Udenrigsudvalget 2006-07

URU Alm.del Bilag 9

Offentligt

StatusReportA Review of the World Bank Group in Fiscal Year 2006The Nordic Baltic OfficeAugust 2006

1

Acronyms and AbbreviationsAAPAfDFCBDCDDCISCODEDCECAEDEUFAS133FYG8G20Africa Action PlanAfrican Development FundCommunity Based DevelopmentCommunity Driven DevelopmentCommonwealth of Independent StatesCommittee on the Development EffectivenessDevelopment CommitteeEurope and Central Asia RegionExecutive DirectorEuropean UnionFinancial Accounting Standards No.133Fiscal YearGroup of Eight (US, Japan, Germany, France, the UK, Italy, Canada and Russia)Group of Twenty (G7 and Argentina, Australia, Brazil, China, India, Indonesia,Mexico, Saudi Arabia, South Africa, South Korea, Turkey and the EU, representedby the rotating Council presidency and the European Central Bank).Gross Domestic ProductGross National IncomeHeavily Indebted Poor CountriesInternational Bank for Reconstruction and DevelopmentInternational Centre for Settlement of Investment DisputesIndependent Evaluation GroupInternational Development AssociationInternational Finance CorporationInternational Financial InstitutionInternational Monetary FundLatin America and the CaribbeanLow Income Countries Under StressMonitoring and EvaluationMultilateral Development BankMillennium Development GoalsMulti-Donor FundMiddle Eastern and North AfricaMultilateral Investment Guarantee AgencyNordic Baltic OfficePoverty Reduction StrategyUnited NationsWorld Bank GroupWorld Development ReportWorld Trade Organization

GDPGNIHIPCIBRDICSIDIEGIDAIFCIFIIMFLACLICUSM&EMDBMDGMDFMENAMIGANBOPRSUNWBGWDRWTO

2

ContentsFOREWORD BYEXECUTIVEDIRECTORSVEINAASS................................................................... 4INTRODUCTION............................................................................................................................... 6DEVELOPMENTCOMMITTEE INFY2006 ...................................................................................... 6MULTILATERALDEBTRELIEFINITIATIVE...................................................................................... 8GOVERNANCE ANDANTI-CORRUPTION.......................................................................................... 9CLEANENERGY ANDINFRASTRUCTURE DEVELOPMENT................................................................ 9STRATEGY ANDOPERATIONALPERFORMANCE........................................................................ 10WORLDBANKSTRATEGY ANDPERFORMANCE............................................................................ 10IFC STRATEGY ANDPERFORMANCE............................................................................................. 12MIGA STRATEGY ANDPERFORMANCE......................................................................................... 13SECTOR ANDTHEMATIC ISSUES.................................................................................................. 14HUMANRIGHTS............................................................................................................................. 14INDEPENDENTEVALUATION.......................................................................................................... 15REGIONAL PERSPECTIVES........................................................................................................... 17SUB-SAHARANAFRICA................................................................................................................. 17SOUTHASIA................................................................................................................................... 18EASTASIA AND THEPACIFIC......................................................................................................... 19EUROPE ANDCENTRALASIA......................................................................................................... 20LATINAMERICA AND THECARIBBEAN......................................................................................... 21MIDDLEEAST ANDNORTHAFRICA.............................................................................................. 21FINANCIALOVERVIEW................................................................................................................ 22VOLUME OF BUSINESS................................................................................................................... 22FINANCIALSTATEMENTS............................................................................................................... 23ALLOCATION OFNETINCOME ANDWAIVERS TOLOANCHARGES............................................... 24FINANCIALCAPACITY................................................................................................................... 24ANNEX 1 – THEWORLDBANK AND THENORDIC-BALTICOFFICE AT A GLANCE................. 25ANNEX 2 – SELECTED FINANCIAL DATA OFIBRD ................................................................... 26ANNEX 3 – SELECTED FINANCIAL DATA OFIFC ...................................................................... 27

List of BoxesBox 1Global Monitoring ReportBox 2Review of the Poverty Reduction Strategy ApproachBox 3Sanctions and Voluntary Disclosure ProgramBox 4Sub-National Development ProgramBox 5Gender Action PlanBox 6Doing Business in 2007: How to ReformBox 7Uganda Joint Assistance StrategyBox 8Natural DisastersBox 9World Development Report 2007

3

Foreword by Executive Director Svein AassNBO has, on earlier occasions, commented on what we called the “Wolfensohn Bank“ asa World Bank that in many ways could be seen as a “Nordic-Baltic Bank”. By this wemade clear that we meant that the World Bank over the past 10-15 years had taken upmany of the development priorities and taken on many of the attributes of the develop-ment paradigm that are prevalent in the Nordic-Baltic constituency. A holistic approachto development, justice and fair income distribution, an effective and just/fair state, socialand environmental aspects of development, the rights of children and women and bettingon the poor – with a focus on Africa in particular, are the signposts.On this background, it was not unnatural that a certain unease and a somewhat tentativeattitude was to be observed when the World Bank was put “under new management”, lit-erally speaking. In last year’s 2005 Status Report, it was too early to make a judgment onwhere the Bank was heading other than observing that the new Bank President offered aprogressive program and vision in his introductory investiture.It is now easier to make such a judgment. As this Status Report from the Nordic-BalticOffice in the World Bank Group shows, the World Bank is poised to remain a premierdevelopment institution and many features, priorities and policies that have grown to bedear to the Nordic-Baltic constituency still characterize the World Bank. Under PresidentWolfowitz, we have therefore been happy to be in a position to support i.a. a continuedBank commitment to equitable and sustainable development, empowerment of the poor,and a strong focus on Africa.In addition, it is worth observing the renewed emphasis in the Bank on growth or en-hanced growth – or as the correct jargon has it: “shared growth”. The upgraded prioritygiven to infrastructure and energy makes extra good sense in this context – and is also areflection of the Bank listening to its members, especially the developing country mem-bers, who have all voiced a strong demand more support for such investments. The con-firmation that the Bank will continue to stay involved in all its developing country mem-bers should also be read into the efforts to elaborate a specific strategy vis-à-vis the mid-dle-income countries. The same goes for the developing of new instruments such as sub-sovereign lending and the insistence of going forward with “country systems”.The World Bank also continues to play an important role in the international financialand developmental architecture in analyzing, promoting and advocating global publicgoods such as an effective multilateral trading system, the safeguarding of the environ-ment and fighting infectious diseases to name a few of the challenges which the interna-tional community has asked the Bank to contribute to solve. The Bank’s research capac-ity, its convening power vis-à-vis international policymakers and perhaps most impor-tantly, its long track record of financial and policy dialogue with its member countries arereasons why groups like the G8, as well as groupings to which countries in our constitu-ency belong, find it useful to ask the Bank to play a supportive role.

4

The importance of the above-mentioned issues notwithstanding, quite clearly there havebeen two issues that have more than anything characterized the work of the Bank – andthus also the Bank itself as a development institution in 2005-2006: radical cancellationof debt to the poorest member countries of the Bank through the “Multilateral Debt ReliefInitiative”(MDRI) and the ambitious new stepped-up campaign to promote good govern-ance and combat corruption. The issues are described in the following pages. Suffice itto say that from our perspective both issues show how the Bank is at the heart of theglobal development strategy. In both cases, it could be debated whether the process cho-sen to forward the initiatives has been the optimal one. But also in both cases, it alsoseems plausible to claim that the end result will turn out better than the point of depar-ture. The work of the Board, capitals such as our own Nordic Baltic Constituency, IDADeputies and World Bank Governors has been shown to be essential if major multilateralinitiatives are to retain their legitimacy.As in previous years our office has, I think, put up a convincing performance. Accordingto our peers, we are seen as representing a certain “development profile”. Personally, Iam most grateful to all and every staff member in the office, including our excellent ad-ministrative staffers, for good-natured and professional efforts beyond the call of duty.Likewise, we all in the NBO value the support and guidance received from capitals, all ina spirit of “never a discouraging word”, which has allowed us to be a “player” influenc-ing the direction of the World Bank.

5

IntroductionDuring President Wolfowitz’ first year in office the World Bank has seen a significantturnaround in senior management levels, the finalization of the Multilateral Debt ReliefInitiative, and increased lending to many countries, especially for infrastructure. Africa isa priority and the Africa Action Plan is being implemented and refined. At the politicallevel, the Development Committee (DC) has focused on financing for development andfollowing up on progress towards the Millennium Development Goals (MDGs) as well asissue ranging from good governance to clean energy, trade and various aspects of aid ef-fectiveness.This report is produced by the Nordic Baltic Office in the World Bank and it takes stockof the past fiscal year (July 2005-June 2006); the Development Committee agenda, theoverall strategy of the main arms of the World Bank Group as well as the regional opera-tions and the financial status of the Bank. The report also includes sections on specifictopics; this year we report on Human Rights and Independent Evaluation in the WorldBank. Finally, the report includes short summaries of important research products anddevelopments in the Bank.

Development Committee in FY2006The Development Committee1met in September 2005 during the Annual Meetings andin April 2006 during the Spring Meetings. Overall, the DC agenda continued to focus onfollowing up the commitments made at the 2002 Financing for Development Conferencein Monterrey by developed and developing countries and on the progress towards theMDGs. As a concrete accountability instrument for the monitoring of these commitmentsthe Bank, together with the IMF, prepare a Global Monitoring Report which is discussedannually at the DC Spring Meeting (see box 1 below). This year’s report also served as apoint of departure for the governance and anti-corruption discourse which will be on topof the agenda at the Annual Meetings in 2006. Other pertinent issues that where dis-cussed in the DC during the last year were the Multilateral Debt Relief Initiative, the re-newed focus on governance and anti-corruption and access to clean energy and infra-structure (see below). Furthermore, topics on the agenda included issues related to eco-nomic growth, “voice” and aid effectiveness.2Related to economic growth, reports on fiscal policy, trade and infrastructure aimed atcoming out with policies and financing in support for these aspects of the economicgrowth agenda in both low and middle income countries.The “voice” discourse refers to a commitment from Monterrey to increase the role andinfluence of developing countries and countries in transition in the multilateral system,including in the Bretton Woods Institutions. The progress report issued for the 2005 An-1

The Development Committee is a 24 member ministerial body providing political guidance for the WorldBank and the IMF on development issues (see also annex 1).2Seewww.devcommittee.orgfor reports and statements from the DC.

6

nual Meetings noted some progress but also pointed to difficult trade offs. Formal discus-sions in the IMFC at the 2006 Annual Meetings in Singapore are expected to further thisagenda.3Box 1. Global Monitoring Report 2006The Global Monitoring report, which is produced every year as the World Bank’scontribution to following up on progress toward the MDGs, contains the message thatgrowth continues to help people out of poverty but that many countries are not ontrack for meeting the human development MDGs. Poverty reduction has been sharpestin East Asia, and remains more or less on target for all other regions except for Sub-Saharan Africa which has only made the smallest of dents in the percentage of popula-tion living on less than USD 1 a day.The key policy messages from the report include:Progress is too slow in improving the business climate, including infrastructurein order to sustain growth in many poor countries.Critical to help countries meet the human development goals is to increase theability of aid to cover recurrent costs to pay for salaries of teachers and healthservice providers and for governance reforms to improve service delivery.Multilateral trade negotiations need to be accelerated. Aid transfers needgreater predictability, less fragmentation, better alignment with needs and bet-ter targeting. Debt relief threatens to become a substitute for aid. 60 percent ofthe increase in total Official Development Assistance between 2001 and 2004was directed to Afghanistan, the Democratic Republic of Congo and Iraq, al-though these countries account for less than 3 percent of the poor people indeveloping countries.International Financial Institutions need to manage for outcomes rather thanfor inputs.Governance should be monitored regularly to track progress, generate greateraccountability and build demand for good governance.Good governance is everyone’s responsibility.Aid Effectiveness is an over-arching priority for the World Bank. Some of the major pol-icy developments discussed by the DC in the last year include reviewing the Poverty Re-duction Strategies as tools for countries to articulate their own development agenda, theincreased focus on managing, measuring and monitoring for results, the World Bankconditionality4and the Paris Declaration on Aid Effectiveness. The main thrust over the

Informal political discussions in the so called G20 have centered on their wish to increase the shares ofsome emerging economies.4The review, to which the Nordic and Baltic countries also contributed analytically, was finalized in thesummer of 2005. It was summarized in last year’s Status report, while being part of the agenda for the 2005Fall meeting of the Development Committee. Noteworthy follow-up papers include a set of Bank wide BestPractice Guidelines on Conditionality which were issued in September 2005, a Development Policy Retro-spective report and a stock-taking report of Policy Conditions in World Bank Investment Lending whichboth were submitted to the Board of Executive Directors in the summer of 2006.

3

7

last year has been to continue implement these ambitious objectives (see for example Box2 below).Box 2. Review of the Poverty Reduction Strategy approachA review of the Poverty Reduction Strategy approach was on the agenda for the Sep-tember meeting of the Development Committee in 2005. The PRS core principles weresummarized as a system of development assistance relying on country-driven, broadlyparticipative reform programs, medium- to long term in perspective, comprehensive,and oriented towards results and partnerships. The main conclusions, fully endorsed bythe DC, were that the PRS approach needs to:Support a balance in accountabilities between governments (to their domesticconstituents for improved policies, governance, and development results) anddonors (to provide more and better aid in ways that support rather than detractfrom domestic accountability).Provide a platform for scaling up aid and demonstrating tangible results at thecountry level.

Multilateral Debt Relief InitiativeIn September 2005, the Committee welcomed the proposal by the G8 countries to cancelthe debt owed by the HIPC countries to the IDA, the AfDF and the IMF. The objective ofthe initiative, later named as the Multilateral Debt Relief Initiative (MDRI), is to increaseresources for making progress towards the MDGs. MDRI reduces the debt service obliga-tions of the beneficiary countries while maintaining the financial integrity and capacity ofthe IFIs involved to ensure that MDRI relief is additional for the developing countries.Subsequent to the September DC meeting, IDA Deputies met several times in order toagree on the financing package for the donor countries while the other implementationdetails were delegated by Governors to the Executive Board. Finally, on March 28, 2006the IDA Executive Board endorsed the implementation package and following the AprilDC meeting and the subsequent adoption of the draft Resolution by the Board of Gover-nors the MDRI became effective on July 1st, 2006 and the first 18 countries received 100percent debt cancellation on their eligible debt to IDA.Going forward, it will be important to monitor that the promised dollar-for-dollar donorcompensation is adhered to in order to avoid a drop in IDA’s financial commitments tothe client countries. For their part, the MDRI beneficiary countries need to ensure that thesaved reflows will be used efficiently for poverty reduction programs that also aim to im-prove the countries capacity to carry debt in the future. After the MDRI much attentionhas been devoted to the need to ensure that the beneficiary countries do not immediatelyre-accumulate unsustainable levels of debt. In this context, the Board has held discussionson how to mitigate the problem of “free riding”, namely that the debt relief will cross-subsidize non-concessional lending to post-MDRI countries. Enhancing informationtransparency related to debt flows, improving creditor coordination as well as carefullydesigned incentives will be part of the policy package aiming to mitigate such “free rid-ing” concerns.

8

Governance and Anti-CorruptionThe idea to reform the process of sanctioning companies and individuals found to be in-volved in corruption in WB projects was first discussed in 2004 (and the subject of anextensive review by former US Attorney General Dick Thornburgh). It was resumed thisyear in early spring after an increased emphasis of the new Bank management on anti-corruption, and the formation of an Anti-Corruption Task Force of Multilateral Develop-ment Banks (MDBs) with the aim to develop a uniform Framework for Preventing andCombating Fraud and Corruption.Simultaneously, a much broader set of issues related to good governance has also comeinto focus. In the Spring Meeting 2006 the most hotly debated issue was the chapter ongovernance in the Global Monitoring Report 2006 (see above). Several developing coun-tries expressed fear that the Bank, which has a non-political mandate as regards allocationof resources to its membership, would start to use explicit political conditionality for itsloans. At the same time the DC recognized the importance of good governance for sus-tained growth and poverty alleviation. A main conclusion of the DC discussion was toask management to come up with a comprehensive framework for strengthening govern-ance and fighting corruption for the Annual Meetings in Singapore this year.Box 3. Sanctions and Voluntary Disclosure ProgramThe sanctions reform expands the possibility to sanction firms and individuals thathave engaged in corruption, broadens the definition of corruption to include private toprivate corruption, and aims to harmonize definitions and approaches across theMDBs. The new rules, approved by the Board, stipulate i.a. that any breach of the un-dertaking in the Anti-Corruption Guidelines would permit the Bank to suspend theloan in question. The suspension would also be imposed if the borrower has been de-clared ineligible to participate in Bank-financed projects for having engaged in fraudand corruption in another Bank project.The Voluntary Disclosure Program (VDP), approved by the Board, is an attempt atcreating incentives for firms to stop engaging in corrupt and fraudulent behavior whileproviding the Bank with vital information. Under the VDP, firms may avoid sanctions(and have their identity kept confidential to the best ability of the Bank) if they:1) disclose to the Bank the results of their internal investigations regarding pastcorrupt and fraudulent behavior in Bank-financed or supported projects;2) commit to stop engaging in such behavior;3) implement a robust, monitored compliance program;4) cover most of the costs associated with the VDP process.However, if the national authorities independently discover a participant’s violation ofits national laws, the latter’s participation in the VDP will not protect that participantfrom prosecution.

Clean Energy and Infrastructure developmentThe profile of the World Bank’s work in the area of both energy and infrastructure morebroadly has been increased substantially over the past few years. Following previous dis-

9

cussions at the Development Committee and in other fora, both the links between cleanenergy and development, as well as the Bank’s activities in the infrastructure sector, werediscussed by ministers at the DC meeting in April 2006. The Bank was requested at thatmeeting to review, in close coordination with other partners, existing financial instru-ments and to explore the potential value of new financial instruments to accelerate in-vestment in clean, sustainable, cost effective and efficient energy. As part of its sectorstrategy, the Bank is using several tools ranging from policy advice for energy sector re-form and work on developing the carbon market to specific investments in new energyrelated infrastructure. Increasingly, the focus of the Bank is also on helping developingcountries adapt to climate change. DC ministers will receive an update on progress madetowards developing an investment framework for clean energy at the Annual Meeting inSingapore. In the area of renewable energy specifically, the Bank committed in 2004 toincreasing its lending for renewable energy and energy efficiency projects by 20 percentannually for the next five years.The Nordic-Baltic countries have shown interest in cooperating with the Bank in the areaof renewable energy, and there is also an understanding in the Bank that the broad ex-periences of Nordic countries in that field could be valuable in many developing coun-tries. The cooperation between our constituency and the World Bank’s energy experts hasbeen further enhanced by visits in both directions.The Bank has also made further progress in scaling up its support to infrastructure pro-jects more broadly than in the energy sector and in implementing the Infrastructure Ac-tion Plan that was launched in July 2003. The total Bank lending commitments5for infra-structure in FY06 reached USD 8.14 bn, which represents a 9.7 percent increase over theFY05 level and a cumulative growth of close to 50 percent over the past three years.

Strategy and Operational PerformanceWorld Bank6Strategy and PerformanceThe World Bank’s fundamental strategy remains based on the two pillars of investing inand empowering people and promoting a favorable investment climate for private sectorled economic growth. As part of its annual cycle of strategy discussions, the Board inMay 2006 endorsed several priority areas for the coming years, where the Bank intendsto intensify its efforts to respond to development challenges.The first priority for the Bank is its work in Africa. To that end, the Africa Action Planhas been developed, which describes 25 specific initiatives to be undertaken during theIDA14 implementation period. Secondly, the institution is currently deepening its workon governance (see above) through its country-level work with governments, as well asby reviewing some of its own operational procedures. Other priority areas where theBank is making an effort to deepen its expertise and development impact are education,health, infrastructure, energy and sustainable development, and agriculture.56

Including IBRD, IDA, GEF, Special Financing product lines and guaranteesWorld Bank here refers to IBRD and IDA.

10

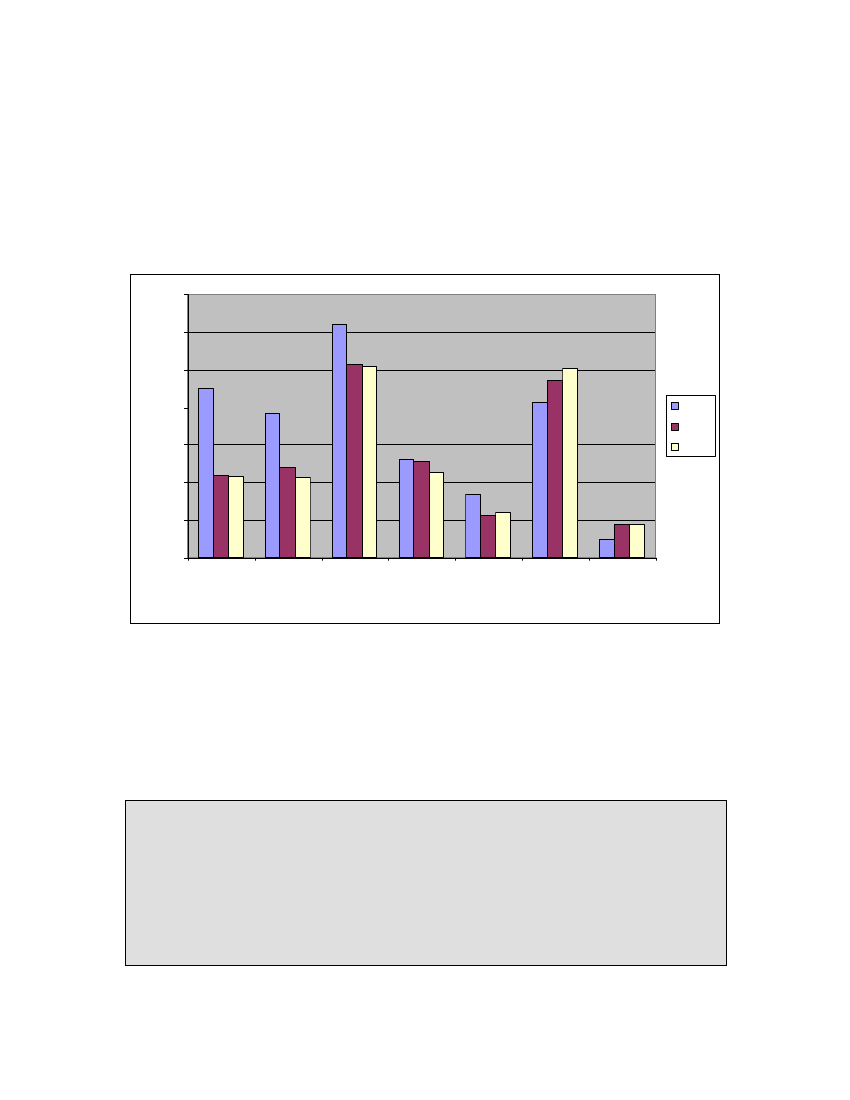

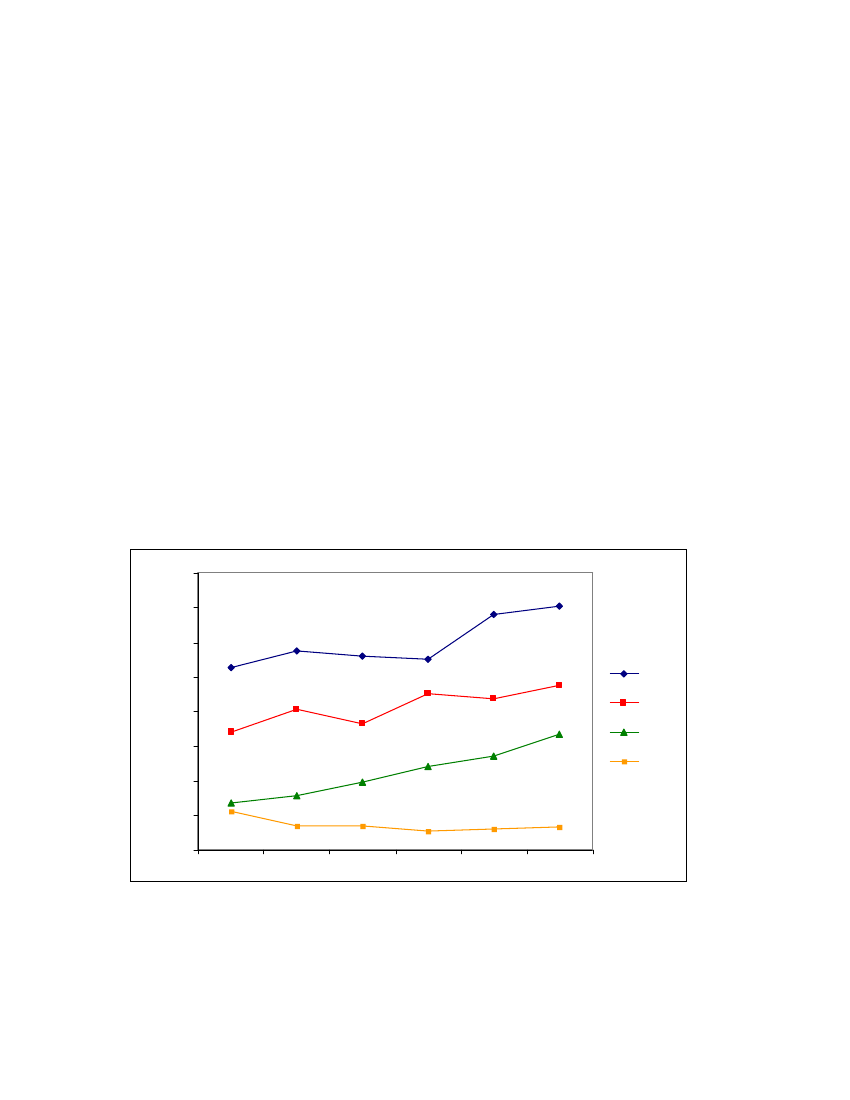

Looking at the portfolio by client grouping and comparing FY00 data to FY05 and FY06,the largest decline over the past five/six years is in the group of IBRD countries classifiedas Investment Grade. The other group of countries showing a significant increase in port-folio includes the Low Income Countries under Stress (LICUS). Issues related to aid ef-fectiveness in LICUS are receiving significant attention from the international commu-nity, including the Bank.Figure 1. Portfolio by Client Grouping (FY00, FY05, FY06)353025USD Billion20151050IBRDInvestmentGradeChinaIBRD Only(Others)IndiaBlendcountries(Others)IDA OnlyLICUS

FY00FY05FY06

In response to the decline of lending to IBRD clients and in order to increase Bank’scompetitiveness, the Bank has intensified its efforts in reviewing the Bank’s strategy forIBRD clients. The outcome of those efforts will be submitted to the Development Com-mittee in September. The proposed strategy will most likely entail a clear commitment toincrease lending and advisory services for this business line; providing stable financing tocountries with little or volatile access to financial markets and advisory services ongrowth and poverty alleviation as well as in the area of global commons.Box 4. Sub-national Development ProgramAs many developing countries move towards fiscal decentralization, sub-national lev-els of government become increasingly important to the World Bank Group. In thesummer of 2006 the Board approved a sub-national development program on a three-year pilot basis, comprising two main instruments:Technical assistance to build institutional capacity (e.g. in financial manage-ment)Financial support without sovereign guarantees

11

Organizationally, President Wolfowitz has started a process to consolidate the work ofthe bank in its many central thematic units. The networks/departments for infrastructure,agriculture, environment and social development will be merged into a central networkfor sustainable development. Similarly, the financial sector and private sector develop-ment units will be merged together. In the regions, there is a process to gradually increasethe number of countries in the portfolio of each country director, thus empowering bothcountry directors and country managers, to whom much of the Bank’s day-to-day opera-tions will have to be delegated. In conjunction with looking over its organizational struc-ture, the Bank also continues to developing its strategic planning tools, to better measurethe effectiveness of the Bank’s work and to strengthen the alignment of resources withoperational priorities. This work has been closely monitored and guided at the Boardlevel by the Budget Committee, of which the NBO has been an active member.Box 5. Gender Action PlanThe High Level Consultation on the Gender Equality MDG in February 2006, spon-sored by the Bank in partnership with the Government of Norway, UNIFEM and oth-ers, resulted in a commitment to prepare a"Gender Action Plan".The Plan is likelyto focus on the promotion of economic opportunities with the aim to empower women,partly because of the Bank's comparative advantage and also as a response to the factthat mainstreaming of gender issues has been stronger in the social sectors than in thenon-social sectors in the Bank. The Draft Action Plan consists of the following fouraction areas:1) Intensify gender mainstreaming in Bank and IFC operations and in key re-gional analytical products2) Mobilize resources to implement and scale up Results-Based Initiatives (RBIs)and other innovative actions that empower women economically3) Improve knowledge and statistics on women’s economic participation and therelationship between gender equality, growth, and poverty reduction4) Undertake a targeted communications campaign to foster partnerships and im-prove project execution.

IFC Strategy and PerformanceIt is now a year since the Board approved an ambitious three-year growth strategy forIFC (aiming at a level of USD6-7 bn by FY08, a 35 percent increase) and the early resultsare promising. The level of commitments in FY06 showed a sharp increase in FY06 andreached ca USD6.7 bn, compared with USD5.4 bn in FY05. Business volumes are alsoup in Africa and the Corporation is doing well as measured by other key indicators of de-velopment impact. In addition, management has suggested to extend the expected growthpath in lending volumes to FY09 as part of their updated three-year forecasts.In May 2006, the Board reinforced the following five strategic priorities for IFC:strengthening the focus on frontier markets (e.g. Sub-Saharan Africa)building long-term partnerships with emerging global corporations in developingcountriesdifferentiating through sustainability competencies

12

addressing constraints to private-sector growth in infrastructure, health and educa-tiondeveloping local financial markets through institution building and innovative fi-nancial productsTechnical assistance and advisory services continue to be a key area of activities for IFCand an important ‘market differentiator’ for the Corporation. All IFC’s technical advisorywork is now organized into five business lines and a new system is being introduced tomeasure the development outcomes and effectiveness of these activities. Among new top-ics, IFC, in line with the rest of the Bank Group, is trying to define its potential role in thefight against corruption. Given the recent exceptionally strong financial results of theCorporation, the Board this year for the first time suggested to Governors to approve atransfer from IFC’s net income to IDA (in the amount of USD150 mn). The funds wouldbe used by IDA as grants to support the growth of private enterprise in countries that aremembers of both IFC and IDA.Box 6. Doing Business in 2007: How to ReformThe Doing Business Report is a joint Bank/IFC analytic study that provides for a com-parison of the regulatory burden that companies face in 175 countries. For an initiativethat was originally planned only as a three-year pilot project, the success of the DoingBusiness Report has been quite notable. By its third year, the Doing Business report hadalready become the most quoted annual publication of the World Bank Group. The ap-peal of the Doing Business Initiative is its straightforward approach to use objective in-dicators to measure and benchmark countries on the time and cost of completing admin-istrative processes that an entrepreneur has to go through. It also provides a unique per-spective for a World Bank publication as the business environment in both developingand industrialized countries is evaluated using identical measures.The main theme of the next year’s edition (4thoverall) will be “How to Reform” and itwill present an analysis of 50 case studies that could be useful for countries that are con-sidering similar regulatory changes. The main messages that emerge from the analysisare:Africa is reformingWhat gets measured gets done – there are 43 reforms informed by the DoingBusiness initiativeReform while you can – most radical reforms usually closely follow electionvictories.Referring to the performance of the Nordic and Baltic countries, one can be pleased tosee that members of our constituency are well represented both among the top econo-mies in terms of ease of doing business, as well as top reformers over the past years.The Doing Business Report together with extensive background information is availablefromwww.doingbusiness.org.

MIGA Strategy and PerformanceMIGA seems to be on a way of recovery judging from the increased volume of guaran-tees, a strong pipeline going forward, as well as a more diversified portfolio. At the same13

time MIGA’s operating income shows a decreasing trend – at USD 17.2 mn in FY06 ascompared to USD 24.1 mn in FY05, despite an increase of USD 268 mn in exposure.FY06 cancellations were USD 665 mn – similar to previous year’s level. The Board ap-proved MIGA’s three-year business plan and the requested budget for FY07 of USD36.922 mn, representing a 3 percent decrease over the previous year’s request in realterms.In FY06, MIGA issued USD 1.3 bn in guarantee coverage for projects in its priority7ar-eas: 23 projects in frontier markets, totaling USD 481 mn in guarantees, 10 projects inconflict-affected countries, with USD 165 mn in coverage, 14 infrastructure projects to-taling USD 469 mn in coverage, 15 South-South investments, supported by USD 389 mnin guarantees; 13 guarantee projects and 13 technical assistance projects in sub-SaharanAfrican countries; 21 guarantee projects and 20 technical assistance projects in IDA-eligible countries.The regional breakdown of guarantees issued by MIGA in fiscal 2006, in terms of num-ber of guarantees issued, shows that sub-Saharan Africa was the top guarantee destina-tion, with 21 contracts in support of 13 projects, totaling USD 180 mn in coverage. LACgenerated the second highest number of guarantees with 19 contracts, totaling USD 242mn in coverage. Europe and Central Asia (ECA) was the third region in terms of numberof guarantees issued. As regards sector diversification, during FY06, infrastructure ac-counted for the largest share of guarantee activity, in terms of number of contracts issued(25), projects supported (14), and the amount of coverage (USD 469 mn).The Small Investors Program (SIP) approved in FY04 became fully operational this fiscalyear, and proved to be popular among smaller investors who find the streamlined under-writing process more user-friendly and appropriate to their needs. During FY06 nine con-tracts worth USD 24 mn were signed under the SIP.

Sector and Thematic issuesHuman RightsThe Nordic-Baltic countries have pushed for reinforcing the Bank’s development andpoverty reduction mission by enhancing attention to human rights considerations. Tangi-ble results include the establishment of a joint Justice and Human Rights Trust Fund(JHRTF) in late June of 2006.In the fall of 2005 the Nordic-Baltic capitals produced a joint working paper titled “TheWorld Bank and Human Rights” outlining why and how the Bank should engage more inthe human rights domain which generated a broad discussion with different stakeholderson ways and means to further promote the human rights agenda in the Bank. The paperpartly came about as a result of an emerging, less restrictive legal interpretation of theBank’s mandate – which, traditionally, has been interpreted as limiting the degree towhich the institution could take non-economic factors into account in its work. A copy of7

investment in infrastructure development; investment into frontier markets; investment in conflict-afflicted environments; and investment among developing countries (South-South investments)

14

the paper was presented to President Wolfowitz at his meeting with the Nordic and BalticGovernors in Stockholm in October. A new legal opinion on the subject of human rightsby the Bank’s former General Counsel was presented to management in January 2006,shortly before he stepped down. The main conclusions and argumentation of this internalpaper are aligned with the reasoning in the Nordic Baltic position paper.Further deepening the joint Nordic-Baltic process was a series of interlinked seminars inthe spring/summer of 2006. Organized in close collaboration with the Bank’s Legal de-partment, these events constituted an opportunity for a diverse group of representatives ofour constituency countries, the Bank, the UN system, and academic institutions to discusscomplicated operational, methodological and policy aspects of human rights and theirlinks to development. Specifically, a seminar in Oslo in May dealt with the question ofhow to measure justice and human rights and a workshop in Stockholm in June focusedon human rights dialogues at the country level. At the third seminar in Copenhagen inJune the objectives and preliminary work program of the JHRTF were discussed beforethe formally launch of the trust fund. Based on total commitments from the Nordic coun-tries of USD 22.6 mn the trust fund is expected to be operational as of the fall of 2006.

Independent EvaluationTo assist management in monitoring and evaluating the effectiveness of WB operations,the Quality Assurance Group and other units contribute to a complex system of internalchecks and balances, largely relying on self-evaluation at all levels. Assisting the Boardin its oversight function, the Independent Evaluation Group validates country and projectteams’ self evaluations. Besides throwing a critical light on project and country level re-sults IEG also produces evaluations on more aggregate and thematic level, in publiclydisclosed evaluation reports.8On request from the members of the Committee on Devel-opment Effectiveness (CODE), IEG’s evaluations are discussed in the Committee, alongwith a formalized Management Response.This year, besides more in depth Country Assistance Evaluations on for example Turkey,Yemen, Senegal, IEG published evaluations on thematic areas such the Bank’s support toLow Income Countries Under Stress, the support for education, the combined efforts ofthe World Bank Group support improvements to countries investment climates, the sup-port for trade, the support for community driven development and the support for finan-cial sector to mention some of the more important publications. Below, two of these stud-ies, and the response to them by the Board, are summarized.

Assessing community based developmentThe main conclusions of IEG’s evaluation of the Bank’s lending for Community Basedand Community Driven Development (CBD and CDD) were that, over the 1994-2003period, CBD/CDD projects in many cases had increased access to service delivery infra-structure like schools and health centers for remote communities, and in conflict andpost-conflict countries they had helped to rehabilitate infrastructure and provide impor-The IEG changed name from Operations Evaluations Department to IEG this year after a merger with theindependent evaluations outfits for MIGA and IFC – seewww.worldbank.org/iegfor reports.8

15

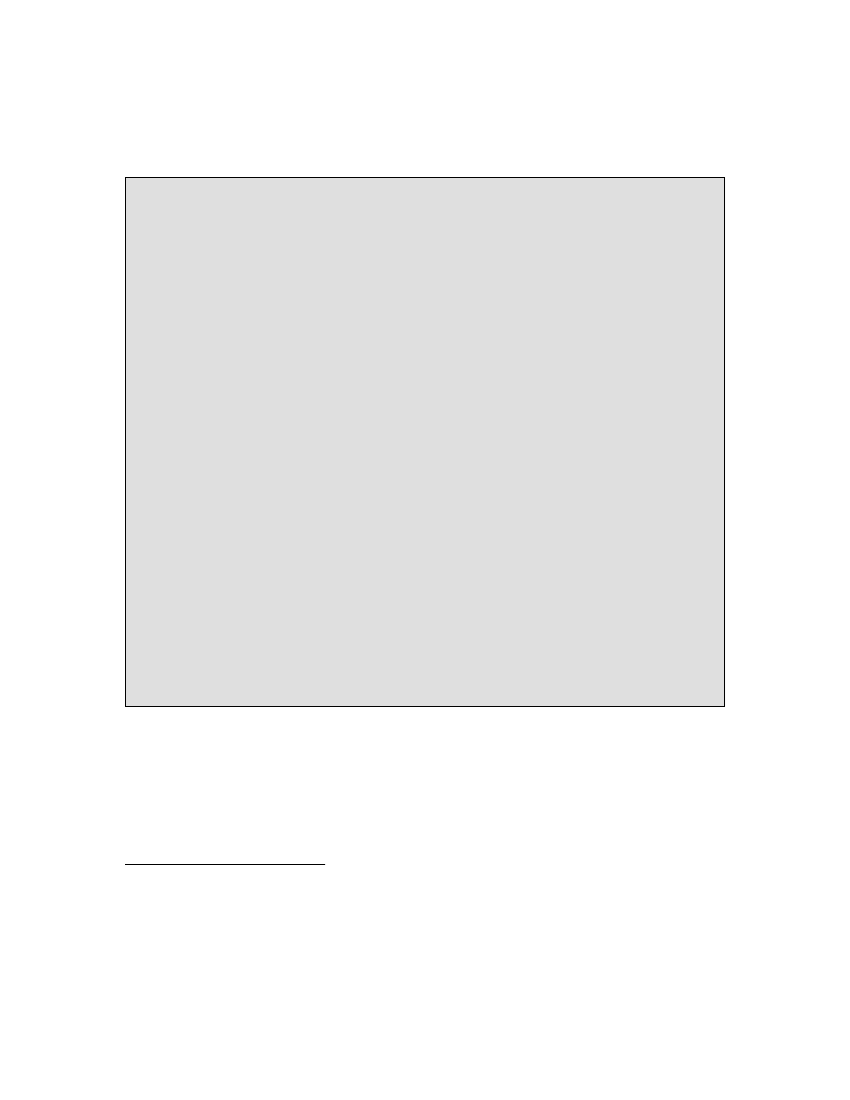

tant benefits to the local population. At the same time monitoring and evaluation ofCBD/CDD projects were found to have been lagging, and costs and benefits had not al-ways been systematically assessed. In some instances, the Bank’s parallel implementationarrangements have hindered long-run enhancement of local government capacity.In response, Bank management criticized IEG’s definition of CBD and CDD as beingmuch broader and bearing little resemblance to the set of operations management tracksunder this heading, thus possibly rendering the conclusions of the report misleading andlimited in their usefulness. The discussion around this report thus served the purpose offocusing on what all agree are important challenges to the CDD/CDB approach and alsoraised principal questions on the role of independent oversight and of how to oversee it.Figure 2. Independent Evaluation in the World Bank – links with Bank operations9

Assessing World Bank support for tradeThe ongoing discussions on how to strengthen aid for trade in the World Trade Organiza-tion and in the Bretton Woods institutions is expected to result in a further increase inWorld Bank assistance for trade. Providing timely input to this work, in January 2006IEG presented an assessment of how the World Bank Group had performed in supportingtrade reforms in its members countries. In the period 1987-2001 countries that pursuedtrade reform with the help of the World Bank were found to have had higher rates of eco-nomic growth than those who reformed without the help of the World Bank. At the sametime, the evaluation found that the Bank often supported trade liberalization reforms inspite of serious macroeconomic instability, that compliance with complementary policies9

This figure is from the 2006 Annual Report on Operations Evaluation, which is a synthesis report done bythe IEG group, which also takes stock of how to improve the IEG function. This report, which can be foundon the IEG website, also contains a more detailed overview of monitoring and evaluation within the WorldBank Group.

16

recommended for improving the investment climate were less successful and that theBank did not adequately focus on the poverty and distributional impact of trade reforms.After a period where the trade department was scaled down and overall trade relatedlending went down from USD 4.3 bn/year in the period 1987-94 to USD 1.7 bn in theperiod 2000-2004, the program was revamped in 2001, to focus on analysis, global advo-cacy on behalf of developing countries and on mainstreaming so called “behind-the-border” issues such as infrastructure and trade facilitating regulation in Country Assis-tance Strategies. The evaluation found that mainstreaming trade in operations has beenless successful than the advocacy pillar. The report also stresses that more attention willneed to be paid to poverty and distributional aspects of trade reform, not least to addressshort term adjustment costs.

Regional perspectivesSub-Saharan AfricaFrom the beginning of his tenure President Wolfowitz has made it clear that achievingpoverty reduction and better development outcomes in Africa is one of his major priori-ties. Progress towards the MDG poverty targets lags the rest of the developing countriesand today close to 320 mn Africans live on less than USD 1 a day, a doubling over thepast 25 years. Of the world’s 48 poorest countries 34 are situated in Africa. Inadequateinfrastructure and finance limit their international competitiveness. The HIV/AIDS pan-demic also has economic costs in the order of 1 percentage point of per capita growth ayear, malaria kills approx. 2.800 Africans every day and millions of children do not at-tend school. On the positive side, economic growth in Africa has picked up over the lastyears as macroeconomic management and structural policies have improved, intra-regional trade intensified and the incidence of conflicts fallen. Fifteen African countrieshave averaged growth of 5 percent p.a. over the past decade and, more generally, Africanper capita incomes are now rising on par with those of other developing countries. Oilexporters and a group of “good performers” has been able to sustain economic growthover a longer time period while other countries face less optimistic growth trajectories.With a portfolio of projects under implementation of USD 18.4 bn the World Bank re-mains the largest single donor in the Africa region. FY06 saw new IDA commitments ofUSD 4.7 bn and aggregate Bank disbursements of USD 4.01 bn. All of these activities areanchored in the Bank’s Africa Action Plan (AAP), developed in late FY05 in response toa request from the Board and endorsed by the Governors at the Annual Meeting in Sep-tember 2005. The AAP aims at helping all African countries to achieve as many of theMDGs as possible by supporting country-led efforts to achieve results, advance a sharedgrowth agenda, build more capable states and improve governance, and encourage part-nerships for Africa at the country, regional and global levels. On the lending side, thereare new commitments for infrastructure (USD 1.8 bn), regional integration (USD 500mn) and projects under the Malaria Booster Program (USD 190 mn). In response to thegovernance and capacity development challenge the Bank’s Task Force on Capacity De-velopment in Africa issued a set of practical recommendations in the reportBuilding Ef-fective States, Forging Engaged Societies,which are currently being translated into en-

17

hanced efforts on the ground via the so-called Capacity Development Management Ac-tion Plan (CDMAP).Box 7. Uganda Joint Assistance StrategyIn Uganda the Bank and ten other development partners, including bilateral agenciesfrom some of our constituency countries, have aligned their support in one joint strat-egy, the Uganda Joint Assistance Strategy (UJAS). The UJAS – approved by theBoard in January 2006 – is an important example of transforming into practice theRome/Paris principles of aid effectiveness. It centers on the following three principles:1) Supporting implementation of Uganda’s Poverty Eradication Action Plan toachieve the MDGs2) Collaborating more effectively3) Focusing on results and outcomes.Under the leadership of the Ugandan government the development partners have allcommitted to increasingly harmonize programming and policy dialogue, including byrationalizing their engagement in sectors, their choice of aid instruments, and theiradvisory capacity, with each partner concentrating its efforts in line with its compara-tive advantage. The UJAS constitutes the first case of the Bank signing up to govern-ance/political economy indicators that are shared with other donors. While individualdonors are still free to react to possible governance changes according to their ownassessment, the shared framework will enable the Government to get a better pictureof all of their partners’ concerns and thereby also the potential consequences of itsown decisions. Seehttp://www.finance.go.ug/peap revision/.

South AsiaDomestic reforms and external assistance in South Asia have helped fuel rapid economicgrowth averaging 5.5 percent a year for the past two decades. This strong performancehas put South Asia on track to achieve the MDGs by 2015. However, South Asia facesenormous human development challenges. India has among the highest number of HIV-infected people in the world and the region is subject to frequent and severe natural disas-ters.The Bank approved lending of nearly USD 3.8 bn to South Asia in fiscal 2006. Banksupport is designed to help accelerate human development in the region by focusing onfour cross-cutting issues: equity and inclusion, HIV/AIDS, regional integration, and pub-lic accountability. The Bank continued its support for rural development, education, andhealth. The Bank has committed some USD 380 mn in South Asia to support HIV/AIDSprojects in Bangladesh, Bhutan, India, Pakistan, and Sri-Lanka and to HIV/AIDS work inAfghanistan and Maldives.Infrastructure is fundamental to accelerating growth in the South Asia region. This fiscalyear, the Bank supported road network development and maintenance in Sri Lanka, urbaninfrastructure in India, Afghanistan, and Pakistan, and private provision of infrastructurein Bangladesh. A project to increase reliable power exchanges between the regions andstates of India was approved.18

New country assistance strategies for Bangladesh, Bhutan and Pakistan were discussedby the Board in FY06. The overriding theme of the Bangladesh strategy is governancewith a plan to increase transparency, institutional accountability, and provide better ser-vice delivery; the Bhutan strategy focuses on connecting communities to markets andpromoting private sector development, and the Pakistan strategy sets forth a broad-basedplan for addressing poverty in various dimensions, including human development, infra-structure, governance, and vulnerability.Box 8. Natural DisastersThe October 2005 earthquake in northern Pakistan led the Bank to focus on emer-gency preparedness. Following the massive earthquake in Pakistan, which left 73,000people dead, more than 70,000 severely injured or disabled, and more than 2.8 millionwithout shelter, the World Bank and the Asian Development Bank undertook a jointDamage and Needs Assessment that estimated the cost of the disaster to be USD 5.2bn. Two weeks after the earthquake, the Bank was able to provide USD 470 mn tohelp with reconstruction and safeguard ongoing reform and poverty reduction pro-grams. In December, an additional USD 400 mn was approved to reduce immediatesuffering and restore livelihoods, reconstruct housing, and finance needed imports.These commitments – mostly IDA credits- were part of the institution’s overall pledgeof USD 1.0 billion for earthquake recovery.An IEG evaluation of the Bank’s assistance for natural disasters, discussed by CODEin March 2006, concludes that the more than 500 disaster projects in the Bank, since1984, has performed better than average – but in almost half of the Bank financed dis-aster reconstruction projects, disaster prevention had not been given any attention inthe country assistance strategy. Accordingly, the report stresses the need for disasterrisk to be built into development planning from the beginning. Furthermore, it is rec-ommended that the Bank involves vulnerable communities more actively in disaster-prone areas in planning, preparation and rebuilding efforts, and supports systematicmaintenance of essential infrastructure in disaster-prone areas. A new global facilityfor disaster reduction and recovery is being established as a means for the interna-tional community to provide speedy and effective technical assistance to countries hitby natural disasters.

East Asia and the PacificThe Bank’s strategy for the region is to support broad-based economic growth, promotetrade and integration, enhance environment for good governance, increase social stability,and achieve the MDGs. To help reach those goals, the Bank approved USD 3.4 bn forEast Asia and the Pacific region in FY06.The World Bank’s new Country Partnership Strategy (CPS) for China aims to assistcountry integration into the world economy, address poverty and inequality, manage re-source scarcities and environmental challenges, strengthen the financial sector, and im-prove public and market institutions.

19

With an updated strategy for assistance to Indonesia, the Bank has reinforced its supportfor anti-corruption efforts and improvements in the investment climate. Post-tsunami re-construction in Aceh has accelerated significantly. The World Bank became the trustee ofthe Indonesia Multi-Donor Fund for Aceh and Nias (MDF) with grant pledges of USD526 mn from 15 donors. The Bank is supervising six of the MDF’s 12 projects, providingassistance for housing, roads, water supply, health, livelihood support, capacity buildingin housing reconstruction, as well as coastal management and project implementation.The World Bank assisted the Indonesian Government in finalizing a damage and loss as-sessment to ascertain the scale of the devastation after the earthquake in Yogyakarta andCentral Java and estimate the cost of rebuilding at USD 3.1 bn.The Bank is also working closely with technical agencies and governments to prevent,prepare for, and control the spread of Avian Flu, which continues to be a major threat inEast Asia. Construction on the Nam Theun 2 Hydropower project in Laos is movingahead satisfactory with the aim to ensure that construction progress is matched by effortsto mitigate the impact on people and the environment.Box 9. World Development Report 2007The World Development Report is by tradition the premier research product of theinstitution. It often provides a first class synthesis of a thematic area while contribut-ing to the production of new research as well, with an aim to come up with policyrelevant conclusions.This year’s report bears the titleDevelopment and the Next Generation.It deals withthe potential opportunities and challenges facing the youth of today – the 1.2 bn peo-ple who will enter the labor market and form families over the next decade. The reportvalidates the demographic shift even in developing countries which will result in thisgeneration of young people having fewer dependants due to changing patterns in fam-ily formation. Thus the report provides hope for increased welfare and per capitagrowth in many parts of the world, while highlighting the challenge of an ageingpopulation for the future. The key policy messages in the report can be summarizedas:Expand access to and improve the quality of education and health services, fa-cilitate the start to a working life and give young people a voice to articulatetheir needs and interests.Recognize young people as decision-making agents and help ensure that deci-sions are well informed.Provide an effective system of second chances – to catch up from bad luck orbad choices - through targeted programs.

Europe and Central AsiaEconomically and socially ECA is a region which covers a range of countries from lowincome countries in Central Asia (all except Kazakhstan) to upper-middle income EUmember countries. FY06, was generally quite successful for the region with overall posi-

20

tive growth rates going hand in hand with re-activation of forgotten reforms. GDP inECA Region grew by 5.7 percent in 2005, comprising 4.5 percent in Central and EasternEurope, 6.7 percent in CIS and 6 percent in Turkey. The Czech Republic completed thegraduation process from the Bank and the Riga office of the World Bank – the last in theBaltic countries - was closed on June 9, 2006.The Board approved 63 projects of total value of USD 4.0 bn, including unplanned emer-gency responses to avian flu with 7 operations approved (Albania, Armenia, Georgia,Kyrgyz Republic, Moldova, Tajikistan and Turkey). The Bank also found ways to stayengaged in booming Middle Income Countries such as Kazakhstan and Russia, imple-menting new cost sharing mechanisms for analytical and advisory services and throughsub-sovereign lending operations.Following the tragic events in Andijon, assistance to Uzbekistan, with the exception ofdisbursement of previously contracted loans, was suspended. After several board discus-sions on this topic, management presented the board with an Interim Strategy Note whichis more short term and less ambitious than a full-blown country assistance strategy.

Latin America and the CaribbeanThe Latin American and Caribbean (LAC) region includes middle income countries onthe verge of graduating from IBRD, as well as poor and fragile states. LAC countries facepersistent poverty challenges with the share of the population living on less than USD2 aday remaining roughly the same as in the late 1980s – about 25 percent of the population.The region has suffered from low and volatile growth and entrenched, high inequalitywith average measures of household income inequality among the highest in the worldfor most countries.The World Bank strategy for the LAC region focuses on these two challenges in support-ing infrastructure, education, health, investment climate reforms and public sector re-forms, tailored to country circumstances. IBRD and IDA lending was USD 5.9 bn forLAC in FY06, up from USD 5.2 bn in FY05. During the last business year, Colombiareceived several large scale program and project loans, and the Bank added a pillar in itsstrategy for Colombia in support of the peace process, actively supporting demilitariza-tion and the rolling out of social services to areas previously not under government con-trol. In Mexico, the Bank has pioneered the use of country systems in environmental andsocial safeguards, sub-sovereign financing and output based aid. In the Caribbean, theBank has stepped up its efforts, trying innovative measures such as community based aidin Haiti, a joint strategy for a cluster of small island states, as well as developing Catas-trophic Risk insurance for the region as a whole.

Middle East and North AfricaThe Middle East and North Africa (MENA) is an economically diverse region that in-cludes both the oil-rich economies in the Gulf and countries that are resource-scarce inrelation to population. The region’s economic fortunes over much of the past quarter cen-tury have been heavily influenced by two factors – the price of oil and the legacy of eco-nomic policies and structures that had emphasized a leading role for the state. Because of

21

the diverse nature of the region, the World Bank country programs in MENA differ con-siderably in their focus. Although the Bank is using a very broad menu of lending andknowledge services, there are a number of cross-cutting challenges for client countries inthe region – governance, private sector development, education and gender. Given therapidly growing and urbanizing population, support for creating new employment oppor-tunities is at the core of the Bank’s assistance in all countries in the region.Lending volumes in MENA increased in FY06 (reaching ca USD 1.7 bn) and the qualityof the portfolio improved, in spite of challenging environments such as Iraq and WestBank and Gaza. In Iraq, the Bank’s engagement has been supported by the WB Iraq TrustFund and an allocation of USD 500 mn of IDA credits. When the new Iraqi full-termgovernment was formed in May, management informed the Board of their plans to in-crease the Bank’s presence in Baghdad as soon as the security situation permits. Untilnow, the Bank’s operational work in Iraq has relied on a growing cadre of professionalIraqi staff based in Iraq, regular meetings with Iraqis outside of Iraq, use of the Bank’svideoconferencing facilities in Baghdad, and close support from the Interim Office forIraq in Amman.

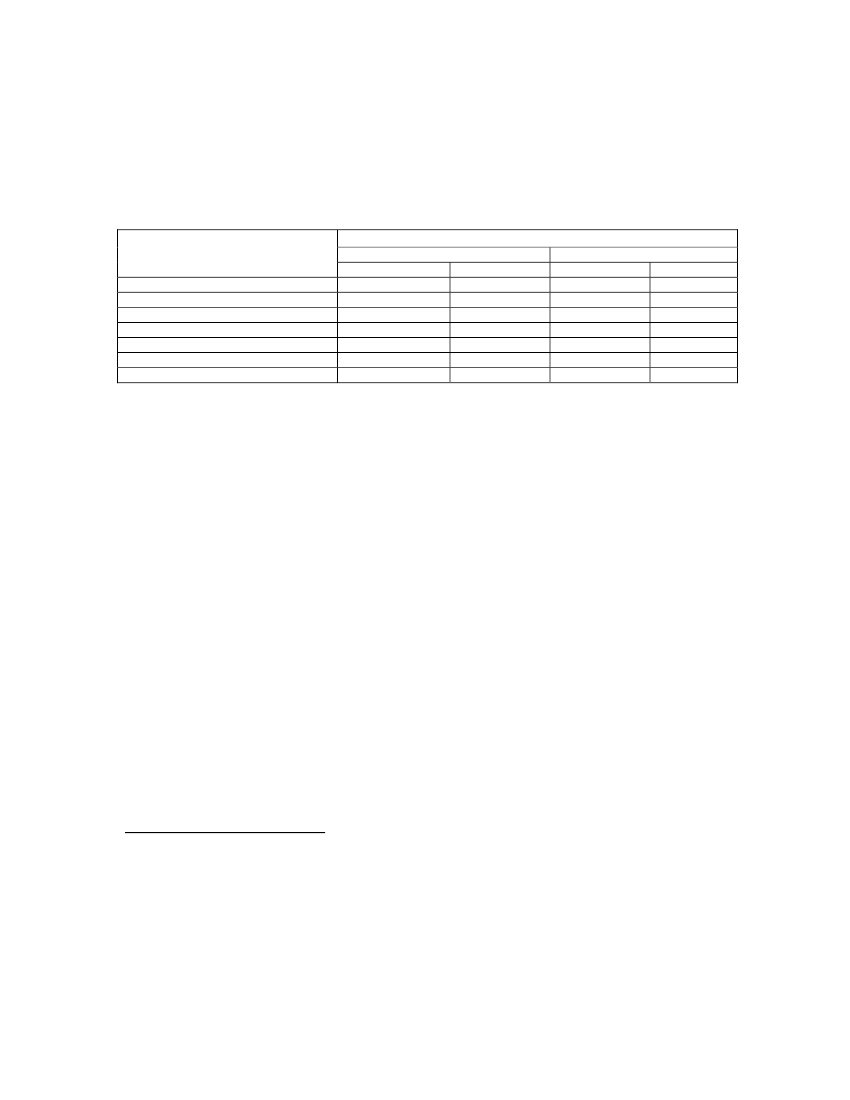

Financial OverviewVolume of businessFigure 3. Financial Commitments in the World Bank Group, in USD bn16.014.012.010.511.511.2119.08.18.06.04.02.00.0FY01FY02FY03FY04FY05FY062.72.23.11.43.96.87.36.75.44.89.58.713.614.1

USD bn

10.0

IBRDIDAIFCMIGA*

1.4

1.1

1.2

1.3

* Guarantees issuedIn FY06, IBRD/IDA lending operations were approved for USD 23.6 bn, which repre-sents a year-on year increase of around 6 percent. IBRD’s FY06 commitments increasedby 4 percent from last year’s level to USD 14.1 bn and IDA’s commitments in FY06 in-

22

creased by 9 percent to USD 9.5 bn compared to USD 8.7 bn in FY05. On a fiscal yearbasis, it’s the highest volume of IDA commitments in the history of IDA. According tothe latest projections, total IBRD/IDA commitments for FY07 are expected to be in therange of USD 22-26 bn. MIGA’s volume of new guarantee business in FY06 amountedto USD 1.3 bn, which represents a modest USD 76 mn increase from last year.Table 1. Regional breakdown of IBRD/IDA lending for FY05-FY06Lending VolumeRegionFY05$ bnShare (%)Africa3.917.4East Asia and Pacific2.913.0Europe and Central Asia4.118.3Latin America and the Caribbean5.223.2Middle East and North Africa1.35.8South Asia5.022.3Total IBRD+IDA22.4100.0

FY06$ bn4.83.44.05.91.73.823.6

Share (%)20.314.417.025.07.216.1100.0

Financial StatementsIn FY06, operating income10of IBRD was USD 1.74 bn, USD 420 mn more than inFY05. After the application of FAS133 (Financial Accounting Standards No.13311) andBoard of Governors-approved transfers12, IBRD reported net loss of USD 2.4 bn (seeAnnex 2 for more on IBRD’s financial data).Income from loans increased by USD 709 mn during FY06 in comparison with FY05mainly because of higher lending rates. However, the effect of higher lending rates waspartially offset by a reduction in income due to lower average loan balances outstanding.A positive impact to a higher income had made a USD 724 mn release of provision oflosses on loans and guarantees. Income from investments increased also by USD 429 mnin FY06 because of higher average short-term interest rates. However, at the same timeborrowing expenses increased by USD 904 mn due to the increase in USD six-monthLIBOR in FY06.IDA incurred an operating loss of USD 2.0 bn for FY06, compared with a loss of USD986 mn in FY05. After applying expenses for HIPC Debt Initiative and MDRI13, net lossof IDA is reported at USD 35 bn. IDA’s income from investments decreased significantlyfrom almost USD 2 bn in FY05 to only USD 24 mn in FY06 on net basis because of thecombined effects of different investment instruments. Income from development creditsOperating income refers to net income before the effect of FAS 133 (see footnote 11).and the Board of Governors-approved trans-fers (see footnote 12).11FAS133 refers to US GAAP and International Standards, which require all derivatives to be reported at their market values. TheIBRD marks all its derivatives to market and reflects those changes on the income statement. However, according to FAS133, move-ments in interest and foreign exchange rates are reflected only on the IBRD’s derivatives side, but not in the offsetting position.12Following external auditors’ recommendations, in FY06 Financial Statements Board of Governors-approved transfers are reportedas expenses while previously such transfers have been reported as dividends.13The provision for MDRI is recorded as a reduction of the disbursed and outstanding development credits and as a charge to income.Following the start of the MDRI implementation by IDA, the applicable development credits will be written off and the provisionreduced accordingly for the first group of post-completion point HIPC countries eligible for MDRI relief, and subsequently uponreaching completion point for the other HIPC countries.10

23

was USD 72 mn lower than in FY05. Development grants provided by IDA were alsolower by USD 96 mn in FY06.

Allocation of Net Income and Waivers to Loan ChargesTaking into consideration the financial position and outlook of the institution, the Boardapproved the following allocations from the IBRD’s FY06 Net Income:USD 1,036 mn to the General ReserveUSD 140 mn to be retained as surplusUSD 500 mn to IDAUSD 300 mn of the net income previously retained as surplus earmarked for fu-ture transfers to IDA, HIPC and/or reserves, would be transferred to IDA.Commitment charge waivers of 50 basis points will be maintained for all payment peri-ods commencing in FY07 on an unconditional basis, and interest charge waivers of 25basis points and 5 basis points will be maintained on new loans and old loans, respec-tively, to eligible borrowers for payment periods commencing in FY07. Most impor-tantly, the Board also decided to completely waive the front-end fee on all new loans inorder to improve the pricing competitiveness of IBRD compared to other multilateral de-velopment banks.

Financial CapacityThe financial capacity of the Bank, as measured by the Equity-to-Loans ratio (E/L) andcapital adequacy, continued to improve in FY06. IBRD finished FY06 with an E/L ratioof 33.1 percent, up from 31.4 percent at end-FY05. The ratio is expected to keep risingover the coming years, reaching 37 percent by FY08. The Bank has also seen a furtherimprovement in the credit quality of its loan portfolio, continuing the positive trend thatstarted already in FY03.A key analytical tool used to assess IBRD’s capital adequacy is the income-based stresstest. It helps to evaluate the adequacy of financial capacity by determining whether pro-jected net income could absorb probable risks while retaining an adequate earnings basefor supporting future loan growth and being able to respond in a crisis affecting theBank’s members. For FY06, the maximum “post-shock” loan growth that IBRD couldsupport, consistent with maintaining its E/L ratio above the desired minimum level over aten-year horizon is 16.5 percent. This compares to 9.9 percent at end-FY05. Reflectingthe improvements in the Bank’s portfolio, the size of the credit shock that the Bank couldface at the 95 percent confidence level measured as a share of accrual loans outstandinghas decreased from 16.3 percent at end-FY05 to 12.2 percent. In terms of loan loss provi-sioning, because of the improved credit quality, total provisioning requirements for theIBRD portfolio declined from USD 3.0 bn at end-FY05 to USD 2.3 bn at end-FY06.In light of IBRD’s increased risk bearing capacity and improved portfolio quality in re-cent years, Management proposed and the Board approved a USD 1.0 bn increase of thepresent USD 13.5 bn Single Borrower Limit (SBL) in FY05. It was decided not to changethe SBL in FY06, in order to not overly increase the exposure to any individual borrowerand to maintain a conservative risk framework.

24

ANNEX 1 – The World Bank and the Nordic-Baltic Office at aglanceThe World Bank was established in 1944 to help rebuild Europe after the Second World War.Today, the Bank’s mission has shifted to help reduce poverty in developing world. The Bank isone of the UN specialized agencies, with its 184 member countries as its shareholders. Alongwith the rest of the development community, the World Bank focuses its efforts on reaching theMillennium Development Goals (MDGs) by 201514.The World Bank Group consists of five separate organizations. The IBRD and the IDA providelow-interest loans, interest-free credit, and grants to developing country governments. The IFCpromotes private sector investment by investing in equity and providing loans to companies indeveloping countries. The MIGA provides guarantees against political risk to investors in andlenders to developing countries. And the ICSID settles investment disputes between foreign in-vestors and their host countries.15The World Bank's highest decision making body is its Board of Governors. The Governors, gen-erally finance and development ministers from its member countries, meet twice a year at a 24member Development Committee meeting providing political guidance for the Bank. The dailydecision making is delegated to the Executive Board, which consists of 24 Executive Directorsrepresenting one or several of the 184 shareholders. The Nordic and Baltic countries are repre-sented at the Executive Board by one Executive Director (ED). The ED is assisted by the NordicBaltic Office (NBO) that has the following composition at the time of writing:16Executive DirectorAlternate Executive DirectorSenior AdvisorSenior AdvisorSenior AdvisorAdvisorAdvisorAdvisorExecutive AssistantProgram AssistantSvein Aass (Norway)Pauli Kariniemi (Finland)Madis Muller (Estonia)Pernille Falck (Denmark)Erik Eldhagen (Sweden)Jurgita Kazlauskaite (Lithuania)Gints Freimanis (Latvia)Anna Hjartardottir (Iceland)Gun-Maj RambergColleen Martin

The Nordic Baltic chair has been a member in two permanent Board committees, the Committeeon the Governance and Administrative Matters (COGAM) and the Budget Committee (BC).NBO also is a member of the Committee on the Development Effectiveness (CODE) Subcommit-tee.

For more information on the MDGs seehttp://ddp-ext.worldbank.org/ext/MDG/home.doThe International Bank for Reconstruction and Development (IBRD), the International DevelopmentAssociation (IDA), the International Finance Corporation (IFC), the Multilateral Investment GuaranteeAgency (MIGA) and the International Centre for Settlement of Investment Disputes (ICSID).16Svein Aass became Executive Director on July 1st, 2006, having served as Alternate Executive Directorduring FY06 with Thorsteinn Ingolfsson as Executive Director for FY06. Pauli Kariniemi became Alter-nate Executive Director on July 1st, having served as Senior Advisor during FY06. Pernille Falck and ErikEldhagen became Senior Advisors on July 1st2006, having served as advisors for FY06. Anna Hjartardottirjoined the office as an advisor in July 2006.15

14

25

ANNEX 2 – Selected financial data of IBRDFiscal years 2002-2006, in USD millions2006

Lending

CommitmentsGross DisbursementsNet Disbursements14,13511,883(1,741)2006

4,8647241,057(3,941)(964)1,740(650)(3,479)(2,389)2005

13,6119,722(5,131)2005

4,155502628(3,037)(928)1,320(642)2,5113,1890.962.323.909.2631.45222,008104,401(3,009)101,29738,5882005

402(273)0.281.1730.8326,395107,549105,69136,9432004

11,04510,109(8,408)2004

4,403665304(2,789)(887)1,696(645)(4,100)(3,049)1.18(2.12)5.21(8.88)29.35228,910109,610(3,505)108,06635,4632004

484(513)0.331.4429.0731,126112,608109,67536,4212003

11,23111,921(7,996)2003

5,7421,300418(3,594)(845)3,021(540)2,3234,8042.063.2710.3214.5526.59230,062116,240(4,045)108,55437,9182003

2,8963941.909.4126.3626,620122,593116,69535,6752002

11,45211,256(812)2002

6,86115738(4,907)(783)1,924(402)8542,3761.291.607.098.3422.90227,454121,589(5,053)110,26332,3132002

2,4518811.608.6523.1025,056126,454114,50232,466

Reported BasisLoan IncomeProvision for Losses on Loans and Guaranteesdecrease (increase)Investment IncomeBorrowing ExpensesNet Non-interest ExpenseOperating IncomeTransfers Approved by the Board of GovernorsEffects of applying FAS133Net Income (Loss)

1.34Net return (%) on Average Earnings Assets17after the effects of FAS133 and Transfers Approved bythe Board of Governors(1.84)5.05Return on Equity (%)after the effects of FAS133 and Tranfers Approved by(6.84)the Board of Governors1833.06Equity to Loans Ratio (%)Total AssetsLoans OutstandingAccumulated Provision for Loan LossesBorrowings OutstandingTotal Equity212,326103,004(2,296)95,83536,4742006

640(446)0.491.8632.5424,888103,88595,25837,590

Current Value BasisNet Incomeof which current value adjustmentNet return (%) on Average Earnings AssetsReturn on Equity (%)Equity-to-Loans Ratio (%)Cash and Liquid InvestmentsLoans OutstandingBorrowings OutstandingTotal Equity

1718

Before the effects of FAS133 and Board of Governors approved transfersBefore the effects of FAS133 and Board of Governors approved transfers

26

ANNEX 3 – Selected financial data of IFCAs of and for the fiscal years ended June 30

Fiscal years 2002-2006, in USD millions2006

Net Income highlights:

Interest income and fees from loansIncome from liquid asset trading activitiesCharges on borrowingsIncome from equity investmentsOf which:Capital gains on equity salesDividends and profit participationsOtherRelease of (provision for) lossesNet non-interest expenseExpenditures for technical assistance and advisory ser-vicesExpenditures for performance based grantsOperating incomeNet gains (losses) on financial instrumentsNet incomeBalance sheet highlights

Total assetsLiquid assets, net of associated derivativesLoans and equity investmentsBorrowings withdrawn and outstandingTotal capitalKey financial ratios

Return on average assetsReturn on average net worthCash and liquid investments as % of next three years'estimated net cash requirementsDebt to equity ratioCash flows from loans and equity investment activi-

ties

Loan disbursementsEquity disbursementsLoan repaymentsEquity redemptionsSales of loans and equity investments807444-6031,228928327-27-15-362-55-351,409-1311,2782005

660358-3091,365723258384261-344-3801,953622,0152004

518177-14165838620765103-304-2998211993528-41487161542152003

477475-22614552147-54-48-2952002

547524-438160288141-269-389-243

38,42012,73012,73114,96711,076

39,56013,32511,48915,3599,798

32,36113,05510,27916,2547,782

31,54312,9529,37717,3156,789

27,73914,5327,96316,5816,304

3.60 %13.70 %112 %1.5:1

5.40 %22.60 %142 %1.8:1

3.10 %13.70 %116 %2.3:1

1.80 %8.20 %107 %2.6:1

0.60 %2.70 %109 %2.8:1

-3,717-7112,75221,456

-2,868-5882,283291,338

-2,684-4681,9354975

-2,646-3131,4025271

-1,250-2851,35023638

27