Erhvervsudvalget 2008-09

ERU Alm.del Bilag 274

Offentligt

Maersk Line in Chile & WCSAErhvervsudvalget – San Antonio March 1, 2009

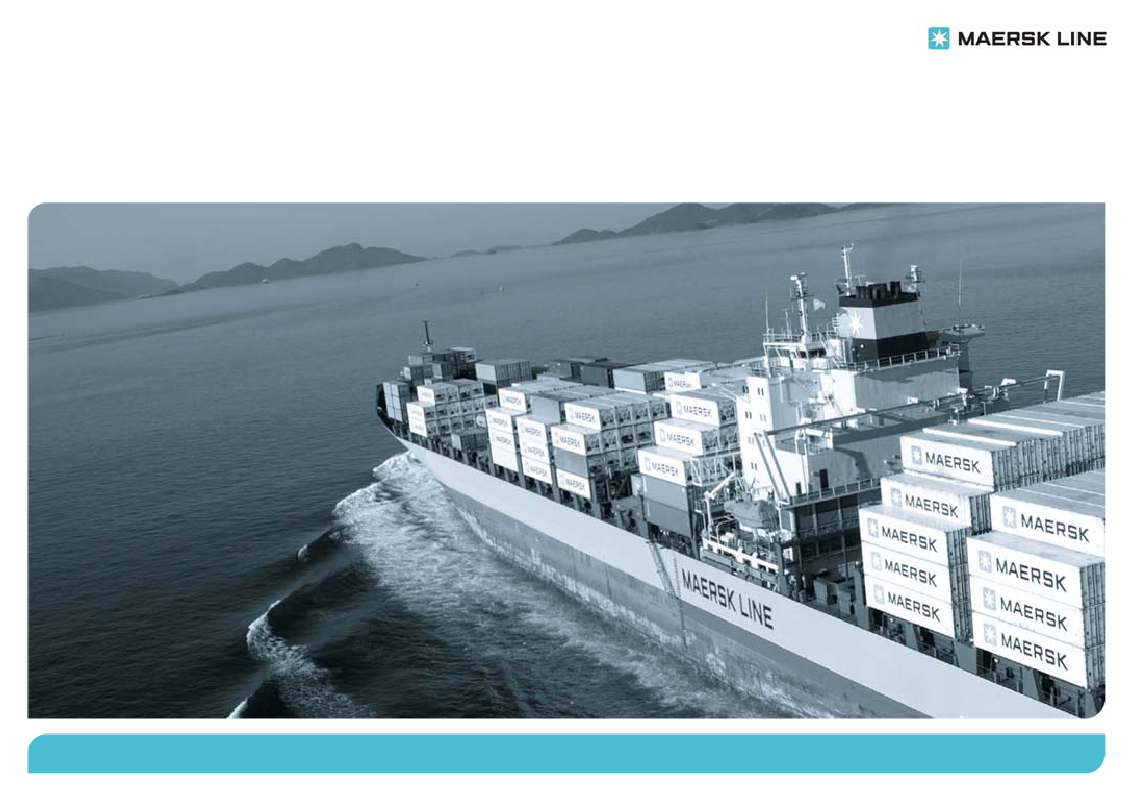

WCSA-clusterEsmeraldas

Area: 3,424,310 sq kmPopulation: 70 millionGDP (PPP): USD 650 billionGDP per capita: USD 9,500GDP growth: 5.8%

GuayaquilPaitaCallaoAricaIquique

San AntonioLirquen

2009 GDP-growth 0.5-1.0%

2

Maersk Line in WCSA

• Established• Employees• Offices• Sales• Port Calls• Total Spend• Relative Size

19931906US$ 800 mill. or more than 200,000 containers/yearMore than 400 per yearapprox. US$ 80 mill.Top-20 cluster in Maersk Line

For Refrigerated cargoes, the WCSA cluster is ranked 3rdin the Maersk Line world

3

Chile

Santiago to Copenhagen is 12,609 kilometers or 6,808 nautical miles –approx. same as from Copenhagen to Darwin, Australia.

4

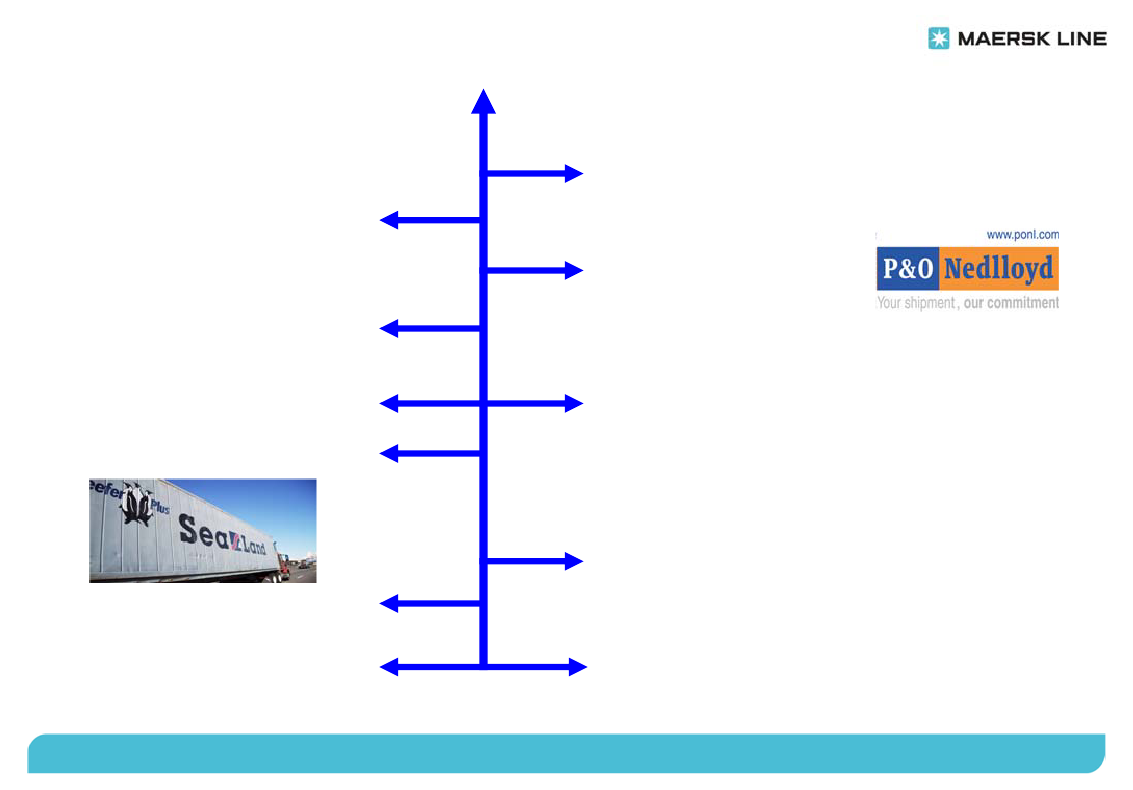

Chile Milestones

2008 WCSA cluster2005 P&O Nedlloyd2003 Andean service2001 Maersk Logistics1999 Sea-Land

2001 Portuaria Andalien

1995 Bridge Intermodal Transport1994 Portuaria Andes1993 Maersk Chile1993 Container Operators

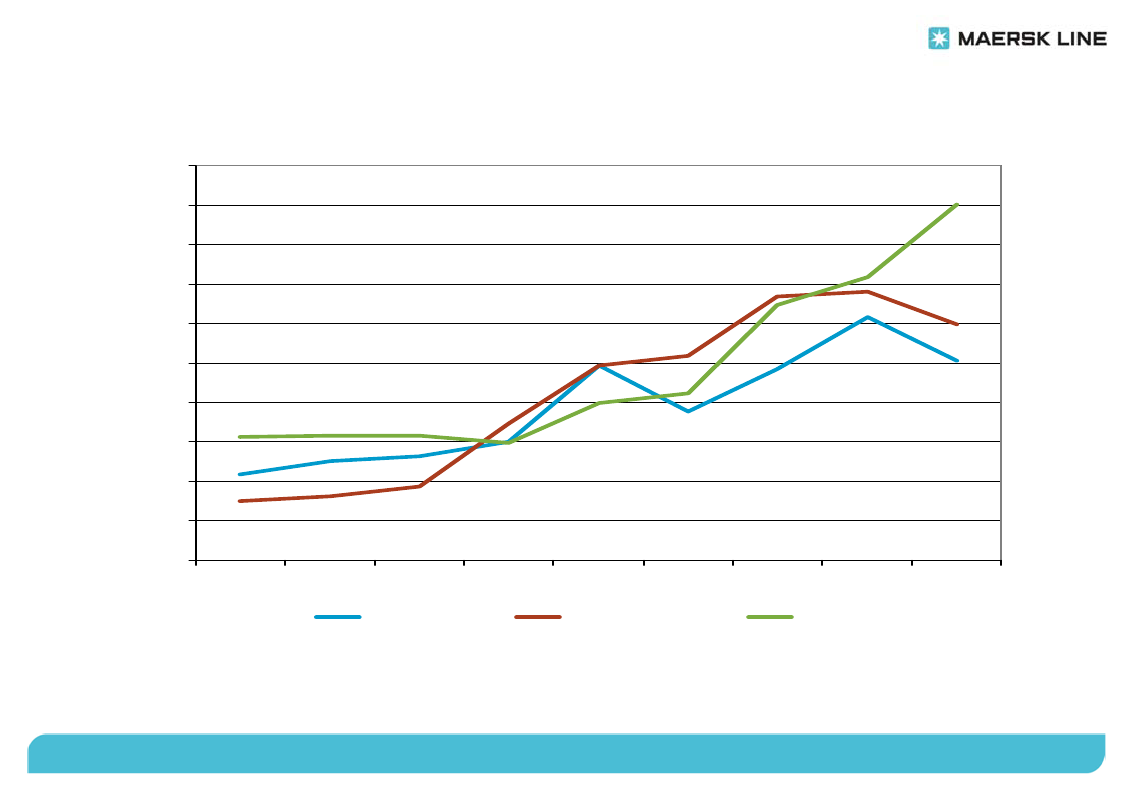

Volume Development50,00045,00040,00035,00030,000

FEF

25,00020,00015,00010,0005,0000200020012002200320042005200620072008

Exports - Dry

Exports - Reefer

Imports

100,000 FFEs during 2008 – 50% of WCSA6

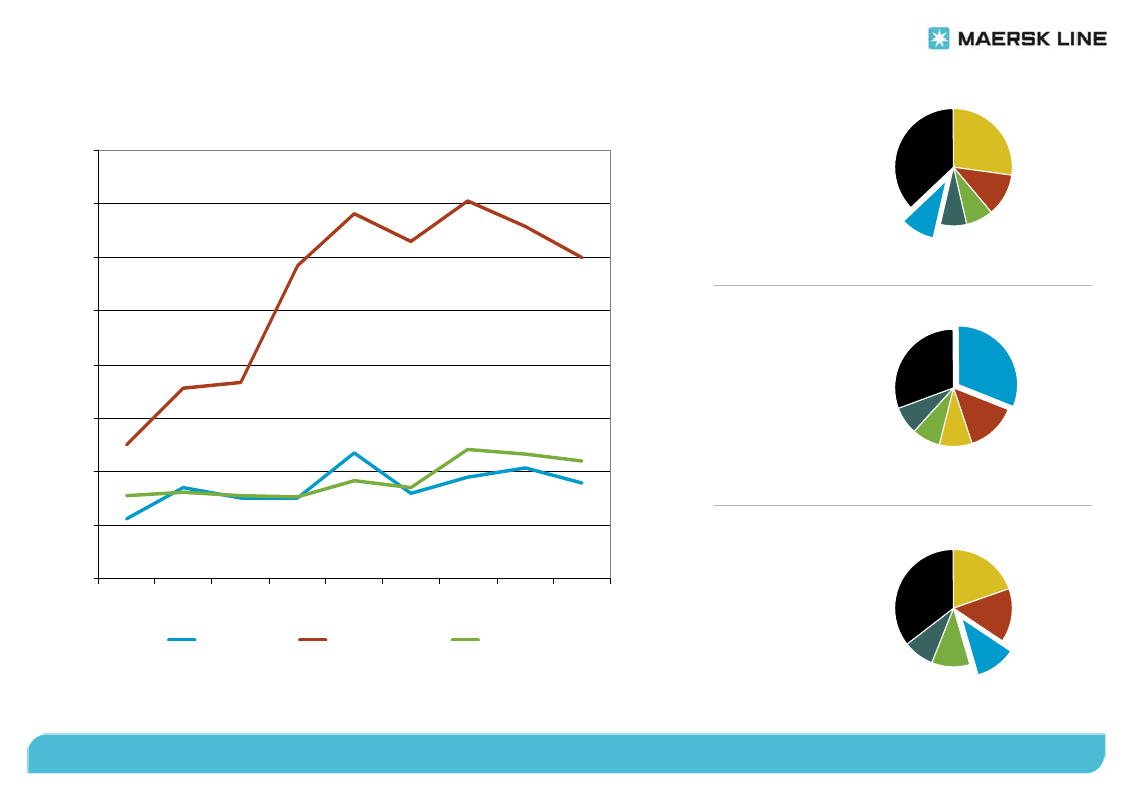

Market Shares40%35%30%25%20%15%10%5%0%200020012002200320042005200620072008Imports2008CCNI8%Others36%CSAV15%Others31%ML30%Others37%MSC27%

Exports – Dry2008

CSAV12%ML9%HALO7%CCNI8%

Exports – Reef2008

CCNI8%HSUD8%MSC9%

CSAV14%

MSC20%

Exports - Dry

Exports - Reefer

Imports

HSUD10%

ML11%

7

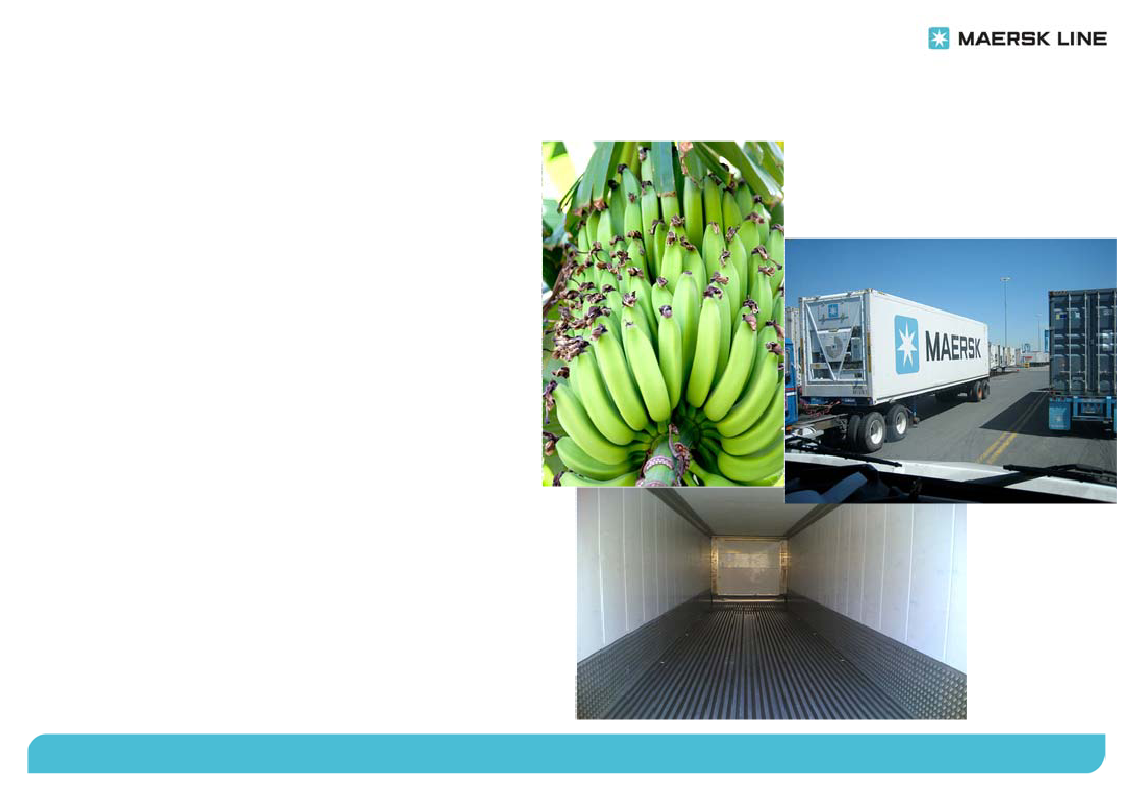

Refrigerated TransportAgriculture one of the main economic sectors in ChileMaersk has competitive advantage because:•Historical focus and expertise•Unsurpassed Vessel and Container capacity•InnovationCA / MAQuestStarCoolStarTrackSuper-Freezers•Financial strength•Conventional vessels being phased-out

Maersk Line is the leader within refrigerated transport!8

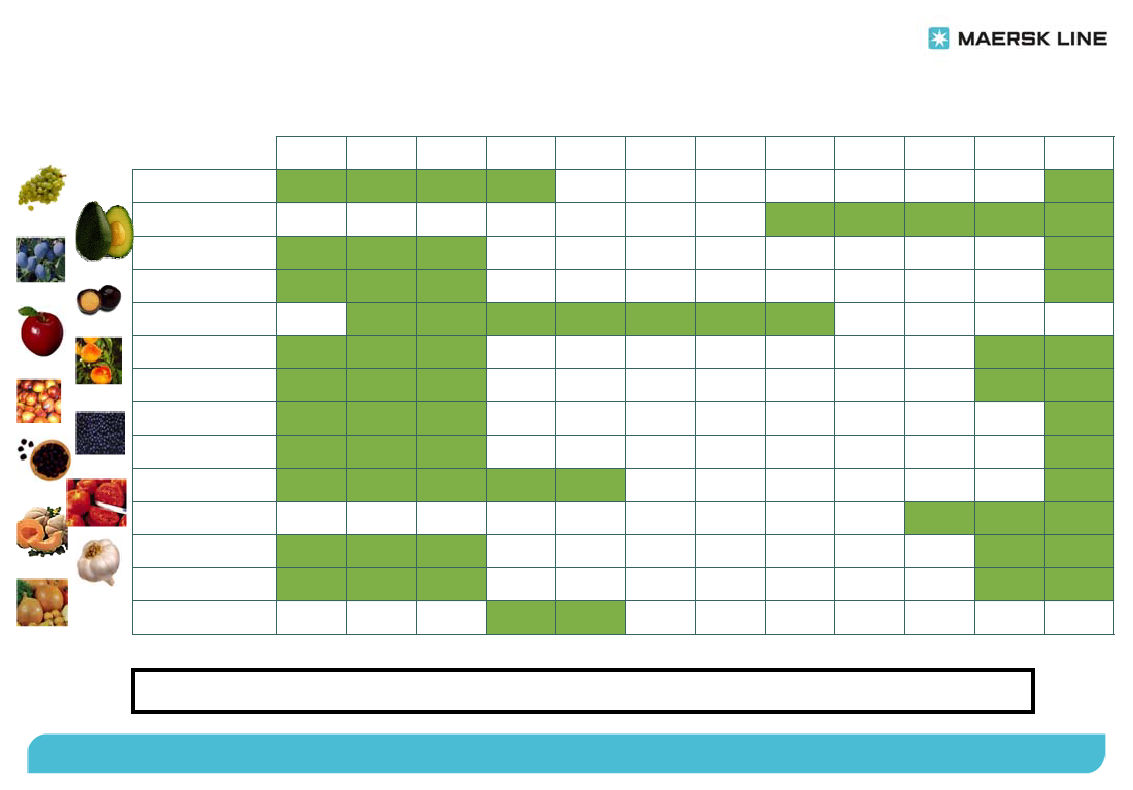

SeasonalityJanGrapesAvocadosPlumsPlumcotApplesPeachesNectarinesBlueberryBlackberryTomatoMelonGarlicOnionPersimmonFebMarAprMayJunJulAugSepOctNovDec

Chile is the largest exporter of fresh fruit in the southern hemisphere10

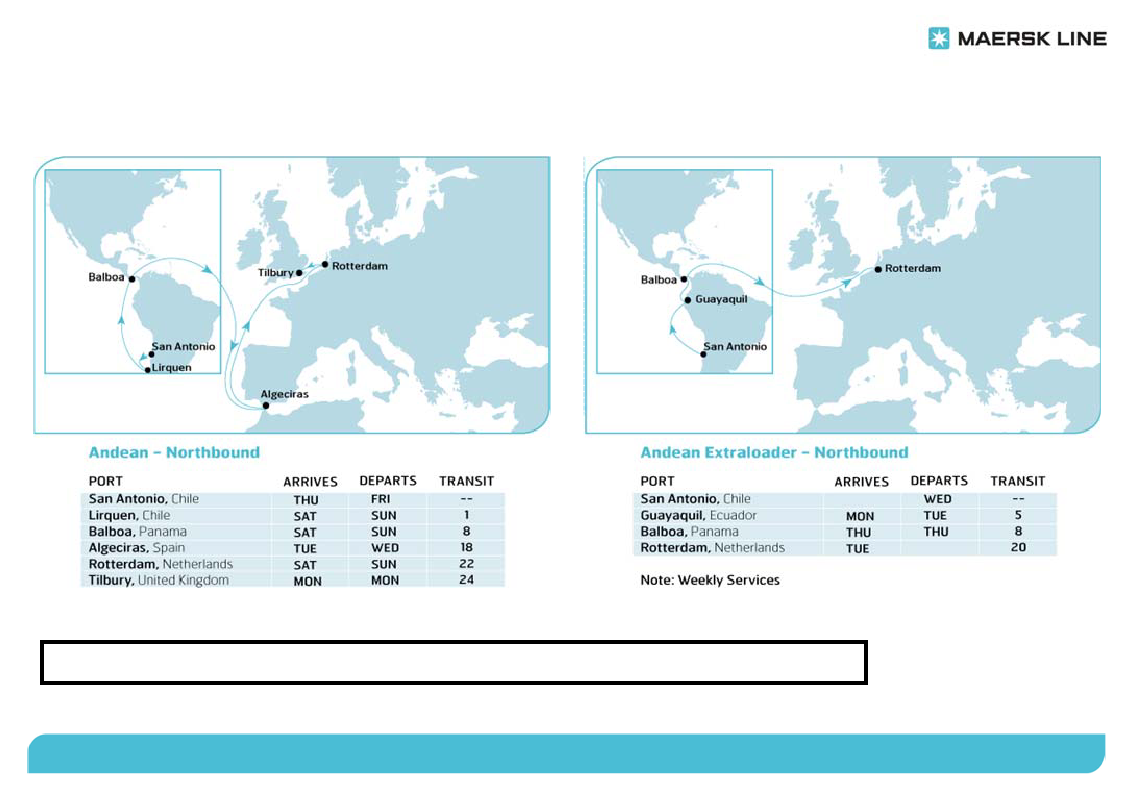

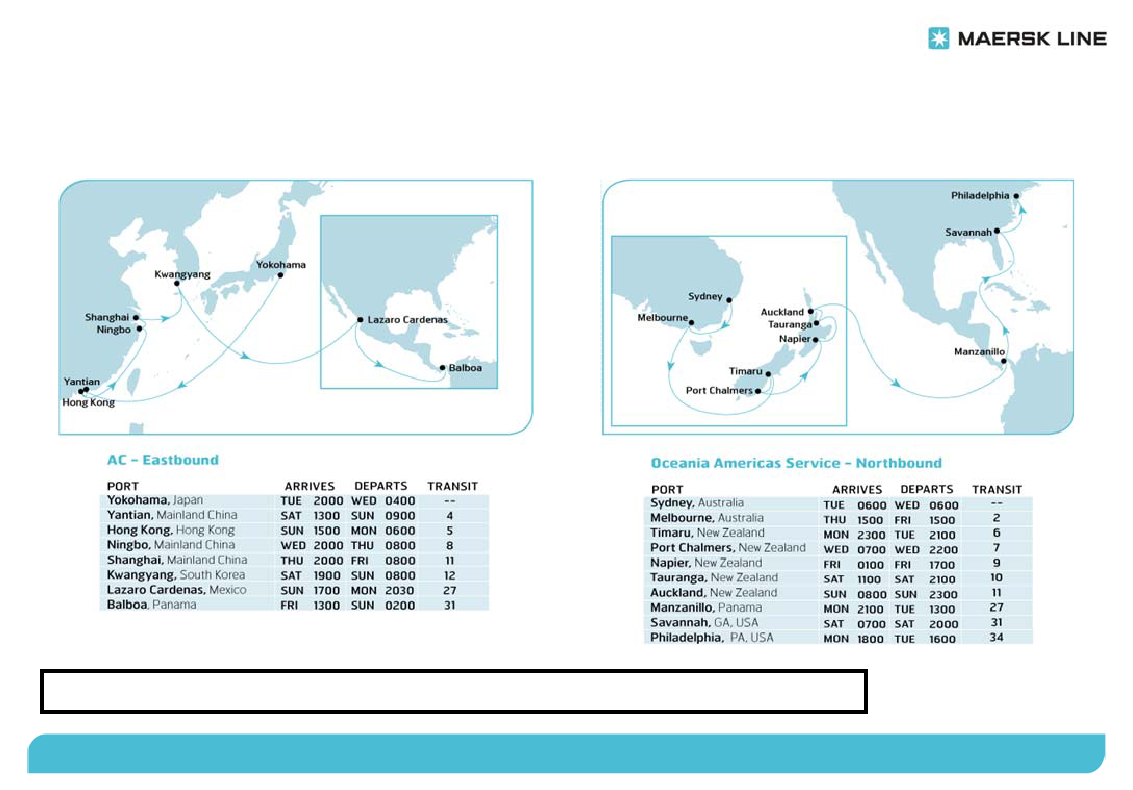

Service CoverageMarket-leader to/from North Europe

Weekly feeder-ships to/from Peru and Ecuador – connecting in Panama

11

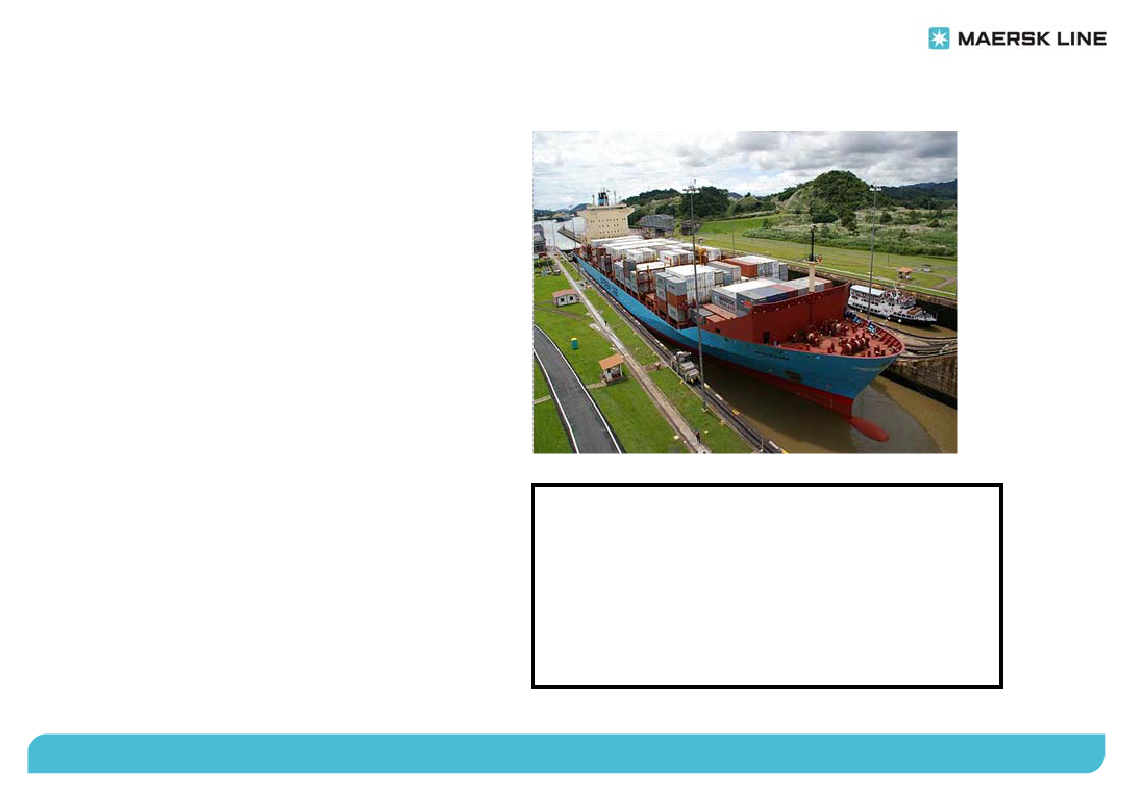

Panama-Hub ConceptConnecting WCSA to and from the world

Weekly feeder-ships to/from Peru and Ecuador – connecting in Panama12

Customer PropositionReliabilityEfficiencyExpertiseStandardisationCapacitySustainabilitySchedules, Services, FinancialTransit Times, Handling, Quality of ProduceExperience, Innovation, Core BusinessGlobal Systems & ProcessesPlanned investments, declining conventional fleetCO2 foot-print, Traceability, Commitment

13

Key Challenges• Panama Canal restrictions• Port infrastructure (Peru and Ecuador)• Port Congestion• Seasonalities• Political instability• Sanitary concerns•GLOBAL FINANCIAL CRISISDistance from Balboa (Panama) to:Lirquén, ChileSan Antonio, ChileCallao, PeruGuayaquil, Ecuador5,110 km4,720 km2,340 km1,240 km

14

Key Opportunities• Commodity-based export• Containerization – particularly Bananas• Panama Canal expansion (2014)• Growing markets• Port infrastructure in-progress• Free-Trade-Agreements• Talent-pool•GLOBAL FINANCIAL CRISIS

15

Other APMM ActivitiesAPM TerminalsSvitzerMaersk Supply ServiceDansk SupermarkedPosorja deep-water terminal in Ecuador - exploring Chile and Peruconcession for LNG-terminal towage in Peru – 7 vesselsPSV newbuildings from Asenav shipyard in Valdivia, Chileimports: Wine, Fruit, etc.

16

Questions ??

17

Maersk Line in Chile & WCSAErhvervsudvalget – San Antonio March 1, 2009

Thank you !

18