Erhvervsudvalget 2008-09

ERU Alm.del Bilag 274

Offentligt

CHILE’S INVESTMENTCLIMATEMarch 2009

FOREIGN INVESTMENT COMMITTEEwww.foreigninvestment.cl

Chileaninvestmentattractiontrackrecord

Starting in 1990, foreign companies have invested overUS$ 80 billion in Chile, both in greenfield projects and inmergers and acquisitions. This is a significant amount for aneconomy with a GDP of US$ 183 billion in 2008.Currently, over three thousand companies from sixty countrieshave business operations in the country.

SnapshotoftheChileanEconomyPopulation:GDP (2008):Income per capita (PPP, 2007):Exchange rate (february 2009):Unemployment rate (2008, september):GDP growth (2007)Projected growth (2008):Projected growth (2009):Export of goods (2008):16.6 millonUS$ 183 billionUS$ 13,936 (FMI)1 US$ = 612 CLP7.2%5.1%3.5%2%US$ 70 billion

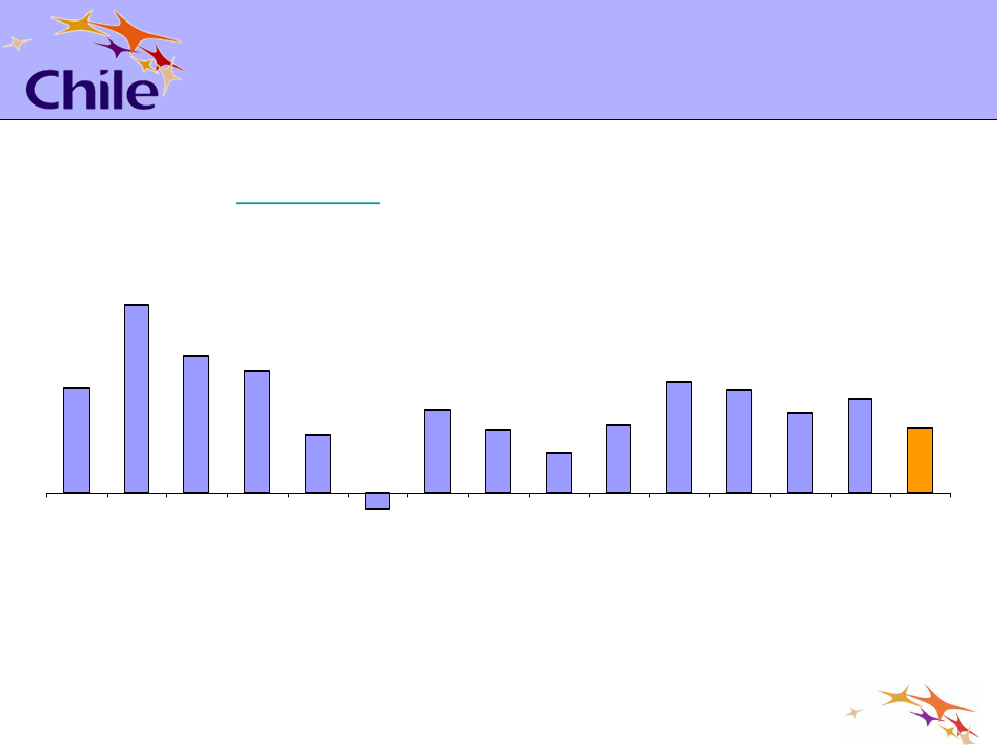

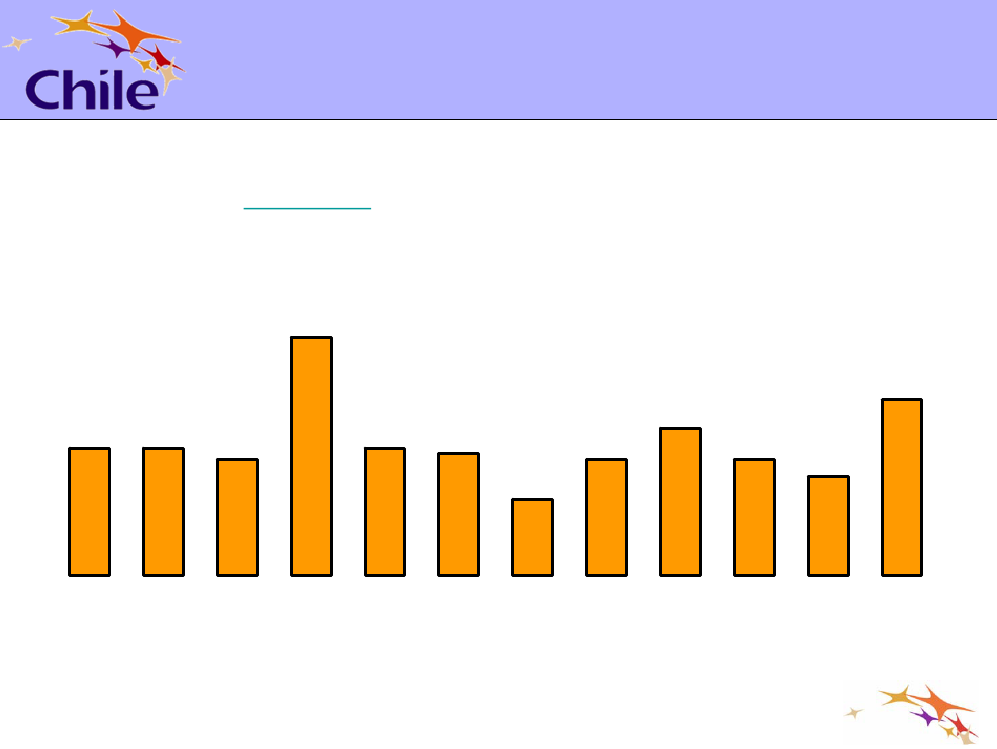

DynamicbusinessenvironmentGDP Growth in Chile (Real Annual Variation, %)Source: Central Bank (www.bcentral.cl) 1994-2008

10.27.45.74.53.23.42.23.7

6.6

6.0

5.64.3

5.13.5

1994

1995

1996

1997

1998

1999-0.8

2000

2001

2002

2003

2004

2005

2006

2007

2008(est.)

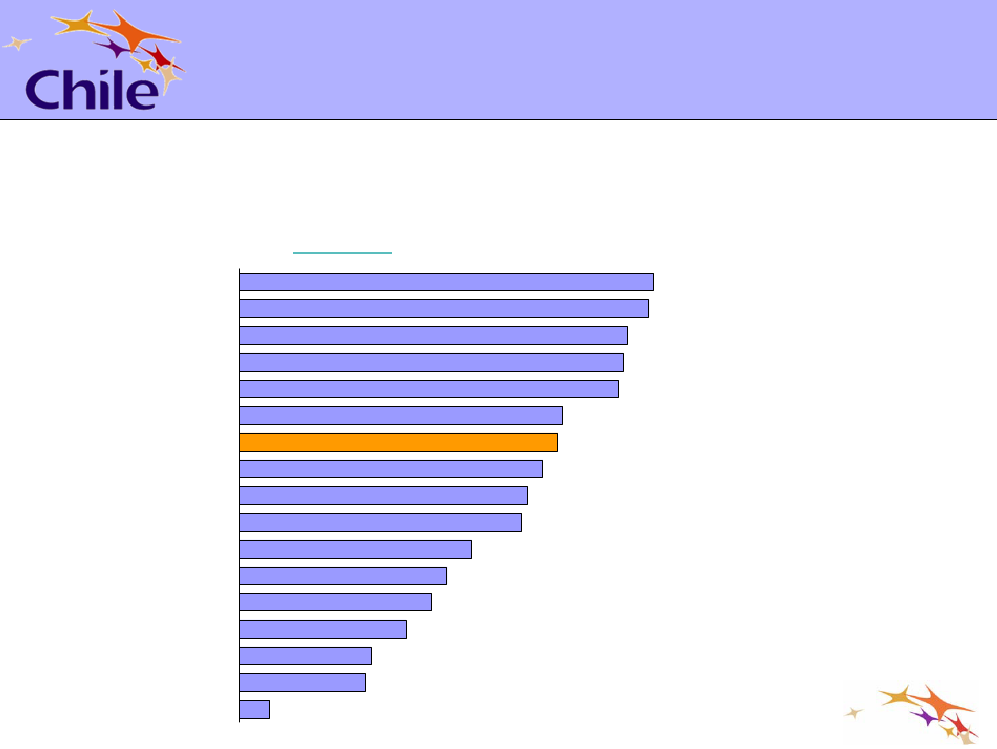

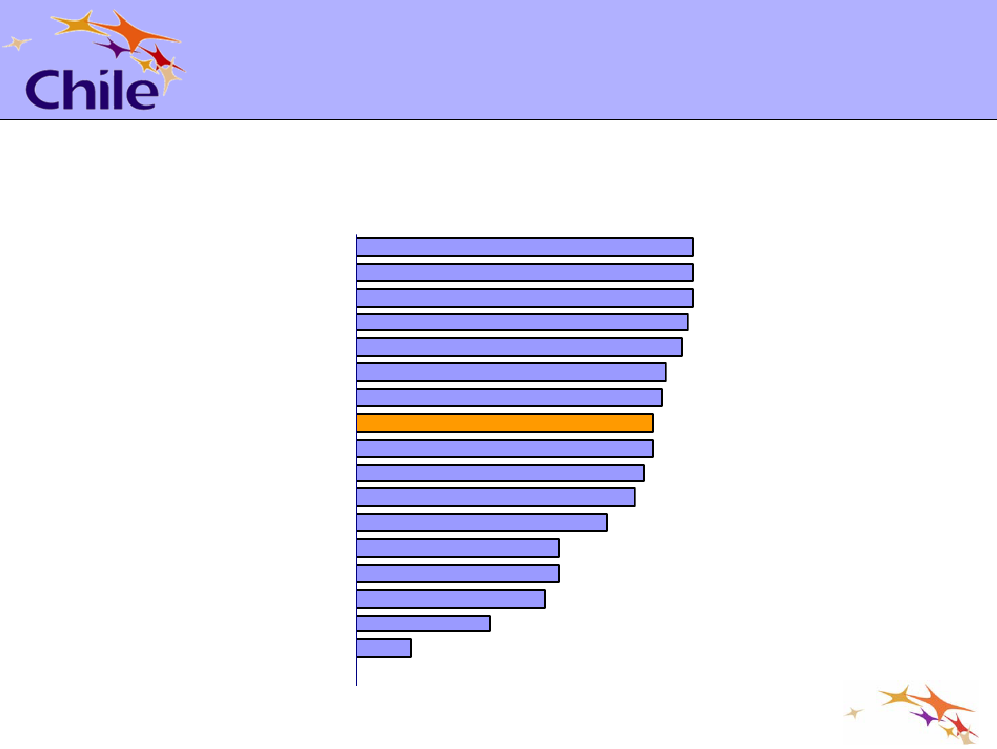

DynamicbusinessenvironmentBusiness Environment Rankings(Best Places to do Business in the Next Five Years,Selected Economies by Position)Source: Economist Intelligence Unit (www.eiu.com), 2006 - 2010DenmarkFinlandIrelandUnited KingdomUnited StatesTaiwanChileIsraelSouth KoreaCzech RepublicPolandMexicoBrazilChinaArgentinaIndiaVenezuela77575850424537192223262767812

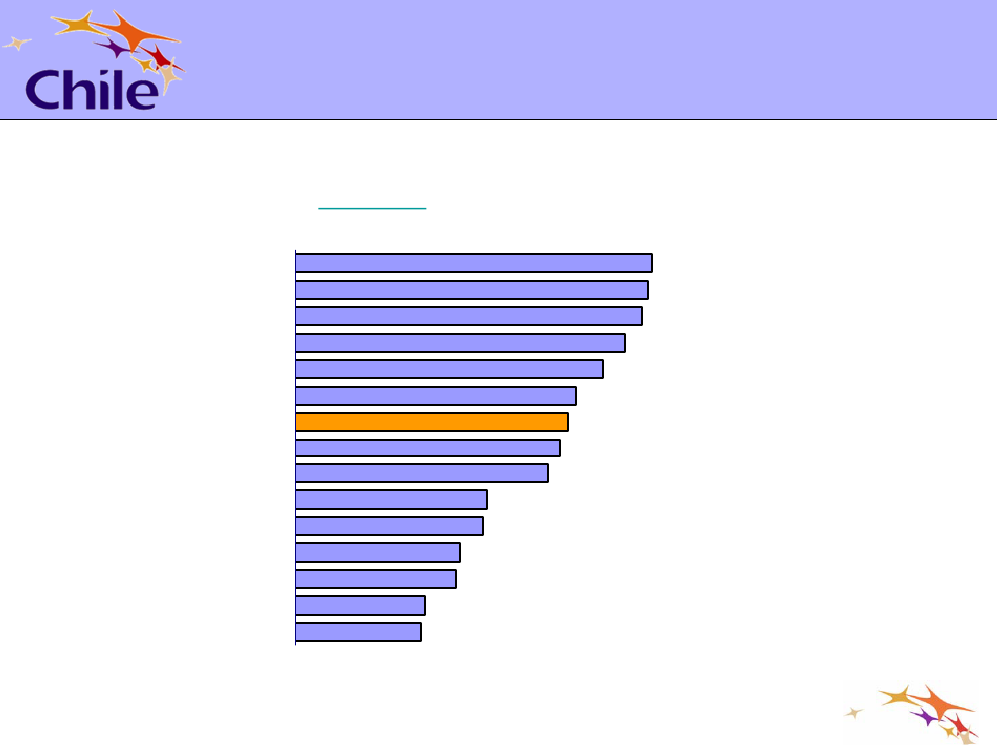

HighlevelsoftransparencyCorruption Perception Index(180 countries studied)Source: Transparency International (www.transparency.org) 2008

New ZealandDenmarkSwedenSingaporeNetherlandsUKUnited StatesChileUruguayPortugalCosta RicaChinaMexicoBrazilArgentinaEcuadorVenezuela

1114716182323283247727280109151

SuccessfulForeignInvestmenttrackrecordFDI as a % of GDP (Annual average 1996 – 2007: 6.7%)Source: Central Bank (www.bcentral.cl)

12,08,86,46,45,86,57,56,13,85,85,95,0

1996

1997 1998

1999 2000 2001 2002 2003 2004 2005 2006 2007

Includes DL600,ChaptersXIV and XIX

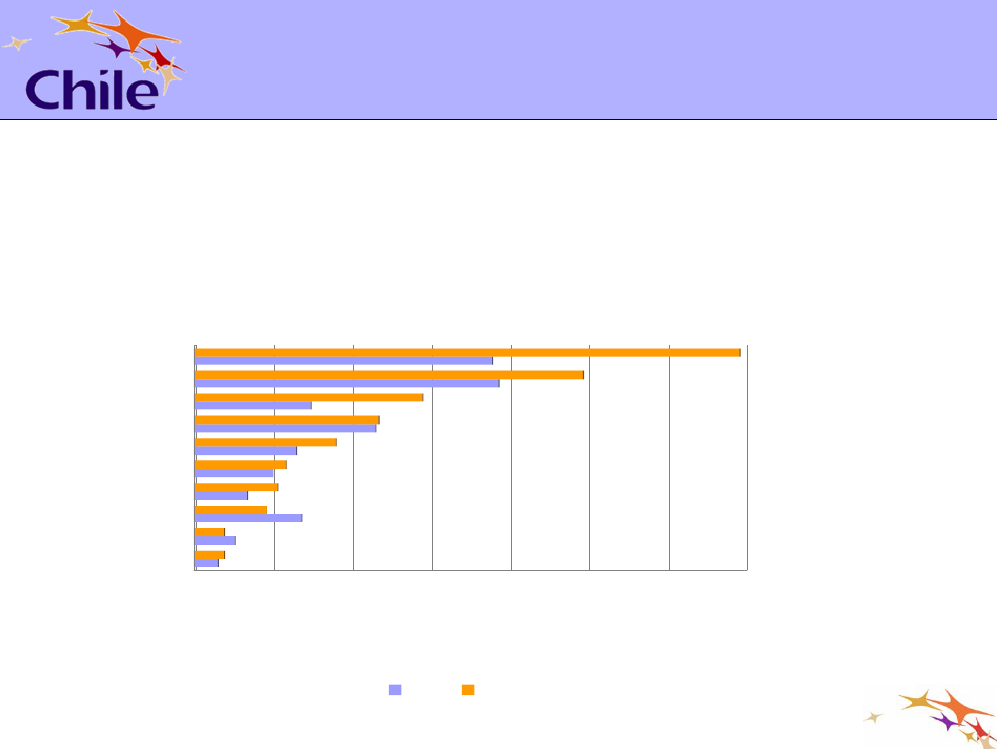

SuccessfulForeignInvestmenttrackrecordLatin America and Caribbean: FDI inflowsTen Most Successful Economies, 2006 – 2007(In billions of dollars)Source: “World Investment Report 2007”, UNCTAD (www.unctad.org)

BrasilMexicoChileVirgin IslandsColombiaArgentinaPeruIslas VirgenesPanamáCosta Rica0

5

10

15

20

25

30

35

2006

2007

SuccessfulForeignInvestmenttrackrecordWorld Investment Prospects to 2011Source: Economist Intelligence Unit (www.eiu.com)

DenmarkFinlandSingaporeUnitedIrelandFranceChileSpainSouth KoreaMexicoItalyCosta RicaBrazilChinaIndia

12371218202225394045465354

RegulationofInvestmentinChileI. Constitutional Framework, 1980-2005•Right to private property:Under the Constitution, all persons, including foreigners,are guaranteed the freedom to acquire ownership of all types of goods, bothtangible and intangible.•Economic freedom:Within the bounds of the legal norms regulating differenteconomic activities, the Constitution guarantees the right to undertake anyeconomic activity that does not contravene moral standards, public order or nationalsecurity (Art. 19 N� 21).•National treatment:The Constitution also guarantees that, on economic matters,foreign investors will receive the same, or not less favorable, treatment as localinvestors from the State and its agencies, and will not be subject to discrimination ofany type (Arts. 19 N� 2 CPE, 57 Civil, 9 and 10 DL 600).

RegulationofInvestmentinChileII. Legal Framework•Decree Law N� 600 (DL 600)Originally introduced in August 1974Ratified by Congress in March 1993 with minor modificationsDemonstrates the importance of a stable foreign investment policy that remains inplace over the long term.Chilean Central Bank's Compendium of Foreign Exchange Regulations(Chapter XIV)

•

ForeignInvestmentStatuteDecree Law N� 600Since DL 600 came into force in 1974, most foreign investorshave used this mechanism. By 2008, foreign directinvestment worth US$ 69 billion had been materializedthrough DL 600, representing 71% of total FDI in Chile duringthat period.

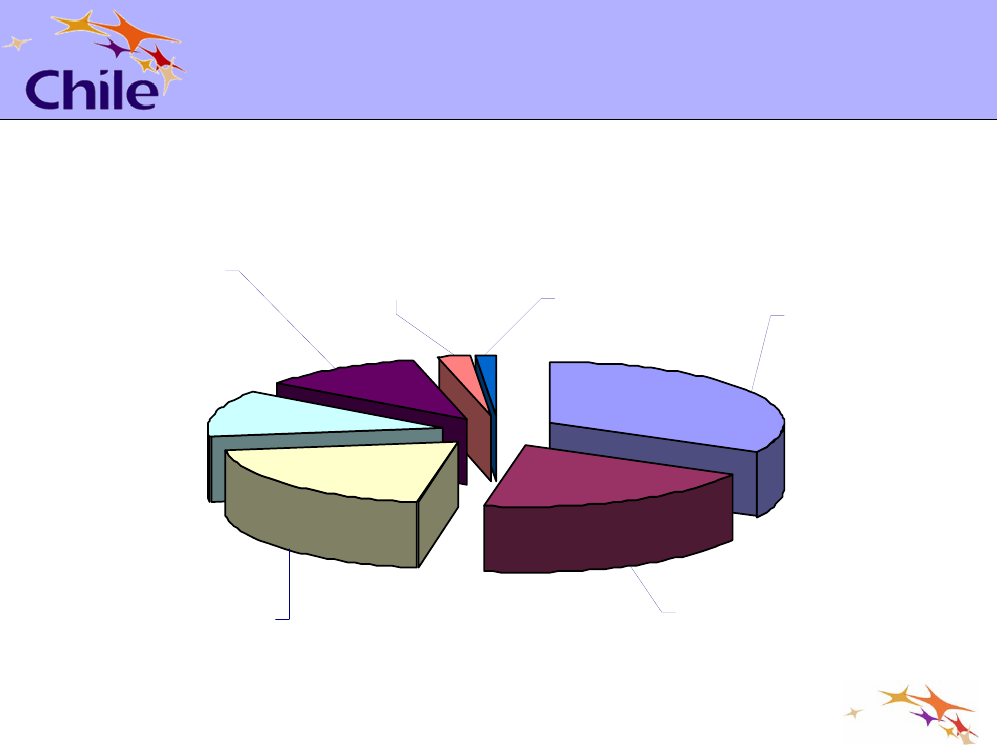

SuccessfulForeignInvestmenttrackrecordFDI under DL 600 by Economic Sector (US$ 69 billion)Source: Foreign Investment Committee (www.doingbusinessinchile.cl), 1974 – 2008Transport &communications11.3%

Construction 2.2%

Others1.5%

Mining32.7%

Industry12.3%

Services19.9%

Electricity, gas &w ater 20.0%

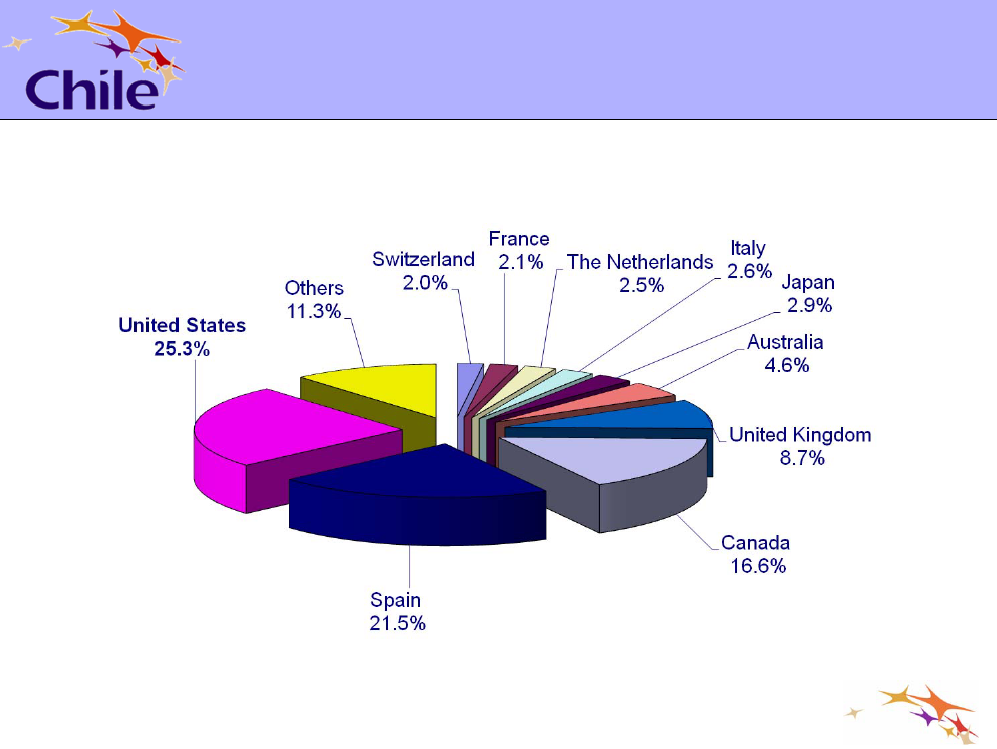

SuccessfulForeignInvestmenttrackrecordFDI under DL 600 by Country of OriginSource: Foreign Investment Committee (www.doingbusinessinchile.cl), 1974 – 2007

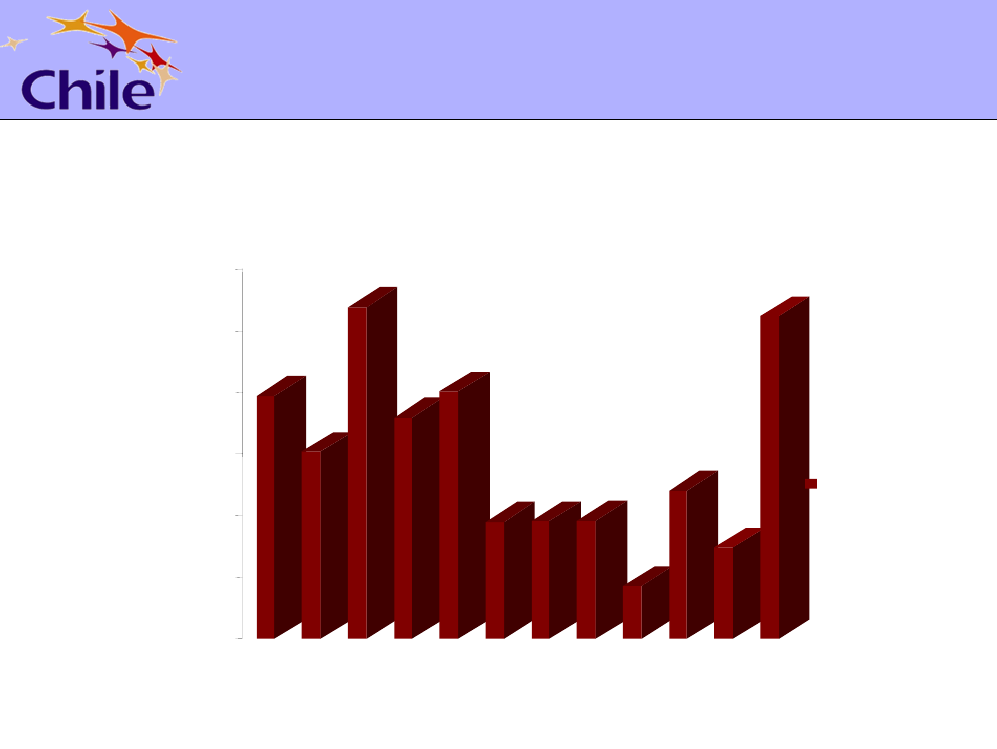

Successful Foreign Investment in 2008: US$ 10.5 billionSource: Foreign Investment Committee

12000

US$ 10.5

10000

8000

6000Total annual4000

2000

0199819972000199920012002200320042005200620072008

DanishinvestmentinChile• Danish foreign investment under DL 600 in Chile is US$38 millions.• This amount is just 0,03% of total foreign investment inChile.• Some Investors: Biomar, Danisco, J.Lauritzen, MaerskSouth America, Danfoss International, Nyklauritzencool,and others.• Main industries: food industry and transportation.

MainCharacteristicsofDL600••••••••Non-discriminationNon-discretionary proceduresFree access to economic sectorsContract with State of ChileAccess to Formal Exchange MarketCapital and profit remittancesChoice of tax regimeSix forms of investment

MainCharacteristicsofDL600INVESTMENT CONTRACT• Formal contract (public deed)• Contract between investor and the State• Cannot be modified unilaterally by the State• Grants to investors rights that are protected by constitutionalguarantee of right to property.

MainCharacteristicsofDL600ACCESS TO FORMAL EXCHANGEMARKET• Obligation to convert incoming equity• Right to acquire currency to remit capital or profits

OtherIssuesThe Foreign Investment Committee approves the entrance offoreign capitals. But some projects also require additional permits,which the investor must obtain with the corresponding authorities.A foreign investment contract does not guarantee a project’simplementation since the investor must also obtain all othernecessary permits.

IntegratedtoInternationalMarketsChile has signed 19 agreements with 57 countries•Free Trade Agreements (FTAs):Canada, South Korea, Central America,Panama, China, Ecuador, United States, European Free Trade Association(EFTA), Mexico, Peru, JapanBilateral Trade Agreements:Bolivia, Colombia, MERCOSUR, Venezuela,Cuba, IndiaAssociation Agreements:European Union (27 countries), P-4 (Brunei, NewZealand, Singapore)Others:Australia (signed but not in force yet), Malaysia, Vietnam (innegotiation), Indonesia, South Africa, Turkey (future negotiations)

•••

ChallengesIn order to become an economy that generates knowledge andtechnology instead of being one that simply imports them, Chileneeds:•To put emphasis on education and training; promote the use ofEnglish as a second language••To promote innovation through R&D

To create incentives for the development of a venture capitalindustry

CHILE’S INVESTMENTCLIMATEMarch, 2009

FOREIGN INVESTMENT COMMITTEEwww.foreigninvestment.cl