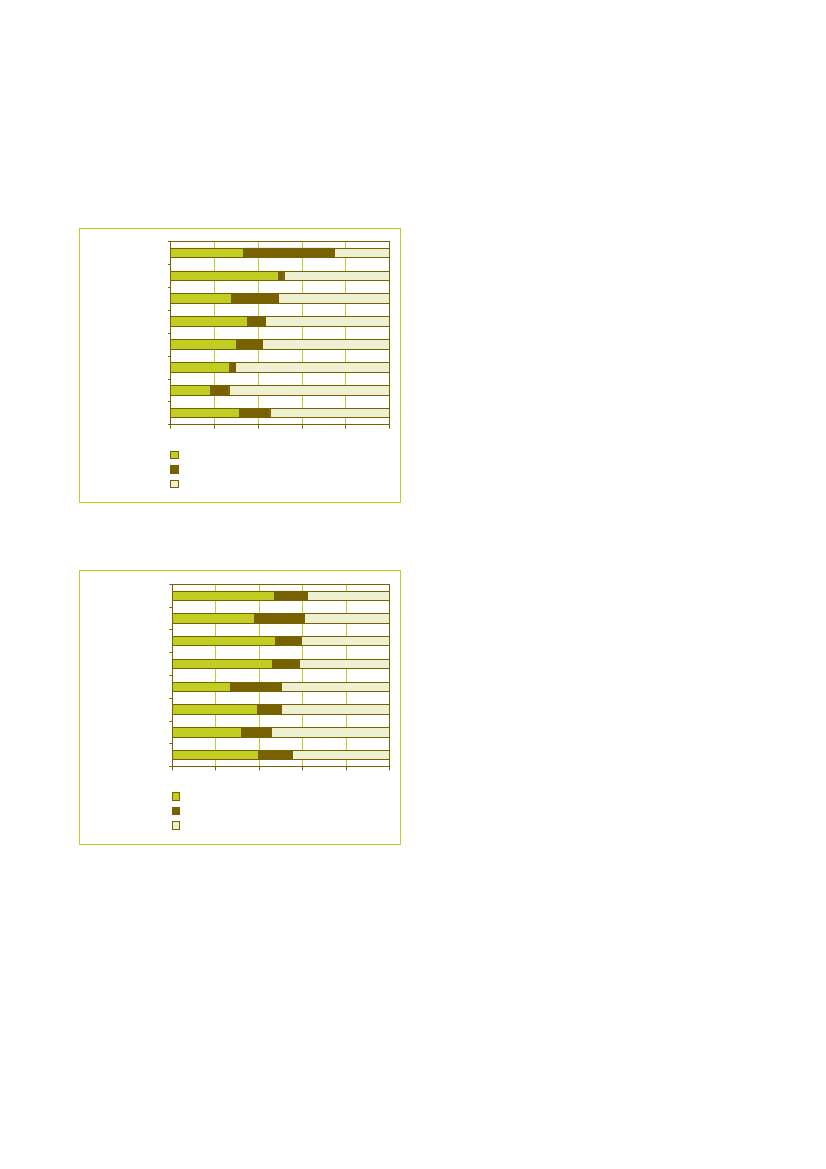

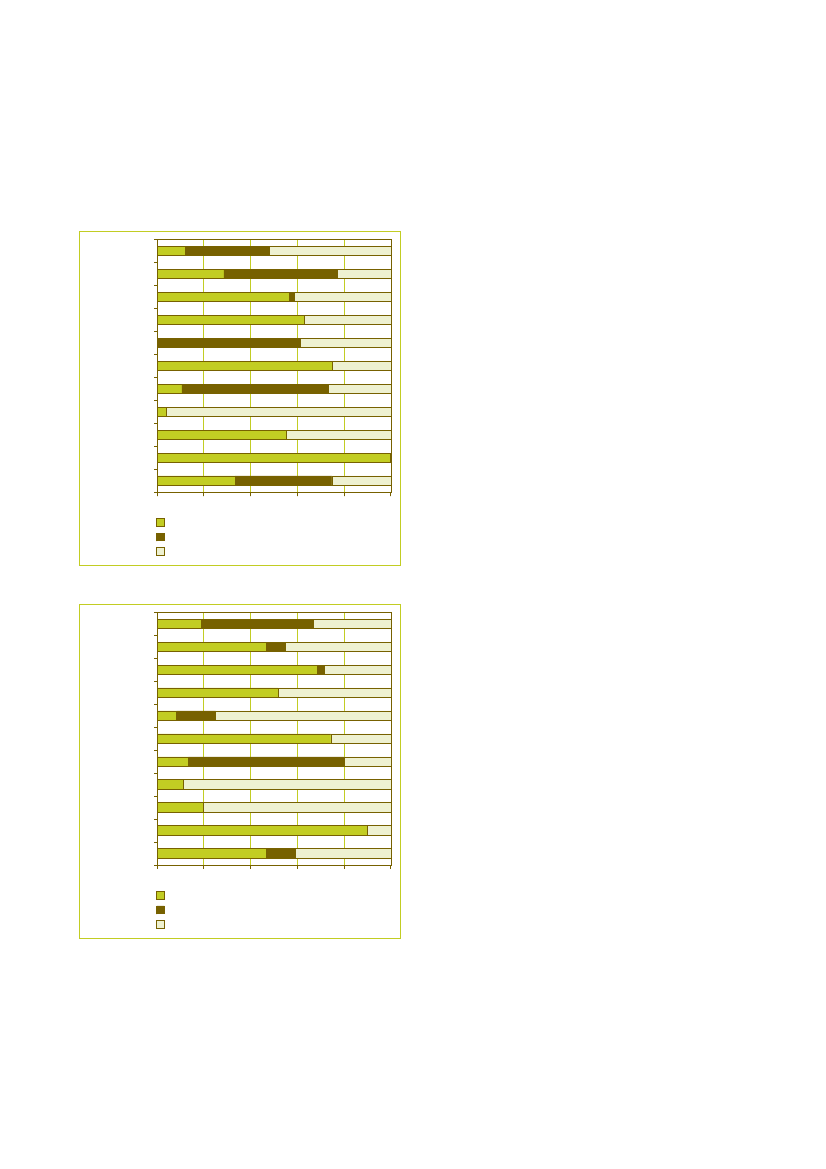

Denmark

Figure 3.3: Overall scores on indicator 1, broken down bycore and comprehensive levels of GPP. Also the average ofthe Green-7 is shown.United KingdomAustriaSwedenFinlandDenmarkGermanyNetherlandsGreen-7 average0%20%40%60%80% 100%

For indicator 2 the overall results show a score of 55%green level of GPP when expressed as a percentage ofthe total amount of contracts, of which is 39% core levelof GPP and 16% comprehensive level of GPP.Concerning the precision levels, we see that for indicator2, all countries have very low uncertainties, while forindicator 1 the uncertainties are much higher. This is aresult of the weighing of product groups on the basis ofprocurement value (indicator 1), which increases thespreading of the data and henceforth the precision level.In Austria, this has even led to high levels of uncertaintyfor indicator, which results in less reliability of the data.Further, we see that in the Netherlands, Sweden andFinland, the uncertainties for indicator 1 are quite low dueto the high response rates in these countries.What is also striking is that indicator 1 shows a differentranking of the seven countries compared to indicator 2.For indicator 1 the United Kingdom is the best performingcountry whereas indicator 2 shows Austria to be the bestperforming country. The difference between the highestscoring country and the lowest scoring country is biggerfor indicator 1 than for indicator 2. Indicator 1 showsUnited Kingdom as the highest scoring country (75%green purchases of total procurement value) and theNetherlands as the lowest scoring country (27% greenpurchases of total procurement value). Indicator 2 showsAustria as the highest scoring country (62% greenpurchases of total number of contracts) and Germany asthe lowest scoring country (46% green purchases of totalnumber of contracts).In the textbox on page 36 a specific case illustrates howthe results of indicator 1 and 2 should be interpreted andhow the differences between the two indicatorscomplement each other. In the following sections, we willpresent results of the levels of GPP at country level.

Core greenComprehensive greenNon green

Figure 3.4: Overall scores on indicator 2, broken down bycore and comprehensive levels of GPP. Also the average ofthe Green-7 is shown.AustriaSwedenUnited KingdomDenmarkNetherlandsFinlandGermanyGreen-7 average0%20%40%60%80% 100%

Core greenComprehensive greenNon green

These four figures show a number of striking results. Firstof all, figures 3.3 and 3.4 show that the level of GPP inthese seven countries shows an average overall level of45% green level of GPP when expressed as a percentageof the procurement value of which is 31% core level and14% comprehensive level of GPP. This means that 55%of the procurement value in the seven participatingcountries has been procured non-green.

28

PricewaterhouseCoopers

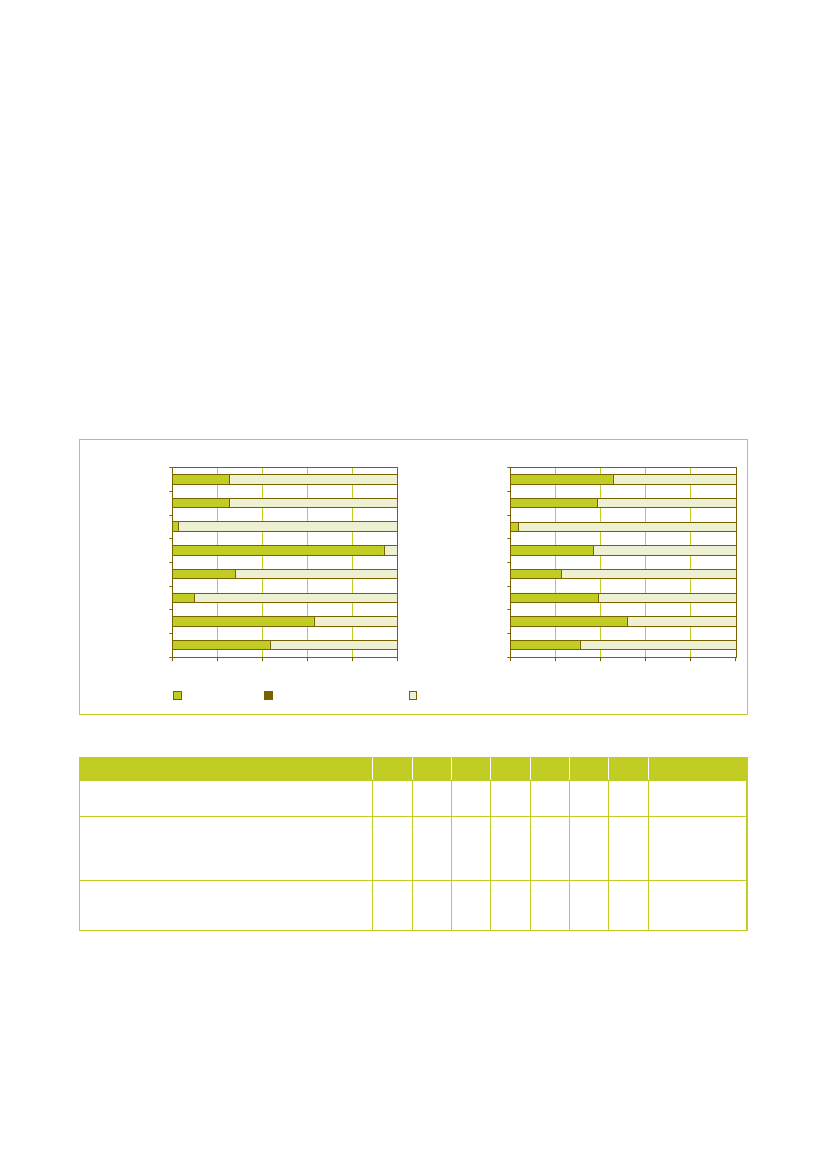

3.2

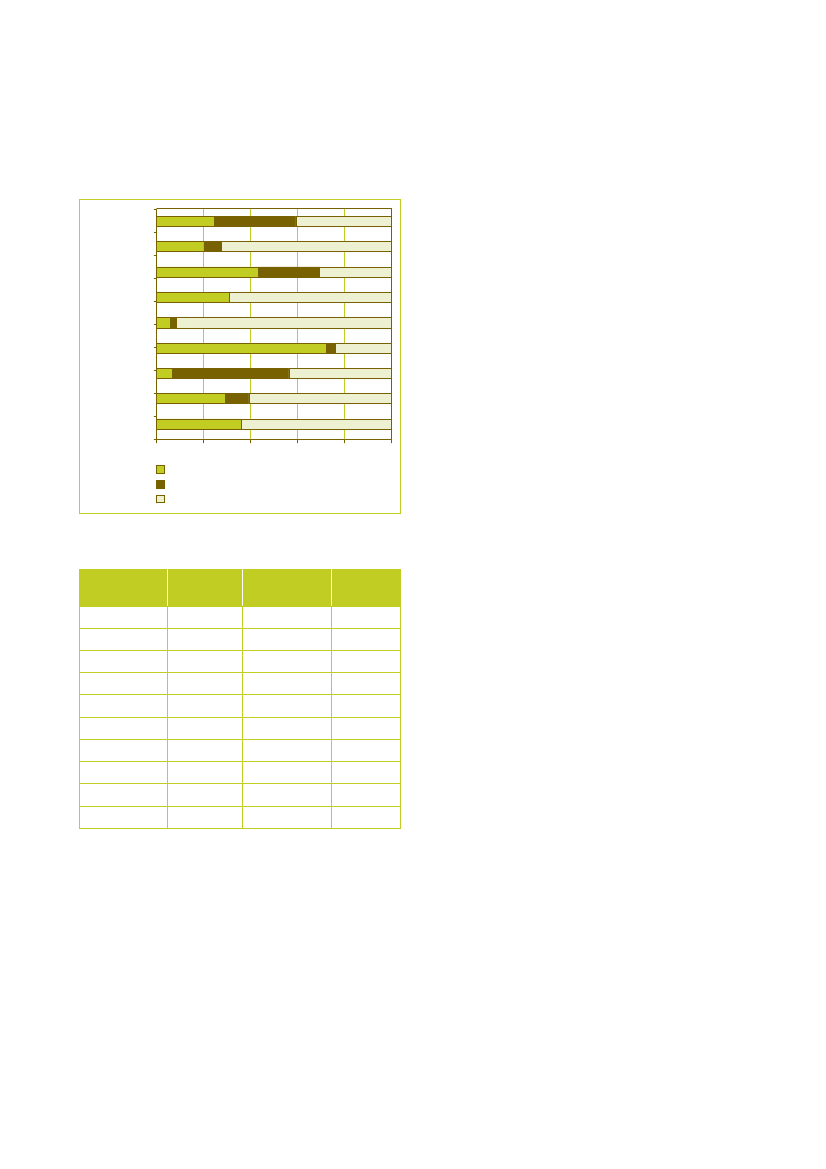

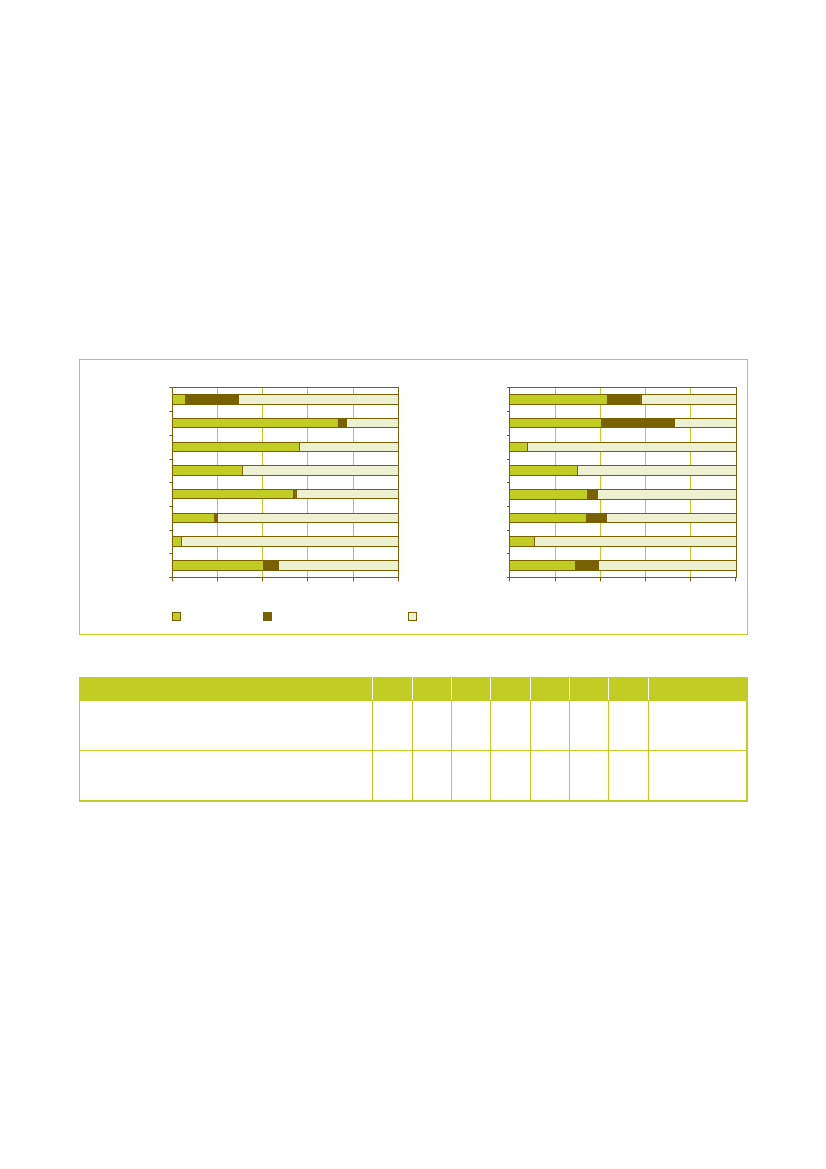

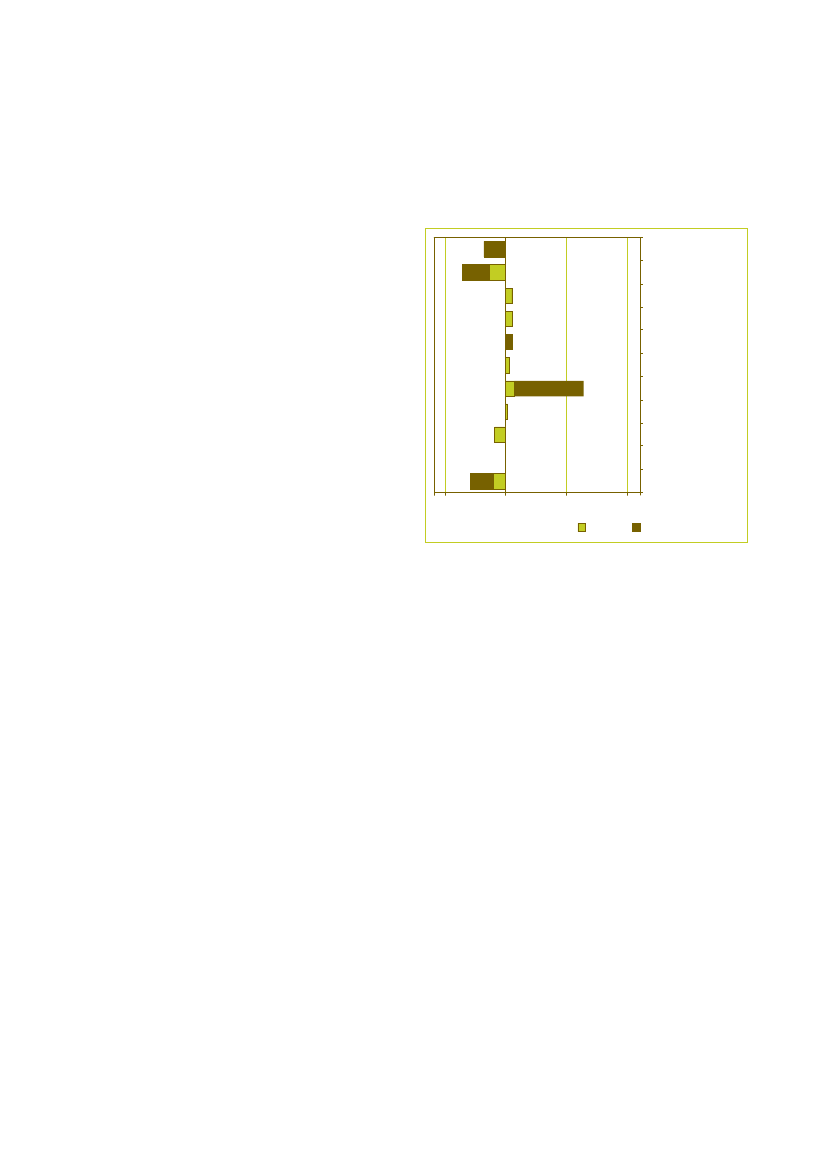

AustriaAustria’s average results for indicator 1 show 52% ofgreen purchasing, which is divided in 49% core level ofGPP and 3% comprehensive level of GPP. Hence 48% ofthe purchasing can be considered as having a non-greenlevel of GPP. The average results for indicator 2 are 62%green purchasing (47% core level of GPP and 15%comprehensive level of GPP) and 38% non-green level ofGPP.The levels of GPP for indicator 1 and 2 for Austria show anumber of interesting results. Austria scores very well onseveral product groups. 98% of the procurement value ofelectricity has been spent on core or comprehensivegreen. When expressed in indicator 2, 53% of thenumber of tenders for electricity in Austria can beconsidered as comprehensive green. For the productgroup gardening, Austria scores for indicator 1 as well asfor indicator 2 100% non-green. The results might beskewed by the relatively low response on this productgroup in Austria. A few responses then heavily influencethe final scores for a product group.Another remarkable result is Austria’s score for theproduct group paper. Austria scores a 100% green levelof GPP for indicator 1 on paper, of which 88% iscomprehensive green.A last interesting result is that Austria scores 100% greenlevel of GPP on furniture for indicator 1 and 95% greenlevel of GPP for indicator 2. One contract contributes 5%to Austria’s score for indicator 2. That specific contractonly has a small procurement value. Therefore the valueof this contract completely disappears when comparedwith the total procurement value for this product group.

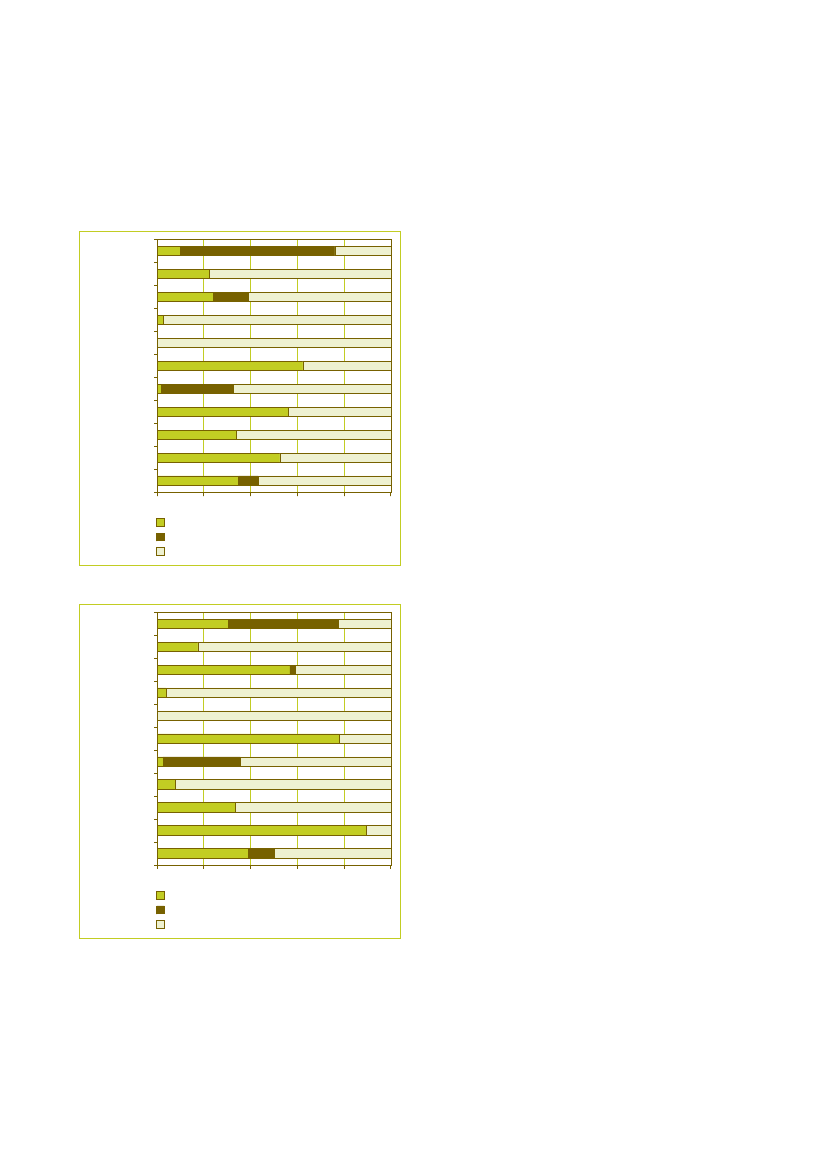

Figure 3.5: Overall scores Austria on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Figure 3.6: Overall scores Austria on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

* Austria’s results for clothing might be skewed because of lowresponse

Collection of statistical information on Green Public Procurement in the EU

29

3.3

DenmarkDenmark’s average results for indicator 1 show 42 % ofgreen purchasing (30% core level and 12%comprehensive level of GPP) and 58% non-green level ofGPP. The average results for indicator 2 are 46% corelevel of GPP, 13% comprehensive level, which sums to atotal of 59% of green purchasing. Hence 41% of theprocurement in Denmark can be considered asnon-green.The results of Denmark for indicator 1 and 2 show a greatvariety in scores for the ten product groups. On theproduct group cleaning Denmark scores 93% green forindicator 1, while for product group office IT Denmarkscores 86% green level of GPP. On the other hand thereare low scores on construction (11% green for indicator1), catering (25% green on indicator 1) and transport(10% green for indicator 1).0%20%40%60%80% 100%

Figure 3.7: Overall scores Denmark on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage

Core greenComprehensive greenNon green

Figure 3.8: Overall scores Denmark on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

The difference between indicator 1 and 2 is shown againby the scores for product groups gardening (92 % corelevel for indicator 1 and 40% core level for indicator 2),paper (91% comprehensive level for indicator 1 and 32%comprehensive level for indicator 2) and clothing (73%core level for indicator 1 and 40% core level for indicator2).

Core greenComprehensive greenNon green

* Denmark’s results for gardening might be skewed because oflow response

30

PricewaterhouseCoopers

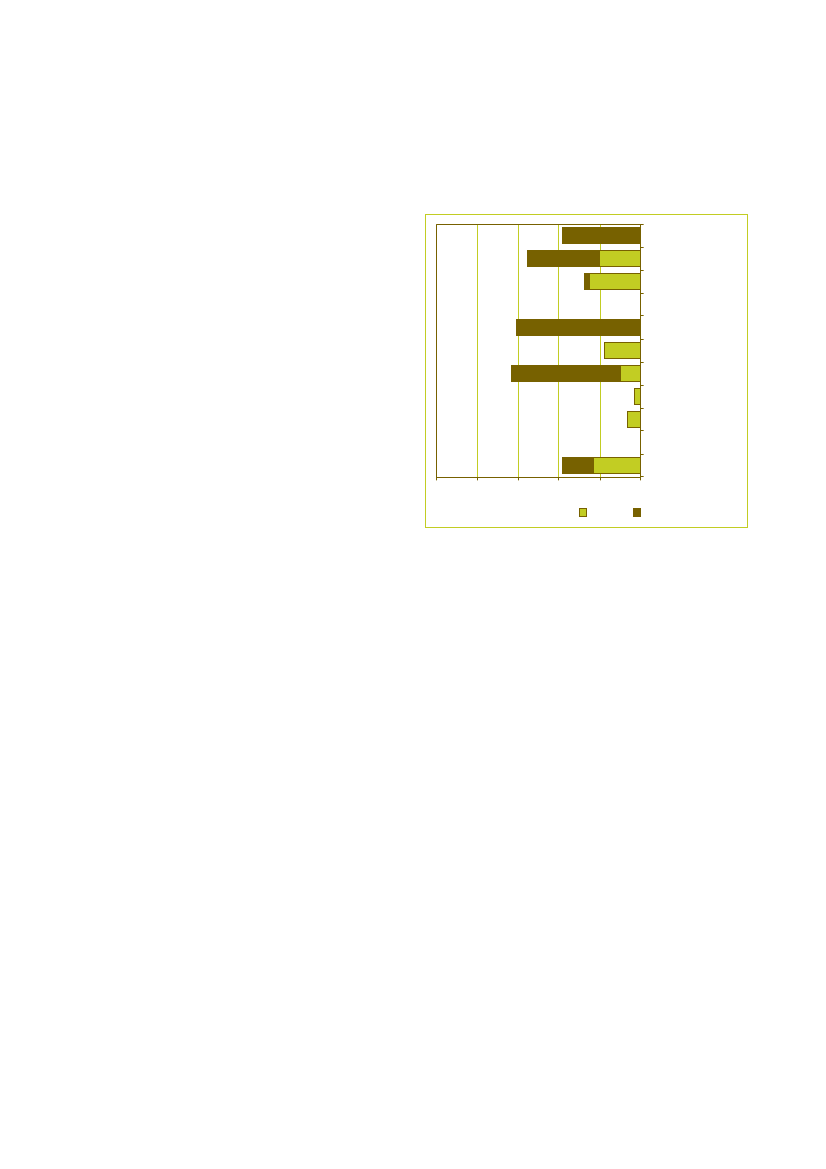

3.4

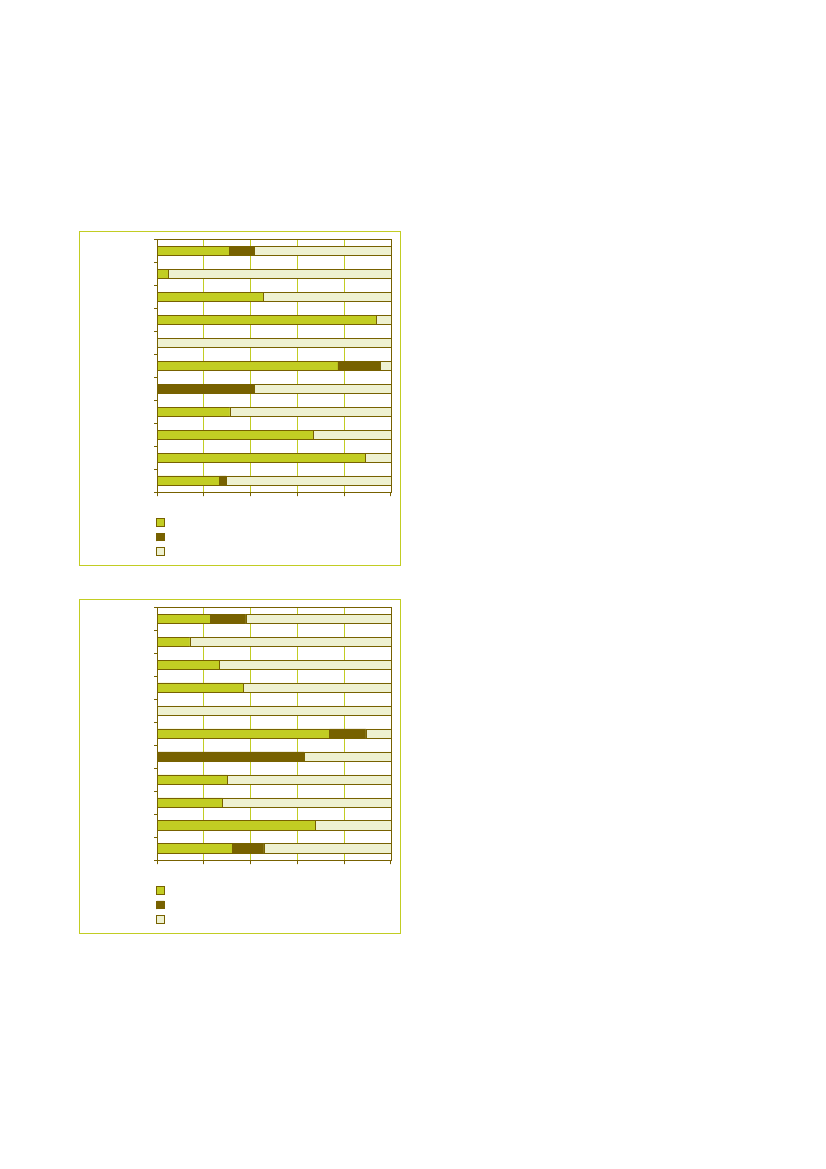

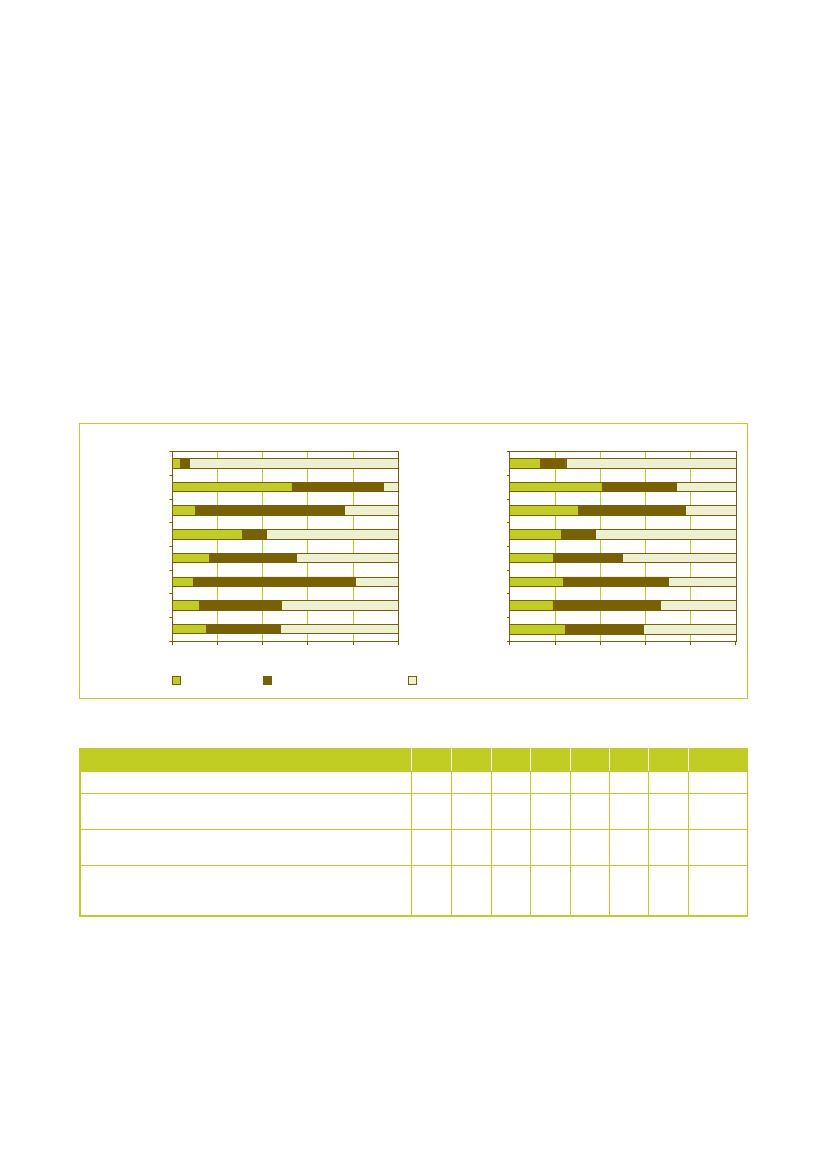

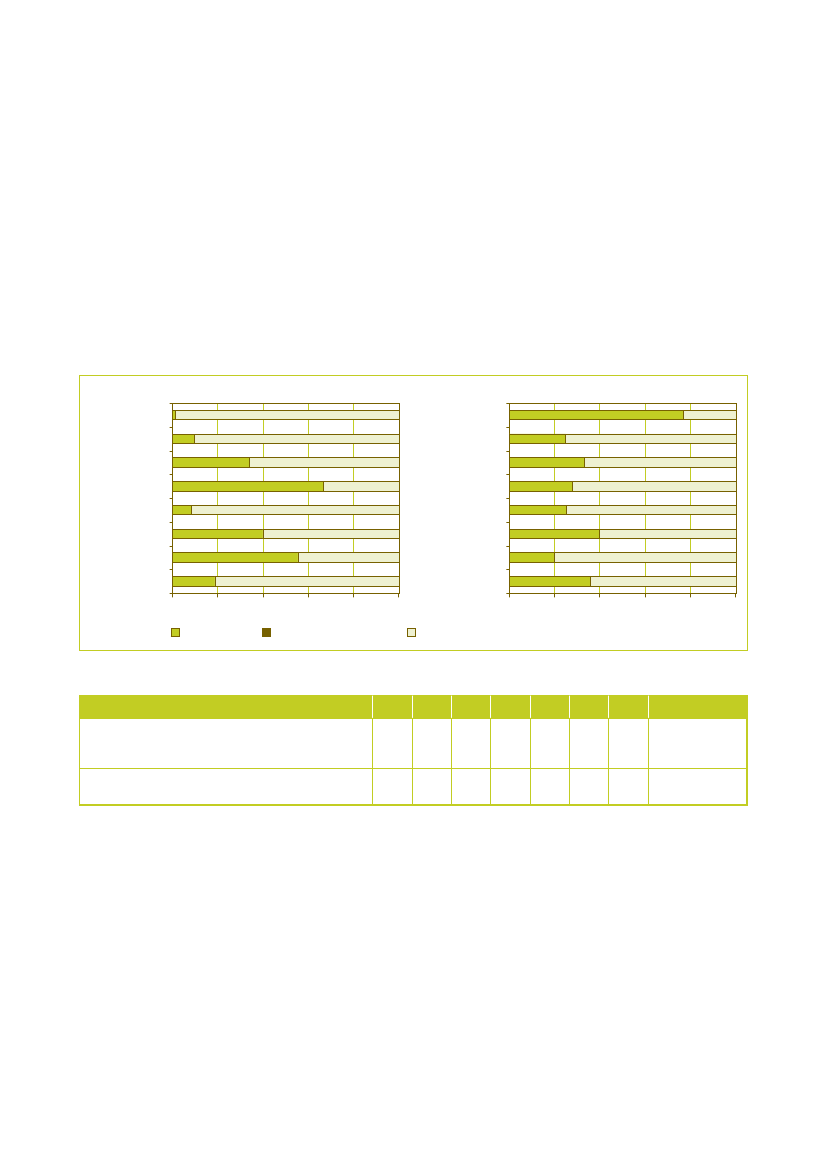

FinlandFinland’s average results for indicator 1 show 43% greenpurchasing, which is divided in 35% core level of GPPand 8% comprehensive level of GPP. The average resultsfor indicator 2 are 39% core level of GPP, 11%comprehensive level of GPP (total green purchases are50%) and 50% non-green level of GPP.The results of Finland show high scores on the productgroups cleaning, office IT and furniture. 66% of the totalamount of contracts for cleaning is comprehensive level(indicator 1). 78% of the contracts for office IT are oncore level of GPP (indicator 2).There are also a couple of product groups that show lowscores of GPP: catering (4% core level for indicator 2),gardening (0% green for indicator 2) and clothing (8%core level on indicator 2).

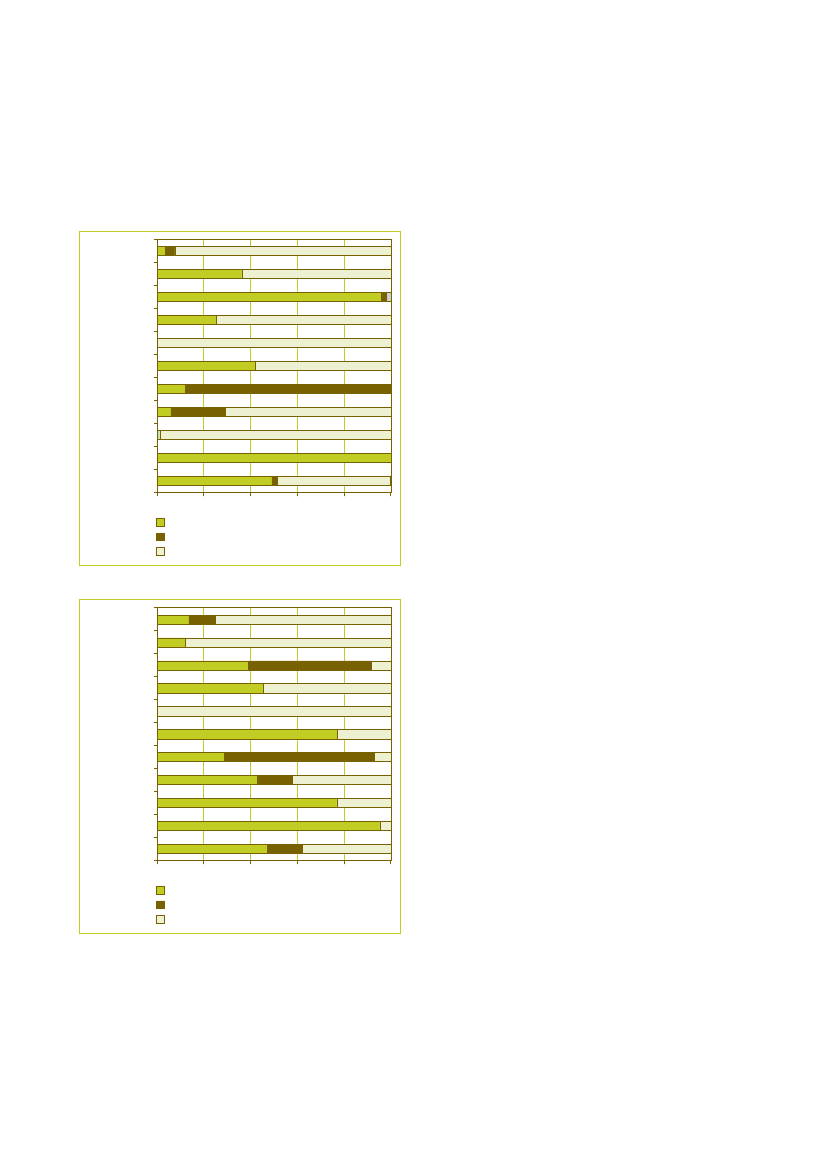

Figure 3.9: Overall scores Finland on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Figure 3.10: Overall scores Finland on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Collection of statistical information on Green Public Procurement in the EU

31

3.5

GermanyGermany’s average results for indicator 1 show 30% ofgreen purchasing (27% core level of GPP and 3%comprehensive level of GPP) and 70% non-green level ofGPP. The average results for indicator 2 are that 46% ofthe contracts can be considered as green (32% corelevel of GPP and 14% comprehensive level of GPP) and54% can be considered as having a non-green level ofGPP.The results of Germany show a high level of GPP foroffice IT (96% green for indicator 1) and furniture (89%core level for indicator 1). The results show an average orlower score of GPP for the product groups construction(5% core level on indicator 1), gardening (0% green onindicator 1) and clothing (31% core level on indicator 1).Germany’s results for catering show again howmeasuring levels of GPP by procurement value leads todifferent results compared to measuring by the number ofcontracts. Germany scores 94% core level for indicator 1and 37% for indicator 2.

Figure 3.11: Overall scores Germany on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Figure 3.12: Overall scores Germany on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

* Germany’s results for construction and gardening might beskewed because of low response

32

PricewaterhouseCoopers

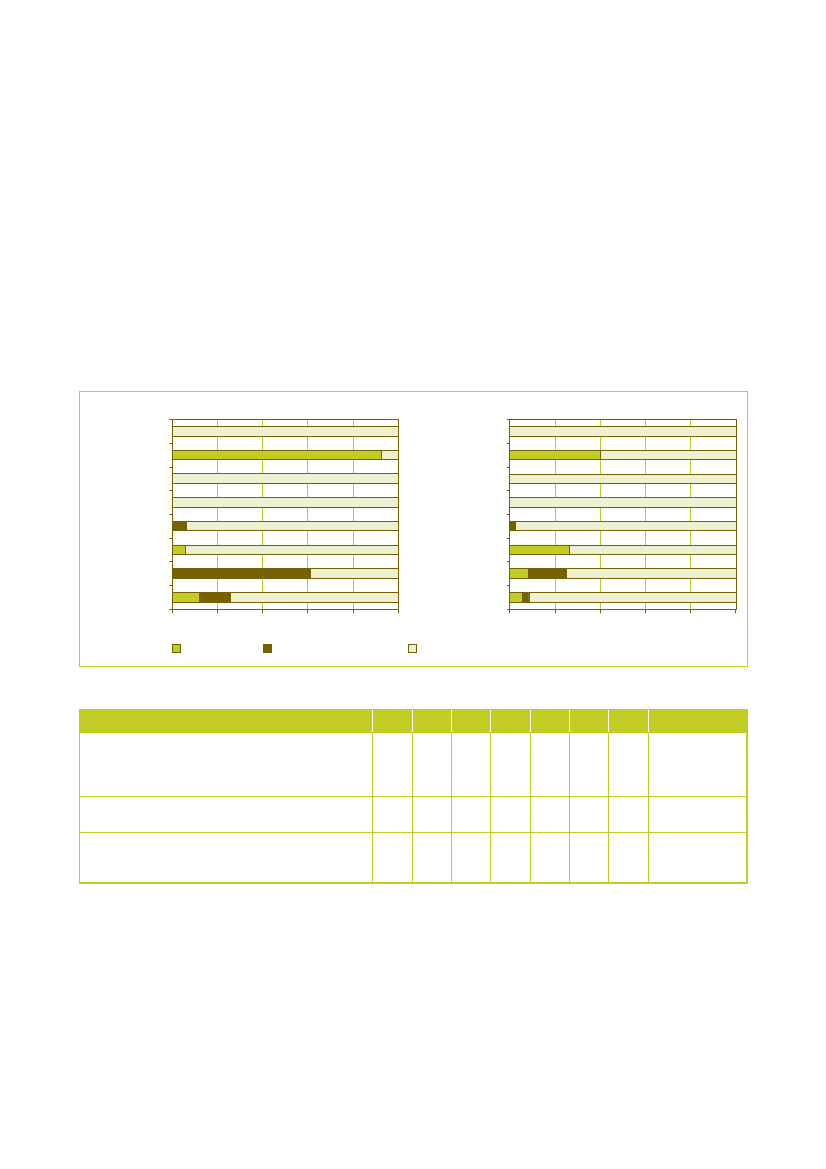

3.6

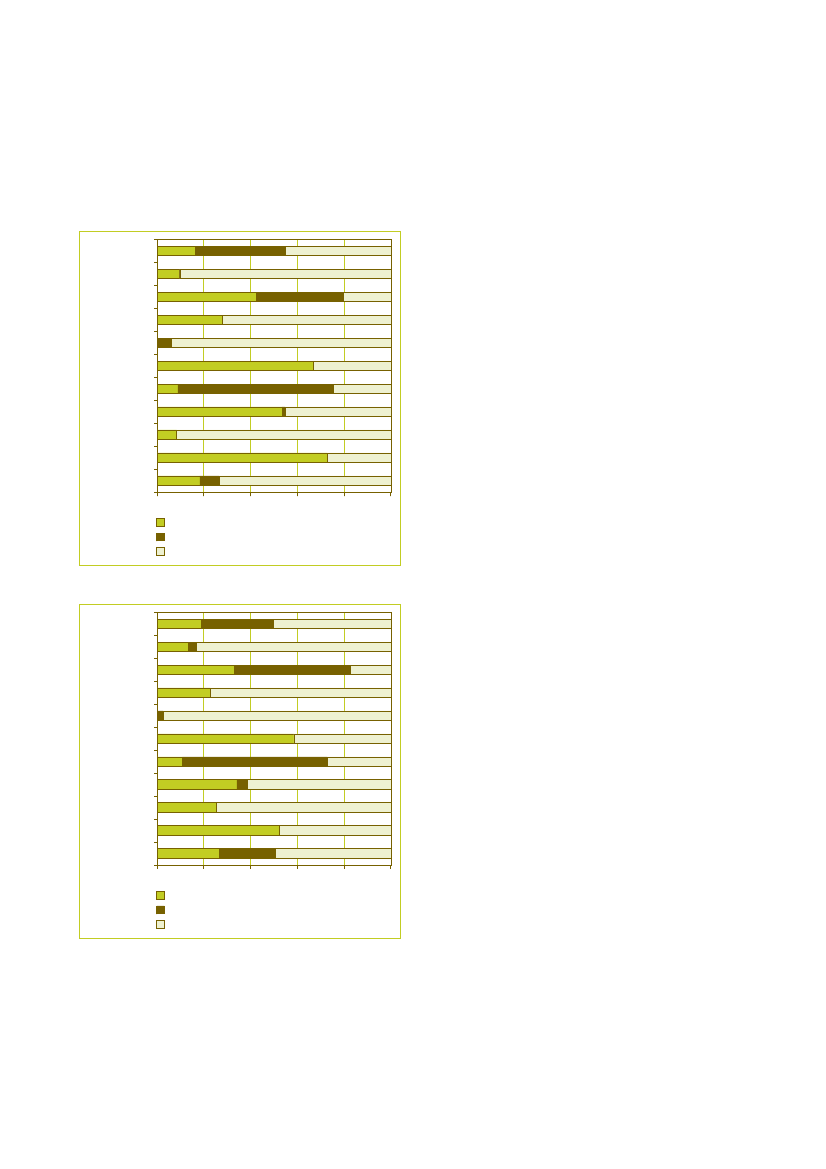

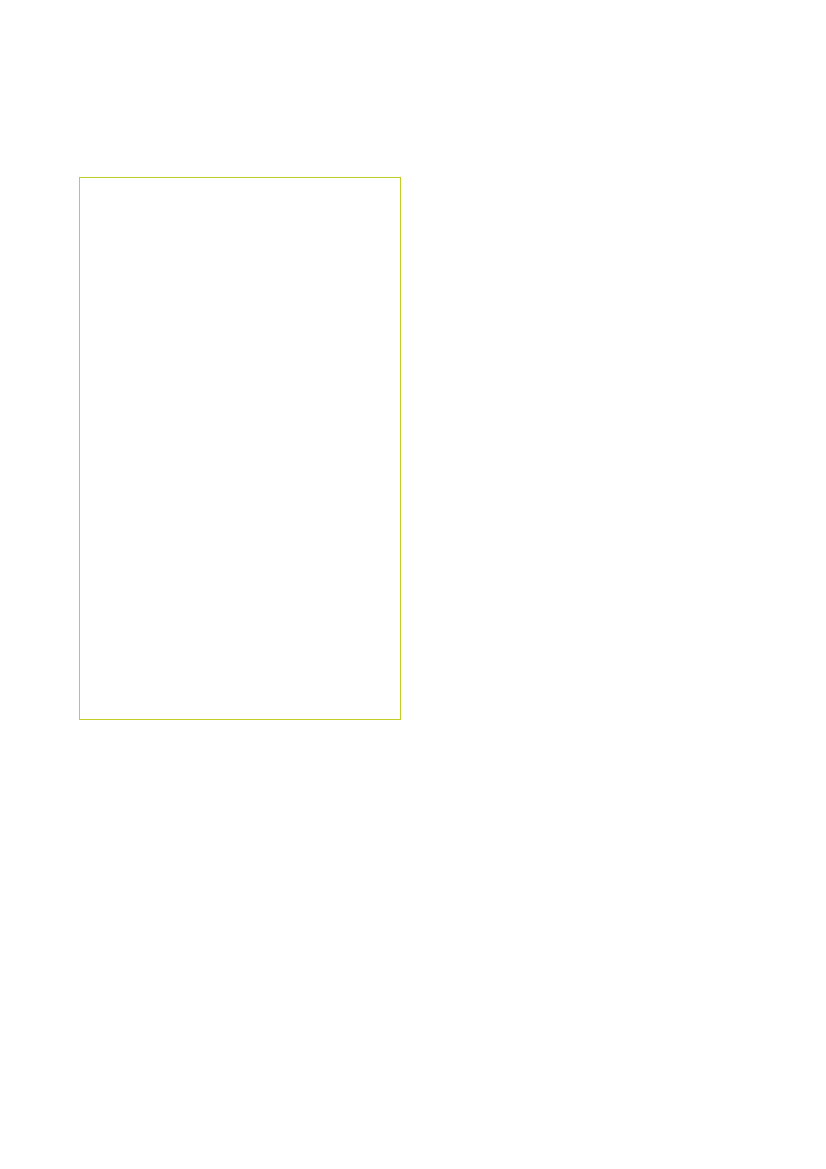

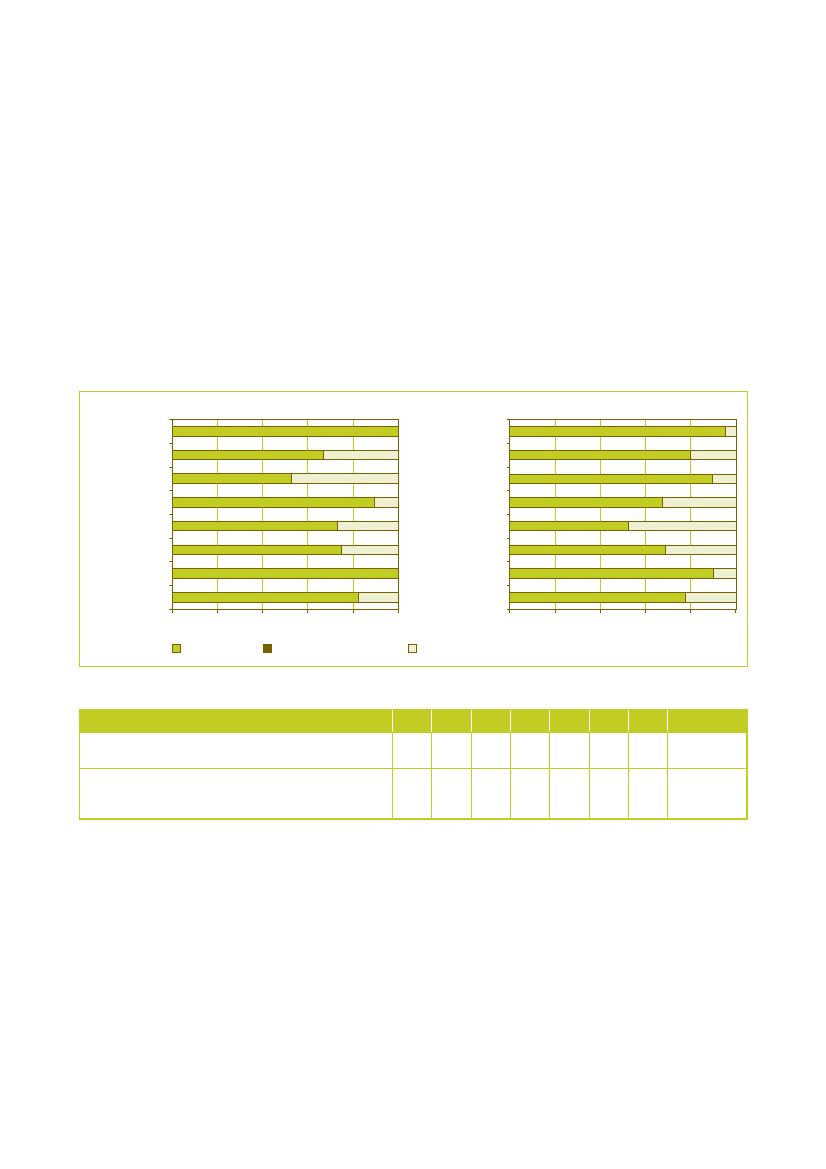

The NetherlandsThe average results of the Netherlands for indicator 1show 18% core level of GPP and 8% comprehensivelevel of GPP which results in a total percentage of greenprocurement of 27%. The average results for indicator 2are 50% green purchasing (27% core level of GPP and24% comprehensive level of GPP) and thus also 50% ofnon-green purchases.The results of the Netherlands show a number of highscores on the comprehensive levels of GPP: 39% forcleaning (indicator 1), 50% for electricity (indicator 2),66% for paper (indicator 1). There are also some Dutchresults that show average or low scores: 10% core levelGPP for construction (indicator 1), 23% core level GPPfor catering (indicator 2), 3% comprehensive level GPPon gardening (indicator 2) and 8% core level GPP fortransport (indicator 1).0%20%40%60%80% 100%

Figure 3.13: Overall scores The Netherlands on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage

Core greenComprehensive greenNon green

Figure 3.14: Overall scores The Netherlands on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Collection of statistical information on Green Public Procurement in the EU

33

3.7

SwedenSweden’s average results for indicator 1 show 28% corelevel of GPP and 22% comprehensive level of GPP whichsums up to 49% of green purchases. Hence, 51% of theprocurement value can be considered as beingnon-green. The average results for indicator 2 are 61%green contracts (38% core level of GPP and 23%comprehensive level of GPP) and 39% non-greencontracts.Sweden’s results show a couple of high scores: cleaning(81% green level of GPP for indicator 1), electricity (76%green level of GPP for indicator 1), office IT (90% greenlevel of GPP for indicator 1), paper (77% green level ofGPP for indicator 1) and furniture (75% green level ofGPP for indicator 1).Sweden’s results show significantly lower scores for theproduct groups construction (33% green level of GPP forindicator 1), catering (10% green level of GPP forindicator 1), gardening (6% green level of GPP forindicator 1) and clothing (20% green level of GPP forindicator 1).

Figure 3.15: Overall scores Sweden on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Figure 3.16: Overall scores Sweden on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

34

PricewaterhouseCoopers

3.8

United KingdomUnited Kingdom’s average results for indicator 1 showtotal green purchases of 75% (33% core level of GPPand 41% comprehensive level of GPP) and 25% ofnon-green purchases. The average results for indicator 2are 47% core level of GPP and 12% comprehensive levelof GPP, which sums up to 59% green contracts. Hence41% of the contracts can be considered as beingnon-green.The results of the United Kingdom vary widely on thedifferent product groups. In six out of ten product groupsthe green level of GPP for indicator 1 (core andcomprehensive level combined) exceeds 60% green levelof GPP (from 61% for gardening and 63% for catering to77% for construction and 100% for furniture). The otherfour product groups score from as high as 59% onelectricity to as low as 4% on clothing.0%20%40%60%80% 100%

Figure 3.17: Overall scores United Kingdom on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage

Core greenComprehensive greenNon green

Figure 3.18: Overall scores United Kingdom on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureAverage0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Collection of statistical information on Green Public Procurement in the EU

35

Concerning construction in the UK, there are twointeresting observations: (1) the level of GPP forconstruction is high compared to other countries and(2) the level of GPP differs a lot between indicator 1and indicator 2. This behaviour is the result of the factthat one respondent in the UK indicated to have spenta huge amount of money on construction, usingcomprehensive criteria. The figures have been verifiedwith the organisation, which turned out to haveembarked a major capital rebuild programme. As aresult of the new buildings in the year of our study, theorganisation spent an substantial amount of money onvarious construction projects.This case is a good example of the differencebetween indicator 1 (based on procurement value)and indicator 2 (based on the number of contracts).From an environmental point of view, indicator 1makes most sense: a huge building project naturallyhas a huge environmental impact. Therefore, if greencriteria are applied, this should be reflected in theoverall figures. On the other hand, because of this oneproject, it might seem that the UK is already verymuch ahead concerning GPP, while this may only bebased on 1 organisation distorting the figure. For thisreason, indicator 2 is necessary as a complementaryindicator.In conclusion, both indicators are equally important toindicate the level of GPP in a certain country. Indicator1 is more relevant from an environmental point ofview, while indicator 2 is more appropriate when oneis interested in the general implementation of GPP in acountry (the change in mentality of public purchasers).

36

PricewaterhouseCoopers

4Green Public

Procurement perproduct group

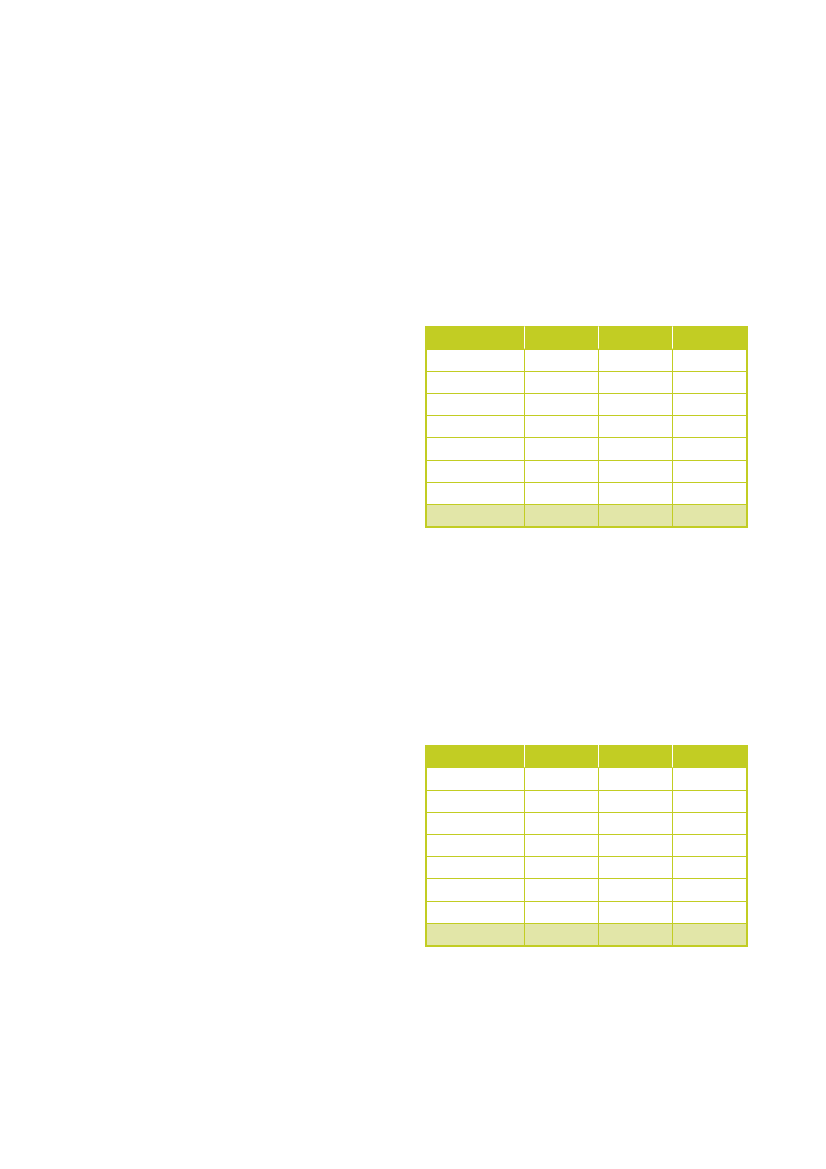

Chapter 3 presented an overall picture of thequantitative levels of Green Public Procurementper country. The current chapter provides somemore detailed information per product group.For each product group, we compare the resultsof the seven Member States (indicators 1 and 2).Furthermore, we report how often (%)respondents said to have used a certain greencriterion in their procurement contracts. Thesecriteria are linked to a core or comprehensivelevel of GPP. A respondent complying with allcore criteria within a product group is said tohave a core level of GPP. If, in addition, therespondent complies with the comprehensivecriteria, he or she attains a comprehensive levelof GPP. This chapter shows to what extent therespondents comply with the green criteria.

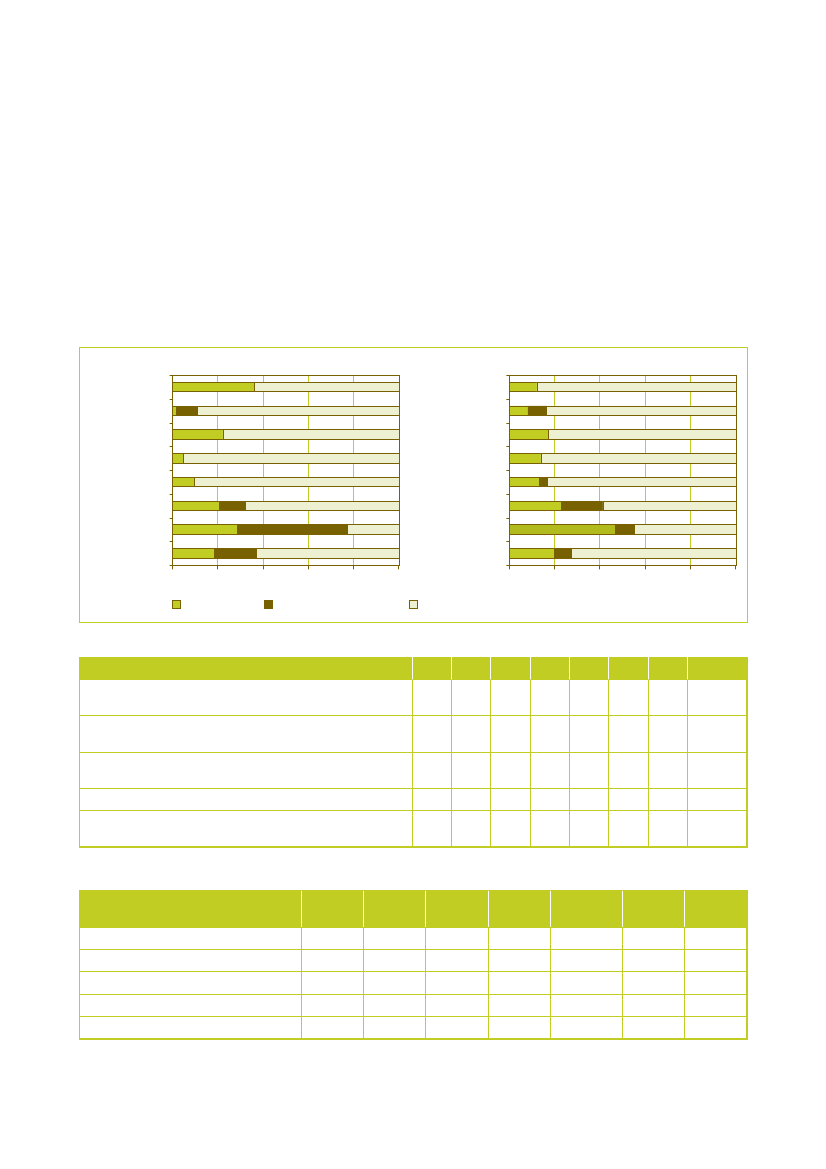

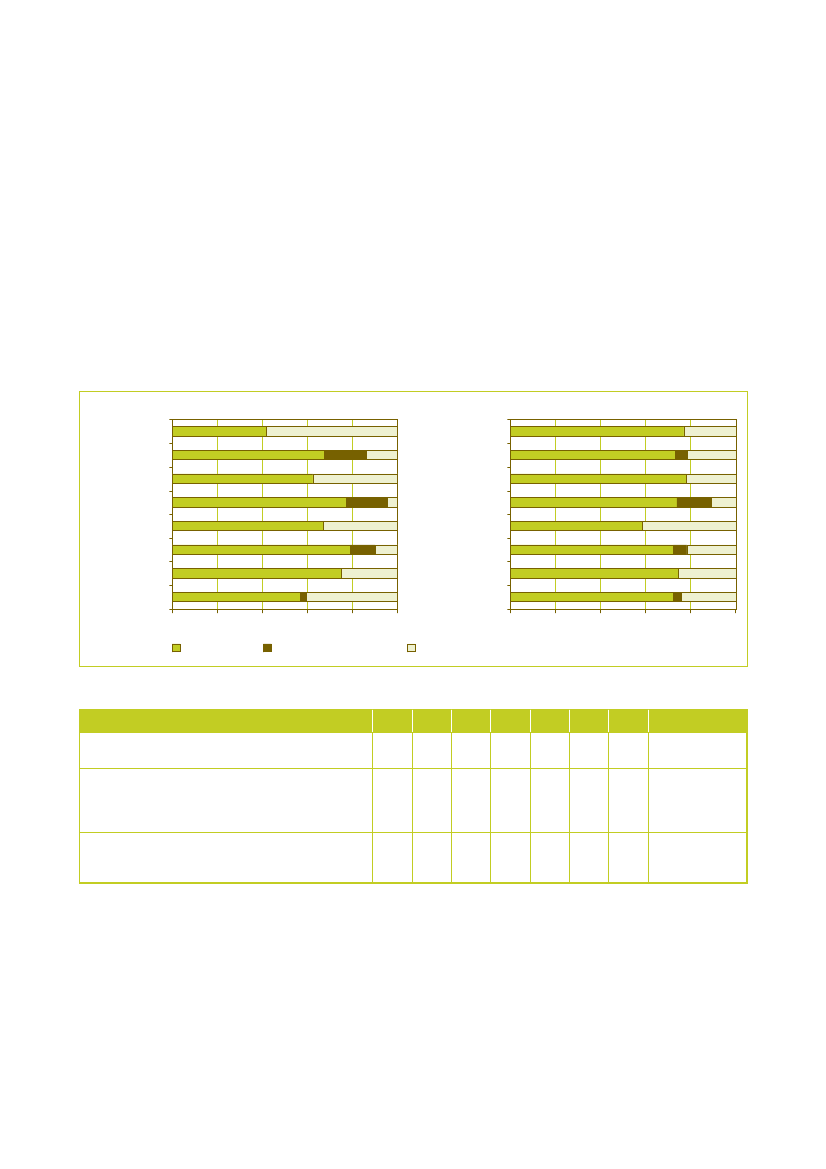

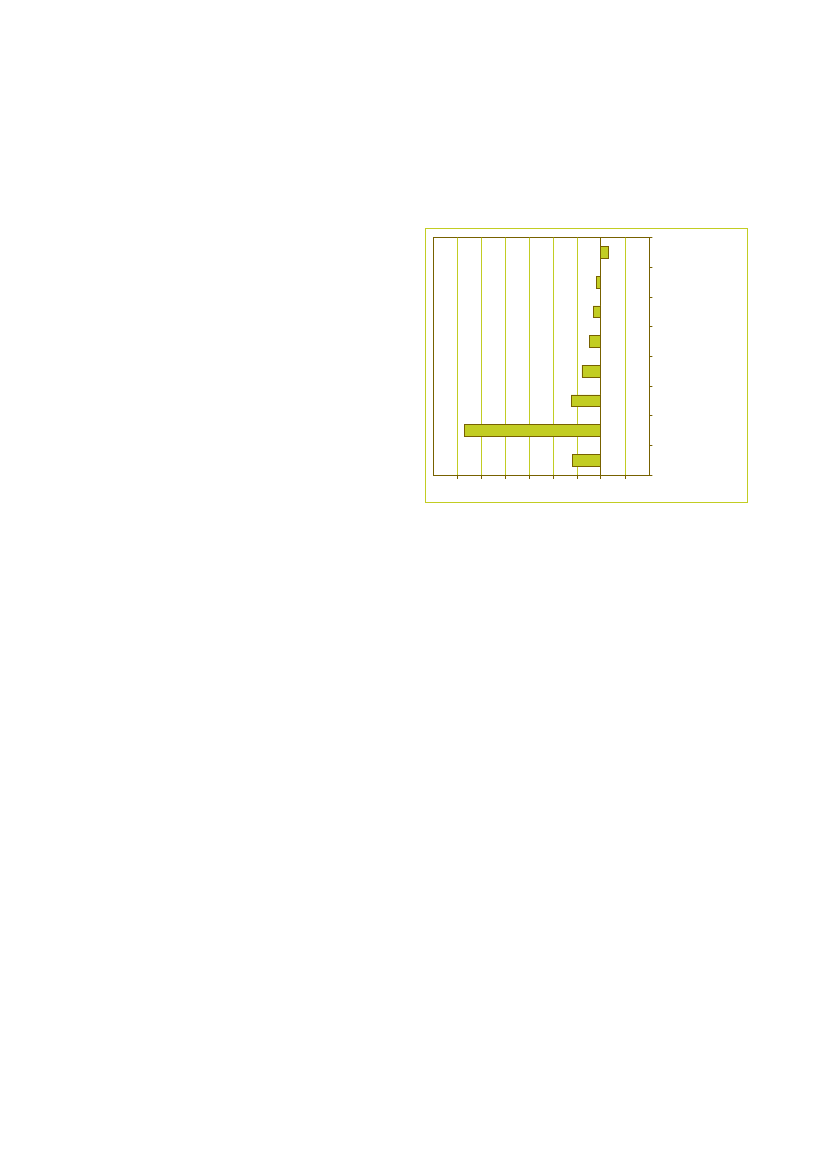

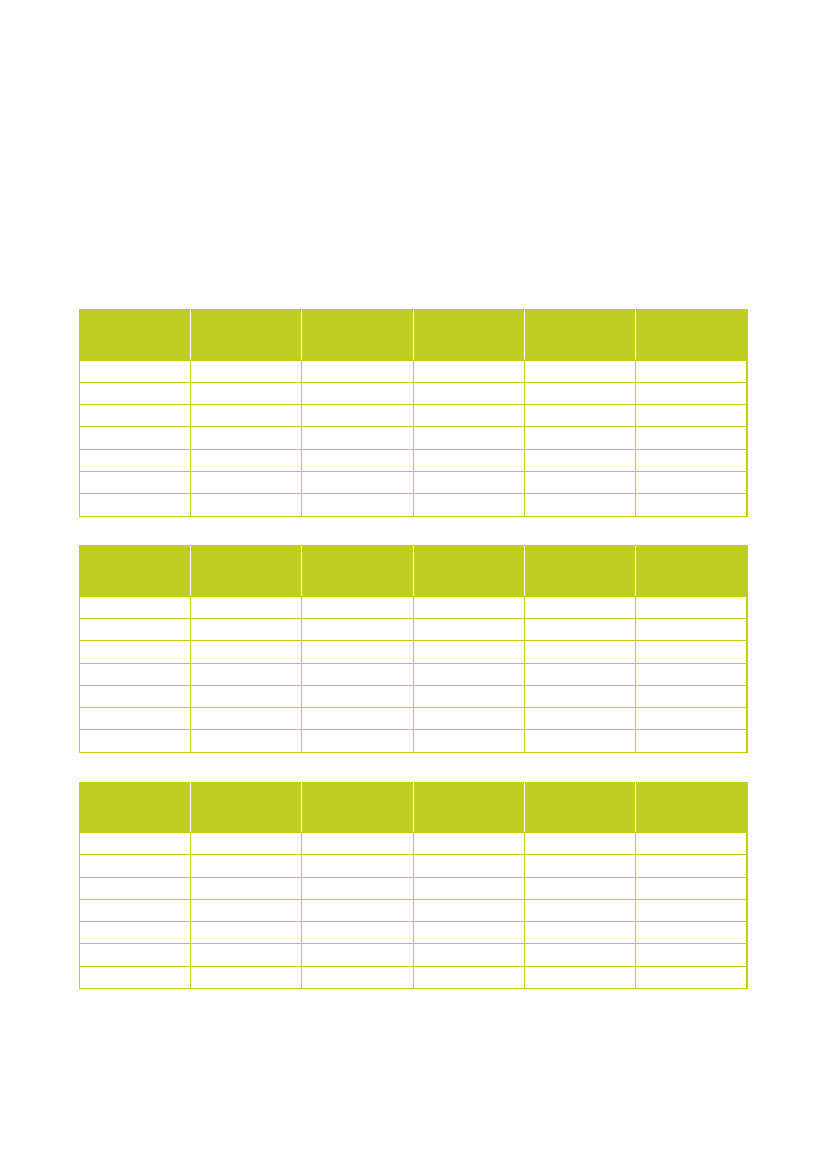

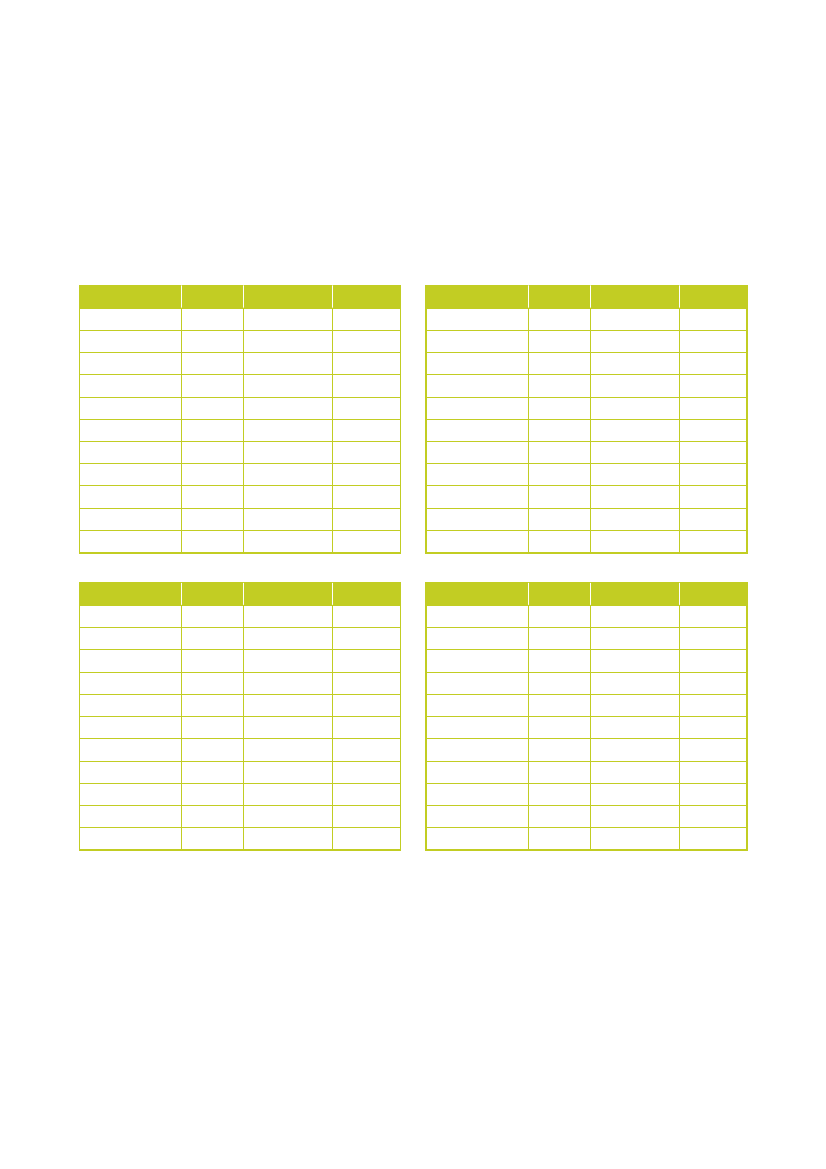

Figure 4.1: Overall scores per product group on indicator 1CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurniture0%20%40%60%80% 100%

Core greenComprehensive greenNon green

The results for indicators 1 and 2 basically follow from the‘score’ (core green, comprehensive green or non-green)of a respondent on a product group. For indicator 1,these scores are multiplied with the correspondingvolume spent by the respondent. For indicator 2, thescores are multiplied with the number of organisations a6respondent purchases on behalf of (1 or higher) .

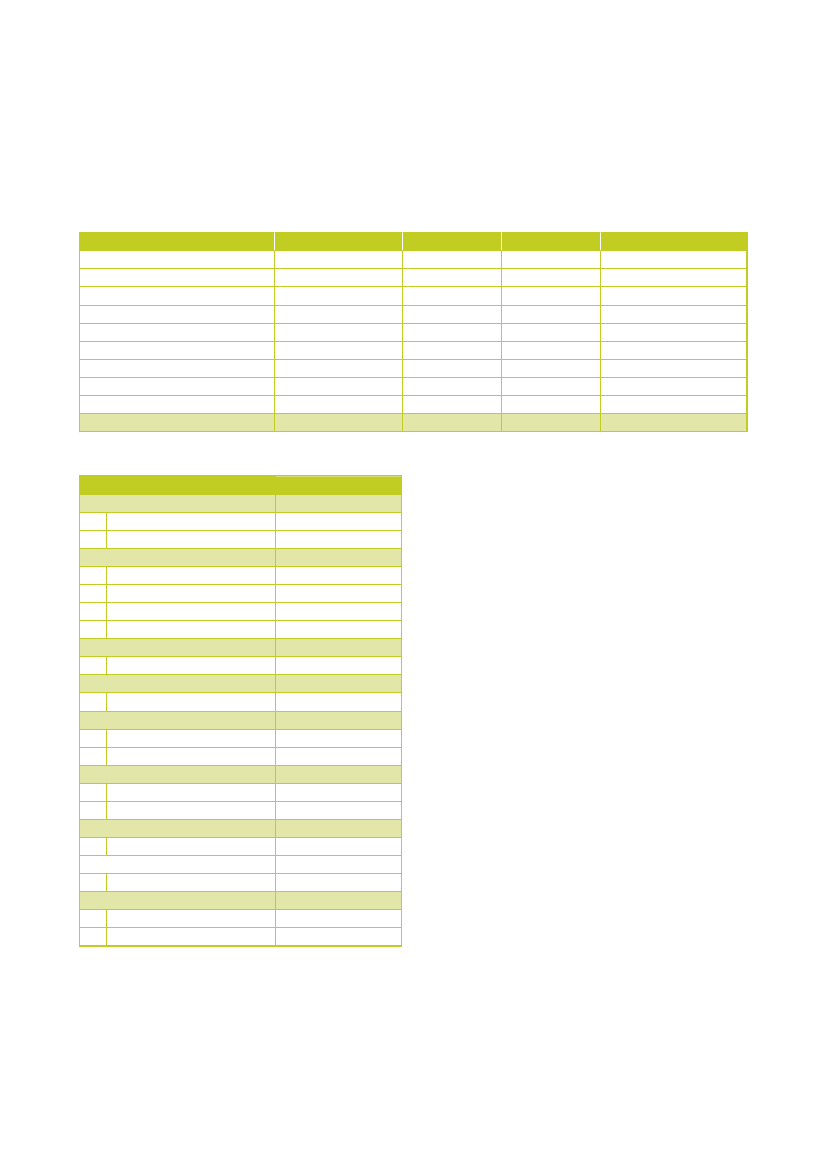

Table 4.1: Overall scores per product group on indicator 1Indicator 1CleaningConstructionCore green15%19%63%43%12%57%5%40%19%82%Comprehensivegreen33%18%17%0%14%3%72%7%0%0%Non-green52%63%20%57%74%41%23%53%81%18%

4.1

Summary

ElectricityCatering

The figures and tables below show that the levels of GPPdiffer widely between the ten product groups (weightedaverage on the seven Member States). Electricity, officeIT and furniture attaining the highest scores; productgroups construction, gardening and transport the lowest.Within product groups cleaning and paper, the levels ofcompliance with comprehensive green criteria are highestamong all product groups. Differences in the level of GPPare caused by differences in scores on the underlyingcore and comprehensive green criteria. We will examinethis within the remaining part of this chapter.

GardeningOffice ITPaperClothingTransportFurniture

6

For more details on the computation of indicators 1 and 2, we refer to the separate report on methodologies.

Collection of statistical information on Green Public Procurement in the EU

39

Figure 4.2: Overall scores per product group on indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurniture0%20%40%60%80% 100%

Core greenComprehensive greenNon green

Table 4.2: Overall scores per product group on indicator 2Indicator 2CleaningConstructionElectricityCateringGardeningOffice ITPaperClothingTransportFurnitureCore green25%20%43%31%6%72%7%29%36%77%Comprehensive Non-greengreen35%7%26%0%3%4%50%10%0%0%41%72%31%69%92%24%44%61%64%23%

40

PricewaterhouseCoopers

4.2

Cleaning products & services

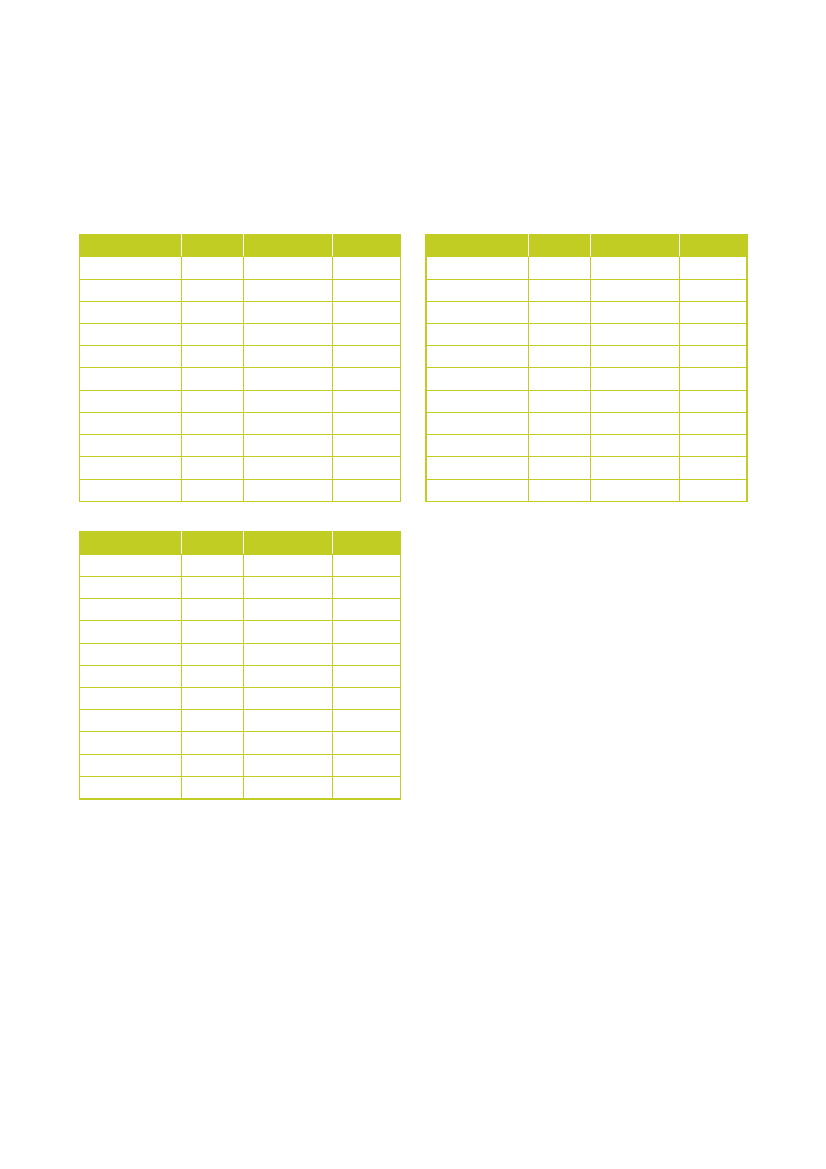

For this product group 351 out of 601 respondentsconcluded a procurement contract in 2006 or 2007.Variation in the level of GPP between the member states7is high . As for Austria and Germany, levels of GPP arelow, due to the relatively low score on the sole core greencriterion (on the avoidance of hazardous substances). Incase the contracted services comply with an appropriateecolabel, such as the European Ecolabel, the contract is8identified to be core green too . Within most MemberStates, scores on the two comprehensive green criteriaare remarkably high (see Table 4.3).Figure 4.3: Overall scores product group cleaningIndicator 1 (% of proc. Value)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%20%Core green40%60%80% 100%

In addition, we analysed the correlation between the GPPlevel of a respondent and the way he has implementedGreen Public Procurement within his organisation (seeChapter 2). For some product groups, this leads to9significant results . For the product group cleaning forexample, the GPP level is significantly higher withinorganisations that have an environmental component intheir procurement policy. 62% of the organisationshaving such a policy attains a core or comprehensivelevel of GPP. With regard to the other organisations, only41% attain those levels.Hence: for this product group, implementation efforts payoff.

Indicator 2 (% of # contracts)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%Non green20%40%60%80% 100%

Comprehensive green

Table 4.3: Percentage of organisations complying with a green criterion for product group cleaningCriterionDoes the contractor avoid the use of hazardous substances?Are all cleaning staff employed in carrying out the serviceregularly trained for their various tasks?Does the contractor use reusable microfibre cloths and/or applydry-cleaning techniques for linoleum flooring where appropriate?Is the acquired product or service being certified by an ecolabelor does it comply with underlying criteria of an ecolabel?AU35%52%60%42%DK55%87%67%80%FIN48%81%66%41%GER39%47%48%42%NL44%79%66%48%SWE66%79%80%61%UK56%95%56%39%GPP-levelCoreCompre-hensiveCompre-hensiveCore (forcertainecolabels)

78

9

‘Total’ in the figures below refers to the weighted average over all countries.The tables in this chapter contain the percentages of all respondents who indicated that their product or service was certified by an ecolabel or didcomply with the underlying criteria. It must be noted, that a ‘yes’-answer to this question does not automatically lead to a green level of publicprocurement. This depends on the actual ecolabel or applied criteria.Based on a so-called Pearson Chi-Square statistical test. Only statistical significant results are presented in this report. This means that with highconfidence (95%), the found results are ‘real’ and not based on statistical chance.41

Collection of statistical information on Green Public Procurement in the EU

4.3

Construction

This explains the overall low level of GPP to aconsiderable extent.It appears that most buildings have been designed so asto reduce the energy consumption. What are theseenergy-saving measures that have been taken? The tablebelow shows that double glazing and insulation havebeen applied most frequently.

For this product group 188 out of 532 respondentsconcluded a procurement contract in 2006 or 2007. Formost Member States, the GPP levels are relatively low,except for the UK. A closer look at the percentages percriterion, shows us that the majority of the constructedbuildings are not guaranteed free of hazardous materials.Figure 4.4: Overall scores product group constructionIndicator 1 (% of proc. Value)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%20%Core green40%60%80% 100%

Indicator 2 (% of # contracts)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%Non green20%40%60%80% 100%

Comprehensive green

Table 4.4: Percentage of organisations complying with a green criterion for product group constructionCriterionHas the building been designed and built to reduce the amountof energy consumed in use?Are all sanitary and kitchen water facilities being equipped withthe latest water-saving technologies available on the market?Has the contracted party declared that the no hazardousmaterials/substances have been used in the construction?Does all timber used in the building come from legal sources?Has a minimum of the energy demand been defined that has tobe provided by localised renewable energy sources?AU85%40%33%44%13%DK68%51%33%27%15%FIN92%48%17%75%0%GER100%63%42%56%28%NL91%44%28%60%15%SWE98%59%37%65%12%UK100%55%35%89%22%GPP-levelCoreCoreCoreCoreCompre-hensive

Table 4.5: Energy saving measures taken in product group construction (% of organisations)What are these energy-saving measures(multiple options)?Natural ventilationDouble glazingInsulationDesign to make best use of natural lightOtherAustria32%56%68%44%12%Denmark39%70%70%51%21%Finland0%39%55%13%23%Germany58%86%86%86%28%TheNetherlands30%67%63%40%23%Sweden24%67%71%37%31%UnitedKingdom75%90%90%75%40%

42

PricewaterhouseCoopers

4.4

ElectricityFor some countries, large differences can be seen in thelevels of GPP based on the procurement value on the onehand (i.e. indicator 1), and based on the number ofcontracts on the other (indicator 2). For Austria, thisdifference is large in particular: comprehensive green ishigh on indicator 2, whereas core green is the dominantlevel on indicator 1. This is due to the fact, that in Austriaone governmental organisation has a very large contract.The contract that was concluded by this organisation,matches a core green level. This explains the highpercentage of core green public procurement onindicator 1. On indicator 2, the impact of this contract ismuch smaller.

For this product group 320 out of 551 respondentsconcluded a procurement contract in 2006 or 2007. Thecountry differences on the level of GPP are clearlyreflected in the scores on the separate green criteria.Austria and the Netherlands attain the highest levels ofGPP; within these countries a large majority of thegovernmental organisations procured electricity fromrenewable sources (for at least 50%).Based on a correlation analysis, it follows thatorganisations having an action plan for meeting goals ongreen procurement, attain significantly higher levels ofGPP. 75% of the organisations having such a plan, buysgreen, against 61% for the other organisations only.Figure 4.5: Overall scores product group electricityIndicator 1 (% of proc. Value)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%20%Core green40%60%80% 100%

Indicator 2 (% of # contracts)AustriaDenmarkFinlandGermanyNetherlandsSwedenUnited KingdomTotal0%Non green20%40%60%80% 100%

Comprehensive green

Table 4.6: Percentage of organisations complying with a green criterion for product group electricityCriterionDoes (part of) the supplied electricity comefrom renewable energy sources?Is the acquired product or service beingcertified by an ecolabel or does the product orservice meet its underlying criteria?AU88%DK49%FIN35%GER26%NL80%SWE62%UK66%GPP-levelCore (50-99%) orcomprehensive(100%)Core (for certainecolabels)

33%

4%

17%

7%

43%

46%

13%

Collection of statistical information on Green Public Procurement in the EU

43

4.5

Catering & foodLarge differences can be seen between organisations.For example, 46% of the organisations having anenvironmental component in their procurement policy,buys green catering, against 6% for other organisationsonly. Similar relations exist between organisations thathave an action plan for green procurement and theattained level of GPP.